Since 2017, The Edge Singapore Billion Dollar Club (sponsored by local business newspaper The Edge Singapore) has become “one of the most prestigious events” in the region focused on “recognizing and celebrating excellence” among companies listed on the Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) with the most recent event being held back in early November.

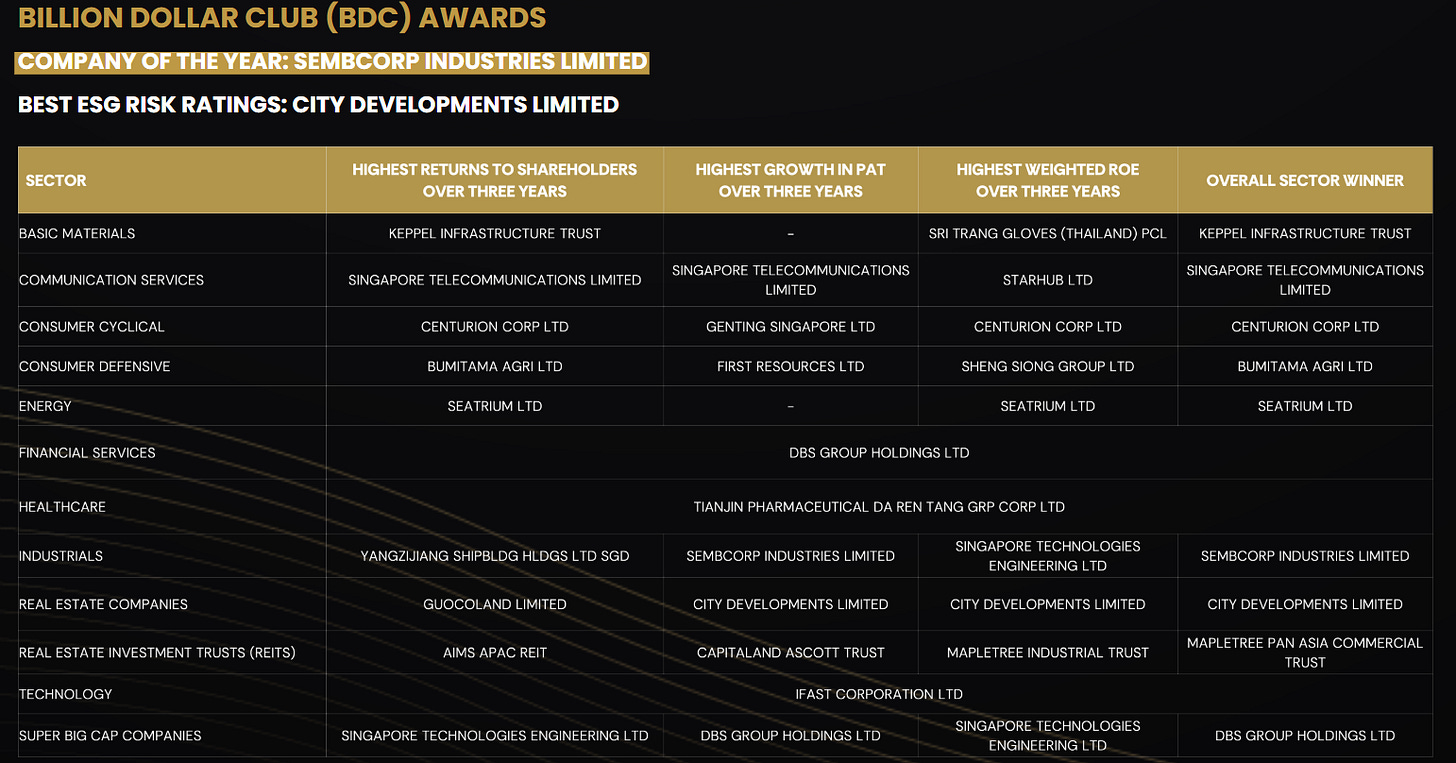

Once again, I realize these sorts of award events are often paid-for and sponsored corporate PR events that don’t mean much. However, this one is a little different as it recognizes Singapore-listed companies (some winners are based elsewhere or operate regionally or globally, but have a listing on the Singapore Exchange) that have done better than their industry sector peers in three key metrics (see their Methodology here):

