If you read most mainstream corporate media accounts, you would think that everyone in Argentina has been crushed into poverty by Milei’s reforms and can’t wait to get rid of him to reembrace Peronist style socialism. But that’s not what happened in last weekend’s midterm elections as ZeroHedge’s ongoing coverage notes:

🇦🇷 Argentine Markets Soar After President Javier Milei’s Midterm Victory; Milei Thanks President Trump (ZeroHedge)

- Update (1020ET):

- Argentina’s bonds, currency, and equities surged early Monday after President Javier Milei’s party secured a crucial midterm victory. The result is key to preserving Milei’s sweeping economic reset in a country crushed by decades of nation-killing socialist mismanagement.

- Milei’s free-market reforms and aggressive austerity program have already begun to cool inflation and stabilize financial conditions, signaling to investors that the restructuring path remains intact.

This does give hope that an electorate can understand that needed changes do not happen overnight and won’t come with atleast some pain.

Note that the 🇦🇷 Argentina section of our North & Latin America Stock Index page has 21 mostly US-listed Argentine stocks plus we covered the holdings of the Global X MSCI Argentina ETF (NYSEARCA: ARGT) last year (The Less Flawed Global X MSCI Argentina ETF’s Holdings (October 2024)).

That piece noted a podcast where it was observed that Milei “seems like a cartoon” and that the podcaster (being more of a Libertarian) can tell when a Marxist tries to write or act like a Libertarian (as in “this is the way they think we talk…”).

Nevertheless, it was also noted that everyone just wants to open Argentina up to further exploitation properly develop its resources (as “Wall Street,” aka the West, has fewer and fewer places to invest as the BRICs etc. continue to expand).

However, and until the problem associated with odious debts to the IMF et al is solved (as in a total default & break with the western financial system…), not much in the developing world can change. Since Argentina won’t be the first country to take such a risky and drastic step, it was concluded that Milei was mostly “new rhetoric, but the same outcomes…” – we will have to wait and see over the next few years whether the country can be made great again…

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🇨🇳 🇭🇰 China & Hong Kong Stock Picks (September 2025) Partially $

- China reality checks

- 🇨🇳 China – Alibaba, Pop Mart International Group, China Mengniu Dairy Company, Inner Mongolia Yili Industrial Group Co, Wanguo Gold Group, Sino Biopharmaceutical Ltd, MINISO Group Holding, Tingyi Holding, Uni-President China, Xiaomi, Eternal Beauty Holdings, Jiangsu Zenergy Battery Technologies Group, China Eastern Airlines Corp Ltd, Air China, China Southern Airlines Co Ltd, JNBY Design, Akeso, Waterdrop, Contemporary Amperex Technology Co. Ltd. (CATL), Black Sesame, JS Global Lifestyle, Nanjing Leads Biolabs Co Ltd, China Life Insurance, NIO Inc, China Merchants Bank, ZTE, New Hope Service Holdings, OmniVision Integrated Circuits Group, CR Beverage, 3SBio, Beijing Geekplus Technology, China Modern Dairy Holdings Ltd, BYD Company, Proya Cosmetics, China Pacific Insurance, PICC Property and Casualty Co Ltd, WuXi XDC, Horizon Robotics, BYD Electronic International Co Ltd, Haier Smart Home, Shenzhen Mindray Bio-Medical Electronics, Shanghai United Imaging Healthcare, Weichai Power, Naura Technology, J&T Global Express, Guangzhou Automobile Group, Nongfu Spring, Duality Biotherapeutics, Great Wall Motor, Shennan Circuit, Midea Group & Shenzhen Dobot Corp Ltd

- 🇭🇰 Hong Kong – China Overseas Land & Investment, Budweiser Brewing Company APAC Limited, New World Development Co Ltd, DFI Retail Group Holdings Ltd, Hongkong Land Holdings, Sun Hung Kai Properties Ltd, Midland Holdings Ltd, Television Broadcasts Ltd, Sunevision Holdings Ltd, BOC Hong Kong Holdings Ltd, China Aircraft Leasing Group Holdings Limited (CFRLF) & Far East Horizon

- 20+ high conviction stock ideas – Geely Automobile Holdings, Zhejiang Leapmotor Technology Co Ltd, Zoomlion Heavy Industry, Sany Heavy Equipment International Holdings, Green Tea Group, Guoquan Food Shanghai Co Ltd, JNBY Design, Luckin Coffee, Proya Cosmetics, CR Beverage, BeOne Medicines (BeiGene), 3SBio, Ping An Insurance, PICC Property and Casualty Co Ltd, Tencent, Alibaba, Trip.com, Greentown Service Group, Xiaomi,, Aac Technologies Holdings, BYD Electronic International Co Ltd, Horizon Robotics, OmniVision Integrated Circuits Group (Will Semiconductor Co Ltd), BaTeLab, Naura Technology & Salesforce

- EM Fund Stock Picks & Country Commentaries (October 26, 2025) Partially $

- China’s food fight, Asia equity market outlook, under-researched Asian small caps, Japanese stocks better positioned, resilient rand, Shari’ah investment framework, September/Q3 fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Brazil Court Blocks Didi’s 99Food From Enforcing Exclusive Deals Against Rival Meituan (Caixin) $

- A São Paulo court has ruled that 99Food, the food delivery unit of Chinese ride-hailing giant DiDi Global (OTCMKTS: DIDIY), violated Brazil’s competition law by signing exclusive agreements with restaurants to block rival Keeta, Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY)’s overseas food delivery brand.

- The Oct. 20 ruling bars 99Food from enforcing contract terms that prevent restaurants from partnering with Keeta. The court found such clauses discriminatory and in breach of constitutional principles of free competition and equal treatment.

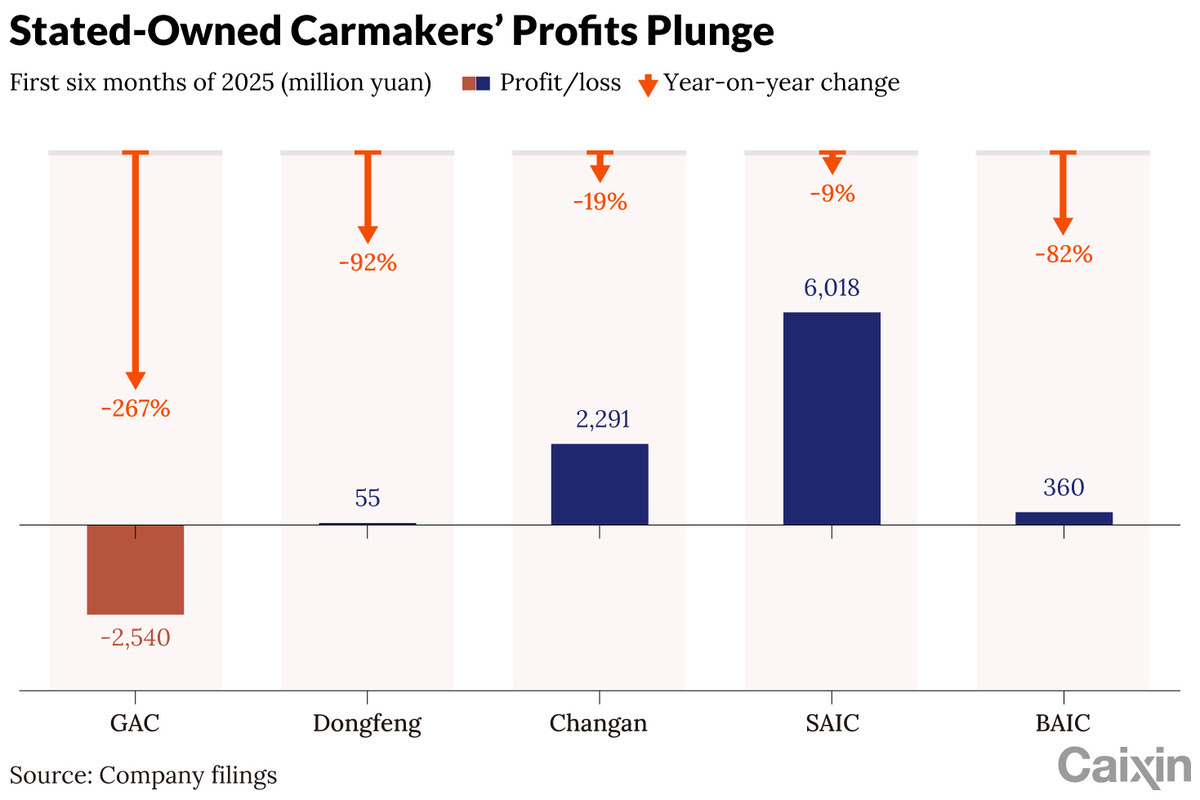

🇨🇳 In Depth: Desperate for Smart Driving Tech, State Carmakers Turn to Huawei (Caixin) $

- China’s state-owned automakers are deepening ties with Huawei Technologies Co. Ltd., turning to the tech giant primarily for its in-car software in a bid to keep up with the rapid transition to smart electric vehicles (EVs).

- Long reluctant to surrender control over core vehicle functions, the state carmakers’ strategic shift comes as they grapple with mounting financial pressure and intensifying competition from private sector rivals including BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF), Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF) and Tesla Inc.

🇨🇳 Pony AI HK Dual Primary Listing: The Investment Case (Smartkarma) $

- Pony AI Inc (NASDAQ: PONY) is a Chinese robotaxi operator and self-driving technology company. It is seeking to raise US$1 billion through a dual primary HKEx listing.

- It was listed on the Nasdaq on 27 November 2024, raising US$260 million at US$13.00 per ADS. Since listing, the shares are up 48%.

- The investment case centres around Pony’s accelerating revenue growth and progress towards positive unit economics. However, the path to profitability is long-dated and the valuation is full.

🇨🇳 UBTech Robotics (9880 HK): Global Index Inclusion Likely in November (Smartkarma) $

- The increase in the stock price over the last 3 months could result in Ubtech Robotics Corp Ltd (HKG: 9880) being added to a global index in November.

- There is a fair amount to buy in the stock and cumulative excess volume has picked up since July. Short interest has dropped over the same period.

- The recent drop in the stock price provides a better entry point for a short-term trade as positioning builds up ahead of the potential passive buying.

🇨🇳 Sany Heavy Industry IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of Sany Heavy Industry (SHA: 600031) is target price of CNY21.1 per share. This represents 7.6% lower than current price of CNY22.83 per share.

