Just a quick note about it being Presidents’ Day in the USA (meaning USA markets are closed) while Chinese New year is just starting with a month of Ramadan to begin Thursday plus Carnival is ongoing in Latin America and of course its the last week of the Winter Olympics in Milan. Global markets may be quiet for at least the rest of the month. However, this does feel like a potential calm before a storm given continued political/geopolitical tensions around the world (but we will soon find out…)…

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 Emerging Market Stock Picks (January 2026) Partially $

- Asia

- East Asia

- SE Asia

- 🇮🇩 Indonesia – Sarana Menara Nusantara, Bank Central Asia Tbk, Abadi Lestari Indonesia Tbk, Erajaya Swasembada Tbk, Bukit Uluwatu Villa Tbk, RMK Energy PT Tbk, Indokripto Koin Semesta, Eagle High Plantations, United Tractors Tbk PT, Bukit Asam Tbk PT, Sido Muncul (PT Industri Jamu dan Farmasi Sido Muncul Tbk) & Astra International

- 🇲🇾 Malaysia – Goldman Sachs raises Malaysia to market weight, lifting KLCI upside to 1,880 & CNMC Goldmine Holdings Ltd

- 🇵🇭 Philippines

- 🇸🇬 Singapore – CSE Global, Nam Cheong Ltd, Genting Singapore, HRNetGroup, GuocoLand Limited, OUE Real Estate Investment Trust, United Overseas Bank & Oversea-Chinese Banking Corp (OCBC), Isoteam Ltd, Frasers Centrepoint Trust, ST Engineering, UOL Group Limited, Coliwoo Holdings, Suntec Real Estate Investment Trust, UltraGreen.ai Ltd, Seatrium Ltd, Raffles Medical Group, Info-Tech Systems, Centurion Accommodation REIT, Centurion Corp, CDL Hospitality Trusts, Frencken Group Ltd, CapitaLand Integrated Commercial Trust, UOB-Kay Hian Holdings Ltd, Marco Polo Marine Ltd, Tiong Woon Corporation Holding Ltd, Soilbuild Construction Group Ltd, Nordic Group Ltd, iFAST Corporation Limited, Singapore Telecommunications Ltd, Soon Hock Enterprise, Food Empire Holdings Ltd, ASL Marine Holdings Ltd, PC Partner Group Ltd, NTT DC REIT, Reclaims Global Ltd, PropNex, Elite UK REIT, Lum Chang Creations, Lendlease Global Commercial REIT, Keppel REIT & Singapore Broker’s Digest

- 🇹🇭 Thailand – Airports of Thailand PCL, Thanachart Capital PCL, Gulf Development PCL, Supalai PCL, Berli Jucker PCL, Siam Cement PCL, Bangkok Chain Hospital PCL, Sansiri PCL, Ichitan Group PCL, Bangkok Dusit Medical Services PCL, SCG Packaging PCL, Thaifoods Group PCL, GFPT PCL, PTT Oil & Retail Business PCL, Tidlor Holdings PCL, Klinique Medical Clinic PCL, Com7 PCL, Plan B Media PCL, TMBThanachart Bank PCL, Kiatnakin Phatra Bank PCL, Thai Oil PCL, Kasikornbank PCL, SCB X PCL, Betagro PCL, Krung Thai Bank PCL, Land and Houses PCL, Home Product Center PCL, PTT Global Chemical PCL, Bangkok Bank PCL, Thai Beverage PCL, Charoen Pokphand Foods PCL, Dohome PCL, Siam Global House PCL, CP ALL PCL, Thai Union Group PCL, CP Axtra PCL, Krungthai Card PCL, Bumrungrad Hospital PCL, TISCO Financial Group PCL, Delta Electronics Thailand PCL, AP (Thailand) PCL, Aeon Thana Sinsap Thailand PCL, PTT Exploration & Production PCL & i-Tail Corporation PCL

- South Asia

- Middle East

- Africa

- Eastern Europe & Emerging Europe

- 🇨🇿 Czech Republic – CSG Nv (Czechoslovak Group)

- 🇭🇺 Hungary – PannErgy Nyrt

- 🇵🇱 Poland – Warsaw Stock Exchange’s NewConnect Market Q4 Newsletter, Catalyst Market Overview – Corporate Bonds, Q4 2025, Digital Network SA, Shoper SA, Cloud Technologies SA, Noctiluca SA, Cyber_Folks SA, Mirbud SA, Newag SA, Ailleron SA, Skarbiec Holding SA, XTPL SA, Lubelski Wegiel Bogdanka SA, ASBISc Enterprises Plc, Izostal SA, Artifex Mundi SA, Atal SA, Fabrity SA, Action SA, Vercom SA, Auto Partner SA, MO-BRUK J Mokrzycki & Creepy Jar SA

- Latin America

- 🤖 DeepSeek Analysis

- Asia

- 🌐 EM Fund Stock Picks & Country Commentaries (February 15, 2026) Partially $

- PE/AI reality checks, Asia investing lessons from TSMC, Japan elections, South Korea/South Africa reforms, Vietnam opportunities, India’s semiconductor moment, January fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 🇭🇰 HSCEI Index Rebalance: BEKE, Horizon Robotics In; CR Beer, Mengniu Out (Smartkarma) $

- KE Holdings (NYSE: BEKE) and Horizon Robotics (HKG: 9660) will replace CR Beer (HKG: 0291 / FRA: CHK / OTCMKTS: CRHKY / CRHKF) and China Mengniu Dairy Company (HKG: 2319 / FRA: EZQ0 / EZQ / OTCMKTS: CIADY / CIADF) in the Hang Seng China Enterprises Index (HSCEI INDEX) in March.

- Estimated one-way turnover at the rebalance is 2.8% resulting in a round-trip trade of HK$3.6bn (US$461m). The final capping will use the close of trading on 3 March.

- KE Holdings (2423 HK) has been added after passing the Velocity Test and could be a surprise to some market participants.

🇨🇳 🇭🇰 Hang Seng Index (HSI) Rebalance: 3 Adds & 1 Delete as More A/H Pairs Selected (Smartkarma) $

- Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750), China Molybdenum (3993 HK) [CMOC Group Limited (SHA: 603993 / HKG: 3993)] and Laopu Gold Co Ltd (HKG: 6181) will be added to the Hang Seng Index in March, while Zhongsheng Group Holdings (HKG: 0881 / FRA: 5Z0 / OTCMKTS: ZSHGY / ZHSHF) will be deleted.

- Estimated one-way turnover is 2.5% and the estimated round-trip trade is HK$9.65bn (US$1.23bn). Big capping inflows for Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY) and big capping outflows for HSBC Holdings plc (LON: HSBA / NYSE: HSBC).

- With decent size to buy from passives, the A/H trades on CATL (3750 HK) / CATL (300750 CH) and China Molybdenum (3993 HK) / CMOC Group (603993 CH) become interesting.

🇨🇳 Short note: ALAB FYQ4 2025 Earnings (Semi Fundamental)

- Alibaba (NYSE: BABA) and Baidu (NASDAQ: BIDU)’s stock price has dropped about 30% since its 5-day peak. I think this could present a good buying opportunity. Below is my summary of the company’s earnings call on Feb 10, 2026, where I’ve highlighted only the most important and meaningful points, along with my own commentary to help put them into context. There’s quite a lot of interesting contents on switches.

- This note is free.

🇨🇳 US concludes Alibaba and BYD have links to Chinese military (FT) $ 🗃️

- The companies are among a number the Pentagon believes could pose a threat to American national security

🇨🇳 Alibaba Stock Nosedives, Then Rebounds, After Pentagon Designates Company As “Military Linked”, Before Inexplicably Deleting (ZeroHedge)

- The Trump administration on Friday added some of China’s biggest companies, including Alibaba (NYSE: BABA) and Baidu (NASDAQ: BIDU), to a list of firms allegedly aiding China’s military – however, strangely the listing was pulled within mere minutes with no explanation initially issued. A Bloomberg newswire Friday morning indicated:

- US PULLS DOCUMENT THAT LISTED FIRMS LINKED TO CHINA MILITARY

- This was quickly followed by a correction: US removes document that listed firms linked to China’s military and then the clarification that US Agency requested withdrawal of document, per the Federal Register. All of this was enough to cause Alibaba Group Holding Limited (BABA) stock to fall 5% and Baidu (NASDAQ:BIDU) to drop 2% Friday immediately on the reports, followed by a swift rebound on word of the sudden delisting.

- Perhaps the ‘mistake’ was realized post-haste in view of the highly anticipated Trump-Xi summit, and that Alibaba ‘military-linked’ sanctions would only poison the water. Or… a risky Trump ‘tactic’ in the lead-in to April?

🇨🇳 Instant commerce war delivers massive loss to Meituan (Bamboo Works)

- China’s leading online-to-offline services company said it expects to report a loss of up to 24.3 billion yuan for 2025, translating to a fourth-quarter loss of about 15.7 billion yuan

- Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) lost more than $2 billion in the fourth quarter, though the figure represented an improvement from its $2.7 billion third-quarter loss

- China’s market regulator called in Meituan, Alibaba (NYSE: BABA) and JD.com (NASDAQ: JD / SGX: HJDD) for a meeting last week to try and tamp down their overheated competition in the emerging instant commerce field

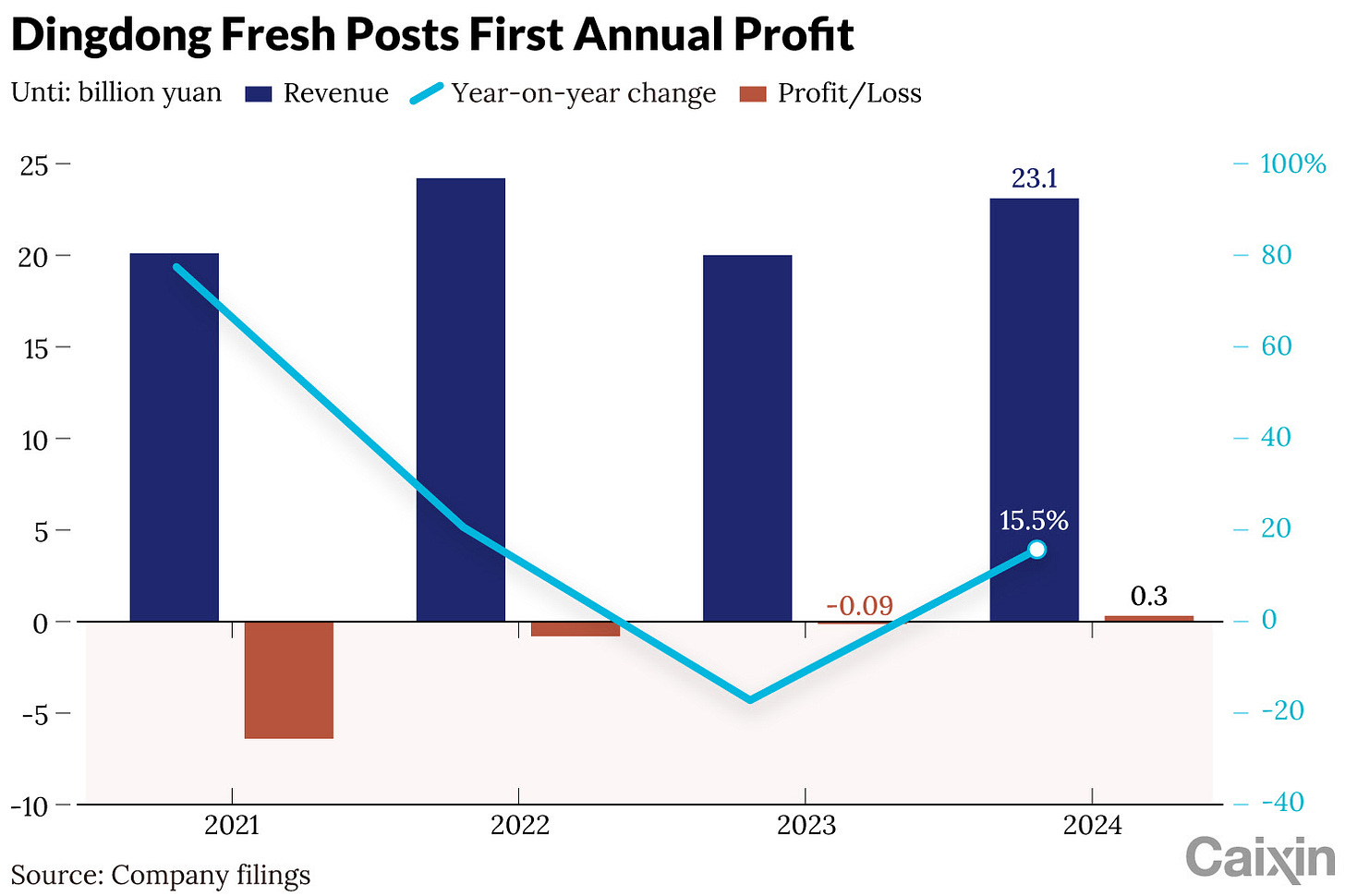

🇨🇳 Analysis: Dingdong Acquisition Set to Bolster Meituan’s Online Grocery Business (Caixin) $

- Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) has agreed to acquire the Chinese operations of Dingdong (Cayman) Ltd. [Dingdong (NYSE: DDL)] for $717 million, a strategic move to consolidate China’s competitive fresh grocery e-commerce market. The deal unites two former rivals under one banner, enhancing Meituan’s competitiveness in a market dominated by Alibaba (NYSE: BABA)’s Freshippo and Walmart Inc (NYSE: WMT)’s Sam’s Club.

🇨🇳 Lenovo Group Limited 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF) 🇭🇰 – Designing, manufacturing & marketing consumer electronics, PCs, software, servers, converged & hyperconverged infrastructure solutions, etc. 🇼

🇨🇳 Lenovo caught napping by ‘democratization of AI’ (Bamboo Works)

- The world’s leading PC maker said it took a $285 million restructuring charge in its latest fiscal quarter related to its infrastructure unit that sells AI servers

- Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF)s profit fell 21% in its fiscal quarter through December, as it took a big restructuring charge prompted by a major shift in the AI computing market

- The company’s gross margin fell 0.6 percentage points year-on-year during the quarter as it struggled with soaring memory prices

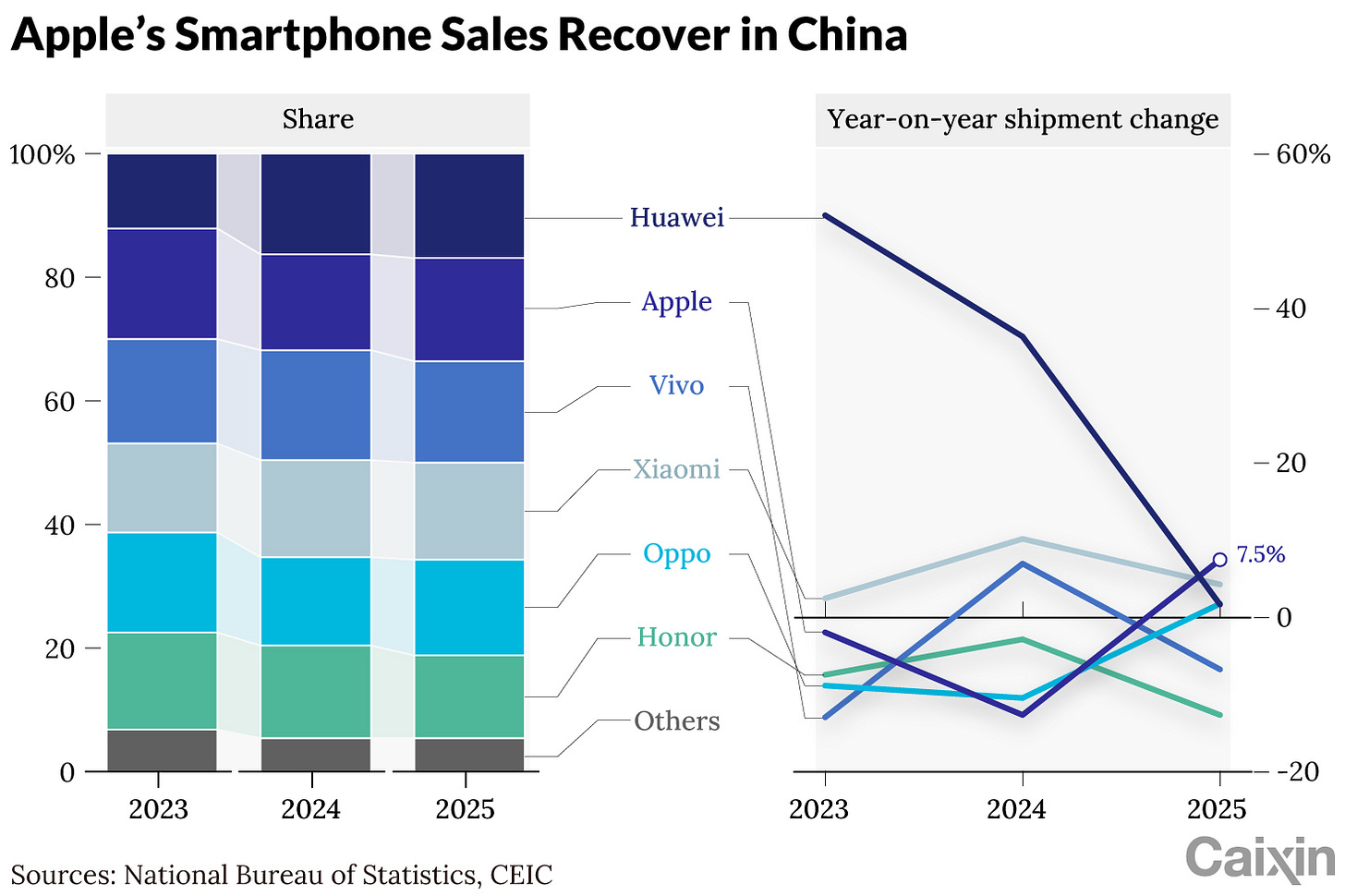

🇨🇳 Chart of the Day: Apple Bucks China’s Smartphone Sales Slump in 2025 (Caixin) $

- Apple Inc. bucked the broader downward trend in China’s smartphone market in 2025 as sales grew 7.5% to become the country’s second-largest smartphone vendor, according to a recent report.

- Efforts to optimize its distribution network and the launch of the iPhone 17 series coinciding with the tail end of a replacement cycle made Apple the fastest-growing brand among China’s top six smartphone sellers. The U.S. giant cornered 16.7% of the market, a hair behind frontrunner Huawei Technologies Co. Ltd., which controlled 16.9%, but only booked 1.7% in shipment growth, according to a report by Counterpoint Research. Overall, China’s total smartphone sales edged down 0.6% in 2025.

- The performance marks a rebound from 2024, when Apple lost its sales crown to China’s Vivo Mobile Communications Co. Ltd., after holding it for just one year. It dropped to the country’s No. 4 smartphone brand as domestic competitors scrambled to roll out upscale models equipped with stronger cameras and more artificial intelligence-powered functions.

🇨🇳 China’s ‘Big Fund’ Trims Chip Stakes as Early Investments Mature (Caixin) $

- China’s state-backed semiconductor investment vehicle has launched a series of divestments from listed chipmakers so far this year, as earlier investment phases enter their exit cycle.

- The China Integrated Circuit Industry Investment Fund, also known as the “Big Fund,” will reduce its holdings in Shanghai Anlogic Infotech Co Ltd (SHA: 688107), the affected company said in a stock exchange filing dated Monday.

🇨🇳 Cango secures big cash infusion in accelerated pivot to AI distributed computing (Bamboo Works)

- The company said that two of its directors will purchase an additional $65 million worth of its stock, a week after it sold more than half of its bitcoin holdings

- Cango (NYSE: CANG) announced that two of its directors have agreed buy $65 million worth of its stock to help finance its accelerating move into distributed computing

- The company has been lowering its bitcoin mining activity amid a rapid decline in prices for the cryptocurrency

🇨🇳 Geekplus’ industrial robots fail to dazzle investors (Bamboo Works)

- The company’s stock sank nearly 10% last week after it reported 31.7% order growth for 2025, though its shares are still up around 50% from their IPO price last July

- Beijing Geekplus Technology Co Ltd (HKG: 2590 / FRA: P58 / OTCMKTS: BGTCF)’ orders grew 31.7% last year to 4.1 billion yuan, driven by geographic and industry expansion

- The robot maker may have reached breakeven in the second half of last year, but its pivot to humanoid robots could drag it back into the red

🇨🇳 Aerospace Power System Maker Skyrockets in Shanghai Debut (Caixin) $

- Shares of CETC Lantian Technology Co Ltd (SSE: 688818), a Chinese developer of aerospace power systems, skyrocketed in their trading debut on Shanghai’s tech-focused STAR Market on Tuesday, reflecting bullish sentiment over prospects for a company that provided power devices for the country’s first satellite.

- The stock opened at 80.88 yuan ($11.7), a 750% premium to its IPO price, before paring some gains to end the day up 596.3%, giving the company a market value of 114.5 billion yuan.

🇨🇳 With BYD backing, autonomous EV mining truck maker Boonray drives toward IPO (Bamboo Works)

- The Shanghai-based company is second only to Eacon Group in autonomous mining solutions and first in self-driving electric mining trucks

- Boonray has filed for a Hong Kong IPO, setting up a race to market with larger rival Eacon

- The company raised $165 million in a recent pre-IPO funding round from investors including BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF), the world’s largest EV maker

🇨🇳 BYD (1211 HK) Tactical Outlook: Taking Off? NOT YET! (Smartkarma) $

- BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) had a difficult week last week, dropped nearly 10%, but a recovery rally this week is bringing the stock back to previous price levels (last close=99.15).

- We insist that BYD (1211 HK) may be in the process of bottoming and possibly restart rallying.

- This insight will update profit targets for this rally just before the start of the holidays in China, next week.

🇨🇳 Dongfeng Motor (489 HK): Precondition Satisfied (Smartkarma) $

- Dongfeng Motor Corporation has satisfied the precondition related to its Dongfeng Motor Group Co Ltd (HKG: 0489 / FRA: D4D / D4D0 / OTCMKTS: DNFGF / DNFGY) offer. The offer comprises HK$6.68 per H Share + 0.3552608 VOYAH H Shares per H Share.

- The composite document must be dispatched within 7 days. The shareholder vote remains low risk. The appraised value of HK$10.85 is the key point of debate.

- The appraised value remains justifiable despite peers’ derating. Based on several methodologies, I estimate the offer is worth HK$11.39-11.44 per H Share.

🇨🇳 China Literature stuck in a print world being overwritten by video (Bamboo Works)

- The online literature company lost up to 850 million yuan last year, largely due to a massive charge related to its New Classics Media video acquisition

- China Literature Ltd (HKG: 0772 / FRA: C2X) warned it expects to report a net loss of up to 850 million yuan for last year

- Much of the loss owes to a 1.8 billion yuan goodwill impairment charge related to New Classics Media, which China Literature bought for 15.5 billion yuan in 2018

🇨🇳 Red Avenue shifts course from rubber additives to chip chemicals (Bamboo Works)

- The firm is accelerating its expansion into the specialist materials used to make semiconductors, as China seeks supply-chain resilience in key sectors

- Red Avenue New Materials Group Co Ltd (SHA: 603650) has filed for a secondary listing in Hong Kong to bolster its capital base as it doubles down on advanced chemicals

- The revenue contribution from electronic materials has jumped by 8.7 percentage points over two years to 27.8%, emerging as the company’s main growth engine.