- Highest Returns to Shareholders Over Three (3) Years

- Highest Growth in Profit After Tax Over Three (3) Years Award

- Highest Weighted Return on Equity Over Three (3) Years Award

- Overall Sector Winner

You can decide for yourself whether or not any calculations for these awards are reasonably accurate…

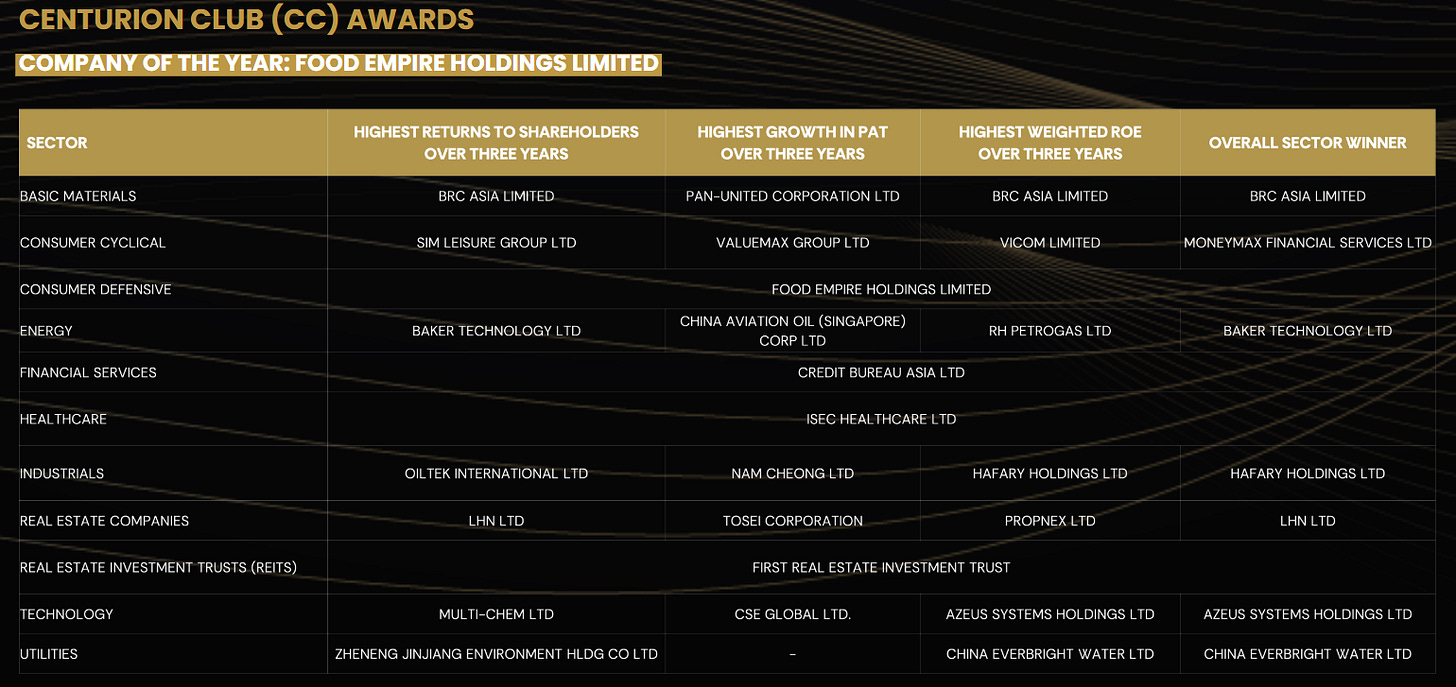

Winners in the Billion Dollar Club (BDC) are those with a market cap that is above $1 billion (I assume this is in Singapore dollars…) while the Centurion Club recognizes companies with a market value of between $100 million and $1 billion:

We did a post for 2023 and 2024 winners plus another post covering The Edge Billion Ringgit Club 2024 for Malaysia listed or based stocks:

- Singapore Stocks: The Edge Billion Dollar Club 2024 Award Winners

- Singapore Stocks: The Edge Billion Dollar Club 2023 Award Winners

- Remembering the CLOB Stock Trading Fiasco + The Edge Billion Ringgit Club (BRC) 2024 Award Winners

Note that the Singapore section of our Oceania & Southeast Asia Stock Index has 187 Singapore stocks.

