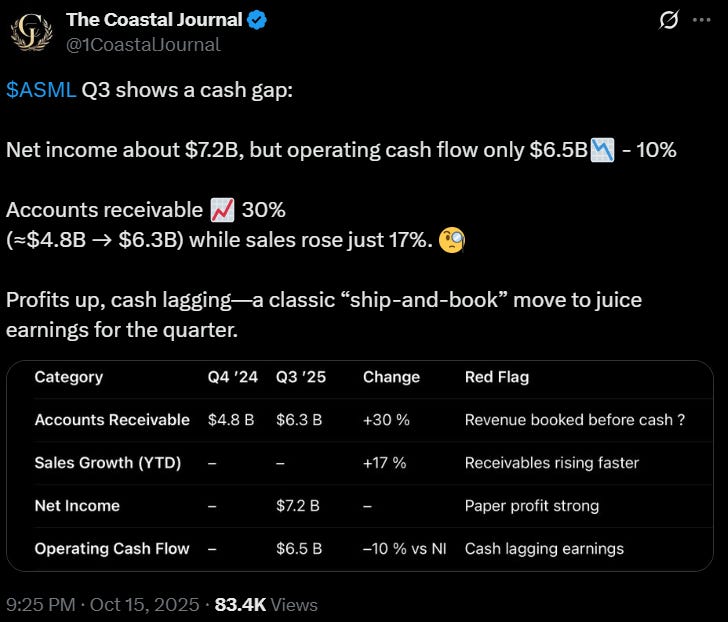

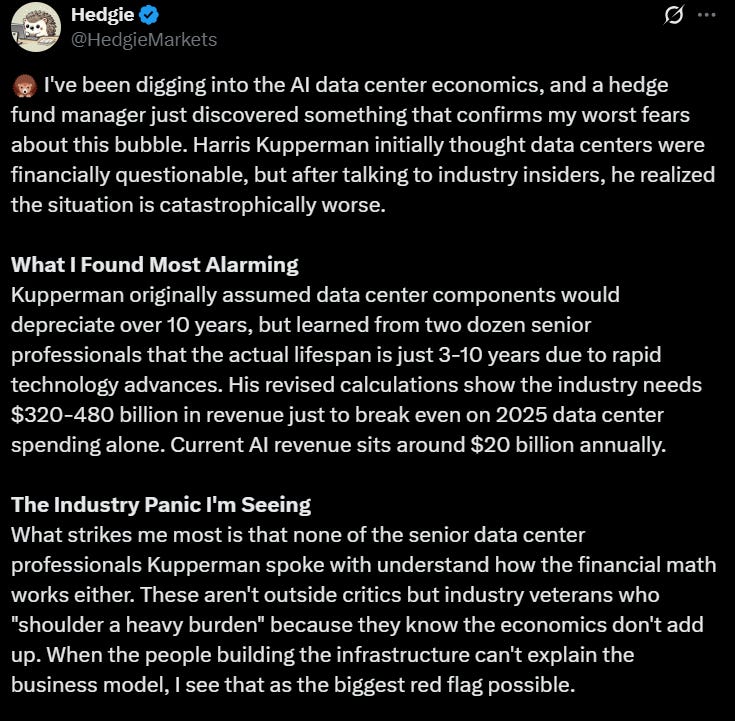

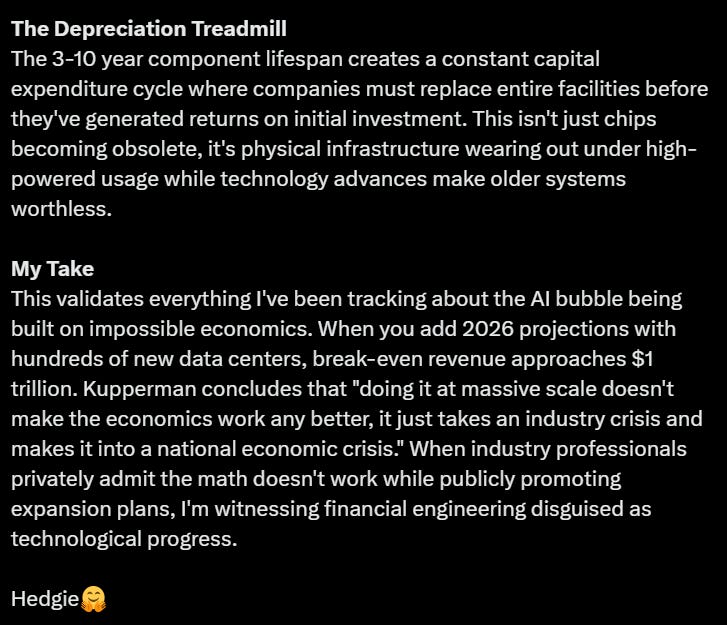

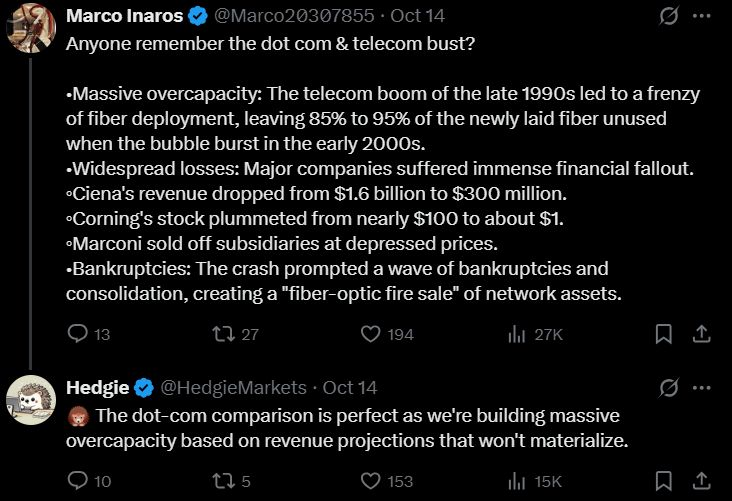

