I am doing the first multiday stopover in Taipei since COVID later this week for around 10 days (meaning coming Sunday and Monday posts could be delayed) as China Airlines (TPE: 2610) has restarted allowing multiday stopovers (depending on availability) for the same price on tickets that would otherwise have a few hours layover. I also came upon this recent FT article saying Taiwan’s economy roars ahead on back of AI demand (🗃️):

Growth forecast for 2025 raised to 7.37%, the fastest rate in 15 years

However:

The electronics boom sharply contrasts with some parts of Taiwan’s domestic economy and traditional industries. “The export momentum of certain traditional products continues to be constrained by global overcapacity,” the statistics agency said.

Real private consumption increased just 1.19 per cent in the third quarter compared with the same period last year.

Note that Kuala Lumpur malls have gone all out with Christmas decorations (as usual…) and were packed last weekend BUT (and despite Malaysia also said to be benefiting from AI & a shift of production away from China) that does not automatically mean ordinary people are spending much money.

Finally, Korea (I’m planning to use expiring FF miles for a long trip there next year) is starting to become more and more interesting thanks to these ongoing and mostly positive reforms noted by the Douglas Research Insights Substack:

- 🇰🇷 Foreigners Integrated Accounts Starting in January 2026: Impact on IBKR & Foreign Trading Platforms (Douglas Research Insights) $

- 🇰🇷 Top Bracket Dividend Tax Rate Lowered to 30% in Korea [Moderately Positive] (Douglas Research Insights) $

- 🇰🇷 Confirmation of Cancellation of Treasury Shares To Be Made Into Law by End of 2025 and a Loophole? (Douglas Research Insights) $

- 🇰🇷 Likely Increase In Mandatory Tender Offer from the Current 50% + 1 Share Requirement (Douglas Research Insights) $

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 EM Fund Stock Picks & Country Commentaries (November 30, 2025) Partially $

- Family offices starting to wake up (& seek liquidity), understanding Chinese competition / growth potential, Mexico’s resilience, excellence in EM individual stock awards, October/Q3 fund updates, etc

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 APAC commercial real estate investments up 25% in Q3 (The Asset) 🗃️

- Hong Kong surges on mainland flows, easing tariff uncertainty and lower financing costs lift other key markets

- Asia-Pacific commercial real estate investment volumes rose 25% year-on-year to US$50.4 billion in the third quarter of 2025, regaining momentum after a subdued first half of the year, according to a new report.

- The rebound was driven by a surge in large portfolio and entity-level deals, which together accounted for half of all transactions during the quarter, MSCI says in its latest Asia-Pacific Capital Trends report.

- Much of the improvement was underpinned by lower financing costs across several key markets, including South Korea, Australia, Singapore, Hong Kong, and India, as well as an easing of trade-related uncertainty.

🇯🇵 Asian Dividend Gems: Daicel Corp (Asian Dividend Stocks) $

- Daicel Corp (TYO: 4202 / FRA: 9DC / OTCMKTS: DACHF) is notable for being Japan’s only manufacturer of acetic acid and for holding world-leading market positions in some cellulose-acetate products and in acetate tow for cigarette filters.

- At current prices, the dividend yield of the company is at a healthy 4.6%. Its dividend yield averaged 4.4% from FY2021 to FY2025.

- The company has enjoyed a solid sales growth of 10.5% CAGR from FY2021 to FY2025. Operating income nearly doubled from FY2021 to FY2025.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 CICC, Dongxing and Cinda to create China’s fourth trillion-yuan brokerage (The Asset) 🗃️

- All-stock merger reinforces industry consolidation aimed at building ‘first-class investment banks’

- China International Capital Corporation ( CICC ) has announced plans to acquire smaller rivals Dongxing Securities and Cinda Securities in a move that would create the country’s fourth-largest investment bank with assets amounting to 1.01 trillion yuan ( US$140 billion ).

- The proposed all-stock merger aims to “accelerate the building of a world-class investment bank, support capital market reforms, and lift the securities sector to high-quality development”, CICC says in a statement.

🇨🇳 Alibaba, Ant Race to Catch Rivals in China’s AI App Boom (Caixin) $

- Alibaba (NYSE: BABA) and its affiliate Ant Group Co. Ltd. are accelerating efforts to capture consumer attention in China’s booming artificial intelligence sector. The companies’ newly released AI apps have notched millions of downloads in just days, bolstered by aggressive marketing campaigns.

- Alibaba said its AI-powered chatbot app Qianwen surpassed 10 million downloads within a week of launching public testing on Nov. 17. Ant’s vibe coding app LingGuang, which debuted a day later, topped 2 million downloads in its first six days.

- The surge has propelled Qianwen to fourth place and LingGuang to sixth on China’s Apple App Store free-app chart. The top spots are held by ByteDance Ltd.’s Doubao, short-drama app Hongguo, and a music service from ByteDance-owned Douyin.

🇨🇳 In a world obsessed with AI, why PDD/Temu refuses to talk about It (Momentum Works)

- In a world obsessed with AI, Temu parent PDD Holdings (NASDAQ: PDD) or Pinduoduo again looks like an anomaly.

- PDD Group announced their Q3 earnings last week. Again the market reacted negatively, sending the share price down by 7.33% in the trading day after the announcement.

- The earnings call, as usual, became a major contributor to the price drop. We have published the Q&A parts of the call here.

- Are investors increasingly becoming impatient about the management? And why do Lei Chen and Jiazhen Zhao, the Co-CEOs, kept dampening the investor mood (highly unusual amongst profitable listed companies)?

- Here are some of our thoughts about the latest performance of the group:

🇨🇳 Brazil’s Lucrative Logistics Market Poses Major Challenges for Chinese Firms, Regional Head Says (Caixin) $

- While the Brazilian market offers significant potential, it also poses challenges such as underdeveloped infrastructure and a complex regulatory and labor environment, the Brazil CEO of J&T Global Express Ltd (HKG: 1519 / SWB: J92) said.

- “After really understanding Brazil, you find that although there are many opportunities, it’s not a market where a novice can just come in and dominate,” said Gui Linqun, who heads the logistics giant’s operations in Latin America’s largest economy.

- The allure of the Brazilian market is driven by rapidly rising e-commerce penetration, which is expected to reach a market scale of $78 billion in 2025, the highest in Latin America, according to eMarketer. This growth has attracted a wave of Chinese platforms. Fast-fashion platform Shein entered Brazil in 2019, followed by PDD Holdings (NASDAQ: PDD) or Pinduoduo’s Temu in June 2024. TikTok and Kwai joined the fray in late 2024 and early 2025, while Alibaba’s AliExpress has been present for years.

🇨🇳 Didi Q3 2025 Earnings – Worse Than Feared (The Great Wall Street) $

- The concerns I raised before turned out worse than I expected.

- Reading through the quarterly report, I was immediately reminded of Wolfgang Pauli, the Nobel Prize-winning physicist famous for dismissing bad theories with the ultimate academic insult: “That’s not right. That’s not even wrong.”

- My first instinct looking at DiDi Global (OTCMKTS: DIDIY)’s numbers was similar—”That’s not good. That’s not even bad.”

- Having sat with it longer, I reconsidered. It’s not that the results exist in some quantum state below bad. They’re just bad. The China business is actually okay—mildly good, even. But some of the concerns I raised in my last piece are actually worse than I initially thought.

🇨🇳 Didi Global Q325 Results | China Solid, But International Goes From Bad to Worse | How to Fix? (Smartkarma) $

- DiDi Global (OTCMKTS: DIDIY)’s China business showed solid Y/Y growth, but International worsened dramatically

- Spending on Sales & Marketing (including incentives) was up CNY 1.7 bn Y/Y, or +55%

- Should it seek an IPO soon, Didi will have to show a path to profits for International segment

🇨🇳 JOYY: Growth In Bigo Unit May Drive Re-Rating (Seeking Alpha) $ 🗃️

- 🇨🇳 JOYY Inc (NASDAQ: YY) – Operates several social products: Bigo Live for live streaming, Likee for short-form videos, Hago for multiplayer social networking, an instant messaging product etc. Singapore HQ. 🇼 🇼 🇼 🏷️

🇨🇳 GDS bets on new AI cycle while balancing expansion, deleveraging (Bamboo Works)

- The data center operator has begun listing its real estate assets to pay down debt as it races to capitalize on growing demand for AI computing

- Data center operator GDS Holdings Ltd (NASDAQ: GDS) reported its third-quarter revenue rose 10.2% to 2.89 billion yuan

- The company generated 1.37 billion yuan from transferring some of its assets into a REIT, contributing to its net profit of 729 million yuan for the quarter

🇨🇳 Dongshan Precision offers investors an acquisitive, but debt heavy, tech component play (Bamboo Works)

- After moving from its original sheet metal processing business into PCBs through acquisitions, the company has filed for a Hong Kong IPO to complement its existing Shenzhen listing

- Suzhou Dongshan Precision Manufacturing Co Ltd (SHE: 002384) has filed for a Hong Kong IPO, offering investors a company that has transformed from sheet metal processor to the world’s third-largest PCB supplier

- The company’s aggressive expansion into AI and automotive markets risks overextending its finances with mounting debt

🇨🇳 Tencent/Netease: Zero Approval in November Despite Game Approvals at New High (Smartkarma) $

- China announced game approval for the November batch. The number of games approved remained at a higher level than 2023.

- The pace of China game approval appears to have accelerated to above the pre-tightening level.

- Of the companies that we are monitoring, while market leader Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY) and Netease didn’t obtained approval, Kingsoft Corporation (NASDAQ: KC) and Bilibili (NASDAQ: BILI) obtained approval for one game each.

🇨🇳 Xiaomi’s EV, AI Units Post First Quarterly Profit (Caixin) $

- Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) reported its first-ever quarterly profit from its electric vehicle (EV) and artificial intelligence (AI) businesses, marking a milestone in the tech giant’s diversification strategy, though the achievement was overshadowed by the mounting pressure on its mainstay smartphone business.

- The company’s EV, AI and other new initiatives segment posted an operating profit of 700 million yuan ($98 million) in the third quarter, reversing a loss of 500 million yuan a year ago, according to its latest earnings report released Tuesday.

- Revenue from its EV business nearly tripled to 28.3 billion yuan. The company said it expects to hit its annual sales target of 350,000 vehicles this week, after delivering 108,800 cars in the third quarter. The average selling price of its cars also rose to 260,100 yuan in the third quarter from 253,700 yuan in the previous quarter, driven by strong demand for its high-end SU7 Ultra.

