A ZeroHedge piece has pointed out the problem faced by many investors in emerging markets and in particular China:

🇨🇳 Chinese Savers Have $23 Trillion And Few Options (ZeroHedge) $ 🗃️

Chinese households are tiptoeing back into equities, driven in part by a stark reality: Almost nothing else looks worth buying.

The piece went on to note that the nation’s four biggest banks offer returns of around 1.3% for five-year savings accounts, bonds are not doing much better, and many families already own another property…

And unlike in many other countries, the Chinese face capital controls that prevents laundering money investing abroad:

Chinese investors have in past years made bets on other markets, including finding ways to get exposure to the Magnificent Seven technology stocks in the US. But capital controls are a big hurdle. Local investors aren’t permitted to convert more than $50,000 into foreign currencies each year, and funds that offer access to foreign markets are subject to their own quotas.

The Asset has also noted that China insurers boost Q2 equity market in stabilization move 🗃️. In other words, Chinese stocks are going to go higher – regardless of company fundamentals or China’s economy…

Again, this Substack has a growing index of 🇨🇳 China (337), 🇭🇰 Hong Kong (92) and 🇲🇴 Macau (11) stocks to help you find the better ones should you decide to allocate some money to these markets:

China, Hong Kong & Macau Stock Index

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🇨🇳 🇭🇰 China & Hong Kong Stock Picks (July-August 2025) Partially $

- China’s great stock market experiment & the politics behind China’s overcapacity + Chinese/Hong Kong stock picks

- 🇨🇳 China – Sany Heavy Equipment International Holdings, Zhongji Innolight, DPC Dash, Giant Biogene Holding, Baozun, Trip.com, Innovent Biologics, Li Auto, SenseTime, Sinotruk (Hong Kong), Akeso, Haidilao International Holding, Anta Sports, Intron Tech, Meituan, CR MixC Lifestyle, Ping An Insurance, China MeiDong Auto Holdings, Jinmao Property Services, BOE Varitronix, Luxshare Precision Industry, Green Tea Group, Henlius Biotech, Angelalign Technology, Ke Holdings, EHang Holdings, China Yongda Automobile Services Holding, ZhongAn Online P & C Insurance Co, Jiangsu Hengli Hydraulic, BaTeLab, Jiumaojiu International Holdings, Tongda Group Holdings Ltd, PDD Holdings, Greentown Service Group, Poly Property Services Co Ltd, RoboSense Technology, Binjiang Service, Li Ning, CSPC Pharmaceutical, Maxscend Microelectronics, Bilibili, TK Group, SANY Heavy Industry, Aac Technologies Holdings, Xunfei Healthcare Technology, Tuhu Car, Kuaishou Technology, iQIYI, Guoquan Food Shanghai Co Ltd, Sichuan Kelun-Biotech Biopharmaceutical, WuXi Biologics, Baidu, Kanzhun Limited, China Hongqiao, Haitian International, Pop Mart International Group Ltd, ZTO Express, Xiaomi, Hansoh Pharmaceutical Group Company, Onewo, Yancoal Australia, Xpeng Inc., Xtep, Zhejiang Leapmotor Technology Co Ltd, Tongcheng Travel, NetEase Cloud Music, Weibo, China Lilang, NetEase, JD.com, Geely Automobile Holdings, Dmall Inc, 361 Degrees International Limited, Beijing Geekplus Technology Co Ltd, Foxconn Interconnect Technology (FIT Hon Teng), Tencent, Tencent Music Entertainment Group, Kingdee International Software Group, Q Technology (Group) Company, Hua Hong Semiconductor, Hutchmed, Uni-President China Holdings Ltd, BeOne Medicines (BeiGene), Yum China, China Tower, Sino Biopharmaceutical Ltd, Luckin Coffee, New Oriental Education, WuXi AppTec, Zhejiang Dingli Machinery, Mixue Group, CGN Mining, Shengyi Technology, Alibaba, J&T Global Express Ltd & LK Technology Holdings

- 🇭🇰 Hong Kong – KLN Logistics Group Limited, China Overseas Land & Investment Ltd, BOC Hong Kong Holdings Ltd, Sino Land Co Ltd, Regal Real Estate Investment Trust, Prudential PLC, China Overseas Grand Oceans Group Ltd, Nissin Foods Co Ltd, Hong Kong and China Gas Co Ltd, Wing Tai Properties Ltd, K. Wah International Holdings Ltd, Henderson Land Development Co Ltd, Hong Kong Exchanges and Clearing Ltd, Stella International Holdings Ltd, AIA Group Ltd, VSTECS Holdings, Kerry Properties Ltd, DFI Retail Group Holdings Ltd, Champion Real Estate Investment Trust, CITIC Telecom International Holdings Ltd, Prosperity Real Estate Investment Trust, CK Asset Holdings Ltd, Hysan Development Co Ltd, SF Real Estate Investment Trust, CK Infrastructure Holdings Ltd, Link Real Estate Investment Trust, Wharf Holdings Ltd, Langham Hospitality Investments Ltd, WH Group Ltd, Cathay Pacific Airways Ltd, Galaxy Entertainment Group Ltd, HK Electric Investments Ltd, Sunlight Real Estate Investment Trust, Luk Fook Holdings International Ltd, Swire Properties Ltd, Wharf Real Estate Investment Company Ltd, Sun Hung Kai Properties Ltd, Techtronic Industries, Fortune Real Estate Investment Trust, CLP Holdings Ltd, Hang Seng Bank Ltd, Budweiser Brewing Company APAC Ltd, Hang Lung Properties Ltd, Prada SpA, Hongkong Land Holdings Ltd, Sands China Ltd, Hutchison Port Holdings Trust, ASMPT Ltd & CSI Properties Ltd

- CMB International Capital Corporation’s 20+ high conviction stock ideas: Geely Automobile, Zhejiang Leapmotor Technology Co Ltd, Xpeng Inc., Zoomlion Heavy Industry, Sany Heavy Equipment International Holdings, Green Tea Group, CGN Mining, JNBY Design, Luckin Coffee, Proya Cosmetics, China Resources Beverage Holdings (CR Beverage), BeOne Medicines (BeiGene), 3SBio Inc, Innovent Biologics, AIA Group Ltd, PICC Property and Casualty Co Ltd, Tencent, Alibaba,, Trip.com, Greentown Service Group, Xiaomi, Aac Technologies Holdings, BYD Electronic International, Horizon Robotics, OmniVision Integrated Circuits Group (Will Semiconductor Co Ltd), BaTeLab, Naura Technology Group & Salesforce

- 🌐 EM Fund Stock Picks & Country Commentaries (September 21, 2025) Partially $

- Destructive competition in China (“involution”), quotes from non-oil commodity executives on China, rising small & midcap India stocks, convenience stores/pizza stock bets, August fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 How to avoid value traps in Asia (Asian Century Stocks)

- 8 rules for better performance.

- Value traps are stocks that look cheap but end up delivering poor returns.

- The main reasons why stocks end up being value traps include hoarding cash, having obsolescent products, selling commodity products in a market with excess supply, related party transactions, aggressive accounting, industry cyclicality, high debt and government interference.

- Cash hoarding is the most common in East Asian market such as Japan and South Korea, while in emerging Asia, the issue is more often complex corporate structure where the owner abuses minorities.

- But in any case, I suggest going through my list to make sure all risk are considered.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Chinese Savers Have $23 Trillion And Few Options (ZeroHedge) $ 🗃️

- Chinese households are tiptoeing back into equities, driven in part by a stark reality: Almost nothing else looks worth buying.

- The CSI 300 Index has surged more than 25% since its April lows, fueled by enthusiasm over artificial intelligence and Donald Trump’s softer rhetoric on China. But other asset classes — from wealth management products to money-market funds — remain stuck in a years-long slump.

- That’s reviving an old bull market mantra: there is no alternative to stocks. The idea that China’s small investors will shift a chunk of their $23 trillion savings pile to the stock market is a tantalizing one for global firms, who are showing signs of returning after years on the sidelines.

- “The pressure to save is fading,” said William Bratton, head of cash equity research in Asia Pacific at BNP Paribas Exane. The huge savings pool is one reason his firm is “structurally positive” on China’s stock market, he said.

- So far, retail investors haven’t driven the rally — local institutions and foreign inflows have, according to Goldman Sachs. But small investors are central to the bull case. JPMorgan sees about $350 billion of additional savings flowing into stocks by the end of 2026.

- Here are some of the other places Chinese investors could put their money — and why they probably won’t want to.

🇨🇳 China insurers boost Q2 equity market in stabilization move (The Asset) 🗃️

- Regulatory push drives trillion-yuan surge, but liquidity concerns loom

- Insurance companies in China have demonstrated their support for the domestic equity market in the second quarter of 2025 by pouring trillions of yuan into it, all with an eye to strengthening and stabilizing it at the urging of financial regulators.

- In Q2, Chinese insurers poured a total of 4.73 trillion yuan ( US$663 billion ) into stocks and securities investment funds, according to the data compiled by the National Financial Regulatory Administration ( NFRA ), up a quarter from the same period in 2024.

- Deepening their bet on the equity market, life insurers expanded the equity portfolio by almost half in Q2 compared with the same period last year, rising to approximately 3 trillion yuan; as well, property insurers boosted their equity allocation by 43% to 196 billion yuan. The share of equity investment by both types of insurers, NFRA data show, edged up beyond 8%.

🇨🇳 China’s Food Delivery War: Meituan, Alibaba, JD, and the Physics of Scale (The Great Wall Street) $

- Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY), Alibaba (NYSE: BABA), and JD.com (NASDAQ: JD / SGX: HJDD) are burning billions in China’s instant retail battle — but scale, density, and cross-selling will decide who survives.

- If you want the short version of China’s instant retail war so far, it goes like this:

- Meituan ruled. JD pulled the moral card. Alibaba said, “hold my beer,” and lit the voucher fuse.

- The result so far: three companies bleeding cash, one very entertained consumer base (free coffee, free drinks, thank you very much), and headlines reduced to a single lazy line: “everyone’s losing money.”

- In this article, I’ll go deeper — into the mechanics, the ecosystem plays, and the cracks that don’t make the press releases.

