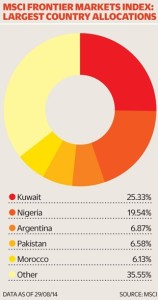

Back in May, MSCI announced that both Qatar and United Arab Emirates, which together make up a third of the MSCI Frontier Markets index, had been upgraded from frontier market to emerging market status. The index now incorporates 24 countries with the biggest constituents now being Kuwait, which is exposed to turmoil in the Middle East, and Nigeria, which has exposure to the Ebola epidemic and the Boko Haram extremist group.

In a detailed article about the changes and frontier markets in general, Money Marketing quoted Tilney Bestinvest managing director Jason Hollands as saying:

“The promotion of UAE and Qatar to the Emerging Market index in May has fundamentally change the make-up, and arguably the risk profile, of the frontier markets universe… You need to be aware that the universe you are investing in today will look quite different to the one at the start of the year.”

In addition, Simon Edelsten of Artemis Fund Managers was quoted as saying he has added to his allocation in frontier markets in recent months, adding names with exposure to Myanmar and Laos. He was quoted as saying:

“Some of the big emerging markets are often large countries which are very reliant on commodities for income and wealth. So the good thing about frontier markets is that a fair number of them, certainly places like Myanmar, are not commodity markets at all and they are also just opening up to investors now.”

Finally, Baring Frontier Markets fund manager Michael Levy commented that frontier markets can go on to prove “increasingly popular hunting grounds” for investors thanks to their long-term growth potential. He added:

“Frontier markets are where emerging markets were 20 to 25 years ago and if you look at what China, India, Russia and Brazil have achieved since then, I think the potential is clear. They represent potential economic powerhouses of the future, so they are increasingly popular hunting grounds.”

To read the whole article, Could seismic shift in frontier markets promise a new dawn?, go to the website of Money Marketing.

Similar Posts:

- Frontier Market ETFs Have 72% Exposure to Oil-Dependent Countries (FT Adviser)

- How the MSCI Emerging Markets Index Changes Will Impact Investors (P&I)

- Fund Managers’ Opinions on the UAE and Qatar’s Emerging Markets Upgrade (The National)

- Frontier Markets: Small, Concentrated & Misunderstood (Financial Advisor)

- History Says Investors Get Gored by MSCI Upgrades (Reuters)

- The “Halo Effect” of Saudi Arabia’s Emerging Markets Arrival (Franklin Templeton)

- ING IM’s Ruijer: China and the Fed are the Biggest Risks to Frontier Markets (Citywire)

- Results of MSCI 2017 Market Classification Review (MSCI)

- MENA Market Outlook: Managing the Economic Fallout (Franklin Templeton)

- What’s Ahead for the MENA Region? (Franklin Templeton)

- Investors Exit Africa for Other Frontier Markets (WSJ)

- Nigeria, Argentina and Vietnam Top the Frontier Markets Sentiment Index (WSJ)

- Nigeria’s Forte Oil Plc and EcoBank Transnational Inc (ETI) Added to MSCI’s Frontier Market Index (AllAfrica.com)

- Investing Beyond the Storm: A View from the MENA Region (Franklin Templeton)

- Frontier and MENA 2021 Outlook: A New Era of Investment (Franklin Templeton)