🇨🇳 Global Index: Potential Changes in February for Asia Pac (Smartkarma) $

- The changes to a global index in February will be announced pre-market open tomorrow and will be implemented at the close of trading on 27 February.

- The big market moves since the last rebalance result in many changes with the final number dependent on the day picked to compute market cap and free float market cap.

- [Yangtze Optical Fibre and Cable JSC Ltd (SHA: 601869 / HKG: 6869 / FRA: 1YO / OTCMKTS: YZOFF)] Yangtze Optical Fibre And H (6869 HK) is up 90% over the last 3 weeks and the AH premium versus Yangtze Optical Fibre & Cable (601869 CH) has dropped significantly.

🇨🇳 Its Chilean venture smoldering in uncertainty, Tianqi Lithium charts its next move (Bamboo Works)

- After losing a court battle in the South American nation, the lithium miner has announced plans to offload part of its local holdings ahead of the metal’s next market cycle

- Tianqi Lithium Corp (SHE: 002466 / HKG: 9696 / FRA: 2220) tried in court, but failed, to challenge recent nationalization measures that undercut Sociedad Química y Minera de Chile (NYSE: SQM), its partly-owned miner of the world’s largest lithium salt flat

- The company concurrently announced an equity placement and convertible note offering to raise about HK$5.8 billion

🇨🇳 Big deal, bigger doubts: CSPC slides after $18.5 billion pact (Bamboo Works)

- After months of rumors drove up its share price, the Chinese drug company has unveiled a record licensing deal with AstraZeneca, only to see its stock tumble

- Going into the deal, CSPC Pharmaceutical Group (HKG: 1093 / FRA: CVG / OTCMKTS: CHJTF)’s earnings have been under pressure after its core drug business was hit by China’s centralized procurement policies

- The company is accelerating its push into novel drugs for the global market under the new leadership of Cai Lei, who served in the U.S. research division and is the son of the firm’s founder

🇨🇳 H World aims to be ‘Marriott of China’ with 20,000 hotels (FT) $ 🗃️

[H World Group (NASDAQ: HTHT)]

- One of the world’s biggest hotel groups plans to consolidate country’s vast and fragmented hospitality market

🇨🇳 Chinese real estate mogul revives empire with new ventures in US (FT) $ 🗃️

- Zhang Xin was one of the few developers able to extricate her wealth from China and rebuild elsewhere

- Zhang, co-founder of Soho China — one of the country’s largest commercial property developers with dozens of landmark projects in Beijing and Shanghai — had long epitomised the country’s economic rise before shifting her focus overseas.

- She began unwinding her operations in China in the mid-2010s, even as the industry was still booming.

🇨🇳 Yum China: Can a 20,000-Store Ambition Supercharge Its Next Growth Cycle? (Smartkarma) $

- YUM China (NYSE: YUMC), a leading restaurant company, has presented both opportunities and challenges in its recent earnings call.

- In 2025, Yum China exhibited significant growth by opening over 1,700 net new stores, totaling more than 18,000 stores across 2,500 cities.

- Both same-store sales and system sales showed positive growth, with the latter improving to 7% in Q4, indicating a resilient market presence.

🇭🇰 Hong Kong to Allow Bitcoin, Ether as Margin Collateral in Crypto Push (Caixin) $

- Hong Kong’s securities regulator plans to allow Bitcoin and Ethereum to be used as collateral for margin financing, part of a broader push to deepen the city’s virtual-asset market.

- Julia Leung Fung-yee, chief executive of the Securities and Futures Commission, unveiled the policy at the Consensus 2026 conference Wednesday. The change will permit brokerages to accept either traditional securities or virtual assets as collateral when extending credit to clients in good standing for margin trading.

🇭🇰 Thoughts on Jardine Matheson (Superfluous Value)

- I wanted to update readers with some brief thoughts on Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF) and how the risk/reward has shifted with the rising share price.

- Lincoln Pan on Bloomberg

- I encourage you to watch this short interview with Jardine’s new CEO Lincoln Pan (shared recently by Mike Fritzell), the implications of which have been growing on me and I hope are useful to others. He made a number of comments I found quite surprising and have me a little wary of my position.

- I also recently came across a discussion of Jardine Matheson on YAVP that I would encourage a watch of, as Dom (of Cayucos Capital) is highly knowlegeable about the company. Unfortunately, the host spent a chunk of the interview pushing an angle that shows the wrong way to think about the company’s valuation, in my view.

🇲🇴 Pre-CNY slowdown in Macau GGR, but Jan and Feb still tracking 13.5pct gain y-o-y: Citi (GGRAsia)

- Macau casino gross gaming revenue (GGR) for the first eight days of February was circa 14 percent lower than the daily run rate in January, says banking group Citi, citing industry sources.

- But the bank still expects January and February GGR combined – i.e., including the coming Chinese New Year (CNY) period in February – to be 13.5 percent better than the same period last year.

- “Macau GGR for the first eight days of February is likely to have reached approximately MOP5.0 billion” (US$621.1 million currently), stated the institution in a Monday note.

🇲🇴 Fitch expects Macau’s GDP to grow 4pct in 2026 on ‘solid’ gaming tourism (GGRAsia)

- Fitch Ratings Inc forecasts Macau’s gross domestic product (GDP) growth to moderate to 4.0 percent in 2026, from 4.7 percent last year, with gross gaming revenue (GGR) “recovering to nearly 89 percent of its 2019 level”, i.e., hitting circa MOP260 billion (US$32.29 billion) this year.

- The commentary was part of a Wednesday report in which the institution affirmed Macau’s long-term issuer default rating at “AA”, with a “stable” outlook.

- “We expect gaming tourism growth [in Macau] to slow but remain solid in 2026, supported by favourable visa-entry policies, expanded cultural and entertainment offerings, and continued non-gaming investments,” wrote analysts George Xu, Kathleen Chen, and Jan Friederich.

🇲🇴 Fitch upgrades Las Vegas Sands’ rating citing strong performance in Singapore (GGRAsia)

- Fitch Ratings Inc has upgraded Las Vegas Sands (NYSE: LVS)’s and its subsidiaries’ issuer default ratings to ‘BBB’, with a ‘stable’ outlook.

- “The rating reflects improved credit metrics, strong performance in Singapore, and a continued but slightly weaker-than-expected rebound in the Macau market,” the institution said on a February 6 report.

- “Las Vegas Sands benefits from its scale in Macau, competitive market positions in Macau and Singapore, and robust free cash flow generation,” it added. “This is offset by a relatively heavy capital programme and potential weakness in the Chinese economy.”

- Fitch’s ‘BBB’ rating indicates good credit quality and low default risk, placing the entity within the investment-grade category, according to the rating agency.

🇲🇴 Sands China announces US$0.06 interim dividend, Dumont confirmed as chairman (GGRAsia)

- Macau casino concessionaire Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) announced on Friday an final dividend of HKD0.50 (US$0.06) per share for financial-year 2025. The dividend, amounting in aggregate to HKD4.05 billion, is due to be paid on June 12, 2026, stated the Hong Kong-listed firm.

- The HKD0.50 final dividend for 2025 was double 2024’s divided.

- Sands China runs a number of casino properties in Macau, including The Venetian Macao, The Parisian Macao, The Londoner Macao, and Sands Macao (pictured).

🇲🇴 Melco Resorts: Macau Growth Creates Upside (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇲🇴 Melco Resorts & Entertainment Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇲🇴 🇵🇭 🇨🇾 Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) – Management & development of casino gaming & entertainment resort facilities. 🇼

🇹🇼 Taiwan

🇹🇼 Gogoro Inc. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Gogoro (NASDAQ: GGR) – Battery-swapping refueling platform for urban electric two-wheel scooters, mopeds & motorcycles. 🇼

🇹🇼 Himax Technologies, Inc. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Himax Technologies (NASDAQ: HIMX) 🇰🇾 – Fabless semiconductor company providing display imaging processing technologies. 🇼

🇹🇼 Taiwan Semiconductor: Transition From An iPhone To An AI Era (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 AUO Corporation 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 AUO Corp (TPE: 2409 / FRA: AU7 / OTCMKTS: AUOTY) – Display-centric technology (smart mobility, industrial intelligence, energy, retail, healthcare, enterprise & education). Taiwan, Asia, US & Europe. 🇼 🏷️

🇰🇷 Korea

🇰🇷 About 10% of Listed Stocks in KOSDAQ Could Be Delisted by the End of 2026 (Douglas Research Insights) $

- There are too many listed stocks in the KOSDAQ exchange. The Korean financial regulators have finally realized this problem and the FSC announced several measures to fix this problem.

- About 10% of the stocks listed on the KOSDAQ exchange could be no mas by the end of 2026.

- The overall impact should be positive on the KOSDAQ index since it helps the investors to focus on the higher quality companies and the zombie companies to be delisted.

🇰🇷 Kiwoom Securities Partners With WeBull to Expand the Foreign Omnibus Account System (Douglas Research Insights) $

- Kiwoom Securities (KRX: 039490) announced that it has entered into a strategic partnership with WeBull Technologies to expand its foreign omnibus account system.

- This would enable overseas investors to trade Korean stocks real time on the WeBull platform without the need for opening a separate account with a local securities firm in Korea.

- We expect the users of WeBull platform to be able to start trading Korean stocks sometime in the next 3-6 months.

🇰🇷 Grand Korea Leisure to spend US$15mln on 2025 final dividend (GGRAsia)

- Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, announced on Monday a final dividend of KRW354 (US$0.24) per share, amounting in aggregate to nearly KRW21.90 billion (US$15.0 million).

- The dividend will be paid on April 24, the company flagged to the Korea Exchange.

- In September, the casino operator paid an interim dividend of KRW60 per share, amounting in aggregate to just over KRW3.71 billion.

🇰🇷 Paradise Co 4Q profit down 4pct y-o-y, despite record revenue at Paradise City (GGRAsia)

- Fourth-quarter net profit at Paradise Co Ltd (KOSDAQ: 034230), a South Korean operator of foreigner-only casinos, declined by 3.6 percent year on year to nearly KRW35.18 billion (US$24.2 million), according to a Tuesday statement.

- The firm also announced a final-year dividend of KRW150 per share, amounting in aggregate to nearly KRW13.13 billion. The dividend will be paid on April 24, the company flagged to the Korea Exchange.

- Paradise Co’s aggregate fourth-quarter sales totalled nearly KRW293.85 billion, up 10.5 percent year on year. The company said the performance was “driven by revenue growth contributions from Paradise City casino and Hotel Busan”.

🇰🇷 Is KB Financial Group Still A ‘Buy’ After Its 2025 Earnings? (Seeking Alpha) $⛔🗃️

- 🌏 KB Financial Group (NYSE: KB) – Financial holding company. Banking, credit card, financial investment, insurance business etc. 🇼 🏷️

🇰🇷 KT Corporation: A Mix Of Positives And Negatives (Seeking Alpha) $ 🗃️

🇰🇷 KT Corporation 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC) formerly Korea Telecom – Provides integrated telecommunications & platform services in Korea & internationally. 🇼 🏷️

🇰🇷 Samsung Prefs: 4% Floor Yield Vs 30% Discount—Unsustainable Vs 2020 Levels (Smartkarma) $

[Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF)]

- At Friday’s close, common yields ~2.9%, prefs ~4%—the floor for tax benefits. Despite a 4%+ pref yield, the 1P discount remains ~30%, unsustainable versus 2020’s 6–8%.