- IPO price of Sany Heavy is expected to be set between HKD20.30 and HKD21.30. Our valuation analysis suggests lack of a meaningful upside for Sany Heavy Industry listing in HK.

- There are still lack of a major turnaround of the property market in China and this could continue to negatively impact the overall construction equipment market in China.

🇨🇳 Sany hopes Hong Kong investors see it as global high-tech heavy hitter (Bamboo Works)

- The heavy construction equipment maker’s IPO is set to become the third largest in Hong Kong this year, raising about $1.5 billion

- Sany Heavy Industry (SHA: 600031) is hoping its rapid globalization story can wow Hong Kong investors, with offshore sales now accounting for more than half of its total

- The construction equipment maker’s fate on the Hong Kong Stock Exchange could hinge on whether investors see it is a high-tech growth story, or a traditional economy company

🇨🇳 Fibocom limps out of IPO gate, weighed down by sagging margins (Bamboo Works)

- The wireless module maker’s shares fell 11.7% in their Hong Kong debut and continued to slump the next day, but still trade at an inflated valuation

- Fibocom Wireless Inc (SHE: 300638 / HKG: 0638)’s shares priced strongly as the company raised $360 million in its Hong Kong IPO, but then fell in their trading debut on concerns about overvaluation and margin pressure

- The wireless module maker’s revenue rose 23.5% in the first half of this year, but its profit grew by a far slower 4.8% as its gross margin got squeezed

🇨🇳 Another insider trade (Turtles Research)

- Lufax again this time

- I think it is time to get back into Lufax Holdings (NYSE: LU) again. First time I wrote it up on my blog I spotted an insider trade on the HK exchange that somehow the US exchange did not pick up on. A very large volume spike the day before earnings (they did announce a large special dividend the next day).

- There are currently no large volume spikes on the HK exchange. Unfortunately the auditor (PWC) resigned early this year about a related party transactions dispute. Which is most likely with Ping An Insurance (SHA: 601318 / HKG: 2318 / SGX: HPAD / OTCMKTS: PNGAY) which owns ~75% of Lufax Shares. So the company has delayed filing its annual report and the stock has stopped trading on the HK exchange.

- What piqued my interest though were some recent unusual trading patterns on the US options exchange, someone seems to be backing up the truck on options (which are normally quite illiquid as Lufax is a $2-3bn Chinese stock with a small float).

🇨🇳 Capital Securities offers limited value in crowded brokerage field (Bamboo Works)

- The company aims to become China’s 14th dual-listed brokerage with its planned Hong Kong IPO, even though its small size could dampen its appeal

- Capital Securities Corp Ltd (SHA: 601136) has filed to list in Hong Kong, reporting its profit in the first half of this year increased just 2.8% despite much bigger gains for its larger rivals

- Hong Kong shares of dual-listed smaller brokers like Capital Securities commonly trade at discounts of 40% or more to valuations for their Shanghai and Shenzhen stocks

🇨🇳 China’s Property Market Splinters From Stocks as Buyers Hold Out for Bargains (Caixin) $

- Government support measures in China’s largest cities have helped reignite home sales, but nationwide housing prices continue to drop as consumer confidence remains weak and sellers slash prices to close deals.

- The average price of new homes in 70 large and midsize cities fell 0.4% in September from the previous month, the sharpest decline this year, according to data released Monday by the National Bureau of Statistics. The drop in the secondhand market was even more pronounced, with prices falling across all 70 tracked cities — the first time this year that has occurred. Prices of pre-owned homes dropped 0.6% month-on-month.

🇨🇳 Joy City Property (207 HK): Wide Spread Ahead of the 17 November Scheme Vote (Smartkarma) $

- Joy City Property Ltd (HKG: 0207)’s IFA opines that the share buyback by way of a scheme at HK$0.62 is fair and reasonable. The vote is on 17 November.

- While the offer implies a P/B of 0.29x, it is reasonable compared to peer multiples and historical trading ranges. No disinterested shareholder holds a blocking stake.

- Nevertheless, there remains vote risk and caution is warranted. At the current price and for a 4 December payment, the gross/annualised spread is 8.8%/103.6%.

🇨🇳 Beauty Farm pretties up with major acquisition (Bamboo Works)

- The beauty services provider will buy rival Siyanli for 1.25 billion yuan, positioning it as an industry consolidator following a recent string of similar purchases

- Beauty Farm Medical and Health Industry (HKG: 2373 / FRA: XC5) will acquire Siyanli for $175 million, its second major acquisition in just over a year, giving it the top three brands in the premium beauty services sector

- Careful financial engineering means Beauty Farm will acquire Siyanli at a big discount, and that the acquisition will almost pay for itself

🇨🇳 Freshly prepared ‘sauerkraut fish’: Jiumaojiu’s salvation or a new sinkhole? (Bamboo Works)

- Once a dominant force on China’s dining scene, the restaurant operator is hoping to revive its business by using live fish killed and prepared on-site for its signature dish

- Same-store sales for Jiumaojiu International Holdings (HKG: 9922 / FRA: 3YU)’s Tai Er sauerkraut fish chain fell 9.3% in the third quarter, continuing to improve from even bigger declines in previous quarters

- The company upgraded 106 Tai Er outlets to a new format focused on fresh fish by the end of September, with 200 stores targeted by year-end

🇨🇳 Pop Mart (9992 HK): 3Q25, Revenue Up by 245% – 80% Upside (Smartkarma) $

Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF)

- The growth rate of total revenue accelerated to 245% YoY in 3Q25.

- Within China revenue, the growth rates of both online and offline accelerated in 3Q25.

- The company highlighted that revenues surged significantly in America and Europe.

🇨🇳 Bloks Group (0325.HK): Stock Premium Is Not Justified, Growth Has Slowed, ~30% Downside (Smartkarma) $

- Bloks Group Ltd (HKG: 0325) shares returned ~47% for IPO investors as of today, trailing the HSI’s 30% gain. The stock peaked at HK$190+ and fell ~55% over the following four months.

- Shares saw pressure after lockup restrictions expired in July. Until this month, the lockup provision had prevented the majority shareholder and other early investors from selling their shares.

- The company’s revenue grew ~28% YoY in the first half of 2025, raising potential concerns of continued slowdown in sales of assembly character toys. Expect stock underperformance to continue.

🇭🇰 Wasion (3393.HK) – Transformational contract with DayOne? (Acid Investments)

- I’ve recently been scouring for East Asian-listed equities and came across this great blog article, flagging Wasion Holdings Ltd (HKG: 3393 / OTCMKTS: WSIOF), as an under-the-radar data center beneficiary, that has yet to be rerated. The firm recently obtained some big contracts to participate in the build out of a large data center for Oracle and Bytedance. The street does not seem to be baking upside numbers from this contract and even without it, we have the entire market cap of the equity at present, covered by an equity stake subsidiary listed on the Shanghai Stock Exchange. Management hopped onto the 1H25 call and constantly reiterated potentially surprising investors bigly and should they deliver, there is ample upside on the stonk.

- Before fleshing out the idea, lets lay the foundation on some key players within the data center space, which will tie into the opportunity we have today.

🇭🇰 Asian Dividend Gems: Nameson Holdings (Asian Dividend Stocks) $

- Nameson Holdings Ltd (HKG: 1982) currently has a very high dividend yield of 12.8% which is one of the highest dividend yields among listed stocks in Asia.

- It has attractive valuations. It has valuation multiples of 5.6x (P/E), 0.8x (P/B), and 4.2x (EV/EBITDA) based on FY25 earnings.

- Uniqlo is the largest customer of Nameson Holdings. Uniqlo accounted for 60% of Nameson’s total sales in FY25 and from FY22 to FY25.

🇭🇰 Lion Rock (1127 HK) — 2025 update (Asian Century Stocks) $

- Printing industry serial acquirer at 5x P/E

- I first wrote about Hong Kong-based printing company Lion Rock Group Ltd (HKG: 1127) back in August 2024. It’s run by self-made entrepreneur CK Lau, whose previous company, Recruit Holdings, compounded capital at a +23% annual rate.

- 70% of Lion Rock’s revenues come from printing illustrated books, but it also owns a majority stake in UK book publisher Quarto. The printing business has significant exposure to Mainland China and is also expanding its printing operations in Malaysia and Australia.

- Investors have been concerned about the risks of higher US tariffs on books imported from Mainland China. However, the tariffs remain low at just 7.5% and there’s no indication that they will rise anytime soon. In addition, Lion Rock has prepared itself for such a scenario by ramping up capacity at its Malaysian plant.

- Lion Rock’s P/E ratio is currently about 5x with a dividend yield of 10%. It also has a net cash position equivalent to 30% of the market cap. Lion Rock’s earnings growth has historically been around +4% per year, partly thanks to clever acquisitions. On 3 October, CK Lau purchased 2.2 million shares at an average price of HK$1.29/share.

- That said, Lion Rock’s earnings guidance is cautious, with no obvious turnaround in its slow-growing book printing business.

🇭🇰 Topsports International Holdings Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇨🇳 Topsports (HKG: 6110 / OTCMKTS: TPSRF) 🇰🇾 – sportswear & healthy lifestyle retailer & platform. 🏷️

🇭🇰 Metalpha: A High-Risk, High-Reward Turnaround Story Trading At A Deep Discount (Seeking Alpha) $ 🗃️

- 🌐 Metalpha Technology Holding Ltd (NASDAQ: MATH) – Blockchain & trading technology solutions.

🇭🇰 Modern Dental (3600 HK) – follow up (Healthy Stock Picks)

- Thoughts on the company and bull / bear arguments

- In this note, I review what happened in Modern Dental Group (HKG: 3600 / FRA: 1MD) since I published my write-up in April last year. I then address the main concerns that investors considering investing in the stock have.

- I went to a new dentist last week, and as usual, I tried to chat about everything dental investment-related with my dentist. The comments from my dentist nicely tie into other discussions I had with investors interested in Modern Dental Group (MDG) the past months. One of those was a 45 min call with a European based fund manager that wanted to discuss the threats to MDG’s business model, so I thought I’d also share these thoughts here.

- But first, a quick recap what happened company-wise since I published my write-up on the company back in April last year.

🇲🇴 Macau’s visitor tally reaches 2.78mln in September, up 10pct y-o-y (GGRAsia)

- Visitor arrivals to Macau in September rose 9.8 percent year-on-year, to nearly 2.78 million, according to data issued on Friday by Macau’s Statistics and Census Bureau.

- September’s tally comes after the city registered a new monthly record in August, at nearly 4.22 million arrivals.

