The Asset has reported that US dollar blues re-ordering Asian portfolios 🗃️

The DXY measures the greenback against a basket of six major world currencies ( euro, yen, pound sterling, Canadian dollar, Swedish krona (SEK ), and Swiss franc), with the euro carrying the most weight. Hovering at 95.60 means the dollar has effectively erased all its gains from the last four years, returning to levels not seen since early 2022.

For the past few years, the dollar was the “king of the hill” due to high US interest rates, but breaking below 96.00 suggests that the “King Dollar” era is officially under siege, according to analysts.

However, some reality checks:

Either have also pointed out:

- The US has never cancelled its currency (e.g. a 1960 US dollar is worth at least its face value and more to a collector) – unlike pretty much every European and other countries who do so on a regular basis [Armstrong]…

- A currency’s strength is not just about how much gold or natural resources a country has as then Russia or Saudi Arabia would have the world’s most valuable currencies and the Euro/Pound etc would be weak. Its also a reflection of a country’s people and their productivity (+ economy)…

- The Dollar’s reserve currency status is backed up and enforced by a nuclear arsenal and the most powerful military in the world – no other military comes close to it…

- If the USA “pulls back the legions” (as in what the Roman empire did in later years), then that’s a bad sign for the Dollar [Ed Dowd] e.g. if the sea lanes, etc. can no longer be kept open…

I would add that very few people in the global elite/professional classes actually wants to live in Moscow/Beijing/Shanghai or Sochi/Hainan Island, etc. or park their money there. They want to live in NYC/London/Paris or Miami/Côte d’Azur/Cayman Islands/Switzerland or maybe more neutral Dubai/Singapore, etc. And those are also the places they tend to want their wealth stashed…

Finally, I still have to do a December and January for 🌐 Emerging Market Stock Picks (November 2025) type stock posts. Hopefully I can get a December one out this week without having to first add too may stocks to our Frontier & Emerging Market Stock Index.

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🇲🇾 The Edge Billion Ringgit Club (BRC) 2025 Award Winners Partially $

- Malaysian stock pick winners of The Edge Billion Ringgit Club 2025 Awards – Growth in profit after tax over three years, returns to shareholders over three years, return on equity over three years etc

- 🌐 EM Fund Stock Picks & Country Commentaries (February 1, 2026) Partially $

- Indian stocks & AI, branded jewellery market, Donroe Doctrine + tariff macro/market impacts, CEE market returns, Latin America’s resource potential, plenty of December/Q4 fund updates, etc.

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 US dollar blues re-ordering Asian portfolios (The Asset) 🗃️

- Greenback plunge triggers rush to safe-haven gold, making US tech stocks look sluggish

- The US dollar index ( DXY ) has cratered to a four-year low, hovering near the 95.60 mark on Wednesday ( January 28 ). For Asian investors, this isn’t just a “story from Washington” but represents a seismic shift that is re-ordering their portfolios.

- The DXY measures the greenback against a basket of six major world currencies ( euro, yen, pound sterling, Canadian dollar, Swedish krona (SEK ), and Swiss franc), with the euro carrying the most weight. Hovering at 95.60 means the dollar has effectively erased all its gains from the last four years, returning to levels not seen since early 2022.

- For the past few years, the dollar was the “king of the hill” due to high US interest rates, but breaking below 96.00 suggests that the “King Dollar” era is officially under siege, according to analysts.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Goldman Sees More Than $500 Billion Flow Into Chinese Stocks in 2026 (Caixin) $

- Goldman Sachs expects Chinese equities to attract 3.6 trillion yuan ($518 billion) in fresh domestic capital this year, betting that rising corporate earnings will drive a sustained market recovery.

- The forecast, presented in Hong Kong by Goldman’s chief China equity strategist Kinger Lau, underpins the bank’s overweight stance on Chinese stocks in the Asia-Pacific region, at a time when broader market sentiment on China remains cautious.

🇨🇳 China Brokerages Poised for Profit Surge in Bull Market (Caixin) $

- A group of listed Chinese securities firms expected profits to have risen sharply in 2025, buoyed by a strong equity rally, with mergers also beginning to deliver gains.

- As of late Wednesday, 12 listed brokerages had released upbeat earnings forecasts or preliminary results, signaling a broad improvement from a weak prior year.

- The upswing followed a policy shift in late 2024 that lifted market sentiment and drove a sharp rise in trading activity.

🇨🇳 2026 watchlist: My thoughts and equity picks for the year ahead Part 2 (Dragon Invest)

- Will the year of the Horse deliver galloping stock returns

- Tak Lee Machinery Holdings Ltd (HKG: 2102)

- Tak Lee Machinery Holdings Limited is a Hong Kong-based heavy equipment sales, leasing, and after-sales service provider that is the sole authorized Hitachi dealer in Hong Kong and Macau, along with other smaller brands like LaBounty and Ramfos.

- Luxshare Precision Industry (SHE: 002475)

- Luxshare Precision is a global leader in precision components and smart manufacturing. Its core edge lies in a multi-engine growth model: Apple’s AI hardware upgrade cycle, high-margin automotive electronics (post-Leoni acquisition), and AI-driven data center components.

- Inspur Digital Enterprise Technology Ltd (HKG: 0596 / FRA: L1CC)

- Inspur Digital Enterprise is the most undervalued play to get exposure to China’s enterprise digital transformation sector. Inspur is catapulated by its dual exposure to cloud and AI and a high-stickiness SOE client base and massive potential upside from potential Hong Kong Stock Connect inclusion and AI-driven margin expansion.

- JCET Group (SHA: 600584)

- JCET is the largest OSAT in mainland China and top 3 globally (behind ASE and Amkor), with a market position built on full-spectrum advanced packaging capabilities, global operational diversification, and exposure to high-growth end-markets including AI, high-performance computing (HPC), automotive, and storage.

- Chongqing Changan Automobile (SHE: 000625 / 200625)

- Changan Automobile is a top-tier Chinese domestic passenger vehicle leader and central SOE auto flagship marquee undergoing a full pivot from traditional ICE cars to an intelligent low-carbon mobility tech firm, underpinned by a tiered new energy brand matrix, in-house core tech, large-scale manufacturing, and accelerating globalization.

🇨🇳 East Buy rides into China’s instant commerce war zone (Bamboo Works)

- The e-commerce company’s move is the latest development in its gradual transformation into an online version of Costco and Sam’s Club

- East Buy Holding Ltd (HKG: 1797 / OTCMKTS: KLTHF) is building up same-day delivery capabilities in its top 10 markets, and plans to trial instant retail fulfillment capabilities in Beijing, Shanghai and Guangzhou

- The company’s stock rallied 14% after it announced the moves, contained in its latest financial report that showed it returned to profitability in the first half of its fiscal year

🇨🇳 TCL Electronics dazzles with upbeat guidance, Sony venture (Bamboo Works)

- The leading TV maker said its profit rose strongly last year, boosted by strong performance for large display models, as it announced a new joint venture with Sony

- TCL Electronics Limited (HKG: 1070 / FRA: TC2A / OTCMKTS: TCLHF) said it expects to report its adjusted net profit rose 45% to 60% last year on strong sales for its large-sized displays

- Separately, the leading TV and display maker announced the formation of a joint venture with Sony Group Corp (NYSE: SONY) to expand its home entertainment products

🇨🇳 Montage Technology H Share Listing (6809 HK): Valuation Insights (Smartkarma) $

- Montage Technology Co Ltd (SHA: 688008), the world’s largest memory interconnect chip supplier, has launched an H Share listing to raise US$902 million.

- I discussed the H Share listing in Montage Technology H Share Listing: The Investment Case. The price momentum is strong amid a well-documented surge in memory chip prices.

- The proposed AH discount of 41.3% (based on the 29 January A Share price) is attractive. Overall, I would participate in the listing.

🇨🇳 Montage Technology (6809 HK): US$1bn Offering at a Near 50% Discount to A-Shares (Smartkarma) $

- Montage Technology Co Ltd (SHA: 688008) could raise up to HK$8.1bn (US$1.04bn) in its Montage Technology (6809 HK) listing if the Overallotment Option is exercised.

- Nearly half the base offering is allocated to cornerstone investors; those shares are locked up for 6 months. That eliminates the already small possibility of early inclusion to global indexes.

- Montage Technology (6809 HK) should be added to Southbound Stock Connect from the open of trading on 9 March following the end of the Price Stabilisation period.

🇨🇳 Ford held talks with China’s Xiaomi over EV partnership (FT) $ 🗃️

- Ford has held talks with electric vehicle maker Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) over a partnership that would pave the way for Chinese carmakers to gain a foothold in the US, according to four people familiar with the talks.

- While the discussions were preliminary, Ford has explored forming a joint venture with Xiaomi to manufacture EVs in the US, according to the people.

🇨🇳 China Merchants Bank falters as economic slowdown wipes out growth (Bamboo Works)

- Operating income growth for the bank, considered one of the most market-oriented among China’s big state-run lenders, came to a standstill in 2025

- China Merchants Bank (SHA: 600036 / HKG: 3968 / OTCMKTS: CIHKY / OTCMKTS: CIHHF)’s operating income increased by just 0.01% last year, while its net profit grew by an only slightly better 1.2%

- The results show that growth is stalling in a slowing Chinese economy for the high-margin retail products that give the bank its competitive edge

🇨🇳 In Depth: Vanke’s Debt Spiral Reveals Limits of China’s Real Estate Backstop (Caixin) $

- Real estate giant Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / OTCMKTS: CHVKF / CHVKY) secured a last-minute extension on a batch of domestic bonds between Jan. 21 and 27, narrowly averting a default that could have rippled through the nation’s battered property market.

