I have finished my first long post-COVID stopover in Taipei while on the way to the USA (post might be at different times for the coming weeks) and do note previous coverage of Taiwan related stocks as Taiwan is more than just TSMC:

- 🇹🇼 Taiwan ETF Holdings (Mid 2025)

- A look at all 120+ stock holdings of the iShares MSCI Taiwan ETF (NYSEARCA: EWT) + Franklin FTSE Taiwan ETF (NYSEARCA: FLTW) + their performance along with that of The Taiwan Fund, Inc (NYSE: TWN).

- Taiwan Stopover + Non-Tech Taiwan Stock Updates

- A short Taiwan stopover; Bafang Yunji International (TPE: 2753) vs. Gourmet Master Co., Ltd. (TPE: 2723); China Airlines (TPE: 2610) vs. Eva Airways (EVA) (TPE: 2618) updates; etc.

- Taiwan ETF Holdings (Early 2024)

Plus some write-ups of the following specific Taiwan stocks:

- E Ink Holdings (TPE: 8069): Moving Beyond ePaper & the Amazon Kindle into Digital Retail Pricing Labels

- Yageo Corp (TPE: 2327 / OTCMKTS: YAGOY): Powering AI with Passive Components

- Gourmet Master (TPE: 2723): Taiwan’s Rapidly Expanding Version of Starbucks

- Bafang Yunji International (TPE: 2753): Turning Things Around and Expanding in HK Plus the USA

Note that I ate at several Bafang Dumpling outlets with 10 potstickers/dumplings or 5 with a small bowl of soup usually comes to NTD70 – a better price than most meals at 7-Eleven / FamilyMart + increasingly pricey night markets (I like to eat at Bafang late in the day and then go to a night market later in the evening for one or two items BUT if you have a western-sized appetite, you can easily spend a few hundred NTD at a night market these days – and probably still be hungry!):

There has definitely been an improvement since my pre-COVID trips as many outlets appear to have been remodelled, they had a steady stream of customers, and they always had what I wanted:

They were also at a Taiwan trade fair in Kuala Lumpur earlier this year when I told them that I hoped they would open in Malaysia as well as in Northern California (they are expanding in Southern California and Texas after closing in mainland China but they continue to operate in HK) – providing they operate as a mass market price point like in Taiwan. Recent stock performance has been tasty – at least since last year:

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 EM Fund Stock Picks & Country Commentaries (December 14, 2025) Partially $

- 7 seven AI firms, China’s innovation goes global + Fourth Plenum, Sri Lanka as a top pick, South Africa’s economy at a turning point, Haw Par Corp, National Bank of Greece, November fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 2026 (”Year of the Horse”) Major IPOs Pipeline in Asia (Douglas Research Insights)

- In this insight, we provide a list of 50 prominent companies in Asia that could complete their IPOs in Asia in 2026 (excluding Korea).

- This report is meant to serve as a comprehensive, REFERENCE GUIDE to help clients get a broad view of the major IPOs that could get completed next year in Asia.

- Some of the most prominent potential IPOs in Asia next year include Reliance Jio, Kunlunxin, Shein, Flipkart, and Canva.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Xi Blasts “Reckless” Projects Exaggerating Growth After China Reveals Dismal Macro Data For November (ZeroHedge)

- And with downside economic risks building, Bloomberg reports that Chinese President Xi Jinping lashed out at inflated growth numbers and vowed to crack down on the pursuit of “reckless” projects that have no purpose except showing superficial results.

- “All plans must be based on facts, aiming for solid, genuine growth without exaggeration, and promoting high-quality, sustainable development,” Xi said last week, according to a report on Sunday in the People’s Daily, the Communist Party’s official newspaper.

- “Those who act recklessly and aggressively without regard for reality, impose excessive demands, or deploy resources without careful consideration, must be held strictly accountable,” he said at the Central Economic Work Conference.

- Xi used stark language to call for quality in economic gains and listed examples of wrongdoing such as unnecessarily huge industrial parks, disorderly expansion of local exhibitions and forums, inflated statistics and “fake construction kickoffs.”

- Access to data in China can be sensitive and controlled, making it hard for observers to assess the health of the economy, but Xi’s latest remarks seem to suggest that he wants a revamp of the existing metrics used to evaluate local officials.

🇨🇳 China signals concern over falling investment (FT) $ 🗃️

- Communist party leadership pledges to ‘stabilise’ major engine of economic growth

- China’s leaders have for the first time explicitly committed to reversing a fall in investment, one of the main drivers of growth in the world’s second-largest economy.

🇨🇳 China’s $1tn trade surplus is a problem for Beijing — and the world (FT) $ 🗃️

- The country’s growth model is becoming increasingly hard to sustain

- The writer is a professor at Cornell, senior fellow at Brookings and author of the forthcoming ‘The Doom Loop: Why the World Economic Order Is Spiraling into Disorder’

🇨🇳 On watering the weeds and cutting the flowers (The Great Wall Street) $

- A contrarian strategy for a broken market

- In my Chinese holdings, I water the weeds and cut the flowers. I do not do this elsewhere. China is different.

- The mechanism is simple:

- I establish a core position at a price that reflects a long-term valuation thesis.

- If the price falls significantly (say, 25%) without a deterioration in the thesis, I add meaningfully.

- Upon a full recovery to my original entry price, I sell the added shares, banking the profit and reverting to my core position.

- I apply the same logic in reverse: trimming on violent, sentiment-driven spikes that dislocate from fundamentals.

- I am not trading the company. I am trading against the emotional volatility of its shareholder base.

🇨🇳 Baidu: Inside the AI Marketing Engine Delivering Triple-Digit Growth! (Smartkarma) $

- Baidu (NASDAQ: BIDU)’s financial performance for the third quarter of 2025 highlights both strengths and challenges.

- The company reported total revenues of RMB 31.2 billion, which represents a 7% decline year-over-year.

- Baidu Core, a significant segment, showed revenue at RMB 24.7 billion, aligning with this downward trend.

🇨🇳 JD.com: A Robust Competitive Positioning Anchored in Proprietary Logistics and Ecosystem Expansion! (Smartkarma) $

- JD.com (NASDAQ: JD / SGX: HJDD)’s third-quarter 2025 earnings indicate a blend of moderate growth and inherent challenges.

- The company reported a 15% year-on-year increase in total revenues, maintaining a double-digit growth pattern.

- This uptick was driven by gains in general merchandise and marketplace and marketing revenues.

🇨🇳 Brussels raids Temu in foreign subsidy investigation (FT) $ 🗃️

- ‘Unannounced inspection’ comes as European Commission steps up efforts against Chinese online retailers

🇨🇳 Tencent Music Entertainment Group: How Live Events & Fan Economies Are Reshaping Growth! (Smartkarma) $

- Tencent Music Entertainment Group (NYSE: TME) reported strong third-quarter results in 2025, driven by significant growth in its online music business.

- Total revenues grew by 21% year-over-year to RMB 8.5 billion, with online music revenues increasing by over 27% to RMB 7 billion.

- The growth in music subscription revenues was notable, with a 70% year-on-year increase to RMB 4.5 billion, propelled by a steady rise in paying users and enhancements in ARPPU, which reached RMB 11.9 compared to RMB 10.8 from the previous year.

🇨🇳 ‘China’s Nvidia’ Moore Threads surges over 400% on trading debut after $1.1 billion listing (CNBC)

- Shares of Moore Threads Technology Co Ltd (SHA: 688795) soared by more than 400% on its debut in Shanghai following its $1.1 billion listing.

- Its IPO comes as Beijing pushes domestic GPU makers despite U.S. sanctions limiting access to advanced manufacturing.

- China’s wider chip drive accelerates, with rivals like Huawei, Cambricon Technologies Corp (SHA: 688256) and newcomers vying for demand.

🇨🇳 Lenovo: Undervalued, But Surging Memory Prices Threaten Margins And End-User Demand (Seeking Alpha) $ 🗃️

- 🌐 Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF) 🇭🇰 – Designing, manufacturing & marketing consumer electronics, PCs, software, servers, converged & hyperconverged infrastructure solutions, etc. 🇼

🇨🇳 Still in U.S. doghouse, ZTE faces pressure from fresh allegations (Bamboo Works)

- The company’s stock fell over 10% amid reports of a new $1 billion fine from the U.S., clouding its outlook as it claws its way back from an earlier clash with Washington

- ZTE (SHE: 000063 / HKG: 0763) may face a U.S. penalty of more than $1 billion over alleged bribery in Brazil, a sum that could wipe out its 2024 profit

- The telecoms equipment maker’s diversification away from Western markets and AI-smartphone momentum may support its stock over the long term

🇨🇳 Reborn Unisplendour trades in chips for digits (Bamboo Works)

- The new rendition of former chip highflyer Tsinghua Unigroup is charting a pragmatic course, shifting from M&A-driven expansion to digital infrastructure

- Unisplendour Corp Ltd (SHE: 000938) has filed for a Hong Kong IPO, reporting its revenue grew 25.9% to 47.4 billion yuan in the first half of this year, even as its margins came under pressure

- The company, formed from former scandal-plagued semiconductor maker Tsinghua Unigroup, is focused on AI computing infrastructure as its primary growth engine

🇨🇳 Middle East expansion charges up Zhida’s stock (Bamboo Works)

- Shares of the EV charger maker, whose backers include BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF), jumped nearly 10% after announcing its latest expansion plan

- Shanghai Zhida Technology Development Co Ltd (HKG: 2650) plans to enter the Middle East, targeting Saudi Arabia, as it seeks growth outside the lower-margin China market

- Despite ongoing losses, shares of the leading EV charger maker currently trade at around triple their IPO price

🇨🇳 Stumbling Transsion calls on Hong Kong investors. But will they answer? (Bamboo Works)

- The budget cellphone specialist has filed for a Hong Kong IPO, even as its revenue began to fall in the second half of last year

- Shenzhen Transsion Holdings (SHA: 688036) has filed to list in Hong Kong, reporting its revenue fell 16% in the first half of this year as its profit plunged by more than half

- The company rose to prominence by focusing on budget feature phones for emerging markets, but is facing more competition as those markets transition to smartphones

🇨🇳 2026 High Conviction: Geely (175 HK) To Be the Largest (Smartkarma) $

- The deliveries still grew strongly by 24% YoY in November 2025.