🇨🇳 Xiaomi, Founder Stem Stock Rout With $115 Million Buyback (Caixin) $

- Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) and its founder have gone on a stock buyback spree, repurchasing more than HK$900 million ($115.6 million) of the company’s shares on three consecutive trading days, as its stock continues to slump.

- The move comes as the Hong Kong-listed electronics giant’s shares have plunged more than 30% since late September, erasing over HK$550 billion in market value and making it a laggard on the Hang Seng Tech Index.

- The stock rout reflects growing investor anxiety over Xiaomi’s future profitability, triggered by a series of setbacks including market disappointment after a new phone launch, a fatal accident involving one of its electric vehicles (EVs) and a warning of shrinking margins at its core smartphone and burgeoning EV businesses.

🇨🇳 Analysis: Xiaomi’s Smartphone Slip Overshadows EV Success (Caixin) $

- Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF)’s quarterly results have prompted several brokerages to cut their forecasts for the Chinese electronics giant’s earnings and stock price, as a dip in revenue from its mainstay smartphone business overshadowed its success in electric vehicles (EVs).

- Bocom International Holdings Co. Ltd. has lowered its revenue estimates for the Hong Kong-listed company to 466.6 billion yuan ($65.9 billion) for 2025 and 534 billion yuan the following year. Huatai Securities Co. Ltd. has cut its estimates for Xiaomi’s non-GAAP net profit growth by 1.6% for 2025 and 7.6% for 2026. The brokerage has also slashed its stock price target for Xiaomi to HK$53.8 ($6.92) from HK$65.4.

🇨🇳 In Depth: Chinese Carmakers Shift to ‘Asset-Light’ Models in Overseas Expansion (Caixin) $

- Chinese carmaker Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF) is betting that an “asset-light” investment model will accelerate its overseas expansion, as competition among China’s automakers to win foreign drivers intensifies amid the global shift toward electric vehicles (EVs).

- Earlier this month, Hong Kong-listed Geely Automobile Holdings Ltd. and its parent, Zhejiang Geely Holding Group Co. Ltd., signed an agreement to acquire a combined 26.4% stake in Renault Group’s Brazilian subsidiary — a move that gives Geely a foothold in South America’s largest auto market while enabling the pair to produce and sell new-energy vehicles there.

🇨🇳 In Depth: Are China’s Futuristic EV Designs Sacrificing Safety for Style? (Caixin) $

- As Chinese automakers race to define the look of the electric-vehicle (EV) era with bold, futuristic designs, a growing safety backlash is forcing an engineering reality check.

- In October, a fatal crash in Chengdu, Sichuan involving Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF)’s SU7 sedan drew national attention when passersby were unable to open the vehicle’s hidden, power-operated door handles. The EV lost power and caught fire, killing the driver. The tragedy came as regulators were already reviewing a draft standard that could effectively outlaw flush handles — a once-fashionable feature popularized by Tesla Inc.

🇨🇳 Robotaxi rollout drives faster earnings pace at WeRide (Bamboo Works)

[WeRide Inc (NASDAQ: WRD)]

- The driverless technology company is enjoying a payoff from expanding its global taxi fleet, with quarterly revenues surging and losses continuing to shrink

- Third-quarter revenue more than doubled, marking the biggest quarterly jump in the company’s history

- Gross margin leapt to 32.9% as robotaxi revenues took off

🇨🇳 ATRenew gears up to take its recycling act global (Bamboo Works)

- The company said it has begun exporting Chinese devices, and plans to build up that part of its business over the next two to three years

- [Pre-owned consumer electronics transactions and services platform] ATRenew (NYSE: RERE)’s revenue rose 27% in the third quarter, as it unveiled a roadmap for the next two to three years that includes a new emphasis on exports

- The company recorded a record profit for the quarter and strong gross margin gains, as its direct-to-consumer retail sales improved

🇨🇳 Haier Smart Home (6690 HK) – Steady Execution to Win the Race (Smartkarma) $

- Solid Q3 and 9M FY25 Financial Delivery: Despite challenging market conditions in China, Haier Smart Home (SHA: 600690 / HKG: 6690 / OTCMKTS: HSHCY / OTCMKTS: HRSHF) delivered solid third-quarter results reinforcing company’s strategic positioning and operational execution.

- Operational Efficiency and Mix Upgrade: The company continued to benefit from digitalised manufacturing, supply-chain optimisation, and higher contribution from high-end segments, supporting EBITDA and net profit resilience despite macro softness

- Strategic Focus Driving Sustainable Growth:Emphasis on Smart Home ecosystem expansion, global penetration, and disciplined capital allocation reinforce its competitive positioning and sets the foundation for sustained earnings momentum into FY26.

🇨🇳 Analysis: Starbucks’ Discounted China Sale Shows Its Struggles in Crowded Market (Caixin) $

- Starbucks Corp (NASDAQ: SBUX) is selling control of its China business at a discount, highlighting the challenges the U.S. coffeehouse chain has faced in an increasingly crowded and competitive market.

- Starbucks and private equity firm Boyu Capital will form a joint venture to operate the coffee chain’s business in China, according to a deal announced Monday. Boyu, which has invested widely in consumer brands and was a cornerstone investor in bubble tea giant MIXUE Group (HKG: 2097 / OTCMKTS: MXUBY)’s Hong Kong IPO, will acquire up to a 60% stake in the venture. Starbucks will retain 40% and license its brand and intellectual property to the new entity.

🇨🇳 Yum China Drops Game-Changing Formats—How Mini Stores & KCOFFEE Are Rewriting the Playbook! (Smartkarma) $

🇨🇳 Gold rally dents sales at China’s jewellery retailers (FT) $ 🗃️

- High prices and a new tax regime have deterred buyers and led to hundreds of store closures

- Chow Tai Fook Jewelry Group (HKG: 1929 / FRA: 1CT / OTCMKTS: CJEWY / CJEWF), China’s biggest jewellery retailer by sales, has closed about 1,000 mainland stores this year, a reduction of 15 per cent. The company on Tuesday reported net profit of HK$2.5bn (US$320mn) in the half-year to the end of September, unchanged from a year earlier, on HK$39bn of revenue, its lowest in five years.

- Over the past year, rival operator Luk Fook Holdings (International) Ltd (HKG: 0590 / FRA: LUY1 / OTCMKTS: LKFLF) has closed more than 200 mainland stores, reducing its total store count since the start of the year by 7 per cent. The company on Thursday said half-year revenue to the end of September increased 26 per cent to HK$6.8bn compared with the same period last year, while net profit rose by 42.5 per cent to HK$619mn.

🇨🇳 Chow Tai Fook(1929 HK): Dark Clouds Are Looming; Valuation Multiple Could Decline (Smartkarma) $

- In this insight, we discuss about various aspects of Chow Tai Fook Jewelry Group (HKG: 1929 / FRA: 1CT / OTCMKTS: CJEWY / CJEWF)‘s H1 FY2026 financial performance. It discusses about divergent performance by region and product.

- Details in this note include why dark clouds are looming over the stock price of this counter and why the valuation multiple could decline.

- Finally, we conclude discuss on valuation and how this will impact the stock price.

🇨🇳 Mens clothier HLA seeks to cast off stagnation with overseas expansion (Bamboo Works)

- The dominant menswear maker has filed for a Hong Kong listing, seeking funds to expand overseas as its growth at home slows and even contracts

- HLA Group CO Ltd (SHA: 600398) has filed to list in Hong Kong, reporting its net profit plunged 25% in 2024 as its revenue fell 3%

- The leading men’s clothing maker reported its revenue edged up slightly in the first half of 2025, while its profit continued declining

🇨🇳 Atour celebrates ‘Year of the Pillow’ with fluffy revenue growth (Bamboo Works)

- The hotel operator expects to report 35% revenue growth for all of 2025, up from a 25% forecast at the start of the year, thanks to strong performance for its retail business

- Atour Lifestyle Holdings (NASDAQ: ATAT) reported 38.4% revenue growth in the third quarter, and raised its full-year guidance to 35% from a previous forecast of 25% growth

- The hotel operator’s revpar continued to decline in the third quarter, but it said the situation should improve after a strong performance during the weeklong Oct. 1 holiday

🇨🇳 China Vanke’s bonds plunge on fears of waning state support (FT) $ 🗃️

- Property developer asks for delay in payment despite backing of Shenzhen Metro

- Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / OTCMKTS: CHVKF / CHVKY) shares and bonds plunged on Thursday after it became the first state-backed property developer to request a delay on a bond payment, reigniting fears around the Chinese real estate sector’s financial health.

🇨🇳 Vanke Seeks to Delay Repayment on 2 Billion Yuan Note as Debt Pressures Mount (Caixin) $

- Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / OTCMKTS: CHVKF / CHVKY) has called a Dec. 10 bondholder meeting to vote on extending repayment of a 2 billion yuan ($282 million) note, underscoring mounting debt pressure grappling the embattled property giant despite months of state-backed support.

- The note, “22 Vanke MTN004,” was issued in December 2022 with a three-year maturity and 3% coupon. The company’s Wednesday filing marks its first public attempt to seek an extension, amid rising convers over its liquidity.

