With Twitter so full of pro-China/pro-CCP trolls (my feed now seems to be full of them arguing with the anti-China/anti-CCP/coming collapse of China crowd), here is a handy reminder about how China analysis often works these days:

However, this recent ZeroHedge piece offers a reality check on the tariffs that the corporate media won’t talk about:

💻 Lutnick: Beijing “Eating” Majority Of China’s 52% Average Tariffs (ZeroHedge) September 2025 🗃️

As Epoch Times notes, Lutnick said that most countries aren’t facing tariffs above 15% and that when they do, the foreign governments step in to keep their businesses afloat while they negotiate better terms.

“The model is clear: 10% tariffs or less are paid by the manufacturers, the distributors, the businesses,” he said. “The consumer doesn’t pay. The consumer doesn’t pay because the seller doesn’t want to raise prices, because if they could, they would, but they don’t want to sell less. So they eat it.”

If the duties are between 10 and 15%, the distributor and manufacturers share the cost at about a 60-40 split, he said, resulting in about a 2 percent price increase with tariffs of 15%.

“And above 15%, no one can handle that … unless the government covers it. So what you saw in cars, when you had 25%, before Europe made their deal and Japan made their deal, the government of South Korea and Japan and Europe covered it, because they didn’t want to hurt their employment,” Lutnick said.

This confirms our own previous reporting, focusing primarily on Japanese auto exports where virtually all these tariff costs have been borne by domestic carmakers.

Also, I can’t open Linkedin or Twitter without seeing a “China always wins” type post from Shaun Rein (who has a marketing consulting firm in Shanghai) that inevitably ends with him hawking his China book (Note: I believe we attended the same university around the same time; but I was an undergraduate while he was a graduate student – I know we exchanged greetings once on LinkedIn some years ago as there were not too many alumni yet in Asia…).

I was thinking that might end soon after I saw this tweet:

But then he added…:

I remember when the now defunct China Daily Show parody site did a hilarious “story” about him that can still be found on the Wayback Machine – here is the first part of it (the comments don’t load properly anymore, but Rein did make a good natured comment to the post):