- We believe Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF) will take BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF)’s place as the largest Chinese producer.

- We also believe the stock has an upside of 49% for the next twelve months.

🇨🇳 New quack at life? Zhou Hei Ya seeks flight back to relevance (Bamboo Works)

- The chain offering snacks made from braised duck necks has opened its first store in Southeast Asia as it concurrently aims to revive its flagging China operation

- Zhou Hei Ya International Holdngs Co Ltd (HKG: 1458 / FRA: ZHY) has opened its first store outside China in Malaysia, seeking relief from hyper-competition in its home market

- The braised duck neck snack chain is slashing its store count at home and taking the brand back to its roots with the return of its founder as chief executive

🇨🇳 Luckin Coffee: Rise, Fall, and Reinvention — Part 1 (Momentum Works)

- The Origin Story: Designing a 15 RMB Coffee Business

- This article is Part 1 of the eight-part chronicle on Luckin Coffee (OTCMKTS: LKNCY)’s rise, collapse, and reinvention. It is the excerpt of a sharing by Luckin Coffee CEO Guo Jinyi in 2024, translated into English here.

- You can also read the other parts of the series here: Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8

🇨🇳 Tian Tu’s Yoplait China sale leaves sweet, but also sour, taste (Bamboo Works)

- The venture capital company has set a new date of Dec. 31 to finalize the sale of its 45% of Yoplait China to a group affiliated with IDG Capital for 814 million yuan

- Tian Tu Capital (HKG: 1973) will book a small loss on the sale of its 45% of Yoplait China to a group affiliated with IDG Capital, as it extended a deadline for finalizing the deal

- The consumer-focused venture investor is examining new areas including digital assets and income-oriented investments to boost its anemic return rates

🇨🇳 Here Group challenges Labubu with Wakuku (Bamboo Works)

- The former adult education company has transformed to a pop toy maker, reporting its revenue from that business rose sharply in its latest quarter

- Here Group Ltd (NASDAQ: HERE)’s revenue nearly doubled sequentially in its latest reporting quarter through September, as it ramps up its recently acquired pop toy business

- The company’s stock currently trades at a P/S ratio of just 2.5 using projected sales for this year, less than a quarter of the 10.3 for collectible toy sensation Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF)

🇨🇳 Yixin cruises in sweet spot in China’s sputtering car market (Bamboo Works)

The online car loan facilitator processed nearly a quarter more transactions year-on-year in the third quarter, defying overall sluggishness in China’s auto market

Yixin Group (HKG: 2858 / FRA: 1YX) handled 235,000 transactions in the third quarter, up 23% year-on-year, outpacing China’s overall growth in car sales during period

The auto financier is shifting its focus to used electric vehicle loans as that part of the sector looks set to boom with the rapid uptake of EVs

🇨🇳 HK 第48b部分; Chinese People Holdings (Jam_invest)

- Picking a fight with Mr Asian Century Stocks, over a net-net that is just too juicy to ignore… trading at just over 2x P/E, while holding >2x its market cap in net cash, and with insider buying

- Coal to Gas replacement was one of the solutions to tackle the air pollution… with wonderful results, I experienced myself earlier this year! Chinese People Holdings Co Ltd (HKG: 0681 / FRA: KEH) has been one of the companies behind the smog reduction. It has been building out the gas distribution infrastructure to support the coal to gas replacement that currently connects over 2.5m households and businesses (including Associate and Joint venture companies, like Fujian Anran Gas).

🇨🇳 China’s Real Estate Collapse Sends Local Debt To Record $18.9 Trillion (ZeroHedge)

- Almost 20 years ago, when the Lehman/AIG collapse and the ensuing global financial crisis sent the world into a brief but acute depression, it was China’s massive debt-fueled growth dynamo that kick started the world economy and lifted the globe out of what would have been a lost decade – if not worse. The one trade off to this historic kickstart: China ended up doubling its total debt, which then continued growing at an exponential rate until the covid collapse sent China’s property sector – the biggest asset of its massive middle class – into a tailspin, and sparked a historic economic crisis. Only this time, because its total debt was already at 350% of GDP, Beijing no longer could wave a magic debt wand, inject a few trillions in credit, and make it all go away. Instead, the housing market has been in steady decline for the past 5 years and if anything, the decline has accelerated now that China’s Vanke – the last remaining state-backed property giant – is on the verge of collapse.

- Unfortunately for China, which has done an admirable job of shoving all its economic woes under the rug while pretending it is growing at a immutable 5% year in and out, it’s about to get worse.

- As Japan’s Nikkei reports, China’s local government debt continues to balloon as the prolonged, 5-year-long and counting, real estate slump has led to slumping income from property sales, pushing local government bond issuance for the year to a record high.

🇨🇳 2026 High Conviction Idea: Zijin Mining – Copper Scarcity Rerating to HK$48 (Smartkarma) $

- Structural copper tightness, strong gold cash flows, and rising silver prices position Zijin Mining Group (SHA: 601899 / HKG: 2899 / FRA: FJZB / OTCMKTS: ZIJMF) for multi-year earnings growth and a valuation re-rating in 2026.

- Leadership transition reduces founder dependence, strengthens governance credibility, and enables multiple expansion as Zijin aligns with global copper-scarcity peers.

- Base valuation is HK$40–41; spot and peer convergence support HK$48–50, implying 35–40% upside with clear catalysts across copper expansions and gold stability.

🇨🇳 Jinke Smart Services (9666 HK): Delisting EGM on 24 December as Acceptances Remain Unchanged (Smartkarma) $

- Jinke Smart Services Group Co Ltd (HKG: 9666)’s revised composite document relating to Boyu’s enhanced offer of HK$8.69 will be despatched on 9 December. The delisting EGM is on 24 December.

- The enhanced offer is conditional on the shareholders’ approval of the delisting resolution (low risk) and the 90% minimum acceptance condition from disinterested shareholders (high risk).

- Acceptances have not budged since 18 November, which explains Boyu’s introduction of two acceptance options on 4 December. The 90% minimum acceptance condition remains problematic.

🇨🇳 3SBio gears up for drugs battle with $400 million equity move (Bamboo Works)

- After grabbing the spotlight this year with a big licensing deal, the Chinese drug developer is now raising extra funds for R&D and shedding a non-core subsidiary

- 3SBio Inc (HKG: 1530 / FRA: 83B / OTCMKTS: TRSBF) is proactively boosting its capital with a share placement while fully divesting from a hair-loss unit that had been a cash generator in the past

- The moves come after 3SBio shares soared more than 400% this year, boosted by the high-profile sale of drug rights to Pfizer in May

🇨🇳 InnoScience makes gains in patent dispute, as growing competition remains bigger threat (Bamboo Works)

- The U.S. International Trade Commission ruled largely in the GaN semiconductor maker’s favor last week in a patent dispute with Infineon, though a final decision is still pending

- InnoScience (Suzhou) Technology Holding Co (HKG: 2577) made an important advance with a ruling largely in its favor in a patent dispute last week, but faces intensifying competition and margin pressures

- The GaN semiconductor maker’s revenue surged 43% in the first half of this year as it logged its first ever positive gross margin, but it remains unprofitable

🇭🇰 Techtronic Industries: Focus On Its Largest Customer (Seeking Alpha) $ 🗃️

- 🌐 Techtronic Industries (HKG: 0669 / FRA: TIB1 / OTCMKTS: TTNDY / OTCMKTS: TTNDF) 🇭🇰 – Cordless technology spanning Power Tools, Outdoor Power Equipment, Floorcare & Cleaning Products. Brands like MILWAUKEE, RYOBI & HOOVER. 🇼 🏷️

🇹🇼 Taiwan

🇹🇼 Taiwan Dual-Listings Monitor: TSMC Historically High Premium Cracks; ChipMOS & CHT Opportunities (Smartkarma) $

- Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM): +23% Premium; Has Broken Down from Historically High Level

- ChipMOS Technologies (TPE: 8150 / NASDAQ: IMOS): -3.0% Discount; Good Level to Go Long the ADR Spread

- Chunghwa Telecom (TPE: 2412 / NYSE: CHT): -1.1% Discount; Good Level to Go Long the ADR Spread

🇹🇼 Taiwan and TSMC: The Systemic Risk Nobody’s Talking About Enough (Public Markets)

- Let’s talk about what this means for the stocks you probably own:

- Apple: 100% dependent on Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) for its A-series and M-series chips. Without TSMC, no iPhones, no iPads, no Macs. Full stop.

- Nvidia: 100% dependent on TSMC for its AI GPUs. The H100 and H200 that everyone’s fighting over? Made in Taiwan. Nvidia’s $3+ trillion market cap is built on Taiwanese fabs.

- AMD: Same story. Their Ryzen CPUs and EPYC server chips? TSMC. Their new AI accelerators competing with Nvidia? TSMC.

- Broadcom: Custom AI chips for hyperscalers? TSMC.

- You see the pattern.