- The main tail risk—dividend cuts via capital reduction—is unlikely. With KRW 400tn retained earnings and bellwether status, Samsung will likely stick to straightforward earnings-based dividends.

- Even on minimum assumptions, Samsung prefs yield low-4%, with ~30% discount likely unsustainable. Easing memory tightness or catalysts like DeepSeek V4 may trigger aggressive pref discount plays.

🇰🇷 Korea Small Cap Gem #55: Samji Electronics (Douglas Research Insights) $

- Samji Electronics Co Ltd (KOSDAQ: 037460) has cheap valuations. It is trading at P/E of 4.8x, P/B of 0.5x, and EV/EBITDA of 5.3x based on recent prices and TTM financials.

- In the next several years, 6G networks are expected to be rolled out aggressively in Korea and Samji Electronics could be one of the beneficiaries of this 6G network expansion.

- Samji Electronics’ 51.1% stake in SAMT (031330 KS) is now worth 243 billion won. This is 68% of Samji Electronics’ market cap (358 billion won).

🇰🇷 Hanwha Aerospace: Out of Bullets After Missing Earnings in 4Q 2025? (Douglas Research Insights) $

- Hanwha Aerospace (KRX: 012450) reported its best ever results in 2025 despite missing its operating profit estimate in 4Q 2025.

- The company missed the consensus operating profit estimate by 35.9% in 4Q 2025. Hanwha Aerospace is not out of bullets after its poor quarterly results in 4Q 2025.

- Nevertheless, if the company misses quarterly earnings once again in 1H 2026 (either 1Q or 2Q), this could result in a nasty sell-off on the stock.

🇰🇷 Hyundai Elevator – A Big Surprise in DPS Increase [Dividend Yield of 11.5%] (Asian Dividend Stocks) $

- On 10 February , Hyundai Elevator Co Ltd (KRX: 017800 / OTCMKTS: HYEVF) announced DPS of 12,010 won in 2025, which represents a dividend yield of 11.5% at the current price.

- This sharply higher dividend payment is likely to positively impact Hyundai Elevator Co (017800 KS) in the next 6-12 months.

- By deciding to pay DPS of 12,010 won per share, Hyundai Elevator would have one of the highest dividend yields among all listed stocks in the Korean stock market.

🇰🇷 An Update on SK Inc (2026 High Conviction Pick) (Douglas Research Insights) $

- In this insight, we provide an update on SK Inc (KRX: 034730 / 03473K) which is our 2026 high conviction pick.

- On 10 February, SK Inc announced annual DPS of 8,000 won for 2025, up 14% YoY. This represents a dividend yield of 2.4%.

- Our updated NAV valuation suggests target NAV per share of 465,286 won, which is 41% higher than current price.

🇰🇷 Truston Asset Managment Goes Activist on KCC Corp (Douglas Research Insights) $

- Truston Asset Management started to go activist on Kcc Corp (KRX: 002380). Truston urges that KCC needs to sell its stake in Samsung C&T Corp (KRX: 028260 / 02826K) or issue an EB backed by Samsung C&T shares.

- KCC Corp’s current market cap is 4.9 trillion won ($3.4 billion). KCC’s stake in Samsung C&T is now worth more than KCC’s own market cap.

- Our updated NAV analysis of Kcc Corp (002380 KS) suggests NAV per share of 673,696 won, representing 23% upside from current levels.

🇰🇷 Hyundai Dept Store Group Plans to Delist Hyundai Home Shopping (Douglas Research Insights) $

- After the market close on 11 February, Hyundai Dept Store Group [Hyundai Department Store Co Ltd (KRX: 069960)] announced that it plans to delist Hyundai Home Shopping Network Corp (KRX: 057050).

- Hyundai Department Store Group also decided to cancel about 350 billion won worth of treasury shares.

- By delisting Hyundai Home Shopping and merging with Hyundai GF Holdings Co Ltd (KRX: 005440), this could result in allowing Hyundai G.F. Holdings to be included in the KOSPI 200 index.

🇰🇷 Daishin Securities: The Most Significant Shareholder Return Program Announced Since Its Founding (Douglas Research Insights) $

- Daishin Securities Co Ltd (KRX: 003540 / 003547 / 003545) announced that it will cancel 15.35 million treasury shares and pay its first tax-free dividend. This represents 18.4% and 16.8% of outstanding common and preferred shares, respectively.

- The company will also pay tax-free dividends. This will be implemented over approximately four years, starting this year, with a limit of 400 billion won.

- This is the MOST SIGNIFICANT shareholder return program announced by Daishin Securities since its founding in 1962.

🇰🇷 Canadian Patrol Submarine Project (CPSP) Worth $44 Billion: Who Will Win – Korea or Germany? (Douglas Research Insights) $

- The Canadian Patrol Submarine Project (CPSP) is one of the largest ever defense contracts that the Canadian government plans to provide worth about $44 billion.

- Two main bidders including Germany’s ThyssenKrupp Marine Systems and Korea’s consortium led by Hanwha Ocean (KRX: 042660) and HD Hyundai Heavy Industries (KRX: 329180) have been formally shortlisted to compete for this contract.

- The final proposals are due in March and a decision expected by May or June 2026.

🇰🇷 K Bank IPO Book Building Results Analysis (Douglas Research Insights) $

- K Bank finalized its IPO price at 8,300 won, which is at the low end of the IPO price range. The demand ratio for the IPO was 199 to 1.

- The 12.4% shares that are under lock-up periods is relatively low and this suggests a bearish sign.

- Our base case valuation of K Bank is target price of 11,986 won per share, which is 44% higher than the IPO price of 8,300 won.

🌏 SE Asia

🇰🇭 NagaCorp could see ‘robust’ cashflow as Naga 3 capex likely scaled down: CLSA (GGRAsia)

- Brokerage CLSA Ltd says it expects Cambodian casino operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) to achieve a net profit compound annual growth rate (CAGR) of 12 percent from 2025 to 2027, while paying circa 30 percent of profits as dividends.

- Along with “improved operating efficiencies,” the casino firm will in likelihood have a “lower finance cost burden” as the scale of its investment for the NagaWorld complex’s Phase 3 is expected to be reduced, the institution said in a Wednesday report, initiating coverage of the casino operator.

- “NagaCorp’s earnings are set to rebound in 2025 from a low base, in our view, with organic growth momentum likely continuing into 2027,” wrote CLSA’s analyst Jeffrey Kiang.

- “The recent escalation of conflict between Cambodia and Thailand is unlikely to challenge NagaWorld’s operations as long as patrons’ mobility from Malaysia, Singapore and Greater China are not restricted,” the analyst added, referring to the “key” feeder markets for the casino operator.

🇮🇩 Telekomunikasi Indonesia: Indonesia’s Digital Backbone At An Attractive Discount And Solid Yield (Seeking Alpha) $ 🗃️

- 🇮🇩🏛️ Telkom Indonesia Persero Tbk PT (NYSE: TLK) – Fixed line telephony, internet & data communications. 🇼 🏷️

🇮🇩 PT Bank Mandiri (Persero) Tbk 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

🇮🇩 PT Indosat Ooredoo Hutchison Tbk 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇮🇩 PT Indosat Ooredoo Hutchison Tbk (IDX: ISAT / FRA: IDO1 / OTCMKTS: PTITF) – Wireless services for mobile phones + broadband internet lines for homes. 🇼 🏷️

🇲🇾 CreditSights sees ‘limited refinancing risk’ for Genting group’s debt maturities (GGRAsia)

- Credit and market research provider CreditSights Inc says it believes Malaysia-listed conglomerate Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) “has multiple funding options at its disposal,” with “limited refinancing risk for all the upcoming maturities”.

- That is according to a Monday memo from analysts Jonathan Tan Jun Jie and Lakshmanan R.

- According to the institution, the Genting group “faces sizable debt maturities” this year and next.

- These include the US$1.5-billion bond under the Genting Overseas Holdings Ltd (GOHL) unit, US$300 million linked to Empire Resorts’ bond, US$665 million in term loans tied to the Resorts World Las Vegas complex in the United States, and MYR3.8 billion (US$968.1 million) of “assorted retail bonds”.

🇲🇾 Sime Darby Berhad (SMEBF) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🌏 Sime Darby Bhd (KLSE: SIME / OTCMKTS: SMEBF) – Trading conglomerate. Automotive & industrial equipment brands. 🇼

🇲🇾 Axiata Group Berhad (AXXTF) Analyst/Investor Day – Slideshow (Seeking Alpha)

🇲🇾 Axiata Group Berhad (AXXTF) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🌏 Axiata Group Bhd (KLSE: AXIATA / OTCMKTS: AXXTF) – Telecommunications & digital conglomerate (digital telcos, infrastructure, & digital businesses). 🇼

🇵🇭 Bank of the Philippine Islands 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇵🇭 Bank of the Philippine Islands (PSE: BPI / OTCMKTS: BPHLF / BPHLY) – Oldest bank in the Philippines & SE Asia. 🇼

🇸🇬 Chinese companies overtake US in Singapore investment (FT) $ 🗃️

- Businesses have been using city-state to avoid geopolitical scrutiny and expand abroad

- The rise of businesses relocating to the city-state to avoid scrutiny often directed at China-based entities has become so prevalent in recent years that it has been labelled “Singapore-washing”.

🇸🇬 CapitaLand Investment Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 CapitaLand Investment Limited (SGX: 9CI) – Real asset manager. 6 listed REITs & business trusts + a suite of private real asset vehicles. 🇼 🏷️

🇸🇬 Grab Holdings: Southeast Asia’s Super-App Sets Its Sights On The U.S. (Seeking Alpha) $ 🗃️

🇸🇬 Grab: The Best Super App In Asia (Seeking Alpha) $ 🗃️

🇸🇬 Grab Earnings: Some Life Experience May Reveal The Secret Sauce (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇸🇬 Grab: Valuation Compression Is Attractive As Company Sets Aggressive Targets (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 Prime US REIT 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇺🇸 Prime US REIT (SGX: OXMU / OTCMKTS: KBSUF) – Prime office assets in the USA. High-quality Class A freehold office properties. 🏷️

🇸🇬 First Ship Lease Trust 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 First Ship Lease Trust (SGX: D8DU / FRA: LJ9) – Diversified fleet of product tankers (fixed-rate period charters).

🇸🇬 Canaan Inc. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Canaan Inc (NASDAQ: CAN) – China founded. Specializes in Blockchain servers & ASIC microprocessors for use in bitcoin mining. 🇼

🇸🇬 DBS Group: Still An Intriguing Play On Asian Growth (Seeking Alpha) $ 🗃️

🇸🇬 DBS Group Holdings Ltd 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

🇸🇬 DBS Group Holdings Ltd 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏 DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) – Financial services group in Asia with a presence in 19 markets: Greater China, Southeast Asia & South Asia. 🇼 🏷️

🇸🇬 Budget 2026 Injects Another S$1.5 Billion Into SGX. Are Singapore Mid-Cap Stocks About to Surge? (The Smart Investor)

- Budget 2026 raises the EQDP to S$6.5 billion, driving institutional flows into Singapore’s Next 50 stocks and boosting mid-cap dividend plays.

- The “Demand Surge”: Why the Government Expanded the Fund

- Where Will the Money Flow? Follow the “Next 50”

- Stock Watch: The Potential Beneficiaries

- The “Next 50” list is home to several quality names that are now in the spotlight.