Needless to say, I don’t pay much attention to his China posts or tweets…

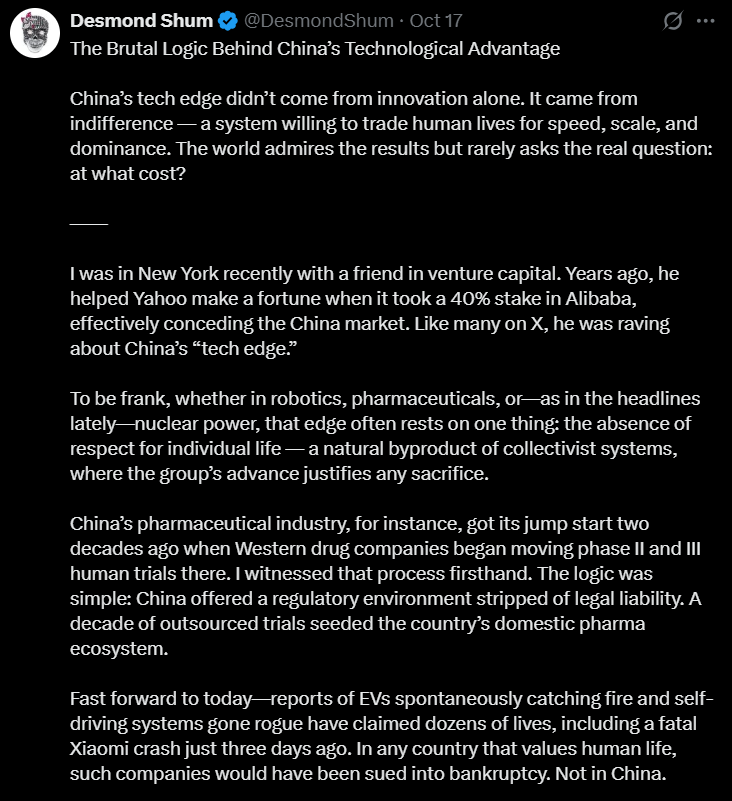

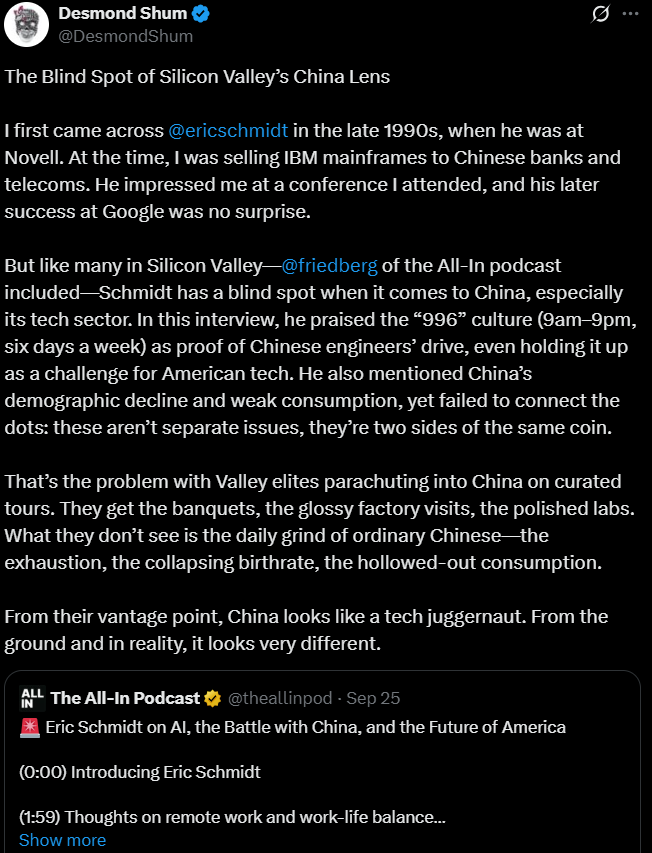

However and as mentioned in the past, I pay attention to tweets or insights from Desmond Shum, the author of Red Roulette: An Insider’s Story of Wealth, Power, Corruption, and Vengeance in Today’s China and who’s billionaire (now ex-) wife Whitney Duan (Duan Weihong) “disappeared” for several years in a corruption crackdown.

Here is his take about “China always wins” technology advantage:

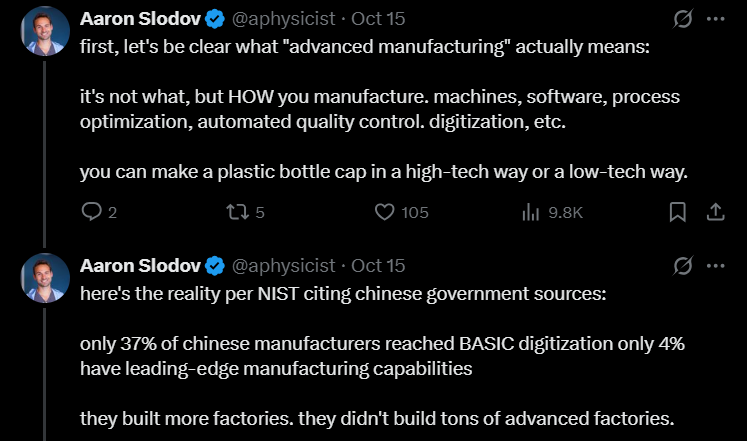

Excerpts from this Twitter thread are also a good reality check that notes some of China’s manufacturing Achilles heals:

The whole thread can be read here:

However, Sharpie has already acted as the WSJ recently noted:

📰 Sharpie Found a Way to Make Pens More Cheaply—By Manufacturing Them in the U.S. (WSJ) October 2025 🗃️

- Newell Brands moved production without cutting employee count or raising prices

This also brings me to another Desmond Shum tweet about the realities of life in China that foreigners don’t often see on their parachute tours:

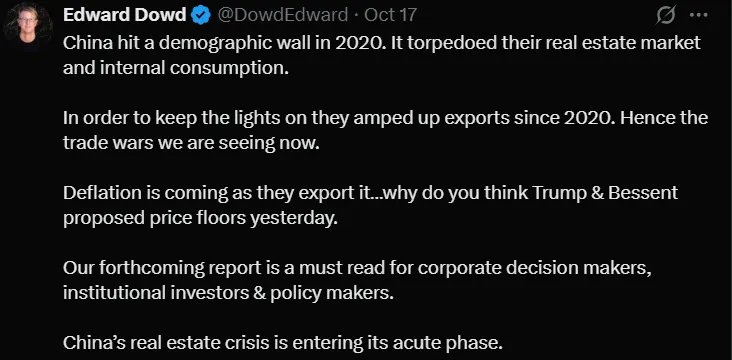

Finally, Ed Dowd (Phinance Technologies) will be putting out a huge report on China intended for institutional investors (given how much it will cost…) and he starts talking about his findings after the 28 minute mark or so in this latest interview:

