I am visiting California as this time of year is the almond harvest (so a little slower with posts) with the trees I planted on my parents’ land scheduled to be shaken later this week with me walking through the orchard with a pole to knock any still sticking to the trees (as its better to get them off now than to have them turn into worm infested mummies that should still be removed in winter). Then the nuts will need to stay on the ground to dry further before being swept up next week (with some raking on my part of any stragglers).

Despite the non-stop talk from the corporate media about tariffs or that they are harming American farmers, almond prices for California farmers since the last harvest seem to have consistently been back to around pre-COVID levels (above $2 a pound) or at least the highest they have been since the record harvest that then got disrupted by COVID supply chain disruptions which lead to carryovers into the following years that kept prices depressed.

While no apparent trade deal or a better trade agreement with India (a huge market for almonds and nuts in general) is a disappointment, better deals with the EU and some other countries are a bright spot for many American farmers – just don’t expect our media to report much about them…

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 EM Fund Stock Picks & Country Commentaries (August 10, 2025) Partially $

- Pop Mart’s Labubus craze, why Indonesian stocks are shunned, identifying “winning businesses,” Iraq trip report, telecom towers stocks, investing in rare earths, June/July/Q2 fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 Interview with “DaBao” (Asian Century Stocks)

FinTwit celebrity.

Table of contents

1. Personal background

2. What he looks for in investments

3. Managing a portfolio

4. Taiwanese equities

5. Hong Kong "shitcos"

6. Taiwan Semiconductor Manufacturing Company

7. Trio Technology

8. Plover Bay Technologies

9. Infinity Development

10. Contact details🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 In Depth: China’s scandal-hit credit ratings industry seeks a new beginning (Caixin) $

- For weeks, investment managers across China have been receiving polite but pointed suggestions from the country’s top credit rating agencies — firms that assess the likelihood of default for trillions of yuan of corporate debt in the world’s second-largest bond market.

- An analyst at China Cheng Xin International Credit Rating Co. Ltd. (CCXI), the nation’s largest by market share, advised a client to register an account on a new company platform. A bond manager at a mutual fund received a similar notice from rival China Lianhe Credit Rating Co. Ltd. to activate online portal access. The message, though subtle, was clear: the free ride for detailed credit analysis may soon be over.

🇨🇳 Still Just a Rat in a Cage: Why Analyst Estimates Drive Investors Mad (The Great Wall Street)

🇨🇳 Chinese game giant XD Inc bets big on studio yet to make any money (Caixin) $

- Chinese video game company XD Inc (HKG: 2400 / FRA: 3OE / OTCMKTS: XDNCF) has agreed to a deal valuing a fledgling game studio at roughly $264 million — even though the studio has yet to generate any revenue. It is a bold bet aimed at finding the next global blockbuster as the industry confronts mounting growth challenges and investor reluctance.

- Hong Kong-traded XD announced in a filing that it would pay $14 million to acquire about 5.3% stake in the gaming studio MiAO. Founded in July 2022 by Wu Meng, the former chief executive of leading game publisher Giant Network Group Co. Ltd., MiAO remains in early development, posting no revenue and accumulating nearly $8.3 million in losses over 2023 and 2024.

🇨🇳 iDreamSky merges ‘shoot-em-up’ and anime in self-made play for profits (Bamboo Works)

- The gaming company raised money via share placements three times in the last year as it bets on its self-developed ‘Strinova’ to lead it back into the black

- iDreamSky Technology Holdings Ltd (HKG: 1119 / FRA: 08IA) has conducted three share placements within a little more than a year, as it banks on its self-developed “Strinova” to lead it back to profitability

- The company expects to report a net profit of between 20 million yuan and 50 million yuan for the first half of 2025, representing its first profit in three years

🇨🇳 Is GigaCloud the latest ‘China Easter Egg’ on Wall Street? (Bamboo Works)

- The B2B e-commerce site’s stock jumped 30% after the release of its latest earnings report, which was filled with signs of turbulence from the U.S.-China trade war

- GigaCloud Technology (NASDAQ: GCT) reported 4% revenue growth in the second quarter and forecast flat growth ahead, as it suffered from fallout of the U.S.-China trade war

- Even after a 30% rally for its shares following the ho-hum report’s release, the e-commerce company’s stock still trades at a relatively depressed P/E ratio of 9

🇨🇳 Beyond BYD: 3 Chinese Companies Dominating the Electric Vehicle Market (The Smart Investor)

- Discover these Chinese EV makers that are transforming the electric mobility scene.

- While BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) has long captured the attention of global investors, a new wave of Chinese EV makers is quickly rising to prominence.

- Here are three companies that are not just riding the EV wave, but are at the forefront of it.

- XPeng (NYSE: XPEV) specialises in smart EVs with advanced autonomous driving and navigation systems driven by artificial intelligence (AI).

- Li Auto (NASDAQ: LI) focuses on extended-range electric vehicles which mainly includes high-tech sport utility vehicles for families.

- ZEEKR Intelligent Technology Holding Limited (NYSE: ZK) is a Chinese luxury EV manufacturer with advanced integrated software in its vehicles.

🇨🇳 Refire strings along investors with hydrogen hype (Bamboo Works)

- The maker of hydrogen fuel cell systems reported its revenue continued to contract in the first half of 2025, though at a lower rate than last year

- Shanghai REFIRE Group Ltd (HKG: 2570)’s revenue fell about 10% in the first half of the year, improving from a 28% decline in 2024

- The company is fiscally conservative, with a gearing ratio of just 0.52 and 1 billion yuan in cash

🇨🇳 Full Truck Alliance gets new lesson in economics (Bamboo Works)

- The trucking company warned that a planned rate hike for its freight brokerage services could lead to a significant decline in that business, which could ‘adversely affect’ its profits

- Full Truck Alliance (NYSE: YMM) will raise rates for its freight brokerage services as it seeks a sustainable model for the business with the winding down of government assistance

- The trucking app operator’s outstanding loans to small businesses grew 25% year-on-year in the first quarter, as its non-performing loan ratio rose to 2.2%

🇨🇳 China’s Cosco seeks at least 20% as Beijing reshapes $23bn Panama ports deal (FT) $ 🗃️

- State-owned shipping group has leverage over BlackRock and MSC as Beijing tries to rewrite terms of sale

🇨🇳 US copper tariffs risk widening China’s lead in metals processing, executives warn (FT) $ 🗃️

- Mining billionaire Andrew Forrest says duties will result in ‘exporting’ of jobs and industry

🇨🇳 Haier D-share (690D GR) — 2025 update (Asian Century Stocks)

- World-leading home appliances business at 7x P/E.

- Haier Smart Home (SHA: 600690 / HKG: 6690 / OTCMKTS: HSHCY / OTCMKTS: HRSHF) is the world’s largest home appliances company, with particular strength in refrigerators and washing machines. It’s got multiple world-renowned brands, including Haier, GE Appliance, Fisher & Paykel, Candy and more.

- The company was largely built by visionary entrepreneur Zhang Ruimin, who created a corporate culture unique in China and beyond. He spearheaded Haier’s international expansion, acquiring companies such as America’s GE Appliances and Italy’s Candy, giving it local distribution networks for its lower-priced Haier offering.

- In late 2020, Haier Smart Home merged with its separately-listed distribution subsidiary Haier Electronics. Following this complex transaction, Haier was left with three separate share classes: A-shares listed in Shanghai, H-shares listed in Hong Kong and D-shares listed in Frankfurt.

- The D-share ended up trading at a massive 60%+ discount to the H-share, even though their cash flow rights and voting rights were identical.

- In this post, I discuss what’s happened to Haier since my first write-up, and what I think might happen in the future. I then discuss current valuation multiples in light of said earnings forecast and discuss the potential impact of US tariffs on Chinese goods as well as China’s recent trade-in program.

🇨🇳 Laopu Gold (6181.HK) – The Business Model, the Concerns, the Valuation Outlook (Smartkarma) $

- The value of Laopu Gold Co Ltd (HKG: 6181) lies in its innovation in business model, successfully breaking away from the low-profit attribute of the industry by following the pricing and operation methods of luxury goods.

- However, Laopu cannot enjoy the valuation system of luxury brands because it cannot “escape” gold price cycle. So, when valuation of Laopu approaches that of luxury brands, it has overvaluation risks.

- Current valuation has priced in overseas expansion, which however isn’t a done deal. During upward cycle of gold prices, it’s easy to optimistically linearly extrapolate Laopu’s growth potential. Valuation faces downward revision risk

🇨🇳 Will new investor Goldstream bring its Midas touch to Saint Bella? (Bamboo Works)

- The investment company disclosed its purchase of 0.3% of the maternity and baby care company’s stock on the open market

- Goldstream Investment Ltd (HKG: 1328) acquired 1.83 million Saint Bella Inc (HKG: 2508) shares, equal to about 0.3% of its stock, through open-market purchases

- The investment company’s stock rose by more than 10 times in July from its low point in June, on excitement about its plans for cryptocurrency-related investments

🇨🇳 Mounting challenges take the fun out of Playmates Toys (Bamboo Works)

- The once dominant toy maker has struggled since last year, and its downward spiral accelerated in the first half of 2025

- Playmates Toys (Playmates) (HKG: 0869 / 0635 / FRA: 45P / OTCMKTS: PMTYF / PYHOF) reported its revenue plunged nearly 60% in the first half of 2025, as the company fell into the red

- U.S. tariffs are rubbing salt into the toy maker’s already wounded business

🇨🇳 Yeahka targets Japan in push for international payments business (Bamboo Works)

- The Chinese payment services firm has been authorized to handle credit card and QR transactions in Japan, but can it crack the notoriously tricky market?

