As noted last week, Taiwan’s economy roars ahead on back of AI demand (🗃️) but Financial Times also notes that Taiwan’s AI boom leaves traditional manufacturers trailing (🗃️):

- Diverging fortunes of technology and other sectors spark concern despite rapid growth in GDP

- But Taiwanese manufacturers of more traditional products, such as car parts and machine tools, have been hit hard by hefty import tariffs imposed by US President Donald Trump and by a rise in the Taiwan dollar that has eaten into their profit margins.

Walking around Taipei for the first time since COVID, I am noticing new and ongoing high rise construction around the city. Not China property bubble levels of new construction as the construction I am seeing looks more sustainable with the most noticeable being two massive high-rises going up by or over the Airport MRT station by the Taipei Main Train Station (with one of the old city gates under restoration) and something getting built on a block of land next to Taipei 101:

The Asset has pointed out how Asian firms are adapting, stabilizing post-tariffs (🗃️) while the Financial Times has noted how US tariffs prompt surge in Chinese exports to south-east Asia (🗃️). This would be a two way street as California almond exports to Vietnam, etc. also surged during Trump’s last trade war (as Australia’s almond industry is much smaller) and then there are the reports of chips exported to Singapore that find their way to China.

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 Emerging Market Stock Picks (November 2025) Partially $

- Asia

- East Asia

- SE Asia

- 🇮🇩 Indonesia – Geo Energy Resources, Bank KB Indonesia PT Tbk, Bank Rakyat Indonesia Tbk PT, PT Bumi Resources Minerals Tbk, PT Hatten Bali Tbk, Rukun Raharja Tbk PT, PT Sinergi Inti Andalan Prima Tbk, Blue Bird Tbk PT, PT Indofood CBP Sukses Makmur Tbk, Telkom Indonesia Persero Tbk PT, PT Bank Mandiri Tbk, Bumi Resources Tbk PT, Bumi Serpong Damai Tbk PT, Metropolitan Kentjana Tbk PT, PT Nusantara Sawit Sejahtera Tbk, Charoen Pokphand Indonesia Tbk PT, MD Entertainment PT Tbk, Jayamas Medica Industri Tbk PT, PT Dayamitra Telekomunikasi Tbk, Astra International & Mitra Keluarga Karyasehat Tbk PT

- 🇲🇾 Malaysia – Mechanical, Electrical and Plumbing (MEP) Stocks

- 🇵🇭 Philippines

- 🇸🇬 Singapore – Isoteam Ltd, Reclaims Global Ltd, United Overseas Bank / DBS Group / Singapore Exchange Limited, Soon Hock Enterprise, Hong Leong Asia Ltd, Seatrium Ltd, Keppel Infrastructure Trust, Wee Hur Holdings Ltd, Telechoice International Ltd, Ireit Global, Kimly Ltd, Starhill Global Real Estate Investment Trust, Sanli Environmental Ltd, CSE Global Ltd, Far East Hospitality Trust, Sembcorp Industries, Centurion Corporation Ltd, CapitaLand Investment, CDL Hospitality Trusts, UOL Group, Frencken, Food Empire Holdings, Venture Corporation, UMS Integration Ltd, Genting Singapore, Oversea-Chinese Banking Corp (OCBC), NetLink NBN Trust, Centurion Accommodation REIT, NTT DC REIT, First Real Estate Investment Trust, ASL Marine Holdings Ltd, Wilmar International, DFI Retail Group, Sheng Siong Group & Prime US REITSingapore Broker’s Digest

- 🇹🇭 Thailand – Bangkok Chain Hospital PCL, Stecon Group PCL, Land and Houses PCL, Thai Beverage PCL, Electricity Generating PCL, Airports of Thailand PCL, WHA Corporation PCL, CH Karnchang PCL, PTT Oil & Retail Business PCL, Minor International, Gulf Development PCL, Osotspa PCL, PTT Public Company Limited, Origin Property PCL, Mermaid Maritime PCL, Thai Airways International PCL, Thai Oil PCL, Berli Jucker PCL, Central Plaza Hotel PCL, Tidlor Holdings PCL, Pruksa Holding PCL, Erawan Group PCL, Srisawad Corporation PCL, Charoen Pokphand Foods, Banpu PCL, Ratch Group PCL, Central Pattana PCL, Carabao Group PCL, Com7 PCL, Plan B Media PCL, LPN Development PCL, Muangthai Capital PCL, Star Petroleum Refining PCL, Bangkok Expressway and Metro PCL, Bangkok Dusit Medical Services PCL, Central Retail Corporation PCL, PTT Global Chemical PCL, Thanachart Capital PCL, AP (Thailand) PCL, Thaifoods Group PCL, Bangkok Commercial Asset Management PCL, Asset World Corp PCL, Bumrungrad Hospital PCL, CP ALL PCL, GFPT PCL, Betagro PCL, CP Axtra PCL, Indorama Ventures PCL, Supalai PCL, Quality Houses PCL, Dohome PCL, Bangchak Corporation PCL, True Corporation PCL, Global Power Synergy PCL, IRPC PCL, Home Product Center PCL, Thai Union Group PCL, Advanced Info Services PCL, i-Tail Corporation PCL & Krung Thai Bank PCL

- South Asia

- Middle East – LuLu Retail Holdings PLC, Dana Gas PJSC & Americana Restaurants International PLC

- 🇧🇭 Bahrain – GFH Financial Group (GFH)

- 🇰🇼 Kuwait – Talabat Holding PLC

- 🇴🇲 Oman – OQ Base Industries

- 🇸🇦 Saudi Arabia – Saudi Telecom Company SJSC & Saudi Basic Industries (SABIC)

- 🇦🇪 United Arab Emirates (UAE) – Investcorp Capital PLC, Abu Dhabi Ports Company PJSC, Agthia Group, Amanat Holdings PJSC, Dubai Electricity and Water Authority PJSC, Presight AI Holding PLC, Aramex PJSC, Abu Dhabi National Insurance Company PSC, Commercial Bank International (CBI), National Central Cooling Company PJSC, E7 Group PJSC, RAK Ceramics PJSC, Agility Global PLC, ADNOC Gas PLC, Emaar Development PJSC, Emaar Properties PJSC, Air Arabia PJSC, ADNH Catering PLC, Dubai Taxi Company PJSC, ADNOC Logistics & Services PLC, Fertiglobe PLC, Parkin Company PJSC, Emirates Central Cooling Systems Corporation (Empower), Tecom Group PJSC, ADNOC Drilling Company PJSC, Pure Health Holding PJSC, Mashreq Bank, ADNOC Distribution PJSC & Dubai Financial Market PJSC

- Africa

- Eastern Europe & Emerging Europe

- 🇭🇺 Hungary – Any Security Printing Co PLC, Duna House Holding, Graphisoft Park SE, AutoWallis PLC, ALTEO Energy Services PLC, Waberer’s International Nyrt & Masterplast Nyrt

- 🇵🇱 Poland – Atm Grupa SA, Vigo Photonics SA, Fabrity Holding SA, Bloober Team SA, Mirbud SA, Enter Air SA, Ailleron SA, Noctiluca SA, XTPL SA, Skarbiec Holding, Elektrotim SA, Stalprofil SA, Torpol SA, Auto Partner SA, Apator SA, Cyber_Folks SA, Agora SA, Newag SA, ZUE SA, Sanok Rubber Company SA, Atende SA, Artifex Mundi SA, Dadelo SA, Wirtualna Polska Holding SA, Izostal SA, Makarony Polskie SA, ASBISc Enterprises Plc & Vercom SA

- Latin America

- 🤖 DeepSeek Analysis

- Summary of Why These Stocks Stand Out

- Asia

- 🌐 EM Fund Stock Picks & Country Commentaries (December 7, 2025) Partially $

- Growing Yieldstreet trainwreck, Chinese stocks make a comeback, India’s innovation boom, Latin America’s reform revival, quiet repricing of reality, case for global small caps, fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 Emerging East Asia LCY bond market slows (The Asset) 🗃️

- Growth in government and corporate bond issuance tapers off in third quarter

🌏 Asian firms adapting, stabilizing post-tariffs (The Asset) 🗃️

- US policy in certain markets boosting short-term trade, with majority of Singapore firms optimistic

- More than six months after the US announced its “liberation day” tariffs, firms in Asia are showing signs of adaption and stabilization, their concerns around revenue have eased and a new trade map is shaping up, according to a recent report.

- Furthermore, certain markets in Asia report that recent trade policy shifts are boosting rather than hindering their short-term growth, finds the HSBC Global Trade Pulse Survey report, which also reveals that more than two in three ( 68% ) of Asian respondents feel more certain about the impact of trade policy than they did six months ago.

- With the tariff dust beginning to settle, firms in Asia, the report shares, expect supply-chain disruption to have a slightly lower impact on revenue than six months ago. On average, Asian respondents forecast a 13% negative impact on revenue over the next two years, down from 18% in the report’s survey from approximately six months ago.

🌏 US tariffs prompt surge in Chinese exports to south-east Asia (FT) $ 🗃️

- Washington’s greater protectionism spurs closer ties between Beijing and the region

- In attempts to protect domestic manufacturers from being undercut by cheaper Chinese imports, some south-east Asian countries have tightened import rules and considered tariffs on certain goods.

- But Liew said such actions were “piecemeal” and “stop-gap measures”. “The fundamental lesson is unavoidable: south-east Asian manufacturers must upgrade or be squeezed out,” she said. “China’s industrial ecosystem is far more innovative.”

🌏 Asia’s wealth growing faster than the systems that serve it (The Asset) 🗃️

- Front office must be reimagined to turn it into a cohesive growth engine

- In its report, The Future of Asia Wealth Management 2025: Front Office Reimagined, global consulting and technology firm Accenture warns that Asia’s wealth industry is falling behind. Clients now expect digital-first experiences, hyper-personalized advice, and seamless engagement, but many institutions are still stuck in legacy operating models.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 HSI, HSCEI, HSTECH, HSIII, HSBIO Index Rebalance: US$6.4bn of Flows Post Capping (Dec 2025) (Smartkarma) $

- The December rebalance of the Hang Seng family of indices will use today’s closing prices to cap the index constituent weights.

- The net round-trip trade across all stocks across the five indices is estimated at HK$50bn (US$6.4bn). There is size to trade in a lot of stocks.

- Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) is the biggest buy due to HSIII Index inclusion and capping, while Alibaba (NYSE: BABA) is the biggest capping sell.

🇨🇳 KWEB Index Rebalance: 5 Adds & A Delete (Smartkarma) $

- The December rebalance of the KraneShares CSI China Internet ETF (KWEB US) will take place at the close of trading on 12 December.

- Alibaba Pictures, East Buy Holding Ltd (HKG: 1797 / OTCMKTS: KLTHF), Ping An Healthcare and Technology (HKG: 1833 / FRA: 1XZ / OTCMKTS: PANHF), XD Inc (HKG: 2400 / FRA: 3OE / OTCMKTS: XDNCF). and CaoCao Inc (HKG: 2643) will be added, while iQIYI (NASDAQ: IQ) will be deleted.

- Short interest has increased in most adds recently and there could be some short covering following the announcement of the index inclusion.

