More signs of a rising Chinese market as The Asset reports Chinese A-share margin debt hits 2.3 trillion yuan, the highest since 2015 🗃️. This comes nine years after China’s last great stock market boom turned into to bust as investors are once again borrowing heavily to buy stocks…

Meanwhile, the Financial Times has reported that Saudi shares jump on hope of foreigner ownership change 🗃️ as investors see the move as signalling further reform in future. However:

“Foreign demand for Saudi stocks is meaningful but still modest,” said Mohammed Alsuwayed, chief executive of Razeen Capital in Riyadh. This is “less about unlocking immediate inflows, and more about the signal it would send: that Saudi markets are committed to further openness and long-term integration with global capital”.

Note that I have further updated our Frontier & Emerging Market Stock Indices, which now has over 2,700 stocks around the world, for anyone thinking of looking beyond the USA and Western European markets for potential opportunities.

I have also updated the ETF launches section near the bottom of this email and it does appear emerging market ETFs are again being launched rather than getting liquidated. At the same time, it does feel like we are hitting peak AI bubble as from scanning IPOScoop.com’s calendar (I only include emerging market or international IPOs later in this email), it also feels like insiders are trying to unload their [underwater…] AI investments onto [unsuspecting] retail investors or cash in on peak AI.

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 EM Fund Stock Picks & Country Commentaries (September 28, 2025) Partially $

- Understanding China’s “anti-involution” drive, EM ex-China demand, India bonds too big to ignore, Ghana/Côte D’ivoire trip reports, restructuring risk in EM debt, int’l + EM/FM fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 Emerging East Asia LCY bond market keeps steady growth (The Asset) 🗃️

- Emerging East Asia has seen steady growth in its local currency bond market, with the outstanding amount up 3% at US$28.6 trillion in the second quarter of 2025, according to the latest Asian Bond Monitor published by the Asian Development Bank ( ADB ).

- With strengthened financial market indicators and a positive outlook, new issuance of LCY bonds reached US$3.1 trillion in the April-June period, representing a 4.8% growth from the previous three months. Issuance from government entities increased by 18.3% quarter-on-quarter, while that from corporate issuers rose by 25.2%.

- China and South Korea drove the market expansion, accounting for nearly 90% of the region’s total LCY bond stock at the end of June, the report shows. Outstanding amount from Asean countries took 9.1% of the regional total.

🌏 Asia’s huge infrastructure financing gap lures investors (The Asset) 🗃️

- Rapidly rising demand for energy and digitalization spurs private capital shift to emerging markets

- As traditional asset classes face heightened market volatility, investors are increasingly turning to infrastructure for its stability and long-term returns. With private capital filling critical gaps, Asia’s infrastructure boom offers opportunities for resilient and impactful investments amid global uncertainties.

- In an interview with The Asset, Adrian Mucalov, head of long-life Infrastructure at Actis, highlights this shift: “Absolutely, we are seeing an increasing interest from Asian investors in infrastructure. This is largely driven by investors seeking resilient, long-term contracted cash flows as well as diversification.”

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 A-share margin debt hits 2.3 trillion yuan, the highest since 2015 (The Asset) 🗃️

- Nine years after China’s last great equity boom turned to bust, investors are once again borrowing heavily to buy stocks

- In a sign of growing investor confidence, the outstanding balance of securities margin financing in China’s A-share market climbed to 2.3 trillion yuan ( US$322 billion ) in the second week of September, the highest in the past nine years. Analysts, however, are quick to point out that the margin debt ratio is still in line with the median since 2016.

- In the first six months of 2025, investors traded 162.7 trillion yuan worth of A-shares, a 61% jump from the same period last year and the highest half-year figure in recent years. “There are signs of households mobilizing their idle savings to the asset market, improving market liquidity. This can be seen in the narrowing of the negative M1-M2 growth gap to its smallest since May 2021,” says Chi Lo, senior market strategist, Asia-Pacific, at BNP Paribas Asset Management. “It indicates a shift of funds from M2 ( fixed deposits ) to M1 ( current accounts ) and then to the stock market.”

🇨🇳 Analysis: Surge in China’s Securities Fraud Lawsuits Tests Courts (Caixin) $

- Three years after China removed a key hurdle for suing listed companies, securities fraud lawsuits have risen sharply, reshaping the legal landscape for courts and businesses.

- In January 2022, China’s top court issued a judicial interpretation — binding guidance to lower courts — that removed the requirement for investors to wait for regulators to impose administrative penalties or for criminal cases to conclude before filing civil claims over misleading disclosures by listed companies.

🇨🇳 The Playbook: Understanding China’s Regulatory Shock Therapy (The Great Wall Street)

- When an industry becomes too powerful or misaligned, Beijing hits pause—hard. Then it rebuilds.

🇨🇳 Alibaba Gets AGI-pilled (ChinaTalk)

- A vibe shift

- We’re running a guest column from afra’s excellent Concurrent substack about Alibaba (NYSE: BABA) claiming to go all-in on AGI.

- Afra’s article extends our imaged Platonic dialogue we ran in April which noted that very few leading voices in China had anything utopian to say about AI’s possibilities. Afra makes a compelling case for Ali CEO Wu as a believer, and I too thought he seemed sincere in his delivery. However, the fact that the stock popped at the growth of its cloud business and reiteration to spend $50bn over three years in AI capex probably has more explanatory power for this narrative shift than anything else. As seen across Nvidia, OpenAI, and Oracle’s valuations, global capital markets have made it clear they want to put money where AI hitting has enormous upside.

- Beyond its cloud business, Alibaba has a world-class AI research team. Given that, according to Nathan Lambert’s highly scientific tier list, their Qwen team is the only AI lab in China besides Deepseek at the frontier, leadership has every financial incentive to pump this narrative that it’s also China’s most pilled company.

🇨🇳 Alibaba steps up global data centre expansion (The Asset) 🗃️

- Stock price more than doubles as investors give thumbs up to lavish investments in AI and cloud computing

🇨🇳 Alibaba (9988 HK): It’s Raining AI at the Apsara Conference, Firing up the Stock. (Smartkarma) $

- Alibaba (NYSE: BABA) launched Qwen3-Max, its largest LLM to date, along with a suite of Qwen3 models and technical upgrades at its annual flagship conference, reinforcing its full-stack AI ambitions.

- The stock has surged nearly 50% month-to-date, fueled by investor optimism over AI-related upside, since the August 29 investor call.

- Investors now await proof that execution and performance will deliver on Alibaba’s bold technical claims and high market expectations.

🇨🇳 Alibaba Goes All-In On AI: $50B+ Budget, Qwen3-Max, Global Cloud Surge, $4T Bet! (Smartkarma) $

- Alibaba (NYSE: BABA) has announced an aggressive expansion of its artificial intelligence ambitions, earmarking over $50 billion in new AI and cloud investments over the next three years—an amount greater than its entire spending over the last decade.

- This significant push is aimed at positioning the company at the forefront of Asia’s generative AI and cloud infrastructure race.

- Central to this effort is the launch of its next-generation large language model, Qwen3-Max, following the success of Qwen2.5, which already has over 90,000 derivative models globally.

🇨🇳 How Regulation Forced Alibaba’s Evolution (Nikhs)

- A platform once punished for its power is now protected by infrastructure—and Jack Ma learned Carnegie’s lesson the hard way

🇨🇳 Apple tiptoes into Douyin Live Commerce (Momentum Works)

- Last week, Apple made its first live selling session on Douyin, TikTok’s China version.

- This follows the opening of the Apple Official Flagship Store on Douyin Store (equivalent to TikTok Shop outside China) just a few weeks ago. By last weekend, the flagship store — with Apple’s signature clean and slick design — already attracted more than 3 million followers.

- Apple’s premium brand image has long been a strength in China. It enjoys a loyal, affluent customer base — and the usual chaotic livestream style, with screaming hosts and steep discounts, doesn’t quite fit.

🇨🇳 Huaqin rides data center boom to Hong Kong IPO (Bamboo Works)

- Data center products, including servers and switches, surged past smartphones to become the ODM’s biggest revenue source in the first half of the year

- Huaqin Technology Co Ltd (SHA: 603296)’s strategic expansion from its original ODM electronics business into data center products helped to double its revenue to 83.9 billion yuan in the first half of 2025

- The contract manufacturer is betting on AIoT products and robotics to boost its margins, but remains dependent on more traditional products like smartphones and tablets

🇨🇳 Geely Brand Rolls Out Updated Models at Cut Prices in Customer Grab (Caixin) $

- Lynk & Co, a premium auto brand under Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF), has launched upgraded versions of two vehicles, offering more advanced driver-assistance and cockpit systems at lower prices, an increasingly common strategy in China’s hotly contested car market.

- This week, Lynk & Co unveiled the latest editions of its 08 EM-P SUV and 07 EM-P sedan. The 08 EM-P, first released in 2023, has now been reengineered with Qualcomm’s 8295 chip for its cockpit system and Nvidia’s Thor chip for assisted-driving functions, supported by a lidar sensor and updated software. The carmaker has also cut the model’s sticker price to as low as 159,800 yuan (about $22,000) under a limited-time offer.

🇨🇳 Motor veteran Broad-Ocean drives towards new image as NEV champion (Bamboo Works)

- The company is seeking a Hong Kong listing, reporting its profit doubled in the last three years on rising sales of its auto-tech, from garage door remotes to EV powertrains

- IPO candidate Zhongshan Broad-Ocean Motor Co., Ltd (SHE: 002249) is ranked second globally by market share for HVAC motors, and holds the top position in China and North America

- The car technology company’s Shenzhen-listed shares are up 130% in the last year, giving it a market cap of about 28.5 billion yuan

🇨🇳 Can dead batteries deliver a profit boost for recycler GEM? (Bamboo Works)

- The repurposer of key metals from electronic waste has filed to list in Hong Kong, looking set to benefit as millions of electric car batteries start to reach the end of their natural life

- After a multi-year boom in Chinese electric vehicle sales, the car batteries are expected to enter a phase of large-scale retirement from 2026

- GEM Co Ltd (SHE: 002340) recycled 22,400 tons of retired lithium-ion batteries in the first half of this year, a 37% year-on-year increase

🇨🇳 China industrial profits return to growth (FT) $ 🗃️

- Boost comes as Xi Jinping calls on companies to stem aggressive price competition

- Profits at industrial companies with annual revenues of more than Rmb20mn ($2.8mn) increased 20.4 per cent in August compared to a year earlier, and an improvement on a decline of 1.5 per cent in July.