- A disruption in Taiwan doesn’t just mean these companies lose a supplier. It means they have no alternative for advanced chips. TSMC’s lead in 3nm and upcoming 2nm processes is so massive that no other foundry can replicate it in the short or medium term.

🇹🇼 TSMC: China’s Tech Independence Ambitions Create Serious Risks (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor Stock: Why Nvidia’s Loss Is TSMC’s Gain (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Wide Moat Remains, But Intel Just Got A Second Life (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇹🇼 Is TSMC Slowing Down? Not For Long (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor: Undervalued AI Infrastructure Backbone With Multi-Year Upside (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 Himax Technologies: The Automotive Segment Is Still A Drag (Rating Downgrade) (Seeking Alpha) $ 🗃️

- 🌐 Himax Technologies (NASDAQ: HIMX) 🇰🇾 – Fabless semiconductor company providing display imaging processing technologies. 🇼

🇰🇷 Korea

🇰🇷 Risk-loving Korean investors made to watch training video before trading (FT) $ 🗃️

- South Korean regulators want to strengthen oversight of retail traders

🇰🇷 Jay-Z’s investment firm targets $500mn Korean pop culture-focused fund (FT) $ 🗃️

- MarcyPen Capital Partners taps into South Korea’s popularity with Hanwha Asset Management partnership

🇰🇷 Gravity Co., Ltd. ($GRVY) (“From $100K to $1M” & More.)

- “A growing, profitable, negative EV company with great prospects in 2026!”

- Gravity Co Ltd (NASDAQ: GRVY) is a South Korean game developer best known for the Ragnarok Online franchise, a classic 2002 MMORPG that defined an era of Korean PC gaming. After a blockbuster IPO in 2005, Gravity’s early growth stalled in the 2010s as PC gaming matured. The company’s fortune turned around post-2015 when it partnered with Shanghai developer Dream Square to bring the Ragnarok IP to mobile platforms.

- This mobile shift was transformative: mobile games now contribute 75% to 85% Gravity’s revenue any given quarter. Gravity now generates revenue through a mix of self-published games (where it earns microtransaction and subscription revenue directly) and licensed titles (where partners run the game and pay Gravity royalties/license fees).

🇰🇷 SK Telecom: The Good And The Bad (Rating Downgrade) (Seeking Alpha) $ 🗃️

- 🇰🇷 SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) – Wireless telecommunication services in Korea. 3 segments: Cellular Services, Fixed-Line Telecommunications Services & Other Businesses. 🇼 🏷️

🇰🇷 Shinhan Financial: Watch Out For Positive Surprises (Seeking Alpha) $ 🗃️

- 🌐 Shinhan Financial Group (NYSE: SHG / KRX: 055550) – 6 segments: Banking, Credit Card, Securities, Life Insurance, Credit & Others. Merchant bank with 200 global channels & 15 subs.. 🇼 🏷️

🇰🇷 A Potential Listing of ADRs for SK Hynix Using Its Treasury Shares? (Douglas Research Insights) $

- According to numerous local media, SK Hynix (KRX: 000660) is considering on listing its treasury shares (2.4% of outstanding shares representing 17.4 million shares) as ADRs.

- SK Hynix could cancel its treasury shares or list them as ADRs. The bigger bang for the buck will likely be to list them as ADRs.

- By listing its shares as ADRs, the valuation gap between SK Hynix and other listed peers (such as Micron Technology Inc (NASDAQ: MU) and Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM)) could be reduced.

🇰🇷 Top 12 Korean Companies – Key Beneficiaries of the SpaceX IPO in 2026

- In this insight, we discuss the top 12 Korean companies that could benefit from the SpaceX IPO in 2026.

- Share prices of 12 Korean companies that are beneficiaries of the SpaceX IPO are up on average 16.7% in the past one week versus KOSPI (up 1.6% in same period).

- SeAH Besteel Holdings Corp (KRX: 001430) is a potential supplier of specialty steel to SpaceX. Kencoa Aerospace Corp (KOSDAQ: 274090) provided rocket parts to SpaceX. Intellian Technologies Inc (KOSDAQ: 189300) partnered with SpaceX on its launch vehicle recovery experiment.

🇰🇷 Korea Small Cap Gem #50: Seah Besteel Holdings – A Potential Beneficiary of SpaceX IPO (Douglas Research Insights) $

- In 2026, one of the emerging investment themes will likely be the main value-chain suppliers to SpaceX which is gearing up for a huge IPO next year.

- SeAH Besteel Holdings Corp (KRX: 001430) is expected to be one of the specialty steel suppliers to SpaceX. Seah is investing about US$155 million to build a special alloy plant in the US.

- In addition to SpaceX, Seah Besteel Holdings plans to gain additional major US customers including Boeing Co (BA US), Lockheed Martin (LMT US), GE Aerospace, and Pratt & Whitney.

🇰🇷 A Tender Offer of 52.5% Stake in Rothwell International by Trillion Luck Group (Douglas Research Insights) $

- After the market close on 11 December, Trillion Luck Group announced a tender offer of a 52.5% stake in Rothwell International Co Ltd (KOSDAQ: 900260).

- The tender offer price is 1,580 won per share, which is 58% higher than current price.

- There has not been a meaningful positive impact of keeping Rothwell publicly listed in Korea. It makes more sense to take the company private.

🇰🇷 SNT Holdings: Issuing CB and EB Totalling 148 Billion Won (Douglas Research Insights) $

- SNT Holdings Co Ltd (KRX: 036530) is issuing convertible bonds (CB) and exchangeable bonds (EB) totalling 148 billion won to improve its financial structure and secure funds for new business investments.

- The investor in this CB and EB is IMM Credit & Solution (ICS), which will acquire the entire amount through a private placement.

- This additional capital raise could result in S&T Holdings potentially increasing its stake in Smec Co Ltd (099440 KS).

🇰🇷 A Pair Trade Between Coupang (Short) And CJ Logistics (Long) (Douglas Research Insights) $

- In this insight, we discuss a pair trade between Coupang, Inc. (NYSE: CPNG) (short) and CJ Logistics (KRX: 000120) (long).

- There are six major factors that have negatively impacted Coupang in the past several weeks including a massive data breach, loss of customers, and potential ban on early dawn deliveries.

- Coupang’s daily active users (DAU) were 16.2 million as of 5 December, down by 1.8 million (10%) from 18 million as of 1 December.

🇰🇷 Korea Zinc Announces a Third Party Capital Raise of 2.9 Trillion Won & 11 Trillion Won US Investment (Douglas Research Insights) $

- On 15 December, Korea Zinc (KRX: 010130) announced a large scale third party capital raise of 2.85 trillion won (US$2.2 billion).

- Korea Zinc plans to issue 2.21 million new common shares (11.4% of current outstanding shares) at the issue price of 1,291,330 won per share (22.7% lower than current price).

- Korea Zinc announced a strategic partnership with the U.S. government and U.S.-based defense contractors to invest approximately 11 trillion won (US$7.4 billion) in constructing a critical minerals smelter in Tennessee, U.S.

🇰🇷 A Tender Offer and Delisting of Shinsegae Food by E-Mart (Douglas Research Insights) $

- On 15 December, it was announced that E-Mart (KRX: 139480) is conducting a tender offer and delisting of Shinsegae Food Inc (KRX: 031440).

- Tender offer price is 48,120 won (20% higher than the closing price on 12 December).

- Shinsegae Food is currently trading at very low valuations. It is trading at P/E of 5.3x, P/B of 0.4x, and EV/EBITDA of 1.5x based on 2026 consensus earnings estimates.

🇰🇷 LivsMed IPO Book Building Results Analysis (Douglas Research Insights) $

- [Precision surgery instruments] Livsmed confirmed its IPO price at 55,000 won, which is at the top end of the IPO price range. Demand ratio was 232 to 1.

- A 98.8% of the IPO shares applied thought that the company’s value is 55,000 won or more.

- Our base case valuation of Livsmed is implied market cap of 2.3 trillion won or target price of 88,294 won per share, representing a 61% upside from the IPO price.

🌏 SE Asia

🇸🇬 Sembcorp Industries Ltd (SCRPF) Alinta Energy Pty Limited, – Pre Recorded M&A Call – Slideshow (Seeking Alpha)

- 🌐 Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF) – Investment holding company. Renewables, integrated urban solutions, conventional energy & other businesses in Singapore, UK, China, India, rest of Asia, Middle East & internationally. 🇼 🏷️

🇸🇬 Wave Life Sciences Ltd. (WVE) Discusses Positive Interim Data from INLIGHT Trial of WVE-007 for Obesity – Slideshow (Seeking Alpha)

🇸🇬 Wave Life Sciences: 200% Rally On 1% Weight Loss Feels Bloated (Seeking Alpha) $ 🗃️

- 🌐 Wave Life Sciences Ltd (NASDAQ: WVE) – Clinical-stage biotech RNA medicines platform.

🇸🇬 Grab: Potential To Take Over The Up-And-Coming AV Sector (Seeking Alpha) $ 🗃️

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 Forget DBS: 3 Undervalued Income Stocks Yielding More (The Smart Investor)

- These three undervalued income stocks offer higher dividend yields than DBS — and may provide better long-term value for income-focused investors.

- HRNetGroup (SGX: CHZ) — Decent Yield Backed by Strong Cash Flow

- HRnetGroup Limited is an Asian recruitment powerhouse which operates across 18 cities with over 1,000 consultants, managing 20 brands including HRNetOne, Recruit Express, and RecruitFirst.

- Kimly Ltd (SGX: 1D0) — Stable Cash Flow Backed by Resilient Business

- Kimly is one of the largest traditional coffee shop operators in Singapore.

