Economics and those who study it can be a dry and boring; but Tucker Carlson recently had a fascinating interview with economist Richard Werner (who predicted the Japanese financial crisis and wrote a book in Japanese called “The Princes of the Yen” which was a best seller in Japan, but is almost unavailable in English outside the country):

🎥 Richard Werner Exposes the Evils of the Fed & the Link Between Banking, War, and the CIA (Tucker Carlson) 2:43:06 Hours (July 2025)

World-renowned economist Richard Werner on where money comes from: banks just create it out of thin air, and keep a pile for themselves.

Chapters:

- 0:00 How Werner Predicted the Japanese Financial Crisis

- 14:16 How Banks Create Money From Nothing

- 24:09 You’re Being Lied to About the Bank’s Role in Economics

- 33:59 The Evils of the Federal Reserve

- 38:51 Why Are Banks Allowed to Create Money?

- 57:12 Was Leaving the Gold Standard a Mistake?

- 1:09:30 The Difference Between Banks and Central Banks

- 1:24:26 How Society and Culture Are Impacted by Banks

- 1:33:11 Did the US Purposely Destroy the Japanese Economy?

- 1:35:42 The Central Bank’s Attempt to Blacklist Werner

- 1:39:03 The CIA’s Threat to Werner

- 1:47:24 Why Werner’s Research on Credit Creation Scared the Central Banks

- 2:03:55 The Link Between Central Banks and Warfare

- 2:18:02 Where Is the US Economy Headed?

- 2:29:49 The World Bank’s Debt Trap to Exploit Developing Countries

- 2:35:34 The Dark Truth About Central Bank Digital Currency

- 2:40:19 Where Can People Learn More About This?

Werner starts by discussing in detail “bank credit creation” theories that he stumbled upon which, to put it simply, is that banks do not act as intermediaries by taking deposits and lending them out. Instead, he argues that banks create money “out of nothing” when they extend credit (e.g. Can Banks Individually Create Money Out of Nothing? – The Theories and the Empirical Evidence).

Such theories were also stumbled upon or written about early in the careers of Keynes, Bernanke and Greenspan – before they all went to work for central banks when they conveniently forgot about such theories. Werner commented that Keynes’ financial wealth in particular increased substantially as he moved away from such theories as he ended up as a Director of the Bank of England while Werner himself got a visit – from the US State Department to tell him the CIA was watching him…

In the interview, it was also discussed why so few “emerging markets” have become “developed countries” – except for countries like South Korea, Taiwan, parts of China, and of course, the USA.

In the case of China, Werner tells an interesting story about how Deng Xiaoping and his people went to Japan to find out why they had such high economic growth. Apparently, he was told to open as many banks as possible because that’s what happened when he went back to China – thousands of “banks” or bank like institutions of all sizes were opened all the way down to the village level to efficiently distribute credit or do money creation in the real economy.

Werner noted how big banks want to do deals with big customers while only small banks lend to smaller firms which account for most employment. This reminds me of how not to long ago, my father was talking to a close family friend who (now retired from an agriculture related job) also farms the land his parent’s farmed.

When he was growing up, he mentioned how his mother (as his father was from the Azores and probably could not speak/read/write English that well) had to go to the local bank to borrow money or get credit at-least five times as they (being farmers) got paid once a year at the time of harvest (but sometimes the money did not last until the next harvest, etc).

In those days, a local bank was truly a local bank as the bank president/directors and all the loan officers probably lived in town or at-least close by and could also find out whether our family friend’s parents were productive farmers or spendthrifts, drunkards, gamblers, etc.

The USA along with Germany (which Werner noted is full of firms considered to be “hidden champions” or the top firms in their respective niches), has long had many thousands, if not tens of thousands of small banks who efficiently lend money to the real or productive economy (rather than just for asset purchases) in their respective geographies. However, the ECB has helped to kill 6,000 banks in Europe through regulation and there is relentless pressure to merge or become bigger in the USA.

Today, the town I grew up in (which is now much bigger than when my great grandfather was alive) has 3 bank branches – one is from a bank headquartered in Chicago, another that was part of a large Spanish multinational banking group (but recently sold to another large banking group from back East), and a third bank that is the closest to being a “local community bank” as it has branches in several surrounding counties (and has its HQ in a nearby town).

Werner noted this relentless consolidation of banks getting bigger and bigger means less lending for productive businesses in local areas plus when banks (especially as they get bigger) lend or are encouraged to lend for asset purchases, you always end up with a banking crisis – which is what happened in Japan in the 1980s-90s.