🎥 Ed Dowd: USA Facing A ‘Toxic Cocktail’ of Trouble In Stocks, Credit, Trade & Housing (Adam Taggart | Thoughtful Money®) October 2025

- 0:00 – Crossroads in Capital Markets

- 2:18 – Economy vs. Markets: Complete Disconnect & Real-World Trouble

- 2:25 – Jobs Data Fraud: Non-Farm Payrolls Revised Down ~1M

- 3:38 – QCEW Discovery: 7-Sigma Disparity Signals Incompetence or Fraud

- 6:02 – Immigration Stimulus: $500B-$1.5T Propped Up 2023-24 Economy

- 7:41 – Real Estate Floor Cracks: Rentals & Immigration Demand Reverses

- 8:18 – Credit Signals: Bonds Rally, High Yield Breaks, Regionals Roll Over

- 9:35 – Auto Sector Implosions: Subprime Lenders & Dealers Bankrupt

- 10:20 – Housing Indicators: Record Gap in Starts vs. Sales, Inventory Surges

- 11:09 – Multi-Tenant Overbuild: 70s-Level Boom for Illegal Immigration Now Sours

- 11:46 – Recap: Artificial Juicing Ends, Headwinds Build

- 13:38 – Valuation Concerns: Forward 10-Year Returns at Zero (Worse Since Feb)

- 15:07 – Toxic Mix: Real Estate, Trade Wars, Credit & Dotcom-Like AI Burst

- 16:29 – AI Reality Check: Declining Corporate Rollouts, Hallucination Errors

- 17:38 – Dotcom Parallels: Stranded Infrastructure, Capex-Revenue Mismatch

- 20:26 – Bitcoin vs. AI: No Pricing Mechanism, Insiders Selling Hand-Over-Fist

- 21:23 – Timing the Bust: Early? Just Like 1997 Dotcom Bears

- 22:04 – 1998-99 Backdrop: Demographics, Y2K, Globalization vs. Today’s Mess 23:06 – Fed Pivot: Behind the Curve, Panic Cuts Incoming

- 24:05 – Ending Moves: Fantastical AI Press Releases (e.g., Oracle +30% on Hype)

- 25:24 – Bond Market Sniffs Recession: Yields Creep Lower on Deflation Fears

- 26:02 – Dollar Bullish: Debasement Trade Over, 4-Year Cycle Low in Sept

- 27:51 – Disinflation Ahead: Tariffs Deflationary, Not Inflationary

- 28:45 – China Woes: GDP 60% of US, Zero Growth Post-COVID, Exports Surge

- 31:14 – Global Liquidity Crunch: EMs (Argentina, S. Korea) Beg for Dollars

- 32:05 – Oil Canary: Down to $30, Signals China & Global Demand Collapse

- 32:53 – Oil Investment: Buy at $30-37 for Next Boom Cycle

- 33:57 – No Systemic Crisis Yet: 50% Stock Drawdown Possible, Then Flip Positive

- 35:48 – China’s Crossroads: Needs Consumer Shift, Fears Own People Most

- 37:18 – Demographics Horror: Echo Boom by 2032, Then Decades of Despair

- 38:10 – Gold Outlook: Consolidates, Then to $10K by 2030; Tier 1 Capital Boost

- 41:32 – Recession Odds: 80-90% for 2026 (Q4 2025 Start?)

- 42:15 – Unemployment Spike: North of 5% by Next Year

- 43:38 – Fed Cuts: 50bps Next, Possible 100bps Panic on Credit Blowup

- 45:07 – Rate Cutting Mode: Like 2000 & 2007, Gravity Wins Despite Cuts

- 45:25 – Private Credit Risk: Opaque $1.5T Market, Fast Feedback Loops

- 48:36 – Investing Approach: De-lever, Raise Cash (Dry Powder for Lows)

- 50:12 – T-Bills Safe Haven: 3.9% Paid to Wait (Buffett Owns 5%)

- 51:48 – Societal Bifurcation: K-Shaped Economy Fuels Global Populism

To summarize some of Dowd’s key points about China:

- China’s GDP going into COVID was 80% of the USA’s (priced in USD). Its now 60% of the USA’s while GDP growth has been zero (priced in USD).