🇨🇳 Qfin goes from fintech stud to dud as new regulations kick in (Bamboo Works)

- The online loan facilitator posted weak third-quarter results and was downbeat on the final three months of the year, contrasting with a strong finish to 2024

- Qifu Technology (NASDAQ: QFIN)’s revenue slipped 0.2% in the third quarter and its net profit fell 17%, reflecting challenges it faces in a lackluster economy

- The company also issued a bearish outlook for the whole year as new regulations are set to squeeze its online loan facilitation business

🇨🇳 Neglected Burning Rock charms investors with high margins, narrowing losses (Bamboo Works)

- The cancer diagnostics company’s revenue rose slightly in the third quarter, as its gross margin rose by nearly 4 percentage points

- Burning Rock Biotech Ltd (NASDAQ: BNR)’s revenue rose 2.3% in the third quarter, as declines for its core cancer diagnostic products were offset by a big rise for its R&D services

- The company’s stock has tripled this year, including a 33% jump in the last week after its latest earnings announcement, as it moves closer to profitability

🇨🇳 Can So-Young find new youth in bricks and mortar? (Bamboo Works)

- The cosmetic surgery specialist’s top line is growing as it opens new ‘light medical aesthetic’ clinics, but its bottom line is sagging as its older platform business evaporates

- Nearly half of So-Young International Inc (NASDAQ: SY)’s revenue came from its growing chain of “light medical aesthetic centers” in the third quarter, just two years after it opened its first such clinic

- But as its clinic revenue quadrupled in the quarter, the other half of its business declined sharply, leading to a net loss for the period

🇨🇳 CSPC feels the pain from sweeping cuts in drug prices (Bamboo Works)

- The pharmaceutical giant is paying the price for its aggressively low bids in China’s centralized drug tenders, as it shifts its focus from traditional to novel drugs

- The company delivered lower nine-month revenues and profits after slashing its unit prices to compete in China’s drug procurement process

- Bucking the sector trend, CSPC Pharmaceutical Group (HKG: 1093 / FRA: CVG / OTCMKTS: CHJTF)’s stock has tumbled as its innovative drug pipeline has yet to make up for the shortfall from generic products

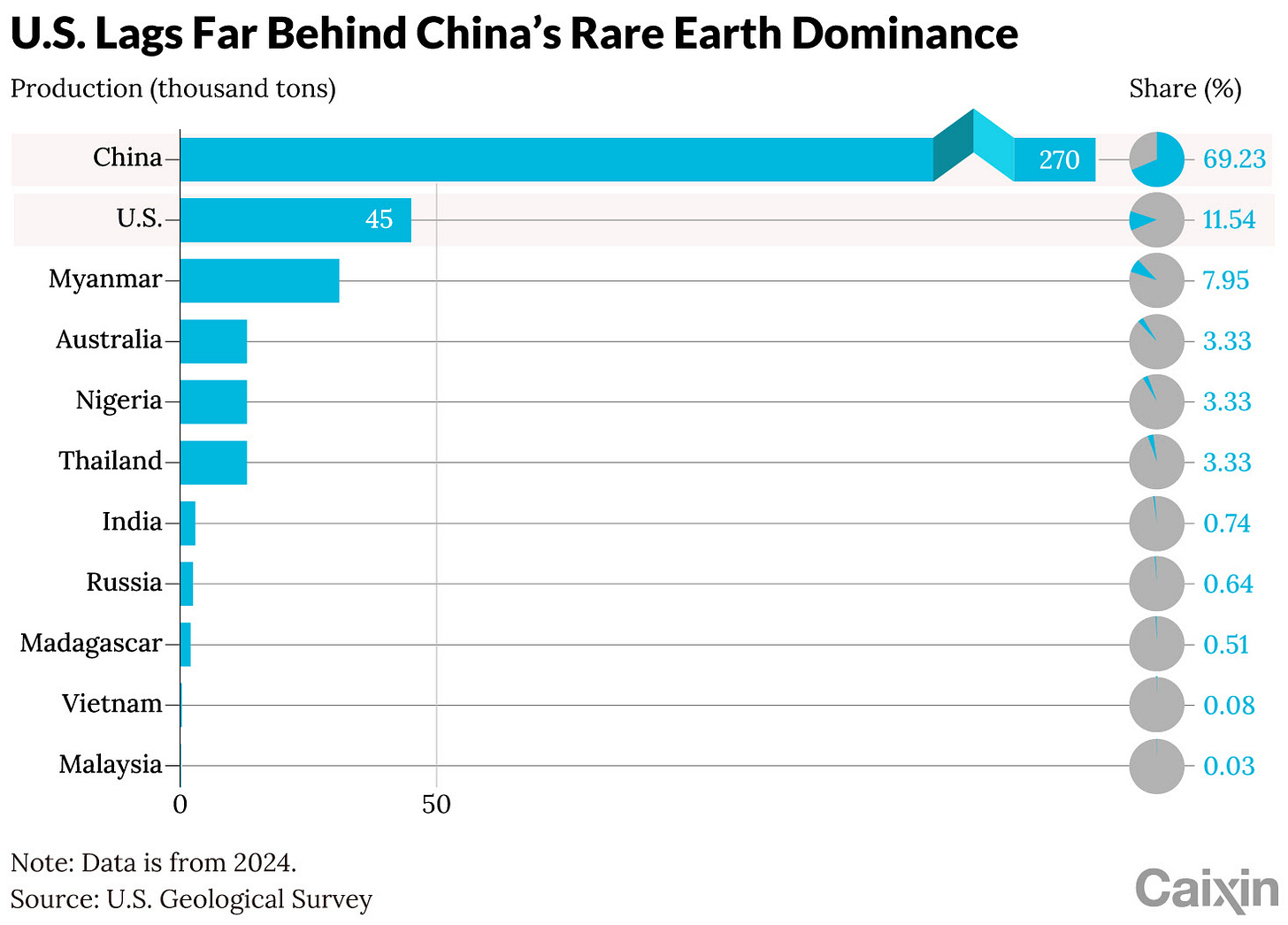

🇨🇳 In Depth: Malaysia Becomes a Lynchpin in U.S.-Led Effort to Break China’s Grip on Rare Earths (Caixin) $

- A fragile truce in the U.S.-China trade war has bought each country something it needs to take on its global rival: time.

- For China, it’s time to curtail its reliance on the West for advanced microchips. For the U.S., it’s time to break something that it sees as a threat to its economic and national security: China’s chokehold on the global supply of the rare-earth elements that have become critical to high-tech economies.

- After President Xi Jinping met with U.S. President Donald Trump in South Korea on Oct. 30, each side began to lower some of the more biting trade barriers against the other. In the days following the meeting, China announced one-year suspensions of its export controls on several heavy rare earth elements and advanced lithium batteries.

🇨🇳 CSI300 Index Rebalance: 11 Changes & US$7.77bn Trade (Smartkarma) $

- There are 11 changes for the Shanghai Shenzhen CSI 300 Index (SHSZ300 INDEX) with implementation taking place at the close on 12 December.

- Nearly all the changes are in line with forecasts. Jiangsu Zhongtian Technology Co Ltd (SHA: 600522) is the one surprise addition.

- The adds outperformed the deletes and the CSI300 from June-September but have given back a chunk of the gains since then. Expect positioning to build over the next few days.

🇨🇳 Jingdong Industrials (JDI) IPO: The Investment Case (Smartkarma) $

- JD Industrial Technology (2231713D CH), a leading industrial supply chain technology and service provider in China, is seeking to raise US$500 million.

- JDI is the largest industrial supply chain technology and service provider in China in terms of GMV, customer coverage and SKU offerings in 2024, according to CIC.

- The investment case is bearish due to weak market share gains, declining product revenue growth, margin pressures, declining cash generation and factoring of receivables.

🇭🇰 Morgan Stanley and Goldman dominate Hong Kong equity deals (FT) $ 🗃️

- A wave of Chinese companies raising money has revived dealmaking in Asia’s financial hub

🇭🇰 Luk Fook Holdings (International) Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Luk Fook Holdings (International) Ltd (HKG: 0590 / FRA: LUY1 / OTCMKTS: LKFLF) 🇧🇲 – Sourcing, designing, wholesaling, trademark licensing & retailing of gold, platinum & gem-set jewellery. 🇼 🏷️

🇭🇰 Vitasoy International Holdings Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Vitasoy International Holdings Ltd (HKG: 0345 / OTCMKTS: VTSYF) 🇭🇰 – Plant-based soyabean range products. 🇼 🏷️

🇭🇰 Link Real Estate Investment Trust 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏🇦🇺 🇬🇧 Link REIT (HKG: 0823 / OTCMKTS: LKREF) 🇭🇰 – Most liquid & largest REIT in Asia. Retail facilities, car parks, offices & logistics assets across China, Australia, Singapore & UK. 🇼 🏷️

🇭🇰 ANE (9956 HK): Precondition Satisfied (Smartkarma) $

- The precondition for the consortium’s privatisation offer for [Investment holding company operates an express freight network in the less-than-truckload (LTL) market in China] ANE (Cayman) Inc (HKG: 9956) has been satisfied. The right to increase the share alternative cap was also satisfied.

- The consortium has until 12 December to decide whether to increase the share cap. The option helps the consortium gain support from shareholders who would not accept the cash offer.

- The scheme vote remains low risk, as the offer is attractive relative to historical ranges and peer multiples. The de-rating of peers is also helpful.

🇲🇴 L’Arc acquisition to reduce SJM group’s liquidity buffer: Lucror (GGRAsia)

- Macau casino concessionaire SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) has “sufficient liquidity” to fund the HKD1.75-billion (US$224.8-million) acquisition of the L’Arc Hotel complex on the Macau peninsula, but the deal “will reduce” the casino firm’s “liquidity buffer”. That is according to a recent memo from Lucror Analytics, a Singapore-based specialist in credit research.

- The L’Arc Hotel (pictured) is a downtown property that is the host venue for one of the SJM group’s satellite gaming venues, Casino L’Arc Macau.

- On Thursday, SJM Holdings said L’Arc Hotel was part of a “core peninsula cluster,” under the licence of the group’s unit, SJM Resorts Ltd. The group’s own Casino Lisboa and associated Hotel Lisboa, as well as the group’s Grand Lisboa property, are close to L’Arc Hotel.

- A principal liability of L’Arc Hotel is an outstanding bank loan of nearly HKD1.93 billion

🇲🇴 Macau’s high-end gamblers supporting sustainable demand: UBS (GGRAsia)

- A survey of Macau’s high-end mass-market gamblers by UBS Securities Asia Ltd has found that a “diversified and premiumised” customer base has been contributing to “demand resilience” in Macau’s gaming industry.

- “Insights from our latest premium-mass gamer survey pointed to the emergence of new customer sources – high-income professionals and more diverse industries – who have potentially contributed to this sustained demand resilience,” stated the institution in a recent research note.

- It added: “We believe this evolving demographic, along with an improved household financial condition, are diversifying and premiumising Macau’s customer base.”

- According to UBS, the survey results suggested that “higher spending gamers have different service priorities compared to base mass customers”.

🇲🇴 Macau 5-star room cost average down circa 2pct y-o-y to US$196 in October: trade (GGRAsia)

- The average nightly cost of a Macau five-star hotel room in October was MOP1,571.7 (US$196.1), down 1.8 percent year-on-year, while the average occupancy rate for the tier was 94.2 percent, flat from a year ago.

- That is according to the latest monthly survey from the Macau Hotel Association, published by the Macao Government Tourism Office.

