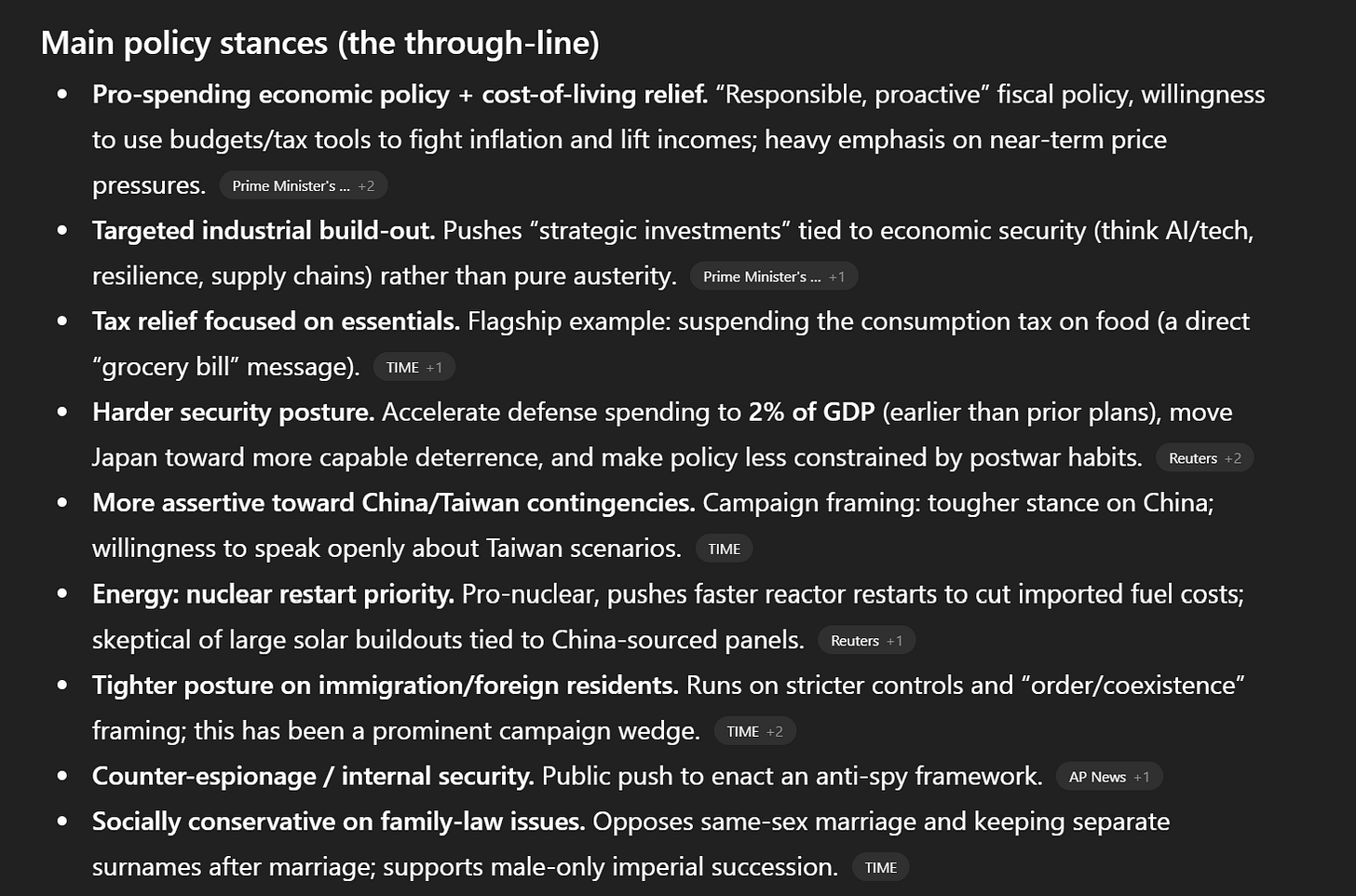

Economic reform-minded conservative Sanae Takaichi has won a “supermajority” in Japan that will apparently enable her to change Japan’s constitution. I saw this screenshot on Twitter outlining her policies (but its not clear where its from):

Otherwise, I should note that Chinese New Year (15 days) and Ramadan (one month) both start next week which will impact Asian and Middle East markets for the next month.

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 Emerging Market Stock Picks (December 2025) Partially $

- Asia

- East Asia

- SE Asia

- 🇮🇩 Indonesia – Janu Putra Sejahtera Tbk PT, Jasa Marga (Persero) Tbk PT, Bank Tabungan Negara, Solusi Sinergi Digital Tbk PT, MDTV Media Technologies Tbk PT, Energi Mega Persada Tbk PT, Telkom Indonesia Persero Tbk PT, Wijaya Karya Bangunan Gedung Tbk PT, PT ITSEC Asia Tbk, MD Entertainment PT Tbk, Sinergi Inti Andalan Prima Tbk, Petrosea Tbk PT, Fast Food Indonesia Tbk PT, Bank Central Asia (BCA) Tbk PT & Raharja Energi Cepu Tbk Pt

- 🇲🇾 Malaysia

- 🇲🇲 Myanmar – Yoma Strategic Holdings

- 🇵🇭 Philippines

- 🇸🇬 Singapore – Seatrium Ltd, Singapore Technologies Engineering Ltd, Hong Leong Asia Ltd, Jumbo Group, Sembcorp Industries, SATS Ltd, Singapore Exchange Limited, Ever Glory United Holdings Ltd, Skylink Holdings Ltd, Keppel REIT, HRNetGroup, Singapore Telecommunications Ltd, Valuetronics Holdings, Delfi Limited, LHN Ltd, Centurion Corporation Ltd, Centurion Accommodation REIT, Marco Polo Marine Ltd & ASL Marine Holdings Ltd, Frasers Property Ltd, Lincotrade & Associates Holdings Ltd, Lum Chang Creations, Sheng Siong Group, Nanofilm Technologies, Nam Cheong Ltd, Old Chang Kee, Bukit Sembawang Estates & BRC Asia Limited

- Singapore Broker’s Digest

- 🇹🇭 Thailand – Advanced Info Services PCL, True Corporation PCL, TMBThanachart Bank PCL, TISCO Financial Group PCL, Krungthai Card PCL, PTT Exploration & Production PCL, Thaifoods Group PCL, Airports of Thailand PCL, Siam Cement PCL & SCG Packaging PCL

- South Asia

- Middle East

- Africa

- Eastern Europe & Emerging Europe

- 🇭🇺 Hungary – Opus Global Nyrt & ALTEO Energy Services PLC

- 🇵🇱 Poland – Warsaw Stock Exchange’s NewConnect Market Q3 Newsletter, Lubelski Wegiel Bogdanka SA, Grodno SA, Eurotel SA, Synthaverse SA, BioMaxima SA, Creotech Instruments SA, ATM Grupa SA, Bloober Team SA, Action SA, Elektrotim SA, Shoper SA, Torpol SA, Fabrity SA, Ailleron SA, Bioceltix SA, Dadelo SA, Enter Air SA, Mirbud SA, Eurocash SA, Agora SA, ZUE SA, Scope Fluidics SA, Medicalgorithmics SA, Makarony Polskie SA & VRG SA

- Latin America

- 🤖 DeepSeek Analysis

- High Dividend Yield & Value Plays

- Growth & Catalyst-Driven Stocks

- Undervalued & Turnaround Candidates

- Tech & Innovation Exposure

- Defensive & Consumer Staples

- Geographic & Sector Diversification

- Asia

- 🌐 EM Fund Stock Picks & Country Commentaries (February 8, 2026) Partially $

- AI/Moltbook/USD reality checks, Asian retail investor mindsets, Morocco as an African heavyweight, what if Trump is right, Monroe Doctrine 2.0, new December/Q4/January fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Asia

🇯🇵 Comment: Snap Election in Japan to Heighten Tension in Asia and Further Empower the Princes at the Central Bank (Werner Economics) $

- Today, Sunday, 8 February 2026, a snap general election is held in Japan, called by Ms Sanae Takaichi, to boost her majority by transforming her popularity with young voters into seats in the Diet.

- One thing in her favour is that, unlike many Japanese politicians, she did not inherit her seat in parliament (the Diet, in Kasumigaseki, Tokyo). She is a self-starter who worked during university years to pay for her own education, as her parents, from humble background, did not have the funds.

🇯🇵 Casino-policy backer Sanae Takaichi wins ‘supermajority’ in Japan Diet’s snap election (GGRAsia)

- Economic reform-minded politician Sanae Takaichi won a “supermajority” in Sunday’s lower-house national election in Japan.

- Ms Takaichi of the Liberal Democratic Party supports the policy of having integrated resorts (IRs) each with a casino as a form of regional economic stimulus for the country. She became in October Japan’s first female prime minister, before in mid-January calling a snap election to bolster her position.

- The casino policy is only one element among a number of economic reform initiatives that Ms Takaichi has promoted.

- Japan’s Cabinet’s had in January proposed a timetable of May 6, 2027 to November 5 that year for a new application round for local governments interested in hosting an [integrated resorts] IR.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 China Drafts Rules to Lure Pension, Bank Funds Into Private Placements (Caixin) $

- China’s securities regulator has proposed amendments aimed at broadening the pool of financial institutions eligible to become strategic investors in private placements. The new rules, which set a minimum 5% subscription threshold, seek to encourage the inflow of “patient capital” into listed companies.

- The draft amendments, released on Friday by the China Securities Regulatory Commission (CSRC) for public comment, are designed to channel funds from pensions, insurers, and banks into the stock market by distinguishing these institutions as “capital investors” from traditional industrial stakeholders.

🇨🇳 China raises taxes on some sectors to boost finances: a one-off fix or tough times ahead? (SCMP)

- A broader push to raise taxes across the private sector is not on the cards, economists say

🇨🇳 China Officials Dismiss Tax Hike Rumors After Tech Selloff (Caixin) $

- Rumors of tax adjustments across multiple industries in China triggered market volatility Tuesday, including a selloff in tech stocks, but local tax officials said the speculation has no factual basis.

- Hong Kong-listed Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY) fell more than 5% in morning trading before paring losses to close down 2.9%.

- The drop followed market chatter about possible value-added tax (VAT) hikes for the gaming and broader internet sectors, where Tencent derives a significant share of its revenue.

🇨🇳 Alibaba is spending RMB 3B to make you stop opening apps, while Tencent is hoping you download a new one (AI Proem)

- China’s AI giants aren’t fighting over red envelope engagement. They’re fighting over where intent begins and behavior forms.

- Alibaba (NYSE: BABA) is spending RMB 3 billion this Spring Festival. Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY) is spending RMB 1 billion. Baidu (NASDAQ: BIDU), half a billion. What looks like the annual red-envelope ritual where big tech burns cash, attempts to acquire new users, a bit of a feel-good marketing campaign, and flex, this year is actually a bit different.