- They have been accelerating exports to get out of the real estate crisis which is about to hit the acute phase where they will need to accelerate even more exports to keep the light on for their industrial capacity (as there won’t be many new real estate projects in the pipeline).

- Commodity producing countries will have big problems. Cases in point: China is Argentina’s and Korea’s biggest trading partners and both are in need of dollars or liquidity.

- Oil is the canary in the coal mine that demand is collapsing and he thinks oil will go to $30 (but won’t stay at that level).

- Japan could export is way out of a hole, but China is just too big to do that.

- China needs to raise their people up to transition from a mercantilist economy to a consumption economy.

- However, the demographic numbers are horrific until 2032 when there will be an echo-baby boom before becoming horrific again for more decades.

In other words, the China shrills and trolls will be even more busy on Twitter; but none of this is to say there are NOT opportunities to be found among Chinese and Hong Kong stocks – as long as you maintain a realistic view of China…

Stocks covered by a couple of equity research providers in this post:

[Note: On desktop browsers, an autogenerated table of contents will appear on the left side linked to each stock. I will add those links below after publishing/emailing this post…]

🇨🇳 China – Alibaba, Pop Mart International Group, China Mengniu Dairy Company, Inner Mongolia Yili Industrial Group Co, Wanguo Gold Group, Sino Biopharmaceutical Ltd, MINISO Group Holding, Tingyi Holding, Uni-President China, Xiaomi, Eternal Beauty Holdings, Jiangsu Zenergy Battery Technologies Group, China Eastern Airlines Corp Ltd, Air China, China Southern Airlines Co Ltd, JNBY Design, Akeso, Waterdrop, Contemporary Amperex Technology Co. Ltd. (CATL), Black Sesame, JS Global Lifestyle, Nanjing Leads Biolabs Co Ltd, China Life Insurance, NIO Inc, China Merchants Bank, ZTE, New Hope Service Holdings, OmniVision Integrated Circuits Group, CR Beverage, 3SBio, Beijing Geekplus Technology, China Modern Dairy Holdings Ltd, BYD Company, Proya Cosmetics, China Pacific Insurance, PICC Property and Casualty Co Ltd, WuXi XDC, Horizon Robotics, BYD Electronic International Co Ltd, Haier Smart Home, Shenzhen Mindray Bio-Medical Electronics, Shanghai United Imaging Healthcare, Weichai Power, Naura Technology, J&T Global Express, Guangzhou Automobile Group, Nongfu Spring, Duality Biotherapeutics, Great Wall Motor, Shennan Circuit, Midea Group & Shenzhen Dobot Corp Ltd

Hong Kong stocks:

[Note: Access to some DBS Insights Direct pieces might be restricted depending on your location or browser.]

🇭🇰 Hong Kong – China Overseas Land & Investment, Budweiser Brewing Company APAC Limited, New World Development Co Ltd, DFI Retail Group Holdings Ltd, Hongkong Land Holdings, Sun Hung Kai Properties Ltd, Midland Holdings Ltd, Television Broadcasts Ltd, Sunevision Holdings Ltd, BOC Hong Kong Holdings Ltd, China Aircraft Leasing Group Holdings Limited (CFRLF) & Far East Horizon

CMB International Capital Corporation, a wholly owned subsidiary of China Merchants Bank (SHA: 600036 / HKG: 3968 / OTCMKTS: CIHKY / OTCMKTS: CIHHF), has a monthly list of 20+ high conviction stock ideas – namely Chinese stock picks (see our 2023 – May, June, July, August, September, October, November & December; 2024 – January-February, March, April, May, June, July-August, September, October, November & December; 2025 – January, February, March, April, May, June & July-August posts summarizing those) BUT these lists do not change too much from month to month. Stocks covered by the CMBI September 2025 list (including Additions and Deletions) and included in this post with updated stats and charts include:

Geely Automobile Holdings, Zhejiang Leapmotor Technology Co Ltd, Zoomlion Heavy Industry, Sany Heavy Equipment International Holdings, Green Tea Group, Guoquan Food Shanghai Co Ltd, JNBY Design, Luckin Coffee, Proya Cosmetics, CR Beverage, BeOne Medicines (BeiGene), 3SBio, Ping An Insurance, PICC Property and Casualty Co Ltd, Tencent, Alibaba, Trip.com, Greentown Service Group, Xiaomi,, Aac Technologies Holdings, BYD Electronic International Co Ltd, Horizon Robotics, OmniVision Integrated Circuits Group (Will Semiconductor Co Ltd), BaTeLab, Naura Technology & Salesforce