🇨🇳 Tencent Cloud Shuns Price War in Intensifying AI Race (Caixin) $

- Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY)’s Cloud unit said Tuesday that it will not join a price war in China’s increasingly competitive artificial intelligence (AI) cloud market, betting instead on sustainable growth and global expansion.

- Speaking at the Tencent Global Digital Ecosystem Summit, Li Qiang, Tencent Vice President and President of Enterprise Business, warned that price-driven competition has historically eroded profits across industries, from ride-hailing to smartphones to electric vehicles.

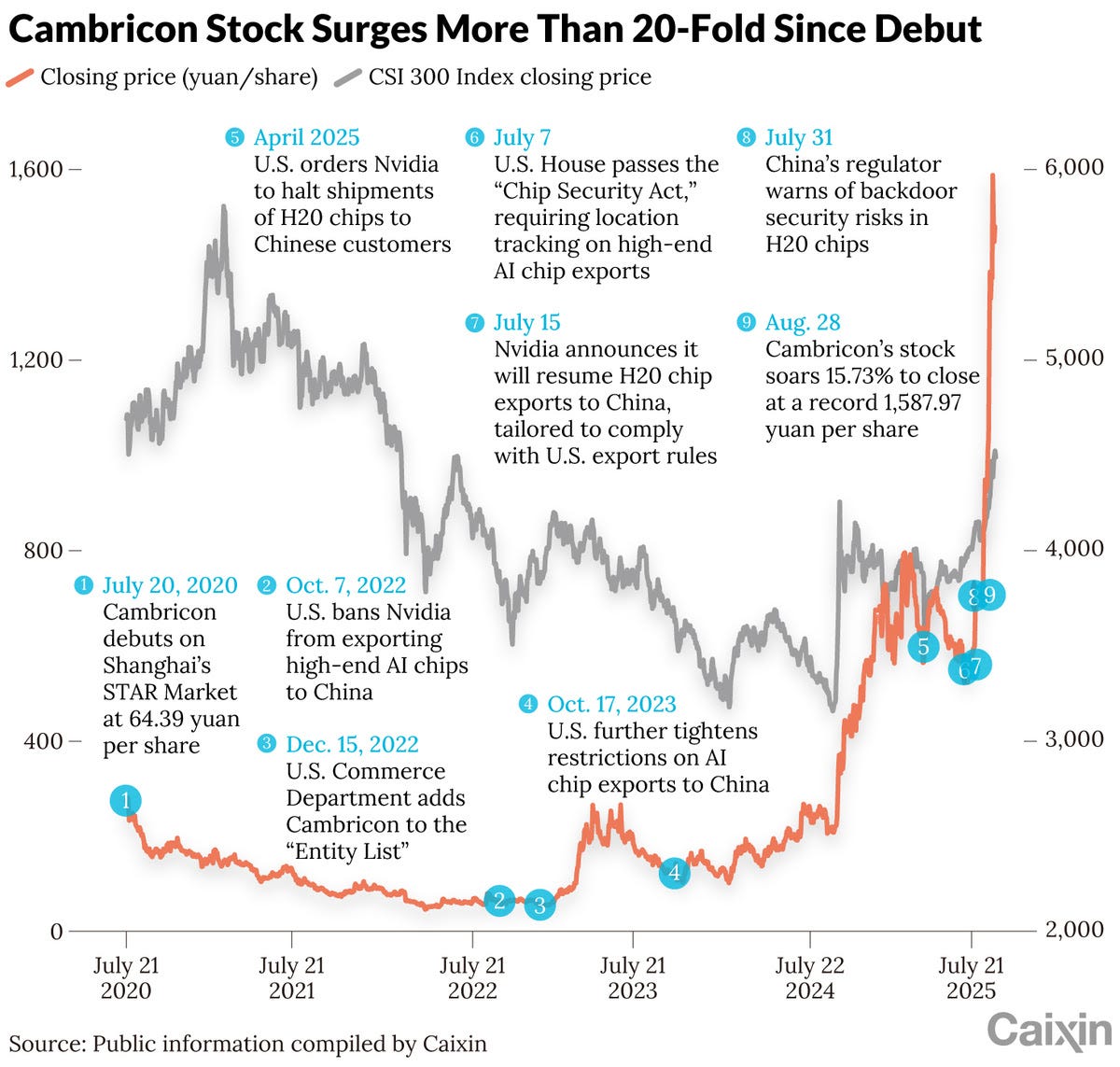

🇨🇳 In Depth: Cambricon’s Meteoric Rise Collides With Harsh Reality Check (Caixin) $

- Chinese artificial intelligence (AI) chipmaker Cambricon Technologies Corp (SHA: 688256) briefly claimed the title of the most expensive stock on the Chinese mainland on Aug. 28, capping a stunning rally fueled by investor fervor around Beijing’s push for semiconductor self-sufficiency.

- Shares in Cambricon soared 15.73% that day to close at a record 1,587.91 yuan ($222.32) per share, lifting it a market capitalization to as much as 660 billion yuan. The company overtook liquor giant Kweichow Moutai (SHA: 600519) as the priciest stock in mainland market before it pulled back. The stock traded down as low as 1,202 yuan in the following week amid a broader market correction but has since rebounded to around 1,400 yuan.

🇨🇳 Longsys nears Hong Kong listing with key regulatory green light (Bamboo Works)

- The maker of memory devices has been cleared for a second IPO in Hong Kong to complement its current Shenzhen listing

- Shenzhen Longsys Electronics Co Ltd (SHE: 301308) looks like a relatively safe bet as it nears a planned Hong Kong IPO due to its low-tech positioning in China’s memory product sector

- The company’s revenue growth improved notably in the second quarter after weakness at the start of the year, as global memory prices stabilized and began to rise

🇨🇳 Flowing Cloud taps investors for more cash as metaverse halo disappears (Bamboo Works)

- The marketing services provider, once billed as Hong Kong’s ‘first metaverse stock,’ plans to raise about $10 million through a share placement to ease its financial pressure

- Flowing Cloud Technology Ltd (HKG: 6610 / OTCMKTS: FWCTF) plans to raise $10 million through a share placement, after reporting it lost 120 million yuan in the first half of 2025 as its core marketing services revenue fell 33%

- The share sale marks the company’s second placement in four months, as its cash reserves fell to just 21 million yuan by the end of June

🇨🇳 iHuman’s international drive hops ahead with Cricket Media tie-up (Bamboo Works)

- The edutech company’s new alliance with a U.S. children’s media brand with more than a half century of history looks more promising than its earlier global expansion efforts

- iHuman Inc (NYSE: IH) has formed a new partnership with U.S. children’s publisher Cricket Media, aiming to boost its three-year-old globalization drive

- The new partnership could help return the edutech company to revenue growth, following two years of declines amid sluggish demand in its home China market

🇨🇳 BYD hits tariff roadblock after ramping up Mexico sales (Bamboo Work)

- The Mexican government’s plans to raise tariffs on Chinese-made cars to 50% could stall BYD [BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF)] ’s growth engine in the North American market

- The Chinese car maker supplies nearly half of all electric vehicles sold in Mexico

- BYD has shelved plans to build a factory in Mexico and is much more exposed to higher import tariffs than its U.S. rival Tesla

🇨🇳 BYD (1211 HK) Tactical Outlook: Rally or Bear Rally? (Smartkarma) $

- In our previous insight from September 2 we suggested if BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) reached 102 could have been a good BUY signal.

- It took a bit more than a couple of week for the stock to bottom at 102.80 (this week), then rally 10% to 113.50. Impressive, but….

- … it could be a Bear rally, so in this insight we will try to assess BYD upside potential, and suggest some tactical positioning for the next few weeks.

🇨🇳 XPeng Partners With Magna to Build EVs in Europe (Caixin) $

- Chinese electric-vehicle maker XPeng (NYSE: XPEV) has begun localized production in Europe through a partnership with automotive manufacturer Magna Steyr, a strategic pivot as Chinese carmakers navigate mounting trade barriers in the region.

- XPeng announced Monday that production of its G6 and G9 sport-utility models began in the third quarter at Magna’s facility in Austria. The first batch of Europe-built XPeng vehicles has already rolled off the production line. The company said the plant will later add sedans and additional SUV models to its European portfolio.

🇨🇳 Chery Automobile IPO (9973 HK): Valuation Insights (Smartkarma) $

- Chery Automobile Co Ltd (HKG: 9973) is a Chinese automobile manufacturer. It has launched an HKEx IPO to raise up to US$1.2 billion.

- I previously discussed the IPO in Chery Automobile IPO: The Bull Case and Chery Automobile IPO: The Bear Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price range is reasonable.

🇨🇳 Chery Auto IPO Valuation Analysis (Douglas Research Insights) $

- Chery Automobile Co Ltd (HKG: 9973) [Bullish]

- Our base case valuation of Chery Auto is target price of HKD 40.6 which is 32% higher than the high end of the IPO price range.

- Our base case valuation is based on EV/EBITDA of 5.9x our estimated EBITDA of 37.1 billion RMB in 2026. Our target multiple is 30% premium to the comps’ average multiple.

- We have chosen to use a premium valuation multiple mainly due to Chery Auto’s higher ROE, sales growth, and net margins vs the comps.

🇨🇳 Shenyang city ups offer for Shengjing Bank to end its misery as a listed company (Bamboo Works)

- A local government entity is trying to privatize the lender, which is reeling from the aftermath of troubles surrounding its former owner, China Evergrande Group

- A government entity from the city of Shenyang has raised its buyout offer by about 20% to privatize Shengjing Bank Co Ltd (HKG: 2066 / FRA: 6SY)

- The bank has been dealing with a double blow from China’s weak economy and the collapse of its former controlling shareholder, property giant China Evergrande

🇨🇳 Shengjing Bank (2066 HK): Minimum Acceptance Condition in Focus as Offer Opens (Smartkarma) $

- On 12 September, Shenyang SASAC increased its Shengjing Bank Co Ltd (HKG: 2066 / FRA: 6SY) offer by 21.2% from HK$1.32 to HK$1.60. The IFA opines it is fair and reasonable.