- The tally of same-day visitors to the city in September rose 19.4 percent year-on-year, to just above 1.56 million, while that of overnight visitors fell by 0.5 percent, to 1.21 million.

- Average length of stay shortened by 0.1 day year-on-year, to 1.2 days. The average for overnight visitors was unchanged at 2.3 days, while that for same-day visitors stood at 0.3 of a day.

🇲🇴 Sands China 3Q profit up, as revenue climbs to US$1.9bln (GGR Asia) $

- Macau casino operator Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) reported net income of US$272 million for the third quarter this year, compared to US$268 million a year earlier.

- On a United States-GAAP basis, total net revenues for Sands China increased 7.5 percent year-on-year to US$1.90 billion, according to results published on Wednesday by the firm’s parent, U.S-based Las Vegas Sands (NYSE: LVS).

- On Wednesday, Las Vegas Sands reported group-wide net income of US$491 million in the third quarter, up 39.1 percent year-on-year, according to a filing in the United States.

- The latest result was based on net revenues that rose 24.2 percent year-on-year, to about US$3.33 billion.

- Mr Goldstein said the company’s investments in Macau position the group “well for future growth”.

- “In Singapore, Marina Bay Sands once again delivered outstanding financial and operating performance. Our new suite product and elevated service offerings position us for additional growth as travel and tourism spending in Asia expands,” he added.

🇲🇴 LVS management flags US$3bln-plus annualised EBITDA potential for Marina Bay Sands (GGRAsia)

- Rob Goldstein, chairman and chief executive of Las Vegas Sands (NYSE: LVS), says the company was “too conservative” regarding the forecast for earnings before interest, taxation, depreciation and amortisation (EBITDA) at its Marina Bay Sands complex in Singapore.

- He made the remarks on a Wednesday call to discuss the group’s third-quarter earnings. Las Vegas Sands operates casinos in Macau via its Sands China Ltd unit, and the Marina Bay Sands property via its Marina Bay Sands Pte Ltd subsidiary.

- Las Vegas Sands broke ground in July on a US$8-billion Marina Bay Sands expansion, known as MBS 2.0. Construction of the new phase will be completed by June 2030, and open in January 2031, according to corporate information.

- Banking group JP Morgan said in a Thursday memo that Las Vegas Sands’ third-quarter results supported its thesis “that the recent acceleration in Singapore is clearly not an anomaly, but a step-change in sustainable demand”.

🇹🇼 Taiwan

🇹🇼 TSMC And ASML: The Deep Value Engine Of The AI Revolution (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Trimming 50% Of My Position After An Impressive Quarter (Seeking Alpha) $ 🗃️

🇹🇼 Here’s Why TSMC Didn’t Rise Despite Record Profits In Q3 2025 (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: There’s No Other Company To Match Its Prowess (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: The AI Megatrend And CoWoS Growth Constraints (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Buy The Dip, But Don’t Buy The Top (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Continues To Embody What A Structural Advantage Looks Like (Seeking Alpha) $ 🗃️

🇹🇼 TSMC’s Margins (Seeking Alpha) $ 🗃️

🇹🇼 Three Serious Problems Owning Taiwan Semiconductor (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 TSMC 3Q25 Earnings: The Sandbagging Monopolist (Nikhs)

- How Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) turned conservative guidance into a weapon of dominance

- TSMC’s “weak” guidance is a power play: By consistently sandbagging expectations and then beating them, TSMC turns conservatism into a weapon — reinforcing trust while concealing its true dominance.

- Monopoly in disguise: With sub-7nm chip production effectively monopolized, customers like Apple and Nvidia lock in years of capacity — paying 50% more per wafer just to stay in line.

- Controlled scarcity fuels pricing power: Rather than balancing supply and demand, TSMC strategically keeps the “gap narrow,” sustaining tight capacity to amplify dependence and protect margins.

🇰🇷 Korea

🇰🇷 Top 10 Korean Stock Picks and Key Catalysts Bi-Weekly (24 October to 7 November 2025) (Douglas Research Insights) $

- In this insight, we provide the top 10 stock picks and key catalysts in the Korean stock market for the next two weeks (24 October to 7 November 2025).

- Top 10 picks in this bi-weekly include Samsung Life Insurance (KRX: 032830), Samsung C&T Corp (KRX: 028260 / 02826K), KT&G Corp (KRX: 033780), LG CNS Co Ltd (KRX: 064400), Samchully Co Ltd (KRX: 004690), Hyundai Elevator Co Ltd (KRX: 017800 / OTCMKTS: HYEVF), Korea Zinc (KRX: 010130), LG Chem (KRX: 051910 / 051915) (Pref), SK Inc (KRX: 034730 / 03473K), and LS Corp (KRX: 006260).

- Rechargeable battery was the best performing sector in KOSPI in the past two weeks including L&F Co Ltd (KRX: 066970) (+87.1%) Posco Future M Co Ltd (KRX: 003670) (+65.4%) Cosmo Advanced Materials & Technology Co Ltd (KRX: 005070) (+51.9%) and Ecopro Materials (KRX: 450080) (+46.8%).

🇰🇷 A Sharp Increase in Short Selling Balance in the Korean Stock Market Past Seven Months (Douglas Research Insights) $

- The net short selling balance in KOSPI reached 12.6 trillion won as of 20 October. This is the largest amount ever.

- The top 5 companies in KOSPI with highest short selling balance/market cap ratio include Kakao Pay (KRX: 377300), L&F Co Ltd (KRX: 066970), Hanmi Semiconductor Co Ltd (KRX: 042700), Cosmax Inc (KRX: 192820), and LG H&H (KRX: 051900 / 051905 / OTCMKTS: LGHMF).

- Net short position In KOSDAQ as a percentage of total KOSDAQ market cap more than doubled from 0.5% as of 31 March to 1.1% as of 21 October 2025.

🇰🇷 Korea Electric Power: Promising Nuclear Energy Expansion (Seeking Alpha) $⛔🗃️

- 🇰🇷 KEPCO (NYSE: KEP / KRX: 015760 / FRA: KOP) or Korea Electric Power Corporation – Integrated electric utility company. Generation, transmission & distribution of electricity in Korea where it’s the largest electric utility. 🇼 🏷️

🇰🇷 Palliser Capital Goes Activist on LG Chem (Douglas Research Insights) $

- Palliser Capital started to go activist on LG Chem (KRX: 051910 / 051915). According to Palliser Capital, LG Chem’s share price is trading at a 74% discount to its NAV.

- Palliser Capital proposed improving the composition of the board of directors, restructuring the executive compensation system to align with shareholder interests, and higher share buybacks.

- Our updated NAV analysis of LG Chem suggests implied price of 613,438 won per share, which represents a 57% higher levels than current levels.

🇰🇷 LivsMed IPO Preview (Douglas Research Insights) $

- LivsMed is getting ready to complete its IPO on the KOSDAQ exchange in December 2025. LivsMed is a medical device manufacturer that specialises in minimally invasive surgery products.

- This is expected to be one of the largest IPOs in KOSDAQ in 2025. The IPO price range is from 44,000 won to 55,000 won per share.

- LivesMed has commercialized the world’s first multi-joint, multi-degree-of-freedom (DOF) technology capable of 90° rotation in all directions.

🇰🇷 Nota IPO Bookbuilding Analysis (Douglas Research Insights) $

- Nota’s IPO price has been confirmed at 9,100 won, which is at the high end of the IPO price range. The demand ratio was 1,058 to 1.

- Our base case valuation of Nota suggests target price of 11,948 won per share, which is 31% higher than the IPO price (9,100 won).

- Nota Provides technology that enables the efficient operation of high-performance AI models even on resource-constrained edge devices, centered around its proprietary AI model optimization platform, NetsPresso®.

🌏 SE Asia

🇮🇩 PT Bank Negara Indonesia (Persero) Tbk 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🌐🏛️ Bank Negara Indonesia (IDX: BBNI / FRA: BKE1 / OTCMKTS: PBNNF / PTBRY) – Originally established as Indonesia’s central Bank. 🇼 🏷️

🇲🇾 Yinson Holdings Bhd (7293.KL) (Fair Value)

- This article is about Yinson Holdings Berhad (KLSE: YINSON) that is listed in Malaysia – an oil and gas player that is immune to short-term oil price movement, which is about to achieve record profits based on recurring lease revenues.

- I was inspired to take a closer look at Yinson after reading several analyses on Valaris—particularly this article by Deep Value Capital, which is well worth your time. While Valaris is focused on exploration and offshore drilling, Yinson stands out for its strategic position in offshore oil production through FPSOs. What truly caught my attention is how Yinson has weathered industry storms—demonstrating remarkable stability during the 2016 oil glut and the historic subzero oil prices seen during Covid-19.

- This is a long write – up, be sure to expand email to see the full article.

🇲🇾 Malaysian and the United States signed a new reciprocal trade deal (Murray Hunter)

- The costs of being flattered by Trump

- This new trade deal with the United States sees tariffs into the US remaining at 19% with exemptions to 1,711 Malaysian products. This includes rubber, palm oil, cocoa, pharmaceuticals, aircraft components, and spare parts. Trade minister Tengku Zafrul Abdul Aziz said that these exports constitute US5.2 billion Malaysian exports to the US.

- However, less than 24 hours after the deal was signed there is much public criticism over many of the terms and conditions of the deal, which are seen to favour the U.S. substantially over Malaysia. Among a number of issues, there is an obligation of Petronas, MAS, Telekom Malaysia Bhd (KLSE: TM / OTCMKTS: MYTEF) and Tenaga Nasional Bhd (KLSE: TENAGA / FRA: 6TN0 / OTCMKTS: TNABF / TNABY) to purchase American goods worth billions of USD.

- A full joint statement of the Malaysia-US reciprocal trade deal was posted on the White House website soon after the signing. This is reproduced below.

🇲🇾 Genting has limited debt headroom amid bid to privatise unit, says RAM Ratings (GGRAsia)

- Malaysian credit rating agency RAM Rating Services Bhd has affirmed the corporate credit ratings of Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) and its unit Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) at ‘AA1’, with a ‘stable’ outlook.

- Malaysia-based conglomerate Genting Bhd made a conditional voluntary takeover offer in mid-October for Genting Malaysia, aiming to delist the unit from Bursa Malaysia.

- “In our review, we have assessed the impact of potential material financial outlays for the proposed privatisation of Genting Malaysia,” wrote analysts Ben Inn and Thong Mun Wai in a Wednesday memo.

- “In our view, a full privatisation of Genting Malaysia is unlikely at the current offer price,” they observed.