- The August bump meant profits in the period from January to August were 0.9 per cent higher than during the same period in 2024, compared with 1.7 per cent lower in the January- to-July period.

🇨🇳 In Depth: Starbucks, Burger King Overhaul China Strategies (Caixin) $

- Starbucks Corp (NASDAQ: SBUX) and Burger King Corp. are rethinking their China strategies as they work to stay relevant in the country’s increasingly saturated and competitive food and beverage market.

- In early 2024, Starbucks floated the idea of seeking new strategic investors for its China business. The move came after two straight quarters of declining revenue and same-store sales in the market. The process stalled that August when then-CEO Laxman Narasimhan was ousted. His successor, Brian Niccol, turned his focus back to the U.S. and hit pause on China, previously saying he needed to “spend time there to better understand” the local market.

🇨🇳 Pop Mart: Opportunity Or Passing Trend? (Seeking Alpha) $ 🗃️

- 🌏 Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF) 🇰🇾 – Design, development & sale of pop toys. 🇼 🏷️

🇨🇳 China’s State Banks Roll Out Pay Cuts, Salary Caps in Sweeping Reform (Caixin) $

- China’s state-owned banks are bracing for deep pay cuts as a new round of compensation reform ripples across the financial sector, capping the salaries of mid-level executives and reshaping how money flows through the country’s biggest lenders.

- The Finance Ministry has circulated guidelines to major state banks and financial firms, according to people familiar with the matter, setting the stage for each institution to craft its own detailed pay plans. The directives follow a broader policy push by the Ministry of Human Resources and Social Security earlier this year to narrow gaps and rein in excessive pay across state-owned enterprises.

🇨🇳 A wild ride for TransThera investors: what’s the story? (Bamboo Works)

- The firm’s core drug has passed a minor clinical milestone, but the rally really took off when the stock was included in an array of indices tracked by passive funds

- The limited size of TransThera Sciences (Nanjing) Inc (HKG: 2617)’s free float, at only about 5.5 million shares, has magnified the stock swings

- The company has yet to launch any of its experimental drugs onto the market, constraining revenues and generating multi-year losses

🇨🇳 WORK Medical enters strategic partnerships in bid to explore RWA initiatives (Bamboo Works)

- The medical products maker hopes to leverage RWA technology to transform and leverage its current product infrastructure and budding AI business

- Work Medical Technology Group Ltd (NASDAQ: WOK) has formed a new alliance with the Hong Kong Web3.0 Standardization Association and was appointed as the organization’s “council vice chairman.”

- The company has also entered into a collaboration with Ruijin Hospital’s Wuxi Branch to accelerate the development of a next-generation, AI-driven smart clinical ecosystem

🇨🇳 Shandong Hi-Speed stock soars, then plunges in mystery power play (Bamboo Works)

- The data center and green power investor’s shares surged more than 200% in the year through July, but gave back all those gains and more with a nearly 80% plunge last Friday

- Shandong Hi-Speed Holdings Group Ltd (HKG: 0412 / FRA: HRI) scrambled to defend its stock by buying back shares after a sudden plunge last Friday wiped out big gains from the previous two months

- Just before the plunge, the Hong Kong securities regulator warned investors that a small number of investors own most of the company’s stock

🇨🇳 Tempest of mismanagement, wrongdoing brews in China Rare Earth’s teacup (Bamboo Works)

- After a barrage of internal accusations, the problem-plagued company, despite its attention-grabbing name, is becoming another cautionary tale for investors

- China Rare Earth Holdings Ltd (HKG: 0769 / FRA: RAE / OTCMKTS: CREQF)’s subsidiaries are facing at least 45 lawsuits and nine enforcement cases over mismanagement, failure to repay debt and other claims

- The firm specializes in rare earth processing, and is distinct from the similarly named but much larger state-owned China Rare Earth Group Co. Ltd.

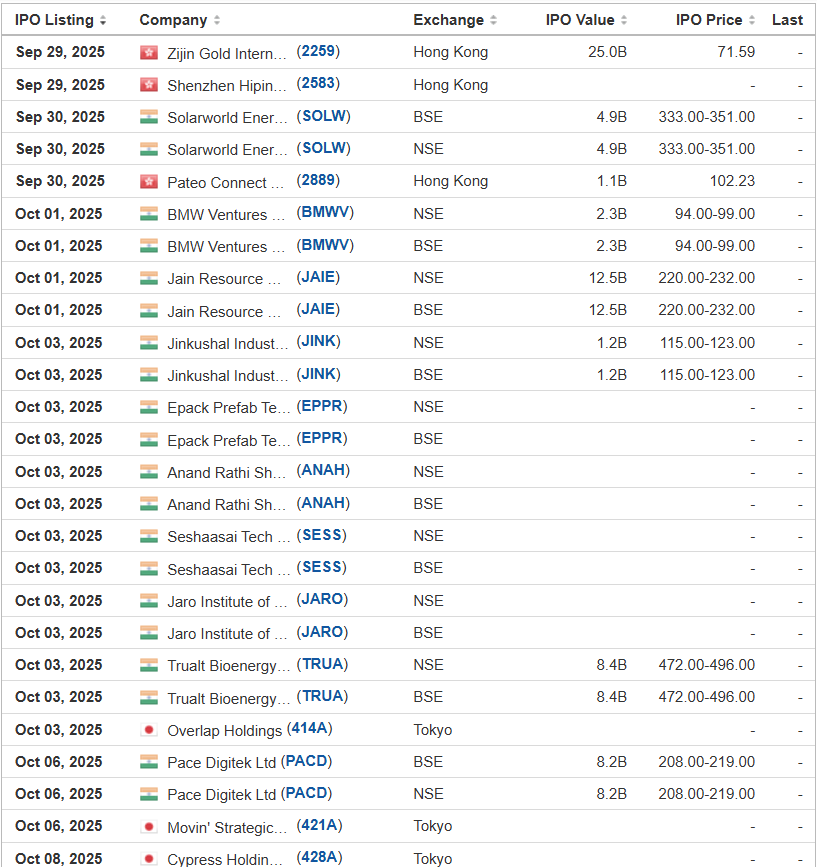

🇨🇳 Trading Strategy of Zijin Gold on the First Day of IPO (Douglas Research Insights)

- Zijin Mining Group (SHA: 601899 / HKG: 2899 / FRA: FJZB / OTCMKTS: ZIJMF) [Bullish]

- Zijin Gold IPO will start trading on 30 September. Zijin Gold is aiming to raise US$3.2 billion (HK$24.98 billion) from its IPO, offering 349 million shares at HK$71.59 each.

- Our base case valuation of Zijin Gold is HK$124.7 per share (74.2% higher than the IPO price). We expect a sharply higher pop on the first day of trading.

- If its share price appreciates more than 30-50% or more, we think it is prudent to take some profits off the table (at least 25%-30% of total investment).

🇨🇳 Berkshire Hathaway Dumps All Its Stake in BYD – Impact on the Chery Auto IPO (Douglas Research Insights) $

- Warren Buffett’s Berkshire Hathaway completely exited its stake in BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF).

- We highlight four major reasons why Berkshire may have exited its entire position including valuations, tariffs, competition and lower profit margins, and greater risk prospects on economic stagnation in China.

- Berkshire selling all its stake in BYD is likely to have a slightly negative impact on the Chery Automobile Co Ltd (HKG: 9973) IPO. However, we maintain a Positive view of Chery Auto IPO.

🇨🇳 Chery Automobile IPO (9973 HK) IPO: Trading Debut (Douglas Research Insights) $

- Chery Automobile Co Ltd (HKG: 9973) priced its IPO at HK$30.75 per share to raise gross proceeds of approximately US$1.2 billion. The shares will begin trading on September 25.

- The IPO was discussed in Chery Automobile IPO: The Bull Case, Chery Automobile IPO: The Bear Case and Chery Automobile IPO (9973 HK): Valuation Insights.

- The market sentiment of the peers has declined since the IPO launch. Chery Auto is fairly valued at the IPO price.

🇭🇰 HK 第45部分; HK +80%… What next?!? (Jam_invest)

- Hong Kong stocks are up about 80%(!!) from the bottom, two years ago. Luckily, there are still loads of (absurd-)cheap HK 第部分. Let’s go through some pockets of opportunities.

- Pockets of Opportunities

- Jam’s strategy

- Running too hot

- Hunting grounds

- Hong Kong (sub-)portfolio

- Binjiang Service Group (HKG: 3316)

- Sitoy Group Holdings Ltd (HKG: 1023 / OTCMKTS: STYDF)

- TI Cloud Inc (HKG: 2167)

- Footnotes

🇭🇰 Henderson Land: Focus On Policy Tailwinds And Cash Distributions (Seeking Alpha) $ 🗃️

- 🇭🇰 🇨🇳 Henderson Land Development (HKG: 0012 / FRA: HLD / OTCMKTS: HLDCY / HLDVF) 🇭🇰 – Property developer. High quality new homes & commercial development. 🇼 🏷️

🇭🇰 🇵🇭 Will Int’l Entertainment’s billion-dollar gamble finally pay off? (Bamboo Works)

- The property developer is betting heavily on its acquisition of a casino in Manila, as the Philippines privatizes its portfolio of government-owned properties

- International Entertainment Corporation (HKG: 1009) issued its fifth profit warning in two years last week, saying its loss widened by 60% in its latest fiscal year

- The company’s $1.2 billion integrated casino and hotel development in downtown Manila will reopen soon, as the Philippines sells off its 43 state-owned casinos

🇭🇰 🇵🇭 International Ent widens annual loss to US$36.3mln as gaming revenue jumps 200pct (GGRAsia)

- International Entertainment Corporation (HKG: 1009), a Hong Kong-listed firm with a casino-hotel business in the Philippines, saw its annual loss widen to HKD282.1 million (US$36.3 million), from nearly HKD132.0 million in the prior financial year, according to a Friday filing.

- That was on revenue for the 12 months to June 30 that rose 146.4 percent year-on-year, to just under HKD566.2 million.

