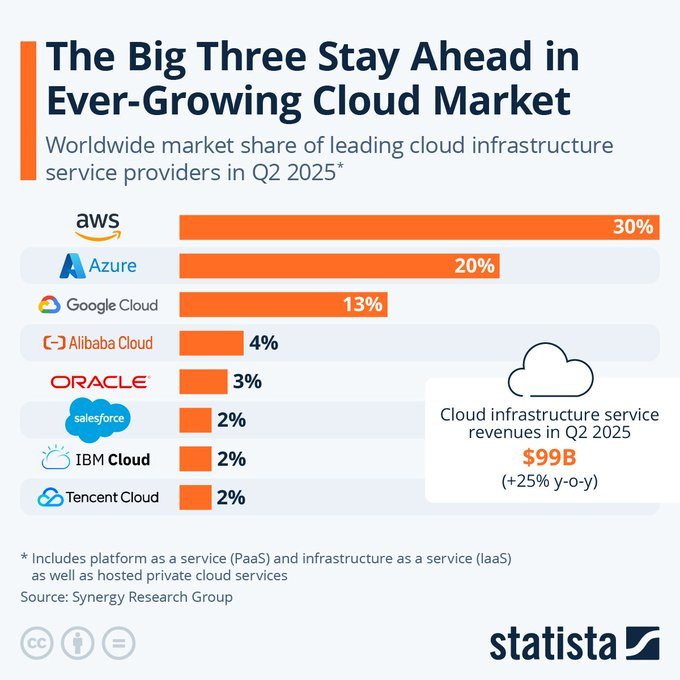

Earlier this month, I mentioned the excerpt chapter covering Amazon (Way past its prime: how did Amazon get so rubbish?) from Enshittification: Why Everything Suddenly Got Worse and What to Do About It which did not cover Amazon Web Services (AWS). Normally this post is on Monday; but yesterday’s outage knocked Substack out for a few hours (and assume a few more hours for any online service to get back to truly normal) during the day Asia time and along with a big chunk of the Internet and many content creators.

If you want to know why that happened (and maybe there is another opening for China tech or someone else):

Twitter though apparently uses a couple of the above services – a reason why everyone could go there to find out what was going on and to complain about…

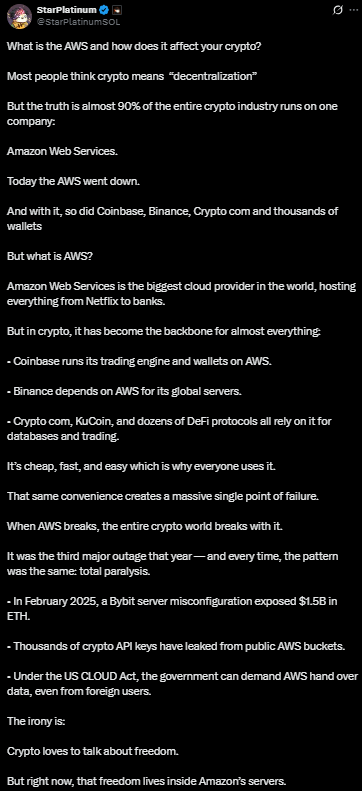

And while this Substack does not cover crypto, those who are into it might want to consider this tweet about how dependent that sector is on AWS:

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- EM Fund Stock Picks & Country Commentaries (October 19, 2025) Partially $

- EM challenger banks, African markets outperform, West Africa’s BRVM exchange, local vs hard currency EM debt, impact of US tariffs on EM companies, tariff winners/losers, Q3/Sept fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Cover Story: China Rewrites the Rules of Financial Failure (Caixin) $

- On Sept. 8, 2025, China’s top legislature began reviewing the first full overhaul of the Enterprise Bankruptcy Law in nearly two decades. The draft, released days later for public comment, explicitly incorporates mechanisms pioneered in cases such as Huishan’s — from merged reorganizations to tighter coordination between courts and local governments.

- The revision marks a milestone in China’s slow embrace of market-based exit rules. When the law first took effect in 2007, bankruptcy was a stigma; today, it is a policy tool.

🇨🇳 The Algorithm Eats the Search Bar – AI Is Rewriting Chinese E-Commerce (The Great Wall Street) $

- AI is reshaping how consumers find products — and China’s e-commerce giants won’t all feel the impact the same way.

- The Brutal Reality of Competition in China

- AI Won’t Flatten the Playing Field — It’ll Tilt It

- Investors, used to a single dominant platform at home, often fail to grasp the diversity of China’s e-commerce landscape. They lump everything together — PDD Holdings (NASDAQ: PDD) or Pinduoduo as a “cheap Taobao,” JD.com (NASDAQ: JD / SGX: HJDD) as “Taobao with warehouses.” That kind of shorthand might feel convenient, but it’s a fundamental mistake.

- These companies aren’t small variations of the same model. They’re structurally different businesses with different incentives, strengths, and strategic logic. The nuances matter.

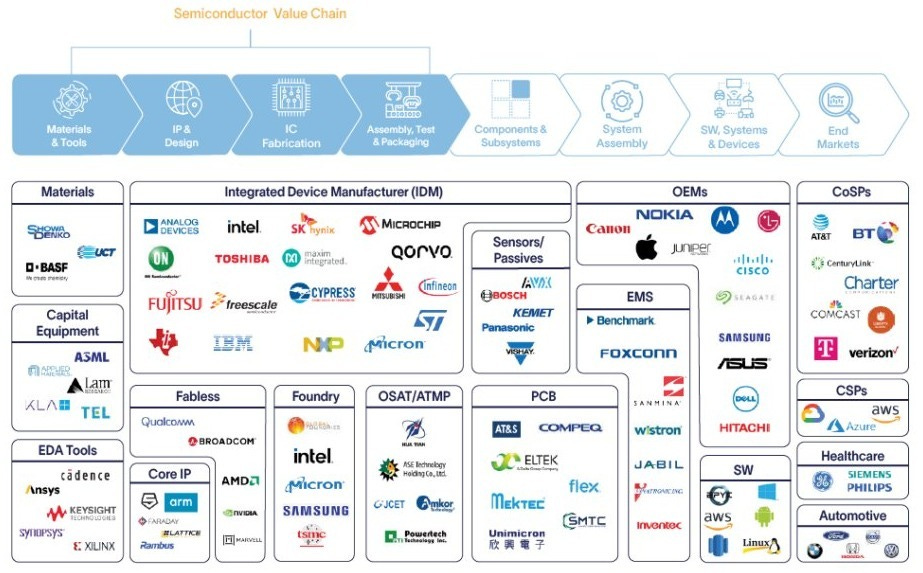

🇨🇳 Dutch govt accused of freezing operations of Chinese semiconductor giant’s chipmaker Nexperia (Pekingnology)

- Wingtech Technology (SHA: 600745), the Shanghai-listed parent, denounces what it essentially calls a boardroom coup involving the Dutch government and local executives

- Wingtech Technology is a privately-run, Shanghai-listed Chinese electronics and semiconductor conglomerate headquartered in Jiaxing, Zhejiang Province. It began as an original design manufacturer (ODM) for smartphones and consumer devices and has since grown into one of China’s most prominent integrated technology companies, combining electronics assembly, chip design, and semiconductor manufacturing.

- Wingtech in 2019 acquired Nexperia, a Dutch semiconductor firm that was formerly part of Philips’ chip division, NXP. Headquartered in the Netherlands, Nexperia is a global semiconductor company with a rich European history and over 12,500 employees across Europe, Asia, and the United States. Another time that Wingtech made international headlines was in November 2022, when the British government ordered Nexperia to sell at least 86% of Britain’s biggest microchip factory citing a national security assessment.

🇨🇳 🇪🇺 Europe slowly awakens to its entry into US-China wars (FT) $ 🗃️

- Dutch seizure of a Chinese-owned chipmaker show EU’s balancing act between Washington and Beijing under strain

🇨🇳 Beijing software pivot puts Kingsoft in focus. But can it deliver? (Bamboo Works)

- A government announcement on a document using the company’s word processing program stirred expectation for accelerated import substitution in software systems

- The Chinese government’s use of Kingsoft Corporation (NASDAQ: KC) word processing software on a key recent document fueled a rally for shares of China’s answer to Microsoft Office

- Despite import-substitution tailwinds and bullish targets, Kingsoft’s penetration among enterprises lags, with 66% of its revenue still coming from individual users

🇨🇳 Sunny Optical, Goertek forge ‘Optical Alliance’ in bet on AI glasses (Bamboo Works)

- The marriage of Sunny Optical (HKG: 2382 / LON: 0Z4I / FRA: SXC / OTCMKTS: SOTGY / SNPTF)’s technology with GoerTek Inc (SHE: 002241)’s manufacturing muscle could create a new giant in China’s optical industry

- Goertek Optical and Sunny Optical will form a joint venture, Goertek-OmniLight Optical Technology, with Sunny Optical holding 31%

- The venture will possess China’s only dedicated ASML lithography machine currently used in volume production for optical waveguide technology used in AI glasses

🇨🇳 Yunji rolls out red carpet for investors with Hong Kong IPO (Bamboo Works)

- The maker of scenario-based, AI-empowered robots, mostly used in hotels, raised about $76 million, as it becomes the first maker of flexible, service-based robots to list in Hong Kong

- Beijing Yunji Technology Co Ltd (HKG: 2670) raised about $76 million in its Hong Kong IPO, with a majority of funds earmarked for R&D to expand its portfolio of AI-empowered robots and service agents

- The company has garnered backing from a diverse group of major investors, including Alibaba (NYSE: BABA), Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF), Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY), and FountainVest Partners

🇨🇳 Deadly SU7 Blaze Triggers $10 Billion Rout in Xiaomi Stock (Caixin) $

- A fatal crash involving a Xiaomi SU7 electric sedan that caught fire has sent shares of Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) sharply lower, marking the third fire-related incident this year involving the tech giant’s debut vehicle.

- The accident occurred around 3:18 a.m. in Chengdu, where a Xiaomi SU7 collided with another vehicle, jumped a median, and burst into flames, local police said. The 31-year-old driver, surnamed Deng, died in the crash. Authorities suspect he had been driving drunk. The investigation remains ongoing.

🇨🇳 In Depth: Why Singapore Sovereign Fund Sued Chinese EV-Maker Nio (Caixin) $

- Singaporean sovereign wealth fund GIC Pte. Ltd. is suing Chinese electric-vehicle (EV) maker NIO Inc (NYSE: NIO) and executives for alleged securities fraud, in a bid to recover “tremendous” investment losses.