- The revised terms should ensure the support of key shareholders. However, the IFA analysis is flawed, and the revised offer is light.

- While the 21 October vote on the delisting proposal should pass, the satisfaction of the minimum acceptance condition (90% of independent H shares) poses a challenge.

🇨🇳 Exclusive: Chinese Banks Guided to Help Clear SOE Arrears to Private Firms (Caixin) $

- Major Chinese banks are being guided to issue loans to local government-linked entities so they can pay off some of the vast arrears they owe private businesses, Caixin learned from people with knowledge of the matter.

- However, banking insiders have raised concerns that rules aiming to curtail hidden government debt and the weak financial state of some of the debtors may limit lending.

🇨🇳 Jinke Smart Services (9666 HK): Boyu’s Unconditional Offer Set to Open (Smartkarma) $

- On 19 September, Boyu completed the auction share transfer to take its [residential property, enterprise, and other services] Jinke Smart Services Group Co Ltd (HKG: 9666) shareholding to 55.91% of outstanding shares.

- Pursuant to Rule 26.1 of the Takeovers Code, Boyu is required to make a mandatory unconditional general offer at HK$6.67. The offer should open by 26 September.

- The offer price is unattractive, suggesting a low chance of breaching the public float requirements (23.4% of outstanding shares). At the last close, the gross/annualised spread is 0.9%/10.0%.

🇨🇳 In Depth: China’s Travelers Return, but Their Spending Stays Home (Caixin) $

- A record number of travelers swarmed China’s train stations and airports over the summer, yet this surge in traffic concealed a now-familiar post-pandemic paradox: while the crowds returned, their spending did not.

- In July and August, a record 943 million passenger trips were taken on China’s railways, up 4.7% year-on-year, according to China State Railway Group Co. Ltd. The civil aviation authority reported a total of 147 million trips, setting an all-time daily record of nearly 2.6 million on Aug. 15.

🇨🇳 361 Degrees sprints ahead of retail rivals with stablecoin exploration (Bamboo Works)

- The sportswear seller announced it is researching the potential for accepting stablecoins as payment as Hong Kong experiments with the cryptocurrency type

- 361 Degrees International Limited (HKG: 1361 / FRA: 36L / OTCMKTS: TSIOF) announced it is exploring the potential of accepting stablecoin payments outside of Mainland China, where cryptocurrencies are banned

- The sportswear maker highlighted that such payments can streamline operations and cut its transaction costs

🇭🇰 Health & Happiness (H&H 1112HK): After the Pain, Is It Finally Time for Gain? (Smartkarma) $

- After sinking to 10-year lows in January, Health and Happiness (H&H) International Holdings Limited (HKG: 1112 / FRA: 8BI / OTCMKTS: BTSDF)’s stock has rebounded more than 75%, raising the question of whether operations are finally turning the corner.

- With signs of stabilizing growth and improving returns across product categories, 1H2025 results seem to signal the end of years of investor agony.

- Nutritional supplements now contribute to 65% of H&H’s revenue – Swisse’s strong positioning in the fast-growing anti-aging category underpins future growth.

🇭🇰 Chow Tai Fook (1929 HK): Strong Rally, Weak Jewellery Demand. Growth Risks. (Smartkarma) $

- China gold jewelry demand slumped in 2Q2025, while investment demand for coins and bars remained resilient amidst rise in gold prices, according to data released by China Gold Association.

- If gold rally continues, Chow Tai Fook Jewelry Group (HKG: 1929 / FRA: 1CT / OTCMKTS: CJEWY / CJEWF) faces heightened demand growth risk due to reliance on the competitive, price-sensitive, consumption-driven jewellery segment.

- Chow Tai Fook’s 140% YTD rally reflects optimism on branding-driven earnings growth, but stretched valuations overlook downside risks to growth if gold prices keep rising.

🇭🇰 🇮🇩 Jardine unit moves into gold mining with US$540 million deal (The Asset) 🗃️

- ASA holds licence for Doup Block in North Sulawesi with 3.1 million ounces of gold

- Singapore-listed Jardine Cycle & Carriage (SGX: C07 / FRA: CYC), through its indirect subsidiaries under United Tractors Tbk PT (IDX: UNTR / FRA: UTY), has proposed to acquire PT Arafura Surya Alam ( ASA ), initiating a step into Indonesia’s gold mining sector.

- The deal, structured through UT’s subsidiaries PT Danusa Tambang Nusantara ( DTN ) and PT Energia Prima Nusantara ( EPN ), involves the purchase of nearly 100% equity interest in ASA from PT J Resources Nusantara and Jimmy Budiarto, for an enterprise value of US$540 million.

🇭🇰 Prudential: An Underrated Buy Case For Asia’s Bullish Prospects (Seeking Alpha) $ 🗃️

- 🌏🌍 Prudential PLC (NYSE: PUK / LON: PRU) 🇬🇧 – Life & health insurance & asset management. 18 million customers across 24 markets in Asia & Africa. London & Hong Kong HQ’d. 🇼 🏷️

🇲🇴 Macau gaming 2024 gross surplus up 25pct y-on-y to US$18bln, but overall expenses up 18pct: govt (GGRAsia)

- The Macau gaming sector’s gross surplus before taxes in 2024 rose 24.7 percent year-on-year to MOP143.12 billion (US$17.87 billion), though the overall cost of doing business also went up in the same period, and by 18.0 percent.

- Nonetheless, the improvement in gross surplus came amid a “gradual recovery” in gaming business, according to the Statistics and Census Service’s latest annual “Gaming Sector Survey” published on Wednesday.

🇲🇴 ‘Significant’ 1H dip in detected illicit forex activity, thanks to new law and police crackdown: Macau security boss (GGRAsia)

- Macau saw “significant” year-on-year decrease in the number of people detected for unlicensed money trading for gambling purposes in the first-half. That was thanks to the recently-created crime category of unlicensed foreign exchange for gaming purposes, and joint enforcement action against that crime by police in Macau and on the Chinese mainland. That is according Wong Sio Chak, Macau’s Secretary for Security, speaking at a Friday briefing for the media.

- Mr Wong was giving a summary of overall Macau crime trends for the opening six months this year.

- In the period, Macau police investigated 410 individuals allegedly engaged in unlicensed gaming-related money exchange business. The figure was down 81.5 percent year-on-year, said Mr Wong.

🇹🇼 Taiwan

🇹🇼 United Microelectronics: Cyclicality, Structure, And Dividends Assessed (Seeking Alpha) $ 🗃️

- 🌐 United Microelectronics Corp (TPE: 2303 / NYSE: UMC) – Global semiconductor foundry. 🇼 🏷️

🇹🇼 TSMC Rallies: Still Too Cheap For Such Relentless Value Creation (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Winning Quietly As AI Titans Battle (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 Himax Technologies: Emerging Display Technologies Are A Potential Game Changer (Seeking Alpha) $ 🗃️

- 🌐 Himax Technologies (NASDAQ: HIMX) 🇰🇾 – Fabless semiconductor company providing display imaging processing technologies. 🇼

🇰🇷 Korea

🇰🇷 Shinhan Financial: A Buy On Positive Macropolitical Developments And Valuation (Seeking Alpha) $ 🗃️

- 🌐 Shinhan Financial Group (NYSE: SHG / KRX: 055550) – 6 segments: Banking, Credit Card, Securities, Life Insurance, Credit & Others. Merchant bank with 200 global channels & 15 subs.. 🇼 🏷️

🇰🇷 Korea Electric Power: Bullish On Nuclear, Favorable Tariff Expectations (Seeking Alpha) $ 🗃️

- 🇰🇷 KEPCO (NYSE: KEP / KRX: 015760 / FRA: KOP) or Korea Electric Power Corporation – Integrated electric utility company. Generation, transmission & distribution of electricity in Korea where it’s the largest electric utility. 🇼 🏷️

🇰🇷 SK Innovation’s Subsidiary SK Geo Centric to Sell Its Entire 35% Stake in Sinopec-SK Petrochem JV (Douglas Research Insights) $

- SK Innovation (KRX: 096770 / 096775) [Bearish]

- On 16 September, it was reported in the local media that SK Innovation‘s subsidiary SK Geo Centric plans to sell its entire 35% stake in the Sinopec-SK Petrochem JV.

- The transaction is expected to be priced closed to its book value of about 819 billion won. Sinopec is a leading potential buyer.

- From 2020 to 2024, SK Geo Centric generated cumulative operating profit of 695 billion won, accounting for 12.7% of SK Innovation’s cumulative operating profit in this period.

🇰🇷 HMM: Results of the Tender Offer (Douglas Research Insights) $

- On 17 September, HMM (KRX: 011200) [formerly Hyundai Merchant Marine] announced the results of the tender offer.

- Its two largest shareholders (Korea Development Bank – KDB and Korea Ocean Business Corp – KOBC) both participated in the tender offer.

- With end of the tender offer, we believe there could be a renewed focus on the continued decline in the global shipping rates which is negative on HMM.

🇰🇷 EQT Partners – To Acquire a Controlling Stake In Douzone Bizon & A Tender Offer of Minority Shares? (Douglas Research Insights) $

- Douzone Bizon (KRX: 012510) [Bullish]

- It was reported in Seoul Economic Daily today that EQT Partners is close to acquiring a controlling stake (31.4%) in Douzone Bizon (012510 KS).

- A 31.4% stake of Douzone is now worth 0.91 trillion won (with no premium or discount).

- Douzone’s chairman Kim has demanded up to twice the market cap of the company for the management rights premium.

🇰🇷 Korea Small Cap Gem #45: Genic (Douglas Research Insights) $

- Genic Co Ltd (KOSDAQ: 123330) [Bullish]

- Genic is a turnaround story. Genic is one of the largest ODM companies that make beauty face masks in Korea.

- Genic is one of the biggest suppliers of hydrogel based face masks of the Biodance brand which has been experiencing an excellent demand in global markets, including the United States.

- Despite surging growth in sales and profits, valuation multiples remain reasonable. It is trading at EV/EBITDA of 12.7x and P/E of 14.2x, based on recent prices and LTM financials.