🇨🇳 Alibaba Cloud Summit HK: The 2B AI Playbook with Qwen, Wan, and Enterprise Stack (AI Proem)

- From Tongyi Lab to pharmacovigilance and smart cockpits. Blending large models, data platforms, and real-world use cases.

- Walking into the Alibaba Cloud Summit in Hong Kong, I felt very far away from the AI conversations I just had in Singapore.

- What the Hong Kong Cloud summit clicked for me was that Alibaba Cloud has always actually played the enterprise strategy, just one card at a time, and it’s now becoming clearer to everyone that the company is using those models as leverage to become the default 2B AI solutions provider.

🇨🇳 Cango looks past its bitcoin phase to a future as AI infrastructure operator (Bamboo Works)

- After booming for much the first year in its pivot to bitcoin mining, the company is looking ahead to a future of creating a ‘global, distributed AI compute grid’

- Cango (NYSE: CANG)’s revenue jumped 60.6% sequentially in the third quarter to $224.6 million, buoyed by the addition of new mining capacity and rising bitcoin prices

- The company said it sees bitcoin mining as a “practical on-ramp” towards its eventual goal of building a global network of high-performance computing centers

🇨🇳 After finding profits, Zhihu faces new questions from AI onslaught (Bamboo Works)

- The online knowledge community operator briefly achieved profitability in the first half of this year, but that momentum didn’t carry into the third quarter

- Zhihu Inc (NYSE: ZH) reported its revenue fell 22% year-on-year in the third quarter, as it slipped back into the red after finding profits earlier this year

- The operator of a knowledge-sharing community, often called the “Quora of China,” said its paid membership revenue for the quarter dropped 16% year-on-year

🇨🇳 Unisound AI IPO Lockup (9678.HK): ~US$1.6B Early Lockup Release for Co-Founders (Smartkarma) $

- Unisound AI Technology Co Ltd (HKG: 9678), a Beijing-based AI solution provider focusing on the sales of conversational AI products and solutions, completed an initial public offering at HK$205/share in June.

- The company raised HK$251M in its Hong Kong IPO, including additional net proceeds from the over-allotment shares issued upon the full exercise of the over-allotment option.

- The stock peaked at HK$879.00 in September and fell ~41% over the next two months. The company’s early IPO lockup will expire on December 29, 2025.

🇨🇳 A Quiet Chinese Mobile Giant in Africa (Asianometry) 23:19 Minutes

- Shenzhen Transsion Holdings (SHA: 688036) (傳音控股) is a Shenzhen company that has quietly grown a mobile phone empire in Africa. They are so low key that in January 2016, a Shenzhen government official remarked that he hadn’t known that a Chinese company was doing so well in Africa. After 15+ years, Transsion has sold hundreds of millions of phones in the continent thanks to smart products and good distribution. But changes are afoot. Competition is intensifying. And it is pushing them out of their comfort zone. In today’s video, let us talk about a unique Chinese mobile phone giant in Africa: Transsion.

🇨🇳 From Burn to Breakeven: NIO’s EV Playbook Gains Traction in China and Beyond (LongYield)

- NIO Inc (NYSE: NIO)’s multi-brand lineup (NIO, ONVO, and FIREFLY) showcased at Auto Guangzhou 2025. The company has expanded its portfolio across premium, family, and compact EV segments to drive growth.

- Key catalysts in 2026 could include: Margin improvement as cost-cutting initiatives fully materialize and newer models (with better economics) form a larger portion of sales.

🇨🇳 2026 High Conviction: Short NIO (NIO US/9866 HK) (Smartkarma) $

- NIO Inc (NYSE: NIO) is a Chinese premium electric vehicle manufacturer listed on three exchanges.

- NIO’s Q4 deliveries guidance was below expectations, and sales momentum is on a declining trend. Sustainably hitting its 20% gross margin target and achieving breakeven in 2026 seems a stretch.

- NIO’s valuation is stretched, trading at a material premium to the median EV/Sales and growth-adjusted EV/Sales multiples of Chinese EV peers.

🇨🇳 BYD Overhauls Payment System as China Tightens Oversight (Caixin) $

- China’s BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) is dismantling a massive digital payment system used to settle obligations to suppliers, marking a major shift in the country’s trillion-yuan shadow receivables market following a sweeping regulatory crackdown, Caixin has learned.

- Since 2018, BYD has increasingly relied on Di Lian (迪链) vouchers — digital receivables certificates backed by the automaker’s own credit — as a key method of settling payments to suppliers. These instruments circulated within BYD’s vast supplier network or were discounted for cash, often through a factoring firm affiliated with BYD.

🇨🇳 Chart of the Day: Pony AI, WeRide Remain in the Red Despite Surging Revenue (Caixin) $

- Two of China’s leading autonomous driving firms reported a jump in third-quarter revenue, fueled by rapid growth in their robotaxi businesses. But profitability remains out of reach as they plow funds into expansion.

- Pony AI Inc (NASDAQ: PONY) posted revenue of $25.4 million, up 72% year-on-year, its third consecutive quarter of growth, according to its latest earnings report. The company’s robotaxi division stood out, with revenue surging 89.5% to $6.7 million, driven by a more than 200% jump in fare-based income.

🇨🇳 Waterdrop splashes back to revenue growth. But are investors listening? (Bamboo Works)

- The insurance broker’s revenue rose 38.4% in the third quarter, boosted by a 20-fold increase for its young technical services business

- Waterdrop (NYSE: WDH) looks set to return to strong revenue growth this year, ending three consecutive years of declines

- The company’s new technical services segment is recording explosive growth, going from nearly nil last year to supplying 23% of its revenue in the third quarter

🇨🇳 GoFintech returns to the black, but sacrifices margins for big revenue jump (Bamboo Works)

- The provider of stock brokerage and other financial services’ revenue surged more than 40-fold in the first half of its fiscal year, but its gross profit margin plummeted

- GoFintech Quantum Innovation Ltd (HKG: 0290)’s revenue soared 47 times year-on-year in the six months to September, as it returned to profitability

- The big revenue gain largely owed to new supply chain brokerage services, but margins for the new business are razor-thin

🇨🇳 Lufax Holding (LU): Governance Crisis or Fraud? (Asymmetric Capital)

- From Rising Star to Red Flags: Understanding Lufax’s Turbulent Journey

- Also Operationally, Lufax Holdings (NYSE: LU) is accelerating its pivot toward a full credit-risk-bearing model, moving away from its legacy dependence on third-party credit enhancement partners. This transition is already visible in the numbers as of Q3 2024.

- The company is winding down the Lujintong and wealth management platform businesses.

- Looking ahead, Lufax has a clear roadmap for scaling its new model, anchored by its 70%-owned consumer finance subsidiary, Ping An Consumer Finance (PPCF). The company’s 2026 Continuing Connected Transactions (CCTs) with Ping An affiliates set revenue caps of RMB 4.1 billion for General Services fees and RMB 2.4 billion for Guarantee Services fees, totaling RMB 6.5 billion.

🇨🇳 This stock will most likely re-rate, upside ~100%+ (Archetype Capital)

- P/E = 3 for a High Margin, Capital Light, Cash Generator

- The China Fintech lending sector has currently been oversold. The best of the bunch (undervalued + great business model) is Qifu Technology (NASDAQ: QFIN). The market is waaay too pessimistic, and the business fundamentals are fine. I expect this to re-rate 100%+.

- I believe the sector-wide sell-off in Chinese fintech was caused by consumer-finance reforms, and investors being skittish on China in general. Yes- I have watched the China-Hustle. I am well aware of the reverse-merger scams that were run. I do not believe QFIN is a scam, but I do believe that many investors believe China to be completely ‘un-investable’ and I thank them, because its for that reason we can make money, reliably, investing in China.

- A credit-tech platform. They connect financial institutions with consumers who need credit. One of their business segments provides the credit but they also generate revenue from service fees. QFIN provides the plumbing, scoring, and servicing and earns fees.

- The loans are small, on average ~9000RMB or $1,200. To individuals and small to medium enterprises (SMEs). Exact portion is not disclosed.

🇨🇳 A strong quarter doesn’t make Yeahka a bargain (Bamboo Works)

- The payment technology company posted impressive third-quarter results, yet its lofty valuation is limiting near-term upside for its stock

- Yeahka (HKG: 9923 / FRA: 4YE / OTCMKTS: YHEKF)’s gross payment value surged 50% in the third quarter compared with the previous three months

- The payment services provider’s stock trades at a forward price-to-earnings ratio around 30 times, signaling a premium valuation

🇨🇳 ICBC Executives Taken Away as Concerns Mount Over China’s Biggest Bank (Caixin) $

- Two executives at Industrial and Commercial Bank of China (SHA: 601398 / HKG: 1398 / FRA: ICK / OTCMKTS: IDCBY / IDCBF) have been taken away by authorities, in a sign of mounting scrutiny at the world’s largest lender following the disappearance of a provincial branch head.

- Fu Jianmin, a manager at the bank’s Guangdong branch, and Lü Hongxiao, a vice president at the Gansu branch, were recently taken away, sources familiar with the matter told Caixin.

- The move comes just after Tao Biao, head of ICBC’s Yunnan branch, went missing last month, though no official investigation into Tao has been announced yet.