🇲🇴 Macau’s US$29bln GGR forecast for 2026 ‘prudent’ budgeting: economy secretary (GGRAsia)

- Tai Kin Ip, the lead official overseeing Macau’s economy, said the city’s 2026 forecast for casino gross gaming revenue (GGR) of MOP236 billion (US$29.43 billion) – circa MOP19.67 billion a month – is regarded as a “prudent” basis for planning next year’s public spending.

🇲🇴 CLSA expects Macau GGR to grow 5pct in 2026, operators dividends to increase (GGRAsia)

- A “stronger renminbi versus the [U.S.] dollar and a currently positive industrial profit indicator in China should drive” Macau casino gross gaming revenue (GGR) growth in 2026, suggested CLSA in a Wednesday memo.

- “We project Macau’s GGR to grow 5 percent year-on-year to US$32.3 billion, implying a daily GGR of MOP709 million [US$88.5 million] per day,” wrote analysts Jeffrey Kiang and Leo Pan.

- Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) last paid a dividend in February 2020. The company said on its third-quarter earnings call earlier this month, it might restart dividends “by the end” of 2026.

🇹🇼 Taiwan

🇹🇼 Silicon Motion (SIMO US): Multiple Growth Drivers Converging Into 2026E (Smartkarma) $

[Silicon Motion Technology Corporation (NASDAQ: SIMO)]

- Four growth drivers ramping simultaneously: PCIe5 targeting 40% market share, NAND makers increased outsourcing of controller design, automotive segment approaching 10% of revenue, and datacenter products approaching 5-10% of revenue.

- Near-Term catalysts compelling as memory supply tightness drives controller outsourcing and gross margins approach 49-50%.

- 19x 2026E PER represents good value if company hits targets. While stock carries market pullback risk, we nevertheless maintain our Structural Long rating due to multi-year growth in view.

🇹🇼 Taiwan’s economy roars ahead on back of AI demand (FT) $ 🗃️

- Growth forecast for 2025 raised to 7.37%, the fastest rate in 15 years

- The electronics boom sharply contrasts with some parts of Taiwan’s domestic economy and traditional industries. “The export momentum of certain traditional products continues to be constrained by global overcapacity,” the statistics agency said.

- Real private consumption increased just 1.19 per cent in the third quarter compared with the same period last year.

🇹🇼 Hon Hai: Focus On Growth Potential Of Key Businesses (Seeking Alpha) $ 🗃️

- 🌐 Hon Hai Precision Industry Co (TPE: 2317 / FRA: HHP2 / OTCMKTS: HNHPF) – Foxconn is the World’s largest electronics manufacturer. 🇼 🏷️

🇹🇼 Fubon Financial Holding Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏🅿️ Fubon Financial Holding Co Ltd (TPE: 2881 / 2881B / 2881C / OTCMKTS: FUISF / FUIZF) – Financial products & services (Fubon Life, Taipei Fubon Bank, Fubon Bank (Hong Kong), Fubon Bank (China), Fubon Insurance, Fubon Securities & Fubon Asset Management). 🇼 🏷️

🇰🇷 Korea

🇰🇷 Foreigners Integrated Accounts Starting in January 2026: Impact on IBKR & Foreign Trading Platforms (Douglas Research Insights) $

- On 27 November, the Korean Financial Services Commission (FSC) finally announced that it has completely abolished the restrictions on the foreigners opening integrated accounts to trade Korean stocks.

- This amendment will start to take effect on 2 January 2026.

- What this means is that major global trading platforms such as IBKR will most likely be allowed to trade Korean stocks without any major restrictions sometime starting 1H 2026.

🇰🇷 Top Bracket Dividend Tax Rate Lowered to 30% in Korea [Moderately Positive] (Douglas Research Insights) $

- On 28 November, the Korean National Assembly reached an agreement on a tax reform plan to officially lower taxes on dividends income.

- The decline in tax on dividends is a definite step in the right direction. Nonetheless, the top bracket dividend tax rate cut was slightly less than what market was expecting.

- Given that about 15%-25% dividend tax rates are more common in other developed countries, Korea’s reduction of dividend taxes is likely to be welcomed highly by many global investors.

🇰🇷 Confirmation of Cancellation of Treasury Shares To Be Made Into Law by End of 2025 and a Loophole? (Douglas Research Insights) $

- On 25 November, the Democratic Party of Korea confirmed that the cancellation of treasury shares will be made into law by the end of 2025.

- Companies that buyback their shares (as treasury shares) will be required to cancel them within one year of the buyback.

- There may be a LOOPHOLE if the company fails to cancel the treasury shares on time. Fine per director is only 50 million won and this may be too low.

🇰🇷 Likely Increase In Mandatory Tender Offer from the Current 50% + 1 Share Requirement (Douglas Research Insights) $

- Korean government is likely to increase the mandatory tender offer from current 50% + 1 share requirement (minimum majority stake) to much higher levels (but below the maximum 100% requirement).

- There is an increasing probability that indeed the Korean government is likely to increase the minimum majority stake requirement to 60% to 75% of total shares in 1H26.

- If the minimum maximum stake rises to 60%-75% of outstanding shares, this would have a further beneficial impact on the minority shareholders.

🇰🇷 KB Financial: The Kospi Rally Might Be Over, And Results Could Be More Tame (Seeking Alpha) $ 🗃️

- 🌏 KB Financial Group (NYSE: KB) – Financial holding company. Banking, credit card, financial investment, insurance business etc. 🇼 🏷️

🇰🇷 POSCO Holdings: It’s All About Capital Allocation (Seeking Alpha) $ 🗃️

- 🌐 POSCO Holdings (NYSE: PKX) – Integrated steel producer. 6 segments: Steel, Trading, Construction, Logistics & Others, Green Materials & Energy & Others. 🇼 🏷️

🇰🇷 A Pair Trade Basket Of Korean Consumer/Leisure Stocks (Long) And Japanese Names (Short) (Douglas Research Insights) $

- In this insight, we discuss a pair trade involving a basket of Korean consumer stocks (long) and a basket of Japanese consumer stocks (short) over the next 3-6 months.

- The 10 Korean names (long basket) include Samyang Foods Co Ltd (KRX: 003230), APR Co Ltd (KRX: 278470), Amorepacific Corp (KRX: 090430 / 090435), Korean Air (KRX: 003490 / 003495), CJ Corp (KRX: 001040 / 001045 / 00104K), Classys (KRX: 214150), NongShim Co (KRX: 004370), Shinsegae [Shinsegae Inc (KRX: 004170) / Shinsegae International (KRX: 031430)], Hotel Shilla (KRX: 008770 / 008775), and Lotte Tour Development (KRX: 032350).

- The 10 Japanese names (short basket) include Fast Retailing, Oriental Land, Kao Corp, Seibu Holdings, ANA Holdings, Shiseido, J.Front Retailing, Kose Corp, Pola Orbis Holdings, and Kyoritsu Maintenance.

🇰🇷 A Tender Offer of 10% Stake in Gabia by Align Partners Asset Management (Douglas Research Insights) $

- After the market close on 24 November, it was announced that Align Partners is conducting a partial tender offer of a 10% stake in Gabia Inc (KOSDAQ: 079940).

- Tender offer price is 33,000 won (20% higher than current price). Tender offer amount is 44.7 billion won.

- If Align Partners successfully completes this tender offer, its stake would rise to 19.03%. Plus, the combined stakes of Align Partners and Miri Capital would be 42.99%.

🇰🇷 SNT Group – Formalizes a Hostile Takeover of SMEC (Douglas Research Insights) $

- On 24 November, the SNT Group formalized its hostile takeover of Smec Co Ltd (KOSDAQ: 099440). S&T Holdings disclosed that it acquired an additional 5.46% stake in SMEC, raising its stake to 13.65%.

- S&T Holdings and SNT Group Chairman Choi combined own a 20.2% stake in SMEC. In comparison, the SMEC CEO Choi Young-seop owns a 9.75% stake in SMEC.

- In our view, this is likely to lead to a potential fight for the control of SMEC’s management rights, pushing up the share price of SMEC even further.

🇰🇷 POSCO Holdings: Selling Remaining Stake in Nippon Steel in a Block Deal Sale (Douglas Research Insights) $

- After the market close on 25 November, it was reported that POSCO Holdings (NYSE: PKX) is selling its remaining stake in Nippon Steel Corporation in a block deal sale.

- The block deal sale involves selling the remaining 39.2 million shares of Nippon Steel. The deal is valued at 24.2 billion yen (approximately 227 billion won).

- Given the overall negative sentiment on POSCO’s potential acquisition of HMM (KRX: 011200), until this uncertainty is resolved, POSCO Holdings’ share price could continue to face stiff headwinds.

🇰🇷 Lotte Corp: Worsening Balance Sheet Offset by Its High Treasury Shares Level (Douglas Research Insights) $

- Despite the higher probability of the cancellation of treasury shares by Lotte Corp (KRX: 004990 / 00499K), we believe that its worsening balance sheet is a greater concern.

- There does not appear to be a rapid business turnaround of its major affiliates including Lotte Chemical (KRX: 011170). As a result, we are concerned about further credit downgrades in 2026/2027.

- Our base case NAV valuation of Lotte Corp is market cap of 2.2 trillion won or target price of 20,918 won per share, which is 29% lower than current price.

🇰🇷 Naver Financial and Dunamu Finalizes the Merger Ratio (Douglas Research Insights) $

- On 26 November, Naver Financial and Dunamu finalized the merger ratio. Under the proposed share swap, one share of Dunamu will be exchanged for 2.54 shares of Naver Financial.

- Dunamu’s equity value is 15.1 trillion won, and Naver Financial’s is 4.9 trillion won.

- Overall, we have a positive view of this merger and it is likely to positively impact Naver’s share price as well.

🇰🇷 M&A Battle for APlus Asset Advisor Heats Up Amid Tender Offer (Douglas Research Insights) $

- There appears to be a M&A battle heating up for A Plus Asset Advisor Co Ltd (KRX: 244920). This is because it was reported that Aplus Asset Advisor Chairman Kwak Geun-ho has increased his stake.

- Chairman Kwak Geun-ho purchased additional 30,904 shares of Aplus Asset’s common stock over three trading days and his stake increased by 0.14 percentage points from 20.06% to 20.20%.

- In the next 3-6 months, we expect additional upside to the stock price (to 10,000 won to 12,000 won) as more investors perceive this could be an attractive M&A target.