- Alibaba’s bet: convenience and the bundle becomes the moat

- Alibaba’s RMB 3 billion feels less like a traffic play and more like an ecosystem integration play.

🇨🇳 Dingdong checks out of China instant commerce wars with sale to Meituan (Bamboo Works)

- One of the country’s oldest online grocers will sell itself to its larger rival for $717 million, in one of the largest such sales to date in a fast-evolving Chinese instant commerce sector

- Dingdong (NYSE: DDL)’s stock fell 14%, dropping its market value to $700 million, after announcing the sale of its core China business to rival Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) for $717 million

- Founder Liang Changlin probably made the move after realizing Dingdong would be unviable as a standalone online grocer in China’s fast-evolving instant commerce space

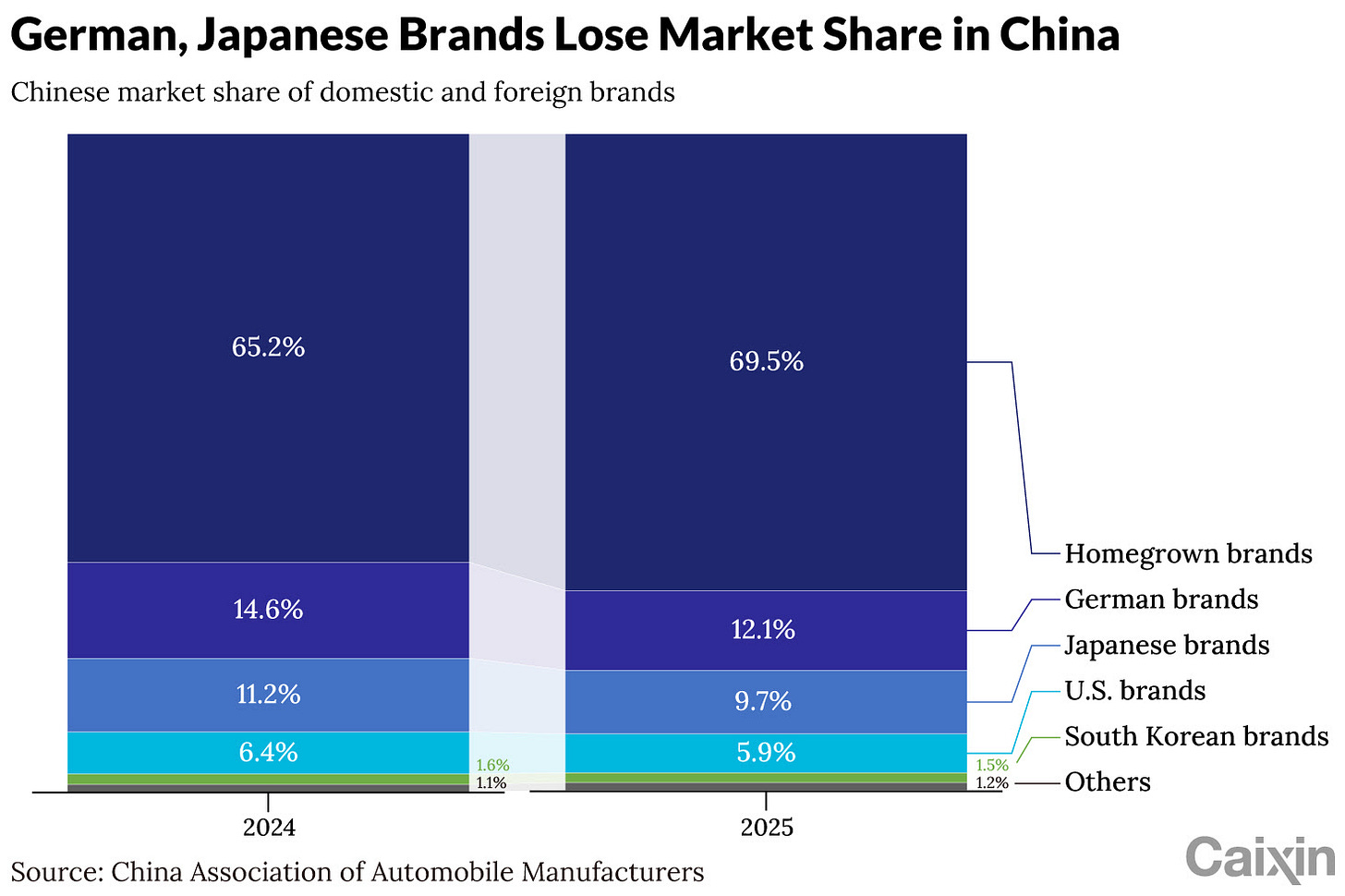

🇨🇳 In Depth: European Automakers Look to China as EV Gap Widens (Caixin) $

- China’s meteoric rise as a global electric vehicle (EV) powerhouse is rattling Europe’s legacy carmakers, many of which are scrambling to forge closer ties with Chinese peers and suppliers after years of slow adaptation to the global shift toward electrification.

- In December, Porsche AG announced plans to gradually shut down its proprietary EV charging network in China and seek deeper cooperation with external charging providers in the country, where the Volkswagen AG subsidiary has continued to lose market share.

🇨🇳 Aequitas: Montage Technology A/H Trading – Highest Insti Coverage so Far (Smartkarma) $

- Montage Technology Co Ltd (SHA: 688008 / HKG: 6809) (MT), a provider of memory interface chips and interconnect chips, raised around US$1bn in its H-share listing

- MT’s product portfolio, mainly comprises memory interface chips and interconnect chips, addresses interconnect bottlenecks while enhancing data rate/bandwidth, reliability, and power efficiency, as per the company.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.

🇨🇳 Montage Technology Hong Kong IPO Preview (Douglas Research Insights) $

- Montage Technology Co Ltd (SHA: 688008 / HKG: 6809) is getting ready to complete its Hong Kong IPO next week (first date of trading is scheduled for 9 February).

- Shares were priced at HK$106.89, the maximum of the marketing range, raising HK$7.04 billion (US$901 million). This values the company at roughly HK$180.36 billion (US$23 billion).

- Montage is one of only three global suppliers of DDR5 memory interface chips (alongside Renesas and Rambus), holding a 36.8% market share.

🇨🇳 Montage Technology Hong Kong IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of Montage Technology Co Ltd (SHA: 688008 / HKG: 6809) is target price of HK$144.1 per share, representing 35% higher than the listing price of HK$106.89.

- To value Montage Technology, we used three comps including GigaDevice Semiconductor (3986 HK), Renesas Electronics (6723 JP), and Rambus (RMBS US).

- We have chosen to use a significant premium to value Montage Technology mainly due to its much stronger expected sales growth and net margins versus the comps.

🇨🇳 CATL Ramps Up Battery Production With Yunnan Deal (Caixin) $

- Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) has signed a strategic cooperation agreement with the Yunnan provincial government to build a new plant, marking the battery giant’s third capacity expansion deal in a month as it tries to consolidate its dominant market position.

- Under the agreement announced Tuesday, CATL will construct a lithium battery manufacturing facility in the Dianzhong New Area in Yunnan, which will be up and running by the end of this year. The parties did not disclose the investment amount and planned capacity.

🇨🇳 Musk’s Team Sparks Stock Rally After Touring Chinese Solar Firms (Caixin) $

- Representatives for Elon Musk recently toured major Chinese solar manufacturing facilities to evaluate capacity and technology for the billionaire’s ambitious energy plans, triggering a sharp rally in the sector’s stocks.

- On Wednesday, shares of JinkoSolar Holding Co Ltd (NYSE: JKS) (688223.SH) and Jolywood Suzhou Sunwatt Co Ltd (SHE: 300393) soared 20% at one point to their daily limits. Other industry heavyweights, including Trina Solar Co Ltd (SHA: 688599), JA Solar Technology Co Ltd (SHE: 002459), TCL Zhonghuan Renewable Energy Technology Co Ltd (SHE: 002129) and LONGi Green Energy Technology Co Ltd (SHA: 601012), posted gains ranging from 3% to 10%.

🇨🇳 Buyer’s remorse? Transforming Yimutian asks for investor patience (Bamboo Works)

- Just a half year after its Nasdaq listing, the operator of a B2B agricultural trading platform is using its IPO funds to move into agricultural management tools and services

- Yimutian Inc (NASDAQ: YMT) has announced a new acquisition and partnership as part of its shift from B2B e-commerce platform operator into agricultural services

- The transformation could get a policy boost from China’s drive to modernize its agricultural sector, but also faces challenges from the company’s limited resources

🇨🇳 New Oriental’s AI Strategy Isn’t Flashy—but It May Be More Durable Than Peers’! (Smartkarma) $

- New Oriental Education (NYSE: EDU) has reported its financial results for the second fiscal quarter of 2026, showcasing both growth and areas of potential concern.

- The company experienced a 14.7% increase in total net revenue year-over-year, reaching $1.19 billion.

- This growth was fueled primarily by strong performance in the K-12 educational business and high school tutoring segments, which reported accelerated revenue growth compared to the previous quarter.

🇨🇳 How TAL Education Is Structuring Its Next Phase of Growth (Smartkarma) $

- The recent quarterly earnings reflects a period of solid operational execution for TAL Education Group (NYSE: TAL), alongside clearer visibility into the trade-offs the company is making between near-term financial performance and longer-term capability building.

- Revenue growth remained strong on a year-over-year basis, supported by continued momentum in learning services and contributions from newer initiatives, most notably learning devices.

- This performance indicates that core demand for enrichment education remains resilient, particularly in offline Peiyou programs and online enrichment offerings, where enrollment growth, retention metrics, and user engagement were cited as stable and supportive of topline expansion.

🇨🇳 Forget appliances, it’s all about AI for Qidian Guofeng (Bamboo Works)

- The jack-of-all-trades group is disposing of a loss-making legacy business after leaping onto the AI business bandwagon

- The company, with interests from education to traditional Chinese liquor, has announced plans to divest its debt-laden home appliance business although the subsidiary was its main revenue earner

- China Qidian Guofeng Holdings Ltd (HKG: 1280) recently acquired an AI tech firm and struck a distribution deal with Metax, which makes graphics processors for AI computing

🇨🇳 FXI Rebalance Preview: Three Changes Likely in March (Smartkarma) $

- There could be 3 constituent changes for the iShares China Large-Cap (FXI) (FXI US) ETF in March. With two weeks left in the review period, that number could change.

- There will be multiple inflows for Zijin Gold International Co Ltd (HKG: 2259 / FRA: 6LU / OTCMKTS: ZJNGF) over the next few months, and this inclusion will take place simultaneously with inclusion in a global index.

- The forecast adds are up over the last year and trading at/near their highs. The forecast deletions are trading higher from a year ago but down from the highs.