- The company [Yeahka (HKG: 9923 / FRA: 4YE / OTCMKTS: YHEKF)] has obtained the licenses through a Japanese subsidiary as it seeks to expand its global reach

- The aim is to serve local customers in overseas markets rather than just facilitate cross-border payments for Chinese tourists

🇨🇳 Huishang Bank’s double-speak: Talking up profits, while highlighting challenges (Bamboo Works)

- The regional lender’s net profit increased 3.8% in the first half of 2025, far less than its asset expansion, suggesting intense margin pressure

- Huishang Bank Corp Ltd (HKG: 3698 / FRA: HB8 / OTCMKTS: HHSSF)’s total assets increased about 17% by the end of June from a year earlier, but its operating income grew only 2.2%, with its net profit up 3.8%

- Chinese banks have been battling pressure on their margins caused by central bank interest rate cuts to stimulate the economy

🇨🇳 State shareholder throws Vanke new lifeline as $2 billion debt payments loom (Caixin) $

- Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / OTCMKTS: CHVKF / CHVKY) has obtained another emergency loan from its largest shareholder as the embattled developer faces nearly $2 billion in upcoming debt repayments and deepening liquidity stress.

- In a Tuesday filing, Vanke said Shenzhen Metro Group Co. Ltd., a state-owned enterprise, has agreed to provide a shareholder loan of 1.681 billion yuan

($234 million). The funds will go toward servicing Vanke’s public bonds and interest on designated borrowings previously approved by Shenzhen Metro.

🇨🇳 🇭🇰 China’s star tech companies rush to list in Hong Kong (FT) $ 🗃️

- The territory has made a series of reforms that have helped fuel an IPO boom

🇭🇰 Foreign Funds Edge Back Into Hong Kong Stocks as Mainland Outflows Ease (Caixin) $

- Overseas investors made net purchases of Hong Kong-listed shares and U.S.-traded Chinese American depositary receipts (ADRs) for the first time in 41 weeks, signaling a tentative return to Chinese markets, even as foreign appetites for mainland stocks remained weak.

- China International Capital Corp. (CICC), citing Emerging Portfolio Fund Research (EPFR) data, said that in the week of July 24-30, active foreign inflows into Hong Kong equities and ADRs reached $4.29 million, reversing a $320 million outflow the week prior.

🇭🇰 Helmed by new chairman, Best Mart 360 navigates changing Hong Kong landscape (Bamboo Works)

- With a personal scandal involving its CEO behind it, the Hong Kong snack chain is trying to hone its hometown advantage as local consumers flock across the border to shop

- Best Mart 360 Holdings Ltd (HKG: 2360 / OTCMKTS: BMTHF) announced its appointment of a new chairman, ending a period of controversy after its CEO was investigated for corruption unrelated to the company

- Support from backer China Merchants Group could give the Hong Kong snack seller an edge over increasing competition from Mainland Chinese retailers

🇭🇰 Techtronic Industries: Margin Beat And Strong Prospects Are Key Positives (Rating Upgrade) (Seeking Alpha) $ 🗃️

- 🌐 Techtronic Industries (HKG: 0669 / FRA: TIB1 / OTCMKTS: TTNDY / OTCMKTS: TTNDF) 🇭🇰 – Cordless technology spanning Power Tools, Outdoor Power Equipment, Floorcare & Cleaning Products. Brands like MILWAUKEE, RYOBI & HOOVER. 🇼 🏷️

🇭🇰 Techtronic finds niche outside the U.S.-China trade war – for now (Bamboo Works)

- The power tool maker’s revenue rose 7.5% in the first half of the year, and its profit rose by 14%, despite its heavy reliance on the U.S. market for sales and China for manufacturing

- Techtronic Industries (HKG: 0669 / FRA: TIB1 / OTCMKTS: TTNDY / OTCMKTS: TTNDF) reported solid revenue and profit growth in the first half of the year, and said it is well positioned to weather “evolving global trade policies” in the second half

- The company has avoided U.S. tariff fallout so far partly by relying on newer factories in the U.S., Vietnam and Mexico to complement its original Chinese manufacturing base

- Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) is spending up to US$250 million this year on concession-related investment commitments made to the Macau government, including upgrades to the hotel tower at its Wynn Macau property (pictured) downtown and on its Wynn Palace resort on Cotai.

- Analysts Anne Ling and Jingjue Pei of Jefferies Hong Kong Ltd observed in a Thursday note: “[Wynn] Management expects minor disruption towards the end of the year for these projects. However once completed, they would enhance its offerings to premium customers.”

- The casino group also hopes by “early 2028” – subject to Macau government approvals – to complete an “event centre” on a parcel of land at the north end of its Wynn Palace site, said group chief executive Craig Billings.

🇲🇴 MGM China to spend US$152mln on interim dividend (GGRAsia)

- The board of Macau-based casino operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) has declared the payment of an interim dividend of HKD0.313 per share to the company’s shareholders.

- The Hong Kong-listed company said in a filing on Thursday it expected to spend just under HKD1.19 billion (US$151.5 million) on the dividend, which it anticipates will be paid on September 3.

- MGM China said its board determined the group had “sufficient resources, after the payment of the interim dividend, to finance its operations,” and pursue “development of its business, and investment commitments” made to the Macau government under its new gaming concession that started on January 1, 2023.

🇲🇴 Studio City International: The Underdog Of Macau’s Casino Rally (Seeking Alpha) $⛔🗃️

- 🇲🇴 Studio City International Holding Ltd (NYSE: MSC) – Operates Studio City Casino (gaming, retail & entertainment resort) in Cotai, Macau. 🇼

🇹🇼 Taiwan

🇹🇼 How TSMC’s 2nm Roadmap Is Redefining Compute Power (Seeking Alpha) $⛔🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 United Microelectronics Corporation: Doubling Down on Specialty Tech… (Smartkarma) $

- United Microelectronics Corp (TPE: 2303 / NYSE: UMC) second quarter financial results for 2025 present a nuanced picture of the company’s current standing and future prospects.

- The Taiwanese semiconductor foundry recorded consolidated revenue of TWD 58.8 billion, a sequential increase of 1.6%, with wafer shipments growing by 6.3% quarter-over-quarter.

- However, the currency appreciation of the Taiwanese dollar impacted profitability, as gross margin slightly reached 28.7%, considering a 3% foreign exchange effect.

🇰🇷 Korea

🇰🇷 Korean Government Confirms Visa-Free Entry of Group Tourists from China to South Korea (Douglas Research Insights) $

- On 6 August, the Korean government confirmed visa-free entry of group tourists from China to South Korea.

- The new policy will allow the group tourists from China to visit South Korea on a visa-free basis from 29 September 2025 to end of June 2026.

- We provide a list of top 20 companies in Korea that are key beneficiaries of the no visa policy for group tour visitors from China to South Korea.

🇰🇷 Chinese tour groups to South Korea can enter visa-free from Sept 29: reports (GGRAsia) $

- Reuters said that shares of South Korean department stores, casinos, hotels and beauty product makers rallied on Wednesday, amid hopes of a boost from Chinese demand.

- Several brokerages recently mentioned that visa-free entry to South Korea for certain Chinese travellers might benefit resort operators there that run foreigner-only casinos at their venues.

- Yanolja Research, a Seoul-based company, said in a February report – citing Korea Culture and Tourism Institute data and the Korean Duty-Free Shop Association – that while South Korea had a “surge” in tourist arrivals in 2024, tourism income had “stagnated”.

🇰🇷 Alpha Generation from the New Entries in the ‘KOSDAQ Rising Stars’ for 2025 (Douglas Research Insights) $

- In this insight, we discuss the potential alpha generation from new entries (2025) in the “KOSDAQ Rising Stars.”

- On 7 August 2024, KRX provided a list of 22 KOSDAQ Rising Stars companies (including 15 existing ones and 7 new companies).

- The 7 new KOSDAQ Rising Stars include ST Pharm (KOSDAQ: 237690), NextBioMedical Co Ltd (KOSDAQ: 389650), SOLiD, Inc. (KOSDAQ: 050890), SemCNS Co Ltd (KOSDAQ: 252990), DE&T Co Ltd (KOSDAQ: 079810), Truen Co Ltd (KOSDAQ: 417790), and Union Biometrics Co Ltd (KOSDAQ: 203450).

