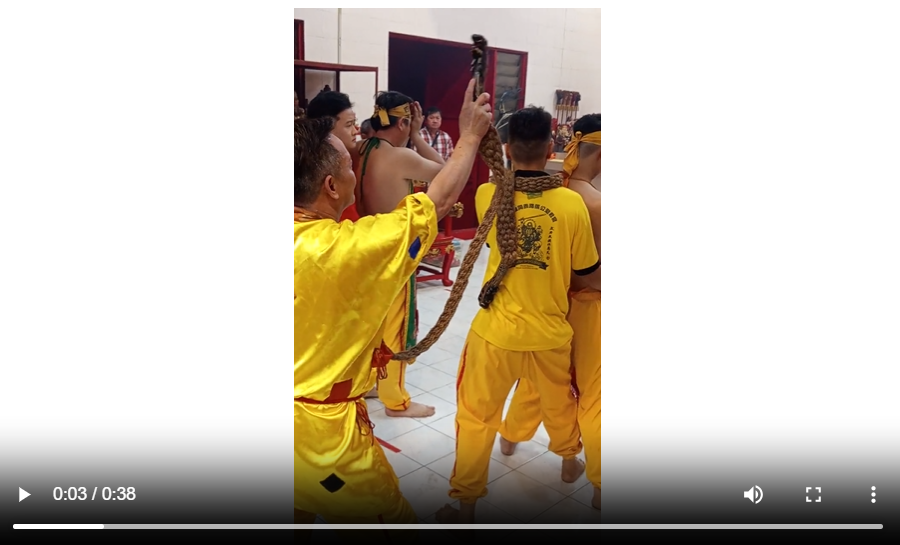

This post and probably Monday’s are a little late as my neighbour Taoist temple had their annual 3 day festival (it also means I received smoke inhalation from all the incense sticks and other burnings) with the procession being on Sunday (another temple did piercing rituals with the piercings being removed after they arrived at this one). Going into trances is always interesting to watch:

As of the middle of September, some August fund updates have become available (our continuously updated post containing all funds is here) and I am going through/updating the Other International Funds page plus new research staring with some non-EM funds – some are finally having a reality check on Europe:

- 🔬🌐 Institutional capital in Asia-Pacific is eyeing the Anglosphere (Fiera Capital) – Writing for PERE, CJ Morrell, Head of Japan explored how institutional investors in Asia-Pacific are under pressure to deliver higher, risk adjusted returns. Many investors are now looking beyond their home markets toward the Anglosphere, with growing appetite for value-add strategies and more liquid structures.

- 🇯🇵 Sumitomo [residential joint venture with Mirvac in Australia]

- 🇦🇺 Mirvac Group (ASX: MGR / OTCMKTS: MRVGF) – Property investment, development & retail services. 🇼

- 🇯🇵 Daibiru – subsidiary of Mitsui O.S.K. Lines, Ltd (TYO: 9104 / FRA: MILA / OTCMKTS: MSLOF) 🇼

- 🔬🇪🇸 Iberia: A Strategic Debt Opportunity (Fiera Capital) – Ignacio Ruíz Gallego, Investment Associate at Fiera Real Estate, recently spoke with Spain’s Brains Real Estate News about Fiera’s European real estate debt strategy, its expansion into the Iberian market and the attractive opportunities the region offers for well-capitalised alternative lenders.

- 🔬🌏 Defense and financials bring strong run for value strategy (Robeco) – Stock picking in defense and European financials has allowed Robeco Boston Partners Global Premium Equities to enjoy a strong run this year.

- Defense firms to benefit from ReArm Europe and NATO targets

- European banks have enjoyed good cash flow and interest margins

- Global Premium Equities remains overweight Europe and underweight US

- 🇩🇪 Rheinmetall AG (ETR: RHM / FRA: RHM / OTCMKTS: RNMBF)– Arms manufacturer.

- 🔬🇫🇷 French bonds under pressure: Our view (Robeco) – France’s turmoil is no longer just political. It’s shaking the French bond market and pushing yields to new highs. We asked our macro strategist Rikkert Scholten for his view.

- French bond spreads have widened sharply, even trading above Italy

- Political deadlock raises downgrade risk and keeps debt costs rising

- We remain underweight France, favoring opportunities in other eurozone markets

- 🔬🇫🇷 Quick View: Political upheaval and budgetary uncertainty leaves France at a crossroads (Janus Henderson) – Following French Prime Minister François Bayrou’s loss of a confidence vote, Robert-Schramm Fuchs explores the implications for investors and explains why he remains positive on Europe, with France’s neighbour Germany offering a compelling macroeconomic narrative.