🇨🇳 Evergrande Property Services: Hot potato or hot property? (Bamboo Works)

- Liquidators of the failed developer are seeking buyers for its property management arm, Evergrande Property Services Group Ltd (HKG: 6666 / OTCMKTS: EVGPF), with several companies reportedly showing interest

- Guangdong Provincial Tourism Holdings and PAG have expressed interest in bidding for the property management arm of failed developer Evergrande, according to media reports

- Evergrande Property’s latest financials revealed it was owed as much as 3 billion yuan it may not be able to collect, much of that from its parent, which is being liquidated

🇨🇳 Wuxi Lead Intelligent Equipment Hong Kong IPO Preview (Douglas Research Insights) $

- Wuxi Lead Intelligent Equipment Co Ltd (SHE: 300450) is getting ready to complete its Hong Kong listing next week. The company is the world’s largest provider of lithium-ion battery manufacturing equipment.

- The company plans to raise up to HK$4.29 billion (US$549 million) by offering 93.6 million H-shares. The shares were offered at a maximum price of HK$45.80.

- Wuxi Lead Intelligent Equipment (300450 CH) is the global and China market leader in lithium-ion battery intelligent equipment, holding a 15.5% global and 19.0% China market share.

🇨🇳 Wuxi Lead Intelligent Equipment Hong Kong IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of Wuxi Lead Intelligent Equipment Co Ltd (SHE: 300450) is HK$58.2 per share, which is 27% higher than the maximum offer price of HK$45.80.

- Given the reasonable upside, we have a Positive View of this Hong Kong IPO.

- Our base case valuation is based on P/E of 38.9x our estimated net profit of RMB2.9 billion in 2027. It also includes a 25% discount for the H-shares listing.

🇭🇰 Hang Seng Index (HSI) Rebalance Preview: Inclusion Candidates for Mar26 (Smartkarma) $

- Post market close on Friday, Hang Seng Indexes will announce the changes for the Hang Seng Index (HSI INDEX) that will be implemented at the close on 6 March.

- We highlight 8 stocks that have a higher probability of being added to the index. With the index committee entitled to a lot of discretion, there will be differences.

- Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750), YUM China (NYSE: YUMC), WuXi XDC Cayman (HKG: 2268 / FRA: L74) and 3SBio Inc (HKG: 1530 / FRA: 83B / OTCMKTS: TRSBF) have better odds than others of being added to the index.

🇭🇰 MiniMax (100 HK): Gross Margin Matters More in B2C AI (Smartkarma) $

- MiniMax Group (HKG: 0100 / FRA: E5A)’s gross margin improved significantly to 23% in 9M2025 from 3% in 9M2024.

- We believe gross margin is more important for B2C than for B2B.

- It is not easy for an early stage company to achieve such a margin improvement.

🇭🇰 Muyuan Foods Hong Kong IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of Muyuan Foods Co Ltd (SHE: 002714 / HKG: 2714) is implied market cap of HK$368 billion post IPO which is 24% higher than HK$297 billion at HK$39 per share.

- Our base case valuation of Muyuan Foods is based on P/E of 12.9x our estimated net profit of RMB25.3 billion in 2027.

- Our target P/E multiple of 12.9x is 20% higher than the comps’ average P/E multiple in 2027.

🇭🇰 OSL firms its capital with new top-up, as it pitches stability in a volatile crypto world (Bamboo Works)

- The provider of stablecoin trading and payment services has raised $200 million through a share sale to Fidelity

- OSL Group Ltd (HKG: 0863 / FRA: 9D2 / OTCMKTS: BCTCF) has raised $200 million by selling shares to Fidelity, just six months after securing $300 million in the largest publicly disclosed share sale by a crypto firm at that time

- The Hong Kong-based company is building up stablecoin services as demand for such digital assets grows exponentially

🇭🇰 Hutchison Port Holdings Trust 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇨🇳 🇭🇰 Hutchison Port Holdings Trust (SGX: NS8U / FRA: H09 / OTCMKTS: HCTPF / HUPHY) 🇻🇬 – Deep-water container terminals in the Pearl River Delta of South China. 🇼 🏷️

🇭🇰 Hang Lung Group Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇭🇰 Hang Lung Group Limited (HKG: 0010 / FRA: HLU / OTCMKTS: HNLGF / HNLGY) 🇭🇰 – Investment holding company. Property development for sales & leasing & management of car parks, properties & dry cleaning businesses. 🇼

🇭🇰 A Memory Super-Cycle Is Highlighting Silicon Motion’s Opportunity (Seeking Alpha) $ 🗃️

🇭🇰 Silicon Motion Technology Corporation 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Silicon Motion Technology Corporation (NASDAQ: SIMO) – Designs, develops, & markets NAND flash controllers for solid-state storage devices. 🇼

🇲🇴 Macau GGR in 1Q could rise 18pct y-o-y after strong January and likely good CNY: analysts (GGRAsia)

- Macau’s February casino gross gaming revenue (GGR) could rise 22 percent year-on-year, from February 2025’s MOP19.74 billion (US$2.45 billion currently), suggests a Sunday note from banking group Morgan Stanley.

- “We expect first-quarter GGR to rise 18 percent year-on-year, on a lower base for the first four months of 2025,” added the institution.

- The memo followed January’s GGR performance this time, announced on Sunday, which saw a 24.0 percent gain from a year earlier, at MOP22.63 billion.

🇲🇴 1.4mln-plus visitor arrivals likely in Macau for 9-day Chinese New Year break: tourism boss (GGRAsia)

- Macau might record 1.42 million to 1.5 million visitor arrivals during this year’s Chinese New Year festive break, said on Tuesday Maria Helena de Senna Fernandes, director of Macao Government Tourism Office (MGTO).

- On the Chinese mainland, Macau’s main tourism feeder market, the public-holiday period for the lunar new year spans nine days this time.

- Speaking to local media on the sidelines of a Tuesday event, Ms Senna Fernandes said her office expected a daily average of 158,000 to 175,000 arrivals during the festivities.

- China’s State Council has designated the break as running from Sunday February 15, to Monday February 23.

🇲🇴 No slow Macau period now even before big holidays like CNY: MGM China CEO (GGRAsia)

- A “new phenomenon” in the Macau casino market is that “even ahead of a holiday” there is “no slow period,” said Kenneth Feng Xiaofeng, chief executive of Macau operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY). He was speaking on Thursday on the call of the parent, MGM Resorts International (NYSE: MGM), to discuss the fourth-quarter earnings of the whole group.

- On Wednesday the parent had reported MGM China’s net revenue for the three months to December 31 as having climbed 21.4 percent year-on-year, to just under US$1.24 billion.

- Jonathan Halkyard, chief financial officer of MGM Resorts, noted on the same call regarding the Macau operation: “A relentless competitive environment is the norm there, but our team has consistently maintained mid-high 20s [of percent] margins with their focus on maintaining high service levels while anticipating evolving customer tastes and preferences.”

- “Given the strength of MGM’s brand, its market size and global reach, the brand has proven its value over time helping drive MGM China’s market share and EBITDA, both of which have almost doubled since 2019,” he noted.

🇲🇴 Fitch affirms Wynn Resorts below investment grade but with good liquidity (GGRAsia)

- Fitch Ratings Inc has affirmed Wynn Resorts Ltd (NASDAQ: WYNN)’s and its subsidiaries’ issuer default ratings at ‘BB-‘, with a ‘stable’ outlook.

- Fitch’s ‘BB’ ratings are below investment grade, and indicate an elevated vulnerability to default risk, though “business or financial flexibility exists that supports the servicing of financial commitments,” according to the institution.

- Wynn Resorts is the parent of Macau casino licensee Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF). The parent is also developing with local partners the Wynn Al Marjan Island resort in the United Arab Emirates (UAE). Wynn Resorts additionally runs a casino complex in Las Vegas, Nevada, and one in Massachusetts, both in the United States.

🇲🇴 MGM China sees 4Q net revenue up 21.4pct y-o-y, to US$1.24bln (GGRAsia)

- Fourth-quarter net revenue at Macau casino operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) rose 21.4 percent year-on-year, to just under US$1.24 billion. That is according to unaudited preliminary data released on Wednesday by its United States-based parent, MGM Resorts International (NYSE: MGM).

- MGM China had a trading halt on the Hong Kong Stock Exchange at 9am on Thursday. That event coincided with the U.S. parent saying it had “inadvertently” the previous day, released fourth-quarter numbers for the group. The results had been scheduled for February 12.

🇲🇴 MGM China had ‘record’ 4Q EBITDA (GGRAsia)

- MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) delivered a “solid beat” in its fourth-quarter results, being “by far the best in Macau” for its casino operations in terms of yearly and sequential gain in earnings before interest, taxation, depreciation, and amortisation (EBITDA), said a Friday note from banking group JP Morgan.

- On Wednesday the parent MGM Resorts International (NYSE: MGM) had reported highlights of MGM China’s fourth-quarter performance, including that net revenue climbed 21.4 percent year-on-year, to just under US$1.24 billion, from its properties MGM Macau and MGM Cotai.

🇲🇴 Sands China likely to boost dividend amount as Macau business ramps: analysts (GGRAsia)

- Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) will in likelihood gain market share in the Macau gaming sector during 2026, which could support “dividend normalisation”, says brokerage JP Morgan Securities.

- “We (still) see Sands gaining share in 2026 and paying HKD1.0 [US$0.13] per annum dividend per share (implying a 5.5 percent-plus yield at current price) this year,” wrote analysts DS Kim, Selina Li, and Lindsey Qian in a Tuesday memo.

- The analysts noted, referring to the casino firm’s performance in the three months to December 31: “We do not see the weak fourth quarter derailing its path towards dividend normalisation, still forecasting HKD0.5 for first-half calendar-year 2026… or HKD1.0 per annum for calendar-year 2026.”

- Seaport Research Partners’ senior analyst Vitaly Umansky mentioned in a Monday note: “Sands China will likely increase its dividend as business improves.”

🇹🇼 Taiwan

🇹🇼 Taiwan Dual-Listings Monitor: Market Volatility Opens Up Multiple Historical Range Breakouts (Smartkarma) $

- Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM): +19.7% Premium; Rebounds from Near-Term Lows, Latest View on Levels

- United Microelectronics Corp (TPE: 2303 / NYSE: UMC): +4.2% Premium; Opportunity to Short the ADR Price Premium

- ChipMOS Technologies (TPE: 8150 / NASDAQ: IMOS): +2.7% Premium; Opportunity to Short the ADR Price Premium

🇹🇼 Yuanta/P-Shares Taiwan Div+ ETF Rebalance Preview: 1 Delete in March, Maybe 2 (Smartkarma) $

- Taiwan Acceptance Corp (TPE: 9941 / 9941A) should be deleted from the Yuanta/P-Shares Taiwan Dividend Plus ETF in March and that will trigger selling of over 8 days of ADV.

- Tung Ho Steel Enterprise Corp (TPE: 2006) is very close to deletion zone and price movements over the next few weeks will determine if it stays or goes.