- The reprieve capped a months-long standoff with creditors and marked a critical turning point for the developer, long viewed as one of the industry’s most resilient players. The deal came just as former Chairman Yu Liang, who had led the company for over a decade, disappeared from public view after stepping down. Yu has been unreachable since his retirement was formally completed in early January, a development that has fueled speculation among sources that he may have been taken away by authorities.

🇨🇳 Zijin to Buy Canadian Miner for $4 Billion as Gold Prices Hit Records (Caixin) $

- Zijin Mining Group (SHA: 601899 / HKG: 2899 / FRA: FJZB / OTCMKTS: ZIJMF), China’s largest gold producer, plans to acquire Canadian miner Allied Gold Corp (NYSE: AAUC) for C$5.5 billion ($4 billion), securing large-scale gold assets in Africa as bullion prices hit record highs.

- Marking the largest acquisition in Zijin’s history, the deal underscores the company’s aggressive drive to expand its global reserve base and production capacity to capitalize on the precious metal’s historic rally, which saw prices breach $5,100 an ounce for the first time on Monday.

🇨🇳 In an increasingly uncertain environment, DPC Dash starts 2026 with a bang (Bamboo Works)

- The Domino’s Pizza master franchisee for Mainland China opened 90 new stores in the first 24 days of January, bringing its total store count to 1,405, the same as its ticker number

- DPC Dash (HKG: 1405 / FRA: X12 / OTCMKTS: DPCDF) opened 307 stores last year, raising its total to 1,315 at the end of December and reaching its annual target of 300 new stores

- The Domino’s master franchisee for Mainland China, Hong Kong and Macao is increasingly seeking the right balance between expansion and profitability

🇨🇳 Starbucks China Revenue Jumps Amid Restructuring Push (Caixin) $

- Starbucks Corp (NASDAQ: SBUX) reported a strong fourth quarter in China as the U.S. coffee chain restructures its operations in the world’s second-largest economy.

- During the three-month period, Starbucks generated revenue of $823 million in the Chinese market where it runs 8,011 stores, up 11% year-on-year, according to its earnings report released Wednesday.

- The company’s China business saw comparable store sales grow 7% during the period after years of stagnation, driven by a 5% rise in comparable transactions and a 2% jump in average ticket, the report said.

🇨🇳 Pop Mart (9992 HK): PUCKY – How a Lucky Plush Drove Shares up 30%. (Smartkarma) $

- Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF) stock was up 7% yesterday and 30% since January 16th, after the launch of “PUCKY” Tap tap series of plush pendant blind boxes on January 15th.

- This new blind-box series is reported to have created a social media buzz with official stocks being sold out quickly leading to a boost in secondary market demand and prices.

- It is too early to conclude if this blind box series can recreate the Labubu magic but by adding an interactive music function, Pop Mart has caught buyer attention again.

🇨🇳 China’s Luxury Slump Eases in 2025 as Shoppers Shift to Domestic Market (Caixin) $

- The Chinese mainland’s personal luxury market showed signs of stabilization in 2025, with a modest recovery in the final quarter as consumers shifted spending back to domestic channels.

- Sales for the year fell by 3% to 5%, a significant improvement from the 17% to 19% decline in 2024, according to a report [China’s personal luxury market contracts 3%–5% in 2025 but shows signs of recovery] released Thursday by Bain & Company.

- This stabilization signals a potential turning point for a sector that has long been a key growth engine for global luxury brands. However, consumption habits are shifting, with an increasing focus on value and experiential luxury. Bain expects the market to resume moderate growth in 2026, reaffirming the Chinese mainland’s crucial role in the global luxury industry despite recent slowdowns.

🇨🇳 Anta Looks to Turn Around Puma in $1.8 Billion Deal (Caixin) $

- ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) has agreed to acquire a 29.06% stake in PUMA SE from the Pinault family’s investment vehicle for 1.5 billion euros (about $1.8 billion), becoming the single largest shareholder in the German sportswear maker.

- The transaction underscores the global expansion of the Chinese athletic apparel giant, which is betting on its ability to revitalize the struggling German brand much as it has with previous acquisitions like Fila in China and Amer Sports (NYSE: AS).

🇨🇳 Kintor regeneration advances with new marketing partnership (Bamboo Works)

- The company says its new tie-up with Dekai Pharma involving its KX-826 hair-loss treatment could be worth 100 million yuan in sales

- Kintor Pharmaceutical (HKG: 9939 / OTCMKTS: KNTPF) shares rallied more than 8% in the three trading days after announcing a marketing partnership for its hair loss treatment

- The company began as a cancer treatment specialist, but has abandoned that business and is rebranding as a maker of more mainstream skin and hair loss treatments

🇨🇳 Joinn’s ‘jumping’ monkey market hides core weakness (Bamboo Works)

- Despite announcing a sharp profit surge, the lab animal provider’s stock ticked up by just a muted 3% over the next three trading days

- Joinn Laboratories China (SHA: 603127 / HKG: 6127) has built up a reserve of around 25,000 laboratory monkeys using a counter-cyclical strategy, creating a significant resource-based moat for its business

- While laboratory monkeys are unlikely to be fully replaced in drug safety testing over the short term, the trend toward technological substitution is irreversible

🇨🇳 Eastroc Beverage Hong Kong IPO Preview (Douglas Research Insights) $

- Eastroc Beverage Group Co Ltd (SHA: 605499) (9980 HK) is getting ready to complete its IPO in Hong Kong next week. The company is selling 40.9 million shares for HK$248 each

- The company plans to raise up to HK$10.1 billion (US$1.3 billion). This would suggest a market cap of about US$21 billion.

- Eastroc Beverage is one of the largest functional beverage companies in China and the dominant domestic energy drink producer, with its Eastroc Special Drink product having displaced Red Bull product.

🇭🇰 Medical Beauty Plays in Hong Kong: Perfect/Water Oasis and Flameglow: A Better Retail Environment? (Smartkarma) $

- If Perfect Medical Health Management (HKG: 1830 / OTCMKTS: PFSMF) replicates in H1FY26 earnings, a 15 HKD cent dividend implies a 12.5% dividend yield on the current share price (100% payout ratio).

- The semi‑annual results suggest modest improvement in retail sales, though management of most firms (except Fameglow Holdings Ltd (HKG: 8603)) remain guarded in their outlooks.

- In order of preference, currently Water Oasis Group Limited (HKG: 1161 / OTCMKTS: WOSSF) seems the safest bet, followed by Perfect Medical Health (1830 HK). While Flameglow’s growth is good, margins are a question mark.

🇭🇰 Eastroc Beverage Hong Kong IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of Eastroc Beverage Group Co Ltd (SHA: 605499) is target market cap of HK$234.7 billion (US$30.1 billion).

- This is 41% higher than the expected market cap of HK$166.4 billion at the high end of the IPO price range. Given the solid upside, we have a Positive View.

- Our base case valuation is based on P/E of 29.6x our estimated net profit of RMB7.1 billion (2027E). Eastroc Beverage has higher sales growth rate and ROE than its comps.

🇭🇰 Muyuan Foods Hong Kong IPO Preview (Douglas Research Insights) $

- Muyuan Foods Co Ltd (SHE: 002714) is getting ready to complete its Hong Kong IPO on 6 February 2026. This listing involves an offering of 273.95 million H shares.

- The offer price is capped at HK$39 per share. The offering involves raising approximately HK$10.7 billion ($1.4 billion USD).

- Muyuan Foods is the largest company globally in the hog farming industry by both production capacity and hog sales volume.

🇭🇰 Sa Sa spruces up sales but will it be just a cosmetic lift? (Bamboo Works)

- The Hong Kong drugstore chain [Sa Sa International Holdings Ltd (HKG: 0178)] has delivered double-digit growth in quarterly sales, driven by tourist and online spending, after axeing its Chinese stores

- Third-quarter revenue rose 12.5%, boosted by higher same-store sales in its core markets of Hong Kong and Macao

- E-commerce revenue climbed 14.9% after a switch to online-only sales in mainland China, but the share of overall turnover barely increased

🇲🇴 Challenging growth path for Macau’s average GGR per visitor this year, says CreditSights (GGRAsia)

- Credit and market research provider CreditSights Inc says it expects Macau’s casino gross gaming revenue (GGR) to post a “low-to-mid-single digit” growth in full-year 2026, though average GGR per visitor would in likelihood see a “more difficult path” for growth.

- In a Monday report, the institution noted that while Macau’s casino GGR last year rose 9.1 percent year-on-year to MOP247.40 billion (US$30.86 billion), the GGR per visitor stood at MOP6,174, which it said was down 5 percent year-on-year.

- “The full year GGR growth was largely driven by the VIP segment, which had jumped to 24 percent year-on-year (2024: +21 percent year-on-year) in 2025 and now forms 27 percent of the total 2025 GGR (2024: 24 percent),” wrote CreditSights’ analysts Nicholas Chen and David Bussey.

🇲🇴 Macau’s January GGR US$2.8bln, up 24pct from a year earlier (GGRAsia)

- Macau casino gross gaming revenue (GGR) for January was just over MOP22.63 billion (US$2.81 billion), showed government data issued on Sunday.

- The figure was up 24.0 percent compared to January 2025’s MOP18.25 billion. Judged month-on-month, it was an 8.4-percent increase on December’s MOP20.89 billion.