- GIC filed a complaint with the New York Southern District Court in late August, accusing Nio, along with its CEO Li Bin and Chief Financial Officer Feng Wei, of violating securities law, alleging that they used a battery rental joint venture (JV) to inflate the automaker’s revenue.

🇨🇳 EHang tries to break from holding pattern with new longer-range aircraft (Bamboo Works)

- The electric vertical take-off and landing aircraft maker unveiled its second major model with a range of up to 200 kilometers, complementing its original model for short distances

- EHang Holdings (NASDAQ: EH) has launched a second major model, the VT35, whose 200-kilometer range complements the much shorter 30 kilometers for its original EH216-S

- The company has found a major benefactor in the municipal government of Hefei, capital of Anhui province, which has pledged 500 million yuan in support

🇨🇳 Seres Group H Share Listing: The Investment Case (Smartkarma) $

- Seres Group Co Ltd (SHA: 601127), a Chinese NEV manufacturer, has filed its PHIP for an H Share listing to raise US$1.5 billion.

- The A Shares were listed on 15 June 2016. In May 2021 and June 2022, Seres conducted private placements to raise RMB2,567.9 million and RMB7,058.6 million, respectively.

- The investment case rests on solid NEV performance, improving margin profile and strong cash generation.

🇨🇳 Vanke Chairman Resigns Amid Deepening Debt Crisis (Caixin) $

- The chairman of Hong Kong-listed Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / OTCMKTS: CHVKF / CHVKY) has resigned after being out of contact for about a month.

- Vanke announced in a stock exchange filing on Monday that Xin Jie had submitted his resignation for “personal reasons.” He has been replaced by Huang Liping, general manager of Vanke’s major state-owned shareholder, Shenzhen Metro Group Co. Ltd.

🇨🇳 China’s Property Rally Fizzles After September Rebound (Caixin) $

- China’s leading property developers posted their first simultaneous monthly and annual sales gains this year in September, but a sharp decline during the subsequent Golden Week holiday shows the market’s recovery remains fragile.

- The top 100 real estate firms logged 252.8 billion yuan ($35.5 billion) in contracted sales last month, up 22.1% from August and 0.4% from a year earlier, data from China Real Estate Information Corp. (CRIC) showed.

🇨🇳 Chinese developers turn to commercial property for better returns (The Asset) 🗃️

- Residential segment continues to face huge inventory amid weak demand

- The backlog of unsold buildings, particularly in old developments, has increased the burden on private developers and tightened their liquidity. On the other hand, state-owned developers with adequate funding access have accelerated land acquisition to maintain their competitiveness.

- While the residential property sector struggles with sluggish sales, shopping malls provide stable rental income that counters the underperformance.

🇨🇳 Gold Fever Grips China, but Regulators Say Beware (Caixin) $

- As gold prices soar to unprecedented highs, Chinese regulators are ramping up warnings over a surge in investment scams targeting retail consumers — ranging from shady purchasing agents to illegal “gold custody” services promising guaranteed returns.

- During the National Day holiday starting Oct. 1, international gold prices surged past $4,000 an ounce. On Oct. 13, London spot gold touched a record $4,060, prompting local prices for gold retailers like Chow Tai Fook Jewelry Group (HKG: 1929 / FRA: 1CT / OTCMKTS: CJEWY / CJEWF) to hit 1,180 yuan per gram. The milestone sparked a retail frenzy, with buyers rushing in on expectations of further gains.

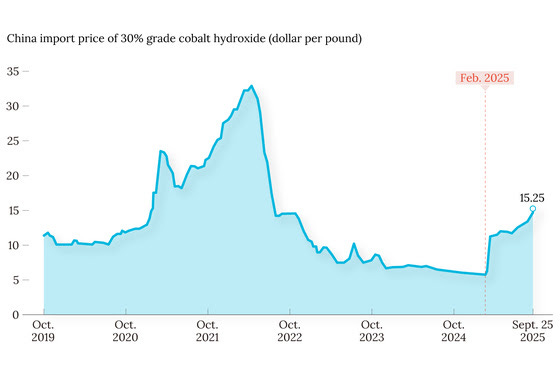

🇨🇳 In Depth: Congo’s Cobalt Controls Deepen Uncertainty for Chinese Miner (Caixin) $

- It has been a rough year for the world’s largest cobalt producer.

- Shanghai-listed CMOC Group Limited (SHA: 603993 / HKG: 3993)’s sales fell over 17% year-on-year in the second quarter, according to the miner’s earnings results. By the end of June, its inventory of the metal, a key raw material for the lithium-ion batteries that power smartphones and electric vehicles (EVs), had increased 35% to more than 57,000 tons.

- On June 30, IXM, a commodities trader owned by CMOC, took the extraordinary step of reneging on its cobalt supply contracts, declaring force majeure and admitting that it could no longer obtain cobalt mined from the Democratic Republic of Congo (DRC).

🇨🇳 Zijin Gold: Less Attractive Relative Valuation Post Share Price Surge (Douglas Research Insights) $

- Zijin Gold International Co Ltd (HKG: 2259 / FRA: 6LU / OTCMKTS: ZJNGF)’s share price has surged by 92% to reach HK$137.4 per share since its IPO price of HK$71.59 per share.

- Zijin Gold now trades at a 61% premium to the comps’ average EV/EBITDA valuation multiple in 2026.

- One could argue that this excessive valuation multiple is a bit too aggressive despite higher growth prospects. Therefore, on a relative valuation basis, we would not chase after Zijin Gold.

🇨🇳 Gold’s bull market lifts Zhaojin to more shiny earnings (Bamboo Works)

- The miner reported impressive profit growth in the third quarter, benefiting from U.S. dollar weakness and a 17% surge for gold in the three-month period

- Zhaojin Mining Industry Company Limited (HKG: 1818 / FRA: ZVL / OTCMKTS: ZHAOF)’s profit soared 140% in the first three quarters of the year on the back of record gold prices.

- A strategic tie-up with Zijin Mining and the imminent startup of its Haiyu Gold Mine should further support the company’s profit growth

🇨🇳 Ganfeng Lithium (1772 HK): Global Index Inclusion, Outperformance & The A/H Trade (Smartkarma) $

- Ganfeng Lithium Group (SHE: 002460 / HKG: 1772 / OTCMKTS: GNENY / GNENF)‘s stock price has surged over the last 6 months, and the higher free float market cap should result in global index inclusion in November.

- Ganfeng Lithium (1772 HK) has outperformed its peers and is trading at higher valuations on most metrics. Tianqi Lithium Corp (SHE: 002466 / HKG: 9696 / FRA: 2220) is trading a lot cheaper.

- The Jiangxi Ganfeng Lithium (002460 CH) / Ganfeng Lithium (1772 HK) premium has drifted lower and there could be a move higher as we near index inclusion.

🇨🇳 Xinte to spread clean power building burden using asset backed securities (Bamboo Works)

- The polysilicon producer and green power farm operator plans to issue ABS backed by two of its wind power projects, which will be traded on the Shanghai Stock Exchange

- Xinte Energy Co Ltd (HKG: 1799 / FRA: 9M7) plans to issue up to 3 billion yuan worth of asset-backed securities backed by two of its wind farm projects

- The solar and wind farm builder has 21 billion yuan worth of mortgaged asset commitments, many tied to power plants under China’s recent green energy buildup

🇨🇳 Mandarin Oriental (MAND SP): Jardine Matheson’s Attractive Scheme Offer (Smartkarma) $

- Mandarin Oriental (SGX: M04 / FRA: 1C4 / OTCMKTS: MAORF) disclosed a privatisation offer from Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF)at US$3.35 (US$2.75 cash + US$0.60 special dividend), a 39.6% premium to the last close.

- The special dividend represents the majority of the proceeds from the sale of the top thirteen floors of One Causeway Bay (OCB) to Alibaba (NYSE: BABA) and Ant Group for US$925 million.

- The offer is final. The scheme is conditional on the completion of the OCB sale and Mandarin shareholder approval. This is a done deal due to an attractive offer.

🇨🇳 Mixue starts selling beer — at just US$0.8 a pint? (Momentum Works)

- Through deep supply chain integration and an interest-aligned franchise model, MIXUE Group (HKG: 2097 / OTCMKTS: MXUBY), China’s ice cream and milk tea giant, has become the world’s largest F&B chain by store count.

- But after reaching over 48,281 stores in China, the question is: how much more can it grow at home? Despite reporting solid half-year earnings, Mixue’s share price has dropped more than 20%, suggesting investors aren’t convinced the domestic market has much room left.

- Now, Mixue is venturing into a new category: beer.

- Last week, the company announced the acquisition of a 53% stake in Fulujia, a fast-growing craft beer chain, for RMB 297 million (US$41.7 million).

🇨🇳 Chinese Coca Cola rising? A diversifying Eastroc makes second Hong Kong IPO bid (Bamboo Works)

- The Shenzhen-based company is rapidly developing beyond its original energy drink focus, as it continued to post strong growth in the first half of this year

- Eastroc Beverage Group Co Ltd (SHA: 605499) has filed a second Hong Kong IPO application, after its original one lapsed, showing its sales rose 37% in the first half of this year

- A billion-dollar listing could help the beverage maker fund new production bases as it expands beyond its original energy drink focus

🇨🇳 China Travel International sheds property unit to focus on core business (Bamboo Works)

- The travel and tourism company will spin off its tourist property segment and significantly reduce its capital in a major restructuring

- China Travel International Investment Hong Kong Limited (HKG: 0308 / FRA: CTI / OTCMKTS: CTVIF) will spin off its property arm, giving shareholders the option of receiving a cash payment of HK$0.336 per share as part of the divestment

- The move comes as the company shifts its focus towards developing scenic tourist attractions and related businesses

🇨🇳 Remegen (9995 HK): Index Inclusion as Sector Starts to Drop (Smartkarma) $

- After a huge upward move earlier this year, [Biologic drugs in the key therapeutic areas of autoimmune oncology & ophthalmic diseases] RemeGen (SHA: 688331 / HKG: 9995 / FRA: REG / OTCMKTS: REGMF)‘s stock has started to drop as the sector starts to give back some of its gains.

- Despite the recent correction, Remegen (9995 HK) should be added to a global index in November and that could help the stock outperform its peers.

- There appears to be a lot of positioning in the stock, but we see a similar trend across stocks in the industry.