- If deleted from the ETF, passives will sell between 6-7.6% of float in the stocks and that could lead to a sharp drop in the stock price.

🇹🇼 Perfect Corp.: The Pendulum Swings (Seeking Alpha) $ 🗃️

- 🌐 Perfect Corp (NYSE: PERF) – SaaS makeup virtual try-on solutions (Beauty AI, Skin AI, Fashion AI & Generative AI SaaS solutions). 🇼

🇹🇼 ASE Technology Holding Co., Ltd. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 ASE Technology Holding (NYSE: ASX) – Independent semiconductor manufacturing services in assembly, test, materials & design manufacturing. 🇼 🏷️

🇹🇼 Taiwan Semiconductor: Winner Of The AI Boom As The Critical Foundry Supplier (Seeking Alpha) $ 🗃️

🇹🇼 The Future Of AI Stocks? TSMC Commentary Suggests AI Megatrend (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 Chunghwa Telecom Co., Ltd. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇼 Chunghwa Telecom (TPE: 2412 / NYSE: CHT) – Largest integrated telecom service provider in Taiwan. Incumbent local exchange carrier of PSTN, Mobile, & broadband services. 🇼 🏷️

🇹🇼 United Microelectronics Corporation: Can Collaboration (Smartkarma) $

- United Microelectronics Corp (TPE: 2303 / NYSE: UMC) reported its fourth-quarter and full-year 2025 financial results, reflecting both positive developments and certain challenges.

- The fourth quarter of 2025 saw consolidated revenue of TWD 61.81 billion, marking a sequential increase of 4.5%, attributed to favorable foreign exchange movements and growth in specific technology segments.

- The gross margin reached 30.7%, an improvement from previous quarters, signaling enhanced operational efficiencies.

🇰🇷 Korea

🇰🇷 Hanwha Asset Mgmt Launching the PLUS Korea Manufacturing Core Alliance Index ETF (KMCA) On NYSE (Douglas Research Insights) $

- Hanwha Asset Management has launched the process of listing the PLUS Korea Manufacturing Core Alliance (KMCA) Index ETF on the NYSE in 1H 2026.

- KMCA ETF will includes companies in six core sectors: 1) AI semiconductors, 2) batteries, 3) shipbuilding, 4), defense, 5) power grids and nuclear energy, and 6) robots and humanoids.

- This is likely to attract additional foreign capital into Korean stocks in the coming months.

🇰🇷 Grand Korea Leisure says ‘currently no plans’ for self-owned venue (GGRAsia)

- Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, said in a Monday filing that “currently” it has “no plans to secure an in-house business site”.

- Last month the Korea Economic Daily had published a story headlined: “GKL to build a casino resort in Seoul,” referring to the South Korean capital.

- In a January 20 filing to the Korea Exchange, the casino group had described the report as a “rumour” and added “no specific decisions” had been made regarding such a project.

- Though Grand Korea Leisure did say at the time, it was “preparing to apply for a preliminary feasibility study with the Ministry of Economy and Finance regarding securing its own business site”.

🇰🇷 GKL reports January casino sales of US$25mln, up 6.6pct from a year ago (GGRAsia)

- January casino sales at Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, reached nearly KRW36.60 billion (US$25.3 million), a 6.6-percent increase from a year ago, according to a filing to the Korea Exchange on Tuesday.

- Judged sequentially, Grand Korea Leisure’s casino sales last month were up 0.8 percent

🇰🇷 Paradise Co’s January casino sales up 31pct y-o-y to US$65mln (GGRAsia)

- Paradise Co Ltd (KOSDAQ: 034230), an operator in South Korea of foreigner-only gaming venues, reported casino sales of nearly KRW94.27 billion (US$65.0 million) in January, a 31.4-percent increase from a year ago.

- Judged sequentially, such sales grew 26.7 percent, the firm stated in a Tuesday filing to the Korea Exchange.

🇰🇷 Jeju Dream Tower’s casino sales top US$31mln in January (GGRAsia)

- Lotte Tour Development (KRX: 032350), promoter of South Korea casino hotel complex Jeju Dream Tower (pictured in file photo), said its casino sales in January rose 55.0 percent year-on-year to nearly KRW45.60 billion (US$31.3 million).

- Judged sequentially, last month’s casino sales were up 11.2 percent, according to a filing lodged on Monday with the Korea Exchange.

🇰🇷 NAVER Corporation 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 NAVER (KRX: 035420 / OTCMKTS: NHNCF) – Global ICT company. Korea’s #1 search portal “NAVER” + LINE messenger, SNOW camera app, digital comics platform + R&D (AI, robotics, mobility & other future technology). 🇼 🏷️

🇰🇷 KB Financial Group Inc. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 KB Financial Group (NYSE: KB) – Financial holding company. Banking, credit card, financial investment, insurance business etc. 🇼 🏷️

🇰🇷 SK Telecom Co., Ltd. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇰🇷 SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) – Wireless telecommunication services in Korea. 3 segments: Cellular Services, Fixed-Line Telecommunications Services & Other Businesses. 🇼 🏷️

🇰🇷 POSCO Holdings Inc. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 POSCO Holdings (NYSE: PKX) – Integrated steel producer. 6 segments: Steel, Trading, Construction, Logistics & Others, Green Materials & Energy & Others. 🇼 🏷️

🇰🇷 SK Telecom: Worsening Results in 4Q 2025 Offset by Positive Investments in Anthropic and AI (Douglas Research Insights) $

- On 5 February, SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) reported consolidated operating profit of 1.07 trillion won in 2025, down 41.4% YoY.

- Investors are placing a greater emphasis on SK Telecom’s earnings turnaround and its investment in Anthropic rather than dwelling on the loss of customers from the cyber incident in 2025.

- If Anthropic’s value is US$350 billion, SK Telecom’s 0.6% stake would be worth US$2.1 billion (3 trillion won) which would be worth about 18% of its market cap.

🇰🇷 Korea Small Cap Gem #54: SOOP (Douglas Research Insights) $

- Net cash as a percentage of market cap is 64%. It also has treasury shares (7.3% of outstanding shares).

- Despite concerns from CHZZK, TikTok, and Youtube Shorts, Soop Co Ltd (KOSDAQ: 067160) has been improving its sales and profit growth.

- IF THE COMPANY DOES NOT ACTIVELY IMPROVE ITS SHAREHOLDER RETURNS, SOOP IS A COMPANY RIPE FOR CORPORATE ACTIVISM.

🇰🇷 Krafton (1 Trillion Won Shareholder Returns Next 3 Years) (Douglas Research Insights) $

- Krafton (KRX: 259960) announced a major shareholder return policy totaling more than 1 trillion won (US$690 million) over the next three years (2026 – 2028).

- The shareholder return policy includes paying 100 billion won annually in cash dividends for three years and buying back and cancelling more than 700 billion won in treasury shares.

- This 1 trillion won shareholder return program over three years (333 billion won annually), represents annual shareholder return of nearly 3% of its current market cap (11.2 trillion won).

🌏 SE Asia

🇮🇩 Under Prabowo, Indonesia is veering off course (FT) $ 🗃️

- Investors are jittery about the government’s fiscal and political record

🇮🇩 PT Bank Negara Indonesia (Persero) Tbk 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐🏛️ Bank Negara Indonesia (IDX: BBNI / FRA: BKE1 / OTCMKTS: PBNNF / PTBRY) – Originally established as Indonesia’s central Bank. 🇼 🏷️

🇲🇾 Gas Malaysia Berhad (GASM.KL) – The pipeline titan powering Malaysia’s industry (Pyramids and Pagodas)

- A quiet utility patiently positions itself for market liberalization, an opportunity the market has yet to recognize

- Gas Malaysia Bhd (KL: GASMSIA) with a market cap of USD 1.5 billion is a leading pipeline operator and distributor of natural gas to primarily industrial customers in Peninsular Malaysia. Their numbers looked compelling on paper, so we wanted to get the full picture from management on a recent trip to KL, which proved insightful as there’s more to the story than meets the eye.

🇸🇬 CapitaLand Integrated Commercial Trust 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍🌏 CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) – First REIT listed in Singapore & largest proxy for Singapore commercial real estate. Germany + Australia properties. 🇼 🏷️

🇸🇬 CapitaLand Ascott Trust Stapled Security 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 CapitaLand Ascott Trust (SGX: HMN / OTCMKTS: ATTRF) – Largest lodging trust in Asia Pacific. Serviced residences, rental housing, student accommodation & other hospitality assets in any country. Ascott, Somerset, Quest & Citadines brands in key gateway cities. 🇼 🏷️

🇸🇬 CapitaLand China Trust 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇨🇳 CapitaLand China Trust (SGX: AU8U / OTCMKTS: CLDHF) – Singapore’s largest China-focused REIT. Retail, office & industrial (business parks, logistics facilities, data centres and integrated developments). 🇼 🏷️

🇸🇬 Keppel Ltd. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) – Property, infrastructure & asset management businesses. 🇼 🏷️

🇸🇬 Keppel REIT 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Keppel REIT (SGX: K71U / OTCMKTS: KREVF) – Prime commercial assets in Asia Pacific’s key business districts. Singapore, Australia, Japan & Korea. 🇼 🏷️

🇸🇬 Keppel Infrastructure Trust 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Keppel Infrastructure Trust (SGX: A7RU / OTCMKTS: KPLIF) – 3 core segments: Energy transition, environmental services & distribution & storage. 🏷️

🇸🇬 Singapore Exchange Ltd. ADR 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇸🇬 Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) – Asia’s most international, multi-asset exchange, providing listing, trading, clearing, settlement, depository, data & index services. 🇼 🏷️

🇸🇬 The First 5 Stocks Every Singapore Beginner Investor Should Look At (The Smart Investor)

- Starting your investing journey doesn’t mean chasing hot tips. These five types of stocks help new Singapore investors learn the basics while keeping risk manageable.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF)

- CapitaLand Integrated Commercial Trust(SGX: C38U / OTCMKTS: CPAMF)

- In Singapore, they don’t get any bigger than CICT, which owns a portfolio of instantly-recognisable retail and office assets, mostly in Singapore.

- These include ION Orchard, CapitaSpring, and Raffles City Singapore.

- Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF)

- Singapore Airlines needs no introduction.

- Many investors would have flown with the city state’s premium national carrier before ever owning any stock in it.

- Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF)

- One such player is Sembcorp, which has an energy portfolio of 25.1 GW at the end of 2024, spanning 11 countries, mostly in Asia.

- Most of Sembcorp’s energy portfolio are in renewable energy sources, such as wind and solar, although gas and diesel-fired plants still form a significant part.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering

- Greater geopolitical uncertainty and increasing aggression from global superpowers are a tailwind for the shares of a company such as ST Engineering, which has a portfolio spanning aerospace, smart city, defence, and public security.