🇵🇭 International Ent flags junket operations at New Coast Hotel Manila (GGRAsia)

- International Entertainment Corporation (HKG: 1009), a Hong Kong-listed firm with a casino-hotel business in the Philippines, says it has “diversified” its revenue streams “by leasing gaming venues to a junket operator” in the 12 months to June 30, 2025.

- The information was disclosed by International Entertainment’s chairman and chief executive, Ho Wong Meng, in comments included in the company’s report for the latest financial year.

- Mr Ho said the current financial year “will see the gradual completion” of renovation work, culminating in the “grand opening” of the property’s new ground-floor casino.

🇵🇭 Robinsons Retail Holdings, Inc. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇵🇭 Robinsons Retail Holdings (PSE: RRHI / OTCMKTS: RRETY) – Multi-format retailer. Subs. of JG Summit Holdings (PSE: JGS / OTCMKTS: JGSHF / JGSMY). 🇼

🇸🇬 Frasers Centrepoint Trust 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇸🇬 Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF) – REIT. One of the largest suburban retail mall owners in Singapore. 🇼 🏷️

🇸🇬 Bitdeer: Could Ride The Bitcoin And AI Tailwinds, Yet Not My Top Pick – A Hold (Seeking Alpha) $ 🗃️

- 🌐 Bitdeer Technologies Group (NASDAQ: BTDR) – Technology company for blockchain & high-performance computing.

🇸🇬 Karooooo Ltd. 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

🇸🇬 Karooooo Ltd: Still A Great Business, But The Price Feels Ahead Of Itself (Seeking Alpha) $ 🗃️

- 🇸🇬 🇿🇦 Karooooo (NASDAQ: KARO / JSE: KRO) – Leading provider of an on-the-ground operations cloud that maximizes the value of data. The Cartrack SaaS platform provides insightful real-time data analytics & business intelligence reports. 🏷️

🇸🇬 If You Invested $10,000 Into Sea Limited at Its IPO, Here’s What It’s Worth Now (The Smart Investor)

- A US$10,000 investment in Sea Limited (NYSE: SE) at IPO grew more than tenfold. We look at its journey, performance, and lessons for long-term investors.

- So, how much would an investment of US$10,000 on its initial public offering (IPO) be worth today?

- Sea’s 2017 IPO

- How the Investment Has Performed

- Shopee: An Underdog to Regional Leader

- Garena: Free Fire’s Comeback

- Monee: A Build Up of Fintech Momentum

- Challenges Along the Way

- What We Can Learn As Investors

🇸🇬 Sea CEO: Gaming Empire, Southeast Asia Strategy and Humble Leadership (In Good Company with Nicolai Tangen) 50:16 Minutes

- What does it take to build Southeast Asia’s largest tech company from scratch? Forrest Li, founder and CEO of Sea Limited (NYSE: SE), joins Nicolai Tangen to discuss the journey of building a $100 billion technology empire. They talk about Sea’s journey from video game distributor to e-commerce leader, the success of the game Free Fire with over 100 million daily players, and expanding into fintech services. Forrest shares his humble leadership approach inspired by the movie Forrest Gump and explains how solving local challenges like complex delivery routes helped Sea beat major competitors. Sea now operates across gaming, e-commerce, and financial services in multiple countries. Tune in!

- In Good Company is hosted by Nicolai Tangen, CEO of Norges Bank Investment Management. New full episodes every Wednesday, and don’t miss our Highlight episodes every Friday.

🇸🇬 Haw Par Corporation: Crouching Tiger (Value Zoomer)

- For this writeup we return to the place where I’ve had so much success over the past year; Singapore. I was surprised I hadn’t come across this company before, however it is a little bit larger than the companies I usually look at. Regardless, it demonstrates that there’s attractive value to be found at all sizes in the Singapore market. For those who haven’t heard of it, I’d love to introduce you to Haw Par Corporation (SGX: H02 / OTCMKTS: HAWPF), a fascinating company at an extremely compelling valuation with some decent short term catalysts that I could see potentially unlocking value. Additionally, I see it as a great candidate to potentially benefit from the reform that is currently occurring across the Singaporean stock market.

- While you may not have heard of Haw Par Corp, there’s a decent chance that you’ve seen their products. Haw Par’s staple product “Tiger Balm” is a muscular pain relief cream that traces its origins all the way back to the 1870’s. They have an iconic, well renowned brand that holds shelf space all over the world. I don’t really have any insightful qualitative analysis to add here. The reviews for Tiger balm are very good, the longevity and brand strength speaks for itself. I think that there is a very clear brand moat here with a very good product underlying it. I don’t expect explosive growth from Tiger Balm, but having grown from $25m operating profit in 2000 to $70m of run rate profit this year it’s reasonable to expect low to mid single digit growth to continue.

🇸🇬 Genting Singapore liquidity strong, credit quality constrained by parent Genting Bhd: Moody’s (GGRAsia)

- Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY), operator of Resorts World Sentosa, has “excellent” liquidity and is expected to have sufficient cash to fund the Singapore gaming complex’s ongoing upgrade to facilities and expansion – known as RWS 2.0 – without the need for extra debt finance, says Moody’s Ratings.

- While Genting Singapore has “strong” credit metrics, its credit rating is constrained at “no more than two notches” above its ultimate parent, Malaysia-listed Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY), the ratings agency also remarked.

- In its Wednesday opinion, Moody’s said it expected Genting Singapore would maintain its net cash position over the remainder of 2025 and 2026.

🇸🇬 This REIT Just Raised Its DPU — Here’s Why It Matters (The Smart Investor)

- At a time when most REITs have been reducing their distribution, Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) announced a 12.8% increase from the prior year.

- Keppel DC REIT’s DPU Increase

- Why This Increase Matters

- How Keppel DC REIT Achieved This

- What Investors Should Watch Next

- What This Means for Investors

- Get Smart: Data Centre Exposure

🇸🇬 Better Buy: CapitaLand Integrated Commercial Trust vs Frasers Logistics and Commercial Trust (The Smart Investor)

- With CapitaLand Integrated Commercial Trust (CICT) recently increasing its distribution payout, investors might wonder if it is a better buy now than logistics-focused Frasers Logistics & Commercial Trust (FLCT). In this article, we compare both companies to shed some light.

- CapitaLand Integrated Commercial Trust (CICT): Stable Domestic Presence

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), or CICT, is Singapore’s largest REIT. It has a portfolio that focuses on prime retail, office, and integrated developments in Singapore. It also has two properties in Germany and three in Australia.

- Frasers Logistics & Commercial Trust (FLCT): Global Logistics Exposure

- Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF), or FLCT, is a REIT that focuses on logistics and industrial properties.

- Head-to-Head Comparison: CICT vs FLCT

- Get Smart: Should Investors Buy CICT or FLCT?

🇸🇬 3 Singapore REITs Reported Their Latest Earnings: Key Takeaways for Investors (The Smart Investor)

- Explore the latest Singapore REIT earnings update plus key takeaways for long-term investors.

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF): Acquisition-Driven Growth Masks Dilution Impact

- OUE Real Estate Investment Trust (SGX: TS0U / OTCMKTS: OUECF): Like-For-Like Gains Provide Relief Amid Divestment Impact

- Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF): Cost Control Drives DPU Growth, But Revenue Challenges Linger

🇸🇬 3 Singapore REITs That Just Reported: Here’s What Investors Need To Know (The Smart Investor)

- See how FCT, MPACT and Digital Core REIT performed in their latest earnings and what these results signal for REIT investors.

- Frasers Centrepoint Trust: Suburban Strength Delivers Consistent Returns

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF), or FCT, delivered results that showcased the enduring appeal of Singapore’s suburban retail sector, with the REIT benefiting from both strategic acquisitions and organic growth.

- Mapletree Pan Asia Commercial Trust: DPU Resilience Masks Underlying Challenges

- Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF), or MPACT, maintained distribution growth in its 2QFY2025/2026 results through active portfolio management, using cost control and strategic divestments to offset underlying revenue challenges.

- Digital Core REIT: AI Tailwinds Drive Revenue, But Watch the DPU Gap

- Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF) delivered impressive top-line growth in its 3Q2025 results, though the benefits to unitholders remain modest for now.

🇸🇬 3 Blue-Chip REITs Reporting Earnings Next Week: What to Watch (The Smart Investor)

- Next week’s earnings will reveal which blue-chip REITs are building momentum and which are merely treading water.

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) offers a window into Singapore’s retail and office recovery, with its ION Orchard acquisition now bedded down.

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF) faces headwinds from currency weakness and China challenges — making this a critical test of resilience.

- Elsewhere, Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF) provides insight into the data centre boom and whether its North American expansion is paying off.

- CapitaLand Integrated Commercial Trust (SGX: C38U): Reporting on 28 October 2025

- Mapletree Logistics Trust (SGX: M44U): Reporting on 28 October 2025

- Mapletree Industrial Trust (SGX: N2IU): Reporting on 30 October 2025

- Get Smart: The interest rate tailwind test

🇸🇬 Singapore’s Next 50: 3 Singapore Stocks Offering Better Dividends Yields than The STI (The Smart Investor)

- Discover 3 of Singapore’s “Next 50” dividend stars yielding more than the SPDR STI ETF (SGX: ES3).

- Today, we’re highlighting three Singapore stocks, each with a market capitalisation under S$1 billion, that are truly “defying gravity” with dividend yields stronger than the STI’s.

- SBS Transit (SGX: S61): Dividend Yield 7.4%

- If you take public transport in Singapore, chances are you’re already a customer of SBS Transit.

- Riverstone Holdings (SGX: AP4): Dividend Yield 5%

- Riverstone Holdings may not be a household name, but this Malaysian glove manufacturer operates six facilities across Malaysia, Thailand, and China with 10.5 billion gloves annual capacity.

- CDL Hospitality Trusts (SGX: J85 / OTCMKTS: CDHSF): Dividend Yield 5%

- With S$3.5 billion in assets under management, CDL Hospitality Trust, which owns 22 properties across eight countries, offers geographic diversification that most Singapore-focused landlords can’t match.

- Get Smart: Looking Beyond the Spotlight

🇸🇬 Beyond STI: 3 Dividend Stocks Offering Retirement Passive Income (The Smart Investor)

- Earn steady passive income with three dependable Singapore dividend stocks for your retirement portfolio.

- SBS Transit (SGX: S61) is Singapore’s largest bus operator and runs three major rail lines (North East Line, Downtown Line, and Sengkang-Punggol LRT), while also generating revenue from commercial operations like advertising and facility rentals.