The rest of this post is organized as follows:

[Note: On desktop browsers, an autogenerated table of contents will appear on the left side linked to each stock. I will add those links below after publishing/emailing this post…]

- Billion Dollar Club

- COMPANY OF THE YEAR

- Best ESG Risk Ratings

- BASIC MATERIALS

- COMMUNICATIONS SERVICES

- CONSUMER CYCLICAL

- CONSUMER DEFENSE

- ENERGY

- FINANCIAL SERVICES

- DBS Group

- Highest Returns to Shareholders Over Three (3) Years

- Highest Growth in Profit After Tax Over Three (3) Years Award

- Highest Weighted Return on Equity Over Three (3) Years Award

- Overall Sector Winner

- Highest Growth in Profit After Tax Over Three (3) Years Award [SUPER BIG CAP COMPANIES]

- Overall Sector Winner [SUPER BIG CAP COMPANIES]

- DBS Group

- HEALTHCARE

- INDUSTRIALS

- REAL ESTATE COMPANIES

- Real Estate Investment Trusts (REITs)

- TECHNOLOGY

- SUPER BIG CAP COMPANIES

- Singapore Technologies Engineering Ltd

- DBS Group

- Highest Growth in Profit After Tax Over Three (3) Years Award

- Overall Sector Winner

- Highest Returns to Shareholders Over Three (3) Years [FINANCIAL SERVICES]

- Highest Growth in Profit After Tax Over Three (3) Years Award [FINANCIAL SERVICES]

- Highest Weighted Return on Equity Over Three (3) Years Award [FINANCIAL SERVICES]

- Overall Sector Winner [FINANCIAL SERVICES]

- Centurion Club

Readers can decide whether these DeepSeek insights about these stocks are accurate (albeit DeepSeek more or less generated a quick summary this time):

- Growth & Sector Leaders

- Value & High Dividend Yield Plays

- Turnaround & Recovery Stories

- High ROE & Efficient Operators

- Niche & Specialized Players

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

📈🗄️ Fund documents / updates; ⚠️ Disclosures or restricted access e.g. based on your location, investor status, etc.; 🇼 Wikipedia page; 🔬 Research analysis (including articles/blog posts from fund managers, etc.); 🎥 Video; 🎙️ Podcast; 🎬 Webinar; 📰 Newspaper/magazine article; 📯 Press release; 💻 Substack/blog/website article; ✅ Our own posts; 🗃️ Linked archived article; ⏰ Upcoming webinar or event.

Frontier & Emerging Market Stock Index

Billion Dollar Club

COMPANY OF THE YEAR

Sembcorp Industries

Highest Growth in Profit After Tax Over Three (3) Years Award [INDUSTRIALS]

Overall Sector Winner [INDUSTRIALS]

📝 Sembcorp wins Company of the Year with growing energy portfolio; ST Eng, YZJ Shipbuilding chalk up respective wins (The Edge Singapore) November 2025

- 🌐 Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF) – Investment holding company. Renewables, integrated urban solutions, conventional energy & other businesses in Singapore, UK, China, India, rest of Asia, Middle East & internationally. 🇼 🏷️

- Price/Book (Current): 2.04

- Forward P/E: 10.29 / Forward Annual Dividend Yield: 3.01% (Yahoo! Finance)

Best ESG Risk Ratings

City Developments Limited

Highest Growth in Profit After Tax Over Three (3) Years Award [REAL ESTATE COMPANIES]

Highest Weighted Return on Equity Over Three (3) Years Award [REAL ESTATE COMPANIES]