- 🔬🇬🇧 The UK’s perfect storm (The Macro Brief by HSBC Global Research) 15 Minutes – From sticky inflation to precarious public finances, Liz Martins, Senior UK Economist, assesses the UK’s financial troubles as the country looks ahead to an Autumn Budget.

New Asia Fund Documents & Research

- 🔬🌏🚩 Why now (really) is the time for emerging markets and Asia (Aberdeen Investments) – The dollar is down, capex is up, and domestic demand is rising. Why emerging markets and Asia are back in focus – and why it’s just the beginning.

- 🇰🇷 HD Korea Shipbuilding & Offshore Engineering Co., Ltd. (KRX: 009540) – Shipbuilding & offshore engineering businesses. 🏷️

- 🇲🇽 Grupo Mexico (BMV: GMEXICOB / FRA: 4GE / OTCMKTS: GMBXF) – Mining, Transportation, Infrastructure & Fundacion Grupo Mexico. ASARCO (American Smelting & Refining Company) + Southern Copper (NYSE: SCCO). 🇼 🏷️

- 🇰🇿🏛️ Kazatomprom (FRA: 0ZQ / OTCMKTS: NATKY) – World’s largest uranium producer. 🇼

- 🇭🇰 Techtronic Industries (HKG: 0669 / FRA: TIB1 / OTCMKTS: TTNDY / OTCMKTS: TTNDF) 🇭🇰 – Cordless technology spanning Power Tools, Outdoor Power Equipment, Floorcare & Cleaning Products. Brands like MILWAUKEE, RYOBI & HOOVER. 🇼 🏷️

- 🇹🇼 MediaTek (TPE: 2454 / OTCMKTS: MDTTF) – Fabless semiconductor company. Systems-on-chip (SoC) for mobile device, home entertainment, connectivity & IoT products. 🇼 🏷️

- 🇨🇳 Zhejiang Sanhua Intelligent Controls Co Ltd (SHE: 002050) – HVAC&R manufacturer of controls & components.

- 🇹🇼 Delta Electronics (TPE: 2308) – Power supply industry for cloud computing, IT equipment, industrial, medical, lighting, machine tools & electric vehicles. 🇼 🏷️

- 🇰🇷 SK Hynix (KRX: 000660) – Manufactures, distributes & sells semiconductor products in Korea, China, Asia, USA & Europe. DRAM, NAND storage products, SSD, MCP & CMOS image sensors for server, networking, mobile, PC, consumer & auto applications. 🇼 🏷️

- 🇮🇳 Bajaj Holdings And Investment Ltd (NSE: BAJAJHLDNG / BOM: 500490) – Invests in listed & unlisted securities. Post-demerger stakes in Bajaj Auto Ltd (NSE: BAJAJ-AUTO / BOM: 532977) & Bajaj Finserv Ltd (NSE: BAJAJFINSV / BOM: 532978). 🇼

- 🇨🇳 ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) 🇰🇾 – Design, R&D, manufacturing, marketing & sales of professional sports products. Acquired Amer Sports (NYSE: AS) (global sportswear group). 🇼 🏷️

- 🇨🇳 Li Ning (HKG: 2331 / FRA: LNLB / LNL / OTCMKTS: LNNGY / LNNGF) 🇰🇾 – Founded by former Olympic gymnast Li Ning. Professional & leisure footwear, apparel, equipment & accessories. 🇼 🏷️

- 🇨🇳🏛️ Wuliangye Yibin Co., Ltd. (SHE: 000858) – Baijiu distillery. 🇼

- 🇨🇳 Midea Group (SHE: 000333 / HKG: 0300 / FRA: 1520 / OTCMKTS: MGCOF) 🇨🇳 – Manufactures & sells home appliances & robotic & automation systems (Smart Home, Electro-Mechanical, Building Technologies, Robotics & Automation & Digital Innovation). 🇼 🏷️

- Asia Frontier Capital has these updates:

- 🗄️🌏AFC Asia Frontier Fund’s August (Asian Frontier Markets Report Another Solid Month – August 2025 Update) discussed the third month in a row of gains for the Dhaka Broad Index in Bangladesh (which could be the start of the upward re-rating cycle for Bangladesh stocks) along with the good performance of Sri Lankan bank holdings and gold mining stocks in Mongolia.Named or unnamed performers/transactions (that can be guessed) discussed or mentioned