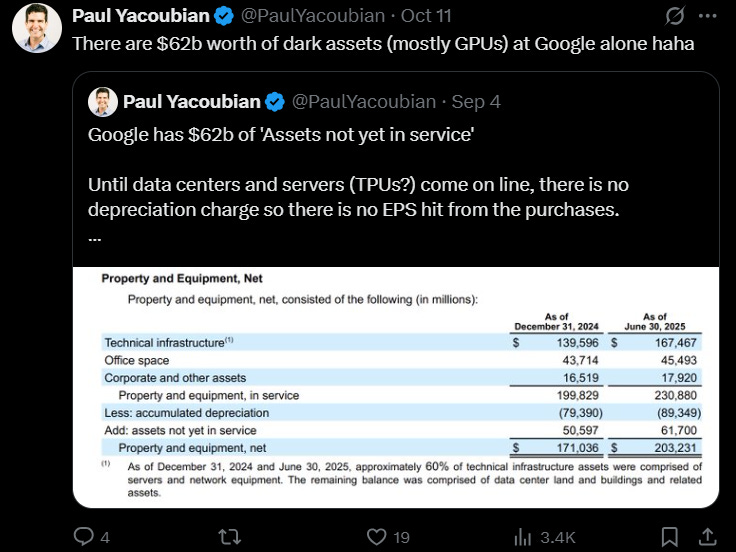

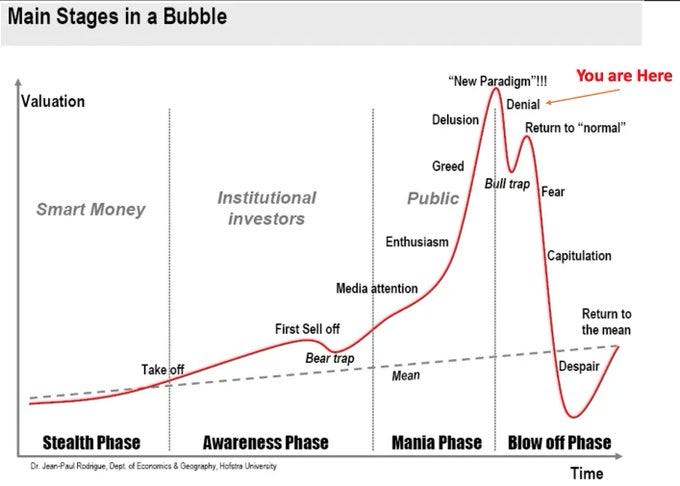

As covered last week, more people are starting to question the “AI boom:”