🌏 SE Asia

🇮🇩 Telekomunikasi Indonesia: Great Vehicle To Access Indonesia, Wait For A Better Entry Point (Seeking Alpha) $ 🗃️

- 🇮🇩🏛️ Telkom Indonesia Persero Tbk PT (NYSE: TLK) – Fixed line telephony, internet & data communications. 🇼 🏷️

🇮🇩 Indonesia’s GoTo replaces chief and paves way for merger with rival Grab (FT) $ 🗃️

- Deal between ride-hailing and delivery companies would create south-east Asian super app valued at $24bn

- Indonesia’s ride-hailing company GoTo Gojek Tokopedia Tbk PT (IDX: GOTO / FRA: CK8 / OTCMKTS: GTOFF) is replacing its chief executive, paving the way for a potential merger with its rival Grab Holdings Limited (NASDAQ: GRAB) that would create a south-east Asian tech super app.

🇲🇾 Genting Malaysia 3Q profit narrows, as revenue grows to US$813mln (GGRAsia)

- Global casino operator Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) reported on Thursday revenue of nearly MYR3.36 billion (US$812.7 million) for the three months to September 30, up 22.1 percent from the prior-year period.

- But the firm posted a net profit attributable to shareholders of just under MYR119.7 million for the third quarter, down 79.0 percent year-on-year.

- Group-wide third-quarter group adjusted earnings before interest, taxation, depreciation, and amortisation (EBITDA) stood at nearly MYR838.1 million, a 35.8-percent decline from a year earlier.

- That was “primarily due to lower Forex [foreign exchange] gains of MYR2.8 million in the third quarter of 2025, compared with Forex gains of MYR601.8 million in the same period last year,” said the casino firm.

🇲🇾 Tenaga Nasional Berhad 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Tenaga Nasional Bhd (KLSE: TENAGA / FRA: 6TN0 / OTCMKTS: TNABF / TNABY – Electricity generation/distribution. UK, Kuwait, Turkey, Saudi Arabia & India presence (including renewables). 🇼

🇲🇾 Axiata Group Berhad 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Axiata Group Bhd (KLSE: AXIATA / OTCMKTS: AXXTF) – Telecommunications & digital conglomerate (digital telcos, infrastructure, & digital businesses). 🇼

🇲🇾 Mega First Corporation Berhad 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Mega First Corporation Bhd (KLSE: MFCB) – 3 main divisions: Renewable energy, packaging & resources (limestone quarrying).

🇲🇾 PETRONAS Chemicals Group Berhad 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏🏛️ PETRONAS Chemicals Group Bhd (KLSE: PCHEM / OTCMKTS: PECGF) – Integrated chemicals producer. 🇼

🇸🇬 Singapore sets up SGX-Nasdaq bridge for dual listings (The Asset) 🗃️

- Market support measures include S$2.85 billion for asset managers, S$30 million for listed firms

- In August 2024, the Monetary Authority of Singapore ( MAS ) convened a high-level group to assess and reinvigorate the city-state’s equities market.

- The Equities Market Review ( EMR ) group was tasked with proposing bold, actionable measures to attract quality listings, deepen market liquidity, and enhance Singapore’s position as a global financial hub. The group was made up of senior leaders from government, industry, and the investment community, including Temasek Holdings CEO Dilhan Pillay.

- After a year of deliberations, the EMR group has now released its final report, a comprehensive set of strategic recommendations designed to inject dynamism into Singapore’s equities market and elevate investor participation.

🇸🇬 Grab Holdings: Cautious Buy Amid Fintech Growth And Improving Unit Economics (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings: Undervalued Super-App With Accelerating Path To Profitability (Seeking Alpha) $ 🗃️

🇸🇬 Grab: A Long Term Winner As Its Marketplace Ecosystem Expands (Seeking Alpha) $ 🗃️

🇸🇬 Grab: Cash Flow Positive, Expanding Cash Moat, Strong Growth Make It A Buy (Seeking Alpha) $⛔🗃️

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 3 Blue-Chip Stocks to Watch for December 2025 (The Smart Investor)

- As we head into the final month of 2025, three Singapore’s blue-chip stocks stand out for making meaningful moves that could shape their long-term growth. Let’s take a closer look.

- CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF) Unlocks Value Through S$381.5 Million Divestment Programme

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) Accelerates Asset Monetisation with S$14 Billion Unlocked Since 2020

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF): Short-Term DPU Pressure, Long-Term Renewal

- Get Smart: What to Know About These Singapore Blue-Chip Stocks

🇸🇬 Beyond STI: 3 Singapore Dividend Stocks to Watch in December 2025 (The Smart Investor)

- These three Singapore stocks offer resilient dividends supported by earnings strength, cash flow visibility and disciplined capital management in December 2025.

- Here are three small caps – companies with market caps under S$1 billion – that may offer the steady income and quiet strength worth a closer look before the new year begins.

- Elite UK REIT Advances Multi-Pronged Portfolio Transformation

- Elite UK REIT (SGX: MXNU) stands out for its defensive income profile, with 99.1% of rental income backed by UK government tenants, making it one of the most secure income plays on the SGX.

- Civmec Order Book Rebounds

- Civmec Ltd (SGX: P9D / ASX: CVL / FRA: 1CV) provides integrated construction and engineering services across the energy, resources, infrastructure, and marine & defence sectors.

- Boustead Singapore Pursues Value Unlocking Through UI Boustead REIT Listing

- Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF) is working to unlock value from its real estate portfolio through the proposed listing of UI Boustead REIT on the Singapore Exchange.

- Get Smart: Small Caps, Steady Income

🇸🇬 December 2025 Dividends: 3 Blue-Chip Stocks Rewarding Shareholders (The Smart Investor)

- One’s selling assets, one’s bleeding profits, one’s actually growing – all three paying December dividends.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering: Paying on 5 December 2025

- ST Engineering is a story of how portfolio optimisation can directly benefit shareholders.

- SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF): Paying on 5 December 2025

- SATS deserves credit where credit is due.

- The 2023 Worldwide Flight Services (WFS) acquisition is starting to deliver.

- Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF): Paying on 23 December 2025

- Singapore Airlines (SIA) faces the toughest narrative, with profit plummeting 67.8% year on year to S$238.5 million for the first half of the fiscal year ending 31 March 2026 (1H’FY26).

- Get Smart: Only One Passes the Sustainability Test

🇸🇬 Beyond Blue Chips: 3 Singapore Stocks Paying Dividends in December 2025 (The Smart Investor)

- Unlock the potential of Singapore stock dividends. Discover three small-cap companies paying dividends this December.

- Beyond the familiar blue-chip names, we spotlight three small-caps (companies with market capitalisations below S$1 billion) that are paying dividends in December.

- Valuetronics Holdings (SGX: BN2 / FRA: GJ7): Paying on 5 December 2025

- Valuetronics is an electronics manufacturing services provider that handles everything from design and development to manufacturing and supply chain support for its customers.

- UMS Integration Ltd (SGX: 558 / OTCMKTS: UMSSF): Paying on 17 December 2025

- UMS Integration is a semiconductor equipment manufacturer with facilities across Singapore, Malaysia, and the USA, alongside smaller Aerospace and medical electronics operations.

- Old Chang Kee (SGX: 5ML): Paying on 19 December 2025

- The homegrown food and beverage company operates a chain of retail outlets and is best known for its signature curry puffs, alongside other snacks, noodle dishes, rice sets, and beverages.

- OCK operates primarily in Singapore, with smaller operations in Malaysia.

- Get Smart: Consistent Payouts Amid Shifting Conditions

🇸🇬 4 Singapore REITs To Buy Before the Next Rate Cut (The Smart Investor)

- Ahead of expected rate cuts, these four Singapore REITs offer attractive yields and potential upside.

- Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF)

- MPACT owns commercial and retail properties across Singapore, Hong Kong, China, Japan and South Korea.

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF)

- MIT has a portfolio of industrial properties and data centres across Singapore, North America and Japan, with assets under management of S$8.5 billion.

- AIMS APAC REIT (SGX: O5RU / OTCMKTS: ACIRF)

- AA REIT is a mid-cap industrial REIT investing in industrial, logistics and business park properties in Singapore and Australia.

- CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF)

- CLAR is Singapore’s first and largest listed industrial REIT, with assets diversified across industrial, logistics, business parks and data centres in Asia Pacific, Europe and the US.

- Why Rate Cuts Could Spark a REIT Recovery

- Get Smart: The Time to Position is Now

🇸🇬 December 2025: 4 Blue-Chip REITs Paying Dividends Amid Headwinds (The Smart Investor)

- December 2025 offers significant blue-chip REITs distributions, but operational headwinds complicate the outlook for investors.

- Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF): Payment on 4 December 2025

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF): Payment on 10 December 2025

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF): Payment on 16 December 2025

- Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF): Payment on 23 December 2025

- Get Smart: Reality Check

🇸🇬 3 Blue-Chip S-REITs Raising Their DPU Before 2026 (The Smart Investor)

- Three REITs raising DPU in 2025—but only one has genuine tailwinds behind it.

- These contrasting strategies offer dividend investors something more valuable than headlines: a glimpse at which sectors have genuine tailwinds — and which require skilful navigation.

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF): Riding the Data Centre Wave

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF): The Dilution Dilemma

- Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF): Engineering a recovery

- Mapletree Pan Asia Commercial Trust or MPACT presents the most intriguing case.

- Get Smart: Same, same but different

🇸🇬 This REIT Still Yields 8.5%. And It’s Hiding in Plain Sight (The Smart Investor)

- Elite UK REIT continues to deliver an attractive 8% yield despite market headwinds, backed by long leases, stable government tenants, and resilient income visibility.

- Background of Elite UK REIT (SGX: MXNU)

- Elite UK REIT’s portfolio consists mainly of freehold properties located mainly in town centres and near amenities and transportation nodes.

- These properties are leased primarily to the UK government and public sector such as the Department for Work and Pensions.