- That is according to figures disclosed by Macau’s casino regulator, the Gaming Inspection and Coordination Bureau.

- In a January 26 memo, banking group JP Morgan said Macau GGR had been “steady and solid” for the first 25 days of the month, at an average of MOP712 million per day.

🇲🇴 Macau’s 2025 GDP up 4.7pct y-o-y, helped by surge in visitors in final three months (GGRAsia)

- Macau’s 2025 gross domestic product (GDP) grew 4.7 percent year-on-year in real terms, to MOP417.28 billion (US$51.89 billion), helped by a surge in fourth-quarter visitors that pushed that quarter’s GDP expansion to 7.6 percent year-on-year.

- Performance in the three months to December 31 was driven by factors including “surging visitor arrivals resulting from the hosting of numerous large-scale events… and government efforts to attract visitors”, said the city’s Statistics and Census Service in a Friday statement.

🇲🇴 Macau EBITDA below expectations as promotional competition intense: Sands China management (GGRAsia)

- Patrick Dumont, president and chief operating officer of Las Vegas Sands (NYSE: LVS), says that while the fourth quarter of 2025 “may not have produced the results” that the group expected in terms of Macau earnings before interest, taxation, depreciation and amortisation (EBITDA), the company is seeing “growth, better market positioning, revenue share growth,” and is “heading in the right direction”.

- He was speaking on a Wednesday call to discuss its fourth-quarter earnings announced that day.

- The group’s Macau unit, Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF), reported adjusted property EBITDA of US$608 million for the three months to December 31, up 6.5 percent from the prior-year period.

- Fourth-quarter results for Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF), the Macau operation of Las Vegas Sands (NYSE: LVS), saw a “big miss on margin,” said a Thursday note from banking group JP Morgan, after the parent issued group-wide figures overnight on Wednesday.

- The bank said Sands China’s fourth-quarter luck‑adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) of US$582 million were down 3 percent sequentially and down 2 percent year-on-year.

- That was 5 percent below JP Morgan’s estimates “despite our recent cut,” said the institution.

- “The culprit was margins”, wrote JP Morgan analysts DS Kim, Selina Li, and Lindsey Qian, describing Sands China’s fourth-quarter EBITDA margin as “really bad”.

🇹🇼 Taiwan

🇹🇼 Taiwan Dual-Listings Monitor: Massive TSMC Spread Breakdown (Smartkarma) $

- Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM): +17.2% Premium; Massive Spread Breakdown; Opens New Long Opportunity

- United Microelectronics Corp (TPE: 2303 / NYSE: UMC): +2.7% Premium; Historically Extreme Premium a Good Level to Short

- ChipMOS Technologies (TPE: 8150 / NASDAQ: IMOS): -3.0% Discount; Opportunity to Go Long the ADR Spread

🇹🇼 United Microelectronics: A Clash Of Expectations And Reality; Reality Wins (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇹🇼 United Microelectronics Corporation 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 United Microelectronics Corp (TPE: 2303 / NYSE: UMC) – Global semiconductor foundry. 🇼 🏷️

🇹🇼 ASE Technology: AI Is Driving A Great LEAP Forward (Seeking Alpha) $ 🗃️

- 🌐 ASE Technology Holding (NYSE: ASX) – Independent semiconductor manufacturing services in assembly, test, materials & design manufacturing. 🇼 🏷️

🇹🇼 GUC’s 3nm Breakout Quarter Reveals How Taiwan’s ASIC Leaders Are Capturing AI Chip Demand (Smartkarma) $

- 3nm and below now accounts for 48% of total revenue, up from near-zero two years ago, as Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) affiliate Global Unichip Corp (TPE: 3443) becomes the go-to partner for hyperscaler custom silicon

- Full-Year revenue grew 36% to NT$34.1bn, outpacing the broader semiconductor industry as custom AI chip demand accelerates

- Companies like Amazon, Google, Microsoft, and Meta have publicly discussed or deployed custom chips for AI inference and training, and GUC’s results suggest these programs are reaching meaningful volume.

🇹🇼 Silicon Valley Thinks TSMC is Braking the AI Boom (Asianometry) 20:330 Minutes

- Stratechery has a recent piece out titled TSMC Risk, in which he calls out Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM)’s conservatism as costing the American hyperscalers “hundreds of billions” in revenue. Before we continue, I want to disclose that I work with Ben. The Asianometry newsletter runs on his platform Passport, and I am friendly with him. I am not trying to flame him. But I am hearing many similar views in the Silicon Valley Borg. That TSMC is the “brake” or “limiter” on the AI boom. As if they’re the reason why we don’t have AGI yet. Because they didn’t and still don’t BELIEVE. If we can ever say that a company that spent $41 billion of capital expenditure in 2025 with another $53-56 billion in 2026 is sitting on its hands doing nothing. And to be clear, I largely agree with Ben’s final message. TSMC having 90% share of the AI chip market looks pretty unhealthy. I was supposed to be working on video about bananas, but I had to do this first. In today’s video, a few scattered thoughts on TSMC taking away the AI punch bowl.

🇹🇼 Taiwan Semiconductor: The AI Boom Is Coming To An End (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Has Become A Buy Again (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Powers America’s AI Boom – Yet, The Valuation Doesn’t Make Sense (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 TSMC (2330 TT) Tactical View: Navigating the Post-Consensus Revision Adjustment Phase (Smartkarma) $

- Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) is a hot stock, but that does not mean it cannot pull back. 7-8 weeks up in a row has become the new normal.

- Our model supports a trend up to 10 weeks for the current trend pattern: it’s not saying it will trend for 10 weeks, but it is saying it could.

- The breaking point is between 7 and 10, our TIME MODEL shows: if this behavior repeats itself, the stock could rally either for 2 weeks or for another 5 weeks.

🇹🇼 Macronix Shows NOR Flash Cycle Turning as AI Infrastructure Reshapes Memory Demand (Smartkarma) $

- Macronix International Co Ltd (TPE: 2337)‘s 11pt gross margin recovery shows the NOR Flash downcycle that began in 2022 has rebounded. Good news for Winbond Electronics Corp (TPE: 2344), GigaDevice Semiconductor Inc (SHA: 603986).

- AI infrastructure demand is reshaping specialty memory, with server and networking driving NOR growth while NAND supply tightens as fabs prioritize capacity

- Product mix transformation and capex discipline have turned free cash flow positive, signaling improved health across the specialty memory sector. After a long downturn, profitability has rebounded significantly.

🇰🇷 Korea

🇰🇷 KOSDAQ in on Fire! Korean Government Encourages Investment in KOSDAQ Companies by Pension Funds (Douglas Research Insights) $

- KOSDAQ has been on fire in the past week. KOSDAQ is up 20% in the past one week, outperforming KOSPI which is up 5.4% in the same period.

- One of the key reasons why KOSDAQ has been on fire is mainly due to expectation of the Korean government encouraging capital inflow into the KOSDAQ listed companies.

- Korean government will encourage investment in the KOSDAQ by incorporating the KOSDAQ index into the evaluation criteria for the management of pension funds’ assets, which amount to 1,400 trillion won.

🇰🇷 Korea ETF Market Monthly: #1 (January 2026) (Douglas Research Insights) $

- We introduce a new monthly publication called Korea ETF Market Monthly. There are 1,068 different ETFs to choose from in Korea.

- The top 100 ETFs in Korea totaled 69% of the total ETF market size amount as of 30 January 2026.

- Korean ETF market surged in the past two years. ETFs in Korea had total market cap of 346.5 trillion won (end of January 2026), up 179% in two years.

🇰🇷 Kangwon Land Inc 4Q sales up 6pct from a year earlier (GGRAsia)

- Kangwon Land (KRX: 035250), operator of a tourism complex (pictured) with the only South Korean casino permitted to serve locals, saw its fourth-quarter sales reach just under KRW365.45 billion (US$256.0 million), up 6.0 percent year-on-year.

- For full-year 2025, Kangwon Land Inc’s sales amounted to nearly KRW1.48 trillion, up 3.5 percent year-on-year, as disclosed b the company earlier this month.

- The fourth-quarter numbers were disclosed in a Wednesday filing to the Korea Exchange. In an earnings deck, the firm said fourth quarter gaming sales accounted for most of overall sales, at KRW325.6 billion.

🇰🇷 Coupang: The “Amazon” of South Korea (Fiscal.AI)

- Today, Coupang, Inc. (NYSE: CPNG) is the leading vertically integrated e-commerce provider in South Korea.

- For all intents and purposes, the “Amazon of South Korea” analogy is a great fit here.

- Coupang’s online marketplace is home to 24.7 million active customers (that’s ~48% of South Korea’s entire population), and consists of a mix between 1st party items and items from 3rd party sellers.

- A customer can buy just about anything they need on Coupang from everyday necessities to fresh groceries or even a set of new tires for their car.

- What truly makes Coupang stand out from other Korean e-commerce providers like NAVER (KRX: 035420 / OTCMKTS: NHNCF) or Gmarket is the speed of delivery. When Bom Kim shelved the initial IPO in 2014, roughly half of Coupang’s customer complaints were about shipping times. To deliver a service that customers couldn’t live without, Kim knew they had to start investing heavily in the delivery side of the business.