I should point out that having lots of small banks is not without its share of risks. My father inherited some shares in a local bank from his grandfather. These shares doubled in valued before the bank went bankrupt in the savings and loan fiasco of the 1980s (if I recall, the bank directors either ended up in jail or in serious legal trouble for their activities…). My father had also bought some shares in a local bank in the San Francisco area he grew up in with this bank or rather its shares, after a series of mergers and divestures, ending up as a bank with several branches on the other side of the country in upstate New York sending a 30 cent dividend checks that needed to be signed.

In other words, investing in small banks comes with considerable risks for investors (as there is no FDIC type insurance to cover share values) BUT they do serve an important purpose in helping countries or local geographies grow their real economies.

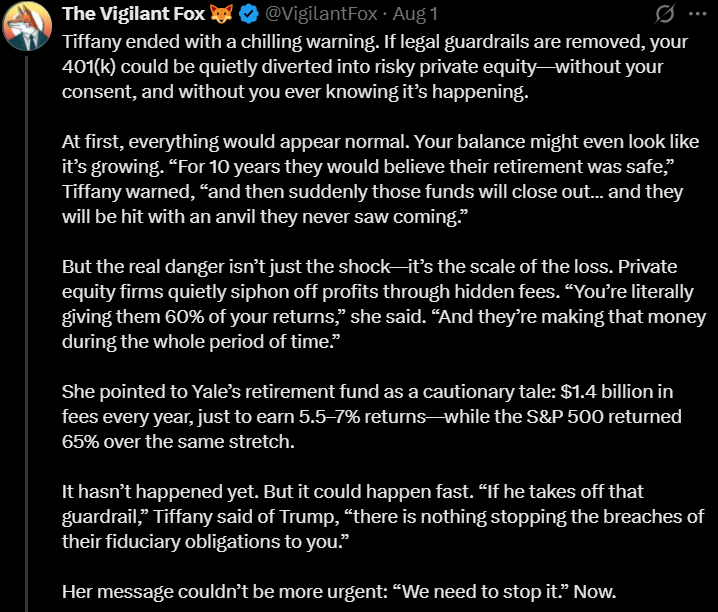

On another recuring theme: Our March 23rd post mentioned an interview with activist Tiffany Cianci (who became an anti-private equity activist after having her franchise taken away and her life almost destroyed when a PE firm took over the company she owned a franchise from and forced her out…) about how private equity and their use of adjustable rate loans can destroy good businesses (aka Red Lobster, Party City, Joann’s, Forever 21, Big Lots and now Hooter’s).

Our April 20th post also mentioned The end of globalisation (Apollo Asia Fund: the manager’s report for 1Q25) which noted predictions of “looming crises in private equity and debt are relevant to American universities, already in some financial difficulty” plus “some Asian pension funds have also been marketing targets for US private equity firms – and major market dislocations usually expose weaknesses in unexpected places.”

In addition, another post of ours noted this piece:

💻 Collapse of Homeplus & More Bankruptcies of PE Owned Companies Globally [A Prelude to Big Short II?] (Douglas Research Insights) Mar 22, 2025 $

Cianci recently has done another interview that was also the subject of a thread on Twitter with these tweets summing up the key points:

The 29 minute interview (including the usual questionable sales pitches/ads in these types of alt-finance podcasts) is worth a listen (although the key points are summed up in the above thread):

Cianci noted that Harvard and Yale are trying to quietly unload their private equity investments they have already strip mined; but nobody wants to touch any of it. Apparently, they are now pitching a continuation fund for the general public that promises “1,000% returns that will make your brain melt” because, in the words of Cianci, “wealthy people always give us access to their investments that give them 1,000% returns…”

This reminds me of some years ago when the asset manager managing my father’s pension or 401k sold us on investing a small portion in some sort of “reinsurance” investment. Without getting into what reinsurance is, the investment pitch was reasonable: Historically and in roughly 1 out of every several years or so, you will have a negative return due to natural disasters. Note that California had not had major earthquakes or fires since I was a kid (I think Northridge & the Oakland Hills fires being the last major ones) and Florida, etc. seemed to be in another lull in the hurricane cycle (except for Katrina hitting New Orleans).

Unfortunately and not long after the investment was made, California suffered from a series of major fires and there were costly hurricanes back east. In the end, all the reinsurance was sold and my dad was lucky as he probably broke even or at-least only lost out on the opportunity cost of not being invested in the general stock market (which was otherwise recovering from the financial crisis).