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

🔬 Research analysis (including articles/blog posts from fund managers, etc.); 🎥 Video; 🎙️ Podcast; 🎬 Webinar; 📰 Newspaper/magazine article; 📯 Press release; 💻 Substack/blog/website article; ✅ Our own posts; 🗃️ Archived article; ⏰ Upcoming webinar or event; ⚠️ Disclosures or restricted access e.g. based on your location, investor status, etc.; 🇼 Wikipedia page; 🏷️ Tagged links to other posts about the stock.

China, Hong Kong & Macau Stock Index

Frontier & Emerging Market Stock Index

🇨🇳 China

Alibaba

🔬 Alibaba (BABA US) – Cloud and e-commerce development both in good shape; reiterate BUY (CMB International) 09-30 2025 ⚠️

🔬 Alibaba (BABA US) – Kicked off FY26 with solid progress on cloud and quick commerce (CMB International) 09-01 2025 ⚠️

🔬 Alibaba (09988 HK/Buy) – Undervalued relative to technological capabilities (Mirae Asset Securities) 09.01.2025 ⚠️

- 🌐 Alibaba (NYSE: BABA) 🇰🇾 – eCommerce, retail, Internet & technology. 🇼 🏷️

- 🌐 Alibaba (NYSE: BABA) 🇰🇾 – eCommerce, retail, Internet & technology. 🇼 🏷️

- Price/Book (Current): 3.08

- Forward P/E: 24.45 / Forward Annual Dividend Yield: 0.63% (Yahoo! Finance)

Pop Mart International Group

🔬 Pop Mart International Group Ltd (9992HK) – Mapping the divergence: Discretionaries vs staples ❓ OR Pop Mart International Group (DBS Insights Direct) 29 Sep 2025 ⚠️

🔬 Pop Mart International Group Ltd (9992HK) – 3Q25 sees robust growth with revenue doubling (DBS Insights Direct) 26 Sep 2025 ⚠️

- 🌏 Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF) 🇰🇾 – Design, development & sale of pop toys. 🇼 🏷️

- 🌏 Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF) 🇰🇾 – Design, development & sale of pop toys. 🇼 🏷️

- Price/Book (Current): 21.86

- Forward P/E: 20.37 / Forward Annual Dividend Yield: 0.35% (Yahoo! Finance)

China Mengniu Dairy Company

🔬 China Mengniu Dairy Co Ltd (2319HK) – Mapping the divergence: Discretionaries vs staples ❓OR China Mengniu (DBS Insights Direct) 29 Sep 2025 ⚠️

🔬 China Mengniu Dairy Co Ltd (2319HK) – Eyes on diversification and margin gains (DBS Insights Direct) 26 Sep 2025 ⚠️

- 🌏 China Mengniu Dairy Company (HKG: 2319 / FRA: EZQ0 / EZQ / OTCMKTS: CIADY / CIADF) 🇰🇾 – Dairy products to Chinese & global consumers. 🇼 🏷️

- Price/Book (Current): 1.28

- Forward P/E: 10.58 / Forward Annual Dividend Yield: 3.88% (Yahoo! Finance)

Inner Mongolia Yili Industrial Group Co

🔬 Inner Mongolia Yili Industrial Group Co Ltd (600887CH) – Mapping the divergence: Discretionaries vs staples ❓(DBS Insights Direct) 29 Sep 2025 ⚠️

🔬 Inner Mongolia Yili Industrial Group Co Ltd (600887CH) – Market share gains continue ❓(DBS Insights Direct) 26 Sep 2025 ⚠️

- 🇨🇳 Inner Mongolia Yili Industrial Group Co (SHA: 600887) – China’s largest dairy producer. 🇼 🏷️

- Price/Book (Current): 3.24

- Forward P/E: 14.71 / Forward Annual Dividend Yield: 4.48% (Yahoo! Finance)