- Elite UK REIT’s Latest Results

- Positives / Strengths

- Risks / Considerations

- Get Smart: Get Hold of Stable Income

🇸🇬 4 REITs That Raised Distributions in 2025 (The Smart Investor)

- We look at some of these names and unpack what’s driving their resurgence.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF), or FCT (SGX: J69U) — Retail Resilience Paying Off

- AIMS APAC REIT (SGX: O5RU / OTCMKTS: ACIRF), or AA (SGX: O5RU) — Industrial Strength in a Softer Economy

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) — Data Centres Powering Dividend Growth

- Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF), or MPACT (SGX: N2IU) — Turning the Corner After Integration

- What This Means for Investors

- Conclusion – Get Smart: Lock In The Yield Before It’s Too Late

🇹🇭 Bangkok Expressway and Metro Public Company Limited (BKKXF) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭 Bangkok Expressway and Metro PCL (BKK: BEM / BEM-F / FRA: B4X / OTCMKTS: BKKXF) – Provision of expressway & metro services + commercial development. 4 segments: Expressway Business, Rail Business, Commercial Development Business, & Others. Subs. of CH Karnchang PCL (BKK: CK). 🇼 🏷️

🇹🇭 Electricity Generating Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏🇺🇸 Electricity Generating PCL (BKK: EGCO / EGCO-F / FRA: ECGF / OTCMKTS: EYUBY) – Independent Power Producer. 🏷️

🇹🇭 Thoresen Thai Agencies Public Company Limited (THAFF) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🌏🌍 Thoresen Thai Agencies PCL (BKK: TTA / TTA-F) – 5 core business groups: Shipping, offshore service, agrochemical, food & beverage & investment.

🇹🇭 Digital Telecommunications Infrastructure FD (TTMMF) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭 Digital Telecommunications Infrastructure Fund (BKK: DIF / DIF-F) – Invests in telecommunication infrastructure assets.

🇹🇭 BTS Group Holdings Public Company Limited (BTSGY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭 BTS Group Holdings PCL (BKK: BTS / BTS-F / OTCMKTS: BTSGY / BTGRF / BTLWF) – Bangkok Mass Transit System PCL (BTSC), operator of the BTS Skytrain & Bangkok BRT + marketing/advertising. 🇼

🇹🇭 Thai Beverage Public Company Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Thai Beverage PCL (SGX: Y92 / OTCMKTS: TBVPF / TBVPY) or ThaiBev – Leading beverage company in SE Asia & the largest in Thailand. Stakes in Fraser and Neave (SGX: F99 / FRA: FNV2 / OTCMKTS: FNEVF), Grand Royal Group in Myanmar, & Saigon Beer Alcohol Beverage Corp (Sabeco) (HOSE: SAB). 🇼 🏷️

🇹🇭 The Siam Cement Public Company Limited (SCVPY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭 Siam Cement PCL (BKK: SCC / SGX: TSCD) – Cement-Building Materials Business, Chemicals Business, Packaging Business & Investment Business. 🇼 🏷️

🇹🇭 Banpu Public Company Limited (BNPJY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🌏🇺🇸 Banpu PCL (BKK: BANPU / BANPU-R / FRA: NVAC / OTCMKTS: BAPUF) – Energy resources (coal & gas); energy generation (conventional & renewable); & energy technology (wind & solar, storage systems & energy technologies). 🇼 🏷️

🇹🇭 Berli Jucker Public Company Limited (BLJZY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🌏 Berli Jucker PCL (BKK: BJC / BJC-F / OTCMKTS: BLJZY) – Manufactures, distributes & services for packaging, consumer, healthcare & technical & modern retail supply chain businesses. 🏷️

🇹🇭 Thai Oil Public Company Limited (TOIPY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭 Thai Oil PCL (BKK: TOP) – Integrated operations in oil refining & petrochemicals. 🏷️

🇹🇭 Minor International Public Company Limited WT EXP 073123 (MINRF) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🌐 Minor International PCL (BKK: MINT / MINT-F / OTCMKTS: MINOF / MIPCF) – Hospitality, restaurants & lifestyle brands distribution. 🇼 🏷️

🇹🇭 IRPC Public Company Limited (IRPSY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭 IRPC PCL (BKK: IRPC / OTCMKTS: IRPSY) – Integrated petrochemical (refinery & petrochemical complex). 🏷️

🇻🇳 VinFast Auto: More Growing Pains (Seeking Alpha) $ 🗃️

- 🌐 VinFast Auto Ltd. (NASDAQ: VFS) – Design & manufacture of EVs, e-scooters, e-buses & parts. 🇼

🇻🇳 🇭🇰 HK 第49部分; Luks Group (Vietnam Holdings) (Jam_invest) $

BUYBACKS… That word alone is often enough for many investors to start salivating. This company is doing a bit of that, while trading at a 20%+ 4-year average FCF-yield, and with…

- Luks Group (Vietnam Holdings) Compny Ltd (HKG: 0366 / FRA: LU4 / OTCMKTS: LKSGF)

- Business activities

- Cement products

- Property investment

- Hotel operation

- Pentahotel Hong Kong Tuen Mun

- Property development

- Rental income

- Le Carré

- Property development

- Corporate and others

🇮🇳 India / South Asia / Central Asia

🇮🇳 India GDP grows faster than expected at 8.2% (FT) $ 🗃️

- Robust consumer spending helps economy shrug off early impact of Trump tariffs

🇮🇳 Khazanchi Jewellers: Scaling Wholesale Strength and Building Retail for the Future (Smartkarma) $

- Khazanchi Jewellers Ltd (BOM: 543953) posts a strong Q2FY26 with 46% revenue growth, 119% PAT surge, and a major 10,000 sq. ft. Chennai flagship store set to launch in Jan 2026.

- High-Margin retail and diamond segments are accelerating, supported by a stable B2B engine with 90% repeat orders, positioning the company for structural margin expansion and stronger long-term earnings visibility.

- Khazanchi enters a high-growth phase, with premiumisation, retail expansion, and strong execution driving sustainable profitability and transforming it from a wholesale-led player into a high-margin retail-focused jewellery brand.

🇮🇳 Olectra Greentech Ltd- Forensic Analysis (Smartkarma) $

- Olectra Greentech Ltd (NSE: OLECTRA / BOM: 532439), part of the MEIL Group, has transformed from a power insulator manufacturer into a pioneer and leading player in India’s electric mobility segment.

- The company is primarily known as the largest pure-electric bus manufacturer in India, operating through a long-term technology partnership with China’s BYD Auto Industry Co Ltd.

- Heavy reliance of the company on its associates for the sale of EVs, along with supplier concentration warrants attention. However, cash flow generation is improving, which is a positive

🇮🇳 Cordelia Cruises IPO: A Game-Changer in India’s Growing Cruise Market (Smartkarma) $

- Cordelia Cruises [Waterways Leisure Tourism], India’s only domestic cruise operator, is going public through an IPO of Rs. 7.27 billion. It plans to triple its fleet by 2028, expanding its passenger capacity significantly.

- The Indian cruise market remains under-penetrated with a CAGR forecast of 35-40% from FY2025-2030, creating a prime opportunity for growth, especially for domestic players like Cordelia.

- The IPO is a crucial step for Cordelia to expand its fleet, cater to increasing demand, and capitalize on the underpenetrated Indian cruise market.

🌍 Middle East

🇮🇱 Ituran: Profitable, Growing, And Ready For Its Next Leap (Seeking Alpha) $ 🗃️

- 🌐 🇧🇷 Ituran Location And Control Ltd (NASDAQ: ITRN) – Leader in the emerging mobility technology field, providing value-added location-based services, including a full suite of services for the connected-car. 🇼 🏷️

🌍 Africa

🇿🇦 PPC Ltd 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇿🇦 Life Healthcare Group Holdings Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇿🇦 🇧🇼 Life Healthcare Group Holdings (JSE: LHC / FRA: L53 / OTCMKTS: LTGHY / LTGHF) – 47 acute hospitals in the Eastern Cape, Free State, Gauteng, KwaZulu-Natal, Mpumalanga, North West, Western Cape & Botswana. 🇼 🏷️

🇿🇦 Octodec Investments Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇿🇦 Octodec Investments (JSE: OCT) – One of the largest property owners in the Tshwane & Johannesburg areas with a diversified portfolio. 🏷️

🇿🇦 Harmony Gold: Playing The Peer Catch-Up Trade As Gold Finds Its Zen (Rating Upgrade) (Seeking Alpha)

- 🇿🇦 🇦🇺 🇵🇬 Harmony Gold Mining Company Limited (JSE: HAR / NYSE: HMY) – Global gold mining & exploration + significant copper footprint. 🇼

🇿🇦 Oceana Group Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Oceana Group Ltd (JSE: OCE / FRA: O1F / OTCMKTS: OCGPF) – Fishing & food processing. 🏷️

🇿🇦 Tiger Brands Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Tiger Brands (JSE: TBS / FRA: UG5 / UG5A / OTCMKTS: TBLMY / TBLMF) – Packaged & branded food company + food service solutions. 🇼 🏷️

🇿🇦 Pepkor Holdings Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍🇧🇷 Pepkor (JSE: PPH / FRA: S1VA / OTCMKTS: PPKRF) – Largest retail store footprint in southern Africa. 10 African countries + Brazil. The majority of Pepkor’s retail brands operate in the discount & value market segment. 🇼 🏷️

🇿🇦 Invicta Holdings Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Invicta Holdings Ltd (JSE: IVT / FRA: I5J / OTCMKTS: IVCHF) – Supply & distribution of replacement parts, services & solutions for the industrial & auto-agri, capital & earth-moving equipment & spare parts & services. 🏷️

🇿🇦 Naspers Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Naspers (JSE: NPN / FRA: NNWN / NNW0 / OTCMKTS: NAPRF / NPSNY) – Global internet group & one of the largest technology investors in the world. 🇼 🏷️

🇿🇦 Netcare Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇿🇦 🇱🇸 🅿️ Netcare Limited (JSE: NTC / NTCP / OTCMKTS: NWKHY) – Healthcare in South Africa & Lesotho. Operates the largest private hospital, primary healthcare, emergency medical services & renal care networks. 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇨🇿 CEZ, a. s. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇪🇺🏛️ CEZ as (PSE: CEZ / WSE: CEZ / FRA: CEZ / OTCMKTS: CZAVF) – Generation, distribution, trading & sale of electricity & heat; trading & sale of natural gas; provision of comprehensive energy services from the new energy sector & coal mining. One of the 10 largest energy companies in Europe. 🇼 🏷️

🇬🇷 Organization of Football Prognostics S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇬🇷 🇨🇾 Greek Organisation of Football Prognostics (ASE: OPAr / FRA: GF8A / OTCMKTS: GOFPY) or OPAP – Exclusive operator of numerical lotteries, retail sports betting games & horseracing mutual betting in Greece. Online sports betting & casino games market. 🇼

🇬🇷 Intralot S.A. Integrated Lottery Systems and Services 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Intralot S.A. Intergrated Lottery Systems and Services (ASE: INLOT) – Integrated gambling, transaction processing systems, game content, sports betting mgmt & interactive gambling services to state-licensed gambling orgs. 🇼

🇵🇱 PGE Polska Grupa Energetyczna S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇱 PGE Polska Grupa Energetyczna SA (WSE: PGE / FRA: 6PG / OTCMKTS: PPOEF) – Poland’s largest energy sector company – fuel resources, power generation & distribution networks. 🇼 🏷️

🌎 Latin America

🌎 LatAm Steel Producer with a 40% Upside Potential; 8.1% Yield as a Bonus for Risk Taken (TheOldEconomy Substack) $

- Rapid urbanization has created a massive infrastructure gap. Despite the decreasing urbanization rate, the gap is growing.