🇰🇷 Korea Local Banks: New Dividend Tax Effectively Locks in a De Facto Minimum Yield Play (Smartkarma) $

- We’ve got a locked-in floor on ’26 DPS and clear upside, providing a solid dividend yield baseline—ideal for leaning into aggressive trade setups.

- We can lean into spot longs with covered calls, but yields (especially KB Financial Group (NYSE: KB), Shinhan Financial Group (NYSE: SHG / KRX: 055550)) aren’t yet compelling. A pullback before the ’26 dividend run is a prime entry window.

- Plus, a bank long-short: long KB/Shinhan, short Hana Financial Group (KRX: 086790)/Woori Financial Group (NYSE: WF). KB and Shinhan face payout increases, with ’26 guidance in 4Q25 earnings as the catalyst.

🇰🇷 A Hidden Trading Angle from Dividend Tax Reform: Tax Timing Creates Dividend Trap Risks (Douglas Research Insights) $

- With new tax rules kicking in from FY2026, firms may hold back FY2025 dividends to front-load later, creating potential downside surprise purely from tax-driven deferral, not fundamentals.

- If FY2025 payouts fall short, dividend names could go ex-div on inflated expectations, then trade heavy — setting up mispricing risk around year-end dividend capture trades.

- This may weaken post-ex-div price rebounds, creating dividend trap risks and short-term mispricing that traders can exploit via shorts, dip buys, or dividend swap long-short strategies.

🇰🇷 Separate Dividend Tax Plan in Korea: Devil Is In the Details (Douglas Research Insights) $

- A closer look at MOSF’s Tax Reform Plan for dividends suggests that it may not have a material impact on most listed companies unless the National Assembly drastically improves it.

- According to MOSF, it currently estimates that approximately 350 of the 2,500 listed companies, or 14%, could meet these requirements (two main dividend tax reduction requirements).

- We provide a list of 70 companies in the Korean stock market with 40% or higher dividend payouts (excluding companies with smaller market caps).

🇰🇷 Magnachip Semiconductor: Cheap Valuations, But Headwinds Outweigh The Tailwinds, In The Short-Term (Seeking Alpha) $⛔🗃️

- 🌐 Magnachip Semiconductor Corp (NYSE: MX) – Designer & manufacturer of analog/mixed-signal semiconductor platform solutions. 🏷️

🇰🇷 Grand Korea Leisure’s July casino sales double from a year earlier (GGRAsia)

- Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, reported casino sales of nearly KRW38.99 billion (US$28.1 million) in July, according to a Tuesday update filed to the Korea Exchange.

- The latest monthly tally was up 102.8 percent from a year earlier, and rose 12.0 percent from June.

- In July, table-game sales were KRW35.34 billion, up 113.4 percent year-on-year, and a 11.9-percent increase sequentially.

- Grand Korea Leisure runs three foreigner-only, Seven Luck-branded, casinos. Two are in the capital Seoul, including one at Gangnam. Its third is in the southeastern port city of Busan.

🇰🇷 Paradise Co’s 2Q profit at US$15mln, up 44pct from a year earlier (GGRAsia)

- Paradise Co Ltd (KOSDAQ: 034230), an operator of foreigner-only casinos in South Korea, reported net income attributable to shareholders of KRW20.88 billion (US$15.1 million) for the three months to June 30, a 43.5-percent increase from a year earlier.

- Revenue for the second quarter of 2025 rose by 4.1 percent year-on-year, to KRW284.46 billion, according to a Thursday filing to the Korea Exchange

- The casino firm also said it plans to increase its revenue “by more than 10 percent” annually through to 2027. That is part of its “plan to increase corporate value” for investors – also referred to by Paradise Co as its “Value Up” plan, according to a statement issued by the casino group.

🇰🇷 Design of second casino building, slated for early 2028 opening, revealed by Kangwon Land Inc (GGRAsia)

- Kangwon Land (KRX: 035250) has issued images of its plans for an under-construction new building – including a second casino – at Kangwon Land, the only resort in South Korea with a casino permitted to serve locals. The update mentioned a likely launch for the new facility in early 2028.

- GGRAsia had reported in April that the target date for completion of the second casino structure, was the end of 2027. The firm now says the new building is likely to open in early 2028.

🇰🇷 Ecopro BM: Another Major Rechargeable Battery Play With A Sharp Improvement In Earnings in 2Q 2025 (Douglas Research Insights) $

- Ecopro BM Co Ltd (KOSDAQ: 247540) reported net profit of 34.3 billion won (up 397% YoY and TB YoY in 2Q25). Profits from its Indonesian investment also contributed to earnings, reaching 40.5 billion won.

- The European EV market started to turn around in 2Q 2025 driven by OEM new car launches and customer inventory normalization compared to the end of 2024.

- There are increasing signs of a positive turnaround at Ecopro BM. The company’s excellent results in 2Q 2025 are likely to result in higher earnings revisions by the consensus.

🇰🇷 T’Way Air – Capital Raise Plan of 200 Billion Won (49% of Market Cap) (Douglas Research Insights) $

- On 7 August, T’Way Air (KRX: 091810) announced a large scale capital raise plan worth 200 billion won, representing 49% of its current market cap (409 billion won).

- This capital raise plan will include a third-party allocation worth 110 billion won based on the market price without discount. It will also issue CB/BW worth 90 billion won

- We maintain Negative on T’Way Air. The capital raise of 200 billion won is likely to be dilutive to existing shareholders and its valuations remain high relative to its peers.

🇰🇷 The Kopran Merger: From APIs to Diagnostics, A Blueprint for Healthcare Integration (Douglas Research Insights) $

- Kopran Ltd (NSE: KOPRAN / BOM: 524280) has approved the merger of its diagnostics arm, Kopran Laboratories, aiming to become a fully integrated pharmaceutical and healthcare solutions provider.

- The merger diversifies Kopran’s revenue mix, enhances EBITDA margins with high-value consumables, and unlocks synergies across pharma and diagnostics distribution channels.

- Kopran transitions from a mid-scale exporter to a multi-vertical healthcare platform, with stronger earnings visibility, improved capital efficiency, and potential for valuation re-rating.

🇰🇷 KT&G: Solid Results in 2Q 2025 + Treasury Shares Cancellation of 300 Billion Won (Douglas Research Insights) $

- KT&G reported solid results in 2Q 2025. It had sales of 1.5 trillion won (up 8.7% YoY) and operating profit of 349.9 billion won (up 8.7% YoY).

- KT&G plans to repurchase and cancel 300 billion won worth of treasury stock starting 8 August.

- KT&G continues to have attractive valuation multiples. It is currently trading at P/E of 12.3x, P/B of 1.6x, and EV/EBITDA of 9.4x.

🇰🇷 Tender Offer and Delisting of Kolon Mobility Group by Kolon Corp (Douglas Research Insights) $

- Kolon Corp (KRX: 002020 / 002025) announced that it is conducting a tender offer and delisting of Kolon Mobility Group (450140 KS).

- The tender offer prices are 4,000 won per common share (20.3% higher than current price) and 5,950 won per preferred share (25.3% higher than current price) for Kolon Mobility Group.

- The tender offer prices and stock swap ratios are especially attractive for Kolon Mobility Group shareholders.

🇰🇷 Asian Dividend Gems: Korea District Heating Corp (KDHC) (Asian Dividend Stocks)

- There are three major reasons why we like Korea District Heating Corp (KRX: 071320). First, the company has been sharply improving its shareholder return program (especially for dividends).

- The BOD members of KDHC and other major Korean utility companies are increasingly likely to focus on improving shareholder value by raising prices.

- Its valuations remain attractive. It is trading at P/E of 3.2x, P/B of 0.4x, and EV/EBITDA of 6.8x based on 2025 consensus estimates.

🌏 SE Asia

🇲🇾 The new US 19% tariff only applies to 61% of Malaysian exports to the United States (Murray Hunter)

- The news about Trumps imposition of a 25% tariff on Malaysian goods was portrayed as ‘shock and awe”. Likewise, the government is playing up the lowering of the US tariff to 19% as a great win to the government, in particular prime minister Anwar Ibrahim.

- However, the truth is that only 61% of goods exported to the United States will incur this tariff. Most of Malaysia’s exports to the United States are actually not affected.

- Malaysia’s palm oil, rubber and latex gloves, semiconductors, agricultural commodities like rubber and cocoa, and pharmaceuticals are exempt from the 19% tariff.

- However, Malaysia has now committed USD 240 billion in commercial transactions over the next five years including USD 150 billion in the purchase of US manufactured equipment, USD 19 billion in Boeing aircraft, USD 3.4 billion purchases in LNG, and USD 70 billion investment in the US economy. In addition, Malaysia must eliminate tariffs on US goods on 98.4% of goods coming into Malaysian from the United States.