🇨🇳 InnoCare licensing deal flops due to lack of upfront cash (Bamboo Works)

- The Chinese biotech agreed to sell some of the rights to its flagship drug for a sum that could exceed $2 billion but investors were unhappy with the fine print

- The counterparty, Zenas Biopharma Inc (NASDAQ: ZBIO), will hand over just $35 million as a cash downpayment, a mere 1.75% of the potential deal value

- Rights to the drug in question, orelabrutinib, were returned in 2023 when multinational Biogen pulled out of a partnership with InnoCare

🇨🇳 Sany Heavy Industry Hong Kong IPO Preview (Douglas Research Insights) $

- Sany Heavy Industry (SHA: 600031) is getting ready for an IPO listing in Hong Kong. It is targeting up to HK$12.36 billion (US$1.59 billion) by offering 580.42 million shares in this listing.

- The IPO price of Sany Heavy is set between HK$20.30 and HK$21.30, with the final price to be determined on Friday.

- Sany Heavy is the largest construction machinery manufacturer in China and third largest globally. Its main products include excavators, concrete equipment, hoisting and piling machines, and road construction equipment.

🇨🇳 Top Toy IPO Preview (Douglas Research Insights) $

- Top Toy International is getting ready to complete its IPO in Hong Kong in the next several months.

- Top Toy was last valued at US$1.3 billion in July 2025 when it received a US$59.4 million Series A financing (of which Temasek contributed US$40 million for a 3.2% stake).

- Top Toy is trading at P/E of 32x (2024 net profit) (valuation of US$1.3 billion) versus Pop Mart (P/E of 103x based on its 2024 net profit).

🇭🇰 TOP TOY IPO: From China To The World — Rapid Growth and Solid Profitability Under MINISO Group

- TOP TOY International Group Limited, a world-class pop toy brand company from China, filed to go public in Hong Kong.

- Founded in 2020, the brand has quickly positioned itself as a domestic rival to China’s Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF), capitalizing on the country’s booming “blind box” and designer toy craze.

- TOP TOY has shown strong growth and execution, going from RMB641m in sales of pop toy products in 2022 to RMB2,554m expected this year.

🇭🇰 🇨🇳 More US-listed Chinese firms set for Hong Kong IPO (The Asset) 🗃️

- Pony AI Inc (NASDAQ: PONY) and WeRide (NASDAQ: WRD) win regulatory approval for dual listing

- With the strong momentum of “A+H” dual listings and the return of US-listed companies, Hong Kong is projected to finish 2025 as the world’s top venue for initial public offerings ( IPOs ).

🇭🇰 🇨🇳 Chinese tech giants pause stablecoin plans after Beijing steps in (FT) $ 🗃️

- Regulators raise concerns about the rise of privately controlled currencies

- Chinese tech giants have paused plans to issue stablecoins in Hong Kong, after Beijing raised concerns about the rise of currencies controlled by the private sector.

- Companies including Alibaba (NYSE: BABA)-backed Ant Group and ecommerce group JD.com (NASDAQ: JD / SGX: HJDD) had said over the summer they would participate in Hong Kong’s pilot stablecoin programme or issue virtual asset-backed products, such as tokenised bonds.

🇭🇰 Pacific Basin Shipping Limited (PCFBY) Q3 2025 Sales/ Trading Statement Call – Slideshow (Seeking Alpha) $⛔🗃️

- 🌏 Pacific Basin Shipping (HKG: 2343 / FRA: OYD / OTCMKTS: PCFBY / PCFBF) 🇧🇲 – Asia-focused dry bulk shipper. 🇼

🇲🇴 JP Morgan halves Macau GGR growth forecast for October (GGRAsia)

- JP Morgan is cutting its year-on-year growth forecast for Macau’s gross gaming revenue (GGR) in October to between 3 percent and 6 percent. That compares with the brokerage’s previous estimate of an 11-percent-plus increase.

- “Golden Week numbers were not so golden,” wrote analysts DS Kim, Selina Li and Lindsey Qian in a note on Tuesday.

- The JP Morgan team described the lacklustre performance during the Golden Week period as “a temporary setback”, possibly driven by weather-related disruptions on October 5 due to the passage of Typhoon Matmo, and a “softer mass market due to the timing of the Mid-Autumn gathering”, which this year fell on October 6 rather than September as in previous years.

🇲🇴 Macau GGR in October 1-19 at US$1.9bln, on ‘surprising’ rebound during third week: JPM (GGRAsia)

- Macau’s casino gross gaming revenue (GGR) for the first 19 days of October was likely to have reached MOP14.85 billion (US$1.86 billion), or MOP781 million a day, suggested JP Morgan in a Monday memo, citing its industry checks. The institution said GGR in the third week of the month appeared to experienced a “surprising rebound” after the October Golden Week holiday period.

🇲🇴 Macau 3Q VIP GGR up 29pct from a year earlier: regulator (GGRAsia)

- Credit and market research provider CreditSights Inc said in a recent memo that it expects the Macau casino sector to be able to achieve the MOP228-billion GGR target set by the city’s government for full-year 2025.

- “We see Macau in a decent position to achieve its 2025 GGR target, with only a monthly average GGR of MOP15.6 billion needed – versus a year-to-date monthly average of MOP20.1 billion – for the fourth quarter,” stated the institution.

🇲🇴 Macau 2025 GGR growth likely 8.6pct y-o-y despite 4Q slowing: Seaport Research (GGRAsia)

- Seaport Research Partners expects full-year Macau gross gaming revenue (GGR) to grow by 8.6 percent year-on-year, in U.S. dollar terms, despite some slight sequential slowing anticipated for the fourth quarter, the institution said in a Sunday memo.

- Macau’s 2024 GGR was just over MOP226.78 billion (US$28.34 billion, currently), according to data from the local regulator, the Gaming Inspection and Coordination Bureau.

- Seaport senior analyst Vitaly Umansky stated: “While 2025 had started softly in Macau, our expectation for a summer pickup and strength in the second half has been bearing fruit.”

🇲🇴 CLSA thinks Macau 3Q casino EBITDA up 10pct y-o-y, and Wynn biggest GGR share gainer q-o-q (GGRAsia)

- That is according to a Monday note from its analysts Jeffrey Kiang and Leo Pan, previewing earnings season covering the three months to September 30.

- CLSA estimated that Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) was the biggest GGR market share gainer sequentially in the third quarter, at 13.5 percent, up 1.6 percentage points from the second quarter.

- The brokerage put Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) has having the leading share of GGR in the three months to September 30, at 23.2 percent, up 50 basis points on the second quarter’s 22.7 percent. The institution put Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) in second place, with 20.8 percent, up 40 basis points sequentially.

- CLSA had MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) in third spot, with 15.5 percent, though that was down 1.2 percentage points quarter-on-quarter. Melco Resorts & Entertainment Ltd was estimated as in fourth, with 14.7 percent of Macau-market GGR, down 1.1 percentage points.

- SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) was put at 12.3 percent of Macau GGR in the third quarter, down 10 basis points on the second quarter.

🇲🇴 MGM Resorts drops bid for downstate New York casino licence (GGRAsia)

- Global casino operator MGM Resorts International (NYSE: MGM) has withdrawn its commercial casino licence application to the New York Gaming Commission and the Gaming Facility Location Board in the United States. The announcement was made by the firm on Tuesday.

- In May, Wynn Resorts Ltd (NASDAQ: WYNN) said it would not take part in the bidding process for a licence in downstate New York. Rival casino operator Las Vegas Sands (NYSE: LVS) also dropped out of the race in April.

- Genting group remains in the running: the conglomerate’s parent, Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY), announced on Monday that it had put forward a conditional voluntary takeover offer for its subsidiary Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF).

🇹🇼 Taiwan

🇹🇼 TSMC: Understanding The Golden Goose Of AI (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: The AI Bottleneck (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Earnings: I Wish I Hadn’t Sold (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Buy The Backbone Of The Semiconductor Industry (Seeking Alpha) $ 🗃️

🇹🇼 3 Reasons To Buy TSMC’s Q3 2025 Beat And Raise (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Is Getting The Best Out Of Everyone’s Buck (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: A Strong Buy At All-Time Highs (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Q3 Earnings: Still The Best AI Play At A Reasonable Price (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Demand For Most Powerful Chips Is Booming (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Soaring To New All-Time High, No Longer An Ultra-Bargain (Downgrade) (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Continues To Outperform, Powered By The AI Boom (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Unprecedented Growth Outlook For A Company Of This Scale (Seeking Alpha) $ 🗃️

🇹🇼 TSMC’s Q3 Triumph: The Wall Street Underestimated The Chip King (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Earnings: Here’s What To Expect As AI Reaches A Fever Pitch (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Cutting Through The Macro Noise Ahead Of Q3 Earnings (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 Why TSMC 3Q25 Indicates Strong AI Accelerator Demand Through 2029E; Maintain Structural Long Rating (Smartkarma) $

- Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) 3Q25: Margins Surge as Pricing Power Strengthens Ahead of 2nm Ramp

- AI Megatrend Continues to Reshape Demand – 40% CAGR Expected for AI Accelerators Through 2029

- Maintain Structural Long Rating — TSMC Remains Inexpensive vs. Tech Companies Highly Dependent on It

🇰🇷 Korea

🇰🇷 KOSPI200 and Major Global Index Rebalance in 4Q25 Highlighted by Locals (Douglas Research Insights) $

- In this insight, we highlight stocks that have been highlighted by locals as potential inclusion/exclusion candidates in KOSPI200 and major global index rebalance in 4Q25.

- The five potential inclusion candidates include Paradise Co Ltd (KOSDAQ: 034230), ASIA Holdings Co Ltd (KRX: 002030), LG CNS Co Ltd (KRX: 064400), APR Co Ltd (KRX: 278470), and HD Hyundai Marine Solution (KRX: 443060).

- The five potential exclusion candidates include TCC Steel Corp (KRX: 002710), KG Mobility (KRX: 003620), Dentium (KRX: 145720), Orion Corp (KRX: 271560), and LG H&H (KRX: 051900 / 051905 / OTCMKTS: LGHMF).

🇰🇷 Kardashian endorsement of skincare gadget creates K-beauty champion (FT) $ 🗃️

- Shares in South Korea’s APR Co Ltd (KRX: 278470) have surged 400% this year as it expands in US and Europe

🇰🇷 South Korea’s Kangwon Land logs 147,550 visitors during Chuseok holiday period (GGRAsia)

- Kangwon Land (KRX: 035250), a South Korean resort with the only casino in the country open to locals, recorded a total of 147,550 visitors from October 3 to 12, coinciding with this year’s Chuseok holiday period.