🇰🇷 LG Display: Going Lower In The Short Term For Several Reasons(Seeking Alpha) $ 🗃️

🇰🇷 LG Display: Core Profit Beat And Memory Headwinds Draw Attention (Downgrade) (Seeking Alpha) $ 🗃️

🇰🇷 LG Display Co., Ltd. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 LG Display (NYSE: LPL) – Leading display company. Innovative displays & related products through differentiated technologies such as OLED & IPS. 🇼 🏷️

🇰🇷 Samsung Electronics Co., Ltd. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐🅿️ Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) – MNC major appliance & consumer electronics corporation. 🇼 🏷️

🇰🇷 Samsung Electronics: A 20% Beat in OP for 4Q25 and a Special Dividend of 1.3 Trillion Won (Douglas Research Insights) $

- Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) announced that it will pay a special dividend of 1.3 trillion won for 4Q 2025.

- Samsung Electronics had excellent results in 4Q 2025. It beat consensus sales and operating profit estimates by 4.8% and 20.1%, respectively in 4Q 2025.

- The combination of the company beating the consensus sales and profit estimates and higher special dividends are likely to further boost the positive sentiment on Samsung Electronics.

🇰🇷 SK Hynix: Record Results, Cancellation of Treasury Shares, & Start of an AI Solution Co in the US (Douglas Research Insights) $

- SK Hynix (KRX: 000660) achieved record high results in terms of sales and operating profit in 2025, fueled by growing demand for artificial intelligence (AI) semiconductors.

- SK Hynix announced that it plans to cancel 15.3 million treasury shares, representing 2.1% of its outstanding shares (728 million) to enhance shareholder value.

- SK Hynix announced that it plans to establish an AI solutions company (tentatively named “AI Co”) in the United States and invest up to US$10 billion (14.3 trillion won).

🇰🇷 Lunit – Rights Offering of 250 Billion Won (Douglas Research Insights) $

- After the market close on 30 January, [AI-powered software & solutions for cancer diagnostics & therapeutics] Lunit Inc (KOSDAQ: 328130) announced a rights offering capital raise of about 250 billion won (US$176 million).

- The number of shares to be issued is 7,906,816, with a new share price of 31,650 won per share, which is 21% lower than current price of 40,200 won.

- Lunit continues to trade at relatively fat valuation multiples. It is trading at P/S of 15.1x in 2026 and 12.9x in 2027.

🇰🇷 DH (Daehan) Shipbuilding – End of Lockup Period for 27% of Outstanding Shares In February (Douglas Research Insights) $

- There is an end of lock-up period for 10.27 million shares (27% of outstanding shares) for Daehan Shipbuilding Co Ltd (KRX: 439260) starting 1 February 2026.

- This could potentially result in additional selling by insiders which could negatively impact its share price in the coming weeks. We are turning BEARISH on Daehan Shipbuilding.

- Order backlog has been worsening in the recent quarters. Valuations are reasonable but not cheap, given the cyclicality of the shipbuilding business.

🌏 SE Asia

🇲🇾 Malaysia ‘Mom-and-Pop’ Retailer Eyes $750 Million IPO Valuation (WSJ) $ 🗃️

- One of Malaysia’s largest convenience-store chains is planning an initial public offering that would give it a market value of around $750 million, people familiar with the process said.

- KK Super Mart is planning to go public in the second half of the year, the people said. The IPO is likely to account for over 25% of its equity value, they added.

- The company didn’t immediately respond to a request for comment.

- Founded in 2001, KK Super Mart also has outlets in India and Nepal that sell daily essentials.

- A potential listing would place it alongside peers like mini-market chain 99 Speed Mart Retail Holdings Bhd (KLSE: 99SMART) and dollar-store Eco-Shop Marketing Bhd (KLSE: ECOSHOP), which held Malaysia’s largest IPOs in 2024 and 2025, respectively.

🇸🇬 Marina Bay Sands EBTIDA tops US$800mln in 4Q, Sands China sees revenue up 16pct (GGRAsia)

- The Marina Bay Sands property in Singapore saw its fourth-quarter adjusted property earnings before interest, taxation, depreciation and amortisation (EBITDA) increase 50.1 percent year-on-year, to US$806 million.

- That is according to results published on Wednesday by U.S-based Las Vegas Sands (NYSE: LVS). The company runs the Marina Bay Sands complex (pictured) via its Marina Bay Sands Pte Ltd subsidiary.

- “High hold on rolling play at Marina Bay Sands positively impacted adjusted property EBITDA by US$45 million” in the last quarter of 2025, said Las Vegas Sands.

- The property’s fourth-quarter net revenues rose 41.0 percent year-on-year, to just over US$1.60 billion.

🇸🇬 Bitdeer: Markets Are Pricing A Miner, But Full-Stack Compute Ahead (Seeking Alpha) $ 🗃️

- 🌐 Bitdeer Technologies Group (NASDAQ: BTDR) – Technology company for blockchain & high-performance computing.

🇸🇬 Keppel DC REIT 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌏🌍 Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) – First pure-play data centre REIT in Asia. Singapore, Australia, China, Malaysia, Germany, Ireland, Italy, Netherlands & UK. 🇼 🏷️

🇸🇬 Frasers Centrepoint Trust 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇸🇬 Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF) – REIT. One of the largest suburban retail mall owners in Singapore. 🇼 🏷️

🇸🇬 DBS Group: Thoughts As We Head Into Earnings Season (Seeking Alpha) $ 🗃️

- 🌏 DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) – Financial services group in Asia with a presence in 19 markets: Greater China, Southeast Asia & South Asia. 🇼 🏷️

🇸🇬 Buying DBS Shares: How to Calculate Your Ideal Entry Price (The Smart Investor)

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) is a long-term blue-chip favourite, but price still matters — here’s a simple framework to help investors calculate a sensible entry price.

- Why Entry Price Still Matters for Blue-Chip Stocks

- Step 1: Understand DBS’s Earnings Power

- Step 2: Use Valuation Benchmarks

- Step 3: Factor in Dividend Yield

- Step 4: Build Your Ideal Entry Price Range

- Step 5: Managing Timing and Execution

- Common Mistakes Investors Make When Buying DBS

- Get Smart: Should You Buy?

🇸🇬 DBS Is at an All-Time High. Should I Sell Now? (The Smart Investor)

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) shares are hitting record highs, but for long-term investors, the real question is whether selling now helps or hurts future returns.

- The age-old question confronting investors here is, should I continue holding my DBS shares, or is it time to sell?

- Why DBS Is Trading at an All-Time High

- The Case for Selling DBS Now

- The Case for Holding DBS

- What Investors Often Overlook

- A Smarter Middle Ground: Trim, Don’t Exit

- Key Questions to Ask Before Selling

- Get Smart: Selling Winners Is Harder Than Buying Them

🇸🇬 3 Blue-Chip S-REITs to Watch This Week: Capital Recycling Takes Centre Stage (The Smart Investor)

- Explore how 3 blue-chip Singapore REITs are pivoting strategies to safeguard unitholder distributions during this upcoming earnings week.

- This week, CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF), Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF), and Parkway Life Real Estate Investment Trust (SGX: C2PU) report earnings, each demonstrating a distinct approach to protecting and growing distributions.

- Here is what dividend seekers should watch for.

- CapitaLand Ascendas REIT (CLAR): The Active Recycler

- As Singapore’s largest industrial REIT, CLAR is currently proving that bigger can indeed be nimbler.

- Frasers Logistics & Commercial Trust (FLCT): The Portfolio Sharpener

- FLCT is currently a tale of two sectors, and management is making a clear choice.

- ParkwayLife REIT: The Contractual Harvester

- While others are busy trading properties, ParkwayLife REIT is reaping the rewards of patient, long-term planning.

- Get Smart: Distribution Sustainability Requires Active Management

🇸🇬 3 Singapore Blue-Chip Stocks That You Can Buy and Pass Down to Your Children (The Smart Investor)

- Looking for suitable stocks to hand down to your kids? These three may make the cut.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF)

- DBS is no stranger to Singaporeans, being Singapore’s largest bank by market capitalization.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY)

- Singapore Exchange Limited, or SGX, is Singapore’s sole stock exchange operator.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF)

- Singapore Technologies Engineering, or STE, is a technology, defence, and engineering group serving customers in the aerospace, smart city, defence, and public security segments.

🇸🇬 Keppel DC REIT vs. Keppel Corporation: Which Keppel Stock Should Be in Your Portfolio? (The Smart Investor)

- Keppel DC REIT and Keppel Corporation offer very different risk-return profiles — here’s how to decide which Keppel stock best fits your investment goals.

- For instance, deciding between Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) and 🌐 Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF), isn’t as straightforward as it looks.

- One offers pure-play data centres exposure while the other is a massive conglomerate.

- The hard part is choosing which fits your portfolio better: a specialised data centre REIT or a diversified giant.

- Let’s examine the key differences and see which name is a better fit for your portfolio.

🇸🇬 3 Singapore Stocks Paying Dividends in February 2026 (The Smart Investor)

- These three SGX-listed companies are set to reward shareholders next month – but their latest results reveal very different pictures of dividend sustainability.

- Kimly Ltd (SGX: 1D0) – The Dividend Standout

- Kimly Limited stands as one of Singapore’s premier coffee shop operators, managing an extensive network of 86 food outlets, 176 stalls, and several restaurants.

- Fraser and Neave (SGX: F99 / FRA: FNV2 / OTCMKTS: FNEVF) – Steady Hand Despite Heavy Investment

- Fraser and Neave, or F&N, is an established Southeast Asian consumer group with a dominant presence in beverages, dairies, and publishing.