- A household name in Singapore, famed for their curry puffs and fried snacks, Old Chang Kee (SGX: 5ML) operates 80 retail outlets.

- Vicom Ltd (SGX: WJP) holds a commanding 72% market share in Singapore’s vehicle inspection sector, providing mandatory vehicle inspections that meet safety and environmental standards, as well as offering non-destructive testing, mechanical testing, and calibration services to manufacturing and construction industries.

- Get Smart: Dive Deeper for Steady Dividends

🇸🇬 Can Singapore Bank Stocks Rise Further? (The Smart Investor)

- Singapore’s local banks have enjoyed strong rallies in the last few years; however, can they rise further in a rate-easing cycle? We examine whether there is more upside in this article.

- Why Bank Stocks Surged

- Singapore’s largest bank, DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), has been making strides in diversifying away from NII, with strong growth seen in its fee-income business, particularly from wealth management.

- Since United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) completed the final phase of its acquisition and integration of Citigroup’s consumer banking assets in November 2023, it has offered investors larger exposure to regional economic growth.

- For 2Q 2025, Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) saw NII decreasing 6% YoY and 3% QoQ to S$2.3 billion.

- Headwinds to Consider

- What This Means for Investors

- Get Smart: Banks Offer Modest Growth but Reliable Income

🇸🇬 UOB vs OCBC: Which Bank Offers the Better Blend of Growth and Dividends? (The Smart Investor)

- With interest rates easing, the real question is how OCBC or UOB will adapt.

- Singapore’s big three banks have long been the backbone of local portfolios.

- It’s not a surprise that both United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), or UOB, and Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY), or OCBC, attract a lot of attention for their long track record in paying dividends.

- UOB: Expanding regional footprint

- OCBC: A diversified source of revenue

- Growth Potential: UOB vs OCBC

- Get Smart: Choose Your Flavour

🇹🇭 Kasikornbank Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇹🇭 Kasikornbank PCL (BKK: KBANK / SGX: TKKD / FRA: TFBF / OTCMKTS: KPCPY / KPCPF) – Commercial Banking. 🇼 🏷️

🇮🇳 India / South Asia / Central Asia

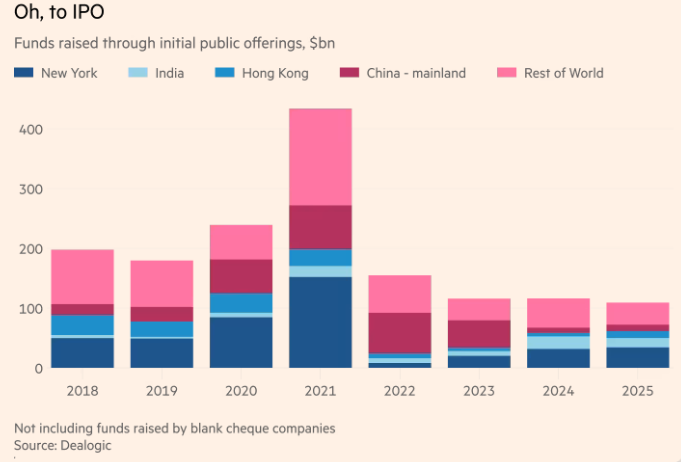

🇮🇳 India’s IPO boom has a goldilocks feel (FT) $ 🗃️

- The country shows that a mood of not too hot, not too cold in equity markets is conducive to healthy capital raising

🇮🇳 IFN: Still A Buy, But With Caveats (Seeking Alpha) $ 🗃️

- 🇮🇳 The India Fund, Inc. (NYSE: IFN) – Closed-end fund covered in Sunday posts.

🇮🇳 Wipro Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

🇮🇳 ICICI Bank: A Tough Balancing Act (Seeking Alpha) $ 🗃️

- 🌐 ICICI Bank (NYSE: IBN) – MNC bank & financial services. Wide range of banking & financial services for corporate & retail customers. 🇼 🏷️

🇮🇳 HDFC Bank: The Good And The Bad From Latest Results (Seeking Alpha) $ 🗃️

- 🇮🇳 HDFC Bank (NYSE: HDB) or Housing Development Finance Corp – One of India’s leading private banks. Nationwide distribution network. 🇼 🏷️

🇮🇳 HDFC Bank (HDFCB IN) Tactical Outlook: Time to Lock In Gains (Smartkarma) $

- Despite good earnings results, HDFC Bank (NYSE: HDB) does not seem to be going anywhere. The stock did rally for the past 3 weeks but after the earnings stayed flat.

- Our quantitative probabilistic model indicates HDFC Bank usually does not rally for more than 4 weeks when this pattern is encountered (we are in the 4th week, this week).

- From a price perspective, our model shows a mildly overbought stock, confirming the slow pace. The pullback should be short-lived (1-2 weeks), but it’s imminent.

🇮🇳 Emirates NBD’s Entry Redefines RBL Bank’s Growth Trajectory (Smartkarma) $

- Emirates NBD to invest USD3 billion for a controlling stake of up to 74% in RBL Bank (NSE: RBLBANK / BOM: 540065) through a mix of preferential issue and open offer.

- The deal boosts RBL’s capital strength, global linkages, and business mix amid ongoing margin and asset-quality challenges.

- Short-Term earnings may stay uneven, but the investment sets up a long-term re-rating opportunity dependent on execution, regulation, and credit control.

🇮🇳 Federal Bank Q2 FY26: Strong Operational Beat, RoA Strategy On Track – But Is the Re-Rating Done (Smartkarma) $

- The Federal Bank Ltd (NSE: FEDERALBNK / BOM: 500469) delivered record net interest income (NII) and fee income in Q2 FY26, while net profit fell ~9½ % YoY.

- Core earnings momentum is intact—CASA growth, margin uptick, asset quality improving—but elevated provisions and subdued credit growth raise questions on earnings durability.

- He bank is executing on key levers, but investors need clarity on the earnings runway and capital/deposit growth ahead—read on for the deeper dive.

🇮🇳 Axis PUNCH: Garware Hi-Tech Films Ltd – 24th October, 2025 (Smartkarma) $

- Growth Beyond the Near-term Headwinds: Garware Technical Fibres (NSE: GARFIBRES / BOM: 509557)’s Q1FY26 performance was impacted by adverse weather conditions in the domestic market and macro uncertainties in the global market.

- While the company expects a flattish performance in FY26, the growth prospects remain strong with the company adding capacities in FY26 and FY27.

- The newer capacities are expected to drive the next phase of growth, reaching full utilization within 2-3 years of commissioning.

🇰🇿 Kaspi: Our National Pride, Cheap For A Reason (Seeking Alpha) $ 🗃️

- 🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🌍 Middle East

🇮🇱 Mobileye: Stabilizing Cash Flow And Rising Sales Trend Justify The Buy (Seeking Alpha) $ 🗃️

- 🌐 Mobileye Global (NASDAQ: MBLY) – Advanced driver assistance systems (ADAS) & autonomous driving technologies. 🇼

🇹🇷 TAV Havalimanlari Holding A.S. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🌍 TAV Havalimanlari Holding AS (IST: TAVHL / OTCMKTS: TAVHF) – Turkish airport operation & services with 15 airports in 8 countries (Turkey, Croatia, Georgia, Kazahstan, Latvia, North Macedonia, Saudi Arabia & Tunisia). Part of Groupe ADP (EPA: ADP). 🇼 🏷️

🇹🇷 Akbank T.A.S. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

🇹🇷 Eregli Demir ve Çelik Fabrikalari T.A.S. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- Eregli Demir ve Celik Fabrikalari TAS (IST: EREGL) or Erdemir – Flat steel. Parent company of OYAK Mining & Metallurgy. 🇼

🌍 Africa

🇿🇦 Clicks Group Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇿🇦 Clicks Group (JSE: CLS / FRA: N1C / OTCMKTS: CLCGY) – Foremost health & beauty retailer + leading full-range pharmaceutical wholesaler. 🇼 🏷️

🇿🇦 Exxaro Resources Limited (EXXAF) Presents at SA Tomorrow Conference – Slideshow (Seeking Alpha) $ 🗃️

- 🇿🇦 Exxaro Resources (JSE: EXX / FRA: LCQ / OTCMKTS: EXXAF) – Diversified resources company with a coal business & acquisitive growth prospects in minerals & energy. Exxaro is among the top 5 coal producers in South Africa. 🇼 🏷️

🇿🇦 Famous Brands Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🌍 Famous Brands Ltd (JSE: FBR) – Africa’s leading quick-service & casual dining restaurant franchisor operating franchised, master license & Company-owned restaurants. Vertically integrated business model & supply chain consisting of Manufacturing, Logistics & Retail operations. 🇼 🏷️

🇿🇦 Calgro M3 Holdings Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇿🇦 Calgro M3 Holdings (JSE: CGR / FRA: 5C2 / OTCMKTS: CLMHF) – Property & related investment company that specialises in the development of Integrated Residential Developments & Memorial Parks. 🏷️

🇿🇦 Capitec Bank Holdings Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇿🇦 Capitec Bank (JSE: CPI / OTCMKTS: CKHGY / CKHGF) – 2nd largest retail bank in South Africa & focused on providing low cost, digital & paperless retail banking services rather than corporate banking services. 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇵🇱 Orange Polska S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇵🇱 Orange Polska SA (WSE: OPL / OTCMKTS: PTTWF) – Leading telecommunication providers in Poland, operating in all segments of the Polish telecoms market. 🇼 🏷️

🌎 Latin America

🌎 #136 Stock Valuation Update – MercadoLibre (Kroker Equity Research)

- Growth, Profits, and a Reasonable Valuation Finally Meet

- Every few years, a company graduates from being an exciting growth story to a mature, profit-generating powerhouse — without losing its growth DNA. MercadoLibre (NASDAQ: MELI) might be one of the best current examples.

- After years of multiple compression, MELI finally looks reasonable valued for what it delivers. It’s far away being a deep-value play, but it doesn’t need to be. The recent pullback offers a healthy reminder that even great companies don’t move up in straight lines. For long-term investors comfortable with emerging-market volatility, MELI still looks like one of the most compelling compounders to own heading into 2026.

🌎 A bet on time MELI 0.07%↑ (Rose’s Substack)

- People keep asking if they should buy MercadoLibre (NASDAQ: MELI) because it’s “cheaper” now at around a $100B valuation after a 20% decline or a so called “correction”. I don’t love answering questions like that because it depends on too many personal factors such as temperament, investment goals, time horizon, etc.