🇰🇷 Myungin Pharmaceutical IPO Bookbuilding Analysis (Douglas Research Insights) $

- Myungin Pharm [Bullish]

- Myungin Pharm’s IPO price has been confirmed at 58,000 won, which is at the high end of the IPO price range.

- A total of 2,028 domestic and foreign institutional investors participated in the IPO demand forecast. The demand ratio was 488.9 to 1.

- Our base case valuation of Myungin Pharm is market cap of 1.2 trillion won, and target price of 80,349 won per share, which is 39% higher than the IPO price.

🌏 SE Asia

🇰🇭 Higher-margin side bet games pushing up win rates at NagaWorld: chairman (GGRAsia)

- Philip Lee Wai Tuck, chairman of Cambodian casino operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF), attributed the improved performance in terms of gross gaming revenue (GGR) in the first half of 2025 to a “steady increase” in the mass-market tables segment, particularly boosted by “higher-margin side bet games”. The company reported in August GGR of nearly US$332.3 million, up 17.2 percent from a year earlier.

- The Hong Kong-listed company reported a net profit of US$148.8 million for the period, on group-wide revenue that grew 16.8 percent year-on-year, to about US$341.8 million.

- “Our positive results were attributed to continued growth in all operational segments, producing an upward, stable trajectory in revenue, net profit and EBITDA,” said Mr Lee in a statement included in the company’s interim report, published on Thursday.

🇵🇭 DigiPlus looking at ‘potential acquisitions’ but doesn’t tie to media reports City of Dreams Manila is a target (GGRAsia)

- Philippines online gaming specialist DigiPlus Interactive (PSE: PLUS) said in a Friday letter to the Philippine Stock Exchange the firm “continues to evaluate potential acquisitions” with “no definitive agreements or plans” finalised currently.

- The communication followed an article in the news outlet Bilyonaryo titled: ‘From bingo to online gaming to casino? DigiPlus eyes buyout of billionaire Lawrence Ho’s stake in City of Dreams Manila.’

- The Philippine bourse had sent a letter on Friday to DigiPlus, seeking clarification on the report, stated DigiPlus. The firm’s reply did not mention either City of Dreams Manila or Lawrence Ho Yau Lung, the chairman and chief executive of the property’s current operator, Melco Resorts & Entertainment Ltd (NASDAQ: MLCO).

🇸🇬 Grab: The Everything App That’s Dominating Southeast Asia (Seeking Alpha) $ 🗃️

🇸🇬 Grab Has Done A Lot Of Heavy Lifting, But High Valuation Merits A Hold (Seeking Alpha) $ 🗃️

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 Is CapitaLand Integrated Commercial Trust Ready to Shine as Rates Fall? (The Smart Investor)

- After three years of higher interest rates, could Singapore’s largest REIT see better days ahead?

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) is Singapore’s largest real estate investment trust (REIT) with a portfolio of prime retail and office assets in the commercial sector.

- Despite rising financing costs, CICT has continued to show resilience.

- With the Fed expected to cut rates in September 2025, could CICT be poised for a stronger run?

- Why CICT has held up well

- Why lower rates could be a catalyst for CICT’s growth

- Risks and challenges

- What this means for investors

- Get Smart: Is CICT on track?

🇸🇬 Beyond the STI: 3 Cash-Rich Singapore Stocks with Dividend Yields of 4% or more (The Smart Investor)

- Take a step outside the STI circle, and you will find that there are cash-rich companies which are more than capable of sustaining a dividend.

- That is our focus for today as we look at 3 cash-rich Singapore dividend powerhouses offering 4% yield, or more.

- As Singapore’s largest bus and rail operator, SBS Transit (SGX: S61) boasts a strong balance sheet with S$340.8 million in cash and no debt as of 30 June 2025.

- Vicom Ltd (SGX: WJP), which stands for “Vehicle Inspection Company”, is a leading provider of vehicle inspection and technical testing services in Singapore.

- Food Empire (SGX: F03) differs from VICOM and SBS Transit in that, unlike the latter two, it has debt.

🇸🇬 Beyond the Blue Chips: SGX’s Next 50 Indices Open Doors for Mid-Cap Opportunities (The Smart Investor)

- The newly launched iEdge Singapore Next 50 indices have returned a little more than 20% as of the end of August, outpacing the Straits Times Index‘s (SGX: ^STI) 17.4% gain.

- The iEdge Singapore Next 50 Indices track the next 50 largest companies on SGX Mainboard after excluding the top 30 by market capitalisation – ensuring no overlap with STI constituents.

- Six companies command the maximum 5% weighting in the iEdge Singapore Next 50 market cap-weighted index, namely NetLink NBN Trust (SGX: CJLU / OTCMKTS: NETLF), Yangzijiang Financial Holding Ltd (SGX: YF8 / OTCMKTS: YNGFF), Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF), Keppel REIT (SGX: K71U / OTCMKTS: KREVF), ComfortDelGro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY), and CapitaLand Ascott Trust (SGX: HMN / OTCMKTS: ATTRF) or CLAS.

- In terms of market cap, Suntec REIT and Olam Group Ltd (SGX: VC2 / FRA: K25 / OTCMKTS: OLGPF) stand above the rest, valued at S$3.9 billion each, representing the largest companies in the mix.

- Next, for the iEdge Singapore Next 50 Liquidity Weighted Index, there are four main companies with the maximum 5% weighting.

- They are Yangzijiang Financial Holding Ltd (SGX: YF8 / OTCMKTS: YNGFF), ComfortDelGro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY), iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF), and recent IPO debutant NTT DC REIT (SGX: NTDU).

- Like the STI, the two indices also have their own reserve list with the trio of Banyan Tree Holdings (SGX: B58 / FRA: 1O7 / OTCMKTS: BYNEF), AEM Holdings (SGX: AWX), and Q&M Dental (SGX: QC7), at the forefront, vying to be part of the next 50 list in the future.

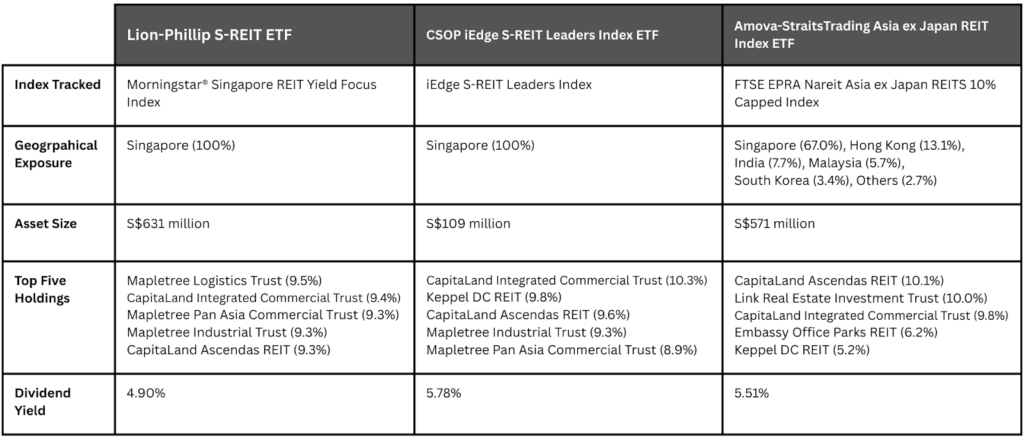

🇸🇬 Falling Interest Rates: Riding the REIT-covery with S-REIT ETF? (The Smart Investor)

- With the softening of interest rate, investing in Singapore REIT ETF could be a viable option.

- For instance, taking a stake in Lion-Phillip S-REIT ETF (SGX: CLR) will give you access to 18 high quality S-REITs screened by Morningstar, across seven sectors including industrial, office, and retail.

- Being the first S-REIT ETF listed on Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY), Lion-Phillip S-REIT ETF (SGX: CLR) is also the largest, with a fund size of S$631 million.

- The other two REIT ETFs with majority of their holdings consisting of S-REITs are CSOP iEdge S-REIT Leaders Index ETF (SGX: SRT) and Amova-StraitsTrading Asia ex Japan REIT Index ETF (SGX: CFA), or Amova-STC AREIT.

- For example, Parkway Life Real Estate Investment Trust (SGX: C2PU), a healthcare S-REIT which has grown its core distribution per unit (DPU) for 17 years since its listing, takes up only about 2% to 3% of these S-REIT ETFs.

🇸🇬 3 Undervalued Stocks Hiding in a Market at Record Levels (The Smart Investor)

- Amidst the record-level noise, three established Singapore-listed companies present a compelling case of undervaluation.

- Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY) is a property investment, management and development group with prime assets in Hong Kong, Singapore, and China.

- Property and hospitality group, UOL Group Limited (SGX: U14 / FRA: U1O / OTCMKTS: UOLGY / UOLGF), owns a diversified portfolio of properties worldwide, including commercial and residential developments.

- With over 1000 manufacturing plants worldwide, Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY) is one of Asia’s largest agribusiness groups.

🇸🇬 4 Blue-Chip Stocks to Watch as the STI Hits Record Levels (The Smart Investor)

- Four blue-chip stocks stand out even as the STI hovers above 4,300.

- DBS: Can its Outperformance Continue?

- SATS Ltd: Ready For Takeoff?

- Genting Singapore: Cashing in on Tourism Recovery

- Shares of Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) are relatively unchanged YTD.

- Singtel: Riding the AI Wave with Data Centres

🇸🇬 3 REITs Offering Yields Above 6% Even at Today’s Highs (The Smart Investor)

- Worried that the market has peaked? Here are three REITs still offering dividend yields above 6%.

- Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF) focuses on logistics and commercial properties, spanning across different developed markets such as Singapore, Australia and the United Kingdom.

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF) is an industrial-focused REIT with exposure to the data centres segment as well as high-specification properties.

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF) is a pan-Asian logistics REIT with a portfolio spanning across Singapore, China, Japan, South Korea, India, Vietnam, Malaysia, and Australia.

🇸🇬 4 Singapore REITs Carrying Out Acquisitions to Boost Their Distributions (The Smart Investor)

- These four REITs look set to boost their DPUs and should be on income investors’ radars.

- Here are four Singapore REITs that have recently carried out such acquisitions, promising higher distributions for investors.