- The company operates an extensive network of 89 food outlets and 195 food stalls, along with kiosks and restaurants.

- NetLink NBN Trust (SGX: CJLU / OTCMKTS: NETLF) — Reliable Yield From a Defensive Sector

- NetLink designs, builds, owns, maintains, and operates Singapore’s fibre network infrastructure that delivers high-speed internet to homes and businesses.

- Get Smart: How They Compare Against DBS

🇸🇬 Better Buy: SATS vs SIA Engineering (The Smart Investor)

- Singapore Airlines (SGX: C6L) is not the only travel stock in town. Investors may want to consider SATS Ltd (SGX: S58) and SIA Engineering (SGX: S59) too.

- SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) – Recovery takes flight

- With its stock price range bound between late 2022 and April 2025, SATS may be finally ready to take flight.

- For those unfamiliar with its business, SATS is recognised as one of the world’s largest providers of air cargo and handling services as well as being Asia’s leading airline caterer.

- SIA Engineering Company (SGX: S59 / FRA: O3H / OTCMKTS: SEGSF) – A Steady MRO Compounder

- Formed from the Singapore Airlines engineering division, SIAEC’s core business operates in the MRO space (maintenance, repair and overhaul).

- Head-to-Head Comparison

- Get Smart: Which Is the Better Buy?

🇸🇬 3 Safer REITs That Could Raise Dividends in 2026 (The Smart Investor)

- With interest rates expected to ease, these three Singapore REITs — CICT, FCT and Parkway Life REIT — look poised to raise their dividends in 2026

- CapitaLand Integrated Commercial Trust(SGX: C38U / OTCMKTS: CPAMF)

- CapitaLand Integrated Commercial Trust (CICT) is Singapore’s largest REIT with a portfolio of properties worth around S$26 billion, consisting of a diversified mix of high-end shopping malls and office buildings such as ION Orchard, Raffles City, and CapitaSpring.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF)

- Speaking of retail, Frasers Centrepoint Trust or FCT focuses on suburban retail malls with a high concentration in essential spending, providing stability during challenging economic conditions.

- These malls are typically located near residential areas with easy access via public transport, which helps maintain strong shopper footfall.

- Parkway Life Real Estate Investment Trust (SGX: C2PU)

- Parkway Life REIT is a healthcare REIT with a portfolio spanning three key hospitals in Singapore, as well as nursing homes in Japan and France.

- Get Smart: What to watch

🇸🇬 Small Cap, Big Income: 3 Singapore Stocks with 5%+ Dividend Yields (The Smart Investor)

- When it comes to dividends, bigger isn’t always better

- Here are three small-cap stocks offering yields above 5%, along with the key factors supporting their distributions.

- Digital Core REIT(SGX: DCRU / OTCMKTS: DGTCF)

- Digital Core REIT owns 11 freehold data centres across the United States, Canada, Germany, and Japan, with US$1.7 billion in assets under management.

- Elite UK REIT (SGX: MXNU)

- Elite UK REIT takes a different approach to dividend sustainability: government-backed income.

- HRNetGroup (SGX: CHZ)

- Unlike the two REITs above, HRnet Group demonstrates that dividend sustainability can also come from operational excellence and a fortress balance sheet.

- Get Smart: Quality Over Yield

🇸🇬 3 Singapore Stocks Hitting New Highs — and Whether They’re Worth Buying (The Smart Investor)

- Three Singapore stocks are at new highs — find out what’s fueling their run and whether they’re worth buying now.

- Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY)

- Oversea-Chinese Banking Corporation, or OCBC, has seen an upward trend of its share prices recently, moving towards a 52-week high of S$18.80, and trading between S$18.12 and S$18.30 in late November 2025.

- iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF)

- iFAST Corporation, a leading wealth-management fintech platform with operations across Singapore, Hong Kong and Malaysia, has been pushing toward its 52-week high of S$9.99, trading around S$9.00 in late November 2025.

- SBS Transit (SGX: S61)

- SBS Transit has seen its share price rise toward S$3.17 in late November 2025, not far from its 52-week high of S$3.40 reached in September 2025.

- What New Highs Really Mean for Investors

- Get Smart: Focus on Quality, Not Price

🇸🇬 3 Overlooked Growth Stocks That Could Double Over the Next 5 Years (The Smart Investor)

- These three overlooked growth stocks have the earnings momentum, balance-sheet strength, and long-run catalysts to potentially double over the next five years.

- On Holding AG (NYSE: ONON)

- The On brand has become more prominent in recent years.

- You might have seen its logo on outfits worn by tennis champ Iga Swiatek, featured in ads starring Zendaya, or even just on the snazzy-looking shoes of the person beside you in the gym.

- On Holding AG, the Swiss parent company of the On brand, is actually listed on the New York Stock Exchange.

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF)

- Keppel Corp was founded in 1968 as Keppel Shipyard and for many years focused on the offshore and marine (O&M) business. In fact, less than five years ago, it was the world’s largest oil rig builder.

- apitaLand Investment Limited (SGX: 9CI)

- Another Singapore-listed company that has undergone a restructuring in recent years is Capitaland Investment (CLI), which was previously known as CapitaLand, a real estate developer which also owned stakes in various listed REITs.

- What Makes a Stock a Potential “Doubler”?

- Conclusion – Get Smart: Look Where Others Aren’t

🇸🇬 4 REITs That Could Lead the Recovery in 2026 (The Smart Investor)

- As the REIT market turns a corner, these four Singapore names may deliver early gains and renewed income growth in 2026.

- CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF)

- Ascendas REIT heads into the new year as a standout player in the industrial sector.

- CapitaLand Integrated Commercial Trust(SGX: C38U / OTCMKTS: CPAMF)

- CapitaLand Integrated Commercial Trust still leads the pack for retail and office REITs in Singapore.

- AIMS APAC REIT (SGX: O5RU / OTCMKTS: ACIRF)

- AIMS APAC REIT catches the eye if you want solid yields without straying into risky waters.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF)

- FCT continues to set the standard for Singapore’s suburban retail scene.

- Why 2026 Could Mark a Turning Point

- Get Smart: Position Early for the Next Upcycle

🇸🇬 4 High-Yield REITs Still Trading at a Discount to Book Value (The Smart Investor)

- These four Singapore REITs offer attractive yields and trade below book value — presenting income investors with potential re-rating opportunities as market sentiment improves.

- CapitaLand Ascott Trust (SGX: HMN / OTCMKTS: ATTRF)

- CapitaLand Ascott Trust, or CLAS, is one of Asia-Pacific’s largest hospitality trusts.

- Stoneweg European REIT (SGX: SET)

- Stoneweg Europe Stapled REIT, or SERT, is a rare REIT listed in Singapore that focuses on European real estate.

- Starhill Global Real Estate Investment Trust (SGX: P40U / OTCMKTS: SGLMF)

- Starhill Global REIT, or Starhill, owns prime retail and office properties in Singapore, Malaysia, Australia, Japan, and China.

- OUE Real Estate Investment Trust (SGX: TS0U / OTCMKTS: OUECF)

- OUE Commercial REIT, or OUE, owns a mix of offices, malls, and hotels in Singapore. Its flagship assets include OUE Bayfront, One Raffles Place, and Crowne Plaza Changi Airport.

- Get Smart: Consider Riding These REITs for Income and Potential Capital Appreciation

🇸🇬 Year in Review: 3 Small-Cap Stocks that Beat the STI in 2025 (The Smart Investor)

- As 2025 draws to a close, it’s worth asking: where did the big winners come from?

- Based on the year-to-date total (YTD) returns for the period January to November 2025.

- CSE Global Ltd (SGX: 544 / FRA: XCC / OTCMKTS: CSYJY / CSYJF): Total Returns 139% YTD

- CSE Global is a systems integrator providing electrification, communications, and automation solutions across various industries.

- Wee Hur Holdings Ltd (SGX: E3B / FRA: 3YM): Total Returns 101% YTD

- Wee Hur Holdings Ltd. is a Singapore-listed investment holding company with operations spanning recurring businesses—workers’ dormitory operations and Purpose-Built Student Accommodation (PBSA)—and property-related businesses including building construction and property development in Singapore and Australia.

- Pan-United Corporation Ltd (SGX: P52): Total Returns 94% YTD

- Pan-United Corporation is an investment holding company operating two key business segments.

- The Concrete and Cement segment manufactures and supplies ready-mix concrete and slag while trading and distributing cement and refined petroleum products across Singapore, Vietnam and Malaysia.

- Get Smart: Different paths, similar outcomes

🇸🇬 3 Singapore Blue-Chips Offering Both Yield and Growth in 2026 (The Smart Investor)

- Looking for income and upside? These three Singapore blue-chip stocks offer both yield resilience and growth in 2026.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) — The Dividend Compounder With Global Ambitions

- SGX continues to stand out as a reliable dividend payer.

- As the only approved financial exchange in Singapore, SGX can earn constant recurring income from its suite of products and services, including trading, clearing and market data services.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) — Banking on Growth and Payout Power

- In recent years, Singapore’s largest local bank has been making strides in establishing its digital leadership.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering — Engineering Steady Growth With Reliable Dividends

- ST Engineering is a diversified industrial business, with operating segments across Commercial Aerospace (CA), Defence & Security (DPS), and Smart City solutions (USS).