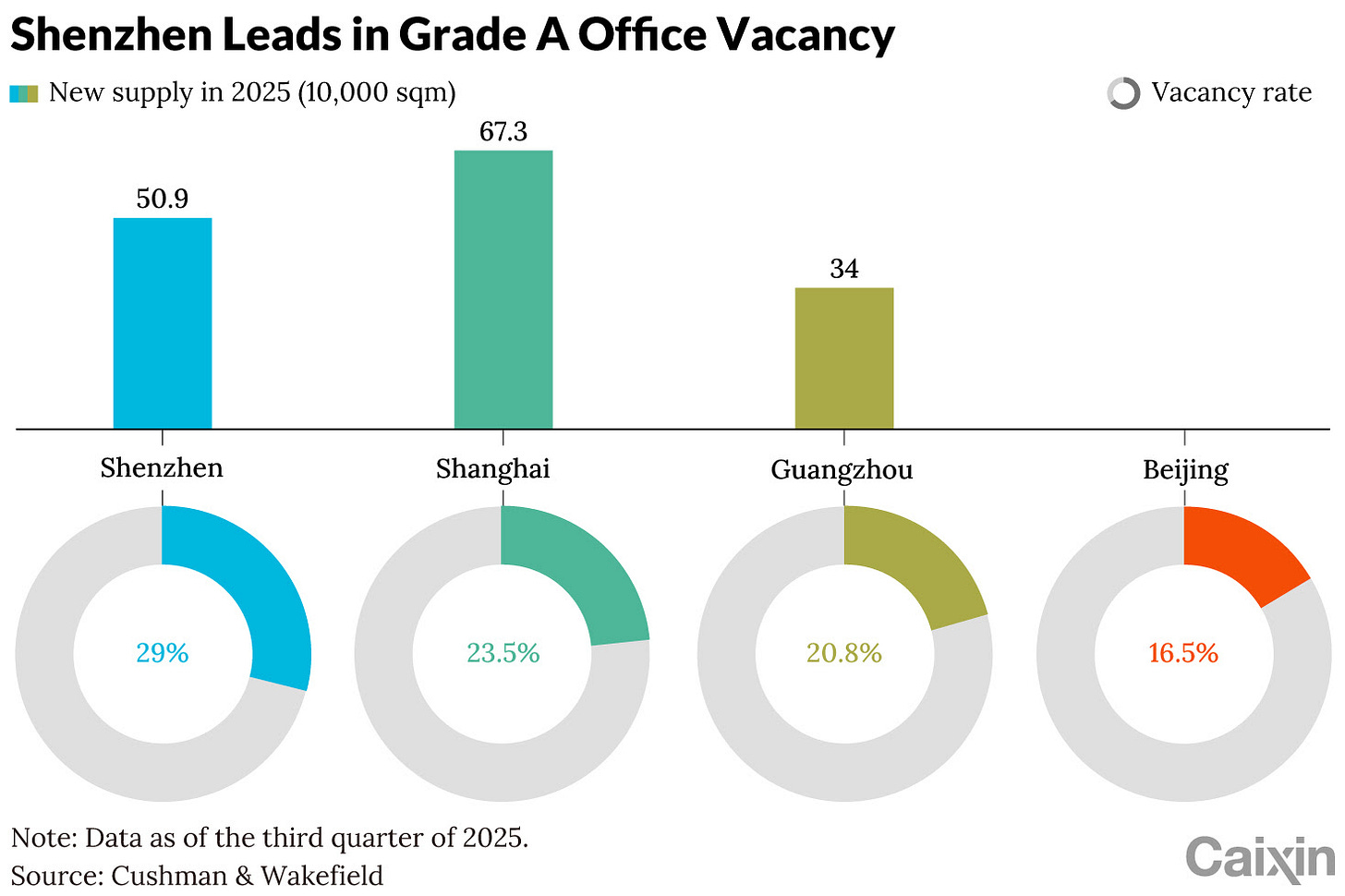

🇨🇳 In Depth: Shenzhen Gorged on Skyscrapers, Now It Faces a Commercial Property Glut (Caixin) $

- Scores of glass-and-steel skyscrapers tower over Shenzhen, monuments to a two-decade surge of economic development. But the crowds of buildings surrounded by bustling streets hide a growing problem haunting the southern metropolis: swaths of vacant office space.

- This is the paradox of modern Shenzhen — a symbol of China’s rapid technological ascent and a key growth engine of the Guangdong–Hong Kong–Macao Greater Bay Area, which is now feeling the after effects of a years-long construction boom colliding with an economic slowdown. By the end of the third quarter of 2025, the vacancy rate for its Grade A office space was around 30%, according to several real estate services firms.

🇨🇳 Vanke Seeks One-Year Extension on 2 Billion Yuan Note as Liquidity Tightens (Caixin) $

- Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / OTCMKTS: CHVKF / CHVKY) has proposed a one-year extension on its 2 billion yuan ($282 million) mid-term note due in December, marking its first public debt deferral and signaling mounting financial strain even on one of China’s strongest state-backed developers.

- According to documents reviewed by Caixin, Vanke’s “22 Vanke MTN004” bond would be pushed to mature on Dec. 15, 2026, with the coupon kept at 3%. All accrued and future interest would be repaid in full at maturity — with no compounding and no upfront cash payment.

🇨🇳 Analysis: Vanke’s Extension Plan Sparks Fresh Jitters in China’s Bond Market (Caixin) $

- Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / OTCMKTS: CHVKF / CHVKY), long viewed as one of the country’s most reliable and conservatively run developers, has jolted the onshore bond market by proposing to extend repayment of a domestic bond coming due in mid-December.

- The move has intensified concerns that even the sector’s strongest names are no longer insulated from the prolonged liquidity squeeze battering China’s real estate industry.

🇨🇳 Muyuan eyes global pig pen with Hong Kong IPO (Bamboo Works)

- The world’s largest pork producer could raise up to $1 billion in a blockbuster listing that would be one of the largest by a consumer company this year

- Muyuan Foods Co Ltd (SHE: 002714) has filed for a Hong Kong IPO, planning to use the proceeds to build a 3.2 billion yuan pig farm in Vietnam, its first outside China

- The hog farming company has also found new growth with recent moves into the slaughtering and meat processing businesses

🇨🇳 JD Industrials IPO (7618 HK): Valuation Insights (Smartkarma) $

- JD Industrials (7618 HK) is a leading industrial supply chain technology and service provider in China. It has launched an HKEx IPO to raise up to US$420 million.

- I previously discussed the IPO in Jingdong Industrials (JDI) IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price range is attractive.

🇨🇳 TOP TOY IPO Valuation Analysis: Is TOP TOY The Next Breakout IPO in Hong Kong? (Smartkarma) $

- TOP TOY is expected to IPO in 2026. The company has completed a ~$60M Series A round that was led by Temasek at a ~$1.3B post-money valuation in July.

- In my insight, I discuss IPO valuation, update relative valuation table and examine competitive landscape among domestic and international toymakers.

- TOP TOY revenue growth accelerated in 2025 coupled with improving profitability and growing free cash flows. TOP TOY was a major growth engine for MINISO Group Holding (NYSE: MNSO)’s business in 3Q.

🇭🇰 ANE (9956 HK): Tempting Fate Through an Unchanged Share Alternative Cap? (Smartkarma) $

- The consortium has decided NOT to exercise its right to increase the [Investment holding company operates an express freight network in the less-than-truckload (LTL) market in China] ANE (Cayman) Inc (HKG: 9956) share alternative cap from 5.00% to 7.50% of outstanding shares.

- The positive read-across is that it signals the consortium’s confidence that the vote will pass, as reflected in the quick decision not to lift the cap (deadline was 12 December).

- The negative readacross is that shareholders requesting the scrip option likely exceeded the 7.5% upper threshold, and the consortium is hoping that these shareholders will instead take the mix option.

🇭🇰 Chow Tai Fook Jewellery Group Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Chow Tai Fook Jewelry Group (HKG: 1929 / FRA: 1CT / OTCMKTS: CJEWY / CJEWF) 🇰🇾 – Extensive retail network in China, Japan, Korea, SE Asia, USA & Canada. 🇼 🏷️

🇭🇰 DFI Retail Group Holdings Limited (DFIHY) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🌏 DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY) 🇧🇲 🇸🇬 – Well-known brands across food, convenience, health & beauty, home furnishings, restaurants & other retailing. Part of Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF). 🇼 🏷️

🇭🇰 Far East Consortium International Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Far East Consortium International Ltd (HKG: 0035 / FRA: FET / OTCMKTS: FRTCF) 🇰🇾 – Property development & investment, hotel operations & management, car park operations & facilities management, securities & financial product investment & gaming operations. 🇼 🏷️

🇲🇴 Macau’s November GGR best recovery rate from pre-pandemic times: analysts (GGRAsia)

- The “beat goes on” said JP Morgan Securities (Asia Pacific) Ltd on Monday, referring to Macau’s official monthly casino gross gaming revenue (GGR) figures, which it said have exceeded market-consensus performance for seven out of 11 months so far this year.

- The brokerage gave the assessment shortly after Macau announced November’s GGR. It came in at nearly MOP21.09 billion (US$2.63 billion), up 14.4 percent year-on-year.

- November “very comfortably beat the (already moved-up) consensus of circa 10 percent year-on-year, which is impressive particularly considering the typically slow seasonality of the month,” wrote analysts DS Kim, Selina Li, and Lindsey Qian.

🇲🇴 SJM dividend prospects clouded by market share pressure, costs pledges: Seaport Research (GGRAsia)

- SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) – best-represented among Macau’s six gaming concessionaires in terms of traditional satellite casino business – could lose gaming market share in the remainder of 2025 and during 2026, suggests Seaport Research Partners.

- That and other pressures including the slow ramp up of its Cotai resort, Grand Lisboa Palace and significant debt, cloud the outlook for it restarting a dividend programme on its Hong Kong-listed stock, according to Seaport senior analyst Vitaly Umansky.

- Grand Lisboa and Casino Lisboa (pictured, right), the SJM group’s core properties on Macau peninsula, might not be able to hold onto former satellite business amid the rolling closure for the latter venues prior to January 1 next year, indicated Mr Umansky.

🇲🇴 Macau Legend’s shareholders nod capital reorganisation, pave way for rights issue (GGRAsia)

- Shareholders in Hong Kong-listed hotel and leisure services business Macau Legend Development Ltd (HKG: 1680 / OTCMKTS: MALDF) have approved a board proposal for a capital reorganisation to enable a rights issue.

- The company will also change its domicile from the Cayman Islands to Bermuda and reduce its share capital, according to proposals passed at an extraordinary general meeting on Tuesday.

- The rights issue, according to previous information, aims to enhance the company’s capital structure and provide flexibility for future corporate actions.

- The company announced in October a proposal for a rights issue, with the intention of raising circa HKD93.0 million (US$12.0 million). The net proceeds from the exercise – after deducting expenses – are estimated to be about HKD86.9 million, stated the firm.

🇹🇼 Taiwan

🇹🇼 Taiwan’s AI boom leaves traditional manufacturers trailing (FT) $ 🗃️

- Diverging fortunes of technology and other sectors spark concern despite rapid growth in GDP

- But Taiwanese manufacturers of more traditional products, such as car parts and machine tools, have been hit hard by hefty import tariffs imposed by US President Donald Trump and by a rise in the Taiwan dollar that has eaten into their profit margins.

🇹🇼 TSMC: Foundry Monopoly, Inelastic Demand, Robust Pricing Power, And Cheap Valuations (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Unmatched Moat, Secular AI Tailwinds, And Still A Buy At Highs (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: An Underrated Gem In The AI Chip Era (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor: I Don’t Think Growth Is About To End (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: The Demand Remains Unmet, And Prices Will Increase In 2026 (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 TCC Group Holdings Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇼🅿️ TCC Group Holdings Co Ltd (TPE: 1101 / 1101B / OTCMKTS: TGBMF) or Taiwan Cement Corp – Cement, cement-related products & ready mix concrete. Cement, Electricity & Energy & Other segments. 🇼 🏷️

🇹🇼 Fubon Financial Holding Co., Ltd. (FUISF) Presents at JPMorgan Greater China Financial Tour – Slideshow (Seeking Alpha)

- 🌏🅿️ Fubon Financial Holding Co Ltd (TPE: 2881 / 2881B / 2881C / OTCMKTS: FUISF / FUIZF) – Financial products & services (Fubon Life, Taipei Fubon Bank, Fubon Bank (Hong Kong), Fubon Bank (China), Fubon Insurance, Fubon Securities & Fubon Asset Management). 🇼 🏷️

🇹🇼 Himax Technologies: Hold Until Profitability Stabilizes And Emerging Technologies Contribute Materially (Seeking Alpha) $ 🗃️

🇹🇼 Himax: A Relatively Fine Balance Of Tailwinds And Headwinds Support A Neutral Stance (Seeking Alpha) $ 🗃️

- 🌐 Himax Technologies (NASDAQ: HIMX) 🇰🇾 – Fabless semiconductor company providing display imaging processing technologies. 🇼

🇹🇼 First Financial Holding Co., Ltd. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 First Financial Holding Co Ltd (TPE: 2892) – Financial products & services in Taiwan, Asia, USA & internationally. 🏷️

🇰🇷 Korea

🇰🇷 A Review of Tender Offers in Korea in 2025 (Douglas Research Insights) $

- In this insight, we review the major tender offers of Korean companies in 2025. Some of the major M&A tender offers in 2025 include HMM (KRX: 011200), Kolon Mobility Group [Kolon Corp (KRX: 002020 / 002025)], and Viol Co Ltd (KOSDAQ: 335890).