- 📈🇧🇩 BRAC Bank (DSE: BRAC) – Provides banking solutions to ‘unbanked’ SMEs. 🇼

- 📈🇱🇰 Commercial Bank of Ceylon PLC (CSE: COMB / COMBt) or ComBank – Premier private sector commercial bank. SME lender. 🇼

- 📈🇱🇰 Hatton National Bank (CSE: HNB / HNBt) – Foremost private commercial bank to institute housing loans. 🇼

- 📈🇲🇳 Mongolian Gold Miners

- 🏧 Bangladeshi Bank (Unnamed)

- 📈🇲🇳 Copper mine developer (Mongolia/Australia)

- 📈🇲🇳 Gold mine developer (Mongolia)

- 📈🇲🇳 Producing gold mine (Mongolia)

- 📈🇻🇳 Vietnamese port operator (Vietnam)

- 📈🇲🇳 Copper/gold mine developer (Mongolia)

- 🇵🇰 Cement producer in Pakistan

- 🇰🇿 Bank in Kazakhstan

- 🗄️🇮🇶 AFC Iraq Fund’s August newsletter (economic and portfolio) discussed the world’s surprise boomtown (Baghdad) and their recent trip report with pictures with this month’s focus being on their visit to Baghdad to Ur, the Marshes, and Al-Qurnah.

- 🗄️🇺🇿 AFC Uzbekistan Fund’sAugust newsletter noted impressive results across the financial services industry and why the fund’s dividend yield has been falling. Stocks discussed:

- 📈🇺🇿 Hamkor Bank (TSE: HMKB) – One of the largest banks in the country.

- 📈🇺🇿🏛️ The Uzbek Commodity Exchange (TSE: URTS) – The largest trading platform in Central Asia & a dynamically developing commodity exchange in the CIS countries. 🏷️

- 🗄️🇻🇳 AFC Vietnam Fund’s August newsletter gave updates on or discussed in detail market developments, Vietnam sees record FDI inflows, era of infrastructure investment, multi billion USD IPOs on the horizon, and Minh Phu Seafood Corp(HNX: MPC). Stocks discussed or mentioned:

- 🇻🇳 Lam Dong Mineral and Building Material JSC (HOSE: LBM) – Precasted concrete, tuynel brick, construction stone, refractory material, kaolin & Bentonite

- 🇻🇳 Agriculture Bank Insurance JSC (HNX: ABI) – Insurance.

- 🇻🇳 Thien Long Group Corp (HOSE: TLG) – Stationery maker.

- 🇻🇳 Minh Phu Seafood Corp (HNX: MPC) – Shrimp farming & processing.

- 🇻🇳 Tng Investment And Trading JSC (HNX: TNG) – Garment maker.

- 🇻🇳 Hoang Quan Consulting Trading Service Real Estate Corp (HOSE: HQC) – Investment & development of social housing + real estate, education & finance businesses.

- 🗄️🌏AFC Asia Frontier Fund’s August (Asian Frontier Markets Report Another Solid Month – August 2025 Update) discussed the third month in a row of gains for the Dhaka Broad Index in Bangladesh (which could be the start of the upward re-rating cycle for Bangladesh stocks) along with the good performance of Sri Lankan bank holdings and gold mining stocks in Mongolia.Named or unnamed performers/transactions (that can be guessed) discussed or mentioned

To read more, please visit this article on Substack

Similar Posts:

- EM Fund Stock Picks & Country Commentaries (July 13, 2025)

- EM Fund Stock Picks & Country Commentaries (March 16 2025)

- EM Fund Stock Picks & Country Commentaries (May 11, 2025)

- EM Fund Stock Picks & Country Commentaries (June 15, 2025)

- EM Fund Stock Picks & Country Commentaries (December 22, 2024)

- EM Fund Stock Picks & Country Commentaries (July 14, 2024)

- EM Fund Stock Picks & Country Commentaries (September 22, 2024)

- EM Fund Stock Picks & Country Commentaries (December 15, 2024)

- EM Fund Stock Picks & Country Commentaries (April 20, 2025)

- EM Fund Stock Picks & Country Commentaries (May 19, 2024)

- EM Fund Stock Picks & Country Commentaries (July 20, 2025)

- EM Fund Stock Picks & Country Commentaries (October 13, 2024)

- EM Fund Stock Picks & Country Commentaries (May 26, 2024)

- EM Fund Stock Picks & Country Commentaries (September 29, 2024)

- EM Fund Stock Picks & Country Commentaries (November 24 2024)