Interesting political news out of China BUT as always, its hard to know what and who to believe: Shockwaves In Beijing: Xi Targets His Own Top General, Longtime Confidant, In Elite Purge / China’s Sacked Top General Accused Of Leaking Nuclear Secrets To US: Report…

For investors though, Caixin has reported how China’s Deposit Repricing Tests Banks and Savers as Trillions Come Due and China Wealth Management Market Hits $4.8 Trillion Despite Yield Drop:

One social media user recently said a family member had bought a five-year certificate of deposit in 2021 at an interest rate of 5.3% — a level the user said now seems almost unimaginable. Renewing that deposit today, it’s hard to get even 2%.

In addition, The Asset has noted how China’s mutual funds start year with a bang 🗃️:

The market excitement underscores how quickly sentiment can swing in this retail-dominated market. It also highlights a structural weakness: the sector still lives or dies on short-term performance.

As money keeps pouring in, regulators continue to encourage long-term capital to enter, aiming to make mutual funds serve as a stabilizer amid a bull market.

China’s mutual industry saw its busiest fundraising week in almost three months at the start of year, with 45 new products opened for subscription, a fourfold jump from the prior week and the largest pipeline since mid-October, according to data from the Asset Management Association of China ( AMAC ).

Meanwhile, Trump Threatens To Raise Tariffs On South Korean Goods To 25%; Won Slides while SK Hynix Soars On Microsoft Supply Deal Report; KOSPI Breaks Out, Shrugs Off Tariff Threat.

Finally, I did not get a chance to finish the normal Sunday post as I was traveling Saturday to Monday and wanted to make sure at least one post (this one) was comprehensive. This means the coming Sunday post (February 1) will be fairly long covering available fund updates until the end of the year plus any new EM related research up to the end of January…

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🇸🇬 Singapore Stocks: The Edge Billion Dollar Club 2025 Award Winners Partially $

- Singapore listed stocks who won the following metric categories by sector: growth in profit after tax, returns to shareholders, weighted return on equity & overall sector winner (+DeepSeek Analysis).

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 Carry trade carries more risk for Asian investors in 2026 (The Asset) 🗃️

- ‘Traffic jam’ for debt issuance to drive up long-term interest rates, leading to funding volatility

- As global markets navigate the opening weeks of 2026, the era of easy profits from carry trades, borrowing in low-interest currencies to chase higher yields elsewhere, is facing its most significant stress test since the sharp bout of market volatility linked to yen carry unwinding in 2024.

- Standard Chartered strategists warned at their 2026 Outlook Media Roundtable that the structural foundations of global liquidity are shifting from central bank support to volatile fiscal spending, creating a “traffic jam” for global debt.

- The most acute risk for 2026 remains Japan, which Divya Devesh, co- head of FX research, Asean and South Asia, at Standard Chartered, described as being in an “unstable equilibrium”.

🌏 Global private equity eyes strategic shift towards Asia (The Asset) 🗃️

- No longer just diversification play, region viewed as growth engine in 2026, Japan, India stand out, China recovering

- The global private equity ( PE ) landscape regained momentum in 2025 as investor sentiment improved markedly in the second half of the year, helping to lift deal activity and setting the stage for more consistent capital deployment in 2026, according to a recent report.

- Global general partners ( GPs ), buoyed by a gradually reopening initial public offering ( IPO ) window and increasing confidence in GP-led secondary solutions, are now repositioning for a more active exit environment, finds international law firm Morrison Foerster ( MoFo )’s Global PE Trends 2025 and Outlook for 2026 report.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Shockwaves In Beijing: Xi Targets His Own Top General, Longtime Confidant, In Elite Purge (ZeroHedge)

- Another significant military purge appears underway in China, as Saturday morning the West woke up to news that China’s most senior military officer, who is second only to Xi Jinping, has been put under investigation over alleged “grave violations of discipline and the law.”

- Gen. Zhang Youxia is a vice chairman of the Central Military Commission, the Communist Party body that controls China’s armed forces, and this comes as somewhat of a major shock given he is widely regarded as President Xi’s closest ally within the military – or at least prior to this.

- Another member of the commission, Gen. Liu Zhenli, has also been placed under investigation, according to the Defense Ministry on the same day. He’s in charge of the PLA military’s Joint Staff Department.

- The Wall Street Journal’s Jonathan Cheng says that General Zhang’s downfall is surprising as not only has he known Xi for decades, but is the “most senior member of military hierarchy to face dismissal since fallout of 1989 Tiananmen protests.”