Note that I can’t remember IF the investment was made after Goldman Sachs had bought the (more or less a local or regional) firm managing what had been the individual pension plans for all the employees of the small manufacturing company my dad spent most of his adult life working for (as for awhile, they were buying up smaller asset or pension managers – only to later divest them or sell them to the employees who worked for the firms).

But if so, it would not have been a surprise to me that this was part of a strategy to unload toxic assets off on unsuspecting retail investors. This means I will be vigilant IF I hear they are trying to put my dad into any kind of “private equity” fund or investment.

In other words, DON’T fall for any investment pitches for unfamiliar types of investment assets – whether reinsurance products or private equity investments that might involve increasingly cash strapped US universities. If you are a simple retail investor looking returns outside the overvalued US stock market, just get an Interactive Brokers or an account from a similar broker that gives you access to thousands of (easier to understand or research) individual stocks and bonds in markets around the world…

As of the start of August, more June/Q2 fund updates have become available (our continuously updated post containing all funds is here – May research has been removed) along with new research starting with a piece that seems to also be pushing investing pensions in private equity:

- 🔬🌐A Rebooting World: Decoding the Changing Pension Landscape (Amundi) – EXECUTIVE SUMMARY

New Asia Fund Documents & Research

- 🔬🌍 APAC Equities: the Sensitivity to Oil Prices (FTSE Russell) – Oil prices have long been one critical driver for macro and equity performance. Amid a volatile oil prices backdrop, we think it is crucial for investors to understand the correlation between oil prices and APAC equity markets.

- 🗄️🌏 Henderson Far East Income Limited (LON: HFEL)’s June monthly factsheet (detailed economic and portfolio – in the top corner + under documents) discussed or mentioned:

- 📈🇰🇷 SK Hynix (KRX: 000660) – Manufactures, distributes & sells semiconductor products in Korea, China, Asia, USA & Europe. DRAM, NAND storage products, SSD, MCP & CMOS image sensors for server, networking, mobile, PC, consumer & auto applications. 🇼 🏷️

- 📈🇨🇳 China Hongqiao Group (HKG: 1378 / FRA: H0Q / OTCMKTS: CHHQF / CHHQY) 🇰🇾 – One of the world’s largest aluminum producer covering the entire aluminum industry chain. 🇼 🏷️

- 📉🌏 Astra International (IDX: ASII / FRA: ASJA / OTCMKTS: PTAIF) – Largest independent auto group in SE Asia. 🇼 🏷️

- 📉🇹🇼 Evergreen Marine Corp Taiwan Ltd (TPE: 2603) – Fleet of 200+ full-containerships. Among the world’s leading international shipping companies. 🇼 🏷️

- 🏧🇨🇳 New China Life Insurance Company (SHA: 601336 / HKG: 1336 / FRA: NCL / OTCMKTS: NWWCF) 🇨🇳 – Nationwide life insurance products & services. 🇼

- 🏧🇮🇳 HCL Technologies (NSE: HCLTECH / BOM: 532281) – Indian multinational IT services & consulting company. 🇼 🏷️

To read more, please visit this article on Substack

Similar Posts:

- EM Fund Stock Picks & Country Commentaries (October 3, 2023)

- Private Equity Group Blackstone to pull out of Russia (FT)

- EM Fund Stock Picks & Country Commentaries (August 24, 2025)

- EM Fund Stock Picks & Country Commentaries (October 5, 2025)

- EM Fund Stock Picks & Country Commentaries (August 22, 2023)

- EM Fund Stock Picks & Country Commentaries (October 10, 2023)

- EM Fund Stock Picks & Country Commentaries (January 4, 2026)

- EM Fund Stock Picks & Country Commentaries (February 15, 2026)

- BNP Paribas’ Chi Lo: Patient Investors Should Build Up China Exposure Now (CMN)

- Asian Banks Are Nibbling the Lunches of Global Banks (CCTV)

- EM Fund Stock Picks & Country Commentaries (May 18 2025)

- EXS Capital’s Solberg: China’s Property and Steel Sectors Look Interesting Now (CMN)

- EM Fund Stock Picks & Country Commentaries (March 23, 2025)

- EM Fund Stock Picks & Country Commentaries (December 14, 2025)

- EM Fund Bank & Financial Stock Picks (Q1 2023)