🇸🇬 Grab: Fierce GMV Growth In All Segments (Seeking Alpha) $⛔🗃️

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 Sea Limited: High Valuation Keeps Me At A Hold (For Now) (Seeking Alpha) $ 🗃️

- 🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Genting Singapore’s market share a record-low 28pct in 2Q but revamp work can boost 2026 EBITDA: analysts (GGRAsia)

- Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY)’s Resorts World Sentosa (RWS) gaming complex in the city-state saw its market share in terms of earnings before interest, taxation, depreciation and amortisation (EBITDA) fall below 30 percent during the second quarter, said banking group JP Morgan.

- The brokerage observed that it was “the first time on record” for Genting Singapore’s share to be below 30 percent, since the opening of casino resorts in the city-state in 2010. Resorts World Sentosa is one of Singapore’s two casino resorts, the other being Marina Bay Sands, promoted by a unit of Las Vegas Sands Corp.

- Such second-quarter 2025 EBITDA share for Resorts World Sentosa was “28 percent, versus 33 percent in the first quarter, or pre-Covid levels of circa 40 percent,” wrote analysts DS Kim, Sigrid Qiu and Selina Li in a Friday note.

- JP Morgan observed that while some of Resorts World Sentosa’s second-quarter “weakness” could be “attributed to the disruptions from non-gaming renovation, etc, it’s surprisingly low if one considers Singapore is supposed to be a ‘duopoly’ market with the similar level of investments and scale.”

🇸🇬 Sheng Siong’s Share Price Achieved a New All-Time High: Can the Retailer Continue to Do Well? (The Smart Investor)

- Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) did even better as its share price surged 28.9% year-to-date, allowing the retailer to attain a new all-time high of S$2.23.

- However, the group’s share price has since declined to S$2.10 because of profit-taking.

- Can investors expect the supermarket operator to continue doing well? Will its share price go on to break new records?

- A solid set of results

- Gross margin continues its climb

- Aggressive store expansion for 2025

- Tailwinds for the business

- Get Smart: On track for further growth

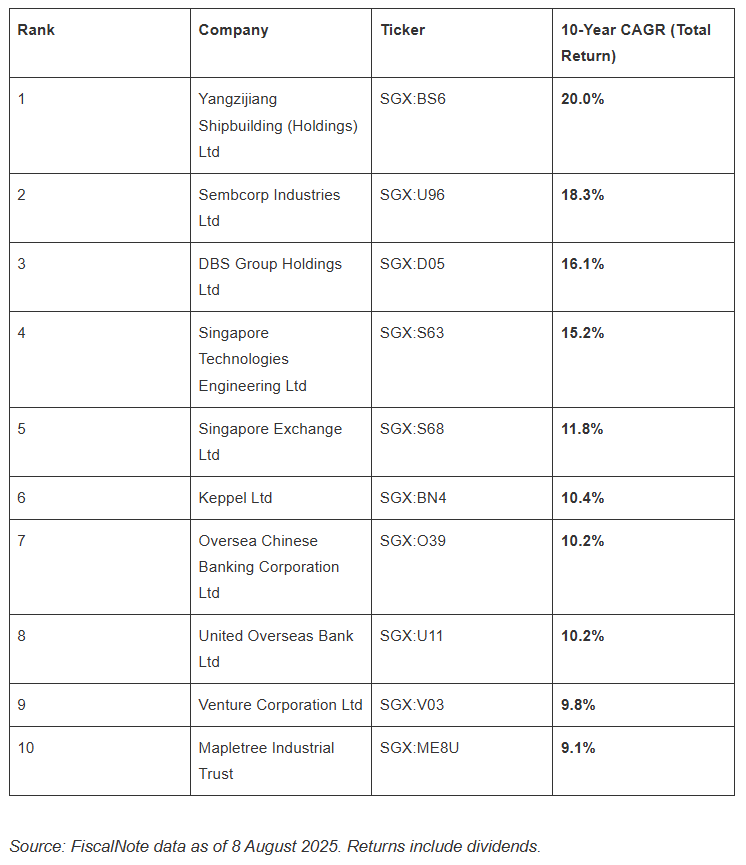

🇸🇬 The Top 10 Singapore Stocks Over the Past Decade — And Which Ones Still Look Good Today (The Smart Investor)

- Over the past decade, the STI delivered a total return of 84%, or 6.3% a year with dividends reinvested. But the index’s best performers did far better, with annualised returns between 9.1% and 20%. Here’s the full list, what they have in common, and which still look attractive today.

🇸🇬 DBS’s Share Price Hits S$50: What’s Next for Singapore’s Largest Bank? (The Smart Investor)

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) recently saw its share price reach a new all-time high, breaking through the S$50 level for the first time.

- Singapore’s largest bank has achieved several milestones in recent years and also won various accolades.

- The group received the “World’s Best Bank” award at the Euromoney Awards for Excellence 2025, marking the third time that the bank has won this award.

- A year ago, the lender became the first Singapore-listed company to achieve S$100 billion in market capitalisation.

- Back in June, DBS once again made headlines as the first local company to surpass US$100 billion in market value, partly aided by a weak US dollar.

- What’s next for the bank, and can it continue to do well?

- A robust set of earnings

- A dividend powerhouse

- Navigating rough seas

- Banks are inherently cyclical

- Get Smart: A robust track record

🇸🇬 Singapore Airlines is Encountering Turbulent Skies: Can the Carrier Recover? (The Smart Investor)

- The airline has seen its share price tumble following a weak set of earnings.

- Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF), or SIA, is flying into stormy skies.

- Singapore’s national carrier saw its share price tumble from its 52-week high of S$7.60 to S$7.04 after it released its first quarter of fiscal 2026 (1Q FY2026) business update.

- Can SIA recover from this fall and soar high again? Read on to find out.

- A mixed financial performance

- Developing its fleet and network

- Advancing on its strategic initiatives

- A bumper bonus for staff

- Get Smart: Cloudy skies ahead

🇸🇬 5 Singapore Stocks Reporting Higher Profits That Could Be Perfect for Your Retirement Portfolio (The Smart Investor)

- Here are five Singapore stocks that announced higher profits during the recent earnings season.

- Soup Holdings (SGX: 5KI / FRA: SR6) operates a chain of restaurant outlets under the name of “Soup Restaurant” in Singapore.

- Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF), or RMG, is an integrated private healthcare provider offering a comprehensive range of services, ranging from primary to tertiary healthcare.

- Indofood Agri Resources Ltd (SGX: 5JS / FRA: ZVF / OTCMKTS: INDFY / IARLF) has a vertically integrated agribusiness model that spans the entire value chain from oilseed breeding, oil palm cultivation, to milling and refining.

- Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) operates one of the largest supermarket chains in Singapore and has 82 outlets around the island as of the end of July 2025.

- Samudera Shipping Line (SGX: S56) is engaged in the transportation of containerised and non-containerised cargo.

🇸🇬 4 Small & Mid-Cap Companies Breaking Their 52-Week Highs: Are They Compelling Buys? (The Smart Investor)

- We highlight four such companies that have broken their 52-week highs to see if they qualify as good investment candidates.

- Tai Sin Electric Ltd (SGX: 500) develops and markets a comprehensive range of electric cables to a diverse range of industries.

- Pasture Holdings Ltd (SGX: UUK) is a global pharmaceutical products and medical supplies, and devices company.

- Combine Will International Holdings Ltd (SGX: N0Z) is an original equipment and design manufacturer of corporate premiums, toys, and consumer products in China, Hong Kong, and Indonesia.

- CSE Global Ltd (SGX: 544 / FRA: XCC / OTCMKTS: CSYJY / CSYJF) provides electrification, communications, and automation solutions across various industries.

🇸🇬 MAS’s S$1.1 Billion Injection into Small & Mid-Cap Companies: Another 5 Singapore Stocks That Stand to Benefit (The Smart Investor)

- We previously wrote about five smaller companies that will benefit from the Monetary Authority of Singapore’s (MAS) S$1.1 billion capital injection to revitalise the Singapore stock market.

- This money has been assigned to three fund managers who will deploy the funds into smaller, neglected stocks.

- We decided to dig around and uncovered five more stocks that we believe will benefit from this massive liquidity injection.

- Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) is a supermarket operator with a total of 82 outlets spread across Singapore as of 30 July 2025, mostly located in the heartland areas.

- ComfortDelGro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY), or CDG, is a multi-model transport operator with an extensive network spanning public transport options such as buses and rail, along with point-to-point options such as taxis and private hire cars.

- Valuetronics Holdings (SGX: BN2 / FRA: GJ7) is a one-stop integrated electronics manufacturing services (EMS) provider offering a full range of services, ranging from conceptualisation to production.

- Marco Polo Marine Ltd (SGX: 5LY / OTCMKTS: MRPMF), or MPM, is an integrated marine logistics company that engages in shipping and shipyard operations.

- LHN Ltd (SGX: 41O / HKG: 1730) is a real estate management services group that generates value for landlords and tenants through its space optimisation expertise.

🇸🇬 Earnings Spotlight: 4 Singapore Blue-Chip Stocks That Grew Their Profits (The Smart Investor)

- During this earnings season, we shine the spotlight on four promising blue-chip companies that managed to increase their profits.

- Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY), or HKL, is a property investment, development, and management group with a mixed-use real estate footprint spanning more than 850,000 square metres.

- DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY) is a leading pan-Asian retailer with over 7,500 outlets and operates popular brands such as 7-Eleven and Guardian Health and Beauty.

- Seatrium Ltd (SGX: SE2 / FRA: S8N / OTCMKTS: SMBMF) provides engineering solutions to the global offshore, marine, and energy industries.

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) is a global asset manager offering solutions spanning the infrastructure, real estate, and connectivity sectors.

🇸🇬 5 Singapore REITs Sporting Dividend Yields of 5.4% or Higher (The Smart Investor)

- We singled out five Singapore REITs with distribution yields of 5.4% or above that you can consider adding to your buy watchlist.

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), or MLT, is a logistics-focused REIT with a portfolio of 178 properties across eight countries.

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF), or MIT, is an industrial REIT with a portfolio of 55 properties in the US, 83 in Singapore, and two in Japan.

- Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF), or DCR, is a data centre REIT with a portfolio of 11 data centres worth US$1.7 billion.

- Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF) owns a portfolio with stakes in Singapore retail and commercial properties such as One Raffles Quay, Suntec City Mall, and Suntec City Convention Centre.

- CapitaLand Ascott Trust (SGX: HMN / OTCMKTS: ATTRF), or CLAS, is a hospitality trust with a portfolio of 101 properties located in 45 cities across 16 countries.

🇮🇳 India / South Asia / Central Asia

🇮🇳 Dr. Reddy’s: Needs To Invest $0.95 To Produce $1 Of New Revenues (Seeking Alpha) $⛔🗃️

- 🌐 Dr. Reddy’s Laboratories Limited (NYSE: RDY) – Manufactures & markets a wide range of pharmaceuticals. 🇼

🇮🇳 All You Need to Know About Anil Ambani’s 17000Cr Loan Fraud Case (Smartkarma) $

- Anil Ambani is being investigated by the ED for a massive INR 17,000 crore loan fraud case involving Reliance Group companies.

- The case centers on allegations of fund diversion and financial irregularities related to loans from a consortium of nearly 20 public and private banks.

- The investigation is being conducted under the PMLA, which involves even arrest and a parallel probe by SEBI into alleged fund diversion by Reliance Infrastructure Ltd (NSE: RELINFRA / BOM: 500390).

🇮🇳 PG Electroplast: KMP Selling and Lowering Guidance (Smartkarma) $ (Smartkarma) $

- [Electronics Manufacturing Services] PG Electroplast Ltd (NSE: PGEL / BOM: 533581) is under limelight after the management cut its revenue guidance from 33% to 21-23%, within a single quarter.

- The management has also flagged concerns regarding RAC demand which has affected performance.

- Additionally, between Feb–Jun 2025, relatives of the CFO sold ~INR 376 mn worth of shares, mostly in June, shortly before the guidance cut, raising potential governance concerns.

🇮🇳 Case Study: Time-Based Exit in Two Long-Running Pair Trades (Smartkarma) $

Canara Bank (NSE: CANBK / BOM: 532483)

- Context: This Insight is an update on two previously published relative value pairs.

- Highlight: The trades provide a case study illustrating how mean-reversion trades can fail to revert or hit stop-losses within extended timeframes.

- Why Read: Gain insights into timing-related challenges in mean-reversion strategies and time-based exit as a risk management choice.

🇮🇳 UCO Bank (UCO IN) Vs. Central Bank Of India (CBOI IN): Statistical Edge in India Bank Pair Trade (Smartkarma) $

- Context: The UCO Bank (NSE: UCOBANK / BOM: 532505) vs. Central Bank of India Ltd (NSE: CENTRALBK / BOM: 532885) price-ratio has deviated two standard deviations from its one-year average, presenting a potential relative value opportunity.

- Highlights: Both stocks are trading near 52-week lows, opening a window for a statistically supported mean-reversion setup.

- Why Read: Essential for quantitative traders seeking mean-reversion opportunities, with detailed execution framework, risk management protocols, and historical simulation showing the statistical basis for this relative value play.

🇮🇳 India’s IT services groups race to reinvent themselves for AI age (FT) $ 🗃️

- Outsourcing sector struggles to adjust as clients shift budgets to artificial intelligence projects

🇰🇿 Kaspi’s Business Continues To Grow Despite Inflation Woes (Seeking Alpha) $ 🗃️

- 🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🌍 Middle East

🇦🇪 NWTN Inc.: Reflexivity Risks Abound With Capital Raising Needed (Seeking Alpha) $⛔🗃️

- 🇦🇪 🇨🇳 🇺🇸 NWTN Inc (NASDAQ: NWTN) – Smart passenger vehicle company. Passenger-centric mobility & green energy solutions.

🌍 Africa

🇿🇦 Harmony Gold Mining: The Copper Pivot Isn’t Enough For A Buy, Yet (Seeking Alpha) $⛔🗃️

- 🇿🇦 🇦🇺 🇵🇬 Harmony Gold Mining Company Limited (JSE: HAR / NYSE: HMY) – Global gold mining & exploration + significant copper footprint. 🇼

🌎 Latin America

🌎 Latin America has a former president problem (Latin America Risk Report)

- Too many former presidents in prison. Too many former presidents challenging the current political situation. And those lists overlap.

🌎 MercadoLibre Q2: Sacrificing Margins For Growth (Seeking Alpha) $ 🗃️

🌎 MercadoLibre’s Accelerating Growth Flywheel Triggers Double-Digit Upside Potential (Seeking Alpha) $⛔🗃️

🌎 MercadoLibre: Incrementally Bullish After Strong Earnings Report (Seeking Alpha) $⛔🗃️

🌎 MercadoLibre: Lessons Learned From The Q3-24 Profitability Blip (Seeking Alpha) $⛔🗃️

🌎 MercadoLibre: Spectacular Growth, Margin Pressure, And Long-Term Opportunity (Seeking Alpha) $⛔🗃️

- 🌎 MercadoLibre (NASDAQ: MELI) – Uruguay HQ’d. The largest online commerce & payments ecosystem in Latin America. 🇼 🏷️

🇦🇷 Vista Energy Reported a Transformational Second Quarter in 2025. (Smartkarma) $

- Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA) reported a transformational second quarter in 2025.

- The company’s acquisition of a 50% stake in La Amarga Chica has significantly expanded its production capacity, making it the largest independent oil producer and exporter in Argentina.

- In Q2 2025, Vista reported a substantial increase in total production, which reached 118,000 barrels of oil equivalent (boe) per day, reflecting an 81% year-over-year growth.

🇧🇷 BrasilAgro: Tariffs Winner With Market-Leading Margins And Dividend Yields (Seeking Alpha) $ 🗃️

- 🇧🇷 Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3 / FRA: 52BA) – One of Brazil’s largest companies in terms of arable land. Acquisition, development, operation & sale of rural properties suitable for agricultural activities. IRSA (NYSE: IRS) has a stake. 🏷️

🇧🇷 Why Nu Holdings Remains A Buy Amid Brazil’s Economic Uncertainty (Seeking Alpha) $⛔🗃️

🇧🇷 Nu Holdings: Q2 Could Be Its Turning Point (Seeking Alpha) $⛔🗃️

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

🇧🇷 Braskem: On The Edge (Seeking Alpha) $ 🗃️

- 🌐🅿️ Braskem SA (NYSE: BAK / BVMF: BRKM3 / BRKM5 / BRKM6) – Largest petrochemical company in Latin America. Controlled by Novonor (Odebrecht SA). 🇼 🏷️

🇧🇷 BB Seguridade Q2: Sustained Pressure Slows Near-Term Growth (Seeking Alpha) $⛔🗃️

- 🇧🇷🏛️ BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY) – Insurance, pension plans & bonds. Subs. of Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY).

🇧🇷 Telefônica Brasil Surpasses Adversity And Reports Great Q2 Result (Rating Upgrade) (Seeking Alpha) $⛔🗃️

- 🇧🇷 Telefônica Brasil S.A. (NYSE: VIV) – Fixed line, mobile, data, pay TV, IT, etc. services. Subs. of Telefonica SA (NYSE: TEF). 🇼

🇧🇷 Ambev: Healthy Brewing Leader With A Generous Dividend (Seeking Alpha) $⛔🗃️

- 🌎 Ambev (NYSE: ABEV) – Brazilian brewing company now merged into Anheuser-Busch Inbev SA (NYSE: BUD). 🇼

🇧🇷 BHP and Vale offered $1.4bn to settle Brazil mining dam lawsuit (FT) $ 🗃️

- Companies proposed resolution ahead of ruling in class action

🇧🇷 Vale Q2: Better Than Expected (Seeking Alpha) $ 🗃️

- 🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 StoneCo: Focused And Disciplined, Trading At A Discount, With EPS Growing Fast (Seeking Alpha) $⛔🗃️

- 🇧🇷 StoneCo Ltd (NASDAQ: STNE) 🇰🇾 – Fintech. Financial technology & software solutions to merchants for eCommerce.