- The Case for Yield + Growth Stocks in 2026

- What This Means for Investors

- Conclusion – Get Smart: Anchor Your Portfolio

🇹🇭 How the Thai-Cambodia conflict may create an opportunity to change the balance of Thai politics (Murray Hunter)

- Winning with the narrative of nationalism

- The resurgence of the Thai-Cambodian border conflict may create an opportunity for the conservative political parties to rout-out the so-called liberal non-establishment political parties. This dissolution of the 500-member lower house on Friday 12 within a ‘fervor of nationalism’ around the nation will greatly favor the conservative parties. This election is coming at a time when according to NIDA polling, where Pheu Thai and the People’s Party currently have a low base compared to earlier in 2025.

- Back in the 2024 general election Pita Limjaroenrat’s Move Forward won 171 seats, while Pheu Thai won 141 seats. Based on current polling and the advent of the nationalist fervor in Thailand, People’s Party and Pheu Thai will certainly struggle to win anywhere near the same number in 2025. Current prime minister Anutin Charnwirakul’s Bhumjaithai Party will likely take up some of the slack, together with a resurgence of the conservative Democrat Party, after losing almost have its seats in 2023.

🇻🇳 Vietnam banks face funding squeeze, bond issuance to rise (The Asset) 🗃️

- Aggressive loan targets may outpace deposit inflows, cause systemic liquidity strain

- Vietnam’s banking sector is under mounting pressure to finance aggressive national growth targets, a mandate that is rapidly creating a systemic funding imbalance and forcing a sustained pivot to debt markets, according to a recent report.

- The Vietnamese government’s push for banks to support “double-digit GDP growth targets” over 2026-30 is expected to accelerate lending, with average credit growth for rated banks projected to exceed 20% in 2026, finds the report by Moody’s Ratings.

- This pace of credit expansion, which already expanded at an average annual rate of 16% over 2022-25, is more than double the country’s 6% real GDP growth over the same period.

- While most private sector banks anticipate seeing credit growth above 25%, large state-owned banks are likely constrained to around 15% growth due to low capitalization, which limits their ability to expand balance sheets.

🇮🇳 India / South Asia / Central Asia

🇮🇳 The Beat Ideas: Kaynes Technology’s Valuation Reset- An Investment Opportunity (Smartkarma) $

- Kaynes Technology (NSE: KAYNES / BOM: 543664) clarified financial disclosures, acquisition accounting, and a related-party reporting lapse, while affirming consolidated accuracy and enhancing internal controls and auditor oversight.

- Despite volatility, Kaynes’ strategic investments in OSAT, PCB, and design-led electronics support long-term growth, with recent share correction viewed as sentiment-based, presenting a valuation opportunity.

- Tightened governance, expanding capacity, and strong demand in key sectors position Kaynes for medium-term growth, offering investors an attractive risk-reward in India’s electronics supply chain evolution.

🇮🇳 The Beat Ideas: Sona BLW- Capturing Europe’s Void While Building India’s Rail Future (Smartkarma) $

[Sona BLW Precision Forgings (NSE: SONACOMS / BOM: 543300)]

- Strong Q2 FY26 performance was driven by the accretive Railways division and domestic EV traction motors, effectively offsetting the deceleration from a major global BEV customer.

- The bankruptcy of three core European competitors has unlocked a substantial INR 2,500-3,000 crore opportunity, accelerating the potential for significant international market share gain and geographic de-risking.

- The pivot into Railways, Rare Earth-Free Motors, and advanced robotics reinforces a high-visibility, multi-year growth runway that transcends near-term EV cyclicality and justifies its premium valuation.

🇮🇳 AU Small Finance Bank (AUBANK IN): Increased FOL & Large Passive Flows/ Impact (Smartkarma) $

- AU Small Finance Bank Ltd (NSE: AUBANK / BOM: 540611) has received approval from the Ministry of Finance to increase its Foreign Ownership Limit from 49% to 74% (the maximum permitted).

- The increased FOL will result in passive inflows from global index trackers in February and March. The inflows are multiple days of ADV.

- There has been little increase in positioning. The increased Foreign Ownership Limit and the passive flows to come could lead to the stock moving higher over the next few weeks.

🇮🇳 2026 High Conviction Ideas: Does the IndiGo Crisis Offer an Entry Point, or Confirms Caution? (Smartkarma) $

- Interglobe Aviation Ltd (NSE: INDIGO / BOM: 539448)’s 2,000+ flight cancellations expose internal planning failures, triggering regulatory scrutiny and a fall of more than 15% in the stock price.

- The crisis mandates permanent higher crew costs, challenging the core cost moat, but regulatory dependence shields its 63%+ dominance.

- Short-Term volatility will persist, yet the long-term outlook remains bullish, supported by unmatched scale and a consolidated market structure.

🇮🇳 The Beat Ideas: Meesho Ltd- Deciphering India’s Value-E-Commerce Giant (Smartkarma) $

- Meesho Ltd (NSE: MEESHO / BOM: MEESHO) successfully went public with a Fresh Issue of up to INR4,250 crore. Notably, nearly 44% of the fresh capital is earmarked specifically for deepening its technology and AI moat.

- Unlike traditional search-led e-commerce, Meesho is proving the viability of a “discovery-led” model powered by an immense data engine (5.9 billion daily data points), integrating a high-growth content commerce business.

- Meesho presents a compelling play on consumption. IPO is not just for funding growth, but for funding AI infrastructure required to defend its “Everyday Low Price” moat against deep-pocketed competitors.

🇮🇳 Diffusion Engineers: Betting on High-Margin Heavy Engineering Through Historic, Doubled Capex (Smartkarma) $

- Diffusion Engineers Ltd (NSE: DIFFNKG / BOM: 544264) is India’s integrated engineering solutions provider specializing in welding consumables, wear plates/parts, and heavy engineering equipment for core industrial sectors.

- The company is targeting to double its top-line in 3 to 4 years with a sustainable EBITDA margin range of 15% to 17%.

- The most critical growth trigger is the INR 70 crore capacity expansion at the Nimji and B33 facilities, which is designed to double production capacity and drive internal cost efficiencies.

🇮🇳 Tata Steel: Strategic Announcements Boost Long-Term Positioning; Valuation Still Balanced (Smartkarma) $

- Recent strategic announcements improve pellet security, downstream mix, and low-carbon readiness, strengthening Tata Steel Ltd (NSE: TATASTEEL / BOM: 500470)’s long-term positioning.

- Balance sheet can fund near-term projects, but upstream expansions require careful sequencing amid non-linear cyclical earnings.

- Valuation remains balanced at ₹165–185/share, with Europe performance the key swing factor for re-rating.

🇮🇳 Tower Semiconductor Reveals What’s Powering Its Rapid SiPho Expansion—and Why It Matters Now! (Smartkarma) $

- Tower Semiconductor (NASDAQ: TSEM)’s third-quarter 2025 earnings report provides detailed insights into the company’s current performance and strategic direction.

- The company concluded the quarter with a revenue figure of $396 million and a net profit of $54 million, demonstrating a 7% year-over-year revenue growth and a 6% quarter-over-quarter increase.

- Tower’s performance is bolstered by robust demand across its core technologies, notably in power management, CMOS image sensors, and RF mobile, all of which are contributing to the company’s revenue growth.

🇮🇳 Max India: The Next Megatrend Play – Scaling India’s Only Integrated Senior Care Ecosystem (Smartkarma) $

- Max India Ltd (NSE: MAXIND / BOM: 543223), part of the historically successful Max Group, is transitioning into India’s only fully integrated senior care platform, Antara.

- The senior care market is projected to reach USD 33 Bn by 2030 from USD 13 Bn in 2024 driven by nuclear families and increasing affluence among the elderly.

- Key growth levers are the annual 1.5M sq. ft. development target in residences and the goal for AGEasy to reach breakeven by late FY ‘27.

🇮🇳 2026 High Conviction: Tenneco Clean Air (Smartkarma) $

- Tenneco Clean Air India Ltd (NSE: TENNIND / BOM: 544612) is part of the Tenneco Group, a U.S.-headquartered global Tier I automotive component supplier.

- It designs and manufactures clean air, powertrain, and suspension solutions for Indian OEMs and export markets.

- Since its listing, the stock is up 19%, but there is still upside potential.

🌍 Middle East

🇮🇱 Kenon: Growth On The Horizon, But Upside May Be Fully Priced (Rating Downgrade) (Seeking Alpha) $ 🗃️

- 🌐 Kenon Holdings Ltd (NYSE: KEN) – Investments in Zim Integrated Shipping Services (NYSE: ZIM), and OPC Energy Ltd (TLV: OPCE / OTCMKTS: OPCEF) (power generation). Spin off from Israel Corporation (TLV: ILCO / OTCMKTS: IRLCF). Singapore HQ. 🇼

🇮🇱 Tower Semiconductor: I’m Skeptical Of Valuation And Future Growth (Seeking Alpha) $ 🗃️

- 🌐 Tower Semiconductor (NASDAQ: TSEM) – Foundry of high value analog semiconductor solutions. 🇼

🌍 Africa

🇿🇦 Mr Price Group Limited (MRPLY) Pegasus Group Holding GmbH – M&A Call – Slideshow (Seeking Alpha)

- 🌍 Mr Price Group (JSE: MRP / FRA: M5M1 / OTCMKTS: MRPLY) – Cash-based omni-channel fashion-value retailer with 4 segments: Apparel, Homeware, Financial Services & Telecoms. 🇼 🏷️

🇿🇦 Sibanye Stillwater: ‘All-Weather’ Metals Portfolio Paying Out Big Time (Seeking Alpha) $ 🗃️

- 🌐 Sibanye Stillwater Ltd (JSE: SSW / NYSE: SBSW) – World’s largest primary producers of platinum, palladium & rhodium & is a top-tier gold producer. Projects & investments across 5 continents. 🇼 🏷️