- CapitaLand Ascott Trust (SGX: HMN / OTCMKTS: ATTRF), or CLAS, is Asia-Pacific’s largest lodging trust with total assets of S$8.8 billion as of 30 June 2025.

- AIMS APAC REIT (SGX: O5RU / OTCMKTS: ACIRF), or AAREIT, is an industrial REIT with a portfolio of 27 properties, 24 of which are in Singapore and the remaining three in Australia.

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), or CICT, is a retail and commercial REIT with a total of 26 properties across Singapore (21), Germany (2), and Australia (3).

- United Hampshire US REIT (SGX: ODBU / OTCMKTS: UNHRF), or UHREIT, owns a diversified portfolio of grocery-anchored and necessity-based retail properties and self-storage properties.

🇸🇬 4 Reliable Singapore REITs That You Can Buy and Keep for Your Retirement (The Smart Investor)

- These four Singapore REITs rank high on reliability and dependability.

- Here are four dependable Singapore REITs that you can own for life.

- Parkway Life Real Estate Investment Trust (SGX: C2PU), or PLife REIT, is a healthcare REIT that owns a diversified portfolio of 75 properties worth S$2.46 billion.

- CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF), or CLAR for short, is Singapore’s oldest and largest industrial REIT with a portfolio of 229 properties.

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) is a data centre REIT with a portfolio of 24 data centres across 10 countries.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF), or FCT, is a retail REIT with a portfolio of nine Singapore suburban retail malls and an office building.

🇸🇬 Centurion Accommodation REIT’s IPO: 6 Key Things Investors Must Know (The Smart Investor)

Centurion Corporation Ltd (SGX: OU8)

- Centurion Accommodation REIT (CAREIT) will be the first pure-play living accommodation REIT to list on the Singapore Exchange.

- Centurion Accommodation REIT (CAREIT) doesn’t offer shopping malls or office towers.

- Instead, it’s carved out a distinctive niche as the first pure-play, purpose-built living accommodation REIT to list on the Singapore Exchange (SGX).

- What exactly does that mean for dividend investors?

- 1. CAREIT’s Starting Portfolio

- The REIT focuses on two specific asset classes that fly under most investors’ radars: Purpose-Built Worker Accommodation (PBWA) in Singapore and Purpose-Built Student Accommodation (PBSA) across the United Kingdom and Australia.

- In layman’s terms, these are dormitories for foreign workers and student halls.

- 2. CAREIT’s Sponsor and Asset Pipeline

- 3. Post-IPO REIT Ownership

- 4. Let’s Talk Numbers

- 5. Gearing up for the future

- 6. Show me the DPU!

- How to Get Your Hands on Units

- Get Smart: Not Your Typical REIT

🇮🇳 India / South Asia / Central Asia

🇮🇳 Adani hails ‘clean chit’ from Indian regulator over Hindenburg probes (FT) $ 🗃️

- Securities and Exchange Board clears conglomerate of fraud allegations included in 2023 report by US short seller

- Sebi sent notices last year to seven listed Adani companies, including its ports business and its renewable energy arm, alleging potential regulatory violations over disclosure rules on some related-party transactions. In August 2024, Sebi said it had completed 23 or 24 investigations into the Adani Group.

🇮🇳 Genpact: The Setup’s Stronger, Even If The Market Hasn’t Caught On (Seeking Alpha) $ 🗃️

🇮🇳 HDFC Bank (HDFCB IN) Tactical Outlook: Will The Rally Continue? (Smartkarma) $

- HDFC Bank (NYSE: HDB) has been in a mild pullback since the end of July. The stock closed up for 2 weeks but has not reached any significative overbought level.

- This week HDFC Bank went down a bit, stayed above the Q1 support level but this pattern is very bullish, in the past it gave way to long, profitable rallies.

- We cannot say for sure if the stock will rally up from here, but if it does, consider profit targets north of 1034 (Q3), and it could rally higher.

🇮🇳 The Beat Ideas: Northern Arc Capital – A Niche Player in a Crowded Field? (Smartkarma) $

- Northern ARC Capital Ltd (NSE: NORTHARC / BOM: 544260) is fast shifting toward direct retail Lending (D2C), while leveraging originator partnerships and technology; recent rate cuts and regulatory relief are improving cost of funds & capital efficiency.

- Northern Arc’s mix of structured finance, co-lending, and fund management creates steady fee income, making it more resilient than traditional NBFCs relying mainly on heavy lending assets.

- Northern Arc is a differentiated NBFC benefits from inclusion & fintech growth, but valuation relies on retail execution, risk control, and asset quality pressures.

🇮🇳 Jindal’s €2 Billion Bet: Can Green Steel Reshape Thyssenkrupp’s Future? (Smartkarma) $

- Jindal Steel International [Jindal Steel Ltd (NSE: JINDALSTEL / BOM: 532286)], part of the Naveen Jindal group, has offered over €2 billion (approx. INR 21,000 crore) to acquire thyssenkrupp Steel Europe, supporting its vital decarbonization projects.

- The deal strengthens Jindal’s position in Europe’s high-grade steel market, helps bypass EU carbon tariffs under CBAM, and secures access to the region’s key automotive supply chain.

- A high-stakes move, success depends on tackling EU regulations, integrating complex operations, and managing pension liabilities, while navigating subdued global steel demand.

🇮🇳 Dr Lal PathLabs Ltd (DLPL IN): Here’s Why Growth to Accelerate and Margin to Improve (Smartkarma) $

- Dr. Lal PathLabs Ltd (NSE: LALPATHLAB / BOM: 539524) started FY26 on a strong note, achieving double-digit improvement in all key parameters, mainly driven by volume resulting from expanding geographic presence.

- Steady secular rise in the number of tests as well as sample per patient is helping DLPL to deliver healthy top and bottom line growth, without indulging in price hike.

- For FY26, the company guided for 11–12% revenue growth (acceleration from 10.5% revenue growth in FY25) and expects FY26 EBITDA margin will be better than initial expectation of 27%.

🌍 Middle East

🇦🇪 Dubai real estate had a great run – where next? (Undervalued Shares)

- In July 2021, I published an extensive feature on “The Great Escape” to havens like Dubai.

- I pointed my readers towards Emaar Properties (DFM: EMAAR) (ISIN AE0005802576, AE:EMAAR), widely credited as the company that created modern-day Dubai.

- The stock was trading with a 50% discount to its book value and a 73% (!) discount to its net asset value. Speak of an investment thesis being out of favour!

- Since then, Emaar Properties’ share price has risen from AED 4 to AED 14.

- What are the company’s further prospects, and which other jurisdictions should hardcore contrarians now look at?

🌍 Africa

🇿🇦 Gold Fields: Record Gold Prices Aren’t The Only Catalyst, Excellent To Buy On Dips (Seeking Alpha) $ 🗃️

- 🌐 Gold Fields (JSE: GFI / NYSE: GFI) – One of the world’s largest gold mining firms. 9 operating mines in Australia, Peru, South Africa & Ghana (including the Asanko JV) & 2 projects in Canada & Chile. 🇼 🏷️

🇿🇦 Lesaka Earnings: Stock Price Could Release Once The Company Reaches Consolidation Phase (Seeking Alpha) $ 🗃️

- 🌍 Lesaka Technologies (NASDAQ: LSAK) – Full-service fintech platform (financial services & software). 🇼

🌎 Latin America

🌎 DLocal’s Rise In Fintech Positions It For Emerging-Market Growth (Seeking Alpha) $ 🗃️

🌎 DLocal Limited: My First Strong Buy (Seeking Alpha) $ 🗃️

- 🌐 Dlocal (NASDAQ: DLO) – Cross-border payment platform for global merchants to get paid & make payments in emerging markets. 🇼

🌎 Millicom’s Bold Bet: How The Company Is Rewriting Its Story (Seeking Alpha) $ 🗃️

- 🌎 Millicom (NASDAQ: TIGO) – Fixed & mobile, telecommunications services, cable & satellite TV, mobile financial services & local content such as music & sports in Latin America. 🇼 🏷️

🇦🇷 Milei Admits “The Market Is In Panic Mode” As Argentine Capital Exodus Accelerates (ZeroHedge)

- Following his government’s resounding loss in local elections – seen as a harbinger of next month’s congressional races – Argentine President Milei is facing a renewed crisis as the embattled South American country’s currency is collapsing amid fears that he will scrap his defense of the peso (which has already cost hundreds of millions of dollars) and let it plunge as so many of his predecessors have done.

- Longtime Argentine observers see few options for Milei to stem the tide and regain confidence.

🇦🇷 Argentina spends $1bn to defend peso as President Javier Milei’s crisis spirals (FT) $ 🗃️

- Monetary authority intervenes in currency market for third time this week, selling $678mn on Friday

- Milei’s economy minister Luis Caputo told local media on Thursday that authorities would “sell to the very last dollar” to keep the peso within its band.

- But the accelerating dollar sales have raised doubts among investors that Milei will be able to keep the band scheme in place.

🇦🇷 Central Puerto: Fundamentals Strong, Momentum Political (Seeking Alpha) $ 🗃️

- 🇦🇷 Central Puerto (NYSE: CEPU) – Makes investments in the national & international energy market. 🏷️

🇧🇷 PagSeguro: Weak TPV And High Rates Keep The Stock In A Value Trap (Rating Downgrade) (Seeking Alpha) $ 🗃️

- 🇧🇷 PagSeguro Digital (NYSE: PAGS) 🇰🇾 – Financial services & digital payments. 🇼 🏷️

🇧🇷 Embraer: Equity Story Has Gotten Structurally Stronger (Seeking Alpha) $ 🗃️

🇧🇷 Embraer: Defense Momentum Builds, But Labor Strike Clouds Execution (Seeking Alpha) $ 🗃️

- 🌐 Embraer SA (BVMF: EMBR3 / NYSE: ERJ) – The 3rd largest producer of civil aircraft after Boeing & Airbus & the leading provider of regional jets worldwide. 🇼 🏷️

🇧🇷 CI&T: Positive On Revenue Mix And Capital Allocation (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇨🇴 GeoPark: A Hedged High-Yield Play In Latin America (Seeking Alpha) $ 🗃️

- 🌎 GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O) – Leading independent Latin American oil & gas explorer in Colombia, Ecuador, Chile & Brazil. 🏷️

🌐 Global

🌐 From Dollars to Dinars (Bond Vigilantes)

- Emerging market economies that issue debt in US dollars (USD) remain heavily tethered to the policy decisions of the US Federal Reserve (the Fed), often at the expense of their own financial autonomy. This dependency, at times, has meant that when the Fed adjusts interest rates to manage domestic inflation and other matters, EMs can experience significant capital outflows, leading to currency depreciation and heightened financial instability.