- The tender offers have mostly been profitable for the investors in these targeted companies (especially those shareholders who owned these shares prior to the tender offer announcement).

- What is also impressive is that even after the 1st day of trading (post tender offer announcement), there have been extra alpha for the following week.

🇰🇷 A Review of Korean Small Cap Gems in 2025 (Douglas Research Insights) $

- In this insight, we review our Korean Small Cap Gem insights that we published in 2025. We published 18 Korea Small Cap Gem Series insights in 2025.

- The 18 Korean Small Caps have generally performed well this year. They were up on average 17% and 45%, respectively one week and two weeks after the insights were published.

- Some of the best performing stocks so far this year include Chunil Express Co Ltd (KRX: 000650), Aurora World Corp (KOSDAQ: 039830), Makus Inc (KOSDAQ: 093520), and Flitto Inc (KOSDAQ: 300080).

🇰🇷 2026 (”Year of the Horse”) Major IPOs Pipeline in Korea (Douglas Research Insights) $

- This is our 11th “Annual Edition of the Major Korean IPOs Pipeline Preview” at Smartkarma.

- This insight features 40 of the biggest potential IPOs in Korea in 2026.

- Some of the largest potential IPOs in Korea in 2026 include CJ Olive Young, DN Solutions, Dunamu, Goodai Global, K Bank, Kurly, Musinsa, SK On, SK Ecoplant, and Sono International.

🇰🇷 A Review of Our IPO Calls in 2025 (Douglas Research Insights) $

- In this insight, we review our IPO calls in 2025. The accuracy rate of our calls on the IPOs this year was 64%.

- The overall sentiment on IPOs in Korea have improved in the second half of this year, paying the way for some completions of major IPOs in Korea in 2026.

- LG CNS Co Ltd (KRX: 064400) and Seoul Guarantee Insurance Co (KRX: 031210) were two of the largest IPOs in Korea in 2025. Some of the best performing IPOs in Korea in 2025 include Nota Inc (KOSDAQ: 486990) and AimedBio.

- We made 42 investment calls in 2020, 37 in 2021, 19 in 2022, 23 in 2023, and 23 in 2024, and 28 in 2025 (as of 6 December 2025). The accuracy rates of our calls on the IPOs from 2017 to 2025 are as follows:

🇰🇷 Paradise Co’s November casino sales up 12pct y-o-y to US$55mln (GGRAsia)

- Paradise Co Ltd (KOSDAQ: 034230), an operator in South Korea of foreigner-only gaming venues, said its casino sales in November rose 11.6 percent year-on-year to KRW80.33 billion (US$54.7 million). Judged sequentially, such sales grew 10.6 percent, the firm stated in a Tuesday filing to the Korea Exchange.

🇰🇷 GKL’s November sales top US$28mln, up 13pct from a year earlier (GGRAsia)

- Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, reported on Tuesday casino sales of nearly KRW41.75 billion (US$28.4 million) for November, up 12.9 percent year-on-year. Judged sequentially, last month’s tally rose 46.2 percent.

🇰🇷 Samsung turns to M&A in its fight for an AI edge (FT) $ 🗃️

[Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF)]

- South Korean group creates acquisition unit to compete in race to supply advanced memory chips

🇰🇷 Doosan Bobcat: To Acquire the Controlling Stake & Conduct Tender Offer for Wacker Neuson? (Douglas Research Insights) $

- According to numerous local media, Doosan Bobcat (KRX: 241560) is pursuing the acquisition of a controlling stake in Wacker Neuson Se (WAC GR), a German based compact construction equipment company.

- Doosan Bobcat is apparently discussing a plan to acquire approximately 60% of Wacker Neuson. There are also discussions to secure the remaining shares of the company through a tender offer.

- Wacker Neuson has a market cap of 1.46 billion EUR (2.5 trillion won) and the acquisition value for a 100% stake is expected to be more than 5 trillion won.

🇰🇷 Hong Ra-Hee To Give 1.8 Million Shares of Samsung C&T to Her Son Lee Jae-Yong (Douglas Research Insights) $

- It was reported that Hong Ra-Hee plans to give all of her 1,808,577 shares in Samsung C&T Corp (KRX: 028260 / 02826K) (1.06% stake) to her son Lee Jae-Yong on 2 January 2026.

- After this stake transfer, Lee Jae-Yong’s stake in Samsung C&T will rise to 20.82% and Hong Ra-Hee will no longer have any stake in Samsung C&T.

- Higher ownership of Samsung C&T by Lee Jae-Yong will likely place a bigger focus on Samsung C&T, especially on its importance as a quasi-holding company of the entire Samsung Group.

🇰🇷 2026 High Conviction Idea: SK Inc (Douglas Research Insights) $

- Three main reasons why SK Inc (KRX: 034730 / 03473K) is our high conviction in 2026 include mandatory cancellation of treasury shares, deep discount to NAV, and the end of divorce for Chairman Chey.

- SK Inc has 17.98 million shares in treasury, representing 24.8% of outstanding shares. Among the stocks included in KOSPI200, this is one of the highest percentage of treasury shares.

- Our NAV valuation analysis suggests NAV of 28 trillion won or NAV per share of 386,469 won. This represents a 46% upside to its current price.

🌏 SE Asia

🇲🇾 Hibiscus Petroleum Berhad 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Hibiscus Petroleum Berhad (KLSE: HIBISCS) – Malaysia’s first listed independent oil & gas exploration & production company focused on enhancing production from mature assets. UK, Malaysia, Australia, & Vietnam. 🏷️

🇲🇾 Telekom Malaysia Berhad 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇲🇾🏛️ Telekom Malaysia Bhd (KLSE: TM / OTCMKTS: MYTEF) – Broadband services, data, fixed line, pay television & network services. 🇼

🇲🇾 IHH Healthcare Berhad 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 IHH Healthcare Bhd (KLSE: IHH / SGX: Q0F / OTCMKTS: IHHHF) – One of the world’s largest healthcare networks, with 83 hospitals in 10 countries – including Malaysia, Singapore, Turkiye and India. 🇼 🏷️

🇲🇾 CIMB Group Holdings Berhad 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 CIMB Group Holdings Bhd (KLSE: CIMB / OTCMKTS: CIMDF) – Various banking products & services. 🇼 🏷️

🇲🇾 Petronas Gas Berhad 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇲🇾 Petronas Gas Bhd (KLSE: PETGAS / OTCMKTS: PNAGF) – Gas processing, gas transportation, regasification & utilities. 🇼

🇲🇾 Genting recommended for downstate New York full casino licence (GGRAsia)

- Genting New York LLC is one of three sets of investors that have been recommended to receive a downstate New York casino licence in the United States.

- That is according to a Monday announcement by the New York Gaming Facility Location Board, which voted 5-0 in favour of the three finalists that remained in the race. The ultimate decision is for the New York State Gaming Commission, and is expected before year-end.

- Last month, Genting New York’s parent, Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY), affirmed that the Resorts World New York City (RWNYC) complex in the borough of Queens – currently offering electronic gaming – could become a fully-fledged casino and “begin operations as early as March 2026”.

🇲🇾 Privatisation of Genting Malaysia remains unlikely, says CreditSights (GGRAsia)

- Credit and market research provider CreditSights Inc says it continues to view the privatisation of Malaysian casino firm Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) as “unlikely”, following the closure of the takeover bid from its parent, Genting Bhd.

- In mid-October, Genting Bhd made a circa US$1.59-billion offer to acquire all shares in Genting Malaysia that it didn’t already own, aiming to delist the unit from Bursa Malaysia. At the time, the parent held a 49.99-percent stake in the casino firm.

- But Genting Malaysia is to remain listed, after the parent’s bid fell short of the 75-percent threshold needed to trigger delisting from Bursa Malaysia.

- In a Monday filing with the bourse, Genting Bhd said that as of 5pm on December 1, it had managed to secure a 73.13-percent interest in the Genting Malaysia at the close of its offer.

🇲🇾 ‘Complex’ for Genting Bhd to take Gen Malaysia private, despite on-market share buys: Nomura (GGRAsia)

- Even though Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) has moved closer to the 75.0 percent share-ownership threshold that might permit it to take private its casino-operator unit Genting Malaysia Bhd, the situation “remains complex,” suggested a Thursday note from banking group Nomura.

- “Under Malaysian regulations, reaching 75 percent would allow Genting [Bhd] to convene a shareholder meeting and make a reasonable exit offer to remaining holders,” wrote analysts Tushar Mohata and Alpa Aggarwal. They were referring to the potential move by the parent to take Genting Malaysia off Bursa Malaysia.

- “However, the delisting can be defeated if more than 10 percent of [Genting Malaysia] shareholders object, and an independent advisor would evaluate the exit offer,” added the analysts.

🇸🇬 Sea: A Puzzling Dip And A Tremendous Buying Opportunity (Seeking Alpha) $ 🗃️

- 🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Wave Life Sciences: Being Realistic, There Is Still So Much To Prove (Seeking Alpha) $ 🗃️

- 🌐 Wave Life Sciences Ltd (NASDAQ: WVE) – Clinical-stage biotech RNA medicines platform.

🇸🇬 CapitaLand Ascendas REIT (ACDSF) Presents at UBS Global Real Estate CEO/CFO Conference – Slideshow (Seeking Alpha)

- 🌐 CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF) – Business Space & Industrial REIT. Australia, Europe, Singapore, USA & UK. 🇼 🏷️

🇸🇬 Grab: Data, Dominance, And A $7B War Chest (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings: Southeast Asia’s Super-App Capitalizing On Region’s Growth Potential (Seeking Alpha) $ 🗃️

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 3 Cash-Rich Small Cap Stocks Offering Passive Income (The Smart Investor)

- We dive into three financially strong small-cap companies that are maintaining high cash reserves while actively returning passive income to shareholders.

- QAF Ltd (SGX: Q01)

- QAF Limited is a bread-and-butter dividend play in every sense, focused on food manufacturing and distribution across Southeast Asia and Australia.

- SBS Transit (SGX: S61)

- For retirees seeking steady passive income, SBS Transit offers exposure to essential public services.

- The group runs Singapore’s Northeast and Downtown rail lines alongside numerous bus packages.

- Valuetronics Holdings (SGX: BN2 / FRA: GJ7)

- Valuetronics isn’t a household name, but this integrated electronics manufacturer is busy pivoting its business toward higher-value segments.

- Get Smart: Follow the Cash, Not Just the Yield

🇸🇬 Keppel at Multi-Year Highs: Can Its Growth Story Continue? (The Smart Investor)

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF)’s share price is at multi-year highs, driven by its strategic shift into renewables and data centres, but can its growth momentum continue in the face of industry risks?