- Thai Beverage PCL (SGX: Y92 / OTCMKTS: TBVPF / TBVPY) – Cash Flow Trumps Profits

- Thai Beverage, Southeast Asia’s largest beverage company, manages a diverse portfolio across spirits, beer, food, and non-alcoholic drinks, while holding controlling stakes in Vietnam’s SABECO and a 69.65% interest in Fraser and Neave, Limited.

- Get Smart: Follow the Cash

🇸🇬 Small-Cap Stocks in Singapore: A Smarter Way to Invest (The Smart Investor)

- Discover why small-cap stocks in Singapore are a smarter way to invest. Go beyond the STI to find quality businesses hiding in plain sight.

- This guide explores the untapped potential within the small-cap space and outlines the essential factors every investor needs to know before venturing beyond the STI.

- Why Small-Cap Stocks Make Investors Uncomfortable

- What Small-Cap Stocks Really Are in Singapore

- The gap between the 30 companies in the STI and the rest of the market is often one of index criteria, not business quality.

- Take Vicom Ltd (SGX: WJP), a vehicle inspection specialist with nearly 73% market share, or SBS Transit (SGX: S61), which operates the very MRT lines we use daily.

- Why Small Caps Are Often Misjudged

- Where Small-Cap Stocks Fit in a Long-Term Portfolio

- How We Think About Small-Cap Investing at The Smart Investor

- Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF), a precision tools manufacturer, generated S$3.8 million in free cash flow in its latest quarter while holding S$27.2 million in cash and zero debt.

- How to Explore Small-Cap Stocks Further

- Get Smart: Small Caps Are About Thinking, Not Timing

🇸🇬 3 Singapore Blue-Chip Dividend Stocks That Could Benefit from Rising Tourism (The Smart Investor)

- Transportation stocks may gain as part of a broader recovery taking shape across Asia’s tourism markets.

- Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF)

- Singapore Airlines is Singapore’s flagship carrier, operating passenger and cargo air transportation through two key brands: Singapore Airlines for full-service and Scoot for low-cost travel.

- SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF)

- While SIA handles the transport, the infrastructure supporting those flights is also seeing a lift.

- ComfortDelGro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY)

- ComfortDelGro is a global land transport company operating in Singapore, Australia, the United Kingdom, and other regions.

- Get Smart: Different ways to play the recovery

🇸🇬 SATS’ Recovery Story: Can the Share Price Finally Take Off? (The Smart Investor)

- SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF)’ latest results show rising profits, surging free cash flow, and a higher dividend. The question now is whether these improvements are enough to drive a sustained share price recovery.

- A Stronger First Half: Growth Across the Board

- SATS has two main divisions: gateway services and food solutions.

- Generally, its business is benefiting from a recovery in global air travel and cargo volumes, as well as improving operating leverage.

- Gateway Services Leads the Recovery

- Food Solutions Provides Stability

- Dividend Growth Signals Confidence

- What Could Hold the Share Price Back

- Get Smart: Recovery Is About Cash, Not Just Growth

🇹🇭 The Siam Cement Public Company Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 Siam Cement PCL (BKK: SCC / SGX: TSCD) – Cement-Building Materials Business, Chemicals Business, Packaging Business & Investment Business. 🇼 🏷️

🇹🇭 SCB X Public Company Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 SCB X PCL (BKK: SCB / SCB-F / FRA: OU80 / OU8) or Siam Commercial Bank – The first Thai bank founded in 1907. 🇼 🏷️

🇻🇳 Asian Dividend Gems: Vedan International Holdings (Largest MSG Producer in Vietnam) (Asian Dividend Stocks)

- Vedan International (Holdings) Ltd (HKG: 2317) is the dominant producer of MSG in Vietnam. Vedan holds approximately a 55% share of the Vietnamese MSG market.

- Vedan provides high dividend yield. Its current dividend yield is estimated to be 10.1%. Its dividend yield averaged 11.8% from 2023 to 2025.

- The company’s gross margin and operating margins have been improving in the past three years. Operating margin recovered from a negative -0.59% in FY2022 to 5.65% TTM.

🇮🇳 India / South Asia / Central Asia

🇮🇳 Larsen & Toubro Limited 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇮🇳 Larsen & Toubro (L&T) (NSE: LT / BOM: 500510) – Engineering, procurement & construction projects (EPC). 🇼

🇮🇳 MakeMyTrip: Business Should Continue To Grow For A Long Time (Seeking Alpha) $ 🗃️

- 🇮🇳 Makemytrip (NASDAQ: MMYT) – Online travel services. 🇼

🇮🇳 Maruti Suzuki – Right Time to Load; All‑time Low Channel Inventory; Operating Leverage Kick In (Smartkarma) $

- Maruti Suzuki (NSE: MARUTI / BOM: 532500) reported steady Q3 FY2026 performance, excluding the one-offs.

- It is entering a phase where demand momentum, sharply lower channel inventory and a visible capacity ramp-up are aligning.

- In this insight, we present various points to why it is right time to load up this name and finally on valuation.

🇮🇳 Waaree Energies Ltd. (WEL): Turning Geopolitical Winds into Structural Tailwinds (Smartkarma) $

- Waaree Energies Ltd (NSE: WAAREEENER / BOM: 544277) delivered a stellar performance in Q3 FY26, achieving a record-breaking module production of 3.5 GW and a 118.8% YoY revenue surge.

- Management dismissed the U.S. domestic push as a threat, instead positioning it as a strategic growth lever for expanding their global manufacturing footprint

- The company is set to overachieve its EBITDA guidance for FY26 of INR 5,500–6,000 Cr , driven by aggressive capacity expansion across the integrated energy transition value chain

🇰🇿 Kaspi: Why The Shift From P2P To M-Commerce Is The Real Story (Seeking Alpha) $ 🗃️

- 🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🇱🇰 🇲🇴 City of Dreams Sri Lanka quarterly EBITDA at US$4.6mln (GGRAsia)

- The City of Dreams Sri Lanka casino resort recorded earnings before interest, taxation, depreciation and amortisation (EBITDA) of nearly LKR1.44 billion (US$4.6 million) for the three months to December 31. That is according to information published this week by John Keells Holdings PLC (CSE: JKH), the real-estate developer partner in the complex.

- Global casino operator Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) was awarded a licence to run the gaming venue at City of Dreams Sri Lanka, valid for a “term of 20 years effective from 1 April 2024”, according to previous information from the casino group.

- City of Dreams Sri Lanka (pictured), in the capital Colombo, has been described as a US$1.2-billion venture. The complex had an official opening in August last year.

🌍 Middle East

🇮🇱 Teva Pharmaceutical Industries Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Teva Pharmaceutical Industries Ltd (NYSE: TEVA) – Branded-drugs, active pharmaceutical ingredients, contract manufacturing services & out-licensing platform. 🇼

🇸🇦 🇦🇪 Businesses fear blowback from Saudi-UAE rift (FT) $ 🗃️

- Emirates workers have had visas to the kingdom rejected since tensions erupted between the Gulf powerhouses

- Tensions between the two traditional allies burst into the open in December after Riyadh alleged that the UAE had supported a Yemeni separatist faction that had launched an offensive against Saudi-backed groups.

- Since then, employees at banks, management consultancies, law firms and oil and gas services firms have all faced issues when applying for Saudi visas from the UAE, according to six people whose companies were directly affected. Saudi Arabia has also been making a broader push to encourage businesses to move operations and staff to the kingdom.

🌍 Africa

🇿🇦 Sibanye Stillwater Limited (SBSW) Discusses Group Strategy Update and Emphasis on Safety Priorities – Slideshow (Seeking Alpha)

🇿🇦 Sibanye Stillwater: More Gains To Come (Seeking Alpha) $ 🗃️

- 🌐 Sibanye Stillwater Ltd (JSE: SSW / NYSE: SBSW) – World’s largest primary producers of platinum, palladium & rhodium & is a top-tier gold producer. Projects & investments across 5 continents. 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇺🇦 Kyivstar: Operational Resilience & The Hidden Digital Alpha (Smartkarma) $

- Kyivstar Group Ltd (NASDAQ: KYIV) reported preliminary 2025 results, with full results to be released in March.

- Revenue and EBITDA growth for 2025 has come in at 25%, roughly in-line with our forecasts.

- KYIV trades at a deep discount to peers despite 25% 2025 revenue growth and the embedded value of its rapidly growing digital platforms. Maintain Structural Long rating.

🌎 Latin America

🌎 Globant: Update For 2026 After Outperformance (Seeking Alpha) $ 🗃️

- 🌐 Globant (NYSE: GLOB) – Luxembourg HQ’d. Argentina-founded IT & software development with a presence in 25+ countries. 🇼 🏷️

🌎 Mercado Libre: The Latin America Winner To Own (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: South America’s E-Commerce And Fintech Leader Trading At A Discount (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Top Quality Stock Deeply Undervalued (Seeking Alpha) $ 🗃️

- 🌎 MercadoLibre (NASDAQ: MELI) – Uruguay HQ’d. The largest online commerce & payments ecosystem in Latin America. 🇼 🏷️

🌎 Pan American Silver: Get Ready For A Potential Q4 Earnings Blowout (Seeking Alpha) $ 🗃️

- 🌎 Pan American Silver Corp (NYSE: PAAS) – Owns & operates silver & gold mines located throughout the Americas. Canada HQ. 🇼

🇧🇷 SLC Agrícola Looks Undervalued, But Current Trends Aren’t Helpful (Seeking Alpha) $ 🗃️

- 🇧🇷 SLC Agricola SA (BVMF: SLCE3 / FRA: GJ9 / OTCMKTS: SLCJY) – One of the world’s largest grain & fiber producers (cotton, soybean and corn + cattle raising, integrating crop-livestock). 🇼 🏷️

🇧🇷 Itaú Unibanco: When 15%-Plus A Year Still Isn’t Enough (Downgrade) (Seeking Alpha) $ 🗃️

- 🌐 Itau Unibanco (NYSE: ITUB / BVMF: ITUB3 / ITUB4) – Largest banking institution in Brazil + Latin America. 🇼 🏷️

🇧🇷 Banco Bradesco Is No Longer Broken, But It’s Too Early To Get Aggressive (Seeking Alpha) $ 🗃️

🇧🇷 Embraer Remains Undervalued As Margins And Free Cash Flow Improve (Seeking Alpha) $ 🗃️

- 🌐 Embraer SA (BVMF: EMBR3 / NYSE: ERJ) – The 3rd largest producer of civil aircraft after Boeing & Airbus & the leading provider of regional jets worldwide. 🇼 🏷️

🇨🇴 Mineros S.A.’s Growth Opportunities Gain Market Visibility: More Value In Sight (Seeking Alpha) $ 🗃️

- 🌎 Mineros SA (TSE: MSA / OTCMKTS: MNSAF) – Gold exploration & production in Colombia & Nicaragua + 20% interest in a property in Chile. Colombia HQ.