- Get Smart: Start Simple, Stay Invested

🇸🇬 3 Dividend Stocks I Will Buy Now with S$10,000 (The Smart Investor)

- These are the three dividend stocks I would buy if I were looking to deploy that capital today.

- 🌏 Parkway Life Real Estate Investment Trust (SGX: C2PU) – The Defensive Growth Aristocrat

- ParkwayLife REIT, or PLife REIT, remains one of the most reliable pillars for any income-focused portfolio.

- With a portfolio of 74 properties valued at S$2.57 billion across Singapore, Japan, and France, the REIT delivered a solid performance for the full year of 2025 (FY2025).

- Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF) – The Cash-Rich Healthcare Giant

- Raffles Medical Group continues to prove that it is a lean, mean, cash-generating machine.

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) – The High-Voltage AI Growth Engine

- If you want your portfolio to ride the wave of the AI revolution, Keppel DC REIT is the infrastructure play to watch.

🇸🇬 3 Singapore Stocks to Watch in the Week of 9 February 2026 (The Smart Investor)

- Earnings updates and strategic developments put these three Singapore stocks in focus for the week of 9 February 2026.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF)

- In its third quarter ended 30 September 2025 (3Q2025), Singapore’s largest bank showcased the resilience of its fee diversification strategy even as interest rate tailwinds began to fade.

- CapitaLand Investment Limited (SGX: 9CI)

- Asia’s largest diversified real estate investment manager is executing a deliberate shift toward capital-light, fee-generating businesses.

- iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF)

- The wealth management fintech exemplifies the recurring revenue model, with recurring net revenue reaching S$201.5 million for 9M2025, up 28.5% YoY.

- Get Smart: Follow the fees

🇸🇬 3 Cash-Rich Singapore Stocks With Higher Dividend Yields Than the STI (The Smart Investor)

- Looking beyond the STI, these three Singapore stocks combine net cash positions with dividend yields that outpace the broader market.

- HRNetGroup (SGX: CHZ)

- HRnetGroup is a leading recruitment and staffing firm operating across 18 Asian cities with over 900 consultants. Built over 33 years, the group runs 20 brands spanning Professional Recruitment and Flexible Staffing.

- QAF Ltd (SGX: Q01)

- QAF Limited is a Singapore-based food manufacturer and distributor operating across Southeast Asia and Australia, with core segments in Bakery and Distribution & Warehousing.

- Vicom Ltd (SGX: WJP)

- VICOM is a leading provider of inspection and technical testing services in Singapore, operating across Vehicle Testing and a broader suite of testing services for the mechanical, civil, and biochemical sectors.

- Get Smart: Cash is king for dividend safety

🇸🇬 Singapore REITs Show Strength in Earnings Season (The Smart Investor)

- Singapore REIT earnings highlight a shift from survival to growth, as rental reversions and strategic acquisitions support income stability.

- Digital Core REIT(SGX: DCRU / OTCMKTS: DGTCF) – Powering Through the AI Revolution

- Digital Core REIT delivered a powerhouse performance for the full year ended 31 December 2025.

- The pure-play data centre specialist saw its gross revenue surge by a staggering 72.2% year on year (YoY) to US$176.2 million, while net property income (NPI) climbed 43.5% to US$88.7 million.

- AIMS APAC REIT (SGX: O5RU / OTCMKTS: ACIRF) – The Industrial Workhorse Keeps Galloping

- AIMS APAC REIT continued to demonstrate why industrial assets are often the backbone of a resilient portfolio.

- Keppel REIT (SGX: K71U / OTCMKTS: KREVF) – Expanding the Footprint for Future Gains

- Keppel REIT’s full-year 2025 (FY2025) results revealed a portfolio that is physically performing well but undergoing a transition in its capital structure.

- Get Smart: Quality Always Rises to the Top

- The common thread across these three REITs is the ability to command higher rents in a competitive environment.

🇸🇬 3 Dependable Singapore REITs Yielding More Than Your CPF Account (The Smart Investor)

- Looking beyond CPF returns, these three Singapore REITs stand out for dependable dividends supported by resilient property portfolios.

- These trusts offer exposure to high-quality retail, office, and industrial assets, delivering yields that make your retirement savings work even harder.

- Starhill Global Real Estate Investment Trust (SGX: P40U / OTCMKTS: SGLMF) – The Orchard Road Retail Specialist

- Starhill Global REIT, or SGREIT, remains a steady hand in the retail space with a portfolio of nine mid- to high-end properties valued at approximately S$2.8 billion.

- Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF) – The Diversified Commercial Giant

- With S$15.7 billion in assets under management (AUM) across five Asian gateway markets, Mapletree Pan Asia Commercial Trust, or MPACT, is a heavyweight in the commercial sector.

- Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF): The Global Logistics Powerhouse

- Frasers Logistics & Commercial Trust, or FLCT, manages a vast network of 113 properties across five countries, focusing heavily on the lucrative logistics and industrial sectors.

- Get Smart: Building a Resilient Income Stream

🇸🇬 iFAST’s Expansion Plans: Too Ambitious or Just Getting Started? (The Smart Investor)

- iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) has been expanding rapidly across markets and platforms, but are its growth ambitions sustainable – or is the company taking on too much, too fast?

- The key question for investors: is iFAST expanding too fast, or is this just the beginning of a longer growth story?

- A Scalable Platform with Recurring Income

- iFAST derives most of its revenue from recurring fees on assets under administration (AUA), advisory fees, and more recently, banking revenue.

- Revenue Growth and Improving Profitability

- What’s Driving iFAST’s Expansion

- There are three key initiatives behind iFAST’s expansion:

- Why the Expansion Could Pay Off

- Too Ambitious – or Just Getting Started?

- Get Smart: Scale Matters More Than Speed

🇸🇬 Is ThaiBev a Bargain Buy Right Now? (The Smart Investor)

- With shares trading at multi-year lows compared to the index’s blue-sky highs, is ThaiBev due for a catch-up rally?

- Thai Beverage PCL (SGX: Y92 / OTCMKTS: TBVPF / TBVPY) or ThaiBev, is up roughly 4% over the past month.

- In this article, we take a closer look at the company and see if the stock is attractive based on current fundamentals or is this rally just another head fake.

- Why the Share Price Is Where It Is Today

- A reason for ThaiBev’s share price climbing over the past month could be investors getting excited about the possibility of the company listing its spirits business in Thailand.

- What the Business Is Really Worth

- ThaiBev’s business is built on a solid foundation with a dominant share in Thailand and a heavy presence in Vietnam.

- Between staple alcohol brands such as Hong Thong and Chang Beer, it has enduring brand loyalty that is hard to disrupt, regardless of a few bad quarters.

- The alcoholic beverage maker’s dominance is seen in its financials.

- Balance Sheet and Risk Check

- What Needs to Go Right

- What Could Go Wrong

- Get Smart: A Value Giant Waking Up?

🇸🇬 Building a Solid 2026 Portfolio? These Blue-Chips Stand Out (The Smart Investor)

- With markets near highs and interest rates shifting, building a resilient portfolio matters more than chasing the next big winner.

- What Makes a Blue-Chip Worth Owning in 2026

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel — Infrastructure-Led Dividend Growth

- As Singapore’s leading telecommunications group, Singtel provides essential mobile, broadband, TV, and digital infrastructure across Asia.

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) — The Asset-Light Fee Generator

- Keppel has successfully transitioned from a traditional conglomerate into a global asset manager and operator, focusing on infrastructure, real estate, and connectivity.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) — The Multi-Asset Capital Gateway

- As Singapore’s only securities and derivatives exchange, Singapore Exchange (SGX) has evolved far beyond a traditional stock market into a critical gateway for global capital.

- Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF) – Balance Sheet Strength as a Moat

- Raffles Medical Group, or RMG, operates a vertically integrated healthcare ecosystem, combining a flagship tertiary hospital with an extensive clinic network and a dedicated health insurance arm.

- What Investors Should Watch in 2026

- Get Smart: Build for Durability, Not Headlines

🇸🇬 3 Singapore Stocks to Watch as the Market Nears All-Time Highs (BRC Asia, Kimly, Innotek) (The Smart Investor)

- As Singapore stocks approach record levels, these three companies stand out for their resilient fundamentals and ability to perform even when markets are expensive.

- In this article, we highlight three Singapore stocks worth watching as the market pushes higher — and explain why they stand out even at elevated levels.

- What Matters When Markets Are Near Highs

- BRC Asia Limited (SGX: BEC)

- Incorporated in 1938, BRC Asia Limited (BRC Asia) is a leading Pan-Asia prefabricated reinforcing steel solutions provider headquartered in Singapore and listed on the Singapore Stock Exchange.

- Kimly Ltd (SGX: 1D0)

- Kimly Limited (“Kimly”) is one of the largest traditional coffee shop operators in Singapore with more than 30 years of experience.

- Innotek Limited (SGX: M14)

- InnoTek Limited (“Innotek”) is a precision metal components manufacturer that serves various industries such as consumer electronics, office automation and automotive.

- Get Smart: Patience and Precision at the Peak

🇸🇬 3 Blue-Chip Stocks to Watch This Week (The Smart Investor)

- Three heavyweights from the Straits Times Index (SGX: ^STI) are preparing to pull back the curtain on their latest financial performance during the week of 2 February.

- The real story lies in the operational metrics and strategic pivots that will determine if these corporate giants can keep their promise of sustainable, growing distributions in the year ahead.

- CapitaLand Integrated Commercial Trust(SGX: C38U / OTCMKTS: CPAMF): The ION Orchard Integration Test

- Singapore’s largest commercial REIT has undergone a significant facelift, and investors are now looking for the payoff.

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF): Cash Windfall and Shareholder Returns

- Keppel’s evolution from a traditional conglomerate to an asset-light powerhouse has been nothing short of transformative.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY): The Dividend Escalator Promise

- SGX remains the ultimate “toll booth” business in the local market, and lately, the traffic has been heavy.

- Get Smart: Three Questions for Dividend Investors

🇸🇬 ST Engineering Set to Pay a Special Dividend – Should Investors Buy? (The Smart Investor)

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering’s special dividend has caught the attention of many investors. But is this payout a genuine opportunity or a one-off boost already priced in?

- ST Engineering’s Performance

- How Special Dividends Should be Interpreted

- ST Engineering’s Dividend Track Record

- The Case for Buying Now

- The Case for Caution

- What Investors Should Watch Before Buying

- Get Smart: Don’t Let Special Dividends Cloud the Bigger Picture

🇹🇭 Anutin’s Bhumjaithai Party rides in on the “Thatcher effect” (Murray Hunter)

- Thailand’s 53.06 million voters, including 3.4 first-time voters went to the polls yesterday (Feb 8) and gave the Bhumjaithai Party led by care-taker prime minister Anutin Charnvirakul a commending lead over other contenders. The Bhumjaithai Party won 194 seats, followed by the People’s Party 116 seats, Pheu Thai Party 76 seats, Klatham Party 56 seats, Democrats 21 seats. These figures are with 92.83 percent of the vote counted.