Note: We mentioned Kuppy’s very reasonable/well thought out Global Crossing Is Reborn… piece at the end of August:

Here is another take (and I have no doubt all those pointless AI slop videos for clicks are sucking up GPUs):

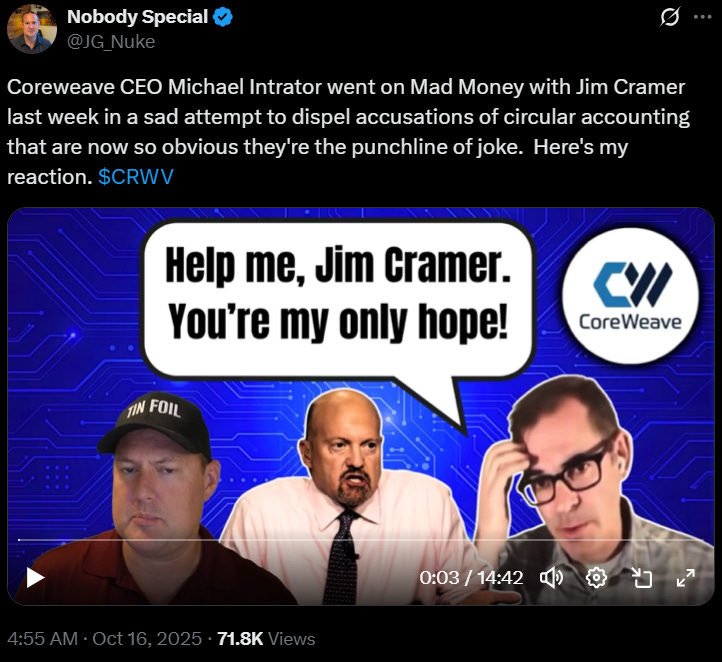

The chart leaves out the part where you appear on Mad Money with Jim Cramer to scam convince retail investors to keep the bubble inflated:

Again, I use free Chinese AI providers such as DeepSeek to help extract and organize or analyse info I give it for these posts and they are very good at doing this (although inconsistent with the output format – perhaps more detailed instructions on my part would mitigate that). Beyond that though, asking them to do something that requires the search aka research function (as in outside research) still needs considerable work (albeit I notice they are now offering footnotes with links).

Last week, I was also trying to find additional providers of free equity research or media with good consistent coverage of them to include in my monthly stock picks post. AI was moderately helpful, but I still ended up going through pages of blue links on Google (the old fashion way) or withing media publications themselves to find some new sources.

With the Internet so full of garbage and outright misinformation or just plain wrong information now, I am not sure how the AI search aka research function can be improved. This means knowing “experts” or sources that can provide accurate information (or having the ability to only have AI use selected sources – I guess they could be included in the user prompt) will increasingly be worth their weight in gold.

“Experts” or sources such as those mentioned earlier who, if they turn out to be right about AI being a bubble right now, are going to be worth listening to instead of the funds, media sources, people like Jim Cramer, etc. who helped to overhype it.

As of the middle of October, more September/Q3 fund updates have become available (our continuously updated post containing all funds is here) along with new research starting with some non-EM research:

- 🔬🌐🚩 Investing Beyond the Cycle: Equity Opportunities in a Slower Growth World (Fiera Capital) – At the same time, the trading framework that drove globalisation for decades is under strain. Supply chains are shifting, developed economies are grappling with higher import costs and export-led emerging markets face reduced demand and limited room for policy manoeuvre.

- 🇺🇸 Rollins Inc (NYSE: ROL) – Pest control company serving residential & commercial clients. 🇼

- 🇺🇸 Heico Corp (NYSE: HEI) – Components & systems (aviation, defense, space, medical & telecommunications). 🇼

- 🇺🇸 Amphenol Corp (NYSE: APH) – Electronic & fiber optic connectors, cable & interconnect systems (coaxial cables, etc). 🇼

- 🔬🇬🇧 Working doesn’t pay in the UK (Morgan Stanley) – The UK’s current policies provide a host of disincentives for British citizens to work. These policies impose great costs at the individual, microeconomic level and are a major drag on GDP. It’s hard to envision a bullish scenario for UK assets until there’s more outrage and less apathy about economic policy.