🇨🇱 Banco de Chile’s Valuation Is Not Attractive Into A Cyclical Top (Seeking Alpha) $ 🗃️

- 🌎 Banco de Chile (NYSE: BCH) – Range of financial services. 🇼

🇨🇱 Embotelladora Andina Is Recovering And Fairly Valued (Seeking Alpha) $⛔🗃️

- 🌎 Embotelladora Andina Sa (NYSE: AKO.A / AKO.B) – Produces, markets, & distributes Coca-Cola trademark beverages in Chile, Brazil, Argentina, & Paraguay. 🇼 🏷️

🇨🇱 Banco Santander Chile Is Fully Priced In A Cyclical Top In Credit (Seeking Alpha) $⛔🗃️

- 🇨🇱 Banco Santander-Chile (NYSE: BSAC) – Part of the Santander group & majority controlled by Santander Spain. The largest bank in Chile by loans & the second largest by deposits. 🇼 🏷️

🌐 Global

🌐 Nebius: Rising Cloud Superpower (Seeking Alpha) $🗃️

🌐 Nebius Likely Hit Peak GPU Capacity (Rating Downgrade) (Seeking Alpha) $⛔🗃️

🌐 Nebius Delivers Excellent Revenue Growth, But Can It Sustain The Momentum? (Rating Upgrade) (Seeking Alpha) $ 🗃️

🌐 Nebius Surges After Booming Q2 Results And I’m Staying Long (Seeking Alpha) $ 🗃️

🌐 Nebius: New All-Time Highs In Sight (Seeking Alpha) $⛔🗃️

🌐 Nebius Group: The New AI Champion (Seeking Alpha) $ 🗃️

🌐 Nebius Group: The Post-Earnings Surge Is Just The Ignition Sequence (Seeking Alpha) $ 🗃️

🌐 Nebius Q2 Earnings: Growth Rates Matter (Seeking Alpha) $⛔🗃️

🌐 Nebius: Updated Thesis And Key Expectations Ahead Of Q2 2025 (Seeking Alpha) $⛔🗃️

🌐 Nebius Group Stock Hits My Target, But I’m Still Bullish (Seeking Alpha) $⛔🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

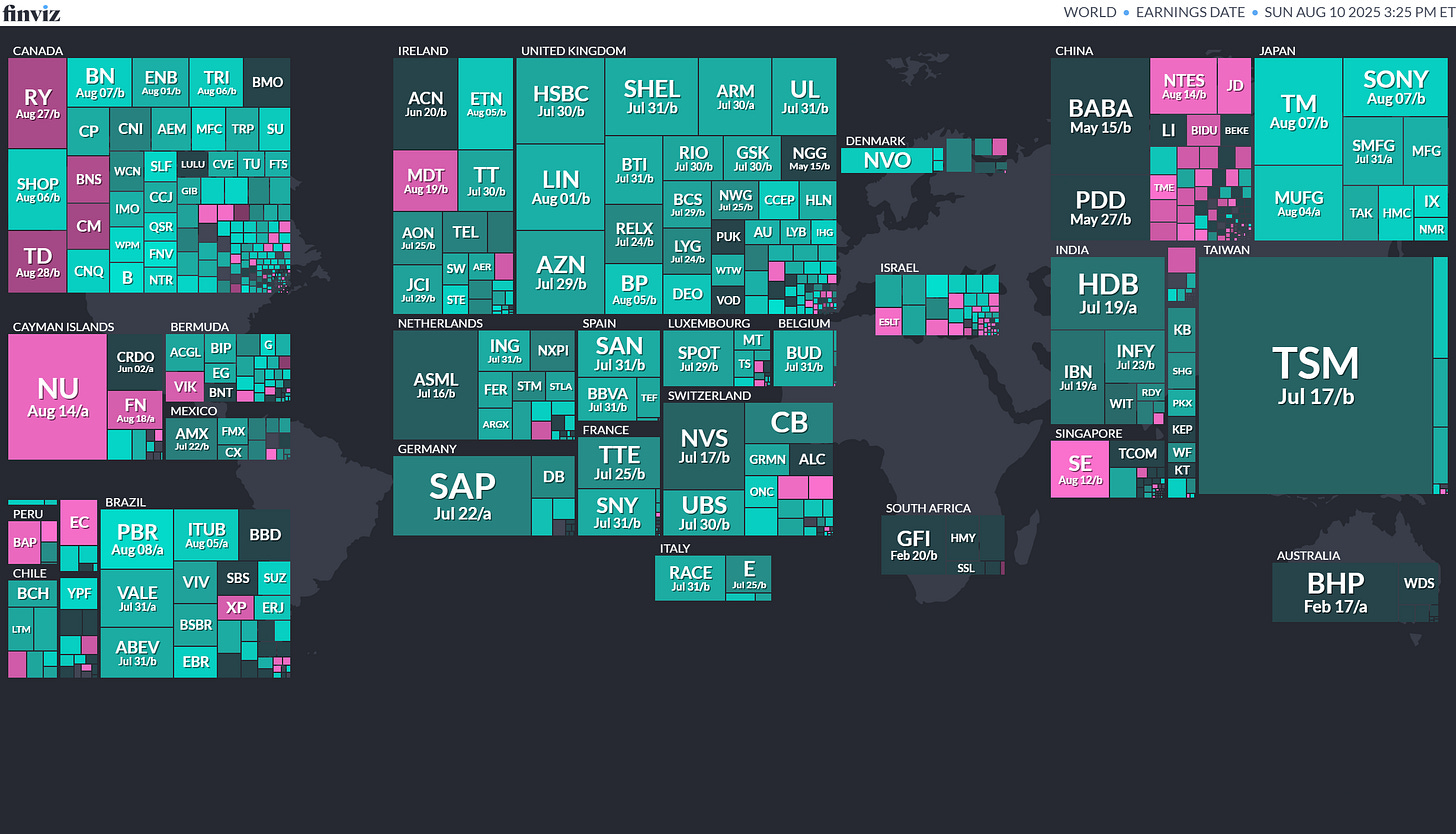

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

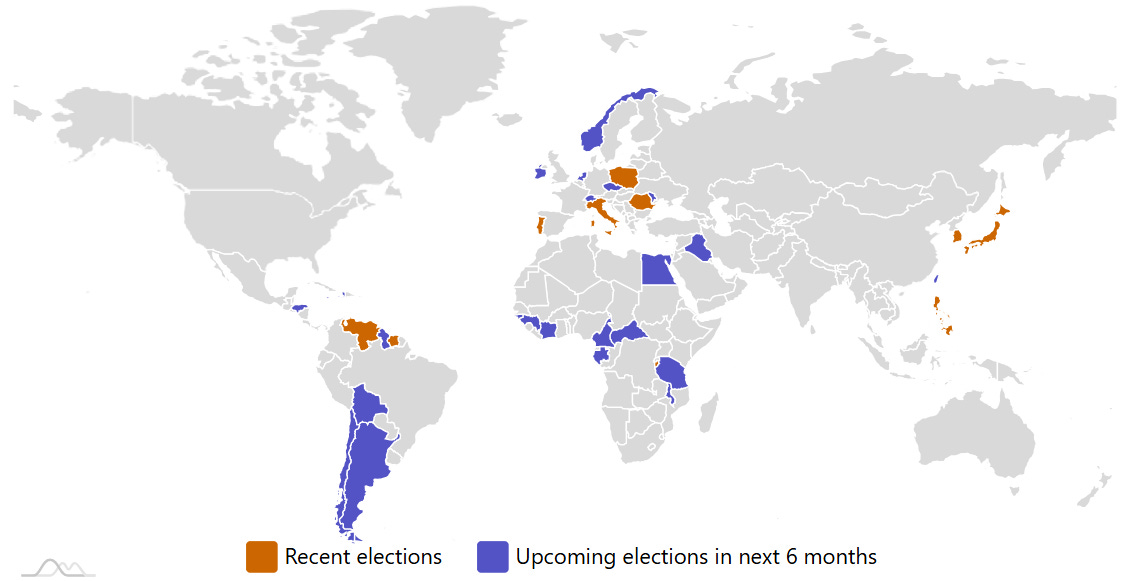

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Taiwan Referendum 2025-08-23 (d) Confirmed 2022-11-26