- And a former Central Intelligence Agency analyst who follows Chinese elite politics, Christopher K. Johnson, tells the NY Times on Saturday, “This move is unprecedented in the history of the Chinese military and represents the total annihilation of the high command.”

🇨🇳 China’s Top General Accused of Giving Nuclear Secrets to U.S. (WSJ) $ 🗃️

- Bribery allegations have also been leveled against Gen. Zhang Youxia, whose downfall carries implications for the country’s military readiness

🇨🇳 China’s Sacked Top General Accused Of Leaking Nuclear Secrets To US: Report (ZeroHedge)

- Another shock is just what he is being investigated for. While all the initial speculation focused on corruption, The Wall Street Journal on Sunday reveals the top general is accused of leaking information about the country’s nuclear-weapons program the United States. However, this has not yet been confirmed through official Chinese statements or sources.

- WSJ’s chief China’s correspondent Lingling Wei describes, “And this is far from the end. With thousands of officers having risen through the ranks under Zhang Youxia and Liu Zhenli, these individuals now recognize they are primary targets for a systemic purge.” She reports that “Mobile devices have been seized across ranks and all units are now on high alert.”

🇨🇳 China’s mutual funds start year with a bang (The Asset) 🗃️

- Market momentum builds after top equity fund gains over 233%

- China’s mutual fund industry kicked off 2026 with frenetic activity after delivering its best performance since 2020 last year.

- The market excitement underscores how quickly sentiment can swing in this retail-dominated market. It also highlights a structural weakness: the sector still lives or dies on short-term performance.

- As money keeps pouring in, regulators continue to encourage long-term capital to enter, aiming to make mutual funds serve as a stabilizer amid a bull market.

- China’s mutual industry saw its busiest fundraising week in almost three months at the start of year, with 45 new products opened for subscription, a fourfold jump from the prior week and the largest pipeline since mid-October, according to data from the Asset Management Association of China ( AMAC ).

🇨🇳 China ETF: Huge Outflows; National Team Unwinding? (Smartkarma) $

- Over US$55bn has been redeemed from mainland China ETFs over the last 3 weeks. Headline ETFs take the largest hit while there have been inflows to sector ETFs.

- The large-scale redemptions across a variety of indices point to the National Team unwinding holdings that have been built up over the last year.

- Margin trading rules have been tightened, and this could be another way of ensuring that markets do not run-up too far in the short-term.

🇨🇳 China private investment funds achieved 25% return in 2025 (The Asset) 🗃️

- Strong performance attracting global attention, injecting momentum for continued growth in 2026

- China’s private investment funds achieved an average return of more than 25% in 2025, driven by the strong performance of the country’s equity market, while global private funds also began returning to Asia – particularly China – injecting renewed momentum for continued growth.

- Among the 9,934 Chinese private investment funds, 8,915 delivered positive returns, accounting for 89.74% of the total. The average overall return reached 25.68%, while the median return stood at 18.78%, according to data provider Shenzhen PaiPaiWang Investment & Management.

🇨🇳 Cover Story: China’s Deposit Repricing Tests Banks and Savers as Trillions Come Due (Caixin) $

- For many Chinese savers, the era of easy, high-interest deposits is ending.

- One social media user recently said a family member had bought a five-year certificate of deposit in 2021 at an interest rate of 5.3% — a level the user said now seems almost unimaginable. Renewing that deposit today, it’s hard to get even 2%.

- That contrast captures a broader shift under way in China’s financial system. After years of rapid inflows into high-interest time deposits, banks have been cutting rates sharply. In this context, a massive wave of household savings is maturing this year, prompting many households to reconsider where to park their money.

🇨🇳 China Wealth Management Market Hits $4.8 Trillion Despite Yield Drop (Caixin) $

- China’s banking wealth management market expanded to a record 33.29 trillion yuan ($4.8 trillion) in 2025, even as average investor returns slipped below 2% for the first time, highlighting the disconnect between asset growth and yield performance.

- The industry’s growth underscores the continued enthusiasm of China’s roughly 143 million retail investors, many of whom remain drawn to low-risk banking products despite diminishing yields. This trend has prompted financial institutions to diversify beyond traditional fixed-income assets to sustain returns.