🇿🇦 The SPAR Group Ltd 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Spar Group (JSE: SPP / OTCMKTS: SGPPF) – More than 2,000 stores in South Africa. Netherlands founded SPAR International is the world’s leading voluntary food retail chain & the largest independent supermarket retail network in the world. 🇼 🏷️

🇿🇦 Prosus Stock: Double-Digit Growth With A Bargain Valuation (Seeking Alpha) $ 🗃️

- 🌐 Prosus (AMS: PRX / JSE: PRX / FRA: 1TY / OTCMKTS: PROSY / PROSF) – Global investment group that invests & operates across sectors & markets with long-term growth potential. Majority-owned by South African MNC Naspers (JSE: NPN / FRA: NNWN / NNW0 / OTCMKTS: NAPRF / NPSNY). 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇭🇺 Gedeon Richter PLC 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇭🇺 Gedeon Richter (FRA: RIG2) – Manufactures 200+ drugs (original, generic & licensed products) in almost every therapeutic area. Focuses on the central nervous system, cardiovascular & gynaecological products. 🇼 🏷️

🇵🇱 LPP SA 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 LPP SA (WSE: LPP / FRA: 1RY) – Polish family company that dresses customers in nearly 40 global markets. Largest fashion company in Central & Eastern Europe. 5 clothing brands: Reserved, Cropp, House, Mohito & Sinsay. 🇼 🏷️

🇵🇱 Dino Polska: Real Problem Or Opportunity? (Seeking Alpha) $ 🗃️

- 🇵🇱 Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) – Nationwide network of medium-sized supermarkets. 🇼 🏷️

🌎 Latin America

🇦🇷 Argentina raises $1bn in dollar debt sale as Milei plots return to global markets (FT) $ 🗃️

- Domestic-law sale paves way for serial defaulter to tap international investors next year

🇦🇷 IRSA: Strength In A Quarter That Was All Uncertainty (Seeking Alpha) $ 🗃️

- 🇦🇷 IRSA Inversiones y Representaciones Sociedad Anónima (NYSE: IRS) – One of Argentina’s leading real estate companies. 🇼 🏷️

🇦🇷 YPF Sociedad: The Roadmap For The Argentine Energy Boom (Seeking Alpha) $ 🗃️

- 🇦🇷 🏛️ Ypf Sa (NYSE: YPF) – Vertically integrated, majority state-owned Argentine energy company. Oil & gas exploration & production + transportation, refining & marketing of gas & petroleum products. 🇼 🏷️

🇧🇷 Petróleo Brasileiro S.A. – Petrobras (PBR) Analyst/Investor Day – Slideshow (Seeking Alpha)

🇧🇷 Petrobras: Cheap For A Reason (Seeking Alpha) $ 🗃️

- 🌐🏛️ Petrobras (NYSE: PBR / PBR-A / BCBA: PBR / PETR4) or Petróleo Brasileiro SA – Explores, produces & sells oil & gas. 🇼

🇧🇷 Nu Holdings: A Top Fintech Pick For 2026 (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: Market Skepticism Persists (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: The Next Chapter After Brazilian Dominance (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: Growing Too Fast For Its Valuation To Keep Up (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: A Latin American Banking Powerhouse Still In Early Growth Mode (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: Exploit Macro-Driven Selloffs For This Compelling Stock (Seeking Alpha) $ 🗃️

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

🇧🇷 BB Seguridade: 11% Dividend Yield And Attractive Valuation Make It An Interesting Income Play (Seeking Alpha) $ 🗃️

- 🇧🇷🏛️ BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY) – Insurance, pension plans & bonds. Subs. of Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY).

🇧🇷 Suzano S.A. (SUZ) Analyst/Investor Day – Slideshow (Seeking Alpha)

🇧🇷 Vinci Compass Investments Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Vinci Partners Investments Ltd (NASDAQ: VINP) – Alternative investments platform. Specialized asset management, wealth management & financial advisory services to retail + institutional clients in Brazil. 🏷️

🇧🇷 Klabin S.A. (KLBAY) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🇧🇷🅿️ Klabin (BVMF: KLBN3 / KLBN4 / KLBN11 / OTCMKTS: KLBAY) – Packaging paper & sustainable paper packaging solutions. 🇼

🇧🇷 Sigma Lithium: Fear Created Deep Value In A Low-Cost Producer (Seeking Alpha) $ 🗃️

- 🇧🇷 Sigma Lithium Corporation (CVE: SGML) – Exploration & development of lithium deposits in Brazil. 🏷️

🇧🇷 Lojas Renner S.A. (LRENY) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🇧🇷 🇦🇷 🇺🇾 Lojas Renner SA (BVMF: LREN3 / OTCMKTS: LRENY) – Department store clothing company. 🇼 🏷️

🇧🇷 Patria Investments’ Christmas Shopping Spree (Seeking Alpha) $ 🗃️

- 🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇨🇱 Chile – Notes on Kast’s election – December 2025 (Latin America Risk Report)

- Chile’s pendulum demands change

- I write all that as Chile’s election went as expected this weekend. Jose Antonio Kast won 58% of the vote in the runoff election. The president-elect was swiftly congratulated by President Boric and his opponent, Jeannette Jara. Chile’s voting process was clean, and the count was swift and respected by all sides.

- Kast is the farthest right candidate to win since Chile returned to democracy, but

- He’s moderated over the past decade compared to his first presidential run

- He’ll be constrained by Chile’s institutions, including a moderate coalition in Congress and the courts

- Despite his past support for Pinochet, he’s ultimately a small-d democrat in the modern era who respects elections. He’ll hand off power to a successor.

🇨🇱 LATAM Airlines Group S.A. (LTM) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subs. in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🌐 Global

🌐 Nebius: Why The Stock Is Trapped In Consolidation (Seeking Alpha) $ 🗃️

🌐 Nebius: It’s The Differentiation! (Seeking Alpha) $ 🗃️

🌐 Nebius: Unparalleled AI Infrastructure Moat (Seeking Alpha) $ 🗃️

🌐 Nebius: Smart Money Bought The Dip, Here’s Why (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