- Egypt Egyptian Senate 2025-08-27 (t) Date not confirmed 2025-08-04

- Macau Chinese Legislative Council (Macau) 2025-09-14 (d) Confirmed 2021-09-12

- Czech Republic Czech Chamber of Deputies 2025-10-03 (d) Confirmed 2021-10-08

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

- Argentina Argentinian Chamber of Deputies 2025-10-26 (d) Confirmed 2023-10-22

- Argentina Argentinian Senate 2025-10-26 (d) Confirmed 2023-10-22

- Iraq Iraqi Council of Representatives 2025-11-11 (d) Confirmed 2021-10-10

- Chile Chilean Chamber of Deputies 2025-11-16 (d) Confirmed 2021-11-21

- Chile Chilean Presidency 2025-11-16 (d) Confirmed 2021-12-19

- Chile Chilean Senate 2025-11-16 (d) Confirmed 2021-11-21

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

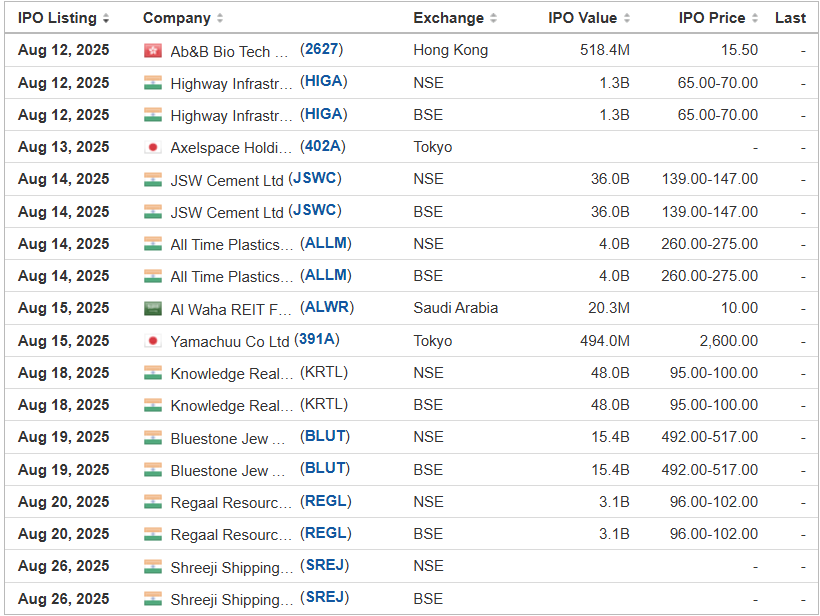

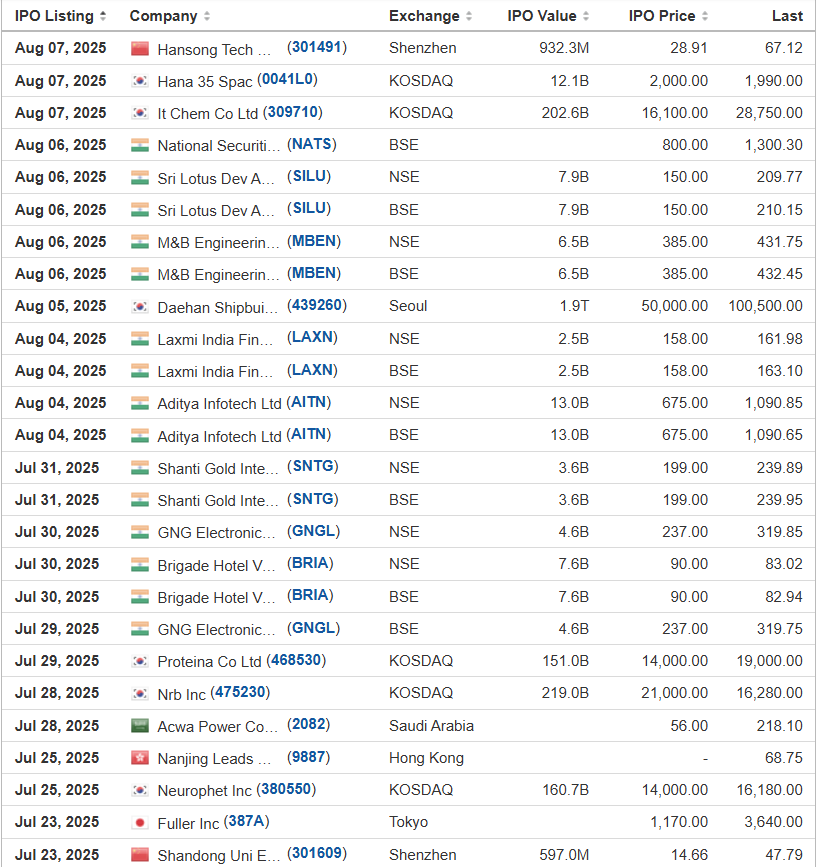

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

BUUU Group Limited BUUU Dominari Securities/Pacific Century Securities/Revere Securities, 1.5M Shares, $4.00-6.00, $7.5 mil, 8/11/2025 Week of

(Incorporated in the British Virgin Islands)

Established in 2017, we have rapidly grown into a premier Meetings, Incentives, Conferences, and Exhibitions (“MICE”) solutions provider based in Hong Kong. Our comprehensive marketing service portfolio is designed to meet the diverse needs of our clients, spanning across two core areas: (i) event management and (ii) stage production.

(a) Event management services

In the realm of event management, our operating subsidiary, BU Creation, excels as creative planners and meticulous executors. We curate and manage a wide spectrum of events, including cultural, artistic, recreational, and corporate promotions. Our approach is deeply collaborative, and we work closely with our clients to bring their visions to life. From the initial concept to the final execution, we ensure every detail is aligned with our clients’ objectives, delivering events that resonate and captivate audiences. In addition, we have collaborated with event production houses to co-host various remarkable events in Hong Kong. Notable examples include the S2O Songkran Music Festival Hong Kong, the Spartan Race Hong Kong, and the Grade 10 Asia Card Show Hong Kong.

Under our event management services, BU Creation directly engages in (i) design and planning, (ii) project management, and (iii) on-site supervision.

Our revenue derived from event management services represents approximately 77.9% and 77.5%, and 80.5% and 72.2% of our total revenue for the six months ended December 31, 2024. and December 31, 2023, and the years ended June 30, 2024, and June 30, 2023, respectively.

(b) Stage production services

Our expertise in stage production lies in our ability to transform spaces into immersive experiences. Our operating subsidiary, BU Workshop, meticulously coordinates with suppliers to integrate advanced lighting, visual and audio systems, stage performance elements and venue decorations. Our goal is to create environments that not only engage but also leave a lasting impression, elevating the impact of every event we manage.

Under our stage production services, BU Workshop directly manages the entire production process, from stage management and technical direction to the fabrication and installation of set elements. The lighting and visual and audio systems involved are sourced from its suppliers.

Our revenue derived from stage production services represents approximately 22.1% and 22.5%, and 19.5% and 27.8% of our total revenue for the six months ended December 31, 2024, and December 31, 2023, and the years ended June 30, 2024, and June 30, 023, respectively.

Our diverse clientele includes public institutions, marketing and public relations firms, real estate corporations, and a number of established brands. This broad customer base reflects our ability to deliver customized solutions that meet the high standards of various sectors.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: BUUU Group Limited is offering 1.5 million shares at a price range of $4.00 to $6.00 to raise $7.5 million, if priced at the $5.00 mid-point of its range, according to its SEC filings.)

ELC Group Holdings Ltd. ELCG D. Boral Capital (ex-EF Hutton), 1.3M Shares, $4.00-6.00, $6.3 mil, 8/11/2025 Week of

(Incorporated in the Cayman Islands)

We are a manpower service provider based in Singapore. Manpower service providers (“MSP”) serve as a bridge between job seekers and businesses to meet each other’s recruitment needs. Typically, MSPs create a platform whereby employers can list job opportunities and recruit individuals looking to secure full, temporary or part-time employment meeting their respective criteria. For companies, MSPs assist the recruitment process to meet particular staffing needs, saving companies time, money, and effort. For job seekers, MSPs help them find an appropriate job matching their skill sets as quickly as possible, and exposing them to more opportunities through their vast network.

Our customers fall into a wide range of industries, including warehouse and logistics, food and beverage, cleaning, manufacturing, retail and events. To provide better service to our customers, we pay close attention to the changing needs of our customers, including new developments in their respective industries, which helps us anticipate the specific roles and skills that they will need. We believe this attention to detail gives us a significant competitive advantage and improves customer loyalty.

We have developed a proprietary platform which connects job seekers and employers through a unique matching program utilizing specific character and skill recognition matrices. Our platform operates a comprehensive database that records the skill preferences and requisite applicant characteristics of our business customers and job criteria of job seekers, thereby reducing reliance on subjective human analysis which can be extremely time consuming and inefficient. While many MSPs offer similar services, we believe our model is more specifically focused on our customers’ individual criteria, therefore we tend to deliver a more tailored approach, rather than providing a one-size-fits-all service.

Job Seekers – We believe we stand out to job seekers in two important ways: (i) we have developed a mobile app to enable clients real-time access to the data and therefore opportunities, and (ii) we are the first manpower provision company operating with an app platform in Singapore that is compensating part-time workers on the very same day they finish their jobs.

We have artificial intelligence (“AI”) technology integrated into our “EL Connect App” to create a positive user-friendly experience for part-time job seekers.