- With Keppel’s stock price up by more than 200% over the past five years, it’s fair for investors to ask whether this growth story can continue.

- Look at me now

- The old Keppel divided its business into four segments.

- Apart from O&M – which accounted for 60% of revenue and 31% of net profit in 2015 – it also had property, infrastructure, and investment arms.

- Today, these have been slimmed to three main segments: infrastructure, real estate, and connectivity.

- Growth Drivers

- Risks & Challenges

- Conclusion – Get Smart: heed the transformation

🇸🇬 Beyond the Numbers: What a Site Visit Reveals About a Business That Investors Might Miss (The Smart Investor)

- A site visit offers insights investors can’t get from reports. Using StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF) as a real-world example, we show how on-the-ground investment research reveals the forces behind a company’s results.

- Recently, I visited StarHub, one of Singapore’s major telco companies, for a behind-the-scenes look at its operations for a behind-the-scenes look at its operations. The experience helped me connect what I see in the financials with the operational realities that sit underneath.

- StarHub’s Latest Numbers: What They Say and What They Miss

- Why Understanding Management Matters More Than Ever

- What a Site Visit Reveals That Reports Can’t

- Cost Cutting Looks Different When You Hear the Details

- Consumer Competition Feels More Intense Up Close

- Enterprise and Cybersecurity Are Important, But Inherently Uneven

- The Real Takeaway for Investors

- Get Smart: The Case for Going Beyond the Spreadsheet

🇸🇬 3 Singapore Stocks Ready to Rally as 2025 Wraps Up (The Smart Investor)

- As markets approach year-end, these three Singapore stocks could see renewed momentum driven by improving fundamentals and upcoming catalysts.

- Lendlease Global Commercial REIT (SGX: JYEU / OTCMKTS: LLGCF): Riding the Tourist Recovery

- Lendlease Global Commercial REIT, or Lendlease, is a local REIT that owns a portfolio of retail and commercial properties.

- NTT DC REIT (SGX: NTDU): Pure Data Centre Exposure with High Yield

- Recently listed on 14 July 2025, NTT DC REIT, or NTT, offers investors exposure to data centre growth.

- Centurion Accommodation REIT (SGX: 8C8U): Essential Housing with an Attractive Yield

- Centurion Accommodation REIT, or CAREIT, is another relatively new listing. It is Singapore’s first pure-play accommodation REIT that offers exposure to purpose-built accommodation (PBA) for both workers (PBWA) and students (PBSA).

- Conclusion – Get Smart: Positioning for a Strong Finish

🇸🇬 3 Under-the-Radar Singapore Stocks that Beat the STI in November 2025 (The Smart Investor)

- These 3 under-the-radar Singapore stocks beat the STI in Nov 2025. Find out how small-caps can crush the market benchmark.

- CSE Global Ltd (SGX: 544 / FRA: XCC / OTCMKTS: CSYJY / CSYJF): Total Returns of 14.5%

- The systems integrator CSE Global delivered a huge win for investors, racking up a massive 14.5% total return in November.

- CSE Global provides mission-critical solutions – electrification, communications, and automation – across 15 countries.

- The Hour Glass (SGX: AGS): Total Returns of 7.7%

- In a challenging retail environment, The Hour Glass (THG) proved that luxury defies gravity, delivering a strong 7.7% return.

- Delfi Limited (SGX: P34 / OTCMKTS: PEFDF): Total Returns of 3.1%

- You might grab a SilverQueen chocolate bar for a snack, but in November, the manufacturer Delfi Ltd offered a quiet treat for investors, delivering a 3.1% return.

- Get Smart: Don’t Dismiss the Underdogs

🇸🇬 3 Blue Chip Losers for November 2025: Bargain or Red Flag? (The Smart Investor)

- Three major Singapore blue-chip stocks stumbled in November, forcing investors to question if they offer a discount or signal a deeper red flag.

- Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF): Total Returns -7.1%

- Sembcorp Industries, the energy and urban solutions giant, posted a discouraging -7.1% return in November.

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF): Total Returns -5.8%

- Mapletree Industrial Trust (MIT) saw its unit price fall by -5.8% in November, driven by a mixed quarterly report.

- Thai Beverage PCL (SGX: Y92 / OTCMKTS: TBVPF / TBVPY): Total Returns -5.2%

- Thai Beverage, Southeast Asia’s major drinks company, fell 5.2% after reporting a mixed set of results for FY2025.

- Get Smart: Opportunity or Value Trap?

🇸🇬 3 Best-Performing REITs in November 2025 (The Smart Investor)

- Centurion, AIMS APAC and FLCT emerged as November 2025’s best-performing REITs, outpacing the market with resilient portfolios and steady fundamentals.

- Centurion Accommodation REIT (SGX: 8C8U): Total Returns 9.4%

- New listings often bring a spark of excitement to the bourse, and Centurion Accommodation REIT is no exception.

- AIMS APAC REIT (SGX: O5RU / OTCMKTS: ACIRF): Total Returns 6.2%

- Industrial REITs have long been a favourite for defensive investors, and AIMS APAC REIT (AA REIT) showed us why in November.

- Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF): Total Returns 2.1%

- Frasers Logistics & Commercial Trust (FLCT) came within a whisker of the index, delivering a 2.1% return for November.

- This heavyweight, with S$6.9 billion in assets under management across five developed countries, reported a mixed bag for its fiscal year ending 30 September 2025 (FY2025).

🇸🇬 3 Blue-Chip Stocks that Beat the STI for November 2025 (The Smart Investor)

- November saw three Singapore blue-chip leaders beat the STI with standout performance powered by resilient fundamentals and strategic growth execution.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel: Total Returns 12.4%

- Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF): Total Returns 9.5%

- The diversified conglomerate, Jardine Matheson Holdings, delivered a strong 9.5% total return, fuelled by a remarkable turnaround in its first-half 2025 results (1H2025).

- Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY): Total Returns 8.1%

- OCBC, one of Singapore’s financial giants, delivered a strong 8.1% total return, confirming its status as a resilient blue-chip anchor in a challenging interest rate environment.

- Get Smart: Execution is Everything

🇸🇬 3 Singapore REITs That Could Raise Their DPU in 2026 (The Smart Investor)

- Find out which Singapore REITs may lift their DPU in 2026 as fundamentals recover and sponsor support stays strong.

- CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF)

- CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF)

- CapitaLand Ascendas REIT (CLAR, SGX: A17U) remains a cornerstone of the industrial and logistics ecosystem across Singapore, Australia, Europe and the United States.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF)

- Frasers Centrepoint Trust (FCT, SGX: J69U) remains Singapore’s suburban retail anchor, a steady and familiar presence in residents’ day-to-day spending patterns.

- Why 2026 Could Be the Turning Point

🇸🇬 3 REITs Yielding More Than 6%. Should You Buy? (The Smart Investor)

- Three REITs boast yields above 6%. Find out if their payouts are sustainable and if they deserve a spot in your portfolio.

- CapitaLand China Trust (SGX: AU8U / OTCMKTS: CLDHF) – China-focused Retail & Business Park Landlord

- CapitaLand China Trust (CLCT) is Singapore’s largest China-focused REIT.

- The REIT’s portfolio is spread across different asset classes such as retail, business parks, and logistics facilities.

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF) – Data Centre & Industrial REIT

- Mapletree Industrial Trust (MIT) is an industrial-focused REIT with exposure to the data centres segment as well as Hi-Tech Buildings and Business Space and General Industrial Buildings.

- United Hampshire US REIT (SGX: ODBU / OTCMKTS: UNHRF) – Essential & Necessity Retail

- United Hampshire US REIT, or UHREIT, owns a portfolio of 20 predominantly grocery-anchored and necessity-based properties along with two self-storage properties.

- What Makes a 6% Yield Safe — or Risky?

- Get Smart: These REITs Deserve More Attention

🇹🇭 Data centres dominate Thai 2025 real estate investment (The Asset) 🗃️

- Market also experiences resilient industrial assets, shifting hotel investment sentiment, evolving ESG standards

- Amid global headwinds and many unexpected events in 2025, real estate investment in selected sectors is strong in Thailand, chief among them, data centres, according to a recent analysis.

- Data centres have become the standout asset of 2025, driven by rising demand from cloud service providers, AI-related infrastructure requirements and stronger regional interest in Thailand as a digital hub, finds the analysis report by real estate firm JLL Thailand, which adds that investor sentiment remains positive, supported by the long-term fundamentals of the asset in Thailand.

🇹🇭 Advanced Info Service Public Company Limited (AVIFY) Presents at Bank of America ASEAN Conference 2025 – Slideshow (Seeking Alpha)

- 🇹🇭 Advanced Info Services PCL (BKK: ADVANC / SGX: TADD) – Operates Mobile Communication Service with 5G & 4G technology. 🇼 🏷️

🇹🇭 TTW Public Company Limited (TTAPY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🇹🇭 TTW PCL (BKK: TTW / TTW-F / OTCMKTS: TTAPF) or Thai Tap Water Supply PCL – Fully-integrated water management (water production & wastewater treatment). 🇼

🇹🇭 Ratch Group Public Company Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Ratch Group PCL (BKK: RATCH / RATCH-F / OTCMKTS: RGPCF) – Holdco. Fossil fuel-based power generation, renewable, electricity & energy + infrastructure & healthcare businesses. 🏷️

🇹🇭 Electricity Generating Public Company Limited (EYUBY) Presents at Opportunity Day Q3/2025 – Slideshow (Seeking Alpha)

- 🌏🇺🇸 Electricity Generating PCL (BKK: EGCO / EGCO-F / FRA: ECGF / OTCMKTS: EYUBY) – Independent Power Producer. 🏷️

🇻🇳 Opinion | New developments in Vietnam’s casino policies for local gamblers (GGRAsia)

- On November 26, 2025, the government of Vietnam issued Resolution No. 8/2025/NQ-CP to extend and expand the pilot programme allowing Vietnamese citizens who meet certain conditions to gamble at three integrated casino resorts in Vietnam:

- Corona Resorts & Casino Phu Quoc (An Giang Province) – Effective immediately, and continuing an ongoing pilot programme that started in 2019.

- The Grand Casino Ho Tram (Ho Chi Minh City) – New pilot programme for five years starting November 26, 2025.

- Van Don Integrated Casino & Tourism Complex (Quang Ninh Province) – New pilot programme for five years from the date the casino receives its licence.

🇮🇳 India / South Asia / Central Asia

🇮🇳 India’s blockbuster labour reforms (FT) $ 🗃️

- The government’s changes promise to liberalise the country’s vast jobs market

🇮🇳 The Beat Ideas: Dodla Dairy: A Story of Value Added Products & Premiumisation (Smartkarma) $

- Dodla Dairy Ltd (NSE: DODLA / BOM: 543306) is entering a new growth phase with its Maharashtra plant, OSAM integration, premium value-added products, and stronger Africa operations, supported by a solid procurement network.

- With over 94% direct milk sourcing, better farmer yields through Orgafeed, and a rising VAP mix, Dodla is building a high-return, self-funded growth model.