🇨🇳 Shanghai Futures Exchange Tightens Rules Amid Precious Metals Surge (Caixin) $

- The Shanghai Futures Exchange will raise margin requirements and widen daily price limits for gold, silver, copper and aluminum futures contracts starting this week, in an effort to rein in risk amid a sharp rally in precious metals.

- Effective from the Jan. 22 settlement, the SFE and its affiliate, the Shanghai International Energy Exchange, will impose tighter trading parameters on these key contracts. The international copper contract will be subject to the same restrictions. This is the second regulatory intervention this month in the silver market, following earlier adjustments to trading fees, limits and margin requirements.

🇨🇳 Why China’s women are having fewer babies (FT) $ 🗃️

- The economy is weak, divorces are rising and fewer young people are getting married

🇨🇳 China’s fear of ‘selling young crops’ spurred review of Meta’s Manus deal (FT) $ 🗃️

- Senior leadership ordered assessment of whether purchase risks losing cutting-edge technology

🇨🇳 PDD Plunges as Regulatory Headwinds Batter Temu (Caixin) $

- PDD Holdings (NASDAQ: PDD) or Pinduoduo extended its losing streak to a seventh consecutive trading session on Tuesday, pushing its market capitalization below $150 billion as investors grow increasingly alarmed over intensifying regulatory scrutiny of its cross-border e-commerce platform, Temu.

- The stock has shed more than 30% of its value since a November 2025 peak, as Temu’s growth trajectory hits turbulence in key markets including the U.S. and Europe, and revenue growth slows broadly.

🇨🇳 Temu Office Raided by Turkish Regulators as Global Scrutiny Mounts (Caixin) $

- Turkish authorities conducted an unannounced inspection of Temu’s local office on Wednesday morning, marking the latest regulatory challenge for PDD Holdings (NASDAQ: PDD) or Pinduoduo’s cross-border e-commerce platform as it navigates intensifying global scrutiny.

- The surprise visit in Turkey came on the same day that Chinese regulators penalized PDD, and follows regulatory actions in Europe and the U.S., underscoring the mounting compliance challenges the e-commerce giant faces both at home and abroad.

🇨🇳 Alibaba eyes sky-high chip valuations with T-Head spinoff plan (Bamboo Works)

- China’s leading e-commerce company is reportedly considering a spinoff and separate listing for its chip-making unit, following a similar plan by Baidu (NASDAQ: BIDU)

- Alibaba (NYSE: BABA) is reportedly weighing a plan to spin off and list its T-Head unit, hoping to join the ranks of other Chinese AI chipmakers with extremely high valuations

- Shares of rival chipmaker Shanghai Biren Technology Co Ltd (HKG: 6082) have nearly doubled since their Jan. 2 Hong Kong trading debut, while Moore Threads Technology Co Ltd (SHA: 688795) is up nearly fivefold since its December Shanghai listing

🇨🇳 Alibaba Stock Slips After AI-Fueled Surge: Here’s What Spooked Investors! (Smartkarma) $

- Alibaba (NYSE: BABA) shares have come under renewed pressure following a blistering AI-driven rally that saw the stock surge nearly 90% over the past year.

- The pullback began with a 3.5% drop on Monday, January 19, 2026, after macroeconomic and company-specific headwinds converged to shake investor confidence.

- Despite robust top-line growth and explosive gains in AI and cloud computing revenue, Alibaba’s core e-commerce business remains vulnerable amid a slowing Chinese consumer environment.

🇨🇳 Top battery equipment supplier gets regulatory nod, hoping to follow CATL’s success (Bamboo Works)

- Wuxi Lead Intelligent Equipment Co Ltd (SHE: 300450) could become the first blockbuster Hong Kong IPO of 2026, after its approval last week by China’s securities regulator

- Hong Kong IPO candidate Wuxi Lead Intelligent commands 15.5% of the global market for lithium battery manufacturing equipment, benefiting from China’s EV dominance

- Solid-state battery equipment offers major growth potential for the company, but the industry’s highly cyclical nature requires careful capital management

🇨🇳 Knowledge Atlas 智谱 (2513 HK): Margin Stagnant, But Favorable Policy Coming Soon (Smartkarma) $

- We believe Knowledge Atlas Technology JSC Ltd (HKG: 2513)’s algorithms and/or models did not provide higher efficiency in 1H25 than in 1H26.

- KA does a full-stack in-house development, which is rare in China.

- We believe authorities will restrict overseas AI companies for national information security.