- As the writer said last December, the conservative parties like Bhumjaithai and Klatham (centre-right populists) were able to rise on the narrative of nationalism, which could be called the “Thatcher effect” where after the Falklands War in 1982, prime minister Margarat Thatcher was able to ride a landslide election victory based upon nationalism. Similarly, many Thais were very concerned over the threat of Cambodian military on Thailand, and appeared to vote for the party that promised to protect Thailand from external threats.

🇹🇭 Advanced Info Service Public Company Limited (AVIFY) Presents at Opportunity Day Quarter 4/ FY 2025 – Slideshow (Seeking Alpha)

🇹🇭 Advanced Info Service Public Company Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 Advanced Info Services PCL (BKK: ADVANC / SGX: TADD) – Operates Mobile Communication Service with 5G & 4G technology. 🇼 🏷️

🇻🇳 I went through every stock in Vietnam (Dunamis Investing)

- Going over my shortlist and how to invest in Vietnam

- Coming off my last post, which was on Viettel Construction, I continued looking for small-cap companies in Vietnam and went through all 1600 of them across the HOSE, HNX, and UpCoM — let’s just say I quickly passed on 99% of them. I didn’t do deep dives on each one, but I did end up with a shortlist of small companies that I think look promising.

- Let me go through each category that sparked my interest:

- Factory stocks

- Rock pits

- Infrastructure monopolies

- Airport plays

- Fahasa

🇮🇳 India / South Asia / Central Asia

🇮🇳 State Bank of India 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇮🇳🏛️ State Bank of India (NSE: SBIN / BOM: 500112) – Indian MNC public sector banking & financial services statutory body. 🇼 🏷️

🇮🇳 Indian Banks Prep For New Provisioning Norms With Strong Asset Quality, Capital (Seeking Alpha) $⛔🗃️

- Healthy credit quality and ample capital make large Indian lenders adequately prepared to transition to the expected credit loss-based provisioning framework due in a little over one year.

- The ECL methodology introduces forward-looking provisioning, unlike the current system that requires Indian banks to provide for loans only after they become nonperforming.

- The ECL rules will require banks to make additional provisions for loans in different stages before they become nonperforming.

- The new rules are likely to affect the capital adequacy ratios (CARs) of Indian banks, though most lenders have enough cushion.

🇮🇳 GAIL (India) Limited 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇮🇳🏛️ GAIL (NSE: GAIL / BOM: 532155) formerly Gas Authority of India Ltd – Diversified interests across the natural gas value chain of trading, transmission, LPG production & transmission, LNG re-gasification, petrochemicals, city gas, E&P, etc. 🇼🏷️

🇮🇳 Transchem Ltd (Watchlist)

- Next Zerodha or Groww?

- Change in managements and takeovers are always fun and more so in such doomsday conditions. Transchem Ltd (BOM: 500422) a company with no operations announced a massive fund raise to the tune 461 crore! The use of funds led me to dig deeper on the key acquirers dynamic strategy with a broking license to be acquired as key target-

🇮🇳 MobiKwik Q3 FY26: The “Profitability” Pivot Is Real? (Smartkarma) $

- One MobiKwik Systems Ltd (NSE: MOBIKWIK / BOM: 544305) achieved PAT profitability in Q3 FY26, delivering a strong INR 593 Mn YoY swing by prioritizing unit economics over vanity growth metrics

- Payments GMV reached an all-time high of INR 481 Bn as UPI volumes surged 3.2x, giving converting opportunity into higher-margin revenue generating categories

- Disciplined cost management reduced people expenses to 14.0% while financial services gross profits soared 405% YoY through a focus on high-quality credit.

🇮🇳 CarTrade Tech: What Cold Be the Reason for the Fall Post a Robust Q3FY26 Result? (Smartkarma) $

- CarTrade (NSE: CARTRADE / BOM: 543333) operates a leading multi-channel auto platform and delivered record performance in Q3FY26, with revenue climbing to INR 228 crores and EBITDA jumping 56%.

- Management aborted the high-profile CarDekho merger to focus on internal growth, incurring a INR 1.8 crore due diligence hit that slightly weighed on quarterly margins.

- Looking ahead, the company expects robust growth through the Elite Buyer program and new fintech products, supported by a massive INR 1,145 crore debt-free cash reserve

🇮🇳 Equitas: Portfolio Diversification – The Path to Stable Earnings (Smartkarma) $

- Equitas Small Finance Bank (NSE: EQUITASBNK / BOM: 543243) is actively meeting strict RBI criteria, including maintaining a Rs. 1,000 crore net worth and using floating reserves to keep Net NPAs below 0.88%.

- Transitioning to a universal license would allow the bank to reduce Priority Sector Lending from 75% to 40% and lower capital adequacy requirements

- By pivoting to a 90% secured loan book and a cloud-native “cyborg bank” model, the institution is stabilizing its risk profile for large-scale operations.

🇮🇳 MIDHANI: Building India’s ‘Metal Bank’ to Fortify the Strategic Supply Chain (Smartkarma) $

- Mishra Dhatu Nigam Ltd (NSE: MIDHANI / BOM: 541195) maintains a robust Rs. 2,590 crore order book and a transformative Rs. 6,000 crore HAL agreement, providing high revenue visibility and a decade-long production floor

- The newly established “Metal Bank” initiative secures national supply chain security by maintaining strategic reserves of critical imported raw materials like nickel, cobalt, and molybdenum.

- Leveraging unique infrastructure like India’s only 6,000-tonne isothermal press, the company is diversifying into high-margin commercial aerospace, biomedical devices, and specialized aluminum alloys.

🇮🇳 PhonePe: A $15 Billion Flywheel Gearing Up for India’s Second-Largest Fintech IPO (Smartkarma) $

- PhonePe has reported Rs. 7,115 crores in FY25 revenue (up 40%) and achieved positive Adjusted EBIT for the first time. Recent secondary transactions valued the entity at approximately $14.5 billion.

- With a 49% UPI market share, PhonePe faces a critical “regulatory ceiling“ by December 31, 2026, forcing an aggressive pivot toward high-margin lending, insurance, and wealth management.

- While its scale is unmatched, the upcoming IPO’s success hinges on proving that its “Growth Flywheel” can convert massive traffic into sustainable, diversified bottom-line profits beyond zero-margin UPI.

🌍 Middle East

🇮🇱 Teva’s ($TEVA) Pivot to Growth hits high Gear: Q4 results and beyond (Kontra Investments)

- Teva Pharmaceutical Industries Ltd (NYSE: TEVA) is officially a biopharma compounder now

- Teva Pharmaceutical has officially entered its “Acceleration Phase.” Following the release of its Q4 and full-year 2025 results, it is clear that the company is no longer just a generics giant in recovery—it has successfully pivoted into a high-margin, innovative biopharma powerhouse. The narrative surrounding Teva has shifted from stabilization to expansion. For the third consecutive year, the company has delivered revenue growth, finishing 2025 with $17.3 billion in sales. More importantly, the quality of these earnings is evolving. In Q4 2025, for the first time in company history, Teva’s trio of core innovative brands—AUSTEDO, AJOVY, and UZEDY—surpassed $1 billion in combined quarterly revenue. This milestone underscores a fundamental transformation in Teva’s business model.

🇮🇱 Mobileye: Mentee Acquisition Doesn’t Address Investor Concerns (Seeking Alpha) $ 🗃️

- 🌐 Mobileye Global (NASDAQ: MBLY) – Advanced driver assistance systems (ADAS) & autonomous driving technologies. 🇼

🇹🇷 Türkiye Is Bankasi A.S. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍🏛️ Turkiye Is Bankasi (IST: ISATR / ISBTR / ISCTR / LON: 98LM) or İşbank – Commercial bankfounded by the orders of Mustafa Kemal Atatürk. 🇼

🇹🇷 Turkiye Garanti Bankasi A.S. ADR 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Turkiye Garanti Bankasi AS (IST: GARAN / / OTCMKTS: TKGBY / TKGBF / TKGZY) or Garanti BBVA – Turkey’s second-largest private bank. Subs. of Banco Bilbao Vizcaya Argentaria S.A. (NYSE: BBVA). 🇼

🇹🇷 Akbank T.A.S. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

🌍 Africa

🇿🇦 Lesaka Technologies, Inc. 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Lesaka Technologies (NASDAQ: LSAK) – Full-service fintech platform (financial services & software). 🇼

🇿🇦 ArcelorMittal South Africa Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Arcelormittal South Africa Ltd (JSE: ACL) – Manufactures & sells steel products. Subs. of ArcelorMittal SA (NYSE: MT). 🇼

🇿🇦 Sappi Limited 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Sappi (JSE: SAP / FRA: SPI / SPIA / OTCMKTS: SPPJY) – South African pulp & paper company with global operations. 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇨🇿 Komercní banka, a.s. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇨🇿 🇸🇰 Komercni banka (PSE: KOMB / FRA: KONN / OTCMKTS: KMERF) – Parent company of KB Group, a member of the Société Générale international financial group. Universal bank. 🇼 🏷️

🇵🇱 Santander Bank Polska S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇱 Santander Bank Polska SA (WSE: SPL / FRA: BZI) – One of the largest financial groups & the largest private bank in Poland. 🇼 🏷️

🌎 Latin America

🌎 Flooded by cheap Chinese goods, Latin America is fighting back to protect its industries (AP)

- Mexico has long sought to protect local industries, imposing tariffs of up to 50% on imports from China, including automotive products, appliances and clothing.

- Brazil is among the countries eliminating or phasing out “de minimis” import tax exemptions for overseas parcels costing less than $50, in part to target cheap imports from China. It’s also increasing tariffs on EV imports. Other countries may follow suit, as some analysts expect more protectionist measures including tariffs and stiffer regulations coming out of Latin America.

- Chile has raised tariffs and imposed a 19% value-added tax on low-value parcels.

🌎 Petro’s meeting with Trump went better than Machado’s (Latin America Risk Report)

- Petro and Delcy are getting along with Trump. Machado and Sheinbaum are not. That applies for this week. It could all change again next week.

🌎 I’m betting on LATAM and you should too (Sveno In The Stock Market)

- I own MercadoLibre (NASDAQ: MELI) for 2 simple reasons:

- Brazil and LATAM has a young “business hungry” population that will spur economic growth.

- The EU-Mercosur deal is huge for Brazil. It opens the EU market to LATAM. This will allow for increased exports and help with the economy in general. It could also be a stepping stone for other deals that doesn’t involve North America which is a big deal when it comes to broadening its economy.