- The company paid HKD180.7 million in gaming tax and licensing fee in the reporting period, compared to HKD17.8 million in the previous financial year.

- The board did not recommend the payment of any final dividend for the latest financial year.

- International Entertainment took over the casino operations at the New Coast Hotel Manila property (pictured) in May last year, under a provisional gaming licence granted by the country’s gaming regulator, the Philippine Amusement and Gaming Corp (Pagcor).

🇲🇴 Typhoon-triggered closure of Macau casinos likely to mean 5pct haircut in full September GGR: experts (GGRAsia)

- The temporary suspension of operations at all Macau casinos for 33 hours this week, due to the passage of Super Typhoon Ragasa, is estimated to have cost the industry about MOP880 million (US$109.9 million) in missed gross gaming revenue (GGR). That is according to CLSA analyst Jeffrey Kiang in comments to GGRAsia.

- Mr Kiang, as well as Ben Lee, managing partner at casino industry adviser IGamiX Management and Consulting Ltd, respectively told GGRAsia the precautionary shutdown was likely to have caused a 5-percent haircut in otherwise-expected September GGR performance.

🇲🇴 Over 20 Macau luxury hotels at casino resorts flag sold out for at least 5 nights of Oct Golden Week (GGRAsia)

- Over 20 luxury hotels in Macau – all housed within casino resort complexes – appear to have sold out their rooms for at least five nights of the upcoming October Golden Week holiday. For residents of the Chinese mainland it covers eight days this time, i.e., October 1 to October 8 inclusive. The snapshot of consumer demand for rooms during that period is based on GGRAsia checks of the official booking engines of those hotels.

- The research covered 34 luxury hotel brands that are represented within properties promoted by the six Macau gaming operators, and are mostly in the Cotai district.

🇲🇴 SJM high-value ‘hub’ for Macau peninsula via shift of satellite tables to Grand Lisboa and Lisboa (GGRAsia)

- SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) says it will use to its advantage the regulatory changes in the Macau satellite casino sector – and its decision to redeploy satellite-venue tables to its downtown Grand Lisboa property and to an upgraded and expanded Casino Lisboa next door – to “consolidate a leadership position on the peninsula” of the city.

- That would result in the group “effectively increasing non-gaming spend and length of stay by customers, and better aligning the peninsula [property] portfolio towards the VIP and premium-mass segments” of gaming customers, said the company in commentary in its interim report published on Monday.

- In an August filing, the firm said its unit SJM Resorts Ltd had signed a promissory agreement with the group parent Sociedade de Turismo e Diversões de Macau SA (STDM) to acquire a portion of Hotel Lisboa, for a total consideration of HKD529 million (US$68.1 million).

🇲🇴 SJM Holdings eyes US$141mln in yuan-denominated bonds: report (GGRAsia)

- Macau casino concessionaire SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) is reportedly considering issuing offshore yuan-denominated bonds in October, with a three-year term.

- The casino firm aims to raise at least CNY1 billion (US$140.6 million), its first public debt offering in four years, said financial news outlet Bloomberg, citing unidentified sources.

- It is expected that proceeds from the offering will fund development projects in Hengqin and for general corporate purposes, according to the news outlet.

🇹🇼 Taiwan

🇹🇼 TSMC: Leading Edge Moats, Still Undervalued (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Don’t Simply Ignore The Warning Signs Amid AI Euphoria (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇰🇷 Korea

🇰🇷 Potential Additions and Deletions to KOSPI200 in December 2025 (Douglas Research Insights) $

- In this insight, we provide an early look at the potential additions and deletions to KOSPI200 rebalance in December 2025.

- The seven potential additions are up on average 200% YTD. The eight potential deletion candidates are down on average 8.8% YTD. KOSPI is up 44.7% YTD.

- The average market cap of the seven potential additions is 3.5 trillion won. The average market cap of the seven potential deletion candidates is 0.6 trillion won.

🇰🇷 SK Telecom Offers Deep Value And AI Optionality (Seeking Alpha) $ 🗃️

- 🇰🇷 SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) – Wireless telecommunication services in Korea. 3 segments: Cellular Services, Fixed-Line Telecommunications Services & Other Businesses. 🇼 🏷️

🇰🇷 Paradise Co’s purchase of new hotel tower to boost firm’s operating profit: brokerage (GGRAsia)

- The decision by Paradise Co Ltd (KOSDAQ: 034230) to acquire the West Wing (pictured) of the Grand Hyatt Incheon hotel, a property near the country’s capital, Seoul, will in likelihood help improve the casino firm’s earnings, said a South Korea-based brokerage.

- Paradise Co, an operator of foreigner-only casinos in South Korea, said on Tuesday that its unit, Paradise Segasammy Co Ltd, will pay KRW210.0 billion (US$150.0 million currently) to acquire the new accommodation tower.

- Grand Hyatt Incheon is adjacent to the Paradise City casino resort, a joint venture at Incheon between Paradise Co and Japan’s Sega Sammy Holdings Inc. Paradise City is directly run by Paradise Segasammy.

🇰🇷 Hanon Systems – A Rights Offering of 900 Billion Won (Douglas Research Insights) $

- Hanon Systems (KRX: 018880) [Bearish]

- Hanon Systems announced that it has finalized a rights offering capital increase of 900 billion won. This capital raise will involve 347.5 million common shares (51.2% of outstanding shares)

- The expected rights offering price is 2,590 won per share, which is 18.4% lower than current price of 3,175 won.

- We remain Negative on Hanon Systems (018880 KS). There is a high probability that this rights offering deal will likely be a dilutive deal for the Hanon System shareholders.

🇰🇷 Ecopro Co – Confirms Raising 800 Billion Won Through a PRS Using Stake in Ecopro BM (Douglas Research Insights) $

- [Ecopro BM Co Ltd (KOSDAQ: 247540) – Negative]

- On 24 September, Ecopro Co Ltd (KOSDAQ: 086520) confirmed that it will be raising 800 billion won through a PRS using its stake in Ecopro BM as the base asset.

- Ecopro BM has a market cap of 11.3 trillion won. A PRS worth 800 billion won represents 7.1% of Ecopro BM’s market cap.

- All in all, we believe this PRS deal worth 800 billion won is likely to negatively impact both Ecopro Co and Ecopro BM.

🇰🇷 KCC Corp – To Issue 430 Billion Won in EB Using Its Treasury Shares? (Douglas Research Insights) $

- On 23 September, Hankyung Business Daily reported that Kcc Corp (KRX: 002380) plans to issue about 430 billion won worth of exchangeable bonds (EB) based on its own treasury shares.

- We believe the overall impact on this EB issue on KCC is likely to be more negative as compared to the EB issue it conducted in July 2025.

- Our NAV valuation of KCC Corp suggests NAV per share of 508,467 won, which is 22% higher than current price.

🇰🇷 A Pair Trade Between Hyundai Elevator and Hyundai Movex Amid a 7% Stake Sale in Hyundai Movex (Douglas Research Insights) $

- On 24 September, Hyundai Elevator Co Ltd (KRX: 017800 / OTCMKTS: HYEVF) announced that it plans to sell 7.8 million shares of Hyundai Movex (KOSDAQ: 319400), representing 7% of its outstanding shares.

- Over the next several weeks, we expect continued outperformance of Hyundai Elevator vs Hyundai Movex.

- We like the pair trade of going long Hyundai Elevator and going short Hyundai Movex over the next 1-3 months, especially due to concerns about a 7% sale in Movex.

🇰🇷 Naver to Acquire Dunamu? (Operator of Upbit – Largest Cryptocurrency Exchange in Korea) (GGRAsia)

- [NAVER (KRX: 035420 / OTCMKTS: NHNCF) – Bullish]

- According to numerous local media, Naver Corp (035420 KS) is set to acquire Dunamu, the operator of Upbit which is the largest cryptocurrency exchange in Korea.

- According to Naver Corp (035420 KS), its subsidiary, Naver Financial, is discussing various collaborations with Dunamu, including stablecoins and potential stock exchange. However, nothing has been finalized so far.

- If Dunamu is valued at 15 trillion won, this would suggest a P/E of 18x based on 2025 annualized net profit of 836 billion won (net profit in 1H25 annualized).

🇰🇷 The Pinkfong Company IPO Preview (Douglas Research Insights) $

- The Pinkfong company (creator of the Baby Shark brand) is getting ready to complete its IPO in KOSDAQ in 4Q 2025.

- The company plans to issue 2 million shares in this listing. The IPO price range is from 32,000 won to 38,000 won per share.

- At this price range, the expected expected market cap of the Pinkfong company ranges from 463 billion won (US$331 million) to 550 billion won ($393 million).

🇰🇷 The Pinkfong Company IPO Valuation Analysis (Douglas Research Insights) $

- The Pinkfong Co [Bullish]

- Our base case valuation of the Pinkfong Co is implied market cap of 671.4 billion won or target price of 46,369 won per share (over the next 6-12 months).

- This represents a 22% upside to the high end of the IPO price range. Given the reasonable upside, we have a Positive view of the Pinkfong Co IPO.

- Pinkfong Co is one of the most sought-after acquisition candidates in the global animation industry and this is one of the major reasons why it should trade at premium valuation.

🌏 SE Asia

🇵🇭 DigiPlus confirms licence applications to enter South African market (GGRAsia)

- Philippine-listed and licensed online gaming operator DigiPlus Interactive (PSE: PLUS) said on Wednesday it had “formally filed” three online-related licence applications with the Western Cape Gambling and Racing Board (WCGRB) in South Africa.

- “This move advances DigiPlus’ entry into one of the most promising regulated online gaming markets globally,” it said in a press release.

- The firm had announced in July that it aimed to expand into South Africa. At the time, the company stated that it was preparing to file three licence applications with the Western Cape Gambling and Racing Board, the regional regulator for the country’s Western Cape province.

🇸🇬 SGX debuts indices targeting liquidity-rich mid-tier stocks (The Asset) 🗃️

- Offering aims to enhance access to next tier of Singapore-listed companies beyond STI top 30

- Singapore’s SGX Indices has introduced the iEdge Singapore Next 50 Indices, a move designed to enhance visibility and investor access to the next tier of large and liquid Singapore-listed companies, beyond the traditional Straits Times Index ( STI ) top 30.