- The Infrastructure Plays: NetLink NBN Trust (SGX: CJLU / OTCMKTS: NETLF) and ComfortDelGro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY) are prominent weights in the new index. Their steady cash flows make them prime targets for managers looking for stability combined with the EQDP’s growth mandate.

- The REIT Tier: While the STI has the giants, the Next 50 holds the “reserve list” stars like Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF) and Keppel REIT (SGX: K71U / OTCMKTS: KREVF). These are often the first to benefit when institutional liquidity pours into the mid-cap space.

- The New Economy: With the inclusion of iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) and NTT DC REIT (SGX: NTDU), the stimulus is also supporting Singapore’s pivot toward digital infrastructure and wealth platforms.

- The Catch: Profits Still Rule Payouts

- Get Smart: Positioning for Mid-2026

🇸🇬 Update: 5 Temasek-Owned Singapore Blue-Chip Stocks for Your Buy Watchlist (The Smart Investor)

- These five Temasek-owned Singapore blue chips combine income, recovery potential, and long-term growth, making them worth a closer look for investors building a resilient portfolio.

- Here are five Singapore blue-chip stocks that Temasek owns that investors can consider adding to their watchlist.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF)

- DBS is Singapore’s largest bank, offering a comprehensive suite of financial services across Asia, including a wealth management division that ranks among the region’s largest.

- SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF)

- SATS provides ground handling and catering services for airlines, and also operates central kitchens that prepare food for corporations.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering

- Singapore Technologies Engineering, or ST Engineering, is a technology and engineering group serving customers across the aerospace, smart city, defence, and public security sectors.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel

- Singtel is Singapore’s largest telecommunications group, providing a range of mobile, broadband, and enterprise digital services across Asia, Australia, and Africa.

- Seatrium Ltd (SGX: SE2 / FRA: S8N / OTCMKTS: SMBMF)

- Seatrium provides engineering solutions to the global offshore, marine, and energy industries, with operations spanning oil and gas, offshore renewables, and vessel repairs and upgrades.

🇸🇬 3 Blue-Chip REITs Raising Their DPUs Before CNY (The Smart Investor)

- Learn why these three Singapore blue-chip REITs are increasing payouts and if their dividend growth is sustainable for 2026.

- ParkwayLife REIT: The Built-In Escalator

- Parkway Life Real Estate Investment Trust (SGX: C2PU), or PLife REIT, owns a defensive portfolio of 74 healthcare properties across Singapore, Japan, and France, valued at S$2.57 billion.

- Keppel DC REIT: Riding the AI Wave

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) owns 25 data centres across 10 countries with assets under management of approximately S$6.3 billion.

- CapitaLand Integrated Commercial Trust: The Compounding Machine

- Singapore’s largest REIT by market capitalisation, CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), or CICT, boasts assets under management of S$27.4 billion.

- Get Smart: Follow the Growth Engine, Not Just the Yield

🇸🇬 Earnings Review: How 4 Singapore Stocks Are Navigating Global and Local Headwinds (The Smart Investor)

- We analyze the latest earnings for Singtel, StarHub, Prime US REIT, and CapitaLand Investment to see how these four Singapore stocks are navigating current market headwinds.

- Navigating this environment requires a close look at how each firm balances growth and capital recycling.

- Singtel’s Underlying Profit Rises as Regional Associates Grow

- StarHub’s Net Profit Tumbles 46% Amid Mobile Competition

- Prime US REIT DPU Doubles Amid Occupancy Recovery

- Prime US REIT (SGX: OXMU / OTCMKTS: KBSUF) demonstrated a notable operational turnaround in its fiscal year 2025 (FY2025) results.

- CapitaLand Investment Scales Fees Amid China Headwinds

- CapitaLand Investment Limited (SGX: 9CI), or CLI, continues to transition toward an asset-light model, as evidenced by its 2025 results.

- Get Smart: Focus on Diversification and Cash Flow

🇸🇬 3 REIT Mistakes Income Investors Should Avoid in 2026 (The Smart Investor)

- S-REITs offer opportunity in 2026, but avoiding common income pitfalls remains crucial for building resilient dividend portfolios.

- Here are three critical mistakes to avoid to ensure a portfolio holds up through the next market cycle.

- Chasing the Highest Yield

- Take Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF) as an example.

- Ignoring Balance Sheet Risk

- A good example is Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF) or FCT.

- The REIT owns nine malls with S$8.3 billion in assets under management, reported a full-year DPU of S$0.12113 for FY2025.

- Overconcentrating in REITs for Income

- Consider Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF), a high-quality data centre REIT with S$6.3 billion in assets under management as of 31 December 2025.

- Get Smart: Building a Resilient Portfolio

🇸🇬 3 Singapore Dividend Stocks to Watch During CNY (The Smart Investor)

- Discover three Singapore dividend stocks hitting their stride this Chinese New Year.

- From a general insurer undergoing a strategic shift to a REIT benefiting from a change in the economic climate, these picks represent different ways to harness the energy of the new lunar year for your portfolio.

- United Overseas Insurance Ltd (SGX: U13 / FRA: IZB): Can a transformation reverse the dividend cut?

- United Overseas Insurance (UOI) finds itself at a crossroads where robust top-line growth meets bottom-line pressure.

- United Hampshire US REIT (SGX: ODBU / OTCMKTS: UNHRF): Lower rates fuel a DPU recovery

- United Hampshire US REIT (UHREIT) offers a compelling example of how macroeconomic shifts can outweigh surface-level revenue dips.

- Vicom Ltd (SGX: WJP): Investing today for bigger dividends tomorrow

- VICOM is currently prioritizing long-term infrastructure over immediate payouts, a move that requires patience from its shareholder base.

- Get Smart: Follow the cash, not just the yield

🇸🇬 Hongkong Land Is at 52-Week Highs. Should We Sell? (The Smart Investor)

- Hongkong Land’s share price is hitting 52-week highs, but long-term investors should look beyond price action to assess whether the business still merits holding.

- Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY), or HKL, hit a 52-week high of S$9.12 on 4 February 2026, marking a significant turnaround after a challenging period for property stocks.

- We look at whether HKL’s rally is supported by improving fundamentals – or if this is a peak worth trimming into.

- Business Overview

- HKL is the largest landlord in Hong Kong’s prime business district, focusing on ultra-premium mixed-use commercial real estate.

- As a core subsidiary of Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF), HKL enjoys operational synergies within an ecosystem of market-leading Asian businesses.

- Why the Stock is at a 52-Week High

- Reasons for Holding

- Reasons for Selling

- What Long-Term Investors Should Watch Closely

- Get Smart: A Bet on a Greater China Recovery

🇸🇬 Singapore’s 11.1 ha Industrial Land Launch: 4 Blue Chip Stocks Poised to Benefit (The Smart Investor)

- Some REITs may stand to benefit from the Ministry of Trade and Industry’s newly released industrial land through its Industrial Government Land Sales (IGLS) programme.

- We look at a few names that might stand out as prime beneficiaries.

- CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF), or CLAR – Anchoring Growth in Singapore’s Industrial Core

- CLAR’s business is globally diversified but anchored in Singapore, accounting for 68% of its portfolio value, allowing the trust to benefit from the tailwinds of rising local rents.

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), or MLT – Rejuvenation Strategy and Logistics Dominance

- In the third quarter of fiscal year 2026 (3QFY2025/2026), MLT’s gross revenue slid 3.1% to S$176.8 million, bringing NPI down 3.3% YoY due to FX headwinds and loss of income from its divested assets.

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF), or MIT – Data Centres and High-Specification Focus

- Like MLT, MIT is also executing a “Rejuvenation Strategy”, but in the data centre space, which accounts for 58.3% of MIT’s assets under management (AUM), positioning it to benefit significantly from the accelerating AI economy

- AIMS APAC REIT (SGX: O5RU / OTCMKTS: ACIRF) – Strong Singapore Concentration and Organic Growth

- Get Smart: Position for the Upswing in Industrial REITs

🇸🇬 DBS, SGX and Keppel – 3 Blue Chips That Raised Their Dividends (The Smart Investor)

- These three Singapore blue-chip stocks stand out for raising dividends, signalling earnings strength and management confidence.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) – The Heavyweight That Keeps Delivering

- DBS has long been a staple for local investors, and its recent performance underscores why.

- The bank reported a record total income of S$22.9 billion for FY2025, a 3% increase year on year (YoY).

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) – The Toll Booth of Singapore’s Capital Markets

- Singapore Exchange (SGX), the nation’s sole market operator, has also stepped up its game

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) – The Shape-Shifter Hitting Its Stride

- Keppel is proving that its pivot from a traditional conglomerate to a global asset manager is paying off.

- Get Smart: Growing dividends signal growing confidence

🇸🇬 These Singapore Stocks Are at Multi-Year Highs: Buy, Hold or Sell? (The Smart Investor)

- When stocks hit multi-year highs, emotions often run ahead of fundamentals. How should investors think about valuation, momentum, and business quality at elevated prices?

- Why Stocks Hit Multi-Year Highs

- Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY), or OCBC — Strong Fundamentals Driving the Rally

- OCBC shares are near fresh highs, trading above S$21 recently.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel — Re-Rating on Changing Perception

- Like OCBC, Singtel shares are also trading at new record highs.

- Unlike the bank, other than strong earnings, Singtel has been rewarded by its shareholders for the smooth execution of its digitalisation strategy (so far).

- Seatrium Ltd (SGX: SE2 / FRA: S8N / OTCMKTS: SMBMF), or Seatrium — Cyclical Recovery at Work

- Rounding things off, another company that is trading near multi-year highs would be the offshore marine giant, Seatrium.

- How to Think About Buy, Hold or Sell at Highs

- Get Smart: High Prices Require Clear Thinking

🇸🇬 Small-Cap Stocks Behind the Businesses We Use Every Day (The Smart Investor)

- Look beyond blue chips to find three household-name small caps that provide the essential services Singapore relies on daily.

- SBS Transit (SGX: S61)

- Most of us interact with SBS Transit daily, yet we rarely think of it as a stock.

- It is the steady heartbeat of our commute, operating the North East and Downtown lines along with an island-wide bus network.

- Vicom Ltd (SGX: WJP)

- VICOM is that rare business you visit not because you want to, but because the law says you must.

- This regulatory moat makes it one of the most resilient stocks on the exchange.

- CSE Global Ltd (SGX: 544 / FRA: XCC / OTCMKTS: CSYJY / CSYJF)

- You might not see CSE Global’s logo on your way to work, but they are the “invisible hand” keeping our world’s power and data moving.

- As a systems integrator, they handle the complex automation and electrification that modern cities and energy sectors require.

- Get Smart: Small Caps Hiding in Plain Sight

🇸🇬 3 Singapore REITs, 3 Different Stories: What the FY2025 Results Really Tell Us (The Smart Investor)

- Three Singapore REITs, three stories, as FY2025 results reveal who is adapting and who is being tested in a higher-rate world.

- These results are about more than just decimals; they are a roadmap for navigating a world where interest rates stay higher for longer.

- CapitaLand Integrated Commercial Trust(SGX: C38U / OTCMKTS: CPAMF): The Steady Overachiever

- If your portfolio had an anchor, CapitaLand Integrated Commercial Trust (CICT) would likely be it.

- First Real Estate Investment Trust (SGX: AW9U / OTCMKTS: FESNF): Fighting the Currency Ghost

- First REIT presents a bit of a paradox.

- If you only look at the headline DPU – which slipped 8.1% YoY to S$0.02170 – you might feel discouraged.

- CapitaLand China Trust (SGX: AU8U / OTCMKTS: CLDHF): Testing the Contrarian’s Resolve

- It’s been a tough year for CapitaLand China Trust.

- Gross revenue was down 9.1% YoY to RMB 1.67 billion, while NPI fell 9.4% to RMB 1.10 billion.