- While issuing in USD has granted EMs access to deeper capital pools and helped reduce borrowing costs, it has also exposed them to external shocks beyond their control. The reliance on dollar-denominated debt has eroded the agency of local governments, leaving them vulnerable to decisions being made in the US.

- The 2013 Taper Tantrum remains one of the clearest illustrations of how vulnerable EMs can be to shifts in US monetary policy. When Fed Chair Ben Bernanke signalled plans to taper the Fed’s easing program, it triggered a sharp rise in US Treasury yields. Investors rapidly reallocated capital away from EMs, leading to widespread capital outflows and financial stress.

- Ultimately, the evolution of EMs moving away from being largely dependent on the dollar to being able to better utilise local currency markets highlights a pivotal shift. Initially, hard currency debt opened doors to global capital but came with the cost of anchoring EM policy to external monetary cycles. the growing depth of the market reflects a growing confidence in domestic matters, but there is still a long way to go, with foreign ownership of these bonds still being relatively low.

- However, as central banks demonstrate greater independence and credibility, and as investors continue to seek new opportunities, local currency debt should stand to benefit and become more widely used within global portfolios. This doesn’t signal the end of dollar dominance, but it does show that EMs are increasingly able to set their own rules.

🌐 Nebius’ Monster Rally Could Be Just The Warm-Up (Seeking Alpha) $ 🗃️

🌐 Nebius Group: Global Infrastructure Expansion To Drive Growth And Value (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

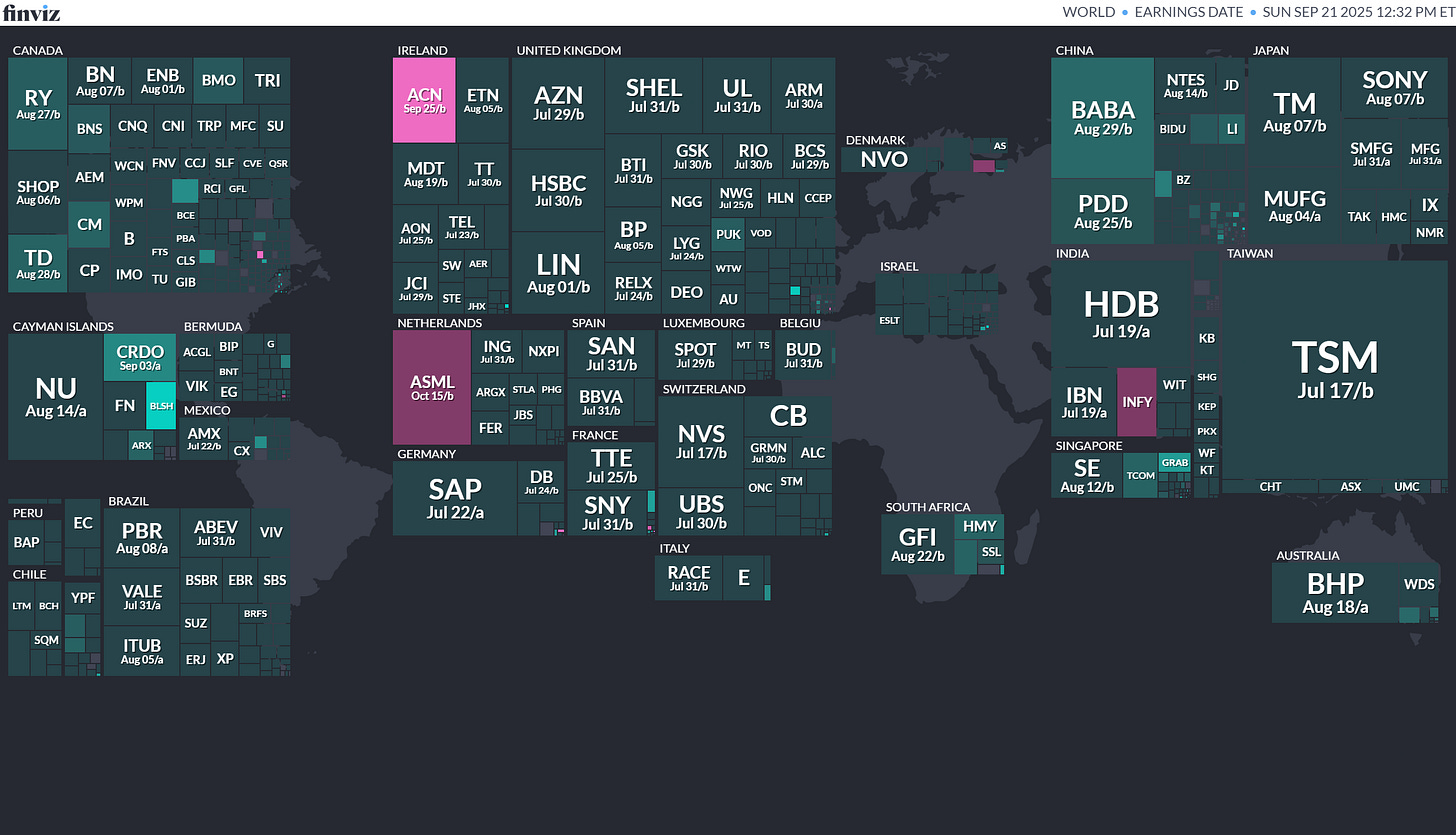

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

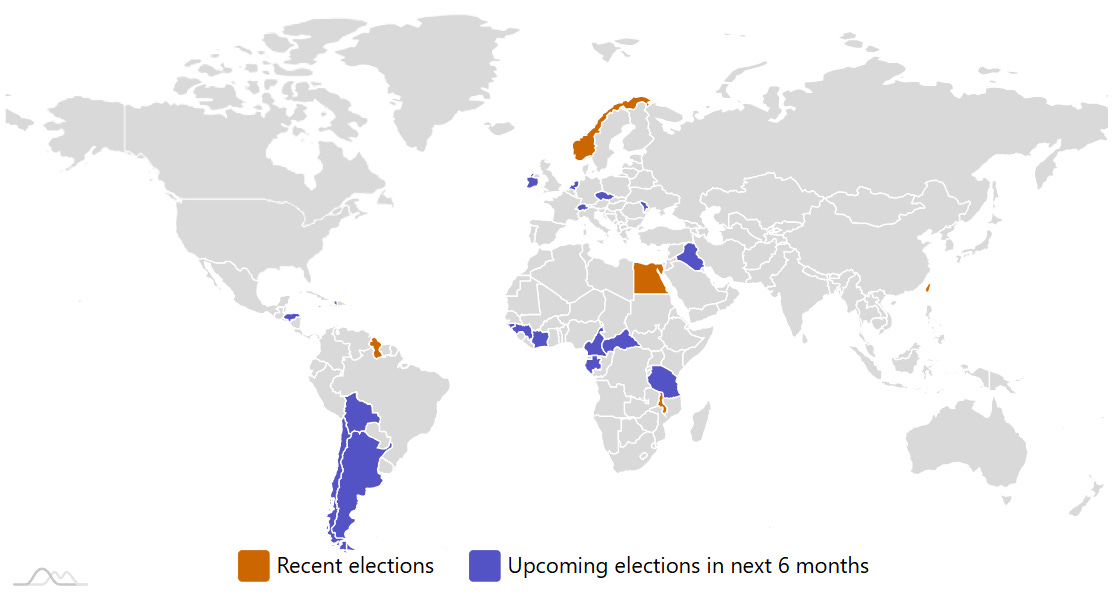

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Czech Republic Czech Chamber of Deputies 2025-10-03 (d) Confirmed 2021-10-08

- Argentina Argentinian Chamber of Deputies 2025-10-26 (d) Confirmed 2023-10-22

- Argentina Argentinian Senate 2025-10-26 (d) Confirmed 2023-10-22

- Iraq Iraqi Council of Representatives 2025-11-11 (d) Confirmed 2021-10-10

- Chile Chilean Chamber of Deputies 2025-11-16 (d) Confirmed 2021-11-21

- Chile Chilean Presidency 2025-11-16 (d) Confirmed 2021-12-19

- Chile Chilean Senate 2025-11-16 (d) Confirmed 2021-11-21

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Platinum Analytics Cayman Ltd. PLTS Kingswood Capital Markets, 2.0M Shares, $4.00-4.00, $8.0 mil, 9/19/2025 Priced

(Incorporated in the Cayman Islands)

We provide foreign exchange (FX) trading software development solutions, data analytics solutions, and technology development solutions to financial institutions focused on serving Asia and other emerging markets.

We operate the Electronics Communications Network (ECN), which supplies brokerage-based trading solutions to institutional and enterprise clients.

Note: Net income and revenue are for the 12 months that ended Sept. 30, 2024.

(Note: Platinum Analytics Cayman Ltd. priced its small-cap IPO at $4.00 – the low end of its $4.00-to-$5.00 price range – and sold 2.0 million shares – the number of shares in the prospectus – to raise $8.0 million on Thursday night, Sept. 18, 2025. Background: Platinum Analytics Cayman ltd. filed its F-1 for its IPO in May 2025 and disclosed the following terms: 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million, if priced at the $4.50 mid-point of its range.)

ELC Group Holdings Ltd. ELCG D. Boral Capital (ex-EF Hutton), 1.8M Shares, $4.00-6.00, $9.0 mil, 9/22/2025 Week of

(Incorporated in the Cayman Islands)

We are a manpower service provider based in Singapore. Manpower service providers (“MSP”) serve as a bridge between job seekers and businesses to meet each other’s recruitment needs. Typically, MSPs create a platform whereby employers can list job opportunities and recruit individuals looking to secure full, temporary or part-time employment meeting their respective criteria. For companies, MSPs assist the recruitment process to meet particular staffing needs, saving companies time, money, and effort. For job seekers, MSPs help them find an appropriate job matching their skill sets as quickly as possible, and exposing them to more opportunities through their vast network.