- The indices aim to capture market opportunities among the 50 most significant mainboard-listed firms that fall just outside the STI. And, built on a transparent and rules-based approach, they consider factors like free-float market capitalization and trading liquidity to determine inclusion.

- Two versions of the index are available, one weighted by market cap, and the other by liquidity, providing investors with tools to gain exposure to companies rising in prominence but not yet part of the STI elite.

🇸🇬 Karooooo: Scaling Beyond South Africa’s Moat (Seeking Alpha) $ 🗃️

- 🇸🇬 🇿🇦 Karooooo (NASDAQ: KARO / JSE: KRO) – Leading provider of an on-the-ground operations cloud that maximizes the value of data. The Cartrack SaaS platform provides insightful real-time data analytics & business intelligence reports. 🏷️

🇸🇬 Harnessing The Flywheel Effect: Why Sea Limited Is A Must-Buy For Investors (Seeking Alpha) $ 🗃️

- 🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Grab Mart! (Global Equity Briefing)

- Huge potential for grocery delivery in Southeast Asia.

- In Grab Holdings Limited (NASDAQ: GRAB)’s Q2 2025 earnings call, the management said that Grab Mart could potentially be much larger than the restaurant delivery business.

- This threw me off guard, as their total deliveries GMV is close to $13B. So, they are saying that just Mart could be larger than that.

- Now that I have had some time to think about it, I understand this comment and see where they are coming from.

- In this quick article, I will explain why Grab Mart could potentially be a relatively much larger and more profitable business than groceries are for Uber or DoorDash (NASDAQ: DASH).

- If you want a more complete analysis of the company, I wrote a Deep Dive a few months ago and a Q2 2025 review a few weeks ago [Grab Mart! / Grab Q2 Earnings Update!].

🇸🇬 3 Defensive Stocks to Own if Market Highs Don’t Last (The Smart Investor)

- The Straits Times Index (SGX: ^STI) has slipped below the 4,300 mark, after spending most of September above this level.

- Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) is Singapore’s sole stock exchange operator.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering has seen its share price skyrocket to all-time highs in August 2025, driven by strong demand across the defence and aerospace sectors.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel has witnessed a significant jump in its share price YTD for 2025, outpacing the broader STI.

🇸🇬 3 Top-Performing Singapore Stocks in 2025: Can the Rally Continue? (The Smart Investor)

- We spotlight three of Singapore’s best-performing stocks and ask: can the rally go further?

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering is a technology, defence, and engineering company headquartered in Singapore.

- DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY) operates a variety of businesses, such as supermarkets, convenience stores, and health and beauty chains in countries like Singapore, Hong Kong, and the Philippines.

- Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF) is a diversified conglomerate, focused principally on Asia, with businesses in retail, property, automotive, financial services, agribusiness, and more.

🇸🇬 Singtel Investors on Alert: Optus Troubles Put Half its Revenue in Focus (The Smart Investor)

- Over the weekend, Australia’s second-largest telco suffered yet another outage affecting a mobile phone tower site in New South Wales (NSW).

- Optus said this latest incident is unrelated to the previous emergency call failure on 18 September 2025.

- The latest outage affected a single cell site out of over 3,000 in NSW, affecting one person requiring emergency services — thankfully, they managed to call using a different phone.

- By comparison, the 18 September 2025 incident was devastating, preventing 600 people across South Australia, Western Australia, and the Northern Territory from reaching emergency services for at least 10 hours, tragically resulting in three deaths.

- The weekend disruption occurred just as Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel Group CEO Yuen Kuan Moon landed in Sydney for crisis talks with Communications Minister Anika Wells, accompanied by Optus CEO Stephen Rue and Singtel Chairman John Arthur.

- What’s At Stake: Half of Singtel’s Revenue

- The Optus Factor in Singtel’s Empire

- Get Smart: Walking the Tightrope

🇸🇬 3 High-Yielding REITs Paying Over 6.5%: Bargains or Traps? (The Smart Investor)

- Discover if high-yielding REITs like AIMS APAC, CapitaLand China Trust, and United Hampshire US REIT are true bargains or hidden traps for income investors.

- AIMS APAC REIT: Singapore Industrial / Logistics Exposure

- AIMS APAC REIT (SGX: O5RU / OTCMKTS: ACIRF) invests in industrial, logistics and business park properties mainly in Singapore.

- CapitaLand China Trust: Betting on China’s Recovery

- CapitaLand China Trust (SGX: AU8U / OTCMKTS: CLDHF) operates a diversified portfolio of retail malls, business parks, and logistics properties across China.

- United Hampshire US REIT: Defensive US Assets Face Headwinds

- United Hampshire US REIT (SGX: ODBU / OTCMKTS: UNHRF) is a REIT whose portfolio is focused on defensive US properties comprising grocery-anchored shopping centers, and self-storage facilities.

🇸🇬 4 Singapore REITs That Possess an Attractive Pipeline of Acquisition Opportunities (The Smart Investor)

- Acquisitions can help to drive growth in both the REIT’s asset base and its distribution per unit.

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), or CICT, is a retail and commercial REIT with a portfolio of 26 properties spread across Singapore (21), Germany (2), and Australia (3).

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF), or FCT, is a Singaporean retail REIT with a portfolio of nine suburban malls and an office building.

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), or MLT, is an industrial REIT with a portfolio of 178 properties across eight countries.

- Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF), or DCR, is a data centre REIT with a portfolio of 11 data centres across the US, Canada, Japan, and Germany.

🇸🇬 4 Singapore Companies Announcing Initiatives to Unlock Shareholder Value (The Smart Investor)

- These four companies are announcing moves that seek to improve their businesses and realise more value for shareholders.

- UOL Group Limited (SGX: U14 / FRA: U1O / OTCMKTS: UOLGY / UOLGF) is a property and hospitality group with total assets of around S$23 billion.

- Isoteam Ltd (SGX: 5WF) provides building and maintenance services along with estate upgrading through its two key divisions, Repairs and Redecoration (R&R) and Addition & Alteration (A&A).

- CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF), or CLAR, is an industrial REIT with a total of 229 properties spread across Singapore, the US, Australia, the UK, and Europe.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF), or FCT, is a retail REIT with a portfolio of nine retail suburban malls and an office building, all located in Singapore.

🇸🇬 Can Keppel Corporation Keep Powering Ahead After its Share Price Surge? (The Smart Investor)

- Keppel Corporation has rallied strongly in 2025, but can it keep powering ahead? We look at what’s fueling the rise and if the stock remains attractive.

- Global asset manager and operator, Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) has surged roughly 29% year to date (YTD) on the back of strong business execution.

- Why Keppel’s share price has climbed

- Growth drivers powering Keppel forward

- Risks to monitor

- Get Smart: Monitor Keppel’s execution and progress

🇸🇬 DBS’s Share Price Near its All-Time High: Should Investors Lock In Profits or Hold On? (The Smart Investor)

- With DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) shares near all-time highs, find out if it’s time to lock in profits or stay invested for long-term growth and dividends.

- Why DBS has climbed

- What happens when rates fall

- Opportunities ahead

- Risks and challenges

- What this means for investors

- Get Smart: Thinking long term

🇹🇭 Thai senate ‘rejected’ now-lapsed casino bill, citing doubts on social, economic impact: report (GGRAsia)

- The Thai Senate has rejected the currently-lapsed draft entertainment complex bill – the enabling proposal for casino legalisation in the country – citing concerns on social impact and economic value, reported local media outlet Bangkok Post on Wednesday.

- The senate reached the conclusion after Tuesday discussion of a report made by a special senate panel tasked with studying the entertainment complex bill.

- The panel report concluded that the entertainment complex bill – had it been enacted – could have lead to money laundering risk and, “erosion of public trust” while yielding “little real economic value”, the Bangkok Post reported on Wednesday.

- The panel also urged that any future casino legalisation efforts should involve “public participation”, with a national referendum.