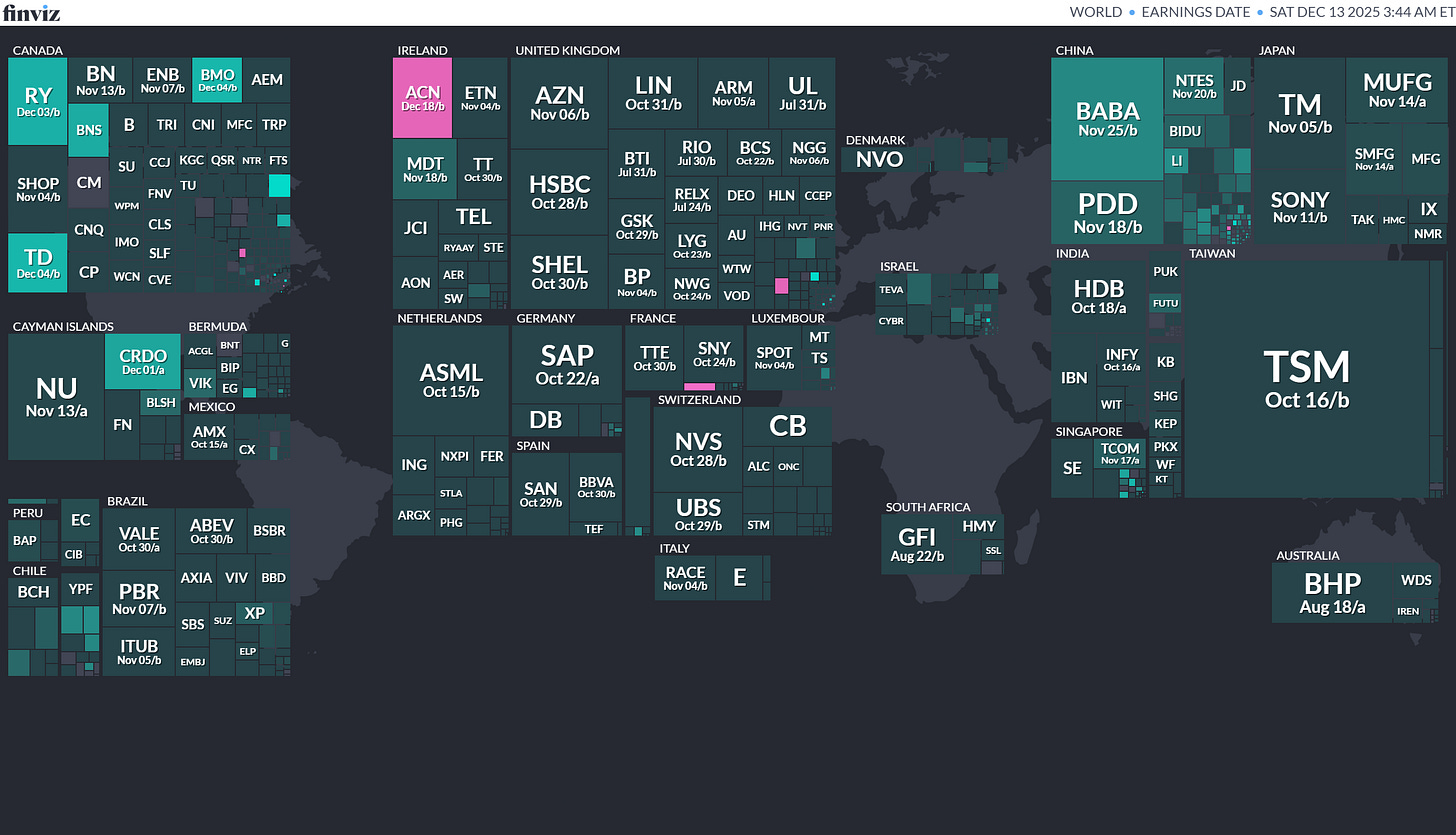

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

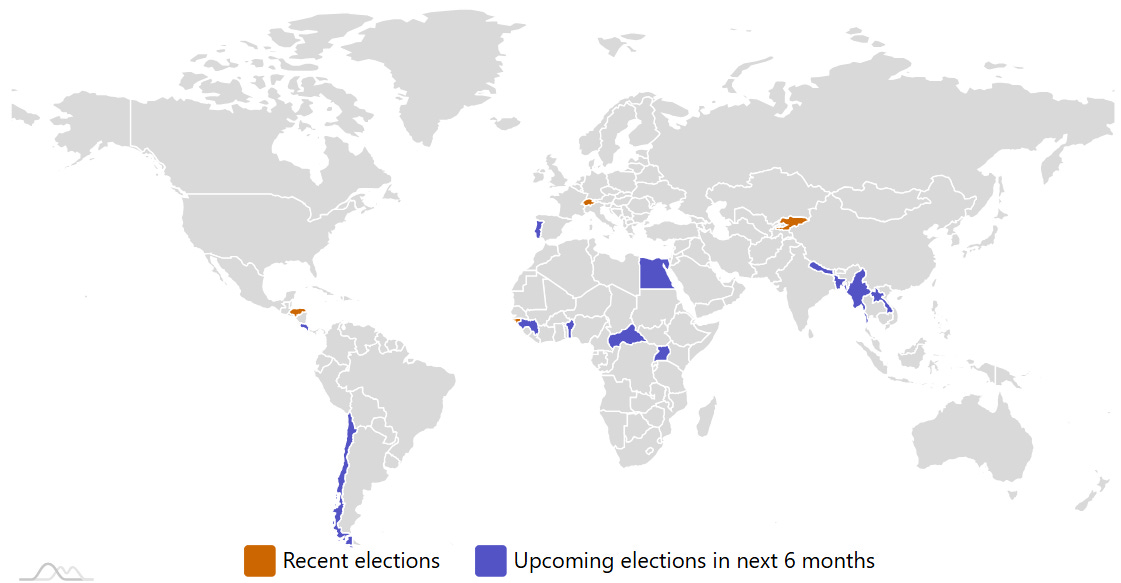

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Chile Chilean Presidency 2025-12-14 (d) Confirmed 2025-11-16

- Myanmar Myanmar House of Representatives 2025-12-28 (t) Confirmed 2020-11-08

- Myanmar Myanmar House of Nationalities 2025-12-28 (t) Confirmed 2020-11-08

- Bangladesh Referendum 2026-02-01 (t) Date not confirmed

- Bangladesh Bangladeshi National Parliament 2026-02-12 (d) Confirmed 2024-01-07

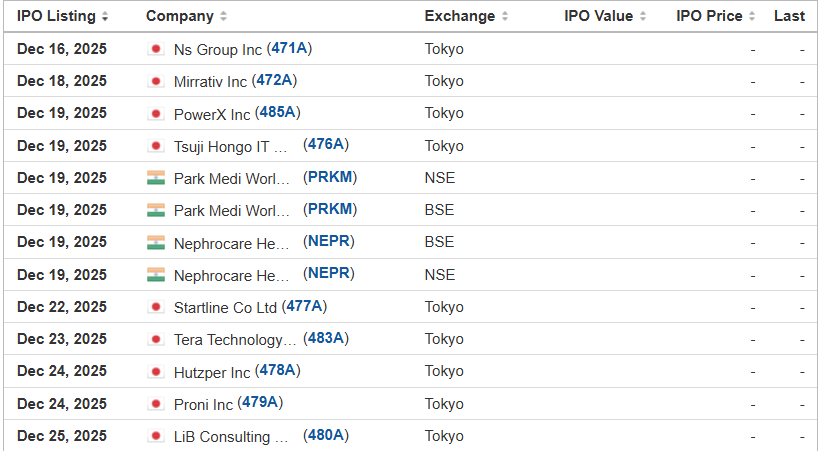

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Uptrend Holdings UPX Cathay Securities, 1.5M Shares, $4.00-5.00, $7.0 mil, 12/16/2025 Tuesday

(Incorporated in the Cayman Islands)

We provide, through our operating subsidiary, subcontractor services in the Hong Kong construction industry. We offer civil engineering services as well as soil and rock transportation services.

Note: Net income and revenue are in U.S. dollars for the year that ended March 31, 2025.

(Note: Uptrend Holdings’ small-cap IPO consists of 1.5 million shares at a price range of $4.00 to $5.00 to raise $7.0 million, if priced at the $4.50 mid-point of its range, according to an F-1/A filing dated July 21, 2025. Background: Uptrend filed its F-1 in December 2024.)

HW Electro Co., Ltd. (NASDAQ-New Filing) HWEP American Trust Investment Services/WestPark Capital, 4.2M Shares, $4.00-4.00, $16.6 mil, 12/18/2025 Week of

We are the first company in Japan to obtain a license plate number for imported electric light commercial vehicles. We are the second company and also one of the three companies that sell electric light commercial vehicles in Japan as of the date of this prospectus. (Incorporated in Japan)

The electric light commercial vehicles we sell belong to the category of “light commercial vehicles,” which are commercial carrier vehicles with a gross vehicle weight of no more than 3,500 kilograms.

We commenced selling and delivering two models of electric light commercial vehicles, ELEMO and ELEMO-K, in Japan in April 2022 and July 2022, respectively, and have been working with Cenntro, our cooperating manufacturer, to produce them under our brand, “ELEMO,” in its factory in Hangzhou, China. ELEMO is the first electric vehicle we sell and (it) is the second electric light commercial vehicle that has ever been sold in Japan since the commencement of sales of MINICAB-MiEV in December 2011, which was the first electric light commercial vehicle produced by Mitsubishi Motors Corporation. Since June 2023, we have commenced the sales of a new model called “ELEMO-L,” a van-type electric vehicle that could be used for commercial and recreational camping purposes, which we expect may enable us to increase consumer market penetration.

Under our Exclusive Basic Transaction Agreement dated March 31, 2021 with Cenntro (the “Exclusive Basic Transaction Agreement”), Cenntro manufactures ELEMO, ELEMO-K, ELEMO-L, and other electric vehicles under the specifications designated by us in their manufacturing factories in China and delivers the electric vehicles to the ports in China designated in the individual agreement for a particular order. We arrange for the shipment from these ports to the Port of Yokohama or other designated ports in Japan. Upon arrival, we transport the vehicles to our research laboratory located in Chiba, Japan, for inspection, and then send them to our business partners’ facilities, Anest Iwata’s factory in Fukushima, Japan, and TONOX’s factories in Kanagawa, Japan. The specialists of Anest Iwata, a Tokyo Stock Exchange-listed company that specializes in industrial machinery, supplies, and components, and TONOX, a Japanese commercial vehicle manufacturer, modify the vehicles to comply with the regulations and standards for the Japanese market, install the accessories, and undertake the inspection in accordance with our instructions. After the inspection and modifications, we deliver the electric vehicles to the governmental vehicle inspection office, the National Agency for Automotive and Land Transportation Technology, for individual imported vehicle inspection, and the local land transportation office for registration. Upon completion of the individual imported vehicle inspection and registration, we conduct the final inspection in our research laboratory located in Chiba, Japan, and deliver the electric light commercial vehicles to the customers.

Since the inception of our operation, we have been leveraging the customizability and adjustability of our electric light commercial vehicles to attract corporations in different industries and local governments that have varying needs from their departments in Japan. During the fiscal years ended September 30, 2023 and 2022, we sold and delivered 52 and 16 electric light commercial vehicles to 14 and 11 customers, respectively.

Note: Net loss and revenue figures are in U.S. dollars (converted from Japanese yen) for the fiscal year that ended Sept. 30, 2024.

(Note – New IPO Plans: HW Electro Co., Ltd. filed an F-1 dated May 8, 2025 – the same date that it withdrew its previous IPO plans in a letter to the SEC. In the new IPO document – the F-1 dated May 8, 2025 – HW Electro Co., Ltd. disclosed that it is offering 4.15 million American Depositary Shares (ADS) at an assumed IPO price of $4.00 to raise $16.6 million. American Trust Investment Services and WestPark Capital are the joint book-runners.)

(Background on Previous IPO plans: Registration Withdrawn on May 8, 2025 – A.C. Sunshine and Univest Securities were the joint book-runners. Note: HW Electro Co., Ltd. filed an F-1MEF to increase its IPO’s size at pricing by 200,000 shares, according to a filing dated Jan. 24, 2025. Note: HW Electro Co., Ltd. filed an F-1/A to increase its IPO’s size to 4.0 million ADS – up from 3.75 million ADS – and increase the assumed IPO price to $4.00 – up from $3.00 – to raise $16.0 million – up from $11.25 million initially – according to an F-1/A filing dated Dec. 23, 2024. In that same filing, AC Sunshine Securities was added as the lead left joint book-runner to work with Univest Securities as the other joint book-runner, and the IPO’s proposed venue was changed to the NASDAQ from the NYSE – American Exchange, with the proposed symbol changed to “HWEP” from “HWEC”. Note: HW Electro Co., Ltd. filed its new F-1 (prospectus) on April 26, 2024, disclosing plans for its IPO and its listing of American Depositary Shares (ADS) on the NYSE – American Exchange: 3.75 million ADS at an assumed IPO price of $3.00 per ADS. Each ADS represents one ordinary share. Background: HW Electro Co., Ltd. withdrew its previous IPO plans that called for a listing on the NASDAQ with a different proposed symbol.)