- Countries must invest between 3% and 5% to address infrastructure shortfalls. However, current investments as a percentage of GDP are below 2%.

- Project inefficiency is a tangible bottleneck. The ongoing political shift to the right is expected to improve project efficiency and, as a result, boost demand for everything related, from complete assemblies to input materials.

🌎 MercadoLibre: The Recent Dip Is A Gift (Seeking Alpha) $ 🗃️

- 🌎 MercadoLibre (NASDAQ: MELI) – Uruguay HQ’d. The largest online commerce & payments ecosystem in Latin America. 🇼 🏷️

🌎 Tenaris: $600M Buyback, Stable Margins, And A Cash Fortress In Energy (Rating Downgrade) (Seeking Alpha) $ 🗃️

- 🌐 Tenaris S.A. (NYSE: TS) 🇱🇺 – Welded steel pipes for gas pipelines (South America). Subs. of Argentine-Italian conglomerate Techint. 🇼

🇦🇷 Corporación América Airports: Rating Downgraded To Buy After 34% Rally (Seeking Alpha) $ 🗃️

🇦🇷 Corporacion America Airports: Staying Bullish After Strong Q3 Earnings (Seeking Alpha) $ 🗃️

🇦🇷 Corporación América Airports S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Corporación América Airports (NYSE: CAAP) – Leading private airport operator in the world. Operating 53 airports in 6 countries (Argentina, Brazil, Uruguay, Ecuador, Armenia & Italy). 🏷️

🇦🇷 Grupo Financiero Galicia S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇦🇷 Galicia Q3 Earnings: A Tough Quarter, A Clean Reset, And A Market Already Looking Ahead (Seeking Alpha) $ 🗃️

🇦🇷 Grupo Financiero Galicia: Not The Best Option For Betting On Argentine Growth (Seeking Alpha) $ 🗃️

- 🇦🇷 Grupo Financiero Galicia Sa (NASDAQ: GGAL) – A group of financial services companies in Argentina. 🇼 🏷️

🇦🇷 Banco Macro: Why 2026 Matters More Than Any Quarter In 2025 (Seeking Alpha) $ 🗃️

- 🇦🇷 Banco Macro Sa (NYSE: BMA) – A universal bank providing a wide range of financial services with focus in low & mid-income individuals & SMEs. 🇼 🏷️

🇦🇷 IRSA Inversiones y Representaciones Sociedad Anónima 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

🇦🇷 YPF: Argentina Finally Turns A Corner And So Does Its Flagship Company (Rating Upgrade) (Seeking Alpha) $ 🗃️

- 🇦🇷 🏛️ Ypf Sa (NYSE: YPF) – Vertically integrated, majority state-owned Argentine energy company. Oil & gas exploration & production + transportation, refining & marketing of gas & petroleum products. 🇼 🏷️

🇦🇷 Grupo Supervielle S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 Grupo Supervielle SA (NYSE: SUPV) – Provides a range of financial & non-financial services. 🏷️

🇦🇷 Loma Negra: A Promising Future, Despite The Recent Results (Seeking Alpha) $ 🗃️

- 🇦🇷 Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE: LOMA) – Production & commercialization of cement in Argentina. 🇼 🏷️

🇦🇷 Lithium Americas: Full-Speed Ahead (Seeking Alpha) $ 🗃️

- 🇦🇷 🇺🇸👼🏻 Lithium Americas (NYSE: LAC) – Focused on advancing lithium projects in Argentina & USA to production. 🇼 🏷️

🇧🇷 Brazil’s Wave of Corporate Meltdowns Share One Commonality (Bloomberg) 🗃️

- The downfall of Daniel Vorcaro and his Banco Master is rippling across Brazil’s business and banking circles, prompting the biggest intervention in the history of Brazil’s financial markets.

- The Banco Master debacle caps a turbulent year for Brazilian companies, with other major corporate implosions including telecom operator Oi Sa (BVMF: OIBR3 / OIBR4 / OTCMKTS: OIBRQ) and waste-management firm Ambipar Participacoes E Empreendimentos (BVMF: AMBP3).

- The repeated corporate failures underscore Brazil’s urgent need to step up oversight, improve its regulatory approach to markets, and strengthen the rights of investors, clients, and pension funds.

🇧🇷 B3’s Q3 Was Pressured By Derivatives, But The Name Remains Resilient (Seeking Alpha) $ 🗃️

- 🇧🇷 B3 SA – Brasil, Bolsa, Balcão (BVMF: B3SA3 / FRA: YBV0 / OTCMKTS: BOLSY) – São Paulo Stock Exchange (Bovespa), Brazilian Mercantile & Futures Exchange (BM&F) & CETIP. 🇼

🇧🇷 Petróleo Brasileiro S.A. – Petrobras (PBR) Discusses New Business Plan and Production Growth Outlook for 2026-2030 – Slideshow (Seeking Alpha)

🇧🇷 Petrobras: Strong Cash, Record Output, Still Cheap (Seeking Alpha) $ 🗃️

- 🌐🏛️ Petrobras (NYSE: PBR / PBR-A / BCBA: PBR / PETR4) or Petróleo Brasileiro SA – Explores, produces & sells oil & gas. 🇼

🇧🇷 Vale: Cost Discipline Is Back, And The Buy Window Is Open (Seeking Alpha) $ 🗃️

🇧🇷 Vale: A Long-Term Buy Despite Near-Term Noise (Seeking Alpha) $ 🗃️

- 🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 Nu Holdings: Positioned For Outperformance (Seeking Alpha) $ 🗃️

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

🇧🇷 Marfrig Global Foods Will Need Packaged Food Growth To Offset Commodity Pressures (Seeking Alpha) $ 🗃️

- 🌐 Marfrig Global Foods Sa (BVMF: MRFG3 / FRA: MGP1 / OTCMKTS: MRRTY) – Global leader in the production of hamburgers + bovine protein. One of the most internationalized & diversified Brazilian food companies. 🇼 🏷️

🇨🇴 Ecopetrol: Priced Like A Dying Asset, Paying Like A King (Seeking Alpha) $ 🗃️

- 🇨🇴🏛️ Ecopetrol SA (NYSE: EC) – Organized under the form of a public limited company, of the national order, linked to the Ministry of Mines & Energy. Mixed economy company of an integrated commercial nature in the oil & gas sector. 🇼 🏷️

🇨🇴 Grupo Aval: The Rally Is Just Getting Started (Seeking Alpha) $ 🗃️

- 🇨🇴🅿️ Grupo Aval Acciones y Valores SA (BVC: PFAVAL) – One of Colombia’s largest banking groups + leader in investment banking through Corporación Financiera Colombiana or Corficolombiana (BVC: CORFICOLCF). 🇼 🏷️

🇪🇨 Lundin Gold: A High-Grade Growth Story The Market Hasn’t Fully Priced In (Seeking Alpha) $ 🗃️

- 🇨🇦 🇪🇨 Lundin Gold Inc (TSE: LUG / FRA: F1YN / OTCMKTS: LUGDF) – Owns the Fruta del Norte gold mine in southeast Ecuador.

🌐 Global

🌐 Nebius: This Decline Might Be A Lifetime Opportunity (Seeking Alpha) $ 🗃️

🌐 Nebius Stock To Surge As Gross Profit Could 50x (Seeking Alpha) $ 🗃️

🌐 Nebius: Highly Dependent On Capital Markets To Meet Its Liquidity Needs (Seeking Alpha) $ 🗃️

🌐 Nebius: Strong Execution Meets Soaring AI Infrastructure Demand (Seeking Alpha) $ 🗃️

🌐 Nebius: Why Its Finland Campus Could Hit $650 To $900M Annually (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 A 5x in the Last Great Oil Trade? Betting Big on Offshore Drillers (TheOldEconomy Substack)