- The average accommodation occupancy rate during the period reached 81.4 percent.

- The information was released by the property’s operator, Kangwon Land Inc, in a press release on Wednesday.

- The firm did not provide a comparison with the same period one year earlier.

- Kangwon Land Inc reported a 62.2-percent year-on-year decline in its second-quarter net profit to KRW60.63 billion (US$42.67 million currently), as the rise in the group’s operational costs outpaced casino sales growth, the firm said in July.

🇰🇷 Korea Small Cap Gem #47: Aniplus (Douglas Research Insights) $

- AniPlus Inc (KOSDAQ: 310200) is increasingly becoming a leading player in the anime contents production and distribution in Korea. The company’s anime contents have potential to expand globally.

- Valuations are attractive. It is trading at P/E of 9x in 2025 and 7.9x in 2026 based on consensus earnings estimates.

- If we use P/E of 15x on 2026E net profit of 26.9 billion won, this would suggest a market cap of 404 billion won (95% higher than current market cap).

🇰🇷 Value Partners: Supports Samyang Holdings’ Equity Spin-Off Plan But Must Cancel Treasury Shares (Douglas Research Insights) $

- On 13 October, Value Partners has come out in support of [chemicals, food, biopharmaceuticals and packaging] Samyang Holdings (KRX: 000070)’s equity spin-off plan but on the condition that the company must cancel its treasury shares.

- Value Partners believes Samyang Holdings is currently severely undervalued, trading at a P/B of 0.34x. A shareholders meeting for Samyang Holdings is scheduled for 14 October.

- We have a positive view of this equity spin-off. Our NAV valuation of Samyang Holdings suggests an implied price per share of 127,138 won (28.6% higher than current price).

🇰🇷 Hanwha Ocean: Negative Impact from Chinese Government’s Efforts to Crack Down on U.S. Subsidiaries (Douglas Research Insights) $

- Chinese government’s efforts to ban Hanwha Ocean (KRX: 042660)’s five U.S. subsidiaries from conducting any transactions with organizations or individuals in China is likely to have material Negative impact on Hanwha Ocean.

- If Hanwha’s U.S. subsidiaries are banned from Chinese suppliers, they’ll need to source alternatives (Japan, Europe, or domestic U.S. firms), that could involve 20–50% higher costs with longer lead times.

- Basically, what’s going on is that the Chinese government wants to slow down the United States’ efforts to rebuild its shipbuilding sector with the help of Korean shipbuilders.

🇰🇷 An Update of Our 2025 High Conviction Pick: Samsung Electronics (Douglas Research Insights) $

- Back on 6 November 2024, we published an insight called 2025 High Conviction: Samsung Electronics. In this insight, we provide an update of Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF).

- Samsung Electronics reported operating profit of 12.1 trillion won (up 31.8% YoY and 18.7% higher than consensus) in 3Q 2025.

- The final installment of the 12 trillion won+ inheritance tax is due in April 2026.

🇰🇷 Block Deal Sale of 1.7 Trillion Won Worth of Samsung Electronics (Douglas Research Insights) $

- It was reported that Hong Ra-hee, Lee Boo-jin, and Lee Seo-hyun will be selling a combined 1.7 trillion won worth of Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) to pay for inheritance taxes.

- This stake sale by the Lee family will represent 0.3% of Samsung Electronics outstanding shares.

- Samsung Electronics still trade at low multiples and its valuations remain attractive. Its recent strategic partnership with OpenAI regarding the Stargate project also remain a major positive catalyst.

🇰🇷 Final Samsung Electronics Stake Sale: Overhang Risk, Control Optics, & Clean Pref Reversion Trade (Smartkarma) $

- Near‑term flow looks muted: Shinhan likely drips ~0.3% SO stake into liquid tape, not a block. With ₩2tn daily turnover, market easily absorbs without price shock.

- Top‑holder stake dips 20.14→19.84% post‑sale, but ₩10tn buyback cancels ~1.5ppt float, restoring 20.14%. The 0.3% selldown’s pre‑calculated; no real trading juice, flow impact minimal.

- Inheritance‑tax overhang done, buyback cycle fading. Gov’t pressure plus family’s last selldown point to dividend ramp. Prefs at 23% discount vs 10% target set up clean reversion trade.

🇰🇷 LS Group Family Members Sold a 6.3% Stake in LS Ecoenergy – To Buy More Shares of LS Corp? (Douglas Research Insights) $

- It was reported that various members of the LS Group family/relatives sold a 6.3% stake in LS Eco Energy Ltd (KRX: 229640) for about 70 billion won in after-hours trading.

- There is an increasing probability that this could lead to these insiders purchasing more shares of LS Corp (KRX: 006260) to defend their controlling stake of the company from the Hoban Group.

- Hoban Group is likely to have acquired more than 3% stake in LS Corp. If so, it can request to inspect LS Corp’s books and convene a shareholders’ meeting.

🇰🇷 Supreme Court Overturns a Lower Court Ruling for the Divorce Case Between Chey Tae-Won and Roh So-Young (Douglas Research Insights) $

- The long-standing divorce case between SK Group Chairman Chey Tae-won and his estranged wife Roh So-young refuses to end.

- Rather, the Supreme Court of Korea overturned a lower court ruling that ordered Chey Tae-won to pay 1.38 trillion won ($973 million) to Ro So-young.

- Our NAV valuation of SK Inc (KRX: 034730 / 03473K) suggests implied market cap of 25.8 trillion won or target price of 355,918 won per share, which is 63% higher than current levels.

🇰🇷 SK Group: Restructuring of Renewable Energy Business of Nearly 1 Trillion Won & Chey’s Divorce Payment (Douglas Research Insights) $

- SK Group plans to restructure its renewable energy businesses that could result in asset sales of more than 1 trillion won.

- SK Group is taking on a major restructuring of its renewable energy businesses, including including fuel cells, energy storage systems (ESS), and solar/wind power generation facilities.

- A consensus has been forming in the local media regarding Chairman Chey’s expected divorce payment to his wife Roh So-young to be about 400 billion won to 700 billion won.

🇰🇷 TeraView Holdings IPO Preview – The First U.K. Based Company to Pursue a Listing in Korea (Douglas Research Insights) $

- TeraView Holdings is getting ready to complete its IPO in KOSDAQ by end of this year. TeraView Holdings is the first U.K. based company to pursue a listing in Korea.

- The IPO price range is from 7,000 won to 8,000 won per share. The book building for the institutional investors will be from 13 to 19 November.

- The company provides ultra-precision inspection equipment and technology services (solutions) that detect microscopic cracks and errors that cannot be seen with the naked eye based on a technology called ‘terahertz’.

🇰🇷 SemiFive IPO Preview (Douglas Research Insights) $

- SemiFive is getting ready to complete its IPO in KOSDAQ in December 2025. The IPO price range is from 21,000 won to 24,000 won per share.

- Total IPO proceeds are estimated to be between 113.4 billion won to 129.6 billion won. The market cap is expected to range from 708 billion won to 809 billion won.

- SemiFive is one of the global leaders in custom AI semiconductor (ASIC) design.

🌏 SE Asia

🇲🇾 Top Glove Corporation Bhd. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🌐 Top Glove Corporation (KLSE: TOPGLOV / SGX: BVA / OTCMKTS: TPGVF) – World’s largest manufacturer of gloves. Manufacturing operations in Malaysia, Thailand, Vietnam and China + marketing offices in these countries, USA, Germany & Brazil. 🇼 🏷️

🇲🇾 Genting Bhd proposes US$1.59bln takeover offer for subsidiary Genting Malaysia (GGRAsia)

- Malaysia-based conglomerate Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) announced on Monday that it has put forward a conditional voluntary takeover offer for its subsidiary Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF).

- Depending on the outcome of the operation, Genting aims to move to delist Genting Malaysia from Bursa Malaysia, where both companies are currently listed, the parent said in a filing.

- Genting Malaysia reported second-quarter revenue of nearly MYR2.92 billion in August, up 9.3 percent year-on-year. That brought first-half revenue to MYR5.51 billion, a 1.5-percent increase from a year earlier.

- According to its Monday filing, Genting said the takeover would also enhance Genting Malaysia’s financial profile as the latter is in the run for one of three full-scale downstate New York casino licences that are likely to be awarded by the end of 2025.

🇲🇾 Genting Malaysia (GENM MK): Genting’s Conditional Voluntary Offer at RM2.35 (GGRAsia)

- Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) disclosed a conditional voluntary offer from Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) at RM2.35, a 9.8% premium to the last close price of RM2.14.

- The 50% minimum acceptance condition is easily met as Genting is the largest shareholder, representing 49.36% of outstanding shares.

- Genting’s preferred endgame is to delist GENM, thereby fully benefiting if GENM successfully bids for a downstate New York casino licence. Therefore, there is a good chance of a bump.

🇲🇾 Genting Bhd should up offer price for Genting Malaysia to value potential U.S. catalysts: Maybank (GGRAsia)

- Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) “ought to raise the offer price” per share in its bid for a conditional voluntary takeover of its unit Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF), a global operator of casino resorts, according to a Tuesday note from Maybank Investment Bank Bhd. That was due to business opportunities in the United States for the unit.

- “While 21 percent higher than our previous sum-of-the-parts target price of MYR1.95, the offer price does not take into account catalysts which could lift our ‘blue sky’ fair value to MYR3.28,” wrote Maybank analyst Samuel Yin Shao Yang.

- Those catalysts included “revaluation” of the Miami, Florida, land that Genting Malaysia acquired in the United States in 2011; potential sale of certain non-gaming assets of associated U.S. business Empire Resorts Inc to the Sullivan County Resort Facilities Local Development Corp in upstate New York; and the possibility of a downstate New York casino licence in a bidding process there.

- Maybank said that is has presently valued the Miami land “at cost”, i.e., US$442 million, though Genting Malaysia had attempted to sell it at “market value” of US$1.2 billion in 2023; however, the deal did not go through.

🇲🇾 Bid for Genting Malaysia shares credit negative for Genting Bhd: CreditSights (GGRAsia)

- The conditional takeover offer from Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) for its unit Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF), a global operator of casino resorts, is “credit negative” for the parent, said credit and market research provider CreditSights Inc.

- That is because it “could worsen” Genting Bhd’s pro-forma net leverage “by nearly a turn to 3.8 times to 3.9 times, and add to refinancing concerns for its US$1.5 billion January 2027 bond,” stated the institution.