- As capex peaks and free cash flows inflect post-FY27, Dodla is transitioning into a structurally compounding dairy platform with improving mix, margins, and regional balance.

🇮🇳 Zydus Lifesciences: The PBC Catalyst, From Generics Volume to Specialty Value (Smartkarma) $

- Zydus Lifesciences Ltd (NSE: ZYDUSLIFE / BOM: 532321) is shifting its business from US generics toward sustained, high-margin revenue. This growth is driven by its specialty pipeline, chronic Indian business, and MedTech.

- The successful Phase 2(B)/3 trial of Saroglitazar for Primary Biliary Cholangitis (PBC) is the key near-term catalyst, promising a long-duration, high-margin revenue stream in the US specialty market.

- The transition to an innovation-led portfolio evidenced by robust pipeline, strong chronic growth in India, and the MedTech acquisition positions Zydus for a potential re-rating as earnings quality improves.

🇮🇳 The Beat Ideas: NLC India-A 1.17 Lakh Crores Capex, Renewable Focus (Smartkarma) $

- NLC India Ltd (NSE: NLCINDIA / BOM: 513683) has outlined a transformative Rs. 1.17 lakh crore capex plan and guided to a 42% PAT growth from FY26E to FY28E.

- This dual-pronged strategy balances India’s persistent base-load thermal power need with an aggressive pivot towards 10 GW of renewable energy by FY30.

- The substantial planned capacity additions and robust financial guidance suggest NLCIL is poised for material earnings expansion, necessitating a fresh look at long-term valuation multiples.

🇮🇳 The Beat Ideas: Ambuja Cements From Consolidation to Cost Leadership – Unpacking the 155 MTPA Plan (Smartkarma) $

- Ambuja Cements (NSE: AMBUJACEM / BOM: 500425) has raised its FY28 capacity target to 155 million tonnes per annum and secured the acquisition of Jaiprakash Associates’ (JAL) cement business.

- This aggressive scale-up, underpinned by a target cost reduction of INR 550/t and a green power push, is expected to drive EBITDA to INR 15000/t over FY26-28E.

- ACEM’s integrated strategy of inorganic growth and operational efficiency suggests a strong re-rating potential, justifying a deeper review of core fundamentals.

🇮🇳 2026 High Conviction Idea: ‘Delhivery’ India’s Largest Full-Range Logistics Platform (Smartkarma) $

- Delhivery Limited (NSE: DELHIVERY / BOM: 543529) has consolidated its leadership position in Express Parcel segment through ‘Ecom Express’ acquisition. We believe this is a cash-cow business with consistent mid-teens industry growth and sustainable 16-18% margins.

- Express PTL business is taking off along with the industry cycle. Supported by Delhivery’s tech stack and deep infrastructure, it is ready to corner market share with margin expansion.

- We estimate 15% revenue CAGR, translating to an EBITDA range of 1,000-1,300cr for FY28 (vs 376cr in FY25). With Net cash of 4,200cr, stock trades at EV/EBITDA of 20-25x.

🇮🇳 Wakefit Innovations IPO: Blending Digital DNA With Offline Ambition (Smartkarma) $

- Wakefit Innovations’ INR 1,288.89 crore IPO signaling the pivot of India’s largest D2C home brand toward institutional funding for accelerated omnichannel expansion.

- The fund utilization is heavily skewed towards offline growth and brand building, confirming a strategic shift from pure-play digital to a capital-intensive, integrated retail model.

- While the model mitigates supply chain risk through vertical integration, we must weigh the past profitability volatility and strategic roadmap for capturing India’s rapidly formalizing home and furnishings sector.

🇮🇳 Wakefit Innovations Ltd IPO- Forensic Analysis (Smartkarma) $

- Wakefit Innovations (1684049D IN) ‘s INR 12.9 bn IPO is a combination of fresh issue worth INR 3.8 bn and OFS component worth INR 9.1 bn.

- Wakefit is among the top 3 companies in the organised mattress market and has been growing much faster than its rival B2C companies.

- Wakefit’s turnaround in profitability in H1FY26 however relies on other income, inventory changes and A&P spends. Moreover, stagnant provisions for loyalty, and slow moving inventory warrant attention

🇮🇳 Meesho – Potential Play on Value E-Commerce (Smartkarma) $

- Meesho has positioned itself as a value-shopping platform catering to rural consumers and small sellers. It charges the seller only for fulfillment and advertising while bringing value deals for consumers

- We believe Meesho has a right to win in the value-shopping category ahead of Flipkart/Amazon with its focus on pricing vs quality/convenience. However, it may not attract high-spending aspirational consumers

- IPO valuation at $5.6bn(5x FY25 sales) is relatively cheap vs listed e-commerce peers (6-13x). Closest peer Flipkart was most recently valued at $35bn (14x FY25 revenues).

🌍 Middle East

🌍 Jumia Resurrected: The Local Playbook Beating Global Giants in Africa this Holiday Season (Hunterbrook)

- For almost a decade, Jumia Technologies (NYSE: JMIA) had been the poster child for tech bro hubris exported to the wrong latitude. Dubbed the “Amazon of Africa” at its 2019 IPO, the company burned through over a billion dollars trying to push a Western model of door-to-door convenience onto a continent with struggling infrastructure and strapped budgets — led by armchair executives in Dubai and Paris.

- The stock lost more than 95% of its value, from over $60 in February 2021 to under $2 in April 2025.

- Compounding Jumia’s challenges, the Chinese e-commerce giants Temu and Shein descended upon Africa, armed with deep pockets and aggressive algorithms. The picture for Jumia seemed bleak. “Nobody thought we would make it through winter,” the company’s CEO told Hunterbrook in an interview.

- But after a corporate coup, the sweeping removal of the old growth-at-all-costs regime, and a pivot that forced executives to relocate to Africa and rebuild the company around what customers actually wanted, Jumia is back.

🇮🇱 Teva’s pivot continues – highlights from Jeffries Healthcare conference (Kontra Investments)

- Why the anti-TL1a hype is real

- At the Jefferies London Healthcare Conference last week, Teva Pharmaceutical Industries Ltd (NYSE: TEVA) didn’t just present quarterly numbers. They continued to rewrite the identify of the company; from generics to novel pharma. For years, the market has viewed Teva primarily as a generic drug manufacturer burdened by debt – something discussed several times here for the readers that have followed along. But the narrative emerging is different. The talk in London focused on a particular part of the pivot to growth; one specific asset doing some heavy lifting: Duvakitug (TEV-’574).

- Is this asset a true valuation multiplier, or just another “me-too” drug in a crowded immunology space?

🇹🇷 Turkcell: Pain Today For More Prosperity Tomorrow (Seeking Alpha) $ 🗃️

- 🇹🇷 🇧🇾 Turkcell Iletisim Hizmetleri AS (NYSE: TKC) – Converged telecommunication & technology services provider. 🇼

🇦🇪 Wynn says two thirds of US$5.1bln budget for UAE project ‘spent or fully bought out’ (GGRAsia)

- Global casino operator Wynn Resorts Ltd (NASDAQ: WYNN) says it has spent or “fully bought out” US$3.4 billion of the total budget for the under-construction Wynn Al Marjan Island casino resort (pictured) in the United Arab Emirates (UAE). That represents circa 66.7 percent of the US$5.1 billion price tag for the property, according to a Thursday presentation.

- The casino group, parent of Macau casino concessionaire Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF), held on Thursday an analyst and investor tour to the UAE, to discuss the market there, and the Wynn Al Marjan Island project.

🌍 Africa

🇿🇦 Araxi Limited 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

🇿🇦 Vodacom Group Limited (VDMCY) Vodacom Group Limited – M&A Call – Slideshow (Seeking Alpha)

- 🌍 Vodacom Group (JSE: VOD / OTCMKTS: VODAF / VDMCY) – Telecommunications, digital and financial services. Subs. of Vodafone Group Plc (LON: VOD / NASDAQ: VOD). 🇼

🇿🇦 Sappi Limited (SPPJY) Discusses Proposed Joint Venture to Combine European Graphic Paper Businesses – Slideshow (Seeking Alpha)

🇿🇦 Sappi Limited (SPPJY) Shareholder/Analyst Call – Slideshow (Seeking Alpha)

- 🌐 Sappi (JSE: SAP / FRA: SPI / SPIA / OTCMKTS: SPPJY) – South African pulp & paper company with global operations. 🇼 🏷️

🇿🇦 MTN Group Offers Opportunity, But It’s Not An Easy Pick (Seeking Alpha) $ 🗃️

- 🌍 MTN Group (JSE: MTN / FRA: LL6 / LL6A / OTCMKTS: MTNOY / MTNOF) – Among the largest mobile network operator in the world & the largest in Africa. 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇭🇺 Gedeon Richter PLC 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇭🇺 Gedeon Richter (FRA: RIG2) – Manufactures 200+ drugs (original, generic & licensed products) in almost every therapeutic area. Focuses on the central nervous system, cardiovascular & gynaecological products. 🇼 🏷️

🇵🇱 LIvechat Software SA (LCHTF) Presents at WOOD’s Winter Wonderland EMEA Conference – Slideshow (Seeking Alpha)

- 🇵🇱 Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF) – Develops & distributes communication software for businesses worldwide. It offers LiveChat, ChatBot, KnowledgeBase & HelpDesk. 🇼 🏷️

🇵🇱 Globe Trade Centre S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Globe Trade Centre SA (WSE: GTC / FRA: G91) – Real estate investor & developer (office & retail). 🇼

🇵🇱 Asseco Poland S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Asseco Poland SA (WSE: ACP / LON: 0LQG / OTCMKTS: ASOZF) – Federation of companies engaged in IT & operates in 61 countries worldwide. 🇼 🏷️

🇵🇱 CD Projekt S.A. 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇱 CD Projekt SA (WSE: CDR / FRA: 7CD / 7CD0 / OTCMKTS: OTGLY / OTGLF) – Development of videogames & global digital distribution. 🇼 🏷️

🇵🇱 InPost: Still Plenty Of Reasons To Stay Bullish (Seeking Alpha) $ 🗃️

- 🌍 InPost SA (AMS: INPST / LON: 0A6K / FRA: 669) – Specializes in parcel locker service + courier, package delivery & express mail service. 🇼 🏷️

🌎 Latin America

🌎 Latin America as the Last Asymmetric Bet, Part 2 (TheOldEconomy Substack) $

- Event Driven Macro 101

- Welcome to Part 2 of my series of Latin American adventures. In Part 1, I explored the region’s structural advantages

- Today’s focus is on Latin America as an even-driven macro opportunity. In other words, how (not) to bet on LatAm dynamics. Originally, I planned two chapters, but during the process, ideas for a third episode emerged. So, Part 3 of our LatAm adventure will come online in January 2026.

🌎 What is the Most Asymmetric Bet in LatAm: Brazil, Chile, or Colombia? (TheOldEconomy Substack)

- November LatAm Report: The EV Edition

- South American indexes closely track the global leaders, South Korea (EWY), Greece (GREK), and Spain (EWP). The distribution across LatAm countries has not changed much; Colombia and Peru are recording >60% gains. Brazil (EWZ), Mexico (EWW), and Chile (ECH) are in the middle, with YTD gains of about 50% to 55%. The laggard is Argentina (ARGT), with 12.5% gains, underperforming even the S&P500. In short, 2025 is a great year for emerging markets connoisseurs. Besides LatAm, a case in point is South Africa (EZA) with 61.8% YTD gains.