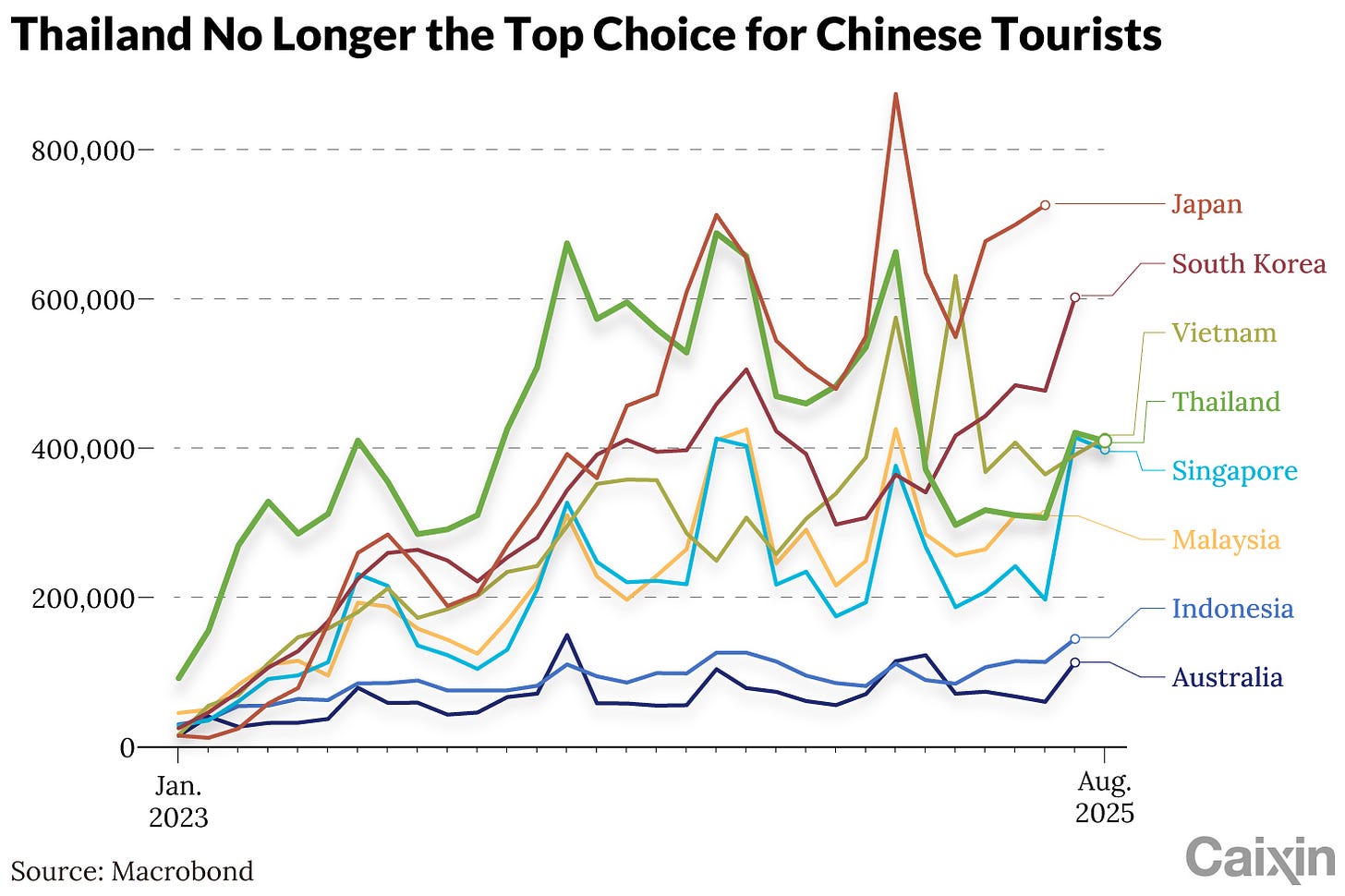

🇹🇭 Chart of the Day: Chinese Tourists Sour on Thailand (Caixin) $

- Chinese tourists are falling out of love with Thailand, opting instead for destinations like Japan, South Korea and Vietnam that are deemed safer and offer favorable travel conditions.

- In August, the number of Chinese visitors to Thailand fell 37.7% year-on-year to around 409,700, according to data platform Macrobond, citing the country’s Ministry of Tourism and Sports. For the first eight months of the year, the number of Chinese tourist arrivals dropped by a cumulative 35.3%.

- The drop comes after a series of events dented Chinese tourists’ confidence in Thailand. The disappearance of Chinese actor Wang Xing in the country earlier this year sparked concerns over personal safety. Earthquakes and a recent border conflict with Cambodia have also added to travel anxiety.

🇮🇳 India / South Asia / Central Asia

🇮🇳 The Beat Ideas: Nuvama Wealth – India’s Affluence Story at the Right Price? (Smartkarma) $

- Nuvama Wealth Management Ltd (NSE: NUVAMA / BOM: 543988) is capitalizing on India’s burgeoning financialization trend, with its re-branding and strategic focus on affluent and ultra-high-net-worth individuals (UHNIs) driving strong growth in client assets and profitability.

- As India’s wealth management market matures and faces increasing regulatory scrutiny, Nuvama’s differentiated model position it uniquely to capture a larger share of the shifting landscape.

- Nuvama’s integrated platform and execution-focused management team are navigating industry-wide challenges, from tightening regulatory framework to sustain a growth trajectory that is outperforming peers and creating long-term value.

🇮🇳 Anand Rathi IPO: A Premium Play in India’s Brokerage Market? (Smartkarma) $

- Anand Rathi Share and Stock Brokers, a three-decade-old full-service brokerage house, is set to go public with a fresh issue to fund its working capital and expansion.

- The offering provides a window into a mature, brand-led brokerage with an industry-leading Average Revenue per Client (ARPC) and a strong presence across Tier I, II, and III cities.

- The company’s structural strengths, including its Margin Trading Facility (MTF) business and client vintage, position it for sustained growth in India’s evolving capital markets.

🇮🇳 Kolte Patil (KPDL): Weak Q1FY26 Performance, However Medium-Term Potential Is Intact (Smartkarma) $

- Q1FY26 pre-sales came in weak led by delayed launches; however, Kolte-Patil Developers Ltd (NSE: KOLTEPATIL / BOM: 532924) management has guided to do INR 3500cr+ (25% YoY growth) in pre-sales for the full-year FY26.

- During Q1FY26, KPDL completed allotment of 14.3% equity stake to Blackstone bringing in INR 417cr of capital that is earmarked to be predominantly used as growth capital.

- Due to ongoing transition phase with Blackstone (BX US) being added as a promoter, the business development activity has been slow. However, more clarity and visibility is expected post Q2.

🇮🇳 Fairfax India, The Programmatic Acquirer (Rock & Turner Investment Analysis)

- Gateway to India, part 3 is the series on Acquisition-as-a-Business

- For foreign investors, however, the Indian market can be challenging to navigate due to issues like withholding taxes, restrictions on capital movement and language/cultural barriers. Not only that, but some of the best investment opportunities exist among private businesses rather than the hyped and often overpriced publicly listed companies. So how does a non-Indian investor play this wonderful opportunity?

- A potential answer is proposed in this podcast which first unpacks why India is so attractive right now, but also focusses on a programmatic acquirer, a holding company named Fairfax India Holdings Corp (TSE: FIH.U / FRA: F5X / OTCMKTS: FFXDF), listed in Canada, it provides foreign investors with exposure to the dynamic Indian market while bypassing these complexities.

🇮🇳 Indian IT shares fall over fears from Trump’s $100,000 H-1B visa fee (FT) $ 🗃️

- US plan for $100,000 application charge threatens $283bn technological services industry

- The Nifty IT index dropped 2.7 per cent in Mumbai as Tata Consultancy Services (NSE: TCS / BOM: 532540), Infosys (NYSE: INFY), HCL Technologies (NSE: HCLTECH / BOM: 532281) and Wipro Ltd (NYSE: WIT) — the country’s largest outsourcing companies — all declined by a similar amount.

🇰🇿 Kaspi ($KSPI) (Calvin Blissett)

- Amazon, Ebay, Instacart and more all in one, for less than 9x earnings?

- I have a 9% position in KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS), I wish it was more as I believe it to be a phenomenal business however my capital is tied up in other opportunities that I believe have even more favorable risk/reward skews. Again, I will not be covering the “nitty gritty” of Kaspi more trying to capture the big idea and mental models surrounding my investment. If you want to acquaint yourself with Kaspi I refer you to none other than Matt Newell’s writeup write up as well as his deconstruction of the short report that was issued against Kaspi short deconstruction. Reading both of these articles really added to my understanding of Kaspi.

- So why does this opportunity exist? Kaspi is a super app, performing many many functions basically the Amazon, Ebay, PayPal, Instacart, Sofi of Kazakstan.

🌍 Middle East

🇮🇱 Teva Pharmaceuticals: Pipeline Momentum Signals New Era For Investors (Seeking Alpha) $ 🗃️

- 🌐 Teva Pharmaceutical Industries Ltd (NYSE: TEVA) – Branded-drugs, active pharmaceutical ingredients, contract manufacturing services & out-licensing platform. 🇼

🇸🇦 Saudi shares jump on hope of foreigner ownership change (FT) $ 🗃️

- Investors see move as signalling further reform in future

- “Foreign demand for Saudi stocks is meaningful but still modest,” said Mohammed Alsuwayed, chief executive of Razeen Capital in Riyadh. This is “less about unlocking immediate inflows, and more about the signal it would send: that Saudi markets are committed to further openness and long-term integration with global capital”.

🌍 Africa

🇿🇦 Gold Fields: Zero Margin Of Safety At Current Levels (Seeking Alpha) $ 🗃️

- 🌐 Gold Fields (JSE: GFI / NYSE: GFI) – One of the world’s largest gold mining firms. 9 operating mines in Australia, Peru, South Africa & Ghana (including the Asanko JV) & 2 projects in Canada & Chile. 🇼 🏷️

🇿🇦 Prosus: Tencent At A Discount, Plus A Growing E-Commerce Ecosystem For Free (Seeking Alpha) $ 🗃️

🇿🇦 Prosus: The Era Of Cash Flow And Profitability Beyond Tencent Has Just Begun (Seeking Alpha) $ 🗃️

- 🌐 Prosus (AMS: PRX / JSE: PRX / FRA: 1TY / OTCMKTS: PROSY / PROSF) – Global investment group that invests & operates across sectors & markets with long-term growth potential. Majority-owned by South African MNC Naspers (JSE: NPN / FRA: NNWN / NNW0 / OTCMKTS: NAPRF / NPSNY). 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇵🇱 InPost | The Locker Giant That Grew 57% a Year and Still Priced Below Its IPO (DeepValue Capital)

🇭🇺 Wizz Air✈️ (DuckPond Value Research)

- Came for the value, stayed for the growth.

- After a few months of discarding a couple of companies in the early analysis phase (I might write about them later), Wizz Air (LSE: WIZZ / OTCMKTS: WZZZY / FRA: WI20 / FRA: WI2), the ‘Ryanair of Eastern Europe,’ came onto my radar. I owe this idea to the Spanish value fund, Cobas Internacional. There’s nothing a value investor loves more than a temporary problem mixed with a dose of pessimism surrounding a company or sector. And that, without a doubt, is what drew me to this company.

- In any analysis, you eventually reach a point where you get a rough idea of how much margin of safety is left in the price. If that margin is already tight—if the market has already priced in the temporary nature of the problems—it might be time to close the file and move on. But WizzAir has some very interesting ingredients, and I can tell you it’s the first company I’ve done a deep dive on where I seriously see the potential for it to be a ‘multi-bagger’.

🇮🇹 🇷🇺 Brunello Cucinelli shares sink as short seller makes new Russia allegations (FT) $ 🗃️

- Morpheus Research alleges luxury brand continues to trade in Russia and misled investors over its operations in the country [From Moscow To TJ Maxx — How Brunello Cucinelli Continues To Lie About Its Russian Business While Aggressive Discounting Damages Its Exclusive Positioning]

- Morpheus Research, a London-based firm “dedicated to exposing fraud and corporate misconduct”, said a three-month investigation had found that Brunello Cucinelli SpA (BIT: BC / FRA: 8BU / OTCMKTS: BCUCF) “continues to operate several stores in Moscow with a wide offering of items priced at thousands of euros”.