🇨🇳 Robots only half as efficient as humans, says leading Chinese producer (FT) $ 🗃️

- Ubtech Robotics Corp Ltd (HKG: 9880) executive highlights difficulty in replacing workers with machines but manufacturers are still racing to order them

- Michael Tam, chief brand officer at Shenzhen-based UBTech, which has partnerships with carmaker BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) and Apple contractor Foxconn, said its Walker S2 robots were 30 to 50 per cent as productive as humans and only in certain tasks such as stacking boxes and quality control.

🇨🇳 TCL Doubles Down on Home Entertainment With Sony Deal (Caixin) $

- TCL Electronics Limited (HKG: 1070 / FRA: TC2A / OTCMKTS: TCLHF) said that it plans to form a joint venture (JV) with Sony Group Corp (NYSE: SONY) that will take over the Japanese electronics giant’s home entertainment business, underscoring the Chinese TV-maker’s effort to diversify amid fierce competition and slowing growth in the global TV market.

- TCL will hold a 51% stake in the JV, with Sony holding the remaining 49%. The new company will handle global operations from product development and design to manufacturing, sales and logistics for TVs and home audio equipment, and will retain “Sony” and “Bravia” branding for its future products, TCL said in an exchange filing dated Tuesday.

🇨🇳 Xiaomi Scrambles to Address EV Fire Incidents Amid $72 Billion Market Rout (Caixin) $

- Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) has revealed two separate vehicle fires that occurred Monday, seeking to ease mounting safety concerns even as the company’s market capitalization has plunged by nearly HK$560 billion ($72 billion) over the past four months

- Shares of the Hong Kong-listed smartphone and electric-car maker fell 2.74% to close at HK$35.48 on Tuesday. Since late September, the stock has slid from almost HK$60 to under HK$40, dragging its market value down to HK$924.2 billion.

🇨🇳 Auntea Jenny survives at periphery of China bubble tea market. Drink with caution (Bamboo Works)

- After a difficult period of revenue contraction in 2024, the mid-tier premium tea seller returned to strong profit growth last year

- Auntea Jenny (Shanghai) Industrial Co Ltd (HKG: 2589) said it expects to report its profit last year rose as much as 60% from 2024

- The mid-tier bubble tea seller’s overseas expansion is stalled at just a single store, significantly trailing behind its more aggressive larger peer

🇨🇳 Zhang Yong Rewrites His Own Playbook at Hot Pot Heavyweight Haidilao (Caixin) $

- Last week, Haidilao International Holding (HKG: 6862 / FRA: 8HI / OTCMKTS: HDALF) made a startling announcement: the company’s founder and spiritual leader, Zhang Yong, has resumed his role as CEO of the popular hot pot chain, returning to the operational helm to navigate a strategic overhaul as earnings flag.

- Zhang’s reinstatement signals a critical pivot for Haidilao. A source close to Zhang told Caixin that while the founder has focused on high-level strategy in recent years, his comeback represents a “second revolution” for the company. His primary objective is to accelerate the rollout of the “Red Pomegranate Plan,” an initiative designed to incubate new restaurant brands and diversify the company beyond its signature hot pot offerings, and to streamline decision-making process, the source said.

🇨🇳 RemeGen scores out-licensing triple play with AbbVie deal (Bamboo Works)

- The agreement marks the drug maker’s third such transaction since last year, setting records for both its largest upfront payment and highest total deal value

- PD-1/VEGF bispecific antibodies like RemeGen (SHA: 688331 / HKG: 9995 / FRA: REG / OTCMKTS: REGMF)’s RC148 have become a hot commodity among multinational drug companies, with strong potential in cancer immunotherapy

- By partnering with AbbVie in its latest out-licensing deal, RemeGen significantly strengthens its entry into the global marketplace

🇨🇳 China’s labs pull ahead as global drugmakers invest in biotech pioneers (FT) $ 🗃️

- Faster trials and lower costs are drawing western multinationals as they seek new treatments

- Investors in western biotechs face the prospect of lower valuations as Chinese start-ups attract growing investment from global drugmakers looking to replenish their pipelines.

- China has emerged in recent years as a hub for drug development, particularly early-stage candidates, with faster timelines allowing companies to reach proof of concept ahead of western rivals.

- Because the country’s biotechs can run clinical trials more quickly and cheaply, rivals from elsewhere risk being “undercut in licensing or partnering discussions”, said Oliver Kenyon, senior director at life sciences investor RTW.