Riku Dining Group RIKU Eddid Securities USA, 2.3M Shares, $4.00-6.00, $11.3 mil, 12/18/2025 Week of

(Incorporated in the Cayman Islands)

We operate and franchise Japanese-style restaurants in Canada and Hong Kong:

In Canada – Ajisen Ramen is our franchise. We run four restaurants and we franchise nine more restaurants across Ontario.

In Hong Kong – We have seven restaurants under three franchised brands – Yakiniku Kakura, Yakiniku 802 and Ufufu Cafe.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended March 31, 2025.

(Note: Riku Dining Group disclosed the terms for its IPO in an Oct. 8, 2025, filing with the SEC: The company is offering 2.25 million shares at a price range of $4.00 to $6.00 to raise $11.25 million. Background: Riku Dining Group filed its F-1 for its IPO in September 2025 without disclosing the terms. Estimated IPO proceeds are $16 million.)

Ultratrex UTX Craft Capital Management, 1.3M Shares, $4.00-6.00, $6.3 mil, 12/18/2025 Week of

(Incorporated in the Cayman Islands)

We make marine environmental cleanup and dredging machinery.

We provide environmental solutions that rely on amphibious machinery, aquatic weed harvesters and dredgers.

Environmental cleanup projects, habitat restoration and land reclamation make up most of our projects. We serve customers mostly in Southeast Asia, the Middle East and some parts of Europe.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended on Dec. 31, 2024.

(Note: Ultratrex is offering 1.25 million shares at a price range of $4.00 to $6.00 to raise $6.25 million, according to its F-1/A filings.)

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 12/19/2025 Week of

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.

We sell our products through both offline and online channels. Our offline customers are mainly business entities, including local community stores and/or high-end boutiques, shopping malls, supermarkets and distributors, who purchase products from us, either by directly placing orders with us or through our proprietary apps designed specifically for our offline customers to place orders efficiently, and on-sell them to end consumers. Our online customers are generally users who purchase products directly from us through third-party E-commerce platforms and our proprietary AigoSmart App.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: AIGO Holding Ltd. is offering 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its F-1 filing dated Aug. 21, 2025.)

DT House Ltd. DTDT American Trust Investment Services, 2.0M Shares, $4.00-5.00, $9.0 mil, 12/19/2025 Week of

(Incorporated in the Cayman Islands)

We are a Cayman Islands exempted company with operations conducted by our subsidiaries in the UAE and Hong Kong. DT House is the holding company of UHAD, UHHK and UFox, all being our wholly-owned subsidiaries. Our headquarters are located in the UAE, and we commenced with the establishment of UHHK in 2020. We provide corporate consultancy services encapsulating environmental, social and governance-related aspects (commonly known as “ESG”) to enterprises and corporations with the purpose of unlocking greater business resiliency and sustainable cost savings along with revenue generating opportunities. As part of our corporate consultancy services around the ESG thematic, we provide travel-related services for leisure travelers into the UAE, which includes primarily the sale of tourism attractions tickets.

Our corporate consultancy services are provided in the UAE and Hong Kong. ESG is an emerging managerial concept for enterprises and corporations. Through technology integration, our corporate consultancy services offer customized hassle-free solutions to clients, from developing the knowledge and acknowledging the importance of ESG criteria, to formulating internal ESG self-assessments and practices, identifying ESG-related risks and opportunities, implementing cost-effective ESG policies and solutions, and eventually to capitalizing on potential ESG-related market opportunities and strategies. Our clients consist of public companies in the United States and Hong Kong, as well as small and medium-sized enterprises and private corporations in the UAE, Hong Kong and southeast Asia. We leverage upon emerging technologies to drive growth, optimize operations, and create new value streams for our clients. We have our own AI driven, cloud-based software program, and will continue to develop such program so that it can interact with various databases, collect relevant data, and use the data collected to perform self-determined tasks to meet predetermined goals (commonly known as “AI Agent”), which enables clients to retrieve, analyze, compare and evaluate ESG performance of themselves, their competitors and other market participants.

In June 2024, we commenced our travel-related services by acquiring UFox. UFox is a company principally engaged in travel-related services in the UAE, with the particular emphasis of eco-friendly and sustainable travel practices. UFox maintains close business relations with various organizations in the MENA Region such as the Union of Overseas Chinese in Saudi Arabia. We believe that our travel-related services could potentially bring about a synergistic effect with our corporate consultancy services if we follow the same set of ESG principles in both segments. Our current plan is to design travel programs based on the sustainable travel concept, such as alternative transport modes with lower carbon footprints and partnering with eco-friendly hotels. Knowledge and experience gained from our design of travel programs would be useful when we develop sustainable travel policies for our corporate consultancy services clients. The cross-over between low carbon footprint travel programs and sustainability business practices would reduce the average development costs of our projects. It also broadens the scope and strengthen the quality of our consultancy in fostering responsible and impactful ESG business strategies and practices for our corporate customers. Through UFox, we started to provide travel-related services for leisure travelers in the UAE. We offer segmented travel-related services to our customers, which includes primarily the sale of tourism attractions tickets. The destinations of the travel-related services offered by us are primarily within the UAE. We offer customizable hassle-free sustainable travel experience to customers. Customers can choose to customize their own tours depending on their demands and requirements and subscribe to services on segmented basis. Currently, we only have limited business activities of travel-related services due to our short operating history of several months in this sector. The major customers of our travel-related services are two online leisure travel platforms, namely, Trip.com Group Limited (Nasdaq: TCOM) and Fliggy international platform (fliggy.com, a member of Alibaba Group (NYSE: BABA) and an online marketplace of tourism products) that connect us with independent travelers for the sales and marketing of our travel products and services. Other customers of ours include travel companies, travel agencies, tour operators, booking agents, as well as other corporations and institutes, which currently contribute an insignificant portion of our revenue from travel-related services. In the future, we hope to expand the clientele of this segment to include retail leisure travelers and clients from our corporate consultancy services, and the scope of this segment to include other types of travel-related services, such as airfreight ticketing, tour guiding, hotel booking and transportation booking, and arrangement of packaged tours.

Note: Net income and revenue are for the year that ended Sept. 30, 2024.

(Note: DT House Ltd. increased its IPO’s size to 2.0 million shares – up from 1.875 million shares initially – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its most recent F-1/A filing. DT House Ltd. has also named American Trust Investment Services as the sole book-runner, replacing Revere Securities. Background: DT House Ltd. filed its F-1 on March 3, 2025, and disclosed the terms for its IPO: The company is offering 1.875 million shares at a price range of $4.00 to $5.00 to raise $8.44 million, if priced at the mid-point of its range.)

ELC Group Holdings Ltd. ELCG D. Boral Capital (ex-EF Hutton), 1.9M Shares, $4.00-6.00, $9.4 mil, 12/22/2025 Week of

(Incorporated in the Cayman Islands)

We are a manpower service provider based in Singapore. Manpower service providers (“MSP”) serve as a bridge between job seekers and businesses to meet each other’s recruitment needs. Typically, MSPs create a platform whereby employers can list job opportunities and recruit individuals looking to secure full, temporary or part-time employment meeting their respective criteria. For companies, MSPs assist the recruitment process to meet particular staffing needs, saving companies time, money, and effort. For job seekers, MSPs help them find an appropriate job matching their skill sets as quickly as possible, and exposing them to more opportunities through their vast network.

Our customers fall into a wide range of industries, including warehouse and logistics, food and beverage, cleaning, manufacturing, retail and events. To provide better service to our customers, we pay close attention to the changing needs of our customers, including new developments in their respective industries, which helps us anticipate the specific roles and skills that they will need. We believe this attention to detail gives us a significant competitive advantage and improves customer loyalty.

We have developed a proprietary platform that connects job seekers and employers through a unique matching program using specific character and skill recognition matrices. Our platform operates a comprehensive database that records the skill preferences and requisite applicant characteristics of our business customers and the job criteria of job seekers, thereby reducing reliance on subjective human analysis which can be extremely time consuming and inefficient. While many MSPs offer similar services, we believe our model is more specifically focused on our customers’ individual criteria, therefore we tend to deliver a more tailored approach, rather than providing a one-size-fits-all service.

Job Seekers – We believe we stand out to job seekers in two important ways: (i) we have developed a mobile app to enable clients real-time access to the data and therefore opportunities, and (ii) we are the first manpower provision company operating with an app platform in Singapore that is compensating part-time workers on the very same day they finish their jobs.

We have artificial intelligence (“AI”) technology integrated into our “EL Connect App” to create a positive user-friendly experience for part-time job seekers.

Employers – For employers, in addition to the EL Connect App, we have also developed our “Taskforce App.” Our TaskForce App is a smart platform to digitalize building and property operations management. Our TaskForce App integrates internet of things (“IoT”) sensors, facial recognition systems and robotics into facilities and workforce management in buildings and properties. TaskForce App bridges the gap between the employees of our customers, such as site supervisors who oversee property management, and contractors or crews of our customers, who perform individual duties and tasks, addressing inefficiencies in traditional and paper-based processes of property management. Our TaskForce App seeks to achieve optimal performance and productivity for our customers by enabling their employees to have real-time monitoring of facilities and workforce management and providing them instant access to a variety of information ranging from attendance records of contractors or crews to real-time usage of consumable supplies in a facility. This has become an invaluable tool to our customers which has prompted us to monetize its application by opening it up to customer subscriptions and licensing, which we expect will become a growing revenue stream.