🌎 Latin America

🌎 Corporacion America Airports: Global Growth Story Still Priced As An Argentina Play (Seeking Alpha) $ 🗃️

🌎 Corporacion America Airports: A Hidden Gem With 11% IRR Potential (Seeking Alpha) $ 🗃️

🌎 Corporación América Airports: Don’t Get Shaken Out By Political Uncertainty (Seeking Alpha) $ 🗃️

- 🌐 Corporación América Airports (NYSE: CAAP) – Leading private airport operator in the world. Operating 53 airports in 6 countries (Argentina, Brazil, Uruguay, Ecuador, Armenia & Italy). 🏷️

🌎 How Mercado Libre’s Founders Built a $100B Business (The Wolf of Harcourt Street)

- Lessons from the climbers & scalers podcast — Part 1

- A couple of weeks ago, a new podcast series called climbers & scalers was released. The 28-episode series, which chronicles MercadoLibre (NASDAQ: MELI) journey through the voices of its protagonists, was originally recorded in Spanish a few years ago. Produced independently by Federico Eisner, the series uses AI to clone the original voices in English.

- This article is Part 1 of a three-part series on key insights from the climbers & scalers podcast. Future installments will cover MELI’s expansion strategies and fintech evolution.

🌎 MercadoLibre: Profitability Under Pressure, But The Long-Term Buy Signal Remains (Seeking Alpha) $ 🗃️

- 🌎 MercadoLibre (NASDAQ: MELI) – Uruguay HQ’d. The largest online commerce & payments ecosystem in Latin America. 🇼 🏷️

🌎 The Globant Case GLOB 3.67%↑ (Edelweiss Capital Research)

- Is it still a tech disruptor, or just a very expensive staffing agency with nice offices? How a Latin American dream company went global — and why the future suddenly looks less obvious.

- Globant (NYSE: GLOB) stands as a symbol of Latin America’s ascent in the global tech landscape, evolving from a modest startup in a crisis-stricken Argentina to a multinational player in digital services. Founded in 2003 by four friends amid the country’s economic collapse, the company began with a vision sketched on a beer-soaked napkin: to harness Latin American talent for world-class software development. By 2014, Globant had achieved a landmark NYSE IPO as the first Latin American software firm to do so, marking its transition from regional underdog to international contender.

- The company grew fast. By 2022, they were making $1.78 billion, which is like 15 times more than when they went public, and growing 40% YoY. They worked with big names—Google, Electronic Arts, Santander—helping them with digital projects, you know, transforming how they work online. Investors loved Globant because it was different, innovative, and they paid a lot for its shares.

🇦🇷 US offers financial lifeline to Argentina’s Javier Milei (FT) $ 🗃️

- Treasury secretary Scott Bessent says ‘all options’ are on the table to support the country through bout of market volatility

🇦🇷 Lithium Americas: Annoying Trump Deal Boosts Stock (Seeking Alpha) $ 🗃️

🇦🇷 Lithium Americas Gets The Trump Premium: Is The 70% Rally Justified? (Seeking Alpha) $ 🗃️

🇦🇷 Trump Is Rumored To Invest In Lithium Americas – And Why It Matters (Seeking Alpha) $ 🗃️

- 🇦🇷 🇺🇸👼🏻 Lithium Americas (NYSE: LAC) – Focused on advancing lithium projects in Argentina & USA to production. 🇼 🏷️

🇧🇴 🇺🇸 Andean Precious Metals: Record-High Gold-Silver Prices Pave The Way For A Mid-Tier Producer (Seeking Alpha) $ 🗃️

- 🇧🇴 🇺🇸 Andean Precious Metals Corp (TSE: APM / FRA: 6ZS / OTCMKTS: ANPMF) – Mid-tier precious metals producer. San Bartolomé processing facility in Potosí, Bolivia & Soledad Mountain mine in Kern County, California. 🇼

🇧🇷 Nu Holdings: Revolutionizing Banking in Latin America (Compound & Fire)

- A Deep Dive into the Digital Disruptor’s Growth, Moats, and Future Potential – Nu Holdings (NYSE: NU) Stock Analysis 2025

- This deep dive article will cover Nu Holdings management, their culture, it’s product and services, business model, strategy and moats, competition, growth expectations and valuation and will include a buy-below price and the final score. Let us know whether you liked this extended deep dive!

🇧🇷 Nu’s Customers Get 34x More Valuable Over Time (The Wolf of Harcourt Street)

- A deep dive into ARPAC by cohort and what it means for revenue in 2030

- As part of Nu Holdings (NYSE: NU)’s quarterly earnings report, the company discloses its monthly average revenue per active customer (ARPAC) by cohort. Based on this data, we know that each customer becomes 34x more valuable over 8 years. In their first month, the average customer generates just $0.80 of revenue, but by year eight this rises to $27.30.

- This is an enormous engine for revenue growth, and it got me thinking: What could Nu’s revenue look like in 2030 simply from existing customers maturing, without adding a single new customer?

🇧🇷 TIM S.A.: From Mobile Underdog In Brazil To Cash-Flow Champion (Seeking Alpha) $ 🗃️

🇧🇷 Sendas Distribuidora: Not Done From Deleveraging Gains (Seeking Alpha) $ 🗃️

- 🇧🇷 Sendas Distribuidora SA (BVMF: ASAI3 / OTCMKTS: ASAIY) or Assaí Atacadista – Self-service wholesale company (Cash & Carry). 🇼 🇼 🏷️

🇧🇷 Eletrobras: 3 Reasons To Remain Bullish (Seeking Alpha) $ 🗃️

- 🇧🇷🅿️ Centrais Elétricas Brasileiras SA (NYSE: EBR / EBR.B / BVMF: ELET3 / ELET5 / ELET6) or Eletrobras – Electric power holding company. Largest generation & transmission company in Brazil. 🇼

🇧🇷 Vale: Solid Low-Cost Exposure To Future Trends At A Great Price (Seeking Alpha) $ 🗃️

- 🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 Embraer: Review About Challenges And Perspectives For The Next 4 Years (Seeking Alpha) $⛔🗃️

- 🌐 Embraer SA (BVMF: EMBR3 / NYSE: ERJ) – The 3rd largest producer of civil aircraft after Boeing & Airbus & the leading provider of regional jets worldwide. 🇼 🏷️

🇨🇱 LATAM Airlines: Valuation Is Flying Too High (Seeking Alpha) $ 🗃️

- 🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subs. in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇵🇦 Bladex: Growth Set To Continue With Fresh Capital Increase (Seeking Alpha) $ 🗃️

- 🌎 Banco Latinoamericano (NYSE: BLX) or the Foreign Trade Bank of Latin America or Bladex – Founding shareholders were the Central Banks & government entities of 23 countries in the region. Specialized in addressing trade finance needs. 🇼 🏷️

🌐 Global

🌐 Nebius: Overvaluation Miss Becomes A Win (Rating Upgrade) (Seeking Alpha) $ 🗃️

🌐 Nebius: Winter Is Coming – So Is GPU Demand (Double Upgrade) (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