🇨🇳 Sinovac Wins Nasdaq Reprieve as Governance Fight Drags On (Caixin) $

- Chinese vaccine-maker Sinovac Biotech Ltd (NASDAQ: SVA) has averted a potential delisting from the Nasdaq, with the bourse granting it a temporary reprieve after failing to file required financial reports on time.

- The Nasdaq Hearings Panel’s decision gives the U.S.-listed company more time to resolve disclosure lapses rooted in a nearly decade-long fight for corporate control that has disrupted audits, governance and shareholder payouts.

🇨🇳 Zijin Gold (2259 HK): Lock-Up Expiry and Index Inclusions/Upweights; US$1.5bn to Buy by June (Smartkarma) $

[Zijin Mining Group (SHA: 601899 / HKG: 2899 / FRA: FJZB / OTCMKTS: ZIJMF)]

- Zijin Gold International Co Ltd (HKG: 2259 / FRA: 6LU / OTCMKTS: ZJNGF) listed on 30 September and was added to the HSCI via Fast Entry in October and to the MGlobal Index in November.

- Zijin Gold was added to Southbound Stock Connect in mid-October and mainland investors now own 25% of the current float.

- Cornerstone lock-up expiry on 29 March increases free float significantly. There will be index inclusions in March/June and index upweights in May/June. There could be over US$1.5bn to buy.

🇨🇳 Busy Ming Hong Kong IPO Preview (Douglas Research Insights) $

- Busy Ming Group (1768 HK) is getting ready to complete its IPO in Hong Kong next week. The IPO price range is between HK$229.60 and HK$236.60.

- At the top of the range, it would bring in about HK$3.3 billion (US$420 million) and value the company at about HK$50.7 billion (US$6.5 billion).

- The company experienced explosive growth in the past four years, driven mainly by rapid store expansion and the Super Ming acquisition.

🇨🇳 Busy Ming Hong Kong IPO Valuation Analysis (Douglas Research Insights) $

- Our base case valuation of Busy Ming Group is implied market cap of HKD84.6 billion (USD10.8 billion) which is 66% higher than the high end of the IPO valuation range.

- We estimate Busy Ming to generate revenue of RMB67.7 billion (up 72.2% YoY) in 2025, RMB84.9 billion (up 25.3% YoY) in 2026, and RMB99.9 billion (up 17.7% YoY) in 2027.

- Given the strong upside, we have a positive view of this IPO. Our base case valuation is based on P/E of 14.9x our estimated net profit of RMB5.1 billion (2027E).

🇭🇰 In Depth: How Hong Kong Became a Global Wealth Magnet (Caixin) $

- Hong Kong has recorded strong growth in its wealth management business.

- In 2024, cross-border wealth booked in the city surged by $231 billion to $2.7 trillion, putting Hong Kong on par with Switzerland, the long-time leader in cross-border wealth management, according to Boston Consulting Group Inc.’s latest Global Wealth Report. The surge was the largest in the world that year.

🇭🇰 Johnson Electric Holdings Limited 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🌐 Johnson Electric Holdings (HKG: 0179 / FRA: JOHB / OTCMKTS: JELCF / JEHLY) 🇧🇲 – Motors, solenoids, micro-switches, flexible printed circuits & micro electronics. 🇼

🇭🇰 Chow Tai Fook(1929HK): Strong Dec-Quarter Print, but the Missing Factor Remains; It’s Wait-And-Watch (Smartkarma) $

- In this insight we discuss the strong operational print by Chow Tai Fook Jewelry Group (HKG: 1929 / FRA: 1CT / OTCMKTS: CJEWY / CJEWF) for quarter ending December 2025.

- We also discuss the the Missing Piece of the Puzzle and why one should still be cautious.

- We finally discuss our view on this counter, its valuation and conclusion.

🇭🇰 Prenetics: Strong Liquidity And Rapidly Rising Revenue (Seeking Alpha) $ 🗃️

🇭🇰 Prenetics Global: Is Undervalued, Supported By Portfolio Optimization In 2026 (Buy) (Seeking Alpha) $ 🗃️

- 🌐 Prenetics Global Ltd (NASDAQ: PRE) – Multi-cancer early detection technologies + IM8 (health & wellness brand) & Europa (sports distribution in the USA). 🇼

🇲🇴 Macau GGR ‘steady and solid’ in first 25 days of January: JP Morgan (GGRAsia)

- Macau casino gross gaming revenue (GGR) stood at MOP17.8 billion (US$2.22 billion) for the first 25 days of January, or MOP712 million a day, according to a Monday report from JP Morgan, citing its own checks. The month-to-date performance remained “steady, and solid”, added the institution.