- Get Smart: Match Your Portfolio to the Market Reality

🇸🇬 Markets Are Turning Up — These Stocks Could Ride the Upswing (The Smart Investor)

- As market sentiment improves and money flows back into equities, some stocks are better positioned than others to benefit from an upswing.

- We look at the types of stocks that could ride this upswing, and highlight what makes them stand out.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) — High-Quality Market Leader

- SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) – Cyclical Recovery Play

- Like many cyclical companies, SATS rebounds as economic activity improves.

- Since the recovery of global air travel following the pandemic, its business has also benefited in the area of cargo volumes, and improving operating leverage.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF) – Rate-Sensitive Beneficiary

🇹🇭 Thai conservatives’ first election win this century buoys markets (FT) $ 🗃️

- Stocks and currency rise over promise of breakthrough after decades of political deadlock

- “With a large pro-establishment party leading the coalition, the next government will have a stronger anchor than has been the case with other administrations in recent years,” said Peter Mumford, south-east Asia head at the consultancy Eurasia Group.

🇹🇭 PTT Exploration and Production Public Company Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

🇹🇭 PTT Exploration and Production Public Company Limited (PEXNY) Presents at Opportunity Day Quarter 4/ FY 2025 – Slideshow (Seeking Alpha)

- 🇹🇭🏛️ PTT Exploration & Production PCL (BKK: PTTEP / PTTEP-R / SGX: TPED / OTCMKTS: PEXNY) – Petroleum exploration, development & production, renewable energy, new forms of energy & advanced technology. 🇼 🏷️

🇹🇭 Advanced Info Service Public Company Limited (AVIFY) Analyst/Investor Day – Slideshow (Seeking Alpha)

- 🇹🇭 Advanced Info Services PCL (BKK: ADVANC / SGX: TADD) – Operates Mobile Communication Service with 5G & 4G technology. 🇼 🏷️

🇻🇳 VinFast Auto: Delivery Surge Meets Cash Flow Headwinds (Seeking Alpha) $ 🗃️

- 🌐 VinFast Auto Ltd. (NASDAQ: VFS) – Design & manufacture of EVs, e-scooters, e-buses & parts. 🇼

🇮🇳 India / South Asia / Central Asia

🇮🇳 Indian UHNWIs diversifying across assets classes, regions (The Asset) 🗃️

- Over 70% of portfolios directed to growth assets, with bold, but careful, attitude towards risk, reward

- The portfolios of the ultra-high-net-worth individuals ( UHNWIs ) in India are becoming more diversified, with significant exposure across asset classes and regions, according to a recent report.

- A significant 68% of the UHNWIs direct more than 70% of their portfolios to growth assets, while 44% seek returns in the range of 13% to 15%, indicating a bold, but careful, attitude towards risk and reward, finds Indian wealth management firm Nuvama Private’s wealth report, titled The Exceptionals, which is a comprehensive study of the attitudes, investment behaviours and changing aspirations of India’s UHNWIs in tier-1 and -2 cities.

- The UHNWIs, the report notes, are seriously involved with passion investments; 58% have made investments as varied as sporting teams to boutique resorts, and 65% continue to collect art and other luxury collectibles. These are motivated by more than simply financial returns, according to the report; they are statements of aesthetic taste, legacy and uniqueness.

🇮🇳 Yatra Online, Inc. 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Yatra Online (NASDAQ: YTRA) – Corporate travel services provider. Airline tickets, hotel & holiday packages & other services. 🇼

🇮🇳 Event Driven: Edelweiss ~ How Housing Finance Stake Sale Unlocks Value? (Smartkarma) $

- Edelweiss Financial Services (EDEL IN) [Edelweiss Financial Services Ltd (NSE: EDELWEISS / BOM: 532922)] is divesting a controlling 73% stake in Nido Home Finance to Carlyle Group and Aditya Puri for approximately INR 2,100 crore

- The transaction infuses INR 1,500 crore capital into Nido for growth while providing liquidity to Edelweiss for reducing corporate debt and strengthening its balance sheet

- This strategic move unlocks significant value by monetizing a mature asset at a premium valuation while pivoting the group towards an asset-light business model

🇮🇳 Samvardhana Motherson: Acquisition Pipeline and Greenfield Execution Strengthen FY27 Visibility (Smartkarma) $

- Samvardhana Motherson International (NSE: MOTHERSON / BOM: 517334), a global automotive components leader, reported record quarterly revenue growth of 14% YoY and PAT growth of 21% YoY.

- Rapid expansion in Aerospace, up 41% YoY, and Consumer Electronics, up 75% QoQ, is offsetting developed market auto softness and reducing earnings dependence on cyclical segments.

- With a strong order book, 12 greenfield projects underway, disciplined leverage, and exposure to premiumization and EV trends, SAMIL remains positioned for sustainable multi-year growth despite macro volatility.

🇮🇳 SBIN: Record Breaking Profits and the Reviving Corporate Credit Cycle (Smartkarma) $

- State Bank of India (NSE: SBIN / BOM: 500112) achieved a historic quarterly profit of INR 210.3 billion in Q3FY26, leveraging its 22% market share and INR 103 trillion business volume to lead India’s economic expansion.

- The YONO ecosystem facilitates 68% of new account openings, while market-leading subsidiaries in insurance and asset management provide significant valuation tailwinds through strong cross-selling and dividends.

- Maintaining two-decadal low NPA ratios, the bank is capturing a reviving corporate cycle with a Rs. 7.86 lakh crore pipeline and 95% YoY gold loan growth.

🇮🇳 Fractal Analytics IPO: Play on Enterprise AI and Analytics, Quality Franchise at Premium Valuation (Smartkarma) $

- Fractal Analytics, India’s leading pure-play enterprise AI and analytics company, is tapping capital markets via a INR 2,833.9 crore IPO.

- The IPO offers rare listed exposure to enterprise AI, decision intelligence, and GenAI-led transformation, beyond traditional IT services.

- Strong client franchise, deep AI capabilities, and global exposure are positives, though valuation appears stretched relative to near-term growth.

🌍 Middle East

🇮🇱 Elbit Systems Rides The Defense Boom, But The Valuation Is Stretched (Seeking Alpha) $ 🗃️

- 🌐 Elbit Systems Ltd (NASDAQ: ESLT) – Primary provider of the Israeli military’s land-based equipment & unmanned aerial vehicles. 🇼

🇮🇱 Tower Semiconductor Q4: Capitalized On The AI Demand, Hold (Seeking Alpha) $ 🗃️

- 🌐 Tower Semiconductor (NASDAQ: TSEM) – Foundry of high value analog semiconductor solutions. 🇼

🇹🇷 Koç Holding A.S. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Koç Holding (IST: KCHOL) – Turkey’s largest industrial & services group. 🇼

🇦🇪 Yalla Group Limited 2025 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌍 Yalla Group (NYSE: YALA) – Online social networking & gaming. Voice-centric group chat platform (Yalla) & casual gaming application (Yalla Ludo).

🌍 Eastern Europe & Emerging Europe

🇵🇱 InPost S.A. (INPOY) Shareholder/Analyst Call – Slideshow (Seeking Alpha)

- 🌍 InPost SA (AMS: INPST / LON: 0A6K / FRA: 669) – Specializes in parcel locker service + courier, package delivery & express mail service. 🇼 🏷️

🌎 Latin America

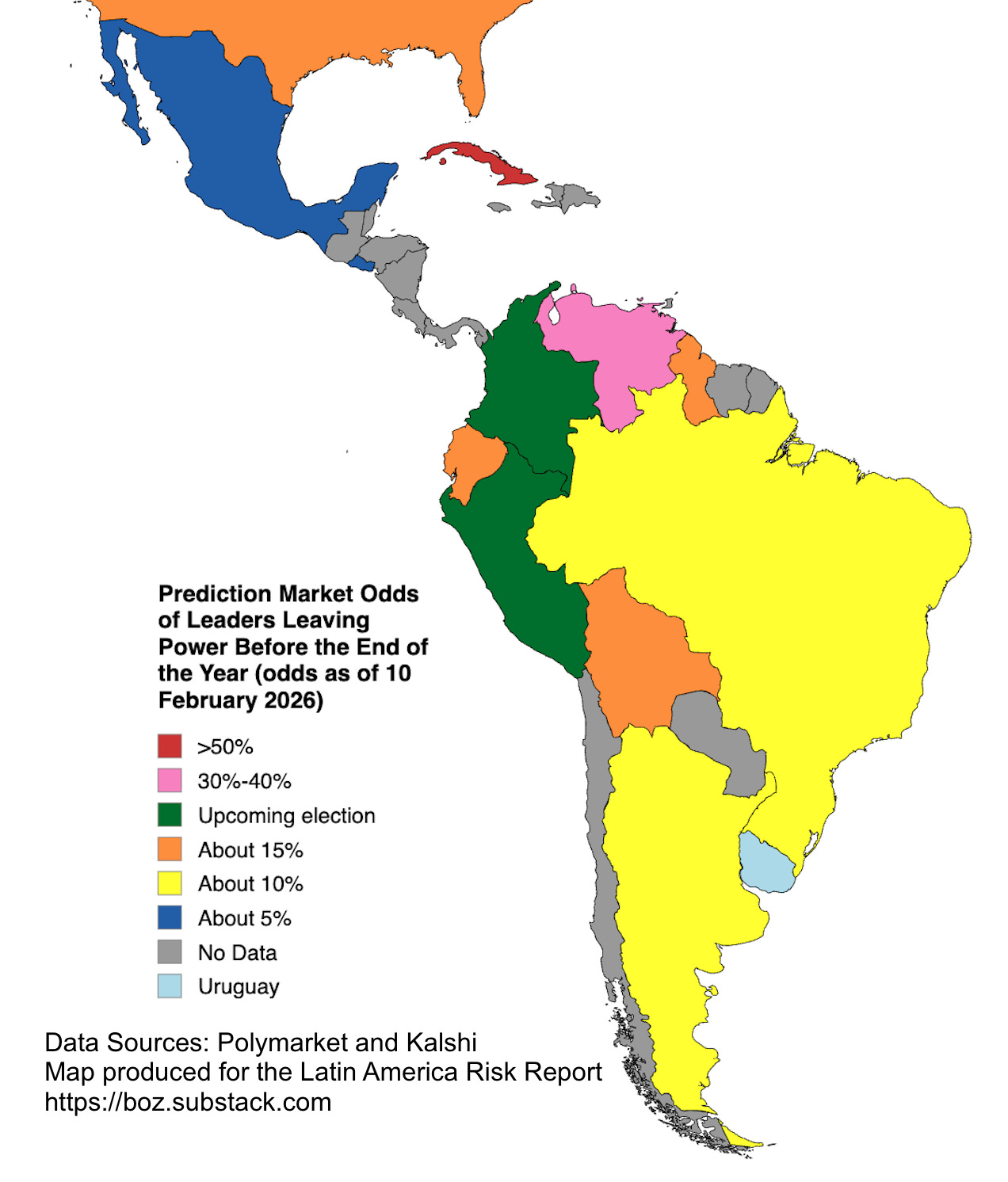

🌎 Which Latin American leaders will be forced from power in 2026? (Latin America Risk Report)

- Comments on what the prediction markets get correct and wrong about political stability in Latin America

🌎 Top Latin American Stocks (Seeking Alpha) $ 🗃️

- SA Quant identified three Latin American stocks with Strong Buy ratings, spanning the financial, material, industrial, and communication sectors.

- I also highlight two bonus stocks that recently fell to Hold, but are worth keeping an eye on.