- As noted, performance is not evenly distributed. However, this fact should not surprise anyone. For example, the Colombian market, and to some degree, the Chilean one, today is where Argentina was in the 2021-2022 period, of course, without the rampant inflation and unbearable debt burden. As a reference point, the Argentine bull market has entered its third phase, whereas Colombia and Chile are just starting.

🌎 Deep Dive Brief: Mercado Libre’s Flywheel – Part II (Expanse Stocks)

- Understanding the Flywheel and The Moat That’s Building Latin America’s Digital Economy

- In Part I, we explored the history and cultural DNA that forged MercadoLibre (NASDAQ: MELI) into a Latin American powerhouse. If you missed Meli’s origin story here is the link:

- 🔗 Deep Dive Brief: Mercado Libre’s Origin Story – Part I

- In this second part, we turn to the engine itself: its fully integrated business model, the competitive moats that protect it, the growth drivers that lie ahead along with a DCF model that capture Meli’s intrinsic value.

- For long-term investors, the beauty of Mercado Libre is not just in its individual parts, but in how they combine to create a self-reinforcing flywheel.

🌎 Mercado Libre Sees Surge in Chinese Sellers Diversifying From U.S. (Caixin) $

- Chinese merchants are flooding into Latin America’s largest e-commerce platform MercadoLibre (NASDAQ: MELI), as rising trade frictions with the U.S. and slowing growth in established markets push merchants to seek new sources of demand.

- The number of Chinese sellers on the platform has recorded triple-digit growth over the past two years, the company told Caixin. Interest from China accelerated from mid-2025 amid changes in U.S. tariff policy and mounting uncertainty over future trade rules, according to Lidia Wu, who leads MercadoLibre Inc.’s China cross-border self-fulfillment operations.

🌎 dLocal: A Rare Blend of Growth and Value (Bullseye Picks)

- Despite strong 52% revenue growth, Dlocal (NASDAQ: DLO)’s stock price dropped 10% after Q3 earnings. At just 24x EBITDA, dLocal represents a rare combo of growth and value

- Investment Thesis: Due to dLocal’s strong TPV and revenue growth, regulatory moat, and strong balance sheet, I give dLocal a STRONG BUY rating, with a price target of $20.50, presenting 52% upside.

- dLocal (NASDAQ:DLO) is not an exciting or highly hyped company. As a transnational payment processor, there’s nothing exciting about it. This presents a great opportunity. The market is pricing in low growth, despite dLocal’s proven, strong, and sustainable growth.

🌎 DLocal Valuation Model (Bullseye Picks)

- We know that Dlocal (NASDAQ: DLO) is growing quickly. The TTM PE ratio doesn’t do justice how undervalued dLocal is. Here is how we can test it

- Earlier today I posted a deep dive on dLocal, but I felt the valuation section was missing some quantitative analysis of different factors that influence the valuation.

- If you have not read the initial deep dive, I strongly suggest you do that now to get a better grip on dLocal’s business model and financials.

- Here was the initial valuation section of the deep dive (the full post can be found here):

🌎 Ternium Hit Hard By Trade-Driven Market Issues, But Not Out Of The Game (Seeking Alpha) $ 🗃️

- 🌎 Ternium S.A. (NYSE: TX) 🇱🇺 – Manufactures & processes steel products (including for oil & gas) with 18 production centers in Argentina, Brazil, Colombia, United States, Guatemala & Mexico. Subs. of Argentine-Italian conglomerate Techint. 🇼 🏷️

🌎 Millicom: Careful After Years Of Undervaluation (Seeking Alpha) $ 🗃️

- 🌎 Millicom (NASDAQ: TIGO) – Fixed & mobile, telecommunications services, cable & satellite TV, mobile financial services & local content such as music & sports in Latin America. 🇼 🏷️

🇦🇷 Pampa Energia: The Turning Point In Argentina’s Most Resilient Energy Player (Seeking Alpha) $ 🗃️

- 🇦🇷 Pampa Energia Sa (NYSE: PAM) – Participates in power generation & transmission. 🇼 🏷️

🇦🇷 Lithium Americas Corp. (LAC:CA) Presents at Citigroup 2025 Basic Materials Conference – Slideshow (Seeking Alpha)

- 🇦🇷 🇺🇸👼🏻 Lithium Americas (NYSE: LAC) – Focused on advancing lithium projects in Argentina & USA to production. 🇼 🏷️

🇧🇷 Gerdau: Too High In This Macro (Rating Downgrade) (Seeking Alpha) $ 🗃️

- 🌎🅿️ Metalurgica Gerdau SA (BVMF: GOAU3 / GOAU4) – Leading global steel producer & the largest producer of long steel in the Americas. 🇼 🏷️

🇧🇷 Suzano S.A. (SUZ) Presents at JPMorgan Brazil Opportunities Conference – Slideshow (Seeking Alpha)

🇧🇷 AXIA Energia: Buy Given Significant +25% Capital Return Expected (Seeking Alpha) $ 🗃️

- 🇧🇷🅿️ Centrais Elétricas Brasileiras SA (NYSE: EBR / EBR.B / BVMF: ELET3 / ELET5 / ELET6) or Eletrobras – Electric power holding company. Largest generation & transmission company in Brazil. 🇼

🇧🇷 Sabesp: Good Potential In A Conservative Industry (Seeking Alpha) $ 🗃️

- 🇧🇷🏛️👼🏻 Companhia de Saneamento Básico do Estado de São Paulo – SABESP (BVMF: SBSP3) – Water & sewage service provider in São Paulo State. 🇼

🇧🇷 CI&T: Investor-Friendly Capital Allocation, But Iffy Revenue Growth And AI Caution (Seeking Alpha) $ 🗃️

🇧🇷 Raia Drogasil S.A. (RADLY) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🇧🇷 Raia Drogasil (BVMF: RADL3 / OTCMKTS: RADLY) – Largest pharmacy chain in Brazil + one of the 10 largest digital retail platforms in the country. 🇼 🏷️

🇧🇷 Afya’s Q3 2025 And Investor Day Provide More Data On Undergraduate Competition Increasing (Seeking Alpha) $ 🗃️

- 🇧🇷 Afya (NASDAQ: AFYA) – Bertelsmann backed medical education & digital health services group in Brazil. Delivering an end-to-end physician-centric ecosystem. 🏷️

🇧🇷 B3’s Q3 Was Pressured By Derivatives, But The Name Remains Resilient (Seeking Alpha) $ 🗃️

- 🇧🇷 B3 SA – Brasil, Bolsa, Balcão (BVMF: B3SA3 / FRA: YBV0 / OTCMKTS: BOLSY) – São Paulo Stock Exchange (Bovespa), Brazilian Mercantile & Futures Exchange (BM&F) & CETIP. 🇼

🇨🇴 Grupo Cibest: The Re-Rating Story Isn’t Done Yet (Seeking Alpha) $ 🗃️

- 🌎🅿️ Grupo Cibest SA (NYSE: CIB / BVC: PFBCOLOM) fmr. Bancolombia – First Colombian financial institution listed on the NYSE. It provides banking products & services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda & Guatemala. 🇼 🏷️

🇨🇴 GeoPark: High Potential, But Still A Long Way To Go After Its Landing In Vaca Muerta (Seeking Alpha) $ 🗃️

- 🌎 GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O) – Leading independent Latin American oil & gas explorer in Colombia, Ecuador, Chile & Brazil. 🏷️

🇲🇽 MXF: Stellar 2025, But Possible Slowdown In 2026 (Seeking Alpha) $ 🗃️

- 🇲🇽 The Mexico Fund (NYSE: MXF) – Closed-end fund.

🌐 Global

🌐 Nebius: Hypergrowth, Early-Stage AI Cloud Leader With Upside Potential (Seeking Alpha) $ 🗃️

🌐 Nebius: A Sober Look At The Math Behind The $9 Billion Target (Seeking Alpha) $ 🗃️

🌐 Nebius Stock: The Market Is Missing A Huge 2026 ARR Growth Surge (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 Nebius – A Misunderstood Company (Darius Dark Investing)

- An In-Depth Analysis

- The investment case for Nebius Group NV (NASDAQ: NBIS) is not as speculative as many may think. It is grounded in hard assets and irrevocable contracts. We are looking at a company with a market cap of ~$21 billion, with a confirmed backlog of over $20 billion from investment-grade counterparties. It is led by a founder, Arkady Volozh, who has already built one $30 billion technology giant from scratch and has now successfully migrated the intellectual core of that empire to the West.

- The market is seemingly obsessed with the company’s Russian origins and the complexity of its divestiture from Yandex. This fails to account for the present reality: Nebius is now a Dutch-headquartered, Nasdaq-listed, audit-cleared entity that serves as an infrastructure partner to the US hyperscalers. The complexity discount is the opportunity. As the company executes on its massive build-out in Vineland, New Jersey, and operationalises its contracts, this discount will close, likely driving a re-rating that could see the stock double or triple from its current levels. This report will review the bear case, assess the hidden value in its engineering stack, and demonstrate why Nebius could be a very compelling investment, something I did not expect when initially researching for this article.

🌐 Nebius Group: Valuation Model (Deepdive’s Substack)

- Nebius Group NV (NASDAQ: NBIS) has exploded onto the scene of AI infrastructure, rapidly becoming a favourite of retail investors captivated by its staggering growth prospects and the promise of being the new AWS of the AI era. The company’s narrative is built on bedrock: securing multi-billion-dollar deals with Microsoft (up to $19.4 billion) and Meta Platforms ($3 billion), contracts that validate Nebius as a critical sold-out provider of high-performance GPU capacity, and on foundational excellence provided by their engineering team.

- Yet, after an astronomical run-up in 2025, the stock has endured a sell-off, plummeting over 30% from its October highs.

🌐 Nebius Group (NBIS): Updated Valuation Model Post-Q3 Results (MVC Investing)

- Earlier this month, Nebius Group NV (NASDAQ: NBIS) reported its Q3 results.

- You can find my detailed review here:

- As you’ll notice, the company significantly raised its capacity expansion estimates, so it’s time to update my Valuation Model based on the new information available.

- It’s always a great sign of execution when you have to repeatedly raise your previous assumptions to reflect reality, and that’s exactly what has been happening with Nebius ever since I started covering it in January.