🇬🇾 Guyana – back on the map following Maduro’s arrest (Undervalued Shares)

- Venezuela had long threatened to invade neighbouring Guyana – a risk that has now effectively disappeared.

- For investors, the more relevant point is economic momentum. Guyana is one of the world’s fastest-growing economies, having expanded its GDP sevenfold over the past seven years and expecting a further 19.3% growth in 2026.

- For a deeper dive into the country’s history and the full array of available investments, see “Guyana and the mystery of the largest ranch of the Americas“.

- There are numerous Guyana-linked stocks listed on Western exchanges, as well as several on the Guyana exchange. Accessing the latter is possible but administratively cumbersome. Many foreign-listed firms, meanwhile, only make a small portion of revenue from the country or suffer from limited liquidity.

- Canada-listed Omai Gold Mines Corp (CVE: OMG / FRA: 0N2 / OTCMKTS: OMGGF) has already benefited from the rising gold price, but the stock received an additional boost after Maduro’s arrest. When I highlighted it as Guyana’s only viable gold miner, its market cap stood at CAD 90m. It now sits around CAD 1.3bn – a tenfold increase. Fittingly, the company’s ticker symbol is “OMG”, a widely recognised exclamation meaning “Oh My God”, used to express shock, surprise, or excitement.

🇲🇽 GCC, S.A.B. de C.V. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇲🇽 GCC SAB de CV (BMV: GCC / FRA: AK4 / OTCMKTS: GCWOF) – Gray Portland cement, ready-mix concrete, aggregates, coal & construction-related services. 🏷️

🇲🇽 Grupo Financiero Banorte, S.A.B. de C.V. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇲🇽 Grupo Financiero Banorte SAB de CV (BMV: GFNORTEO / FRA: 4FN / OTCMKTS: GBOOY / GBOOF) – Leading financial institution in Mexico. 🇼 🏷️

🇲🇽 Regional S.A.B. de C.V. 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇲🇽 Regional SAB (BMV: RA / OTCMKTS: RGNLF) aka Banco Regional de Monterrey S.A. or BanRegio – Focused on serving the financial needs of SMEs. 🇼 🏷️

🌐 Global

🌐 Nebius: The Q4 Results Should Trigger A Rally (Earnings Preview) (Seeking Alpha) $ 🗃️

🌐 Nebius: Ignore The Volatility – Follow The Capacity (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

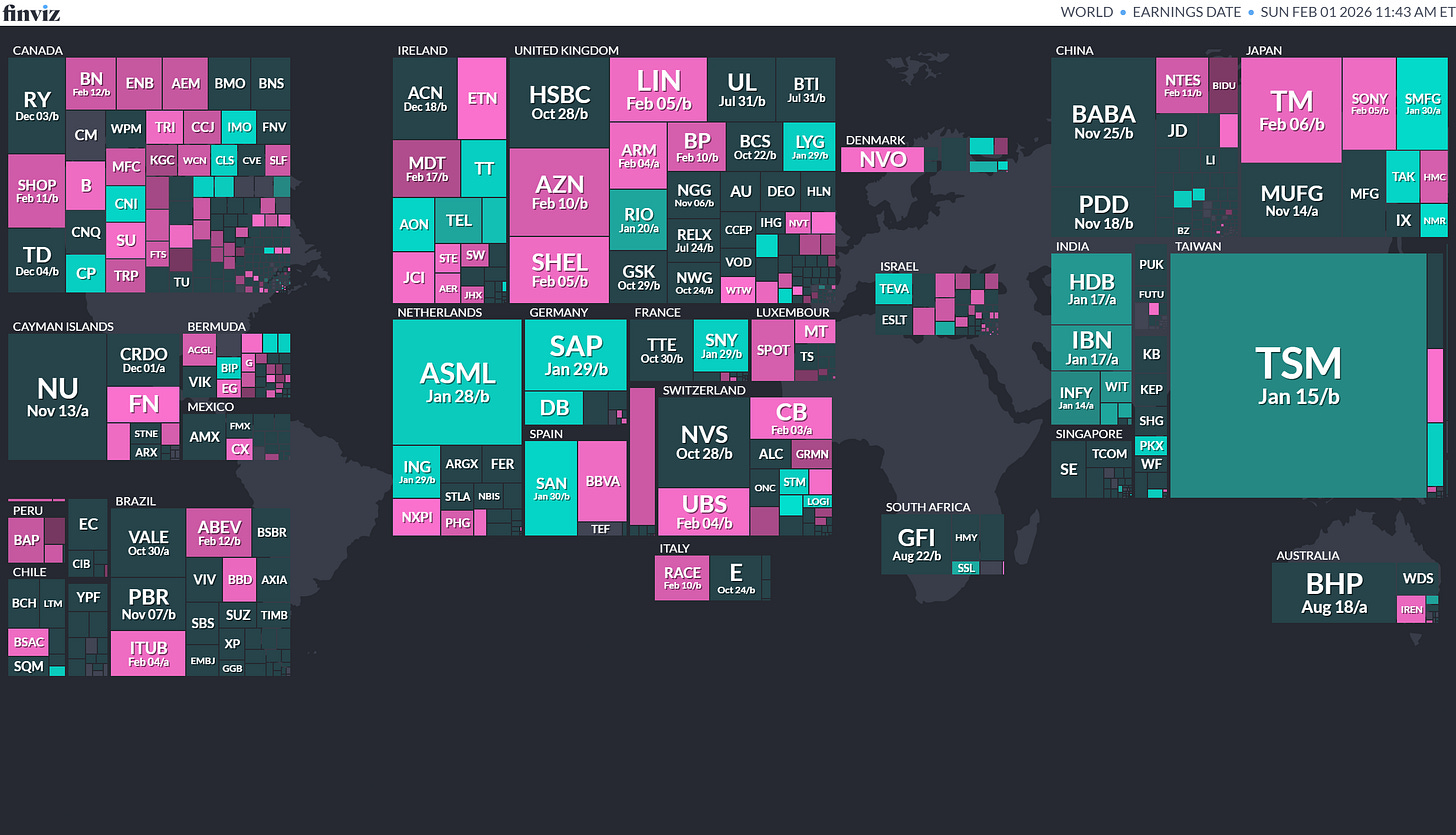

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

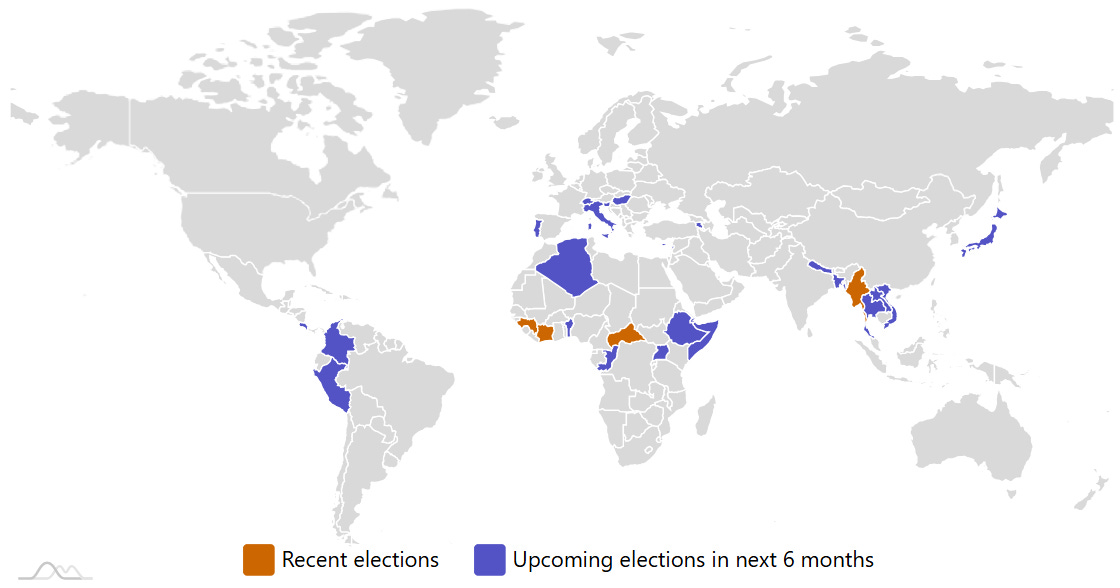

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Japan Japanese House of Representatives 2026-02-08 (d) Confirmed 2024-10-27