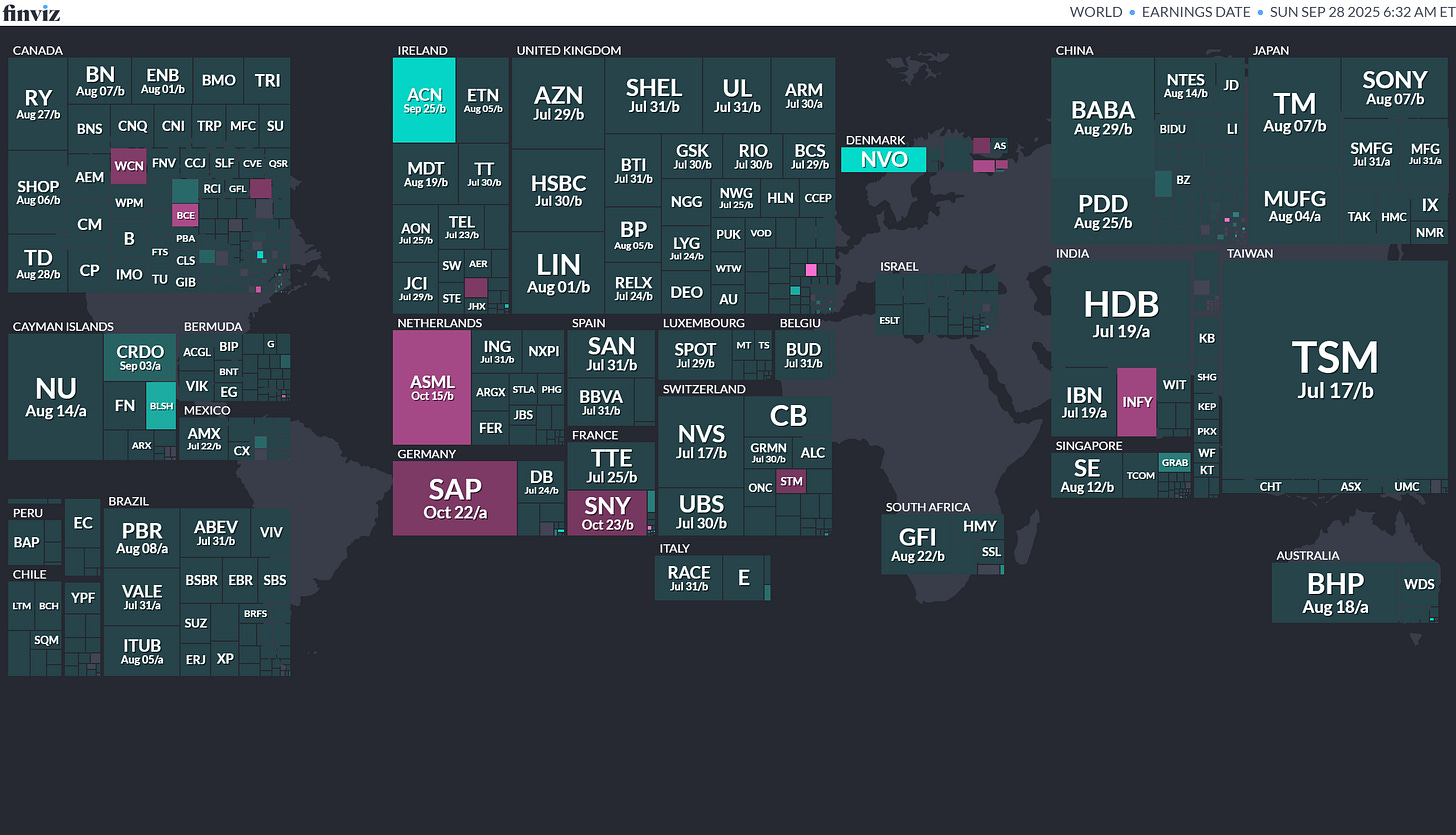

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

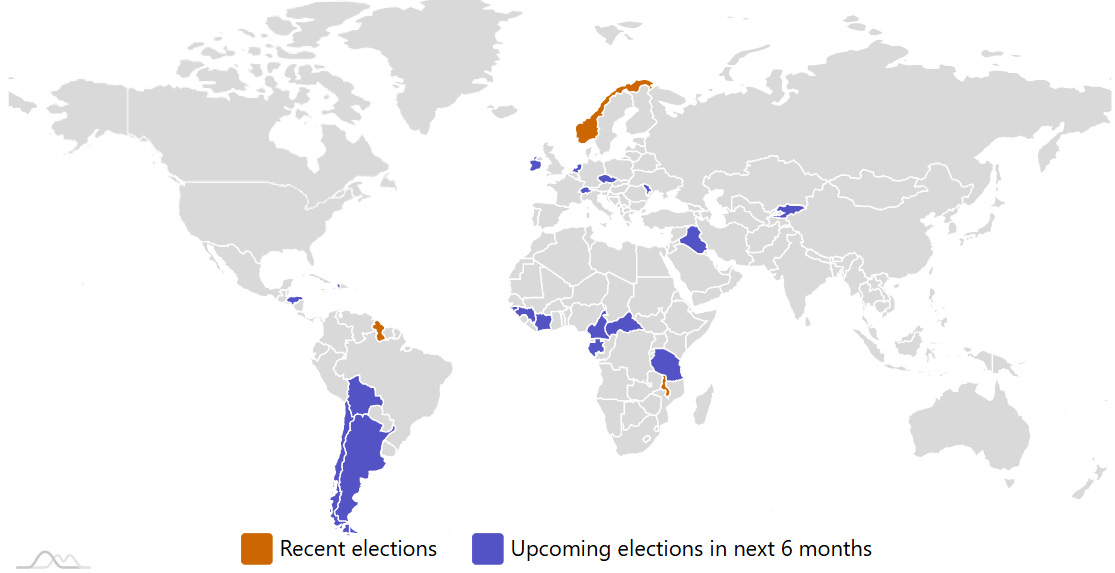

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Czech Republic Czech Chamber of Deputies 2025-10-03 (d) Confirmed 2021-10-08

- Argentina Argentinian Chamber of Deputies 2025-10-26 (d) Confirmed 2023-10-22

- Argentina Argentinian Senate 2025-10-26 (d) Confirmed 2023-10-22

- Iraq Iraqi Council of Representatives 2025-11-11 (d) Confirmed 2021-10-10

- Chile Chilean Chamber of Deputies 2025-11-16 (d) Confirmed 2021-11-21

- Chile Chilean Presidency 2025-11-16 (d) Confirmed 2021-12-19

- Chile Chilean Senate 2025-11-16 (d) Confirmed 2021-11-21

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Megan Holdings Ltd. MGN D. Boral Capital (ex-EF Hutton), 1.3M Shares, $4.00-4.00, $5.0 mil, 9/26/2025 Priced

We are a company principally engaged in the development, construction and maintenance of aquaculture farms and related works. (Incorporated in the Cayman Islands)

Our operations are based in Malaysia. Since our inception in 2020, we have strived to establish ourselves as a trusted and experienced provider of shrimp farm-related maintenance services in Malaysia. As of the date of this prospectus, we have been carrying out a series of upgrading and maintenance work projects for aquaculture farms, all of which are located in Tawau, Sabah, Malaysia. This constitutes 71.8%, 43.7% and 15.5% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively. Besides that, we also carried out upgrading work for a pineapple plantation farm located at Kota Tinggi, Johor, Malaysia in 2022 and 2023. This constituted nil, 25.3% and 22.6% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively.

Complementary to our upgrading and maintenance services, we also assist customers with the design and development of new farms. As of the date of this prospectus, we are currently involved in the development and construction of a shrimp hatchery center in Semporna, Sabah, Malaysia, where we have been engaged to undertake the construction of hatchery buildings and related functional facilities. We are also assisting in the development of a 111-acre shrimp farm at Tawau, Sabah, Malaysia. The design and development of new farms comprised 22.2%, 16.4% and 61.7% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively. From time to time, we also assist our customers in sourcing for building materials and machinery available for rental for use on their farms. This comprised 6.0%, 14.6% and 0.2% of our revenue for the financial years ended December 31, 2021, 2022 and 2023, respectively.

With our wide suite of services and diverse revenue streams, we are well-positioned to serve customers as a one-stop center for their aquaculture and agriculture needs.

Note: Net income and revenue are in U.S. dollars (converted from the Malaysian ringgit) for the 12 months that ended Dec. 31, 2023.

(Note: Megan Holdings Ltd. priced its small IPO – just 1.25 million shares – at its assumed IPO price of $4.00 – to raise $5.0 million on Thursday night, Sept. 25, 2025. Background: Megan’s small IPO was cut – back to its original size – of 1.25 million shares – down from 2.5 million shares – and the price range was kept at $4.00 to $6.00 – to raise $6.25 million, if priced at the $5.00 mid-point of its range, according to an F-1/A filing dated Sept. 4, 2025.)

(Note: Some on Wall Street expected Megan’s small IPO to price during the last week of August 2025. As of Friday midday on Aug. 29, 2025, Megan’s IPO appears to still be in pre-launch status, the Street hears. Background: Megan Holdings Ltd. adjusted its small IPO’s price range back to the original level of $4.00 to $6.00 – and kept the size at 2.5 million shares – to raise $12.5 million, according to an F-1/A filing dated March 11, 2025.)

(Background: Megan Holdings Ltd. doubled its small IPO’s size – to 2.5 million shares – up from 1.25 million shares originally – and trimmed the price range to $4.00 to $5.00 – pulling back from the original $4.00-to-$6.00 price range – to raise $11.25 million, according to an F-1/A filing dated Feb. 20, 2025. Previously: Megan Holdings Ltd. filed its F-1 on Aug. 8, 2024, and disclosed the terms for its micro-cap IPO: 1.25 million shares at a price range of $4.00 to $6.00 to raise $6.25 million. Megan Holdings did not name an underwriter in its F-1 filing.)

Harvard Avenue Acquisition Corp. HAVAU D. Boral Capital (ex-EF Hutton), 18.0M Shares, $10.00-10.00, $180.0 mil, 9/29/2025 Week of

(Incorporated in the Cayman Islands)

We are a newly organized blank check company. We have not selected a sector or a geographic region of interest.

Sung Hyuk Lee, CEO and a director, has extensive experience in corporate finance, financial advisory and business consulting. Since May 2021, Mr. Lee has served as the CEO of the Seoul, South Korea, office of Plutus Partners Co., Ltd., a private equity and high-value asset brokerage firm based in Tampa, Florida. Before that, between June 2016 and March 2021, Mr. Lee served as the senior managing director at DTR Partners (Seoul office). Mr. Lee holds a bachelor’s degree in political science from Yonsei University, Korea, and an MBA from Hass School of Business, California.

Hoon Ji Choi, CFO and a director, has more than a decade of experience in investment management. Since May 2021, Mr. Choi has served as a managing director in the Seoul, South Korea, office of Plutus Partners Co., Ltd., a private equity and high-value asset brokerage firm based in Tampa, Florida. Before that, between October 2014 and December 2020, Mr. Choi served as a managing director at Qing Shan Investment’s Seoul office. As a senior leader of Qing Shan Investment, Mr. Choi was engaged on various buy-side and sell-side cross-border M&A advisory deals. Prior to joining Qing Shan Investment, Mr. Choi served as Asia Regional Director at Deesse AG (Seoul office), from April 2012 to October 2014, where he was responsible for sales and promotion for Asia market, especially for South Korea. Earlier in his career, Mr. Choi served as an Associate with Colony Capital Inc. from October 2010 to March 2012, where he assisted in analyzing and researching investment strategies and targets. Mr. Choi holds two bachelor’s degrees in real estate finance and accounting from the University of Southern California’s Marshall School of Business and the Levanthal School of Accounting, respectively.

(Note: Harvard Avenue Acquisition Corp. cut its SPAC IPO’s size to 18.0 million units – down from 25.0 million units originally – and kept the price at $10.00 per unit – to raise $180.0 million, according to an S-1/A filing dated July 15, 2025. Each unit includes one share of stock and one right to receive one-tenth (1/10th) of a share of stock upon the consummation of an initial business combination.)

Knorex Ltd. KNRX R.F. Lafferty & Co./Craft Capital Management, 3.0M Shares, $4.00-4.00, $12.0 mil, 9/29/2025 Monday

We supply advertising software to marketers. We are based in Singapore. (Incorporated in the Cayman Islands)

We are a B2B technology company specializing in providing programmatic advertising products and solutions to marketers to streamline and automate their advertising and marketing workflows. Our software offers marketers cost-effective solutions and productivity-enhancing capabilities to target their desired audience across various advertising channels and devices through automated processes and algorithms, which is known as “programmatic advertising” in our industry. Leveraging our proprietary AI/ML technology and steered by the marketer’s directive, our cloud-based software can autonomously execute split-second advertisement purchasing transactions, strategically acquiring advertising placements and optimizing online advertisement from the global advertisement and data marketplaces using the insights gleamed from diverse data points consolidated across various ad channels, including the Open Internet and the Walled Gardens. It is critical for marketers to connect to as many online ad channels as possible to attain the sufficient reach to engage with their desired audience at the right time to effectively promote their products and services. However, advertising to two or more of these disparate and siloed ad channels and to enable tracking between offline and online channels, or “omni-channel advertising”, is a complex and costly operation. Our mission is to simplify the increasingly complex digital marketing landscape to help accelerate our customers’ business growth through a data-driven approach.