- 🇧🇷 Tim SA (NYSE: TIMB) – Mobile & fixed telephony services. Subs. of Telecom Italia Finance SA. 🇼

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

- 🌐 CEMEX (NYSE: CX) – Leading vertically integrated building materials / cement company. 🇼 🏷️

- 🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subs. in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

- 🇵🇪 Compania de Minas Buenaventura SAA (NYSE: BVN) – Precious metals mining & exploration (gold, silver, copper, zinc, etc.). Energy generation & transmission services & industrial activities. 🇼

🌎 First Quantum Minerals Ltd. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 First Quantum Minerals Ltd (TSE: FM / FRA: IZ1 / OTCMKTS: FQVLF) – High-quality, low-cost copper mines. Kansanshi (Africa) & Cobre Panama. Copper & nickel projects in Africa & Australia. Gold, zinc & cobalt. 🇼

🇦🇷 Lithium Americas: Government Support Comes At Equity’s Expense (Seeking Alpha) $ 🗃️

- 🇦🇷 🇺🇸👼🏻 Lithium Americas (NYSE: LAC) – Focused on advancing lithium projects in Argentina & USA to production. 🇼 🏷️

🇦🇷 IRSA Inversiones y Representaciones Sociedad Anónima 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 IRSA Inversiones y Representaciones Sociedad Anónima (NYSE: IRS) – One of Argentina’s leading real estate companies. 🇼 🏷️

🇦🇷 Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria WT EXP 030926 2026 Q2 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇦🇷 🇧🇷 🇧🇴 🇵🇾 Cresud Sa (NASDAQ: CRESY) or Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria – Argentine agricultural production chain + investments in Brazil [Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3)], Paraguay & Bolivia. Real estate business in Argentina through IRSA (NYSE: IRS). 🇼 🏷️

🇧🇷 Vale: The Rally Has Outpaced Iron Ore Fundamentals (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Vale: A Cyclical Sell As Asymmetry Turns Negative (Seeking Alpha) $ 🗃️

- 🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 Usinas Siderúrgicas de Minas Gerais S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷🅿️ Usinas Siderurgicas de Minas Gerais (BVMF: USIM3 / USIM5 / USIM6 / FRA: U1S0 / OTCMKTS: USNZY) – One of the largest producers of steel in the Americas, with major steel mills in Brazil. 🇼 🏷️

🇧🇷 Sendas Distribuidora: Deleveraging Delivered, Awaiting The Macro Turn (Seeking Alpha) $ 🗃️

🇧🇷 Sendas Distribuidora S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Sendas Distribuidora SA (BVMF: ASAI3 / OTCMKTS: ASAIY) or Assaí Atacadista – Self-service wholesale company (Cash & Carry). 🇼 🇼 🏷️

🇧🇷 Klabin S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷🅿️ Klabin (BVMF: KLBN3 / KLBN4 / KLBN11 / OTCMKTS: KLBAY) – Packaging paper & sustainable paper packaging solutions. 🇼

🇧🇷 Ambev S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Ambev (NYSE: ABEV) – Brazilian brewing company now merged into Anheuser-Busch Inbev SA (NYSE: BUD). 🇼

🇧🇷 TOTVS S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 TOTVS (BVMF: TOTS3 / OTCMKTS: TTVSY) – Delivers productivity by the digitalization of businesses + systems & platforms for business management. 🇼 🏷️

🇧🇷 TIM S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 TIM S.A. Q4: Good Results, But I Don’t Recommend Buying (Seeking Alpha) $ 🗃️

🇧🇷 Suzano S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

🇧🇷 BB Seguridade Participações S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷🏛️ BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY) – Insurance, pension plans & bonds. Subs. of Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY).

🇧🇷 Bradesco: The Re-Rating Case Is Still Alive Heading Into 2026 (Seeking Alpha) $ 🗃️

🇧🇷 Multiplan Empreendimentos Imobiliários S.A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇧🇷 Multiplan Empreendimentos Imobiliaris SA (BVMF: MULT3 / OTCMKTS: MLTTY) – Full-service company that plans, develops, owns & manages one of the country’s largest & highest-quality commercial property portfolios. 🏷️

🇧🇷 XP Inc.: Shifting Its Advisory Strategy, And Trades At Attractive Earnings Multiple (Seeking Alpha) $ 🗃️

🇧🇷 XP Inc. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 XP Inc (NASDAQ: XP) – Wealth management & other financial services (fixed income, equities, investment funds & private pension products). 🇼

🇧🇷 Patria Investments: Emerging Market Tailwinds May Soon Unlock Upside (Seeking Alpha) $ 🗃️

- 🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇨🇱 Banco de Chile 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Banco de Chile (NYSE: BCH) – Range of financial services. 🇼

🇨🇱 Embotelladora Andina At Close To 20x Earnings Does Not Incorporate Discretionary And Currency Risk (Seeking Alpha) $ 🗃️

- 🌎 Embotelladora Andina Sa (NYSE: AKO.A / AKO.B) – Produces, markets, & distributes Coca-Cola trademark beverages in Chile, Brazil, Argentina, & Paraguay. 🇼 🏷️

🇨🇱 LATAM Airlines: Why I Am Upgrading One Of My Favorite Airlines’ Stock To A Strong Buy (Seeking Alpha) $ 🗃️

- 🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subs. in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇨🇴 Grupo Cibest: A Good Diversification Play In The Global Banking Sector (Seeking Alpha) $ 🗃️

- 🌎🅿️ Grupo Cibest SA (NYSE: CIB / BVC: PFBCOLOM) fmr. Bancolombia – First Colombian financial institution listed on the NYSE. It provides banking products & services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda & Guatemala. 🇼 🏷️

🇰🇾 Consolidated Water: Utility Stability With Project-Driven Upside (Seeking Alpha) $ 🗃️

🇰🇾 Consolidated Water: Big Catalysts On Tap (Seeking Alpha) $ 🗃️

- 🇰🇾🌎 Consolidated Water Company Ltd (NASDAQ: CWCO) – Designs, builds, operates & in some cases finances seawater reverse osmosis (SWRO) desalination plants & water distribution systems in several Caribbean countries. 🏷️

🇲🇽 Mexico’s Cheeky Airline Merger Is an Anti-Trust Nightmare (Bloomberg) $ 🗃️

- In the final days of 2025, two low-cost airlines — Grupo Viva Aerobus SA and Controladora Vuela Compania de Aviacion SAB de CV (NYSE: VLRS) or Volaris, better known as Volaris — stunned the industry by announcing a merger that would hand them roughly 70% of Mexico’s passenger airline market. Even more striking, President Claudia Sheinbaum publicly welcomed the deal soon after, calling it good for Mexico because it would allow the companies to “invest more.”

🇲🇽 Sigma Foods, S.A.B. de C.V. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎🌍 Sigma Foods SAB de CV (BMV: SIGMAFA / FRA: G4L / OTCMKTS: ALFFF) – Cooked & fresh meats, dry meats, dairy & other brands. Part of Alfa SAB de CV (BMV: ALFAA / OTCMKTS: ALFFF). 🇼

🇲🇽 América Móvil, S.A.B. de C.V. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 America Movil SAB de CV (NYSE: AMX) – Leading Latin America telecommunication service provider. 🇼 🏷️

🇵🇦 Banco Latinoamericano de Comercio Exterior, S. A. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌎 Banco Latinoamericano (NYSE: BLX) or the Foreign Trade Bank of Latin America or Bladex – Founding shareholders were the Central Banks & government entities of 23 countries in the region. Specialized in addressing trade finance needs. 🇼 🏷️

🇵🇪 Buenaventura: Trifecta Of Gold, Copper And Silver (Seeking Alpha) $ 🗃️

- 🇵🇪 Compania de Minas Buenaventura SAA (NYSE: BVN) – Precious metals mining & exploration (gold, silver, copper, zinc, etc.). Energy generation & transmission services & industrial activities. 🇼

🌐 Global

🌐 Litigation investing – a route to riches (sometimes) (Undervalued Shares)

- The first major investment I made in the 1990s was a litigation stock. It was controversial enough that I’ve never written about it before.

- Ever since, I have kept an eye on this complex niche of the market.

- Join me for a stroll through some of the names that make up this sector today – along with a few historical cases worth learning from.

🌐 Emerging economies shine despite US volatility (FT) $ 🗃️

- For the rally to endure, developing markets need to build on their resilience

- Despite the risks of Donald Trump’s aggressive protectionist agenda, the mood among policymakers and central bankers at the Conference for Emerging Market Economies in AlUla, Saudi Arabia, this week was cautiously upbeat. Assets across the ragtag grouping of economies have been on a tear. Last year, benchmark equity indices in countries including South Korea, Poland and Vietnam more than doubled the S&P 500’s 16 per cent gain. Returns on local-currency bonds and sovereign credit outpaced developed markets too. The rally has rolled on into 2026.

🌐 Nebius: AI Discount Bin (Seeking Alpha) $ 🗃️

🌐 Nebius: Getting Ready To Take Off As AI Boom Accelerates (Seeking Alpha) $ 🗃️

🌐 Nebius: Inflection Point (Seeking Alpha) $ 🗃️

🌐 Nebius: In Energy We Trust (Seeking Alpha) $ 🗃️

🌐 Nebius: Incrementally Bullish After Positive Report (Seeking Alpha) $ 🗃️

🌐 Nebius Q4: Path To Potential $180 Share Price (Seeking Alpha) $ 🗃️

🌐 Nebius Group Stock: Build, Sell, Repeat (Seeking Alpha) $ 🗃️

🌐 Nebius: The AI Powerhouse You Can’t Ignore (Seeking Alpha) $ 🗃️

🌐 Nebius Group Earnings: Ignore The Noise, This Stock’s A Winner (Seeking Alpha) $ 🗃️

🌐 Nebius: A Sober Look At Q4 Earnings (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

