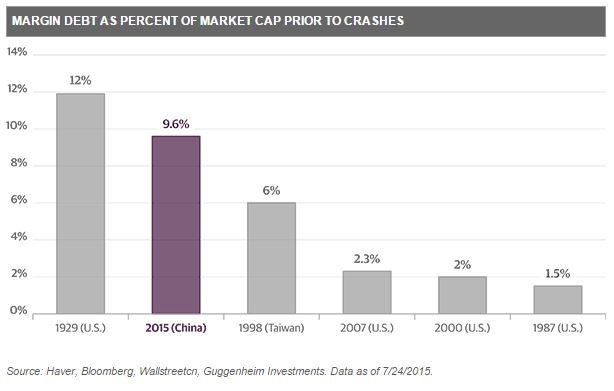

A recent market view article from Guggenheim Investments noted that a key factor driving the Chinese stock market higher over the past year has been a rapid run up in margin debt, which climbed to a high of 9.6% of market cap at the market peak back in June. This figure is high by both historical and global standards, and is likely understated due to significant hidden leverage outside the system. While margin debt has begun to unwind in the midst of the latest stock selloff, there is still a great deal of margin debt outstanding. This will mean continued turbulence for the Chinese stock market.

Guggenheim Investments also has the following chart showing Chinese margin debt (we assume its the debt that is known to exist) had reached a level almost as high as the level in the US stock market prior to the 1929 crash while more recent US crashes have seen much less margin debt exposure:

To read the whole article, China’s Dilemma: Is it 1987 or 1929?, go to the website of Guggenheim Investments. In addition, check out our China closed-end fund list and China ETF list pages.

To read the whole article, China’s Dilemma: Is it 1987 or 1929?, go to the website of Guggenheim Investments. In addition, check out our China closed-end fund list and China ETF list pages.

Similar Posts:

- Chart: Stock Market Capitalization as a Percent of GDP (Guggenheim Investments)

- Stop Worrying About Chinese Debt? (The Asset)

- Vietnamese Verses Chinese Retail Investors (AFC)

- Macau Casino Boom-Bust Cycle in One Chart (Bloomberg)

- eCommerce Grows Among Rural Chinese & Easterners (Nielsen)

- China’s Mutual Funds Industry Now the Second Biggest in Asia (The Asset)

- US-Chinese Business Partnerships Are Thriving (Kraneshares)

- U.S.-China Trade War: The New Long March (Guggenheim Investments)

- Chinese Stocks: Cheap Long-term Play or Value Trap? (FE Trustnet)

- China’s Property Troubles Have Pushed One Debt Indicator Above Levels Seen in the Financial Crisis (CNBC)

- Templeton’s Chow: “No Reason the Goat and the Bull Cannot be Friends” (Mobius Blog)

- Five Misconceptions About China’s Stock Markets (KraneShares)

- China: Navigating the Regulatory Landscape (UBS AM)

- Macro Tailwinds That Could Propel China’s Internet Sector (KraneShares)

- 2021 Midyear Asia Fixed Income Outlook: Fundamentals Trump fears (PineBridge Investments)