Our customers fall into a wide range of industries, including warehouse and logistics, food and beverage, cleaning, manufacturing, retail and events. To provide better service to our customers, we pay close attention to the changing needs of our customers, including new developments in their respective industries, which helps us anticipate the specific roles and skills that they will need. We believe this attention to detail gives us a significant competitive advantage and improves customer loyalty.

We have developed a proprietary platform which connects job seekers and employers through a unique matching program utilizing specific character and skill recognition matrices. Our platform operates a comprehensive database that records the skill preferences and requisite applicant characteristics of our business customers and job criteria of job seekers, thereby reducing reliance on subjective human analysis which can be extremely time consuming and inefficient. While many MSPs offer similar services, we believe our model is more specifically focused on our customers’ individual criteria, therefore we tend to deliver a more tailored approach, rather than providing a one-size-fits-all service.

Job Seekers – We believe we stand out to job seekers in two important ways: (i) we have developed a mobile app to enable clients real-time access to the data and therefore opportunities, and (ii) we are the first manpower provision company operating with an app platform in Singapore that is compensating part-time workers on the very same day they finish their jobs.

We have artificial intelligence (“AI”) technology integrated into our “EL Connect App” to create a positive user-friendly experience for part-time job seekers.

Employers – For employers, in addition to the EL Connect App, we have also developed our “Taskforce App.” Our TaskForce App is a smart platform to digitalize building and property operations management. Our TaskForce App integrates internet of things (“IoT”) sensors, facial recognition systems and robotics into facilities and workforce management in buildings and properties. TaskForce App bridges the gap between the employees of our customers, such as site supervisors who oversee property management, and contractors or crews of our customers, who perform individual duties and tasks, addressing inefficiencies in traditional and paper-based processes of property management. Our TaskForce App seeks to achieve optimal performance and productivity for our customers by enabling their employees to have real-time monitoring of facilities and workforce management and providing them instant access to a variety of information ranging from attendance records of contractors or crews to real-time usage of consumable supplies in a facility. This has become an invaluable tool to our customers which has prompted us to monetize its application by opening it up to customer subscriptions and licensing, which we expect will become a growing revenue stream.

We derive our revenue primarily from the following sources: (i) manpower supply services – which provides part-time manpower to customers on our employment and recruitment portal “EL Connect Mobile”; (ii) manpower contracting services – which provides cleaners for cleaning services; (iii) software as a service (“SaaS”) sales, which grants users the right to access our “Taskforce” app; (iv) software licensing sales, which grants clients the right to use the Taskforce app customized to their specific requests (updates and maintenance included); and (v) project management services.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended June 30, 2024.

(Note: ELC Group Holdings Ltd. priced its small IPO at $4.00 – the low end of its range – on Wednesday night, Aug. 27, 2025. Background: ELC Group Holdings Ltd. increased its IPO’s size again – this time to 1.8 million shares – up from 1.7 million shares – and kept the price range modest at $4.00 to $6.00 – to raise $9.0 million, according to an F-1/A filing dated Aug. 25, 2025.)

(Note: ELC Group Holdings Ltd. raised the size of its IPO to 1.7 million shares – up from 1.25 million shares originally – and kept the price range at $4.00 to $6.00 – to raise $8.5 million. Background: ELC Group Holdings Ltd. disclosed the terms for its small IPO – 1.25 million shares at a price range of $4.00 to $6.00 – to raise $6.25 million, if priced at the $5.00 mid-point of its range, according to an F-1/A filing dated June 27, 2025. Initial Filing: ELC Group Holdings Ltd. filed its F-1 on March 4, 2025.)

DT House Ltd. DTDT American Trust Investment Services, 2.0M Shares, $4.00-5.00, $9.0 mil, 9/23/2025 Tuesday

(Incorporated in the Cayman Islands)

We are a Cayman Islands exempted company with operations conducted by our subsidiaries in the UAE and Hong Kong. DT House is the holding company of UHAD, UHHK and UFox, all being our wholly-owned subsidiaries. Our headquarters are located in the UAE, and we commenced with the establishment of UHHK in 2020. We provide corporate consultancy services encapsulating environmental, social and governance-related aspects (commonly known as “ESG”) to enterprises and corporations with the purpose of unlocking greater business resiliency and sustainable cost savings along with revenue generating opportunities. As part of our corporate consultancy services around the ESG thematic, we provide travel-related services for leisure travelers into the UAE, which includes primarily the sale of tourism attractions tickets.

Our corporate consultancy services are provided in the UAE and Hong Kong. ESG is an emerging managerial concept for enterprises and corporations. Through technology integration, our corporate consultancy services offer customized hassle-free solutions to clients, from developing the knowledge and acknowledging the importance of ESG criteria, to formulating internal ESG self-assessments and practices, identifying ESG-related risks and opportunities, implementing cost-effective ESG policies and solutions, and eventually to capitalizing on potential ESG-related market opportunities and strategies. Our clients consist of public companies in the United States and Hong Kong, as well as small and medium-sized enterprises and private corporations in the UAE, Hong Kong and southeast Asia. We leverage upon emerging technologies to drive growth, optimize operations, and create new value streams for our clients. We have our own AI driven, cloud-based software program, and will continue to develop such program so that it can interact with various databases, collect relevant data, and use the data collected to perform self-determined tasks to meet predetermined goals (commonly known as “AI Agent”), which enables clients to retrieve, analyze, compare and evaluate ESG performance of themselves, their competitors and other market participants.

In June 2024, we commenced our travel-related services by acquiring UFox. UFox is a company principally engaged in travel-related services in the UAE, with the particular emphasis of eco-friendly and sustainable travel practices. UFox maintains close business relations with various organizations in the MENA Region such as the Union of Overseas Chinese in Saudi Arabia. We believe that our travel-related services could potentially bring about a synergistic effect with our corporate consultancy services if we follow the same set of ESG principles in both segments. Our current plan is to design travel programs based on the sustainable travel concept, such as alternative transport modes with lower carbon footprints and partnering with eco-friendly hotels. Knowledge and experience gained from our design of travel programs would be useful when we develop sustainable travel policies for our corporate consultancy services clients. The cross-over between low carbon footprint travel programs and sustainability business practices would reduce the average development costs of our projects. It also broadens the scope and strengthen the quality of our consultancy in fostering responsible and impactful ESG business strategies and practices for our corporate customers. Through UFox, we started to provide travel-related services for leisure travelers in the UAE. We offer segmented travel-related services to our customers, which includes primarily the sale of tourism attractions tickets. The destinations of the travel-related services offered by us are primarily within the UAE. We offer customizable hassle-free sustainable travel experience to customers. Customers can choose to customize their own tours depending on their demands and requirements and subscribe to services on segmented basis. Currently, we only have limited business activities of travel-related services due to our short operating history of several months in this sector. The major customers of our travel-related services are two online leisure travel platforms, namely, Trip.com Group Limited (Nasdaq: TCOM) and Fliggy international platform (fliggy.com, a member of Alibaba Group (NYSE: BABA) and an online marketplace of tourism products) that connect us with independent travelers for the sales and marketing of our travel products and services. Other customers of ours include travel companies, travel agencies, tour operators, booking agents, as well as other corporations and institutes, which currently contribute an insignificant portion of our revenue from travel-related services. In the future, we hope to expand the clientele of this segment to include retail leisure travelers and clients from our corporate consultancy services, and the scope of this segment to include other types of travel-related services, such as airfreight ticketing, tour guiding, hotel booking and transportation booking, and arrangement of packaged tours.

Note: Net income and revenue are for the year that ended Sept. 30, 2024.

(Note: DT House Ltd. increased its IPO’s size to 2.0 million shares – up from 1.875 million shares initially – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its most recent F-1/A filing. DT House Ltd. has also named American Trust Investment Services as the sole book-runner, replacing Revere Securities. Background: DT House Ltd. filed its F-1 on March 3, 2025, and disclosed the terms for its IPO: The company is offering 1.875 million shares at a price range of $4.00 to $5.00 to raise $8.44 million, if priced at the mid-point o its range.)

Megan Holdings Ltd. MGN D. Boral Capital (ex-EF Hutton), 2.5M Shares, $4.00-6.00, $12.5 mil, 9/23/2025 Tuesday

We are a company principally engaged in the development, construction and maintenance of aquaculture farms and related works. (Incorporated in the Cayman Islands)

Our operations are based in Malaysia. Since our inception in 2020, we have strived to establish ourselves as a trusted and experienced provider of shrimp farm-related maintenance services in Malaysia. As of the date of this prospectus, we have been carrying out a series of upgrading and maintenance work projects for aquaculture farms, all of which are located in Tawau, Sabah, Malaysia. This constitutes 71.8%, 43.7% and 15.5% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively. Besides that, we also carried out upgrading work for a pineapple plantation farm located at Kota Tinggi, Johor, Malaysia in 2022 and 2023. This constituted nil, 25.3% and 22.6% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively.

Complementary to our upgrading and maintenance services, we also assist customers with the design and development of new farms. As of the date of this prospectus, we are currently involved in the development and construction of a shrimp hatchery center in Semporna, Sabah, Malaysia, where we have been engaged to undertake the construction of hatchery buildings and related functional facilities. We are also assisting in the development of a 111-acre shrimp farm at Tawau, Sabah, Malaysia. The design and development of new farms comprised 22.2%, 16.4% and 61.7% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively. From time to time, we also assist our customers in sourcing for building materials and machinery available for rental for use on their farms. This comprised 6.0%, 14.6% and 0.2% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively.

With our wide suite of services and diverse revenue streams, we are well-positioned to serve customers as a one-stop center for their aquaculture and agriculture needs.

Note: Net income and revenue are in U.S. dollars (converted from the Malaysian ringgit) for the 12 months that ended Dec. 31, 2023.