- “While Genting Bhd affirmed to pare down the new debt incurred for the deal via incremental dividends from Genting Malaysia and other fundraising exercises, we think it may take longer to realise this considering Genting Malaysia’s heavy expansion plans in New York once it wins the new casino bid” there, wrote Creditsights analysts Lakshmanan R and Jonathan Tan Jun Jie.

🇲🇾 Caixin Deep Dive: Visa-Free Travel, U.S. Tariffs Drive Chinese Companies to Malaysia (Caixin) 7:40 Minutes

- Note: The conversation segment of this episode was generated using AI and has been edited for accuracy. It is based on this Caixin story:

- In Depth: Visa-Free Travel, U.S. Tariffs Drive Chinese Companies to Malaysia

🇸🇬 Bitdeer: Could Ride The Bitcoin And AI Tailwinds, Yet Not My Top Pick – A Hold (Seeking Alpha) $ 🗃️

- 🌐 Bitdeer Technologies Group (NASDAQ: BTDR) – Technology company for blockchain & high-performance computing.

🇸🇬 Karooooo Ltd: Still A Great Business, But The Price Feels Ahead Of Itself (Seeking Alpha) $ 🗃️

- 🇸🇬 🇿🇦 Karooooo (NASDAQ: KARO / JSE: KRO) – Leading provider of an on-the-ground operations cloud that maximizes the value of data. The Cartrack SaaS platform provides insightful real-time data analytics & business intelligence reports. 🏷️

🇸🇬 3 Singapore REITs Reporting Earnings Next Week: What to Watch (The Smart Investor)

- Three Singapore REITs are first to the earnings dock, each offering different insight.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF): Reporting on 22 October 2025

- Frasers Centrepoint Trust is home to nine prime suburban malls with S$7.1 billion in assets under management and 2.7 million square feet of retail space.

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF): Reporting on 24 October 2025

- Next, there’s data centres.

- Here’s a hint: Keppel DC REIT owns 24 data centres across 10 countries with assets under management of around S$5.0 billion.

- Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF): Reporting on 23 October 2025

- Unlike FCT, Mapletree Pan-Asia Commercial Trust or MPACT has a mixed portfolio consisting of 17 retail and commercial properties across Asia with assets under management of S$15.7 billion.

🇸🇬 SIA Engineering’s Share Price Is Soaring — What’s Driving the Rally? (The Smart Investor)

- SIA Engineering’s share price has soared recently, with the stock up around 43% year-to-date (YTD). Investors may be asking: What is contributing to this rally, and will it persist?

- SIA Engineering Company (SGX: S59 / FRA: O3H / OTCMKTS: SEGSF), or SIAEC, is the maintenance, repair, and overhaul (MRO) arm of Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF).

- Recent Performance

- Growth Drivers Behind SIA Engineering’s Rally

- Risks and Challenges Investors should monitor

- Overall Verdict – Strong Fundamentals and Industry Tailwinds

- Get Smart: A Stable Cyclical Play on Travel

🇸🇬 ST Engineering vs SIA: Which Stock Is the Better Growth Play in 2025? (The Smart Investor)

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering and Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF) offer investors aerospace and defence exposure. However, which one is the better buy? We look at these companies individually and determine which one is more attractive.

- ST Engineering — The Steady Compounder

- Singapore Airlines — The Cyclical Rebounder

- ST Engineering vs Singapore Airlines Comparison

- Sector Prospects

- Get Smart: Which Stock Wins?

🇸🇬 Sea Limited’s Path to Profitability: Can Shopee Keep Leading E-Commerce? (The Smart Investor)

- As Sea Limited (NYSE: SE) turns its focus to profits, can Shopee keep its lead in Southeast Asia’s fast-moving e-commerce race?

- Inside Sea’s Three Pillars Ecosystem

- From Burn to Earn

- Land, Expand, Grow, Repeat

- Dominance Isn’t Destiny, And It Comes at a Cost

- Still Leading, But Far From the Finish Line

- Get Smart: Shopee’s Edge Is Both Sea’s Opportunity and Risk

🇸🇬 3 Stocks Hitting New 52-Week Highs And Whether They’re Worth Buying (The Smart Investor)

- Today, we examine three standout stocks: DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), SBS Transit (SGX: S61), and Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) to determine if they remain attractive investments after reaching their 52-week highs.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) is Singapore’s largest bank, providing commercial banking and financial services in various countries, including Hong Kong, China, Indonesia, and more.

- Singapore’s leading public transport operator, SBS Transit (SGX: S61), runs a significant portion of the country’s bus network, two MRT lines, and an LRT line.

- Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) is one of Singapore’s largest supermarket chains, focusing on value-driven grocery offerings in the heartlands.

🇸🇬 3 Under-the-Radar Stocks Paying More than Your CPF OA (The Smart Investor)

- Explore three Singapore dividend stocks quietly outperforming CPF OA returns.

- Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF)

- This multi-industry conglomerate may have seen revenue contract 31% to S$527.1 million for the fiscal year ended 31 March 2025 (FY2025), but don’t let that fool you.

- Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF)

- When the semiconductor cycle turns, suppliers like Micro-Mechanics feel it first.

- The Hour Glass (SGX: AGS)

- A familiar name in the luxury watch sector, which cooled from the pandemic-era frenzy, The Hour Glass demonstrated admirable resilience.

🇸🇬 This 4.7% Yielding REIT Just Raised Its Payout — Should You Buy Now? (The Smart Investor)

- Having recently raised its payout, we examine if CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) is a buy here.

- CICT is Singapore’s largest REIT. The trust has a diverse portfolio of 26 properties valued at S$27 billion as of 31 December 2024. 21 of the trust’s properties are in Singapore with the remaining in Germany (two) and Australia (three).

- Recent Performance

- What Sets CICT Apart

- Risks / Considerations

- Putting it altogether

- Get Smart: CICT – A Solid Bedrock for Any Dividend Portfolio

🇸🇬 How Investors Can Ride Asia’s Growing Tourism Boom (The Smart Investor)

- Learn how investors can capitalise on Asia’s fast-growing tourism boom and the stocks set to gain.

- As one of Asia’s leading hospitality trusts, CDL Hospitality Trusts (SGX: J85 / OTCMKTS: CDHSF) holds a portfolio of hotels, resorts, and rental properties distributed across Singapore, Japan, Australia, and the United Kingdom.

- Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) operates Resorts World Sentosa (RWS), one of Singapore’s two integrated resorts, featuring casinos, hotels, and attractions such as Universal Studios Singapore.

- A critical player in the aviation ecosystem, SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) is Singapore’s leading provider of ground handling and food solutions for airlines and airports, with operations spanning multiple countries.

- Get Smart: Opportunities Are There, But Beware

🇸🇬 Top 5 Future Blue-Chip Stocks Paying a Dividend for 2025 (The Smart Investor)

- Discover five dividend-paying Singapore stocks that could become the next generation of blue chips in 2025.

- Starting with a familiar name in the property space is Keppel REIT (SGX: K71U / OTCMKTS: KREVF), which owns a S$9.4 billion portfolio of 13 prime commercial properties across Singapore, Australia, South Korea, and Japan.

- NetLink NBN Trust (SGX: CJLU / OTCMKTS: NETLF) owns and operates Singapore’s nationwide passive fibre network infrastructure, generating stable revenue through regulated services (84% of revenue) including residential and non-residential fibre connections, and non-regulated services like installation and ancillary projects.

- You’ve probably visited Suntec City Mall or the convention centre – both part of Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF), which owns 10 properties across Singapore and manages a S$12.2 billion portfolio, including assets in Australia and the UK.

- Switching gears to finance and maritime, Yangzijiang Financial Holding Ltd (SGX: YF8 / OTCMKTS: YNGFF) operates in fund management, investment management, and maritime ventures.

- Finally, let’s look at Olam Group Ltd (SGX: VC2 / FRA: K25 / OTCMKTS: OLGPF), a global agricultural products company engaged in sourcing, processing and merchandising.

🇹🇭 TISCO Financial Group Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇹🇭 🅿️ TISCO Financial Group PCL (BKK: TISCO / TISCO-F / TISCO-P / FRA: 47T / OTCMKTS: TSCFY) – Retail & corporate banking + wealth & asset management. 🇼 🏷️

🇻🇳 Vietnam capital reforms to pay dividends in coming decades (The Asset) 🗃️

- Long-awaited equity market upgrade signals country’s rising global profile can withstand near-term challenges

🇻🇳 Vietnamese stocks fall sharply after regulator points to violations in credit market (FT) $ 🗃️

- State audit of $17bn in domestic bonds found flaws in disclosure and misuse of proceeds

- A report on 67 issuers by Vietnam’s Government Inspectorate issued on Friday found flaws in disclosure and misuse of proceeds in some bond sales.

- The report also referred alleged violations by Novaland (HOSE: NVL), one of Vietnam’s biggest property developers, for police investigation. Novaland denies any wrongdoing.

🇮🇳 India / South Asia / Central Asia

🇮🇳 ‘Shoestring’ R&D budgets force India to rely on Chinese tech, says steel tycoon (FT) $ 🗃️

- JSW chair Sajjan Jindal calls for country to boost research and development spending as he prepares to launch EV brand

🇮🇳 ICICI Bank Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🌐 ICICI Bank (NYSE: IBN) – MNC bank & financial services. Wide range of banking & financial services for corporate & retail customers. 🇼 🏷️

🇮🇳 HDFC Bank Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇮🇳 HDFC Bank (NYSE: HDB) or Housing Development Finance Corp – One of India’s leading private banks. Nationwide distribution network. 🇼 🏷️

🇮🇳 HDFC Bank (HDFCB IN) Set to Report Q2 Results Ahead of Diwali Break (Smartkarma) $

- HDFC Bank (NYSE: HDB) is scheduled to report its FY 2026 Q2 results on Saturday, 18 October 2025.

- Highlight: Consensus sees EPS near INR 11.3 and revenue around INR 437 Bn; options imply a ±2.3% move, above the historical ±1.7% average.

- Portfolio Impact: As the largest constituent of the Nifty 50 and BSE Sensex, HDFC’s earnings will be closely watched and could set the tone for the broader market.