- In the short term, $MELI could easily fall another 50%. It’s volatile, and Latin America isn’t exactly a stable region. But if you’re thinking in 10–20 year terms, I think this company has one of the clearest runways on the planet.

- If you believe Latin America will keep digitizing commerce, finance, logistics, and credit then you’re basically betting on $MELI as the backbone of that transformation. It’s one of the few companies that could be multiple times larger a decade from now without relying on unrealistic or unknown assumptions.

🌎 Why dLocal’s Margin Pressure Narrative Is Overblown (Seeking Alpha) $ 🗃️

- 🌐 Dlocal (NASDAQ: DLO) – Cross-border payment platform for global merchants to get paid & make payments in emerging markets. 🇼

🇦🇷 Investors bet on Argentine peso devaluation after weekend elections (FT) $ 🗃️

- Forward contracts indicate a 12% decline for currency despite $40bn US support package

🇦🇷 America’s risky bid to make Argentina great again (FT) $ 🗃️

- Treasury secretary Scott Bessent is taking a big gamble with his $20bn swap line to prop up a Trump ally

- Indeed, wags are now talking about the acronym “Mada” — or “Make Argentina Default Again” — as doubts surface about whether Milei can really avoid a financial crunch, even with this US support package, and a hefty, frontloaded loan from the IMF.

🇦🇷 Argentine Markets Soar After President Javier Milei’s Midterm Victory; Milei Thanks President Trump (ZeroHedge)

- Earlier this month, US Treasury Secretary Scott Bessent arranged a $20 billion currency swap with Argentina’s central bank to stabilize the country’s bond market ahead of Sunday’s elections. The midterm results were surprising, as President Javier Milei’s party scored a major comeback, and the move may now pay dividends for the US.

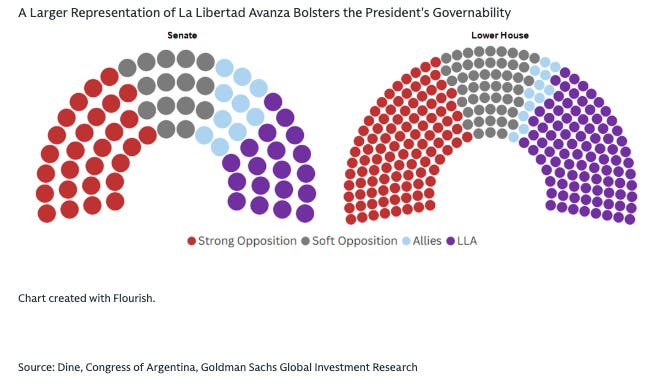

- Goldman analyst Clara Mourey provided clients with midterm election results:With 94% of ballots counted, President Milei’s party, La Libertad Avanza, received 40.8% of the votes, above expectations, and will increase its representation in Congress starting December 10, up from the current 10% in the Senate and 15% in the Lower House. Importantly, the government’s representation would exceed the one-third threshold in the lower house, and together with allies also in the Senate. This outcome would enhance the President’s veto authority and bolster governability.The left-wing coalition Fuerza Patria received 24.4% of the votes, and together with other Peronist groups reached 31.6% of the votes. Finally, the group of governors united under the Provincias Unidas coalition received 7.0% of the vote.

🇦🇷 Lithium Argentina: A Patient Strategy Paying Off (Seeking Alpha) $ 🗃️

- 🇦🇷 👼🏻 Lithium Argentina AG (NYSE: LAR) – Lithium brine evaporation ponds & processing facility. Pipeline of development & exploration projects.

🇧🇷 Brazil’s corporate bond market rocked by credit concerns (FT) $ 🗃️

- Plunging prices for bonds of high-profile issuers draw comparisons with jitters in US credit

- A series of blow-ups in Brazil’s corporate bond market has pushed up dollar borrowing costs across Latin America’s biggest economy, drawing parallels with the jitters in US credit following the collapse of auto parts group First Brands.

- Bonds issued by waste manager Ambipar Participacoes E Empreendimentos (BVMF: AMBP3), petrochemicals behemoth Braskem SA (NYSE: BAK / BVMF: BRKM3 / BRKM5 / BRKM6) and biofuels maker Raizen Sa (BVMF: RAIZ4) have slumped in price over the past month, sending a chill through Brazil’s corporate credit market.

🇧🇷 Nubank takes aim at the U.S.

- Revolut tried. Now it’s Nu Holdings (NYSE: NU)’s turn.

- Nubank just applied for a U.S. banking charter, taking its first step to expand beyond Latin America. It’s a bold move…and one that many international neobanks have tried before. Revolut, Europe’s largest neobank, entered the U.S. in 2020, but has struggled to gain traction.

- Despite being lumped together as “neobanks,” Revolut and Nubank are very different. Revolut rose to prominence in Europe with a sleek app and a free debit card with no FX fees, a formula that worked well at home, but failed to stand out in a market dominated by Cash App and Chime.

- Nubank, meanwhile, built its business around credit. It started by offering credit cards to underserved Brazilians, and lending remains its core engine today. Revolut still makes most of its money from interchange and FX fees; Nubank earns it from loans.

- Nubank also has something Revolut didn’t: a built-in customer base. The company already serves Latin Americans living in the U.S.

🇧🇷 Inter & Co: Thesis Holds, Even If Targets Still Far Off (Seeking Alpha) $ 🗃️

- 🇧🇷 Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) – Holding company of Inter Group & indirectly holds all of Banco Inter’s shares. Inter is a Super App providing financial & digital commerce services. 🏷️

🇧🇷 Cosan: End Of An Empire (Seeking Alpha) $ 🗃️

🇧🇷 WEG: Powering Global Electrification With Unmatched Industrial Momentum (Seeking Alpha) $ 🗃️

🇧🇷 WEG S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇧🇷 WEG SA (BVMF: WEGE3) – Operates worldwide in the electric engineering, power & automation technology areas. Electric motors, generators, transformers, drives & coatings. 🇼 🏷️

🇧🇷 Usinas Siderúrgicas de Minas Gerais S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇧🇷🅿️ Usinas Siderurgicas de Minas Gerais (BVMF: USIM3 / USIM5 / USIM6 / FRA: U1S0 / OTCMKTS: USNZY) – One of the largest producers of steel in the Americas, with major steel mills in Brazil. 🇼 🏷️

🇧🇷 PagSeguro: Hidden Gem In Brazil’s Booming Fintech Market With Double-Digit EPS Growth (Seeking Alpha) $ 🗃️

- 🇧🇷 PagSeguro Digital (NYSE: PAGS) 🇰🇾 – Financial services & digital payments. 🇼 🏷️

🇧🇷 Telefônica Brasil: From Yield Play To Defensive Compounder (Seeking Alpha) $ 🗃️

- 🇧🇷 Telefônica Brasil S.A. (NYSE: VIV) – Fixed line, mobile, data, pay TV, IT, etc. services. Subs. of Telefonica SA (NYSE: TEF). 🇼

🇧🇷 Afya Limited (AFYA) Analyst/Investor Day – Slideshow (Seeking Alpha) $ 🗃️

- 🇧🇷 Afya (NASDAQ: AFYA) – Bertelsmann backed medical education & digital health services group in Brazil. Delivering an end-to-end physician-centric ecosystem. 🏷️

🇧🇷 Braskem: Novonor To The Rescue (Rating Upgrade) (Seeking Alpha) $ 🗃️

- 🌐🅿️ Braskem SA (NYSE: BAK / BVMF: BRKM3 / BRKM5 / BRKM6) – Largest petrochemical company in Latin America. Controlled by Novonor (Odebrecht SA). 🇼 🏷️

🇧🇷 My Biggest Investment Is Soaring: An Update On Patria Investments (Seeking Alpha) $ 🗃️

- 🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇨🇱 How Chile Embodies A.I.’s No-Win Politics (NY Times) 🗃️

- Political debates have flared across Chile over artificial intelligence. Should the nation pour billions into A.I. and risk public backlash, or risk being left behind?

🇨🇱 LATAM Airlines Group S.A. (LTM) Shareholder/Analyst Call – Slideshow (Seeking Alpha) $ 🗃️

- 🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subs. in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇨🇱 Sociedad Química y Minera de Chile: Strong Bet On Lithium Recovery With A Multi-Commodity Edge (Seeking Alpha) $ 🗃️

- 🌐 Sociedad Química y Minera de Chile (NYSE: SQM) – Lithium, potassium nitrate, iodine & thermo-solar salts. 🇼

🇨🇴 GeoPark Limited (GPRK) Analyst/Investor Day – Slideshow (Seeking Alpha) $ 🗃️

- 🌎 GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O) – Leading independent Latin American oil & gas explorer in Colombia, Ecuador, Chile & Brazil. 🏷️

🇲🇽 Gruma, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🌎 Gruma SAB de CV (BMV: GRUMAB / FRA: 3G3B / OTCMKTS: GMKKY / GPAGF) – One of the world’s leading tortilla & corn flour producers. 🇼 🏷️

🇲🇽 Alfa S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇲🇽 Alfa SAB de CV (BMV: ALFAA / OTCMKTS: ALFFF) – Petrochemical & synthetic fiber, refrigerated food & telecommunications businesses + Alpek SAB de CV (BMV: ALPEKA / FRA: 27A / OTCMKTS: ALPKF) + Sigma (Leading MNC food company). 🇼 🏷️

🇲🇽 Vista Energy, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇦🇷 🇲🇽 Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA)’s – Mexico HQ’d. Main asset in Argentina is the largest shale oil & shale gas play under development outside North America. 🏷️

🇲🇽 Grupo Aeroportuario del Sureste, S. A. B. de C. V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Aeroportuario del Sureste: The Recent Dip Is A Buying Opportunity (Seeking Alpha) $ 🗃️

- 🇲🇽 🇵🇷 🇨🇴 Grupo Aeroportuario del Sureste (ASUR) (NYSE: ASR) – operates 9 airports in the southeast of Mexico + the main airport in San Juan, Puerto Rico & six airports in Colombia. 🇼 🏷️

🇲🇽 GCC, S.A.B. de C.V. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $ 🗃️

- 🇲🇽 GCC SAB de CV (BMV: GCC / FRA: AK4 / OTCMKTS: GCWOF) – Gray Portland cement, ready-mix concrete, aggregates, coal & construction-related services. 🏷️

🇲🇽 America Movil: Still Undervalued After Strong Q3 Results (Seeking Alpha) $ 🗃️

- 🌎 America Movil SAB de CV (NYSE: AMX) – Leading Latin America telecommunication service provider. 🇼 🏷️

🌐 Global

🌐 Critical Minerals Shopping List (TheOldEconomy Substack)

Note: Mentions a number of stocks…

- October Critical Minerals Report: The Shopping Edition

- REE Shopping List

- United States

- Australia

- Latin America

- Tungsten Shopping List

- United States and Canada

- Australia

🌐 AI Capex Warnings: Separating Signal from Noise in Tech’s Biggest Bet (The Great Wall Street) $

- How to Tell Which Companies Are Actually Burning Cash

🌐 Nebius Pullback: The Smart Money Entry Point (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 Is Nebius still a Buy? (Global Equity Briefing)

- Updated Nebius Group NV (NASDAQ: NBIS) Investment Case!