Overall Sector Winner [REAL ESTATE COMPANIES]

📝 CityDev leads real estate sector; GuocoLand generates highest returns to shareholders with twin-engine strategy (The Edge Singapore) November 2025

📝 CDL back on track with South Beach divestment while keeping pace with nature reporting (The Edge Singapore) November 2025

- 🌐 City Developments Limited (SGX: C09 / FRA: CDE / OTCMKTS: CDEVY) – Global real estate company. 143 locations in 28 countries & regions. Residences, offices, hotels, serviced apartments, student accommodation, retail malls & integrated developments. 🇼 🏷️

- Price/Book (Current): 0.91

- Forward P/E: 29.67 / Forward Annual Dividend Yield: 0.87% (Yahoo! Finance)

BASIC MATERIALS

Keppel Infrastructure Trust

Highest Returns to Shareholders Over Three (3) Years

Overall Sector Winner

📝 Keppel Infrastructure’s essential role underpins steady returns; Sri Trang Gloves (Thailand) delivers record earnings (The Edge Singapore) November 2025

- 🌐 Keppel Infrastructure Trust (SGX: A7RU / OTCMKTS: KPLIF) – 3 core segments: Energy transition, environmental services & distribution & storage. 🏷️

- Price/Book (Current): 1.92

- Forward P/E: 51.55 / Forward Annual Dividend Yield: 7.65% (Yahoo! Finance)

Sri Trang Gloves (Thailand) PCL

Highest Weighted Return on Equity Over Three (3) Years Award

📝 Keppel Infrastructure’s essential role underpins steady returns; Sri Trang Gloves (Thailand) delivers record earnings (The Edge Singapore) November 2025

- 🌐 Sri Trang Gloves (Thailand) PCL (BKK: STGT / STGT-F / SGX: STG) – Natural latex, nitrile examination & general-purpose disposable gloves. 🏷️

- Price/Book (Current): 0.71

- Trailing P/E: 27.79 (no forward P/E) / Forward Annual Dividend Yield: 5.29% (Yahoo! Finance)

COMMUNICATIONS SERVICES

Singapore Telecommunications Ltd

Highest Returns to Shareholders Over Three (3) Years

Highest Growth in Profit After Tax Over Three (3) Years Award

Overall Sector Winner

📝 Singtel tops sector as shareholder-friendly strategy gains traction; StarHub shines with ‘best in class’ ROE (The Edge Singapore) November 2025

- 🌏 Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Sintel – Telecommunication + data center, ICT, etc. services. 🇼 🏷️

- Price/Book (Current): 2.70

- Forward P/E: 22.22 / Forward Annual Dividend Yield: 2.95% (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- Singapore Stocks: The Edge Billion Dollar Club 2024 Award Winners

- Singapore Stocks: The Edge Billion Dollar Club 2023 Award Winners

- High-Yield Singapore Banks & REITs (Mid-2024)

- OCBC Bank (SGX: O39 / FRA: OCBA / OCBB / OTCMKTS: OVCHY): Record Profits as Money Flows to Singapore

- Singapore’s GIC Remains Cautious Over its Medium-term Outlook (Today)

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF): Record Earnings But Profit Margins From Higher Rates Have Peaked

- The Edge Billion Ringgit Club (BRC) 2025 Award Winners

- United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF): Betting on ASEAN Growth With 2M New Citibank Clients

- Luckin Coffee is Launching in Singapore, Will it Do Well? (Momentum Asia)

- Remembering the CLOB Stock Trading Fiasco + The Edge Billion Ringgit Club (BRC) 2024 Award Winners

- The One Country With “Significant Real Income Growth” (Channel NewsAsia)

- The Singapore Story: Not a Sure Thing for Investors?

- Are Asian Households Over Their Head in Consumer Debt? (CNBC)

- FLASHBACK: An (Anonymous) Expat Rant About Singapore In: “i dun unerstan u lah!: An exposé of Singapore and Singaporean retardation”

- Singapore Banks: Breaking Out (Smart Karma)