- “This implies last week’s run-rate remained steady week-on-week at MOP693 million a day despite a lower VIP win rate, which is pretty solid if compared to December’s MOP624 million a day,” wrote analysts DS Kim, Selina Li, and Lindsey Qian.

- They added: “We are still comfortable modelling January GGR to grow 15 to 20 percent year-on-year, likely towards the high-end of this range, which in turn should allow GGR to grow circa 13 percent in [the first] two months of 2026 and first-quarter 2026.”

🇲🇴 Macau’s Chinese visitor volume excluding Guangdong up 4.7pct y-o-y in 2025, hit 79pct of 2019-level (GGRAsia)

- Macau’s 2025 non-Guangdong visitor volume from the Chinese mainland reached circa 79 percent of the 2019 level, show final figures released on Friday.

- The visitor aggregate actually from the neighbouring Chinese-mainland province of Guangdong was 33.4 percent higher than 2019, the year prior to the Covid-19 pandemic.

- The 2025 contribution of Zhuhai – the Guangdong city nearest to Macau – surged. That coincided with 2.9-million visits from residents from there, that could be directly linked to exit visa easing measures by mainland authorities and in effect from early in the year.

- The detailed numbers are according to the official data published by Macau’s Statistics and Census Service.

🇲🇴 Macau December 5-star room average nightly rate down 6pct to US$193, full-year 2025 rate down 5pct: trade (GGRAsia)

- The average nightly cost of a Macau five-star hotel room in December was MOP1,552.3 (US$193.3), down 6.2 percent year-on-year, while the average occupancy rate for the tier was 95.2 percent, flat from a year ago.

- That is according to the latest monthly survey from the Macau Hotel Association, published by the Macao Government Tourism Office.

- The survey data were drawn from the 48 hotels that are members of the association, 27 of them five-star properties. Most of those five-star hotels are within casino resort complexes in the city. The rest of the association’s hotel members as of December were in either the four-star or three-star category: a few in casino resorts, but most not.

🇲🇴 Macau Legend raises US$12mln via rights issue, but underwriters end up with 51pct of rights on offer (GGRAsia)

- Troubled Macau hotel and satellite casino services firm Macau Legend Development Ltd (HKG: 1680 / OTCMKTS: MALDF) has raised approximately HKD93.0 million (US$12.0 million) via a rights issue, the company announced on Thursday in a filing to the Hong Kong Stock Exchange.

- Macau Legend said that only 49.49 percent of the total number of rights shares offered were taken up.

- Macau Legend announced in October last year a proposal for the rights issue, with the aim of enhancing the company’s capital structure and providing flexibility for future corporate actions. The proceeds, it said at the time, would be used as working capital.

🇲🇴 Melco Resorts ‘could garner US$600mln’ if disposes of City of Dreams Manila interests: analyst (GGRAsia)

- Global gaming operator Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) could “garner close to US$600 million” from any disposal of its interest in the City of Dreams Manila casino resort (pictured) in the Philippine capital.

- That is according to a Thursday note from analyst David Bain at Texas Capital Securities, instituting coverage of Melco Resorts’ U.S.-listed stock.

- “We believe Melco Resorts could garner close to US$600 million should it sell its Manila operations, which could reduce net leverage close to 3.5 times by the end of 2026,” stated Mr Bain.

- He added: “While Manila has become more competitive, the market has stabilised, in our view.”

🇲🇴 Melco Resorts: Focus Is On Industry Headwinds, Company Positives (Downgrade) (Seeking Alpha) $ 🗃️

- 🇲🇴 🇵🇭 🇨🇾 Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) – Management & development of casino gaming & entertainment resort facilities. 🇼

🇹🇼 Taiwan

🇹🇼 TSMC: Sell The Perfect Quarter, A Contrarian View (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor: Capex Guidance Raise Suggests AI Buildout Cycle Until 2028 (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor: AI Value Stock Hiding In Plain Sight (Seeking Alpha) $⛔🗃️

🇹🇼 Taiwan Semiconductor: The Joule Advantage Through The N2 Super-Cycle (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 Taiwan Semiconductor Manufacturing Company ( TSMC) (Long-term Investing)

- Q4 Results

- We have looked at Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) before. The reports can be found here and here.