- On June 19, I released my Nebius Investment Case in which I analyzed the business. While I identified the potential of this company, I was not particularly bullish.

- This is because I didn’t find the unit economics of the GPU rental that particularly attractive and found the company to be a VC-like, very high-risk, very high-reward opportunity.

- Since then, it has become glaringly obvious that I was wrong!

- As Nebius has jumped over 160% in these 4 months, I thought it could be useful to look back at what happened.

- I believe I made the following mistakes in my analysis:

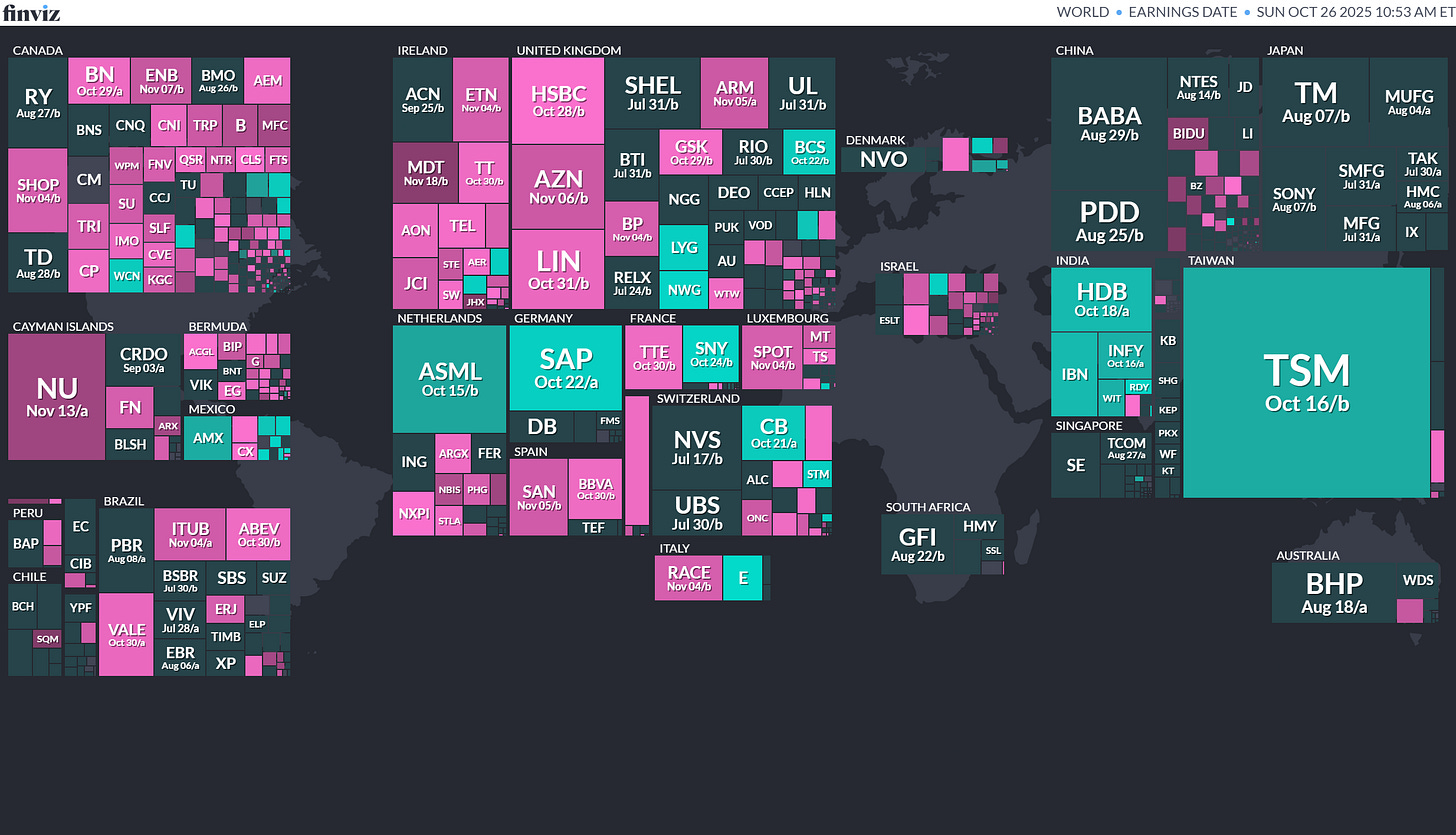

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

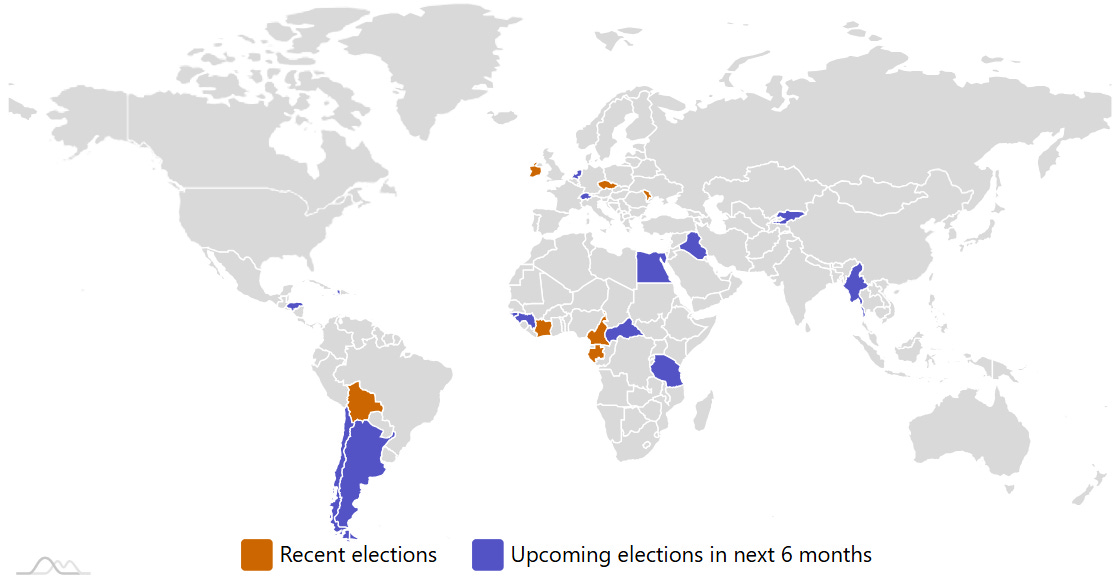

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

ArgentinaArgentinian Chamber of Deputies2025-10-26 (d) Confirmed 2023-10-22ArgentinaArgentinian Senate2025-10-26 (d) Confirmed 2023-10-22- Egypt Egyptian House of Representatives 2025-11-10 (d) Confirmed 2020-10-24

- Iraq Iraqi Council of Representatives 2025-11-11 (d) Confirmed 2021-10-10

- Chile Chilean Chamber of Deputies 2025-11-16 (d) Confirmed 2021-11-21

- Chile Chilean Presidency 2025-11-16 (d) Confirmed 2021-12-19

- Chile Chilean Senate 2025-11-16 (d) Confirmed 2021-11-21

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

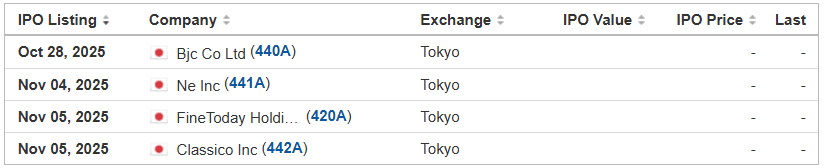

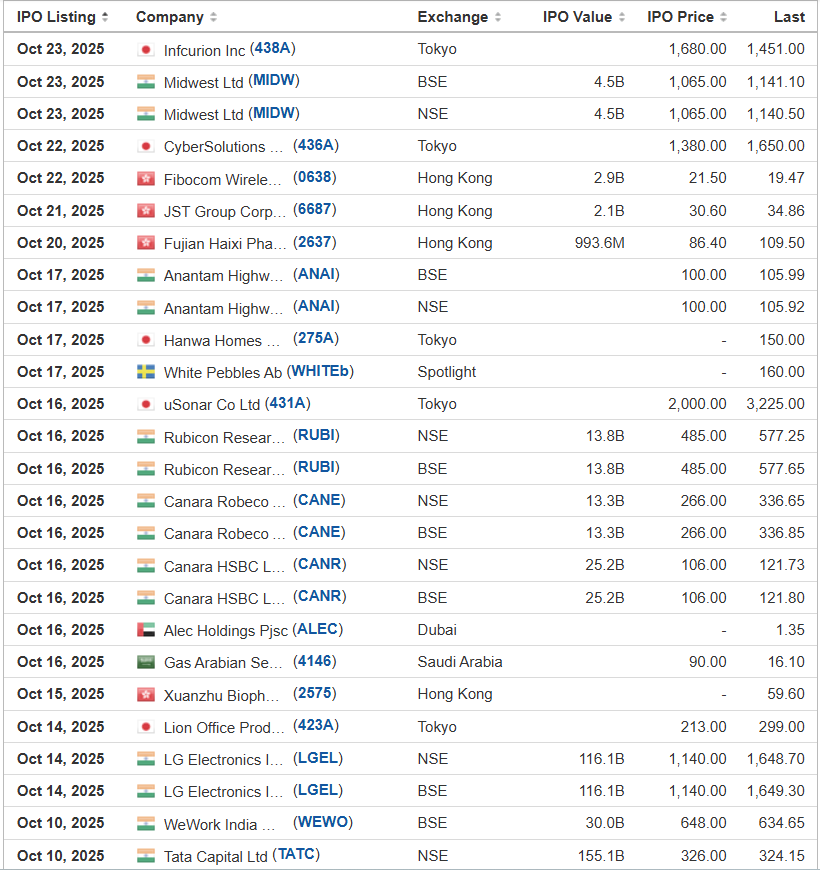

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Monkey Tree Investment Ltd. MKTR Craft Capital Management/Revere Securities, 1.6M shares, $4.00-5.00, $7.0 mil, 10/31/2025 Week of

(Incorporated in the Cayman Islands)

We run English learning centers for children in Hong Kong.