🇮🇳 Wipro: Profit Margin Beat Is Overshadowed By Revenue Guidance Miss (Seeking Alpha) $ 🗃️

🇮🇳 Wipro Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

🇮🇳 Infosys: A Quality Name, But The Price Already Knows It (Seeking Alpha) $ 🗃️

🇮🇳 Infosys (INFO IN) Q2 Results: (Smartkarma) $

- Infosys (NYSE: INFY) reports Q1 FY26 results on Thursday, 16 October 2025 at 15:45 IST; earnings days historically triggered outsized price moves.

- Expect Volatility: Results have historically driven price swings of up to ±9%. Options imply a ±3.5% swing. Implied volatility is expected to drop significantly post earnings.

- Portfolio Impact: As a Nifty 50 and BSE Sensex heavyweight, earnings-day moves ripple across the benchmark, making results market-relevant beyond the single stock.

🇮🇳 Indian Public Sector Banks: Taking Profits on Bank of Baroda (BOB IN)(Smartkarma) $

- We focus on the five Indian public sector banks under our coverage in this report, and we identify growing credit and political risks for this group, including Bank of Baroda Ltd (NSE: BANKBARODA / BOM: 532134)

- Political risk, in the form of a potential new round of public sector bank consolidation, could cut shareholder returns in the larger public sector banks absorbing the smaller banks

- Bank of Baroda is prominent – and well capitalised – amongst the larger public sector banks; we downgrade it to a neutral from a buy, locking in profits

🇮🇳 Sammaan Capital: Can Capital Boost from Abu Dhabi Turnaround Its Fortunes? (Smartkarma) $

- Sammaan Capital Ltd (NSE: SAMMAANCAP / BOM: 535789) approved a 3-part preferential issue to Avenir, part of Abu Dhabi’s sovereign-controlled IHC, aggregating INR 8,850 crore (USD 1.06 billion) in equity and warrants (convertible in 18 months)

- Sammaan has been looking out for an equity partner for few quarters now. Avenir’s backing not just improves capital positioning but also helps restructure overall liability side of the business

- Upon consummation (80% probability), we anticipate material re-rating potential. However, there are multiple risks in the near term, including accelerated write-offs. Further, an ongoing litigation may jeopardize the deal itself.

🇮🇳 Securing the Franchise: Whirlpool India’s Long-Term Tech & Brand Deal De-Risks Growth (Smartkarma) $

- Whirlpool Of India (NSE: WHIRLPOOL / BOM: 500238) renewed its Brand and Technology License Agreements with its US parent, granting exclusive brand and tech rights in India and neighboring countries until 2054.

- The revised agreements clarify long-term royalty, technical fee, and service markups, which together represent recurring outflows that materially impact earnings quality.

- While Whirlpool India secures continuity and exclusive IP access, its profit pool remains structurally capped by parent-level economics, making earnings trajectory highly sensitive to royalty and transfer pricing governance.

🇮🇳 ICICI Prudential Life (IPRU IN) Vs. ICICI Lombard General (ICICIGI IN): Stat Arb Targeting 5% Return (Smartkarma) $

- Context: The ICICI Prudential Life Insurance Company (NSE: ICICIPRULI / BOM: 540133) vs. ICICI Lombard Insurance (NSE: ICICIGI / BOM: 540716)) price-ratio has deviated two standard deviations from its one-year average, presenting a potential relative value opportunity.

- Highlights: Going long ICICI Prudential Life (IPRU IN) and short ICICI Lombard General Insurance (ICICIGI IN) targets a 5% return.

- Why Read: Essential for quantitative traders seeking mean-reversion opportunities, with detailed execution framework, risk management protocols, and historical simulation showing the statistical basis for this relative value play.

🌍 Middle East

🇮🇱 Zion Oil & Gas: could Israel’s #1 shit co finally take off? (Undervalued Shares)

- Lately, some of the worst mining stocks have turned into the market’s biggest winners.

- Zion Oil & Gas Inc (OTCMKTS: ZNOG / ZNOGW) (ISIN US9896961094, US OTC: ZNOG) is headquartered in Dallas, Texas, but its oil and gas exploration efforts are focused onshore in Israel.

- The company’s history is slightly bonkers, which is one of the reasons it deserves to be featured as a proper shit co.

- The company latest update for shareholders came in the form of a 22-minute recorded call with management. These regular recordings, along with accompanying press releases, tend to focus on technical details, and are, for that reason, not easy to interpret. Zion Oil & Gas does offer an information package that can be delivered by post, but it does not provide a conventional investor presentation on its website. Anyone looking to analyse the company in depth has to dig through a lot of material, both across the website and from external sources.

🌍 Eastern Europe & Emerging Europe

🇵🇱 Dino Polska: A High-Growth Compounder Hiding In Plain Sight (Seeking Alpha) $ 🗃️

- 🇵🇱 Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) – Nationwide network of medium-sized supermarkets. 🇼 🏷️

🌎 Latin America

🌎 Patria Investments: Undervalued Growth Powerhouse In Latin America With High Potential (Seeking Alpha) $ 🗃️

- 🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇦🇷 Donald Trump says US support for Argentina is ‘gone’ if Javier Milei suffers election losses (FT) $ 🗃️

- US president suggests $20bn swap line is contingent on libertarian’s victory in midterm elections

🇧🇷 Bradesco Q3 Earnings Preview: Expectation Of Further Improvements (Seeking Alpha) $ 🗃️

🇧🇷 Lavoro Cannot Cover Its Cost Of Capital, And The Situation Is Too Hairy (Seeking Alpha) $ 🗃️

- 🌎 Lavoro Ltd (NASDAQ: LVRO) – Agricultural/fertilizer inputs, soil analysis, insurance, forestry inputs/equipment, etc.

🇧🇷 Vale: China Factor Remains, But Its Long-Term Value Is Secure (Rating Upgrade) (Seeking Alpha) $ 🗃️

- 🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 Banco Santander (Brasil): A Lean Bank Playing It Safe (Seeking Alpha) $ 🗃️

- 🇧🇷🅿️ Banco Santander Brasil (NYSE: BSBR / BVMF: SANB3 / SANB4 / SANB11) – Various banking products & services to individuals, SMEs & corporate customers. Part of Spain based Santander Group. 🇼

🇧🇷 Petrobras: Low-Risk Energy Play (Seeking Alpha) $ 🗃️

- 🌐🏛️ Petrobras (NYSE: PBR / PBR-A / BCBA: PBR / PETR4) or Petróleo Brasileiro SA – Explores, produces & sells oil & gas. 🇼

🇧🇷 SLC Agrícola S.A. (SLCJY) Presents at BTG Pactual Latam CEO Conference 2025 – Slideshow (Seeking Alpha) $ 🗃️

- 🇧🇷 SLC Agricola SA (BVMF: SLCE3 / FRA: GJ9 / OTCMKTS: SLCJY) – One of the world’s largest grain & fiber producers (cotton, soybean and corn + cattle raising, integrating crop-livestock). 🇼 🏷️

🇧🇷 Companhia de Saneamento Básico do Estado de São Paulo – SABESP (SBS) M&A Call – Slideshow (Seeking Alpha) $ 🗃️

- 🇧🇷🏛️👼🏻 Companhia de Saneamento Básico do Estado de São Paulo – SABESP (BVMF: SBSP3) – Water & sewage service provider in São Paulo State. 🇼

🇨🇱 Enel Chile: Poised To Benefit From De-Risked Regulations Amid Renewable Expansion (Seeking Alpha) $ 🗃️

- 🇨🇱 Enel Chile (NYSE: ENIC) – Develops, operates, generates, distributes, transforms and/or sells energy. 🇼

🇲🇽 Coca-Cola FEMSA: Value In An Overpriced Market (Seeking Alpha) $ 🗃️

- 🌎 Coca-Cola Femsa SAB de CV (NYSE: KOF) – Largest franchise bottler of Coca-Cola products in the world by volume. 🇼 🏷️

🇲🇽 América Móvil, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🌎 America Movil SAB de CV (NYSE: AMX) – Leading Latin America telecommunication service provider. 🇼 🏷️

🇻🇪 Venezuelan bonds surge as Trump administration ‘plays hardball’ (FT) $ 🗃️

- Rally in defaulted debt has gained pace with US military build-up in Caribbean

- Prices have rallied this month to about 25 cents on the dollar, their highest level in more than half a decade, up from 16 cents at the start of the year as Maduro’s grip on power has appeared to weaken.

🌐 Global

🌐 Nebius Stock: Why I’m Finally Buying In (Seeking Alpha) $ 🗃️

🌐 Nebius: Why Microsoft’s Deal Makes It Far More Valuable Than Most Realize (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 Pareto Pure Alpha Growth Portfolio +20.5% YTD — October 2025 Update (The Pareto Investor)