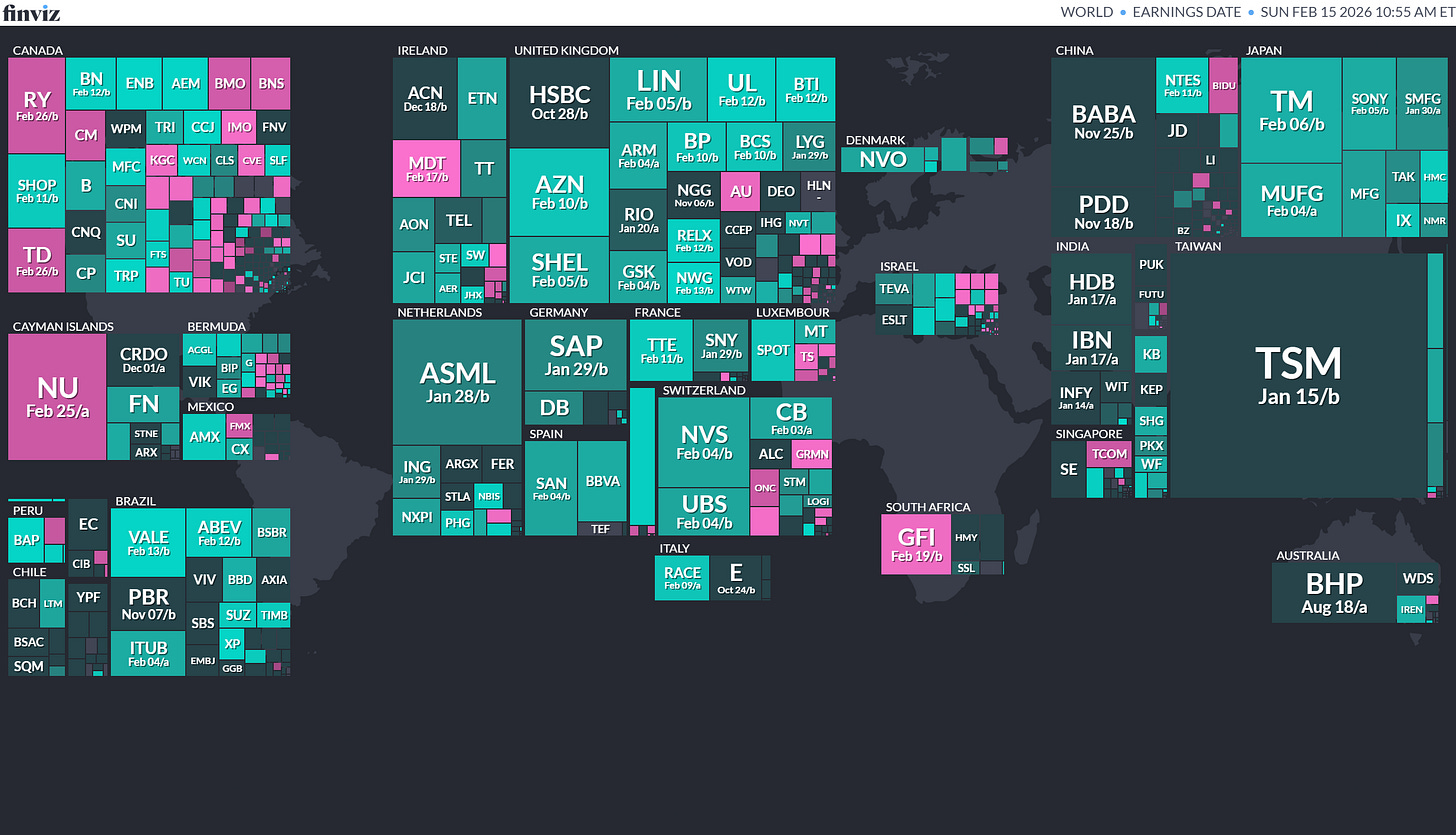

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

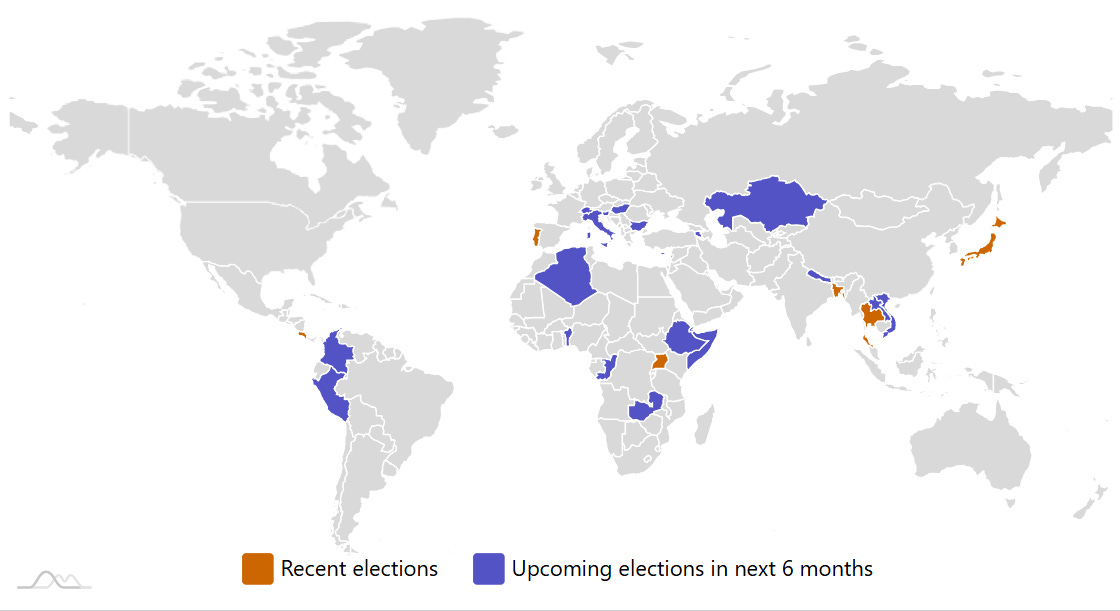

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

JapanJapanese House of Representatives2026-02-08 (d) Confirmed 2024-10-27ThailandThai House of Representatives2026-02-08 (t) Confirmed 2023-05-14ThailandThai House of Representatives2026-02-08 (t) Confirmed 2023-05-14BangladeshBangladeshi National Parliament2026-02-12 (d) Confirmed 2024-01-07BangladeshReferendum2026-02-12 (d) Confirmed- Colombia Colombian Senate 2026-03-08 (d) Confirmed 2022-03-13

- Colombia Colombian House of Representatives 2026-03-08 (d) Confirmed 2022-03-13

- Kazakhstan Referendum 2026-03-15 (d) Confirmed 2024-10-06

- Slovenia Slovenian National Assembly 2026-03-22 (t) Confirmed 2022-04-24

- Peru Peruvian Congress of the Republic 2026-04-12 (d) Confirmed 2021-04-11

- Peru Peruvian Presidency 2026-04-12 (d) Confirmed 2021-04-11

- Bulgaria Bulgarian National Assembly 2026-04-14 (t) Date not confirmed 2024-10-27

- Hungary Hungarian National Assembly 2026-04-30 (t) Date not confirmed 2022-04-03

- Cyprus Cypriot House of Representatives 2026-05-31 (t) Date not confirmed 2021-05-30

- Colombia Colombian Presidency 2026-05-31 (t) Date not confirmed 2022-06-19

- Morocco Moroccan Chamber of Representatives 2026-09-30 (t) Date not confirmed 2021-09-08

- Czech Republic Czech Senate 2026-09-30 (t) Date not confirmed 2024-09-27

- Russian Federation Russian Federal Duma 2026-09-30 (t) Date not confirmed 2021-09-19

- Brazil Brazilian Federal Senate 2026-10-04 (d) Confirmed 2022-10-02

- Brazil Brazilian Chamber of Deputies 2026-10-04 (d) Confirmed 2022-10-02

- Brazil Brazilian Presidency 2026-10-04 (d) Confirmed 2022-10-30

- Israel Israeli Knesset 2026-10-27 (d) Confirmed 2022-11-01

- Bulgaria Bulgarian Presidency 2026-11-30 (t) Date not confirmed 2021-11-21

- Bahrain Bahraini Council of Representatives 2026-11-30 (t) Date not confirmed 2022-11-12

- Viet Nam Vietnamese National Assembly 2026-03-15 (d) Confirmed 2021-05-23

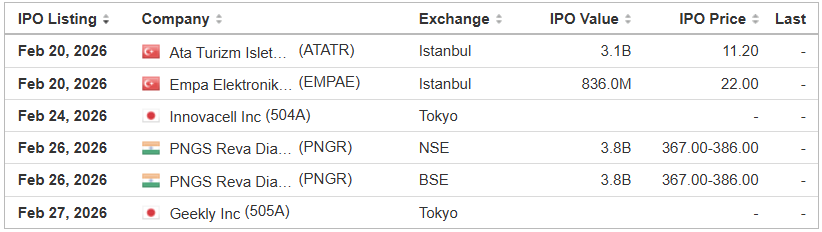

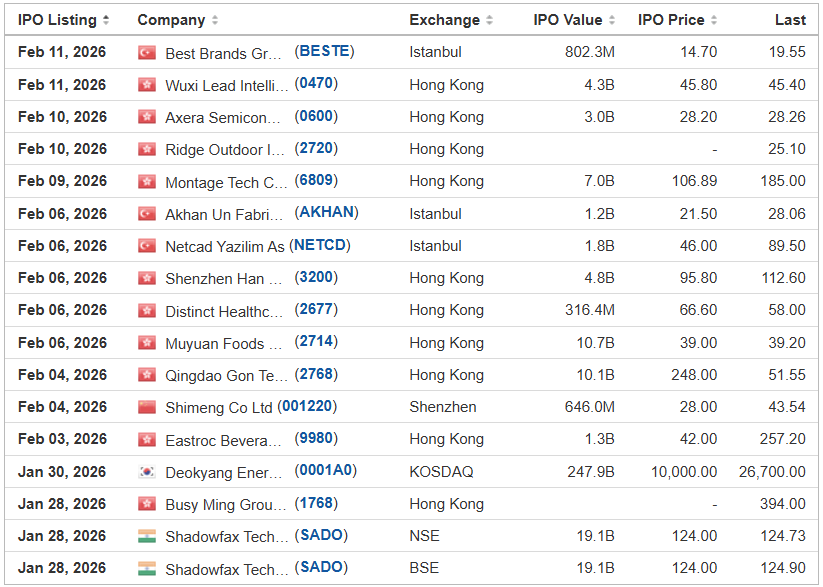

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

XFLH Capital Corp. XFLHU Maxim Group, 10.0M Shares, $10.00-10.00, $100.0 mil, 2/12/2026 Priced

(Incorporated in the Cayman Islands)

We intend to focus our search initially on target businesses operating in Asia. We may consummate a business combination with an entity located in the People’s Republic of China (including Hong Kong and Macau) (the “PRC” or “China”).

Our focus will be on acquiring a middle-market growth business (or more than one business in this category) with a total enterprise value between $200 million and $400 million.

We will not consider or undertake an initial business combination with any target company the financial statements of which are audited by an accounting firm that the United States Public Company Accounting Oversight Board (the “PCAOB”) is unable to inspect for two consecutive years.

Yanzhe Yang has served as our CEO and a director since September 2025. Yanzhe Yang has served as the CEO and founder of Aorui Health Management Co., Ltd. since December 2024. Mr. Yang has multiple years of experience in strategic investment, corporate consulting, and market management.

Tianshi Yang has served as our CFO since September 2025. Mr. Tianshi Yang has more than 12 years of experience in finance as well as management experience in four Nasdaq-listed companies – SunCar Technology Group Inc. (Nasdaq: SDA); TD Holdings, Inc. (NASDAQ: GLG); Aesthetic Medical International Holdings Group Limited (NASDAQ: AIH), and Meten EdtechX Education Group Ltd. (NASDAQ: METX).

The majority of our executive officers and directors are located in or have significant ties to China:

– Yanzhe Yang, our CEO and a director, holds Chinese citizenship and resides in China;

– Tianshi Yang, our CFO, holds Chinese citizenship and resides in China.

– Heung Ming Henry Wong, our independent director nominee, holds Hong Kong citizenship and resides in Hong Kong;

– Chennong Huang, our independent director nominee, holds Chinese citizenship and resides in China, and

– Jonathan Yee Fung Cheng, our independent director nominee, holds Hong Kong citizenship and resides in Hong Kong.

As a result, it may be difficult for investors to effect service of process within the United States on our company, executive officers and directors, or enforce judgments obtained in the United States courts against our company, executive officers and directors. (From the prospectus)

(Note: XFLH Capital Corp. priced its SPAC IPO on Feb. 11, 2026, in sync with the terms in the prospectus – 10 million units at $10.00 each – to raise $100.0 million. Each unit consists of one ordinary share and one right to receive one-seventh (1/7) of an ordinary share upon the consummation of an initial business combination. Background: XFLH Capital Corp. increased the size of its SPAC IPO to 10 million units – up from 6 million originally – and kept the price at $10.00 each – to raise $100 million, in an S-1/A filing dated Jan. 26, 2026. In that filing, XFLH Capital Corp. said it planned to apply to list its units on the New York Stock Exchange.

(Background: XLFH Capital Corp. filed its S-1 for its SPAC IPO on Sept. 29, 2025, and disclosed the terms: 6 million units at $10.00 each to raise $60 million. In the S-1 filing, XLFH Capital Corp. said it planned to list its units on the NASDAQ.)