- Thailand Thai House of Representatives 2026-02-08 (t) Confirmed 2023-05-14

- Thailand Thai House of Representatives 2026-02-08 (t) Confirmed 2023-05-14

- Bangladesh Bangladeshi National Parliament 2026-02-12 (d) Confirmed 2024-01-07

- Bangladesh Referendum 2026-02-12 (d) Confirmed

- Colombia Colombian Senate 2026-03-08 (d) Confirmed 2022-03-13

- Colombia Colombian House of Representatives 2026-03-08 (d) Confirmed 2022-03-13

- Slovenia Slovenian National Assembly 2026-03-22 (t) Confirmed 2022-04-24

- Peru Peruvian Congress of the Republic 2026-04-12 (d) Confirmed 2021-04-11

- Peru Peruvian Presidency 2026-04-12 (d) Confirmed 2021-04-11

- Hungary Hungarian National Assembly 2026-04-30 (t) Date not confirmed 2022-04-03

- Cyprus Cypriot House of Representatives 2026-05-31 (t) Date not confirmed 2021-05-30

- Colombia Colombian Presidency 2026-05-31 (t) Date not confirmed 2022-06-19

- Morocco Moroccan Chamber of Representatives 2026-09-30 (t) Date not confirmed 2021-09-08

- Czech Republic Czech Senate 2026-09-30 (t) Date not confirmed 2024-09-27

- Russian Federation Russian Federal Duma 2026-09-30 (t) Date not confirmed 2021-09-19

- Brazil Brazilian Federal Senate 2026-10-04 (d) Confirmed 2022-10-02

- Brazil Brazilian Chamber of Deputies 2026-10-04 (d) Confirmed 2022-10-02

- Brazil Brazilian Presidency 2026-10-04 (d) Confirmed 2022-10-30

- Israel Israeli Knesset 2026-10-27 (d) Confirmed 2022-11-01

- Bulgaria Bulgarian Presidency 2026-11-30 (t) Date not confirmed 2021-11-21

- Bahrain Bahraini Council of Representatives 2026-11-30 (t) Date not confirmed 2022-11-12

- Viet Nam Vietnamese National Assembly 2026-03-15 (d) Confirmed 2021-05-23

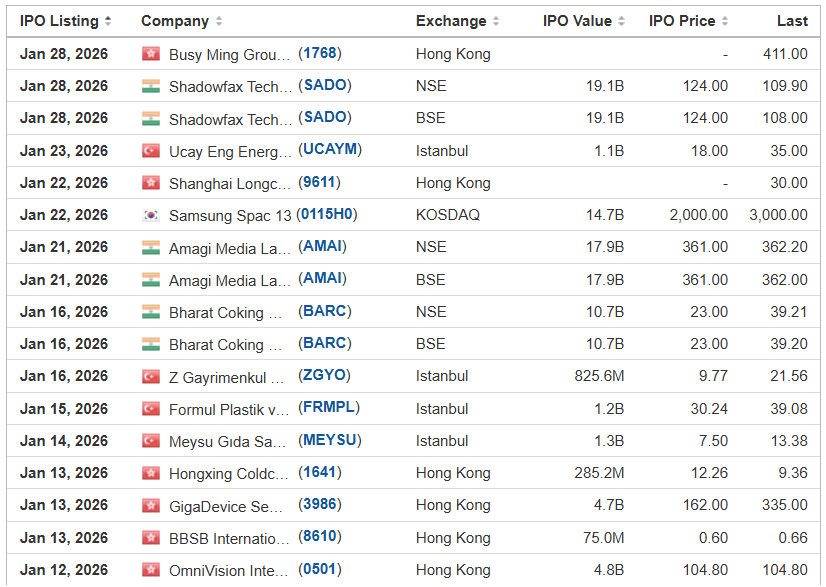

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

White Pearl Acquisition WPACU D. Boral Capital (ex-EF Hutton), 10.0M Shares, $10.00-10.00, $100.0 mil, 2/2/2026 Priced

(Incorporated in the British Virgin Islands)

We are a newly established blank check company. We intend to focus on these sectors – FinTech (financial technology), InfoTech (information technology) and business services – in our search for a target company for an acquisition or an initial business combination.

We will primarily seek to acquire one or more businesses with a total enterprise value of between $150 million and $600 million.

CEO Naphat Sirimongkolkasem is also the chairman and the CFO of White Pearl Acquisition. He is the co-founder of Collis Capital, where he worked between 2021 and 2024. He has over a decade of experience in management, business development and capital market transactions, including M&A, fundraising, initial public offerings, and restructurings in Asia. Since 2023, he has served as a director of Bitdeer Technologies Group, a technology company for blockchain and high-performance computing (HPC). Mr. Sirimongkolkasem previously served as the chief financial officer and a director of Blue Safari Group Acquisition Corp. from April 2021, until it consummated a business combination with Bitdeer Technologies Group in April 2023. Since 2023, Mr. Sirimongkolkasem has been the director of First Sino-Asia (Thailand), where he is responsible for operations, business development and investment activities.

(Note: White Pearl Acquisition Corp. priced its SPAC IPO on Friday, Jan. 30, 2026, in sync with its recently upsized terms in the prospectus: 10 million units at $10.00 each to raise $100 million. Each unit consists of one share of stock and one right to receive one-fifth (1/5th) of a share of stock upon the consummation of an initial business combination. White Pearl Acquisition’s units are expected to trade on Monday, Feb. 2, 2026, on the NASDAQ.)

(Background: White Pearl Acquisition Corp. doubled the size of its SPAC IPO to raise $100 million – 10 million units at $10.00 each – up from 5 million units at $10.00 each to raise $50 million, according to its S-1/A filed on Jan. 16, 2026. White Pearl Acquisition also doubled the size of the rights portion of its unit – so each unit now consists of one right to receive one-fifth (1/5th) of a share of stock upon the consummation of an initial business combination – along with one share of stock, which is the same as before.)

(Background: White Pearl Acquisition Corp. filed its SPAC IPO plans on Oct. 16, 2025, in an S-1 filing: The company is offering 5 million units at $10.00 each to raise $50 million. Each unit consists of one share of stock and one right to receive one-tenth (1/10th) of a share upon the consummation of an initial business combination.)

Jaguar Uranium Corp. JAGU Titan Partners Group, 6.0M Shares, $4.00-6.00, $30.0 mil, 2/3/2026 Tuesday

(Incorporated in British Columbia)

We are based in Canada. We develop nuclear fuel uranium exploration projects in Colombia and Argentina. We are a pre-revenue company focused on three uranium exploration projects – one in Colombia and two in Argentina:

The Berlin Project in Caldas Province, Colombia, is our principal project. It’s a sedimentary deposit of uranium, vanadium, nickel, phosphate, rare earth elements, molybdenum and zinc. We are located about 12 kilometers from a hydroelectric dam and 65 kilometers from a river port with access to the Caribbean coast.

In Argentina, we are working on the Laguna Project in Chubut Province and the Huemul Project in Mendoza Province.

Note: Net loss is in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: Jaguar Uranium Corp. disclosed the terms for its small IPO – 6 million shares at a price range of $4.00 to $6.00 – to raise $30 million, if priced at the $5.00 mid-point of its range – in an SEC filing dated Jan. 26, 2026. Background: Jaguar Uranium Corp. disclosed its IPO plans in an SEC filing dated Dec. 8, 2025, without revealing the terms. At the time, it was estimated that Jaguar Uranium’s IPO would raise about $30 million.)

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 2/9/2026 Week of

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.

We sell our products through both offline and online channels. Our offline customers are mainly business entities, including local community stores and/or high-end boutiques, shopping malls, supermarkets and distributors, who purchase products from us, either by directly placing orders with us or through our proprietary apps designed specifically for our offline customers to place orders efficiently, and on-sell them to end consumers. Our online customers are generally users who purchase products directly from us through third-party E-commerce platforms and our proprietary AigoSmart App.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: AIGO Holding Ltd. is offering 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its F-1 filing dated Aug. 21, 2025.)

Amatuhi Holdings AMTU Spartan Capital, 1.0M Shares, $5.00-5.00, $5.0 mil, 2/9/2026 Week of

(Incorporated in Delaware)

AMATUHI HOLDINGS, Inc., was incorporated on June 24, 2025, in Delaware to act as the holding company of AMATUHI Inc. AMATUHI Inc. (“AMATUHI”) was incorporated on February 22, 2021, and is an operating company in Japan with the headquarter in Yokohama, Kanagawa, and a branch in Osaka. AMATUHI operates under the “AMANEKU” brand in Japan.

Our company operates group homes in Japan for people with disabilities under the brand name of “AMANEKU.” “AMANEKU” is a “communal living assistance” service based on the “Comprehensive Support for Persons with Disabilities Act” which is implemented based on the self-support benefits provided by the Japanese government under the act. The act supports people who wish to live independently so that they can advance toward their respective goals through communal living in small groups and interaction with the local community.

In the fiscal year that ended March 31, 2025, Amatuhi added 18 group homes and cumulatively operated 29 group homes, according to the prospectus.

AMANEKU provides group homes with Daytime Service Support, which was established as a result of amendments to the Comprehensive Support for Persons with Disabilities Act, that allows for the provision of extensive 24-hour services in response to the increasing aging population and people with disabilities.