- Undervalued and Underwater: A Deep Dive into Offshore Driller Equities

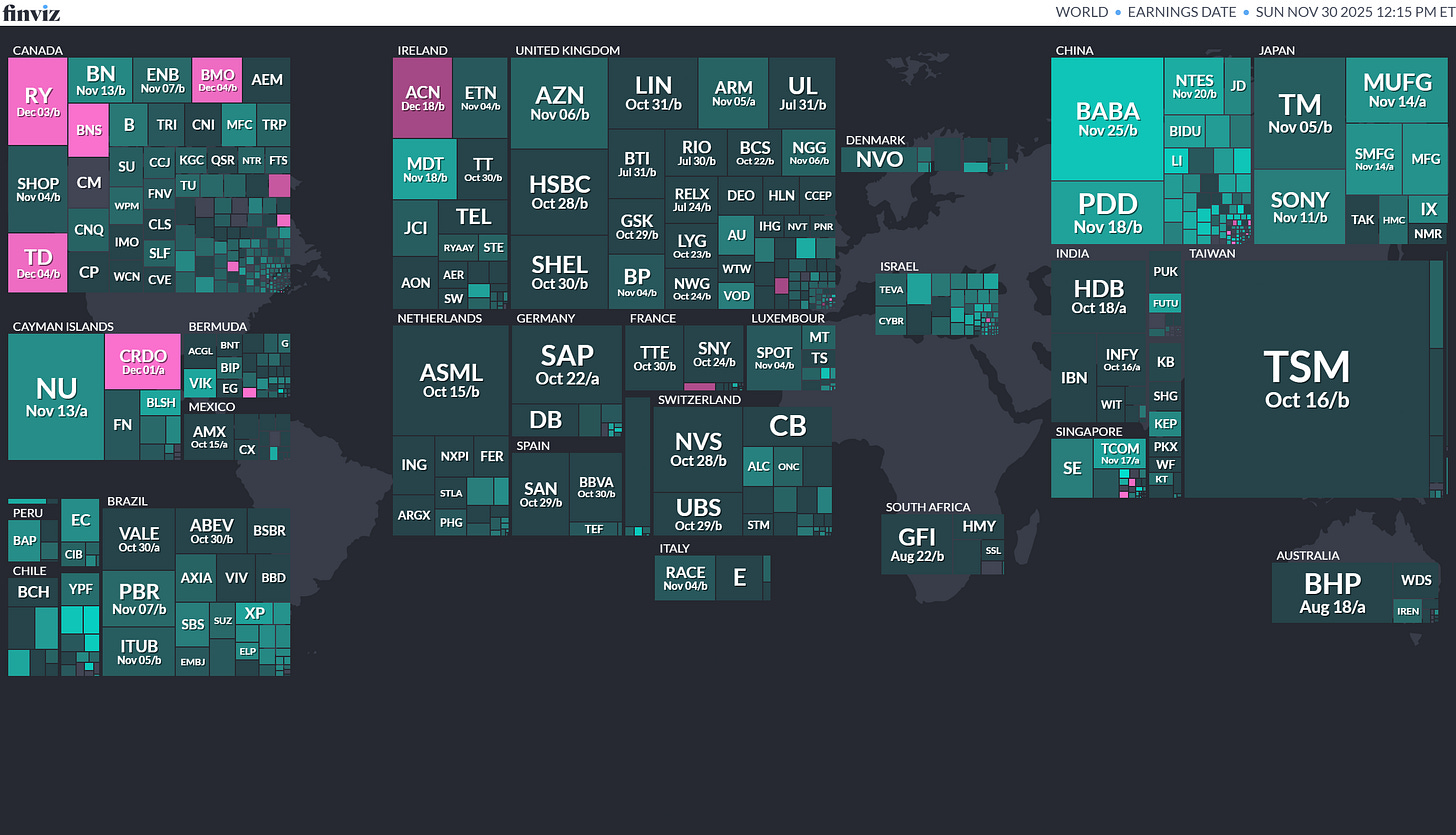

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

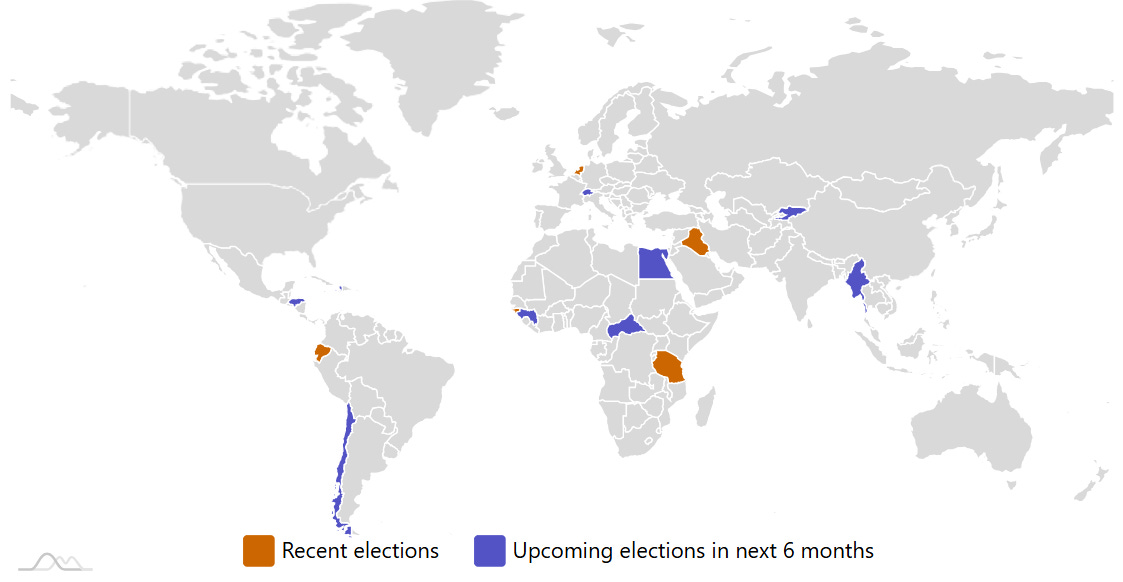

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Chile Chilean Presidency 2025-12-14 (d) Confirmed 2025-11-16

- Myanmar Myanmar House of Representatives 2025-12-28 (t) Confirmed 2020-11-08

- Myanmar Myanmar House of Nationalities 2025-12-28 (t) Confirmed 2020-11-08

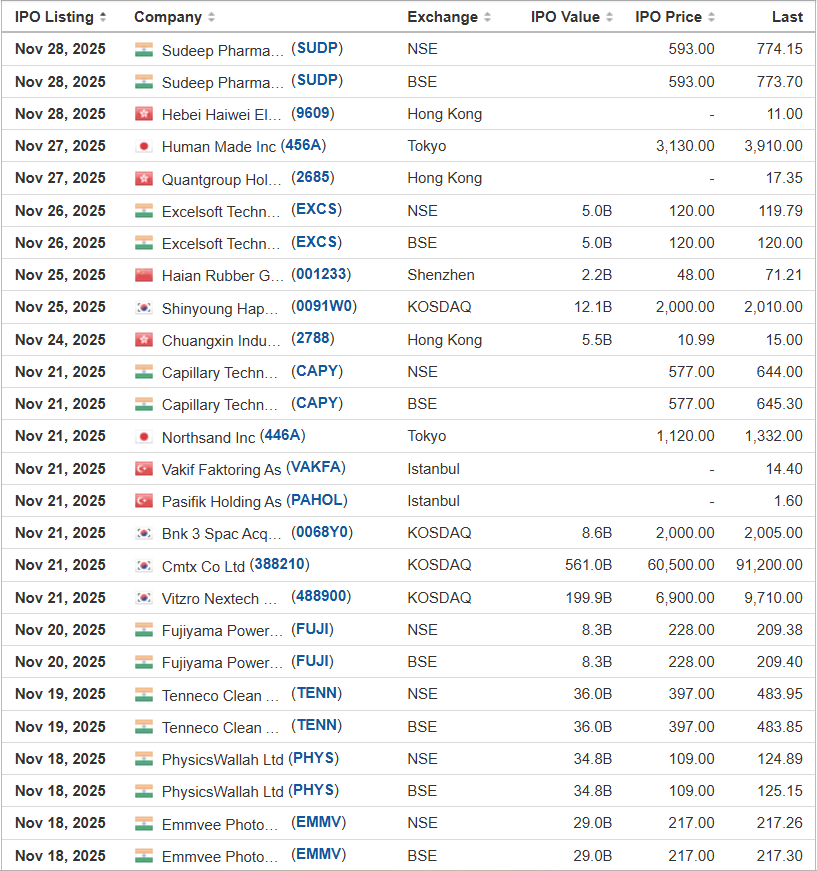

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 12/1/2025 Week of

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.

We sell our products through both offline and online channels. Our offline customers are mainly business entities, including local community stores and/or high-end boutiques, shopping malls, supermarkets and distributors, who purchase products from us, either by directly placing orders with us or through our proprietary apps designed specifically for our offline customers to place orders efficiently, and on-sell them to end consumers. Our online customers are generally users who purchase products directly from us through third-party E-commerce platforms and our proprietary AigoSmart App.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: AIGO Holding Ltd. is offering 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its F-1 filing dated Aug. 21, 2025.)

ALE Group Holding Limited ALEH D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-6.00, $7.5 mil, 12/1/2025 Week of

We are a holding company incorporated in the BVI with all of our operations conducted in Hong Kong by our wholly owned subsidiary, ALE Corporate Services Ltd., also known as ALECS. (Incorporated in the British Virgin Islands)

We provide accounting and corporate consulting services to small and medium-sized businesses. Our services include financial reporting, corporate secretarial services, tax filing services and internal control reporting. Our business is operated through our wholly owned subsidiary, ALE Corporate Services Ltd. (ALECS), a Hong Kong company incorporated on June 30, 2014. Our goal is to become a one-stop solution for all the accounting, corporate consulting, taxation and secretarial needs of small and medium enterprises operating in Asia and the U.S.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the fiscal year that ended March 31, 2024.

(Note: D. Boral & Company (formerly E.F. Hutton) is the sole book-runner. Background: The company disclosed that E.F. Hutton was named the sole book-runner – replacing Prime Number Capital – according to an F-1/A filing dated March 26, 2024.)

DT House Ltd. DTDT American Trust Investment Services, 2.0M Shares, $4.00-5.00, $9.0 mil, 12/1/2025 Week of

(Incorporated in the Cayman Islands)

We are a Cayman Islands exempted company with operations conducted by our subsidiaries in the UAE and Hong Kong. DT House is the holding company of UHAD, UHHK and UFox, all being our wholly-owned subsidiaries. Our headquarters are located in the UAE, and we commenced with the establishment of UHHK in 2020. We provide corporate consultancy services encapsulating environmental, social and governance-related aspects (commonly known as “ESG”) to enterprises and corporations with the purpose of unlocking greater business resiliency and sustainable cost savings along with revenue generating opportunities. As part of our corporate consultancy services around the ESG thematic, we provide travel-related services for leisure travelers into the UAE, which includes primarily the sale of tourism attractions tickets.

Our corporate consultancy services are provided in the UAE and Hong Kong. ESG is an emerging managerial concept for enterprises and corporations. Through technology integration, our corporate consultancy services offer customized hassle-free solutions to clients, from developing the knowledge and acknowledging the importance of ESG criteria, to formulating internal ESG self-assessments and practices, identifying ESG-related risks and opportunities, implementing cost-effective ESG policies and solutions, and eventually to capitalizing on potential ESG-related market opportunities and strategies. Our clients consist of public companies in the United States and Hong Kong, as well as small and medium-sized enterprises and private corporations in the UAE, Hong Kong and southeast Asia. We leverage upon emerging technologies to drive growth, optimize operations, and create new value streams for our clients. We have our own AI driven, cloud-based software program, and will continue to develop such program so that it can interact with various databases, collect relevant data, and use the data collected to perform self-determined tasks to meet predetermined goals (commonly known as “AI Agent”), which enables clients to retrieve, analyze, compare and evaluate ESG performance of themselves, their competitors and other market participants.