🌎 DLocal Limited: Growing Payment Volumes To Boost Overall Profitability In 2026 (Hold) (Seeking Alpha) $ 🗃️

- 🌐 Dlocal (NASDAQ: DLO) – Cross-border payment platform for global merchants to get paid & make payments in emerging markets. 🇼

🌎 Millicom International Cellular: Infrastructure Re-Rating Driven By Colombia Consolidation Edge (Seeking Alpha) $ 🗃️

🌎 Millicom International Cellular: The Turnaround Is Over – The Cash Flow Rerating Begins (Seeking Alpha) $ 🗃️

- 🌎 Millicom (NASDAQ: TIGO) – Fixed & mobile, telecommunications services, cable & satellite TV, mobile financial services & local content such as music & sports in Latin America. 🇼 🏷️

🌎 Pan American Silver: Finding Value In An Already Hot Market (Seeking Alpha) $ 🗃️

- 🌎 Pan American Silver Corp (NYSE: PAAS) – Owns & operates silver & gold mines located throughout the Americas. Canada HQ. 🇼

🇦🇷 Milei Hunts for Over $250 Billion That Argentines Have Hidden in Secret Stashes (WSJ) $ 🗃️

- The president needs the U.S. dollars long stowed in teddy bears and safe-deposit boxes for his free-market overhaul

🇦🇷 Argentina’s homegrown companies lead oil and gas boom (FT) $ 🗃️

- Production accelerates as domestic producers fill gap left by international majors

- “Argentine companies have regained a more prominent role largely because of a greater appetite for risk,” said Pablo Vera Pinto, co-founder of Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA), the country’s second-largest oil producer after state-controlled Ypf Sa (NYSE: YPF), citing local executives’ experience dealing with the country’s chronic volatility.

🇧🇷 Petrobras: My Controversial Top Pick For 2026 (Rating Upgrade) (Seeking Alpha) $ 🗃️

- 🌐🏛️ Petrobras (NYSE: PBR / PBR-A / BCBA: PBR / PETR4) or Petróleo Brasileiro SA – Explores, produces & sells oil & gas. 🇼

🇧🇷 BrasilAgro – Companhia Brasileira de Propriedades Agrícolas 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3 / FRA: 52BA) – One of Brazil’s largest companies in terms of arable land. Acquisition, development, operation & sale of rural properties suitable for agricultural activities. IRSA (NYSE: IRS) has a stake. 🏷️

🇧🇷 WEG: Valuation Caps Upside After The Reset, Fundamentals Hold Into 2026 (Seeking Alpha) $ 🗃️

- 🇧🇷 WEG SA (BVMF: WEGE3) – Operates worldwide in the electric engineering, power & automation technology areas. Electric motors, generators, transformers, drives & coatings. 🇼 🏷️

🇧🇷 Banco Santander (Brasil): Stability Is Back, But Asymmetry Is Not (Seeking Alpha) $ 🗃️

- 🇧🇷🅿️ Banco Santander Brasil (NYSE: BSBR / BVMF: SANB3 / SANB4 / SANB11) – Various banking products & services to individuals, SMEs & corporate customers. Part of Spain based Santander Group. 🇼

🇧🇷 Nu Holdings: Why I Remain Constructive Heading Into 2026 (Seeking Alpha) $ 🗃️

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

🇧🇷 Patria Investments Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇧🇷 Braskem: The Alagoas Counterpunch (Penny on the Dollar)

- A public defender’s office is trying to block the IG4 deal. Here’s what it means.

- In January, I published my full thesis on Braskem [Braskem SA (NYSE: BAK / BVMF: BRKM3 / BRKM5 / BRKM6)], arguing that the IG4 Capital transaction could finally break the decade-long governance deadlock that has kept this stock in purgatory.

- The ink was barely dry when the Defensoria Pública do Estado de Alagoas launched a coordinated legal offensive to stop it.

- On the 1st of February, the state public defender’s office filed simultaneous petitions with CADE (antitrust regulator), CVM (securities regulator), and CGU (federal auditor) seeking to halt the transfer of control from Novonor to IG4.

- The core allegation: the deal structure constitutes a “fraud against victims” of the Maceió disaster.

- Let me walk through what’s actually happening and what it means for the thesis.

🇨🇱 Banco Santander-Chile 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇨🇱 Banco Santander-Chile (NYSE: BSAC) – Part of the Santander group & majority controlled by Santander Spain. The largest bank in Chile by loans & the second largest by deposits. 🇼 🏷️

🇲🇽 Quick trade idea: Bolsa Mexicana de Valores (BOLSA.A) (Acid Investments)

- In that vein, color me ignorant, but I came to discover that Mexico is a global leader in silver and copper, being the largest silver producer, double that of runner ups i.e. China and Peru, as well as the tenth largest copper producer in the world. In fact, take a look at the share price performances of the country’s largest silver miner (Fresnillo Plc (LON: FRES / BMV: FRES / FRA: FNL / OTCMKTS: FNLPF)), and largest copper miner (Grupo Mexico (BMV: GMEXICOB / FRA: 4GE / OTCMKTS: GMBXF)).

- Overall, the Mexican stock market has been doing fantastic. The IPC Mexico has made new ATHs, and the EWW (measured in USD) had also just touched a new ATH.

- There are a few writeups (here, here, here) that cover the business minutiae of Bolsa Mexicana de Valores SAB de CV (BMV: BOLSAA / FRA: BC51 / OTCMKTS: BOMXF). In my piece, I’ll be approaching BMV from a different angle. Do let me know if there are areas you disagree on.

🇵🇦 Bladex: Practically Perfect Execution On Long-Term Plan (Seeking Alpha) $ 🗃️

- 🌎 Banco Latinoamericano (NYSE: BLX) or the Foreign Trade Bank of Latin America or Bladex – Founding shareholders were the Central Banks & government entities of 23 countries in the region. Specialized in addressing trade finance needs. 🇼 🏷️

🌐 Global

🌐 A 3-4x in the Next Offshore Squeeze? Betting on Jackups (TheOldEconomy Substack)

- Undervalued and Underwater: A Deep Dive into Jackups

- In this +50 page report we will cover:

- Offshore market updates (recent contract awards and near-term developments in the offshore thesis)

- Jackups 101

- Bull thesis

- Bear thesis

- Comparison to drillers: similarities and differences (does it make sense to have both in our portfolios?)

- Scenario modelling

- Company analysis

- Conclusion: ways to invest in the thesis (debt, equity, and different “portfolios” depending on investor profile)

🌐 Active Electrical Cable (AEC) Fundamentals (Semi Fundamental)

- AECs in AI Data Centers: The Full Stack Deep Dive from Physics to Procurement | CRDO, APH, ALAB, MRVL, AVGO

🌐 LVMH Q4’25: “We Will Make It Through the Winter” (StockOpine’s Newsletter)

- We are now deep into the second year of the fashion luxury industry downcycle, and it feels like a never-ending story. The silver lining? LVMH Moët Hennessy Louis Vuitton (EPA: MC / OTCMKTS: LVMUY / LVMHF) is not suffering in isolation. The Group performed significantly better than its closest competitor, Kering SA (EPA: KER / OTCMKTS: PPRUF), confirming that these headwinds are industry-wide rather than company-specific. Of course, we must exclude the ultra-premium outlier, Hermes International (EPA: RMS / OTCMKTS: HESAF), from this comparison. Their ability to sustain positive revenue growth serves as a testament to the fact that ultra-premium scarcity is far more recession-resistant than broader luxury.

🌐 MGM Resorts (MGM): Japan’s First Casino and a 7-Year Return Table (The Rational Investor)

- Buybacks and Japan make MGM a Buy

- The market is obsessing over the short-term Vegas slowdown for MGM Resorts International (NYSE: MGM). Room remodels at the MGM Grand took inventory offline, and Las Vegas tourism softened in 2025. While analysts fixate on next quarter’s Vegas revenue, they’re missing the bigger picture: MGM is building the future of Asian gaming.

- Here’s why I’m bullish. MGM is buying back 7-8% of its shares every year, funded by a business trading at a 14.2% owners earnings yield. BetMGM just turned profitable and sent $100M back to the parent company in Q4. MGM is building Japan’s first casino opening in 2030 in Osaka. The catalyst isn’t waiting until 2030 it’s the market waking up over the next year to realize MGM is shrinking the float at a massive discount while multiple growth engines kick in.

🌐 Nebius: This Correction Looks Overdone Ahead Of Q4 (Earnings Preview)(Seeking Alpha) $ 🗃️

🌐 Nebius Earnings Preview: Growth Now, Rubin Expansion Ahead(Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