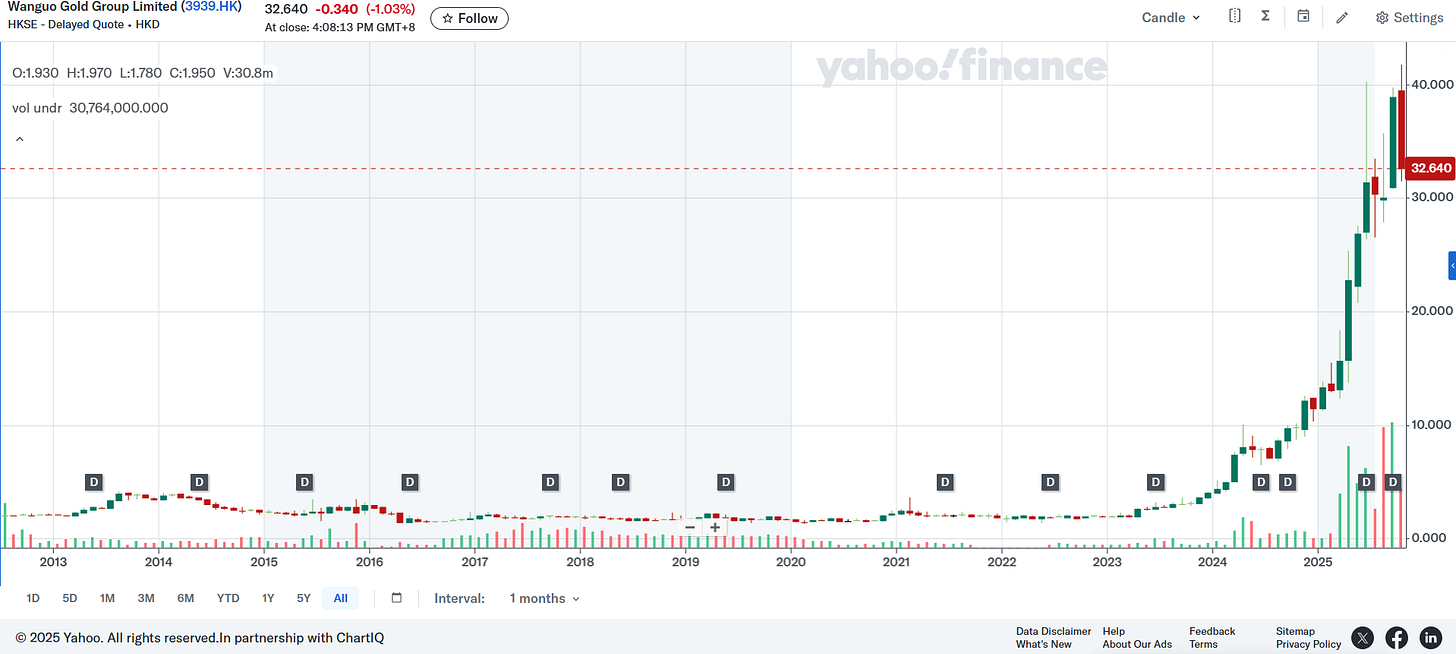

Wanguo Gold Group

🔬 Wanguo Gold Group (03939 HK): Gold Ridge Mine Is Accelerating Value Unlocking, Initiate With “Buy” (Guotai Junan International) 2025-09-29 $ ⚠️

- 🇨🇳 Wanguo Gold Group Ltd (HKG: 3939 / FRA: WI0) – Mining, ore processing & sale of the concentrates product (copper & iron concentrates). 🏷️

- Price/Book (Current): 11.52

- Trailing P/E: 40.41 (no forward P/E) / Forward Annual Dividend Yield: 1.09% (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- China & Hong Kong Stock Picks (November 2024)

- China & Hong Kong Stock Picks (May 2025)

- China & Hong Kong Stock Picks (December 2024)

- China & Hong Kong Stock Picks (October 2024)

- CMBI Research China & Hong Kong Stock Picks (September 2023)

- China & Hong Kong Stock Picks (April 2025)

- CMBI Research China & Hong Kong Stock Picks (September 2024)

- China & Hong Kong Stock Picks (June 2025)

- China & Hong Kong Stock Picks (July-August 2025)

- CMBI Research China & Hong Kong Stock Picks (May 2024)

- China & Hong Kong Stock Picks (February 2025)

- China & Hong Kong Stock Picks (January 2025)

- CMBI Research China & Hong Kong Stock Picks (April 2024)

- CMBI China and Hong Kong Equity Research (June 2023)

- China & Hong Kong Stock Picks (October 2025)