- Why AI’s Infrastructure Layer Is Creating Generational Wealth

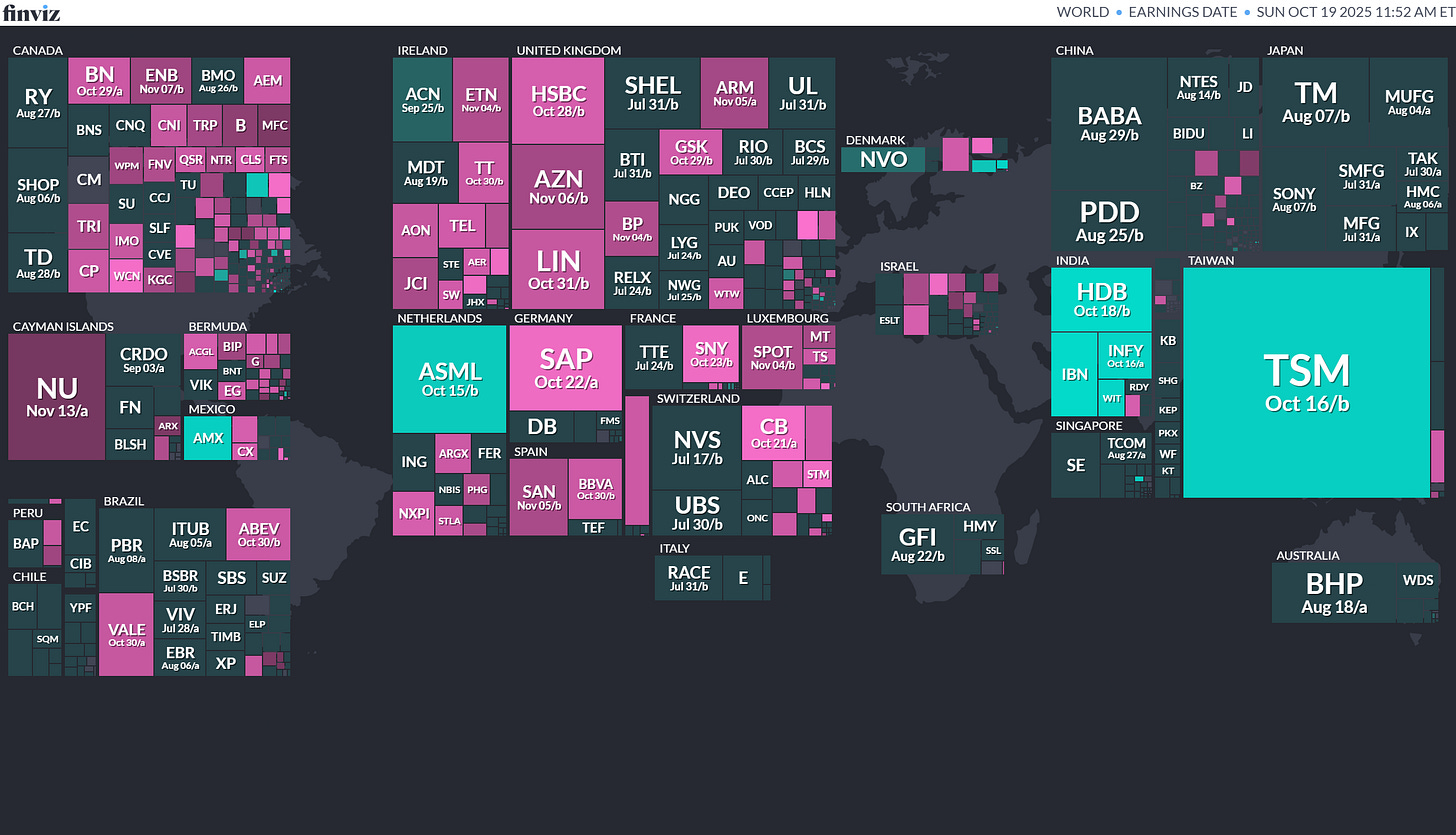

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

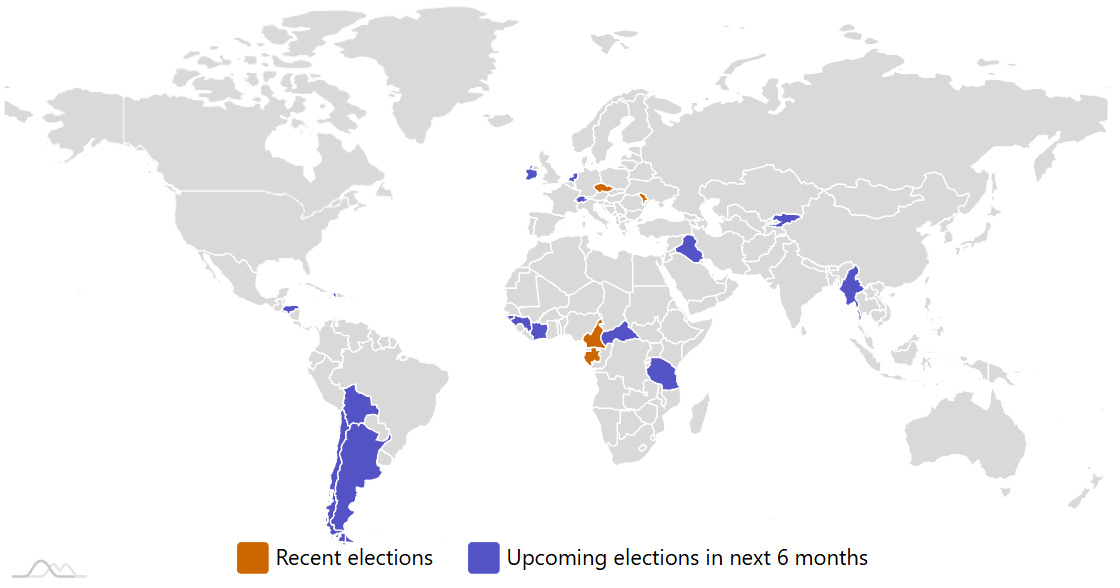

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Argentina Argentinian Chamber of Deputies 2025-10-26 (d) Confirmed 2023-10-22

- Argentina Argentinian Senate 2025-10-26 (d) Confirmed 2023-10-22

- Iraq Iraqi Council of Representatives 2025-11-11 (d) Confirmed 2021-10-10

- Chile Chilean Chamber of Deputies 2025-11-16 (d) Confirmed 2021-11-21

- Chile Chilean Presidency 2025-11-16 (d) Confirmed 2021-12-19

- Chile Chilean Senate 2025-11-16 (d) Confirmed 2021-11-21

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

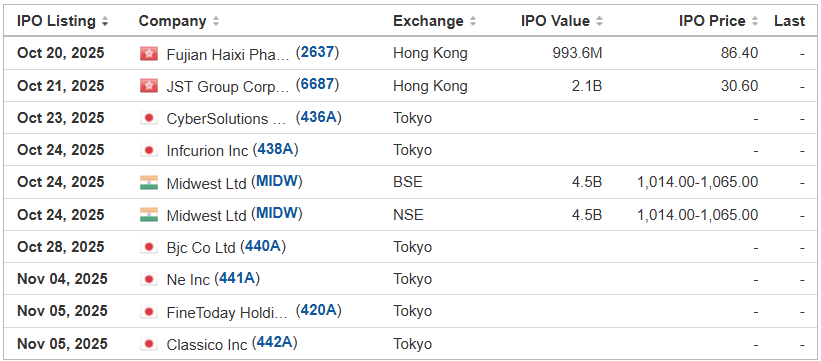

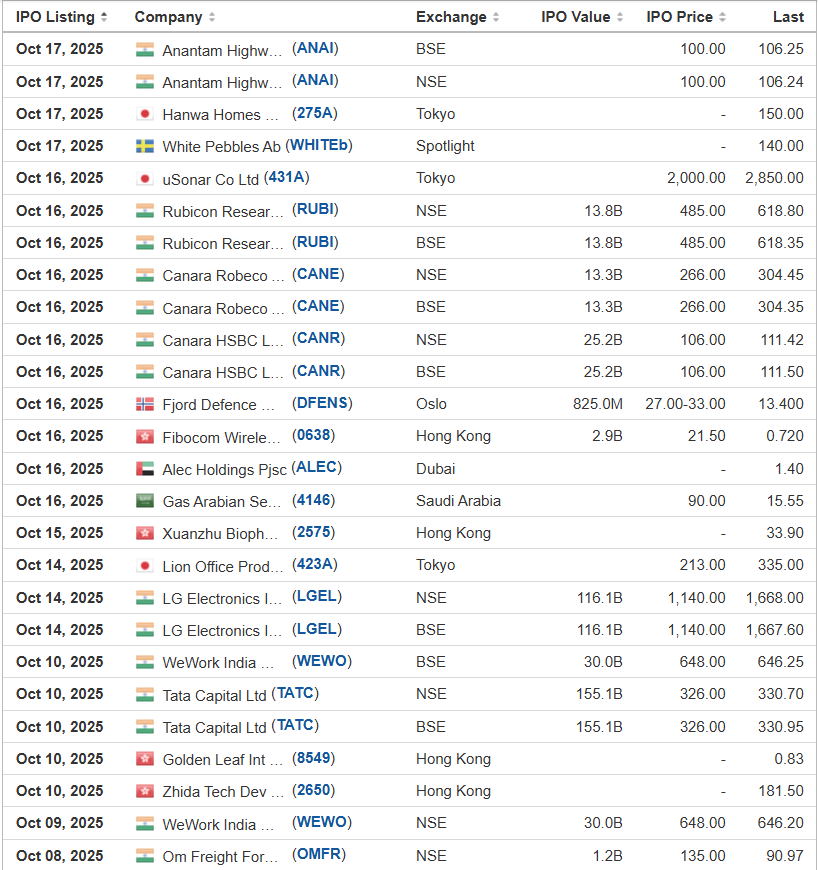

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Acco Group Holdings Ltd. ACCL Revere Securities/ Craft Capital Management, 1.4M Shares, $4.00-4.00, $5.6 mil, 10/17/2025 Priced

(Incorporated in the Cayman Islands)

We provide, through our operating subsidiaries, corporate secretarial services and accounting services in Hong Kong, as well as intellectual property (IP) registration services in Singapore.

Most of our revenue during the six months that ended Dec. 31, 2024, came from our corporate secretarial services.

At year-end 2024, Acco Group Holdings had 2,902 active client engagements in Hong Kong and 210 in Singapore.

Note: Net income and revenue are in U.S. dollars for the year that ended on Dec. 31, 2024.

(Note: Acco Group Holdings Ltd. priced its micro-cap IPO at $4.00 – the low end of its $4.00-to-$6.00 price range – and sold 1.4 million shares – the number of shares in the prospectus – to raise $5.6 million on Thursday night, Oct. 16, 2025. Background: Acco Group Holdings Ltd. filed its F-1 to go public on July 18, 2025, and disclosed the terms: The company is offering 1.4 million shares at a price range of $4.00 to $6.00 to raise $7.0 million, if the deal is priced at its $5.00 mid-point.)

Agencia Comercial Spirits AGCC D. Boral Capital (ex-EF Hutton)/Revere Securities, 1.8M Shares, $4.00-6.00, $9.0 mil, 10/20/2025 Week of

(Incorporated in the Cayman Islands)

We are a whisky wholesaler and distributor based in Taichung City, Taiwan.

We are committed to offering imported whisky of world-class quality to our clients. Agencia Taiwan has grown rapidly since its inception, leveraging its extensive industry experience, strategic partnerships and innovative business model to establish itself as a trusted and prominent player in the whisky market. Our mission is to enhance the whisky experience in Taiwan and other Asia-Pacific countries by offering expert guidance, competitive pricing and exceptional customer service.

Our Group operates across three primary business areas:

• Bottled Whisky Sales: Sourcing bottled whisky from local suppliers in Taiwan and reputable distilleries in the UK, the company, along with its downstream distributors, sells these products to bars, restaurants, nightclubs, VIP lounges and corporate clients.

• Raw Cask Whisky Sales: Starting in 2023, our group expanded into the procurement and sale of raw cask whisky sourced directly from distilleries in the UK. These unprocessed casks are sold directly to other liquor and spirits distributors, enabling our Group to tap into a broader market segment.