Our flagship product, Knorex XPOSM, is a self-service enterprise-grade cloud platform with a comprehensive suite of advertising management and execution (AMX) applications. Our highly differentiated platform empowers marketers to orchestrate omni-channel advertising across the Open Internet, and the Walled Gardens or the Native Platforms owned by the big tech giants, and to streamline and automate manual processes to drive advertising efficiency and performance. XPO enables intelligent automation and scaling, allowing marketers to seamlessly manage and control core mission-critical online advertising processes from a centralized UI, to advertise across a diverse range of ad channels including search, social media, apps, websites, desktop, mobile, smart TVs or connected televisions, streaming devices, and digital billboards. Our AI/ML-powered platform revolutionizes digital advertising management by offering marketers a truly integrated solution for omni-channel orchestration. It seamlessly consolidates the key functions of planning, creation, measurement, monitoring, management, and optimization of advertisements across the world’s leading ad channels, into a singular unified platform. This eliminates the need for marketers to grapple with multiple siloed platforms, creating XPO as an all-encompassing system of record that closes the customer marketing analytics loop.

Since our inception in September 2009 in Singapore, we have expanded our operation to the U.S., Vietnam, India, and Malaysia, where the U.S. is now by far our largest market. Over the years, we have consistently made substantial investments in research and development, forging robust partnerships with leading media, data, and technology partners across the United States, Europe, and Asia. These efforts have been pivotal in shaping our commercial development and product roadmap as we actively pursue expansion initiatives.

Our commitment to excellence has been recognized by our industry partners, including recently being enlisted as a Meta Business Partner and Google Premier Partner (among the top 3% exclusive tier) in recognition of our technical, operation, and business excellence. We were awarded the MarTech Breakthrough Awards for “Best Remarketing Platform” in 2022 and named a Top 10 Marketing Automation Solution Provider in 2021 by MarTech Outlook.

Note: Net loss and revenue are for the 12 months that ended Dec. 31, 2024.

(Note: Knorex Ltd. is offering 3.0 million shares at an assumed IPO price of $4.00 to raise $12 million. This is a change from the price range of $4.00 to $5.50 – in the prospectus – on 3 million shares – to raise $14.25 million, if priced at the $4.75 mid-point, according to its F-1/A filings.)

(Background: Knorex Ltd. filed its F-1 on Nov.12, 2024, without disclosing terms for its IPO. Estimated initial proceeds were $12 million.)

OBOOK Holdings (Direct Listing) OWLS D. Boral Capital (ex-EF Hutton) (Financial Adviser), 0.0M Shares, $0.00-0.00, $0.0 mil, 9/29/2025 Week of

Note: This is NOT an IPO. This is a Direct Listing on the NASDAQ. D. Boral Capital will serve as the financial adviser. Existing shareholders will sell stock in the direct listing. No new stock will be issued and/or sold, according to the prospectus..

The company’s operating entity, OwlTing Group, runs blockchain-driven service platforms for companies in a variety of industries:

- OBOOK – for e-commerce, hospitality and payments – for companies and people involved in cross-border transactions;

- OwlPay – for payment products and services

- OwlNest – for hospitality products and services

- OwlTing Market – for an e-commerce platform and services.

Note: Net loss and revenue are in U.S. dollars for the 12 months that ended Dec. 31, 2024.

(Note: OBOOK Holdings’ shareholders will sell up to 4.73 million shares (4,729,695 shares) of stock in the NASDAQ Direct Listing, according to an F-1/A filing dated Sept. 19, 2025. No reference price has been set yet. In 2025, OBOOK Holdings said its stock sold for $10.00 per share in a private placement, according to the prospectus.)

Bgin Blockchain Ltd. BGIN D. Boral Capital (ex-EF Hutton), 6.3M Shares, $7.00-9.00, $50.0 mil, 10/1/2025 Week of

We make cryptocurrency mining equipment. Our focus is on alternative currencies. (Incorporated in the Cayman Islands)

Through our operating subsidiaries, we are a digital asset technology company based in Singapore, Hong Kong, and the U.S. with proprietary cryptocurrency-mining technologies and a strategic focus on alternative cryptocurrencies.

For the fiscal year ended December 31, 2022, we generated substantially all of our revenue from cryptocurrency mining. Since April 2023, we have generated revenue from selling mining machines designed by us, and sales of mining machines contributed approximately 85.43% and 65.71% of our total revenue for the fiscal year ended December 31, 2023, and the six months ended June 30, 2024, respectively.

Our subsidiaries design and sell mining machines equipped with our proprietary 8nm or 12nm ASIC chips under different series dedicated to the mining of KAS coins, ALPH coins, RXD coins, and ALEO coins. These machines are available for purchase only through our website, iceriver.io. Customers may view and place orders for machines they intend to purchase directly through the website, and have the option to enroll in our miner hosting services, through which we operate and manage mining machines on customers’ behalf in return for service fees. Customers purchasing machines sold by our subsidiaries are primarily based in Hong Kong, the U.S. and Southeast Asia. For the fiscal year ended December 31, 2023, and the six months ended June 30, 2024, we sold an aggregate of 67,998 and 47,252 mining machines, respectively, to customers across the world. As of the date of this prospectus, we host a total of 4,020 machines on behalf of our customers, of which 2,969 are in operation at our mining farm located in York, Nebraska, and a hosting facility in Coon Rapids, Iowa, and 1,051 are stored in our warehouse in Beatrice, Nebraska.

As our subsidiaries produce cryptocurrencies through their mining operations, they exchange cryptocurrencies mined for fiat currency on a regular basis to generate cash flow to fund our subsidiaries’ business operations. We attribute our substantial growth since our inception to our competitive advantages in our subsidiaries’ research and development capacities, our experienced and visionary management team, and our strategic focus on alternative cryptocurrency mining. According to the Frost & Sullivan Report, alternative cryptocurrencies refer to cryptocurrencies other than Bitcoin and Ethereum. Alternative cryptocurrencies are generally considered to have more growth potential with higher risks compared to large-capitalization cryptocurrencies. To mitigate such risks and maximize profit potential, our subsidiaries adopt a flexible approach to mining operations by using their proprietary cloud-based mining machine management software to monitor mining results on a daily basis and, on an as-needed basis, adjust the ratio of cryptocurrencies to be mined.

We believe that the strong design of our mining machines and the research and development capabilities of our subsidiaries represent key competitive strengths that afford us the ability to conduct cryptocurrency mining with greater computing power and power efficiency. Our subsidiaries fully rely on their self-designed mining machines for their daily cryptocurrency mining operations. To date, through our subsidiaries, we have designed 26 and put into use 14 different models of cryptocurrency mining machines, each specifically adapted and dedicated to alternative cryptocurrency mining.

As of the date of this prospectus, our subsidiaries own a total of 48,277 mining machines for operation purposes, of which 34,390 are in operation, 11,475 are not operated and are stored in mining farms and hosting facilities in the U.S. or our warehouses in Hong Kong and Beatrice, Nebraska, and 2,412 are currently being detained by U.S. Customs and Border Protection (“U.S. Customs”) and are now the subject of re-export proceedings. See also “Business — Legal Proceedings.” Through our subsidiaries, we currently manage and operate some of our mining machines in the U.S. at mining farms owned by our subsidiaries in Omaha, Nebraska, and York, Nebraska. The remaining mining machines are hosted by third-party hosting service providers at four different locations in the States of Iowa, Texas, West Virginia and Ohio. As of the date of this prospectus, other than 425 mining machines located in our warehouse in Hong Kong, all the mining machines owned by our subsidiaries are located in the U.S. See “— Growth Strategies — Improving and Integrating Our Business Model to Encompass a Value Chain.”

We strive to continuously develop and implement technological improvement into our subsidiaries’ mining process. The technological cornerstone of our subsidiaries’ cryptocurrency mining operations is their proprietary cloud-based mining machine management software, which is used at all of the mining farms in which our subsidiaries maintain and operate mining machines, and allows them to make timely and informed decisions as to the use and management of their mining machines.

Since September 2023, we have been operating a mining pool, currently dedicated to mining five cryptocurrencies, through which we generate income by receiving crypto coins as rewards and deducting a percentage of such rewards as pool fees from payouts to pool participants. See “— Mining Pool.”

For the fiscal years ended December 31, 2022, and December 31, 2023, and the six months ended June 30, 2024, the company’s business operations were heavily dependent upon KAS coins. See “Risk Factors — Risks Related to Our Business and Industry — Our business operations are heavily dependent upon the stability and popularity of KAS coins” and “Industry — Total Market Capitalization of Cryptocurrencies — KAS.”

Note: Net income and revenue are in U.S. dollars for the 12 months that ended June 30, 2024.

(Note: Bgin Blockchain Ltd. filed its FWP (free writing prospectus) on March 20, 2025, for its IPO: 6.25 million shares at a price range of $7.00 to $9.00 to raise $50.0 million.)

(Note: D. Boral Capital is the sole book-runner, replacing Chardan and The Benchmark Company, the joint book-runners.)

HW Electro Co., Ltd. (NASDAQ-New Filing) HWEP American Trust Investment Services/WestPark Capital, 4.2M Shares, $4.00-4.00, $16.6 mil, 10/2/2025 Week of

We are the first company in Japan to obtain a license plate number for imported electric light commercial vehicles. We are the second company and also one of the three companies that sell electric light commercial vehicles in Japan as of the date of this prospectus. (Incorporated in Japan)

The electric light commercial vehicles we sell belong to the category of “light commercial vehicles,” which are commercial carrier vehicles with a gross vehicle weight of no more than 3,500 kilograms.

We commenced selling and delivering two models of electric light commercial vehicles, ELEMO and ELEMO-K, in Japan in April 2022 and July 2022, respectively, and have been working with Cenntro, our cooperating manufacturer, to produce them under our brand, “ELEMO,” in its factory in Hangzhou, China. ELEMO is the first electric vehicle we sell and (it) is the second electric light commercial vehicle that has ever been sold in Japan since the commencement of sales of MINICAB-MiEV in December 2011, which was the first electric light commercial vehicle produced by Mitsubishi Motors Corporation. Since June 2023, we have commenced the sales of a new model called “ELEMO-L,” a van-type electric vehicle that could be used for commercial and recreational camping purposes, which we expect may enable us to increase consumer market penetration.