We offer children’s language classes – mostly in English – and some in Mandarin. We serve students ages 3 to 14 through our 20 learning centers in Hong Kong that offer classes in phonics, reading, grammar, writing, conversation and preparation for exams.

We have licensed the “Monkey Tree” brand to other operators that run another 38 centers in Hong Kong.

Note: Net income and revenue are in U.S. dollars for the year that ended March 31, 2025.

(Note: Monkey Tree Investment Ltd. named Craft Capital Management as its lead left underwriter in an F-1/A filing dated Oct. 21, 2025 – to work with Revere Securities. Background: Monkey Tree Investmenet Ltd. disclosed its IPO terms on Aug. 15, 2025, in an F-1 filing: The company is offering 1.6 million shares at a price range of $4.00 to $5.00 to raise $7.0 million, according to its F-1 filing dated Aug. 15, 2025.)

Anew Health Ltd. AVG D. Boral Capital (ex-EF Hutton), 1.8M shares, $4.00-6.00, $9.0 mil, 11/3/2025 Week of

(Incorporated in the Cayman Islands)

Established in 2007, we are a Hong Kong-based pain management and health services provider with over 16 years of experience in pain management and functional enhancement, under our “ANKH” brand. ANKH, stands for “A New Key to Health”, testifying our aspiration to be a health brand not only for alleviating physical pain but also for allowing individuals to emanate joy, health, and vitality from within and throughout.

We offer a broad range of non-surgical, non-invasive, and non-pharmacological pain management treatment and therapies, functional enhancement therapies, and topical use and dietary supplements health products, to our clients to eliminate pain points, invigorate blood circulation, enhance the body’s detoxification function, strengthen muscle and joint, and ultimately enhance functionality.

The theoretical and technological underpinning of our therapies and treatment, the “RDS+” (Restore, Detox, and Strengthen) approach to pain management and function enhancement, combines the wisdom of Traditional Chinese Medicine (“TCM”) and various energy-based treatment and therapy devices we sourced internationally, to enable our trained therapists performing broad range of treatment procedures involving the use of laser, bioelectrical current, electromagnetic, radiofrequency, and ultrasound, and to provide symptomatic relief and addressing root cause of our client’s pain and subhealth condition, reducing the chances of pain and condition recurrence, ultimately helping our clients to regain health and vitality.

Our “RDS+” approach to pain management and function enhancement is inspired by the concept of meridian system (Jing Luo) of Traditional Chinese Medicine. Jing Luo, commonly translated as meridians, is a concept in Traditional Chinese Medicine describing the network of pathways through which vital energy, or Qi, and blood circulate in the body. According to the Traditional Chinese Medicine theory, the stagnation, blockage, or the deficiency of the flow of Qi, are the root cause of pain and illness. Our RDS+ approach to pain management and function enhancement combines the wisdom of Traditional Chinese Medicine, the modern technology and various advanced energy-based treatment devices, to restore, detox, and strengthen the healthy flow of Qi, and to ease and eliminate acute and chronic musculoskeletal and nociceptive pain, alleviate muscle fatigue, relieve muscle stiffness, remove stagnation, detoxing metabolic wastes, improve blood circulation, strengthen muscle and joints, and ultimately enhance body functionality.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended March 31, 2025.

(Note: Anew Health Ltd. is offering 1.8 million shares at a price range of $4.00 to $6.00 to raise $9.0 million, according to its SEC filings for its IPO.)

Libera Gaming Operations LBRJ D. Boral Capital (ex-EF Hutton)/Craft Capital Management/ Boustead Securities, 1.3M shares, $4.00-4.00, $5.0 mil, 11/3/2025 Week of

We operate 11 pachinko gaming halls in Japan, as of March 15, 2024. (Incorporated in Japan)

We are a large and growing pachinko hall operator in Japan. Libera Gaming Operations, Inc. was founded in Japan in May 1965 and has been operating pachinko halls for over 58 years. Pachinko halls provide a venue for customers to play two types of recreational arcade games: “pachinko” and “pachislot,” which are played using pachinko balls and pachislot tokens, respectively, for the purpose of obtaining more balls and tokens and exchanging them for prizes. Customers can convert some prizes into cash by having independent buyers from pachinko halls buy them. The pachinko and pachislot industry is highly regulated under Japanese laws and regulations. Playing pachinko and pachislot machines are not considered a form of gambling in Japan because customers do not directly win cash. They win tokens that may be redeemed for prizes, which in turn may be sold for cash by independent buyers. We have over 58 years of experience in the pachinko industry, operating eleven pachinko halls in Japan as of March 15, 2024. There are only 161 pachinko hall operators that operate more than ten pachinko halls out of a total of 1,623 operators in Japan as of 2023, and we are one of the largest pachinko hall operators as we are in top 10% of all pachinko hall operators with respect to the number pachinko halls operated (Source: “Pachinko hall operator survey 2023”, Yano Research Institute). For the years ended October 31, 2023 and 2022, with respect to our pachinko operation business, we reported total revenues of ¥4,874,215 thousand (US$32,182 thousand) and ¥3,966,010 thousand, respectively.

We also operate a real estate business, in which we conduct real estate redevelopment, property rental and property brokerage. We focus our real estate business in the central Tokyo area, where we use our experience and our network of real estate brokers gained through our pachinko and pachislot business to determine investment decisions with a goal of maintaining a profitable real estate business. Our main source of real estate revenue is from real estate redevelopment. We purchase old real estate in the central Tokyo area where we expect increasing demand in the future and we believe rents and asset values are unlikely to decline, and we redevelop and renovate the properties by using third party contractors with a goal to generate higher rental revenue. We believe the central Tokyo area has many prospective buyers, and therefore we believe that we can sell the real estate and generate a high profit in a short period of time. In addition, since we have historically purchased real estate for redevelopment purposes in what we consider good locations close to train stations in the city center, we believe we can generate rental revenue during the period between our purchase of the properties until we begin redevelopment. During the year ended October 31, 2023 we generated ¥980,543 thousand (US$6,474 thousand) from the sale of one property and during the year ended October 31, 2022 we generated ¥3,705,626 thousand from the sale of two properties. We believe that the real estate market in Tokyo is relatively cheaper than other international cities, and as such we expect that more investors will be attracted to property in Tokyo and the real estate market will continue to grow in the future.

For the years ended October 31, 2023 and 2022, we reported total revenues of ¥6,106,306 thousand (US$40,317 thousand) and ¥7,906,120 thousand, respectively, net income of ¥557,802 thousand (US$3,685 thousand) and ¥200,185 thousand, respectively, and net cash provided by operating activities of ¥3,203,829 thousand (US$21,153 thousand) and ¥5,257,783 thousand, respectively, on a consolidated basis. As noted in our audited consolidated financial statements, as of October 31, 2023, we had retained earnings of ¥10,375,305 thousand (US$68,502 thousand). As noted in our audited consolidated financial statements, as of October 31, 2023, we had total liabilities of ¥17,769,154 thousand (US$117,319 thousand).

Note: Net income and revenue are in U.S. dollars (converted from the Japanese yen) for the fiscal year that ended Oct. 31, 2023.

(Note: Libera Gaming Operations said it has applied to the NASDAQ as its listing venue, according to a Free Writing Prospectus dated Sept. 18, 2024, for its micro IPO – just 1.25 million shares at $4.00 – the low end of its $4.00-to-$6.00 price range – to raise $5.0 million. Background: Libera Gaming Operations increased the number of shares in its IPO to 1.25 million shares – up from 1.0 million – and cut the price range to $4.00 to $6.00 – down from $5.00 to $7.00 previously – to raise $6.0 million, assuming that the IPO will be priced at $4.00, the low end of its new range, according to an F-1/A filing dated Sept. 16, 2024. Background: Libera Gaming Operations said in a June 26, 2023, filing that it intends to apply to the NYSE – American Exchange to list its stock. The company has already applied to the NASDAQ to list its stock.)

Grupo Aeromexico AERO Barclays/ Morgan Stanley/ J.P. Morgan/ Evercore ISI/ Apollo Global Securities, 11.7M shares, $18.00-20.00, $222.8 mil, 11/6/2025 Thursday

We are uniquely positioned as the only full service carrier, or FSC, based in Mexico and the only airline that provides long-haul, wide-body service connecting Mexico with the rest of the world.(Incorporated in the United Mexican States)

We are uniquely positioned as the only full service carrier, or FSC, based in Mexico and the only airline that provides long-haul, wide-body service connecting Mexico with the rest of the world. We offer a premium experience to both international and domestic destinations. As of June 30, 2025, we served every major city in Mexico and 52 international cities in 22 countries across multiple continents: North America, South America, Europe and Asia. We maintain the most attractive route network in Mexico, and we are the leading airline at MEX, the largest airport in Mexico, which is capacity constrained, and accounted for 36.3% of total passengers flying within, to and from Mexico in the twelve-month period ended June 30, 2025, according to the AFAC. We also have a strong presence in Mexico’s other large business markets, including Guadalajara and Monterrey, where we provide global connectivity by offering long-haul intercontinental flights. In addition, we have a large footprint in high-demand leisure markets, such as Cancún and Puerto Vallarta. We are the only Mexican airline that is a member of one of the three global airline alliances through our membership in SkyTeam, a global network of 18 international carriers, which we co-founded with Delta more than 25 years ago.

In 2022, as a result of the economic downturn caused by the COVID-19 pandemic, we completed a reorganization process. We believe we are positioned for significant and profitable growth through our reduced cost structure following our Chapter 11 restructuring and the upgauging of our fleet to larger, more efficient aircraft. In the years following our restructuring, we intend to invest to expand our fleet and improve the product and customer experience for our passengers. These investments will allow us to maintain the highest service standard as the only FSC based in Mexico, as well as our position as Mexico’s airline of choice. We are well-positioned for strength, as we operate in one of the largest and highest-growth aviation markets, according to the World Bank, and our CASK is significantly lower than that of U.S. legacy carriers and major European international FSCs. The Mexican airline competitive landscape has materially changed since the start of the COVID-19 pandemic. We believe the combination of air travel market size and growth in Mexico has created one of the best air travel market environments in the world.