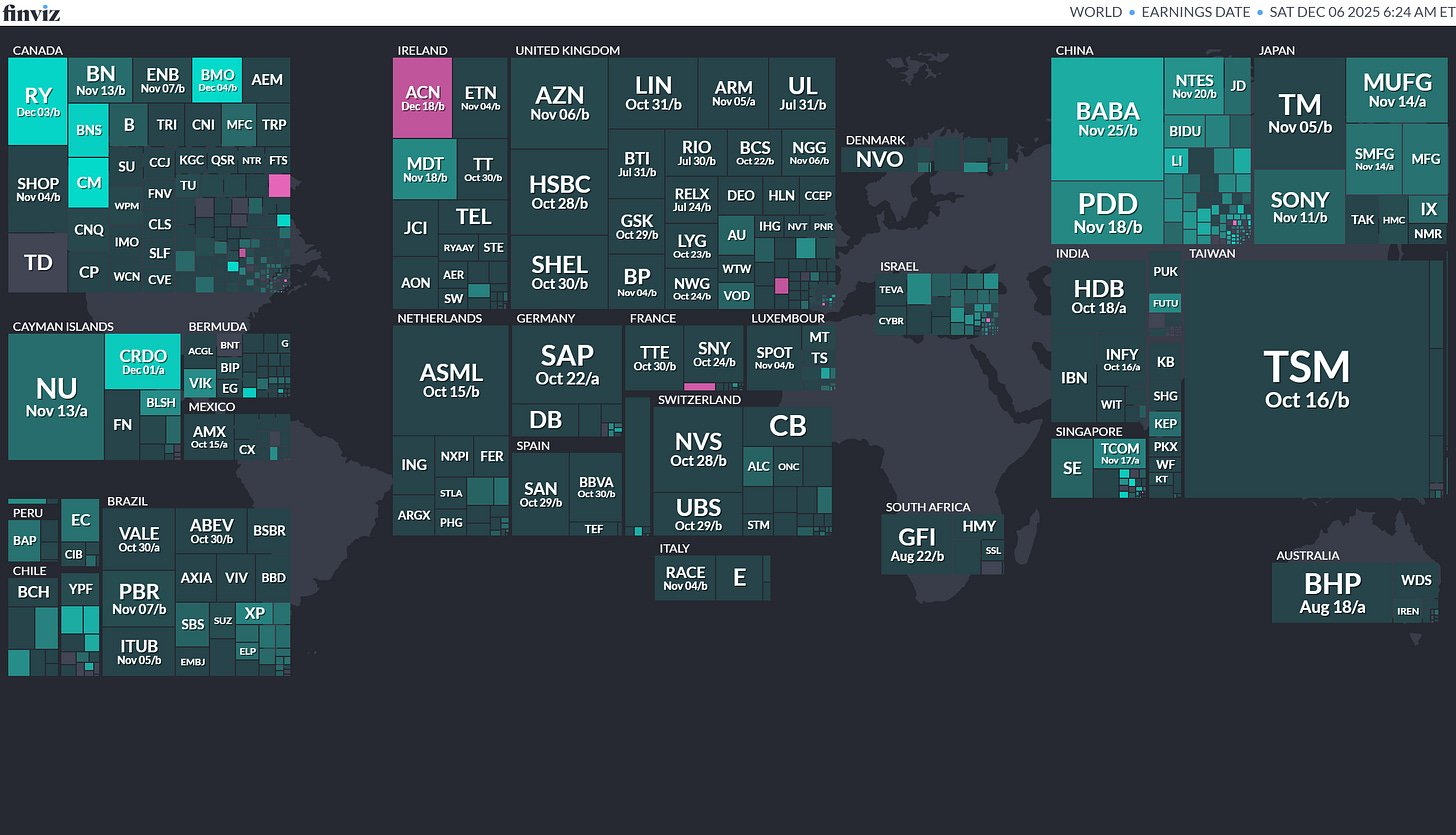

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

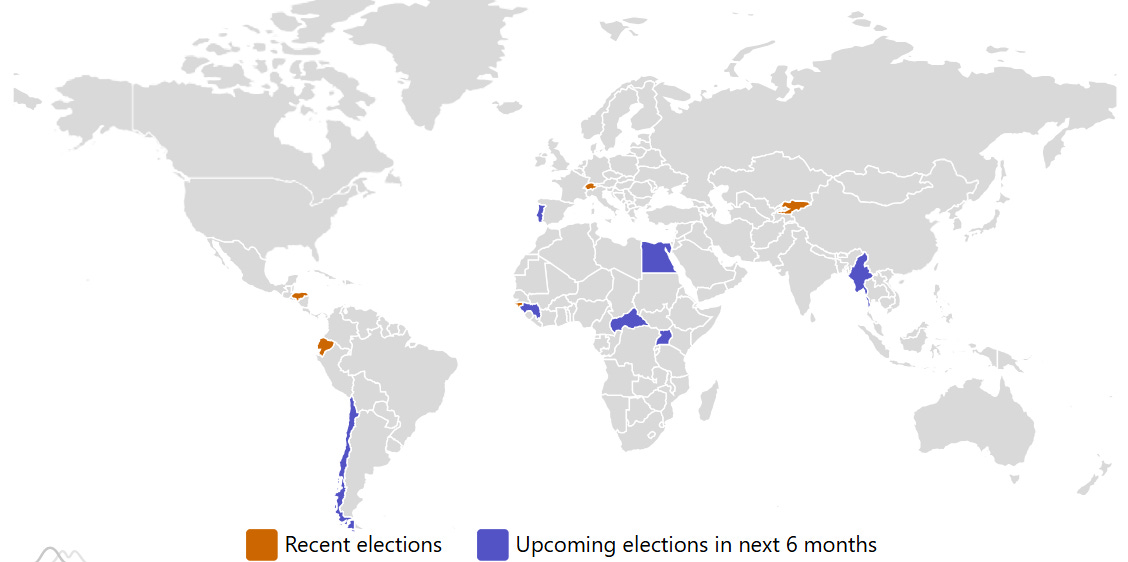

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Chile Chilean Presidency 2025-12-14 (d) Confirmed 2025-11-16

- Myanmar Myanmar House of Representatives 2025-12-28 (t) Confirmed 2020-11-08

- Myanmar Myanmar House of Nationalities 2025-12-28 (t) Confirmed 2020-11-08

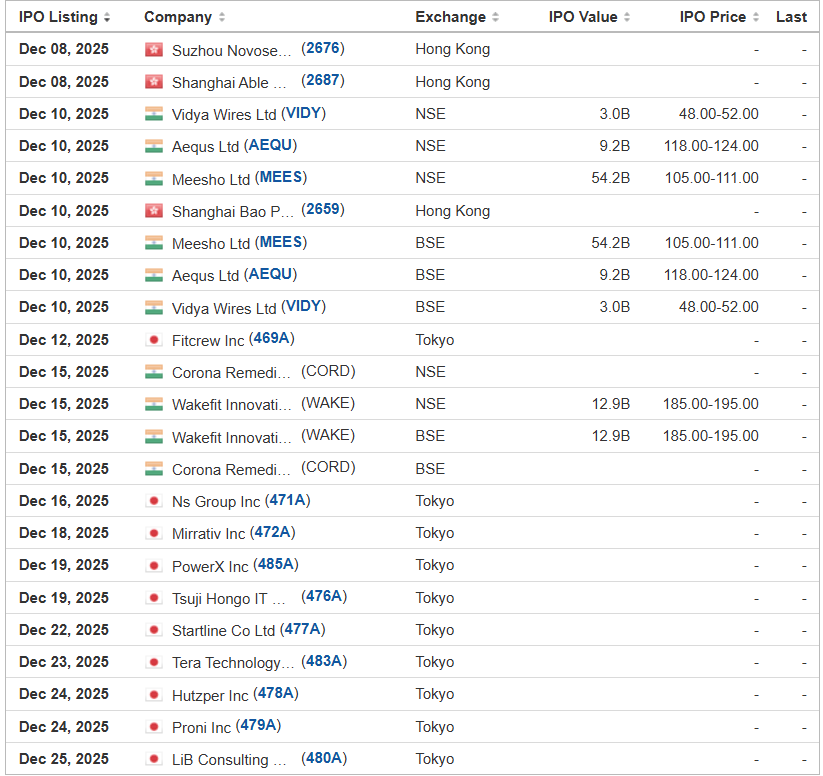

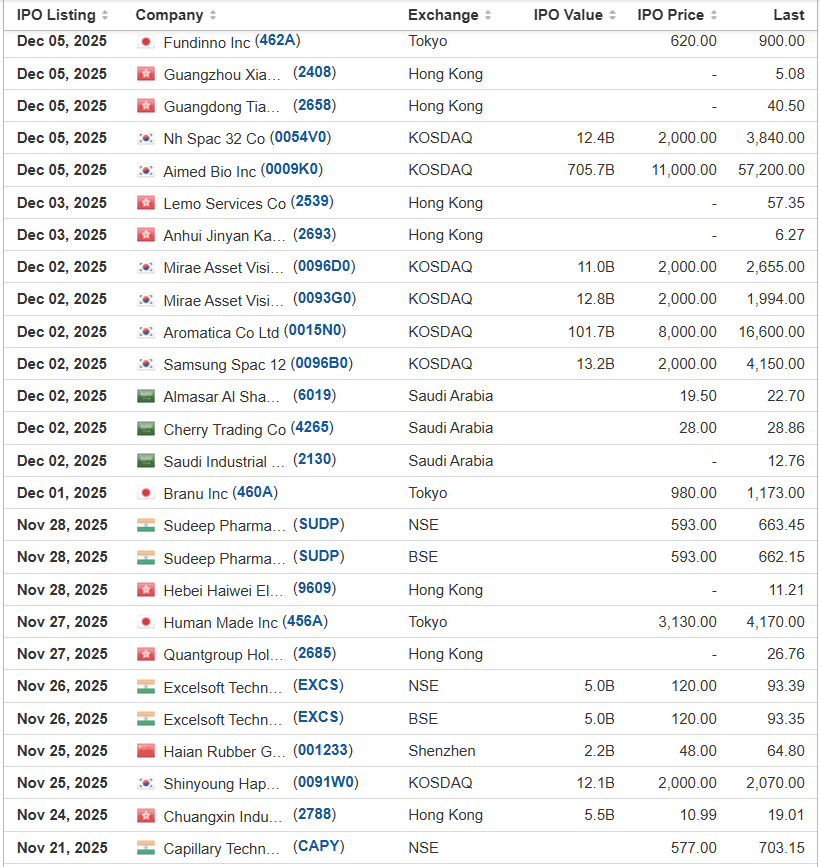

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

JM Group Ltd. JMG Webull/Prime Number Capital, 3.8M Shares, $4.00-5.00, $17.0 mil, 12/9/2025 Tuesday

(Incorporated in the British Virgin Islands)

We are a merchandise wholesaler, based in Hong Kong. We serve clients in mainland China as well as in Hong Kong, Australia, the U.S. and Mexico.

The majority of our revenue is driven by sales of electronics, home goods and tools, seasonal décor and party supplies, sports and outdoor goods, and toys and games for the years ended Sept. 30, 2024 and Sept. 30, 2023, as well for the years ended March 31, 2025, and March 31, 2024.

Note: Net income and revenue are for the 12 months that ended March 31, 2025.

(Note: JM Group Ltd. filed its F-1 for its micro-cap IPO in August 2025 and disclosed the terms: 3.8 million shares at a price range of $4.00 to $5.00 to raise $17 million, if priced at the $4.50 mid-point of its range. )

SFIDA X SFDX ThinkEquity, 1.0M Shares, $5.00-6.00, $5.5 mil, 12/12/2025 Friday

(Incorporated in Japan)

We offer website design, development and numerous other IT (information technology) services.