New Asia Fund Documents & Research

- Asia Frontier Capital has these updates:

- 🗄️🌏 AFC Asia Frontier Fund September (Asian Frontier Markets Deliver a Firm Quarter – September 2025 Update) newsletter (detailed economic and portfolio) covered the Sri Lanka recovery story, a mine tour held in Kazakhstan by Kazatomprom, meeting with 17 companies in Hanoi/Ho Chi Minh City, and an investor conference in Muscat (Oman).Named or unnamed performers/transactions (that can be guessed) discussed or mentioned

- 📈🇵🇰 Lucky Cement (PSK: LUKC / LON: LKCA) – Cement maker. Yunus Brothers Group (YBG). 🇼

- 🇰🇿🏛️ Kazatomprom (FRA: 0ZQ / OTCMKTS: NATKY) – World’s largest uranium producer. 🇼

- 🇰🇿 Halyk Bank (LSE: HSBK / FRA: H4L1) – Corporate Banking, SME Banking, Retail Banking & Investment Banking. 🇼

- 📈🌏 Technology company focussing on Asian frontier countries

- 📈🇲🇳 Gold mine developer (Mongolia)

- 📈🇰🇭 Gold producer in Cambodia

- 📈🇵🇰 Tobacco company (Pakistan)

- 📈🇵🇰 Power equipment producer (Pakistan)

- 🏧🇲🇳 Mongolia-focussed gold explorer.

- 🗄️🇮🇶 AFC Iraq Fund’s September newsletter (economic and portfolio) noted much hotter than usual temperatures coupled with much more than usual frequent power cuts. The update included their recent trip report with pictures with this month’s focus being on their visit to Bashra and sout hern Iraq.

- 🗄️🇺🇿 AFC Uzbekistan Fund’s September newsletter noted President Mirziyoyev’s US trip (he also met with Nasdaq’s President/CEO) has the investment banking world circling Uzbekistan for what they see as potential fees, Tashkent Stock Exchange management changes, etc.

- 🗄️🇻🇳 AFC Vietnam Fund’s September newsletter gave updates on or discussed in detail market developments, a detailed site visit to shrimp farmer & processor Minh Phu Seafood Corp(HNX: MPC) and how Vietnam’s Stock market has been ignited by blockbuster IPOs. Stocks discussed or mentioned were recent or planned IPOs:

- 🗄️🌏 AFC Asia Frontier Fund September (Asian Frontier Markets Deliver a Firm Quarter – September 2025 Update) newsletter (detailed economic and portfolio) covered the Sri Lanka recovery story, a mine tour held in Kazakhstan by Kazatomprom, meeting with 17 companies in Hanoi/Ho Chi Minh City, and an investor conference in Muscat (Oman).Named or unnamed performers/transactions (that can be guessed) discussed or mentioned

To read more, please visit this article on Substack

Similar Posts:

- EM Fund Stock Picks & Country Commentaries (January 12, 2025)

- EM Fund Stock Picks & Country Commentaries (October 13, 2024)

- EM Fund Stock Picks & Country Commentaries (April 20, 2025)

- EM Fund Stock Picks & Country Commentaries (March 16 2025)

- EM Fund Stock Picks & Country Commentaries (December 15, 2024)

- EM Fund Stock Picks & Country Commentaries (May 19, 2024)

- EM Fund Stock Picks & Country Commentaries (July 13, 2025)

- EM Fund Stock Picks & Country Commentaries (July 14, 2024)

- EM Fund Stock Picks & Country Commentaries (December 14, 2025)

- EM Fund Stock Picks & Country Commentaries (November 24 2024)

- EM Fund Stock Picks & Country Commentaries (January 11, 2026)

- EM Fund Stock Picks & Country Commentaries (June 15, 2025)

- EM Fund Stock Picks & Country Commentaries (November 3, 2024)

- EM Fund Stock Picks & Country Commentaries (May 11, 2025)

- EM Fund Stock Picks & Country Commentaries (December 21, 2025)