Employers – For employers, in addition to the EL Connect App, we have also developed our “Taskforce App.” Our TaskForce App is a smart platform to digitalize building and property operations management. Our TaskForce App integrates internet of things (“IoT”) sensors, facial recognition systems and robotics into facilities and workforce management in buildings and properties. TaskForce App bridges the gap between the employees of our customers, such as site supervisors who oversee property management, and contractors or crews of our customers, who perform individual duties and tasks, addressing inefficiencies in traditional and paper-based processes of property management. Our TaskForce App seeks to achieve optimal performance and productivity for our customers by enabling their employees to have real-time monitoring of facilities and workforce management and providing them instant access to a variety of information ranging from attendance records of contractors or crews to real-time usage of consumable supplies in a facility. This has become an invaluable tool to our customers which has prompted us to monetize its application by opening it up to customer subscriptions and licensing, which we expect will become a growing revenue stream.

We derive our revenue primarily from the following sources: (i) manpower supply services – which provides part-time manpower to customers on our employment and recruitment portal “EL Connect Mobile”; (ii) manpower contracting services – which provides cleaners for cleaning services; (iii) software as a service (“SaaS”) sales, which grants users the right to access our “Taskforce” app; (iv) software licensing sales, which grants clients the right to use the Taskforce app customized to their specific requests (updates and maintenance included); and (v) project management services.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended June 30, 2024.

(Note: ELC Group Holdings Ltd. disclosed the terms for its small IPO – 1.25 million shares at a price range of $4.00 to $6.00 – to raise $6.25 million, if priced at the $5.00 mid-point of its range, according to an F-1/A filing dated June 27, 2025. Background: ELC Group Holdings Ltd. filed its F-1 on March 4, 2025.)

Nasus Pharma Ltd. NSRX Laidlaw & Company (UK)/Craft Capital Management, 1.3M Shares, $8.00-10.00, $11.3 mil, 8/11/2025 Week of

(Incorporated in Israel)

We are a clinical-stage specialty pharmaceutical company focused primarily on the development of intranasal drugs to treat severe allergies and emergency medical conditions such as anaphylaxis. Intranasal administration is especially suitable for medical emergencies when prompt drug administration is critical, since the nose is lined up with a very rich vascular bed enabling quick drug absorption.

We are developing NS002, an intranasal powder epinephrine nasal spray to treat Type 1 severe allergies and anaphylaxis. We plan to conduct two Phase 2 trials of NS002.

We are also developing NS001, an intranasal naloxone powder nasal spray to treat opioid overdose. We intend to search for partnership opportunities to continue developing this product.

Note: Net loss and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: Nasus Pharma Ltd. increased its IPO’s size – to 1.25 million shares – up from 1.0 million shares initially – and cut the price range to $8.00 to $10.00 – down from $10.00 to $12.00 originally – to raise $11.25 million, if priced at the $9.00 mid-point of its new range. Background: Nasus Pharma filed its F-1 for its small-cap IPO on July 8, 2025, and disclosed the terms – 1 million shares at a price range of $10.00 to $12.00 – to raise $11.0 million, if priced at the mid-point of its range.)

Hang Feng Technology Innovation Co., Ltd. FOFO Kingswood, 1.4M Shares, $4.00-4.00, $5.5 mil, 8/18/2025 Week of

(Incorporated in the Cayman Islands)

We are committed to providing comprehensive corporate management consulting and asset management services, tailored to address the specific needs of each client. Our goal is to empower our clients to design, implement, and achieve their unique business and investment objectives.

Incorporated as an exempted company with limited liability in the Cayman Islands on October 15, 2024, we operate as a holding company with no material operations. Since 2023, we have been identifying market opportunities and offering consulting services through Starchain to a growing network of clients. Through the corporate management consulting practice, Starchain built strong relationships with clients, advising them on operational and strategic challenges. This privileged access has revealed a recurring need for sophisticated asset management solutions, tailored for both corporate and personal capital and the struggle to find trusted partners. Recognizing this gap, our management team strategically refined our business strategy to include a complementary asset management arm. Starting in 2024, we began offering asset management services through HF CM, HF IAM and HF Fund SPC.

As of the date of this prospectus, all our business activities are conducted through our direct and indirect wholly owned subsidiaries. Our business consists of two main segments: (i) corporate management consulting services and (ii) asset management services.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended Dec. 31, 2024.

(Note: Hang Feng Technology Innovation Co., Ltd. is offering 1.375 million shares at an assumed IPO price of $4.00 to raise $5.5 million, according to its F-1/A filing dated July 25, 2025.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 04/02/2025 – Goldman Sachs India Equity ETF – GIND

- 03/21/2025 – FT Vest Emerging Markets Buffer ETF – March – TMAR

- 02/25/2025 – Touchstone Sands Capital Emerging Markets ex-China Growth ETF – TEMX

- 02/19/2025 – abrdn Emerging Markets Dividend Active ETF – AGEM

- 02/14/2025 – GMO Beyond China ETF – BCHI

- 02/06/2025 – PLUS Korea Defense Industry Index ETF – KDEF

- 01/04/2025 – Simplify China A Shares PLUS Income ETF – CAS

- 12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

- 11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

- 11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

- 11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

- 10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

- 09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

- 09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

- 09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

- 09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

- 09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

- 09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

- 08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

- 08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

- 07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

- 05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

- 05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

- 03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

- 03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

- 03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

- 02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

- 01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

- 01/10/2024 – Matthews China Discovery Active ETF – MCHS – Active, equity, small caps

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 02/14/2025 – Global X MSCI Emerging Markets Covered Call ETF – EMCC

- 01/06/2025 – iShares Frontier and Select – FM

- 10/10/2024 – Pacer CSOP FTSE China A 50 ETF – AFTY

- 09/26/2024 – American Century Emerging Markets Bond ETF – AEMB

- 09/19/2024 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF – KDIV

- 09/19/2024 – KraneShares CICC China 5G & Semiconductor Index ETF – KFVG

- 09/05/2024 – Amplify Emerging Markets FinTech ETF – EMFQ

- 07/27/2024 – iPath GEMS Asia 8 ETN – AYTEF

- 05/23/2024 – Defiance Israel Fixed Income ETF – CHAI

- 05/17/2024 – Global X Next Emerging & Frontier ETF – EMFM

- 03/25/2024 – Global X MSCI Nigeria ETF – NGE

- 03/21/2024 – VanEck Egypt Index ETF – EGPT

- 03/14/2024 – KraneShares Bloomberg China Bond Inclusion Index ETF – KBND

- 03/14/2024 – KraneShares China Innovation ETF – KGRO

- 03/14/2024 – KraneShares CICC China Consumer Leaders Index ETF – KBUY

- 03/13/2024 – Xtrackers MSCI All China Equity ETF – CN

- 03/13/2024 – Xtrackers MSCI China A Inclusion Equity ETF – ASHX

- 02/16/2024 – Global X MSCI China Real Estate ETF – CHIH

- 02/16/2024 – Global X MSCI China Biotech Innovation ETF – CHB

- 02/16/2024 – Global X MSCI China Utilities ETF – CHIU

- 02/16/2024 – Global X MSCI Pakistan ETF – PAK

- 02/16/2024 – Global X MSCI China Materials ETF – CHIM

- 02/16/2024 – Global X MSCI China Health Care ETF – CHIH

- 02/16/2024 – Global X MSCI China Financials ETF – CHIX

- 02/16/2024 – Global X MSCI China Information Technology ETF – CHIK

- 02/16/2024 – Global X MSCI China Consumer Staples ETF – CHIS

- 02/16/2024 – Global X MSCI China Industrials ETF – CHII

- 02/16/2024 – Global X MSCI China Energy ETF – CHIE

- 02/14/2024 – BNY Mellon Sustainable Global Emerging Markets ETF – BKES

- 01/26/2024 – The WisdomTree Emerging Markets ESG Fund – RESE

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (August 11, 2025) was also published on our Substack.

Frontier & Emerging Market Stock Index

Emerging Market Skeptic (Website)

Stocktwits @EmergingMarketSkptc

Similar Posts:

- China Internet Update (KraneShares)

- Housebound Consumers Lift Lenovo to Record Revenues & Profits (HKEXnews)

- Johnson & Johnson vs Abbott Laboratories in Emerging Markets (TheStreet)

- Why Tencent’s Golden Share Arrangements Could Be Worse for Investors Than Alibaba’s (China Tech Shorts)

- Best Consumer Stocks for Emerging Market Investors (Morningstar)

- EM Fund Stock Picks & Country Commentaries (June 8, 2025)

- Russia’s Mechel to Dump US and Other Assets to Focus on Asia (MT)

- Global Smartphone Shipments to Reach 1.2Bn This Year on Emerging Market Strength (Juniper Research)

- US-Chinese Business Partnerships Are Thriving (Kraneshares)

- Water Tech Stock Xylem Inc Wants More Revenue from Emerging Markets (Bloomberg)

- Emerging Market Links + The Week Ahead (May 29, 2023)

- New UPS CEO Will Focus on Emerging Markets (FT / Reuters)

- Income Ideas From Emerging Markets (Institutional Investor)

- Investing in South Korea ADRs / South Korean Stocks List

- Emerging Market Links + The Week Ahead (January 16, 2023)