Our primary services to the disabled include but are not limited to: Three nutritionally balanced meals daily, counselling and support, assistance with personal care (bathing, dressing, mobility, oral care), medication management, money management, room cleaning, working with medical professionals to provide required medical care and helping our clientele with public assistance, pensions and family matters.

AMANEKU daytime support group homes are mainly two-story buildings with a capacity of 10 residents on each floor. Based on the aging population in Japan, there is a shortage of group homes for people with severe disabilities. Our Company is working to fulfil the needs of the growing disabled population, by providing a number of services to address their needs.

We are reimbursed for the services we provide to disabled people through Japanese government funding issued under the Comprehensive Support for Persons with Disabilities Act.

We are engaged in businesses that support the lives of people with disabilities, including the construction of group homes for people with disabilities and social participation for people with disabilities.

We are specialized in designing, constructing and operating group homes for individuals with disabilities. We also focus on providing supportive living environments, particularly for individuals with significant needs through our Daytime Service Support Type group homes. We are expanding within a market characterized by high demand and insufficient supply, positioning ourselves as a key provider addressing critical social needs related to disability care and housing.

AMATUHI specializes in providing communal living assistance (group homes) as defined under Japan’s “Comprehensive Support Law for Persons with Disabilities.” This is a government-regulated sector where services are funded primarily through social security benefits.

Japan Lifestyle No.1 Investment Limited Partnership directly and indirectly controls approximately 95.0% of the voting power of our outstanding capital stock. As a result, it will have the ability to determine all matters requiring approval by stockholders. In other words, the fund will be able to control any action requiring general stockholder approval, including the election of our Board of Directors, the adoption of amendments to our certificate of incorporation and bylaws, and the approval of any merger or sale of substantially all of our assets.

If we obtain a listing on the Nasdaq Capital Market, we will be a “controlled company” as defined in Nasdaq Listing Rule 5615(c)(1) because more than 50% of our voting power will be held by a single entity — Japan Lifestyle No.1 Investment Limited Partnership — after the offering.

As a “controlled company,” we will be exempt under Nasdaq listing standards from certain corporate governance requirements that would otherwise apply to companies that are not controlled, including the requirements that:

(i) a majority of the Board of Directors consist of “independent” directors as defined under Nasdaq listing standards,

(ii) we have a nominating and corporate governance committee composed entirely of independent directors with a written committee charter, and

(iii) we have a compensation committee composed entirely of independent directors with a written committee charter.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended March 31, 2025.

(Note: Amatuhi Holdings filed its S-1 for its small IPO on Sept. 12, 2025, and disclosed the terms – 1 million shares at an assumed IPO price of $5.00 – the mid-point of its $4.00-to-$6.00 price range – to raise $5 million. The holding company is incorporated in Delaware. But the company’s business is based in Japan.)

DT House Ltd. DTDT American Trust Investment Services, 5.0M Shares, $5.00-5.50, $26.3 mil, 2/9/2026 Week of

(Incorporated in the Cayman Islands)

DT House Ltd. is the holding company of UHAD, UHHK and UFox, our wholly owned subsidiaries. We are headquartered in the UAE.

We began with the establishment of UHHK in 2020. We provide corporate consultancy services in the UAE and Hong Kong on environmental, social and governance (ESG) themes. As part of that work, we provide travel-related services for leisure travelers in the UAE, which includes primarily the sale of tickets to tourist attractions. Our clients are public companies in the United States and Hong Kong, as well as small and medium-sized enterprises and private corporations in the UAE, Hong Kong and Southeast Asia. We have our own AI-driven cloud-based software program.

In June 2024, we launched our travel-related services by acquiring UFox, a company principally engaged in travel-related services in the UAE, with a particular emphasis on eco-friendly and sustainable travel practices. UFox maintains close business relations with various organizations in the MENA Region such as the Union of Overseas Chinese in Saudi Arabia. We believe that our travel-related services could potentially bring about a synergistic effect with our corporate consultancy services if we follow the same set of ESG principles in both segments. Our current plan is to design travel programs based on the sustainable travel concept, such as using alternative transport modes with lower carbon footprints and partnering with eco-friendly hotels.

We offer customizable and hassle-free sustainable travel experiences. Our clients can customize their own tours or subscribe to services on a segmented basis. The major customers of our travel-related services are two online leisure travel platforms, namely, Trip.com Group Limited (Nasdaq: TCOM) and Fliggy international platform (fliggy.com, a member of Alibaba Group (NYSE: BABA) and an online marketplace of tourism products).

Note: Net income and revenue are in U.S. dollars for the 12 months that ended Sept. 30, 2025.

(Note: DT House Ltd. more than doubled its IPO’s size – to 5.0 million shares – up from 2.0 million shares – in an F-1/A filing on Jan. 20, 2026 – after the previous IPO plan was withdrawn, at the company’s request. The new price range is $5.00 to $5.50 – an increase from the previous range of $4.00 to $5.00.. Under the new terms, DT House Ltd. would raise $26.25 million, if the IPO is priced at $5.25, the mid-point of its new range. Background: DT House Ltd. increased its IPO’s size to 2.0 million shares – up from 1.875 million shares initially – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its F-1/A filing dated Oct. 24, 2025. DT House Ltd. has also named American Trust Investment Services as the sole book-runner, replacing Revere Securities. Background: DT House Ltd. filed its F-1 on March 3, 2025, and disclosed the terms for its IPO: The company is offering 1.875 million shares at a price range of $4.00 to $5.00 to raise $8.44 million, if priced at the mid-point of its range.)

Hartford Creative Group, Inc. (Uplisting) HFUS WestPark Capital, 1.5M Shares, $4.00-4.00, $6.0 mil, 2/9/2026 Week of

Note: This is NOT an IPO. This is a NASDAQ uplisting from the OTC Markets Group – a public offering of 1.5 million shares at an assumed public offering price of $4.00 – to raise $6 million. The last reported sale price of Hartford Creative Group’s stock on the OTC Market was $4.50 on Dec. 12, 2025, according to the prospectus.

(Incorporated in Nevada)

Disclosure: “We currently have three subsidiaries located in the People’s Republic of China (the “PRC” or “China”), and some of our executive officers and directors are located in or have significant ties to China. These ties to China present legal and operational risks to us and our investors, including significant risks related to actions that may be taken by China in the areas of regulatory, liquidity and enforcement, which exist and could affect our current operations and the offering of our securities. For example, if these ties were to cause China to view us as subject to their regulatory authority, China could take actions that could materially hinder or prevent our offering of securities to investors and cause the value of such securities to significantly decline or be worthless.”

Hartford Creative Group, Inc. (“HFUS,” “we,” “us,” or “Company”) specializes in delivering marketing solutions tailored to businesses of small and medium-sized enterprises (SMEs). Our suite of precision marketing services offers cross-media strategies that enable advertisers to effectively target and engage audiences across premier media platforms. We leverage our interconnecting network and keen insights into market demands to develop and implement bespoke marketing initiatives. These initiatives encompass the design, placement, monitoring, and optimization of advertising campaigns.

Navigating the intricate landscape of the modern marketing and sales value chain presents numerous challenges, particularly for enterprises lacking the necessary expertise. Many struggle with creating ample marketing content, devising effective strategies, converting leads, and managing customer relations—tasks made more daunting by the sheer volume of use cases across diverse marketing channels. According to the publication Digital Transformation Market Size, Share, Growth & Trends Analysis Report By Solution, By Deployment, By Service, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 – 2030, the global digital transformation market size was estimated at USD 880.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 27.6% from 2024 to 2030. With 1.02 billion internet users and the world’s largest social media population, China’s growing economy, booming technology sector, and thriving e-commerce scene make it one of the most intriguing markets in the world today. Social media has long been one of the most important communication channels in China, with the country having the world’s largest number of social media users at over 983.3 million as of November 2024.

The pent-up demand from social media influencers’ marketing needs on social media apps led the Company to seize the opportunity in providing precise marketing services. As an advertising collaborator of China’s major social media markets, we aim to provide customers with vertical integration services, from early-stage such as advertising video creation, photography and editing, to advertising operation and management on social media apps. Furthermore, we plan to initiate TikTok advertising campaigns overseas and equip our Chinese clientele with the tools to penetrate international markets, including the United States.

We have been committed to building an efficient sales network and mechanism to achieve effective customer coverage and sustainable growth. We seek to maintain mutually beneficial relationships with customers and have gained the trust of many customers across a spectrum of industries, presenting us with further cross-selling and up-selling opportunities. We have built a diversified customer base with a strong willingness to pay. During fiscal year 2025, we have secured advertising service agreements with about 43 customers and received approximately RMB 279.9 million (USD 38.8 million) from these customers. We also entered about 53 supplier contracts for advertising placement and paid RMB 262.6 million (USD 36.4 million) during fiscal year 2025.

During the year ended July 31, 2025, we reported net revenues of $2.0 million, compared to $1.4 million for the same period of 2024, reflecting the launch of our advertising business in January 2024. Net income was $1.1 million, or $0.04 per share, for both the years ended July 31, 2025 and 2024. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion.

Based on market research and discussions between the board and third-party suppliers and experts, the Company has further developed a plan of mini-drama business. The Company is strategically positioned to capture considerable market interest and enhance revenue streams from our innovative mini-drama business. While initial steps toward this ambitious goal have been initiated, it is important to note that the commencement and future success of the mini-drama venture are not yet guaranteed.

Our mission is to excel as the premier partner for enterprises worldwide, driving digital and intelligent transformation with unparalleled expertise and commitment.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended July 31, 2025.