• Cask-to-bottle and distribution business: Beginning in 2025, our Group ventured into the cask-to-bottle and distribution business, which involves brand-authorized whiskey bottling, packaging and sales. Under this model, it obtains brand licenses, sources raw cask whisky directly from brand owners, and conducts bottling and packaging in Taiwan with the aid of local contract manufacturers.

From 2020 to now, our development can be divided into the following stages:

• Start-up period (2020-2022): During its initial years, our Group primarily focused on bottled whisky sales, following a business-to-business (B2B) model. By sourcing both locally and internationally, our Operating Subsidiary developed a network of suppliers and clients.

• Growth period (2023-2024): Our Group expanded its operations to include the sale of raw cask whisky sourced directly from distilleries, accounting for a significant portion of its revenue. This diversification allowed it to offer unique high-quality products while continuing to focus on B2B relationships.

• Expansion in 2025 and Beyond: Our Group plans to expand its operations to include collaboration with brand owners. This will involve obtaining brand authorization through the payment of licensing royalties, sourcing raw cask whiskey from these brand owners, and conducting bottling and packaging in Taiwan, primarily through local contract manufacturers, for which processing fees will be incurred. Our Group will then market and sell products under the respective brands. Initially, the primary customers will be distributors, focusing predominantly on a business-to-business model.

“From Barrel to Bottle” represents our Group’s core value, highlighting its dedication to delivering a comprehensive one-stop whiskey distribution service. Our Group provides an extensive range of products and utilizes a diverse array of sales channels. Consequently, both business volume and profit have experienced average annual growth. Our distribution channels encompass a broad swath of Taiwan, including clubs, restaurants, bars, hotels, VIP lounges, and corporate clients through our downstream distributors. Looking ahead, we aim to further diversify our product offerings, expand its footprint in the Asia-Pacific region, and solidify our position as a trusted key whisky distributor. By combining our client-centric approach, strategic partnerships, and focus on premium products, we believe that we are well-positioned to capture a significant share of the growing demand for high-quality whiskey in Asia and beyond.

Note: Net income and revenue are for the 12 months that ended Dec. 31, 2024.

(Note: Agencia Comercial Spirits filed its F-1 on July 10, 2025, and disclosed the terms for its IPO: 1.75 million shares at a price range of $4.00 to $6.00 to raise $9.0 million, if priced at the $5.00 mid-point of its range.)

Bgin Blockchain Ltd. BGIN D. Boral Capital (ex-EF Hutton), 6.0M Shares, $5.00-7.00, $36.0 mil, 10/21/2025 Tuesday

We make cryptocurrency mining equipment. Our focus is on alternative currencies. (Incorporated in the Cayman Islands)

Through our operating subsidiaries, we are a digital asset technology company based in Singapore, Hong Kong, and the U.S. with proprietary cryptocurrency-mining technologies and a strategic focus on alternative cryptocurrencies.

For the fiscal year ended December 31, 2022, we generated substantially all of our revenue from cryptocurrency mining. Since April 2023, we have generated revenue from selling mining machines designed by us, and sales of mining machines contributed approximately 85.43% and 65.71% of our total revenue for the fiscal year ended December 31, 2023, and the six months ended June 30, 2024, respectively.

Our subsidiaries design and sell mining machines equipped with our proprietary 8nm or 12nm ASIC chips under different series dedicated to the mining of KAS coins, ALPH coins, RXD coins, and ALEO coins. These machines are available for purchase only through our website, iceriver.io. Customers may view and place orders for machines they intend to purchase directly through the website, and have the option to enroll in our miner hosting services, through which we operate and manage mining machines on customers’ behalf in return for service fees. Customers purchasing machines sold by our subsidiaries are primarily based in Hong Kong, the U.S. and Southeast Asia. For the fiscal year ended December 31, 2023, and the six months ended June 30, 2024, we sold an aggregate of 67,998 and 47,252 mining machines, respectively, to customers across the world. As of the date of this prospectus, we host a total of 4,020 machines on behalf of our customers, of which 2,969 are in operation at our mining farm located in York, Nebraska, and a hosting facility in Coon Rapids, Iowa, and 1,051 are stored in our warehouse in Beatrice, Nebraska.

As our subsidiaries produce cryptocurrencies through their mining operations, they exchange cryptocurrencies mined for fiat currency on a regular basis to generate cash flow to fund our subsidiaries’ business operations. We attribute our substantial growth since our inception to our competitive advantages in our subsidiaries’ research and development capacities, our experienced and visionary management team, and our strategic focus on alternative cryptocurrency mining. According to the Frost & Sullivan Report, alternative cryptocurrencies refer to cryptocurrencies other than Bitcoin and Ethereum. Alternative cryptocurrencies are generally considered to have more growth potential with higher risks compared to large-capitalization cryptocurrencies. To mitigate such risks and maximize profit potential, our subsidiaries adopt a flexible approach to mining operations by using their proprietary cloud-based mining machine management software to monitor mining results on a daily basis and, on an as-needed basis, adjust the ratio of cryptocurrencies to be mined.

We believe that the strong design of our mining machines and the research and development capabilities of our subsidiaries represent key competitive strengths that afford us the ability to conduct cryptocurrency mining with greater computing power and power efficiency. Our subsidiaries fully rely on their self-designed mining machines for their daily cryptocurrency mining operations. To date, through our subsidiaries, we have designed 26 and put into use 14 different models of cryptocurrency mining machines, each specifically adapted and dedicated to alternative cryptocurrency mining.

As of the date of this prospectus, our subsidiaries own a total of 48,277 mining machines for operation purposes, of which 34,390 are in operation, 11,475 are not operated and are stored in mining farms and hosting facilities in the U.S. or our warehouses in Hong Kong and Beatrice, Nebraska, and 2,412 are currently being detained by U.S. Customs and Border Protection (“U.S. Customs”) and are now the subject of re-export proceedings. See also “Business — Legal Proceedings.” Through our subsidiaries, we currently manage and operate some of our mining machines in the U.S. at mining farms owned by our subsidiaries in Omaha, Nebraska, and York, Nebraska. The remaining mining machines are hosted by third-party hosting service providers at four different locations in the States of Iowa, Texas, West Virginia and Ohio. As of the date of this prospectus, other than 425 mining machines located in our warehouse in Hong Kong, all the mining machines owned by our subsidiaries are located in the U.S. See “— Growth Strategies — Improving and Integrating Our Business Model to Encompass a Value Chain.”

We strive to continuously develop and implement technological improvement into our subsidiaries’ mining process. The technological cornerstone of our subsidiaries’ cryptocurrency mining operations is their proprietary cloud-based mining machine management software, which is used at all of the mining farms in which our subsidiaries maintain and operate mining machines, and allows them to make timely and informed decisions as to the use and management of their mining machines.

Since September 2023, we have been operating a mining pool, currently dedicated to mining five cryptocurrencies, through which we generate income by receiving crypto coins as rewards and deducting a percentage of such rewards as pool fees from payouts to pool participants. See “— Mining Pool.”

For the fiscal years ended December 31, 2022, and December 31, 2023, and the six months ended June 30, 2024, the company’s business operations were heavily dependent upon KAS coins. See “Risk Factors — Risks Related to Our Business and Industry — Our business operations are heavily dependent upon the stability and popularity of KAS coins” and “Industry — Total Market Capitalization of Cryptocurrencies — KAS.”

Note: Net income and revenue are in U.S. dollars for the 12 months that ended Dec. 31, 2024.

(Note: Bgin Blockchain Ltd. cut its IPO’s size to 6 million shares – down from 6.25 million shares originally – and cut the price range to $5.00 to $7.00 – down from $7.00 to $9.00 initially – to raise $36.0 million, if priced at the $6.00 mid-point of its new range, according to an F-1/A filing dated July 31, 2025. Background: Bgin Blockchain Ltd. disclosed its IPO’s terms on March 20, 2025, in its FWP (free writing prospectus): 6.25 million shares at a price range of $7.00 to $9.00 to raise $50.0 million, if priced at the $8.00 mid-point of the range.)

(Note: D. Boral Capital is the sole book-runner, replacing Chardan and The Benchmark Company, the joint book-runners.)

Miluna Acquisition MMTX D. Boral Capital (ex-EF Hutton)/ ARC Group Securities, 6.0M Shares, $10.00-10.00, $60.0 mil, 10/21/2025 Tuesday

(Incorporated in the Cayman Islands)

We are a newly organized blank check company. Our search for a prospective target business will not be limited to any specific geographic region, except that we will not pursue a target company that is based in, or has the majority of its operations in, the PRC (People’s Republic of China).

Mr. Shang Ju Lin has served as our CEO since July 2025. Mr. S. Lin has extensive experience in investment and management. Since June 2020, he has served as a partner and member of the investment committee board at LBank Labs, where he manages multiple strategic funds with assets totaling $100 million, including hedge funds, primary investments, and funds of funds.

(Note: Miluna Acquisition Corp. filed an S-1 on Sept. 2, 2025, and disclosed the terms for its SPAC IPO: 6 million units at $10.00 each to raise $60 million. Each unit consists of one share and one-half of a redeemable warrant.)

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 10/22/2025 Wednesday

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.

We sell our products through both offline and online channels. Our offline customers are mainly business entities, including local community stores and/or high-end boutiques, shopping malls, supermarkets and distributors, who purchase products from us, either by directly placing orders with us or through our proprietary apps designed specifically for our offline customers to place orders efficiently, and on-sell them to end consumers. Our online customers are generally users who purchase products directly from us through third-party E-commerce platforms and our proprietary AigoSmart App.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: AIGO Holding Ltd. is offering 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its F-1 and F-1/A filings with the SEC.)

Harvard Avenue Acquisition Corp. HAVAU D. Boral Capital (ex-EF Hutton), 18.0M Shares, $10.00-10.00, $180.0 mil, 10/22/2025 Wednesday

(Incorporated in the Cayman Islands)

We are a newly organized blank check company. We have not selected a sector or a geographic region of interest.

Sung Hyuk Lee, CEO and a director, has extensive experience in corporate finance, financial advisory and business consulting. Since May 2021, Mr. Lee has served as the CEO of the Seoul, South Korea, office of Plutus Partners Co., Ltd., a private equity and high-value asset brokerage firm based in Tampa, Florida. Before that, between June 2016 and March 2021, Mr. Lee served as the senior managing director at DTR Partners (Seoul office). Mr. Lee holds a bachelor’s degree in political science from Yonsei University, Korea, and an MBA from Hass School of Business, California.