(Note: Some on Wall Street expected Megan’s small IPO to price during the last week of August 2025. As of Friday midday on Aug. 29, 2025, Megan’s IPO appears to still be in pre-launch status, the Street hears. Background: Megan Holdings Ltd. adjusted its small IPO’s price range back to the original level of $4.00 to $6.00 – and kept the size at 2.5 million shares – to raise $12.5 million, according to an F-1/A filing dated March 11, 2025.)

(Background: Megan Holdings Ltd. doubled its small IPO’s size – to 2.5 million shares – up from 1.25 million shares originally – and trimmed the price range to $4.00 to $5.00 – pulling back from the original $4.00-to-$6.00 price range – to raise $11.25 million, according to an F-1/A filing dated Feb. 20, 2025. Previously: Megan Holdings Ltd. filed its F-1 on Aug. 8, 2024, and disclosed the terms for its micro-cap IPO: 1.25 million shares at a price range of $4.00 to $6.00 to raise $6.25 million. Megan Holdings did not name an underwriter in its F-1 filing.)

Rise Smart Group Holdings Ltd. RSHL American Trust Investment Services/Prime Number Capital, 1.8M Shares, $4.00-4.00, $7.2 mil, 9/23/2025 Tuesday

We are a holding company whose operating subsidiary, Rise Smart Holdings Limited, provides educational services to local students who are seeking secondary education and higher education studies in the United Kingdom (UK), Australia, Canada and New Zealand. (Incorporated in the Cayman Islands)

Our mission is to become the leading overseas studies consultancy service provider in Hong Kong. We strive to provide one-stop services that cater to students’ overseas studies needs.

We believe that the following strengths have contributed to our success and are differentiating factors that set us apart from our peers.

• Established track record: In our operating history of more than 15 years, we have focused on providing overseas studies consultancy services and built up our expertise and track record in overseas studies consultancy. We devoted substantial efforts to expanding our network of overseas education providers. We take pride in our network in successfully placing students with the overseas education providers. Through our quality of service and continued marketing efforts, we believe we have established our reputation as a reliable overseas studies consultancy services provider in Hong Kong.

• One-stop service to cater to students’ overseas studies need: We provide a one-stop service to cater to students’ overseas studies needs by offering a wide range of services to students before and after their placement to overseas education providers. In 2018, we expanded our service offerings to provide value-added services such as tutoring and visa consultation to students. We believe that by providing a one-stop service to the students we can ensure their satisfaction and eliminate the hassle of looking for other service providers.

• Established network of subagents: Since 2018, we have been establishing business relationships with subagents, which include overseas studies consultancy service providers and individuals, who refer students seeking overseas studies with overseas education providers who we have a business relationship with. Since 2021, we have been actively cooperating with subagents to enhance our market presence among students. We believe having a wide network of subagents allow us to reduce reliance on word of mouth referrals from students and parents, while enabling us to broaden the base of potential students whom we can serve and ensure a stable revenue stream.• Experienced and dedicated management and education consultants: Our management team has extensive knowledge and experience in providing overseas studies consultancy services in Hong Kong. Mr. Kin Cho Li, our Chief Executive Officer and Chairman, has approximately 15 years of experience in the overseas studies consultancy service industry. We believe our management and our education consultants understand the needs of students and their parents well to offer them suitable study programs, assist them with their applications, and offer them value-added services to cater to their individual needs. We plan to expand our presence in North America by setting up regional offices in major cities in Canada and/or the U.S.. We plan to selectively pursue mergers and acquisitions, investments, and corporations with local companies to deepen our connection with local education service providers. We will also explore the possibility of forming strategic partnerships with other overseas education consultancy service providers in Hong Kong with a strong establishment in North America to expand our service coverage in North America in a swift and effective manner. We plan to invest in our technological platform by upgrading the function and capabilities of our existing information technology system by (i) investing in the use of artificial intelligence in the recommendation of overseas education providers to students in the application process; and (ii) improving our existing data related technology in relation to student relationship management and commission management. Such improvements will increase the likelihood of our successful placement and enable our management to closely monitor and manage each student’s case to provide the best possible services to them.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: American Trust Investment Services and Prime Number Capital are the lead joint book-runners, replacing Pacific Century Securities and Revere Securities.)

(Note: Rise Smart Group Holdings Ltd. filed its F-1 on May 13, 2024. The Hong Kong-based company submitted confidential IPO documents to the SEC on Aug. 25, 2023.)

Agencia Comercial Spirits AGCC Revere Securities, 1.8M Shares, $4.00-6.00, $9.0 mil, 9/25/2025 Week of

(Incorporated in the Cayman Islands)

We are a whiskey retailer and distributor based in Taipei City, Taiwan.

We are committed to offering imported whiskey of world-class quality to our clients. Agencia Taiwan has grown rapidly since its inception, leveraging its extensive industry experience, strategic partnerships and innovative business model to establish itself as a trusted and prominent player in the whiskey market. Our mission is to enhance the whiskey experience in Taiwan and other Asia-Pacific countries by offering expert guidance, competitive pricing and exceptional customer service.

Our Group operates across three primary business areas:

• Bottled Whiskey Sales: Sourcing bottled whiskey from local suppliers in Taiwan and reputable distilleries in the UK, the company, along with its downstream distributors, sells these products to bars, restaurants, nightclubs, VIP lounges and corporate clients.

• Raw Cask Whiskey Sales: Starting in 2023, our group expanded into the procurement and sale of raw cask whiskey sourced directly from distilleries in the UK. These unprocessed casks are sold directly to other liquor and spirits distributors, enabling our Group to tap into a broader market segment.

• Cask-to-bottle and distribution business: Beginning in 2025, our Group ventured into the cask-to-bottle and distribution business, which involves brand-authorized whiskey bottling, packaging and sales. Under this model, it obtains brand licenses, sources raw cask whiskey directly from brand owners, and conducts bottling and packaging in Taiwan with the aid of local contract manufacturers.

From 2020 to now, our development can be divided into the following stages:

• Start-up period (2020-2022): During its initial years, our Group primarily focused on bottled whisky sales, following a business-to-business (B2B) model. By sourcing both locally and internationally, our Operating Subsidiary developed a network of suppliers and clients.

• Growth period (2023-2024): Our Group expanded its operations to include the sale of raw cask whiskey sourced directly from distilleries, accounting for a significant portion of its revenue. This diversification allowed it to offer unique high-quality products while continuing to focus on B2B relationships.

• Expansion in 2025 and Beyond: Our Group plans to expand its operations to include collaboration with brand owners. This will involve obtaining brand authorization through the payment of licensing royalties, sourcing raw cask whiskey from these brand owners, and conducting bottling and packaging in Taiwan, primarily through local contract manufacturers, for which processing fees will be incurred. Our Group will then market and sell products under the respective brands. Initially, the primary customers will be distributors, focusing predominantly on a business-to-business model.

“From Barrel to Bottle” represents our Group’s core value, highlighting its dedication to delivering a comprehensive one-stop whiskey distribution service. Our Group provides an extensive range of products and utilizes a diverse array of sales channels. Consequently, both business volume and profit have experienced average annual growth. Our distribution channels encompass a broad swath of Taiwan, including clubs, restaurants, bars, hotels, VIP lounges, and corporate clients through our downstream distributors. Looking ahead, we aim to further diversify our product offerings, expand its footprint in the Asia-Pacific region, and solidify our position as a trusted key whisky distributor. By combining our client-centric approach, strategic partnerships, and focus on premium products, we believe that we are well-positioned to capture a significant share of the growing demand for high-quality whiskey in Asia and beyond.

Note: Net income and revenue are for the 12 months that ended Dec. 31, 2024.

(Note: Agencia Comercial Spirits filed its F-1 on July 10, 2025, and disclosed the terms for its IPO: 1.75 million shares at a price range of $4.00 to $6.00 to raise $9.0 million, if priced at the $5.00 mid-point of its range.)

Regentis Biomaterials, Ltd. RGNT ThinkEquity, 1.0M Shares, $10.00-12.00, $11.0 mil, 9/25/2025 Week of

We are a regenerative medicine developing orthopedic hydrogel implants. (Incorporated in Israel)

We are a regenerative medicine company dedicated to developing innovative tissue repair solutions that seek to restore the health and enhance the quality of life of patients. Our current efforts are focused on orthopedic treatments using our Gelrin platform based on degradable hydrogel implants to regenerate damaged or diseased tissue. Gelrin is a unique hydrogel matrix of polyethylene glycol diacrylate (a polymer involved in tissue engineering) and denatured fibrinogen (a biologically inactivated protein that normally has a role in blood clotting).

Our lead product candidate is GelrinC, a cell-free, off-the-shelf hydrogel that is cured into an implant in the knee for the treatment of painful injuries to articular knee cartilage. GelrinC was approved as a device, with a Conformité Européene, or CE, mark in Europe, in 2017 (number 3900600CE02); we plan to identify strategic partners in Europe to bring our product to market. While we currently do not have any strategic partners in place in Europe, we plan to engage strategic partners in Europe in the future.

With GelrinC, we aim to bring to market a product for the therapy of an unmet need for the large market of cartilage injuries in the knee. Because GelrinC serves as an impenetrable barrier that stops cells from migrating away from the wound’s edges, we believe our product is the only product that helps to regenerate cartilage inwards from the edges of the cell walls. Creating new contiguous tissue is not the natural, lowest energy, alternative for cartilage cells. If such cells were left alone, they would tend to migrate and either not create new cartilage tissue or create cartilage tissue that is fibrotic (containing an excessive deposition of extracellular matrix, leading gradually to the disturbance and finally to loss of the original tissue architecture and function). By GelrinC creating such impenetrable barrier and thereby preventing the migration of the cells, the cells are forced to take a different route of creating aggregate and contiguous tissue. Unlike GelrinC, cellular products used by competing companies require a plug of two layers of which the lower layer is a mineral scaffold, which is a foreign body material that has been engineered to be inserted into the bone tissue even though the bone is often healthy. Additionally, GelrinC does not have any biological activity. As a result, we believe our product offers a simple and economic procedure, which we believe will allow patients to recover quickly with potentially long-term outcomes.

Note: Net loss and revenue are for the 12 months that ended June 30, 2024.