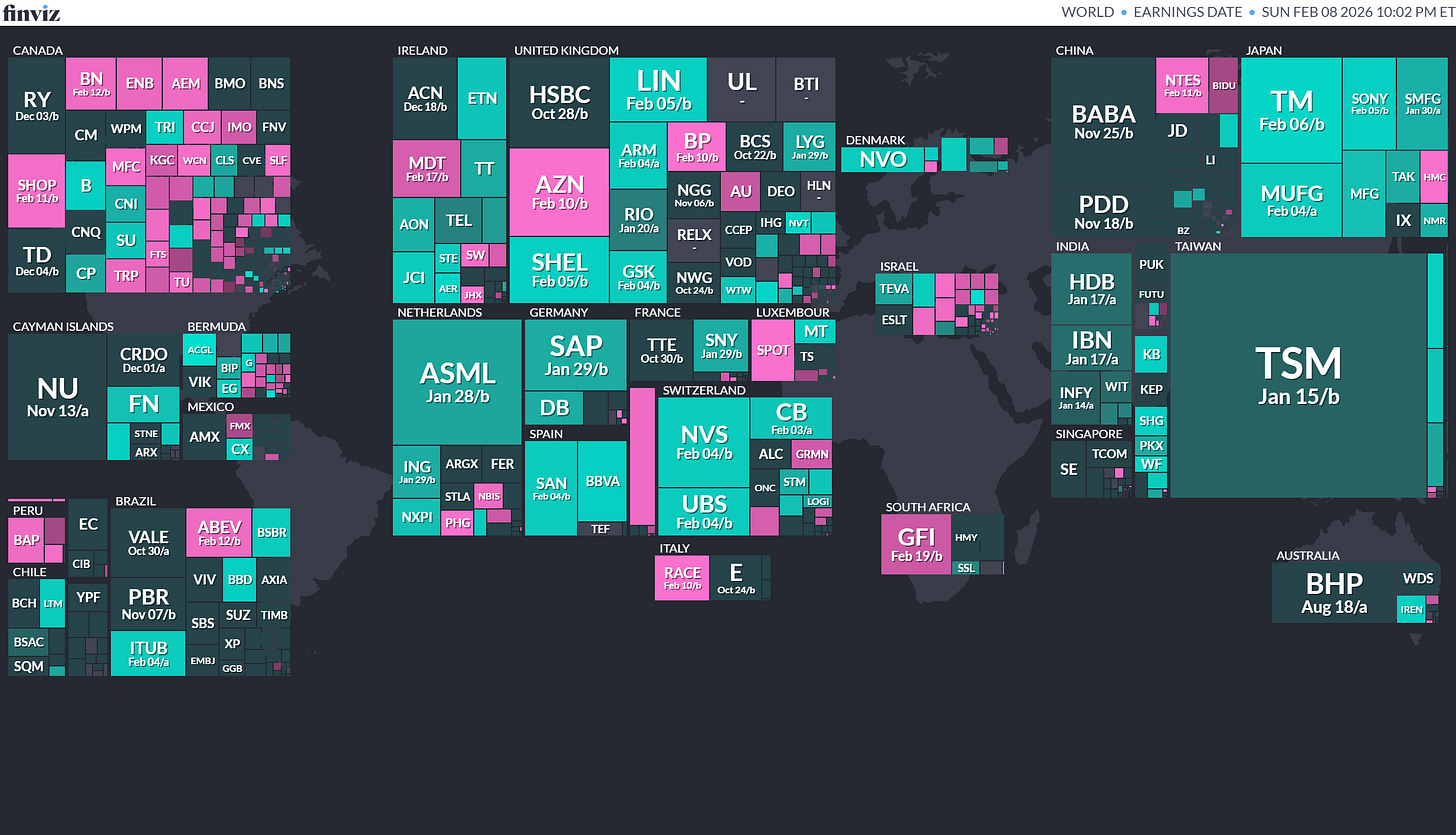

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

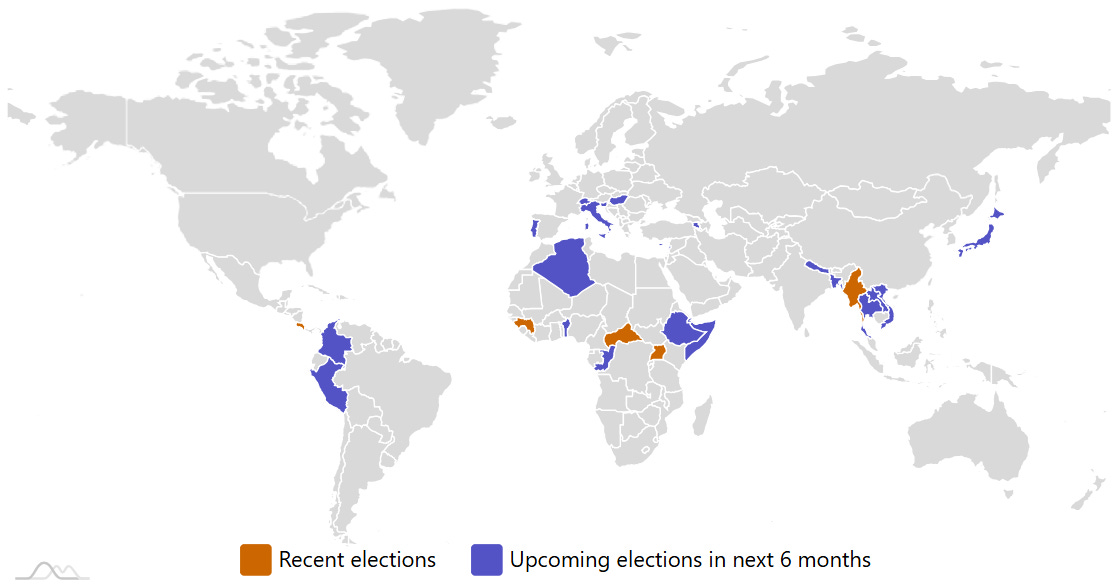

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Japan Japanese House of Representatives 2026-02-08 (d) Confirmed 2024-10-27

- Thailand Thai House of Representatives 2026-02-08 (t) Confirmed 2023-05-14

- Thailand Thai House of Representatives 2026-02-08 (t) Confirmed 2023-05-14

- Bangladesh Bangladeshi National Parliament 2026-02-12 (d) Confirmed 2024-01-07

- Bangladesh Referendum 2026-02-12 (d) Confirmed

- Colombia Colombian Senate 2026-03-08 (d) Confirmed 2022-03-13

- Colombia Colombian House of Representatives 2026-03-08 (d) Confirmed 2022-03-13

- Slovenia Slovenian National Assembly 2026-03-22 (t) Confirmed 2022-04-24

- Peru Peruvian Congress of the Republic 2026-04-12 (d) Confirmed 2021-04-11

- Peru Peruvian Presidency 2026-04-12 (d) Confirmed 2021-04-11

- Hungary Hungarian National Assembly 2026-04-30 (t) Date not confirmed 2022-04-03

- Cyprus Cypriot House of Representatives 2026-05-31 (t) Date not confirmed 2021-05-30

- Colombia Colombian Presidency 2026-05-31 (t) Date not confirmed 2022-06-19

- Morocco Moroccan Chamber of Representatives 2026-09-30 (t) Date not confirmed 2021-09-08

- Czech Republic Czech Senate 2026-09-30 (t) Date not confirmed 2024-09-27

- Russian Federation Russian Federal Duma 2026-09-30 (t) Date not confirmed 2021-09-19

- Brazil Brazilian Federal Senate 2026-10-04 (d) Confirmed 2022-10-02

- Brazil Brazilian Chamber of Deputies 2026-10-04 (d) Confirmed 2022-10-02

- Brazil Brazilian Presidency 2026-10-04 (d) Confirmed 2022-10-30

- Israel Israeli Knesset 2026-10-27 (d) Confirmed 2022-11-01

- Bulgaria Bulgarian Presidency 2026-11-30 (t) Date not confirmed 2021-11-21

- Bahrain Bahraini Council of Representatives 2026-11-30 (t) Date not confirmed 2022-11-12

- Viet Nam Vietnamese National Assembly 2026-03-15 (d) Confirmed 2021-05-23

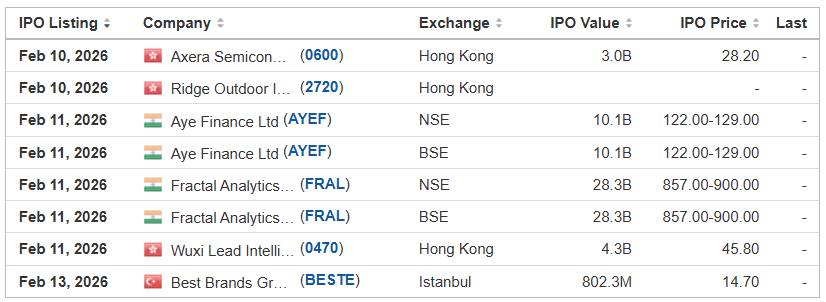

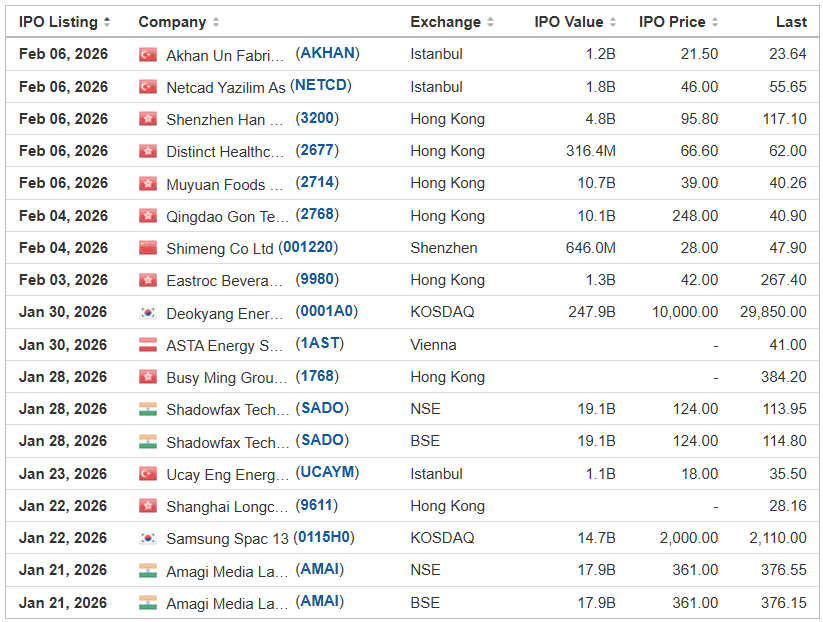

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

AGI AG BK Goldman Sachs/Morgan Stanley/Citigroup/Bradesco BBI/BTG Pactual/Itaú BBA/Santander/SOCIETE GENERALE/XP Investments, 43.6M Shares, $15.00-18.00, $720.0 mil, 2/11/2026 Wednesday

(Incorporated in the Cayman Islands)

Our journey began over 25 years ago with a vision from our founder, Mr. Marciano Testa: to make credit more accessible and affordable for the Brazilian consumers who needed it most. While still a college student in 1999, Mr. Testa founded Agiplan, the first building block of what eventually became the Agi that we are today. As our business grew, we identified new opportunities and adapted our strategy to better serve our target customers. In each phase, we strengthened our business, enabling us to offer our consumers greater value.

AGI Inc. is a leading technology-powered provider of specialized financial services in Brazil. We served nearly 6.4 million active clients as of September 30, 2025, helping them to access their social security benefits, severance fund benefits, and public- or private-sector payrolls through innovative secured lending solutions and complementary banking, credit and insurance products tailored to their needs. Social security benefit loans, for example, accounted for 79.2 percent of our total credit portfolio of R$34.5 billion as of September 30, 2025.

Our mission is to revolutionize financial services for the largest and fastest-growing segment of Brazil’s population: individuals who have been underserved by incumbent banks and have not been effectively reached by digital-only banks.

We believe we are one of the most profitable financial institutions in Brazil, based on our annualized return on average equity (ROAE) of 39.1 percent for the nine months that ended September 30, 2025.

We seek to make credit and banking solutions more accessible and affordable for the Brazilian consumers who we believe need it the most, including social security beneficiaries and private- and public-sector workers. We have designed a unique value proposition for this population, who may be older, have a lower income, be less tech-savvy or have less access to education. Our target market: (1) includes 107 million people, comprised of 41.4 million social security beneficiaries, 52.7 million private-sector workers and 12.8 million public-sector workers; and (2) represents a total estimated addressable market of over R$1.9 trillion in financial services as of September 30, 2025, based on data from the Central Bank of Brazil and SUSEP.

Note: Net income and revenue are in U.S. dollars (converted from Brazil’s reais) for the 12 months that ended Sept. 30, 2025.

(Note: AGI disclosed the terms for its IPO on Jan. 29, 2026, in an F-1/A filing: 43.64 million shares at a price range of $15.00 to $18.00 to raise $720 million. Background: AGI filed its F-1 for its IPO on Jan. 14, 2026, without disclosing the terms. Estimated proceeds were $100 million, a placeholder figure. This IPO could raise as much as $1 billion, Bloomberg had reported on Jan. 14, 2026.)

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 2/16/2026 Week of

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.