- The first one is comprehensive and is worth reading if you want to get a good understanding of the company.

- TSMC is in a very strong position as the dominant producer of leading-edge chips in a world of high demand growth and capacity shortages.

- The short to medium outlook looks strong.

- TSMC trades at roughly 26x 1-year forward earnings. This looks attractive for a high growth company which has an ROE in the range 32% to 35% and impressive ability to grow margins. The structure of demand is improving as it is becoming less cyclical.

🇹🇼 TSMC: Consensus Revised Up, but Modestly. Stock at Reasonable Valuations (Smartkarma) $

- Last week, Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) revised up long-term guidance. Long-Term US$-revenue Cagr 20% -> 25%, AI 45% -> 50% Cagr, gross margin 53% -> 56%. Consensus has revised up modestly

- It’s less a question of Consensus upside than 1) valuations are reasonable 2) TSMC is the simplest trade in terms of monopoly with pricing power. 2nd best is still Micron.

- Don’t worry, be invested. Tomorrow: Intel’s results. Buckle up – one way or the other.

🇰🇷 Korea

🇰🇷 Trump Threatens To Raise Tariffs On South Korean Goods To 25%; Won Slides (ZeroHedge)

- President Trump threatened to hike tariffs on goods from South Korea to 25% from 15%, citing in a Truth Social post what he said was the failure of the country’s legislature to codify the trade deal the two nations reached last year, a failure which was obvious from miles away as the terms of the trade deal require Korea to invest hundreds of billions – which it doesn’t have – in the US.

- The new rate would apply to autos, lumber, pharmaceutical products and “all other Reciprocal TARIFFS,” he wrote in a social media post. It probably would not apply to memory chips which are already the most expensive thing on plant earth, at least until the RAM producing cartel starts to, well, producing RAM again.

- If implemented, the move could have wide-ranging effects on major South Korean companies that export to the US, such as Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF), which sent 1.1 million vehicles to America in 2024.

🇰🇷 SK Hynix Soars On Microsoft Supply Deal Report; KOSPI Breaks Out, Shrugs Off Tariff Threat (ZeroHedge)

- SK Hynix (KRX: 000660) shares hit an all-time high in overnight trading in South Korea after a local media outlet reported that the semiconductor company, which specializes in memory chips, has become the sole supplier of advanced memory for Microsoft’s new artificial intelligence chip. Also overnight, despite President Trump’s tariff threat against South Korea for “not living up” to a trade deal cemented last year, the Korea Composite Stock Price Index surged above 5,000 for the first time.

- Business Korea reports that Hynix will exclusively supply high-bandwidth memory (HBM) for Microsoft’s next-generation AI chip, the Maia 200.

🇰🇷 KOSDAQ’s 7% Rise Today – A Fake Reversal or Sustainable by a Potential 17 Trillion Won Inflow? (Douglas Research Insights) $

- The KOSDAQ index rose by 7.1% today to 1,064.4 today which was one of the largest single day returns for KOSDAQ in the past three decades.

- Will this 7% upside move be a fake reversal or the start of a strong, sustainable momentum trade driven by a potential 17 trillion won inflow into the KOSDAQ companies?

- The Korean government is trying to encourage the injection of nearly 17 trillion won into KOSDAQ listed companies through venture capital (raised through integrated market assets (IMAs) and commercial papers).

🇰🇷 10pct yearly of Kangwon Land revenues maybe used to pay off US$1.67bln Korea Coal debt: report (GGRAsia)

- South Korea’s Ministry of Trade, Industry and Energy is considering using a government-affiliated company, Kangwon Land (KRX: 035250), to pay off a KRW2.46-trillion (US$1.67-billion) debt of a ministry affiliate, the Korea Coal Corp. That is according to local news outlet Chosun Biz.

- Kangwon Land Inc is operator of Kangwon Land (pictured), a resort with the country’s only casino allowed to serve locals.

- Per Chosun Biz, the ministry thinks the debt could be settled by setting aside 10 percent of Kangwon Land Inc’s annual revenue over a period of 20 years. The casino firm’s current gaming licence runs until 2045.

🇰🇷 Kangwon Land Inc 2025 net income plunges 31pct due to decline in non-operating income (GGRAsia)

- Net income for full-year 2025 at Kangwon Land (KRX: 035250), operator of South Korea’s only casino open to local residents, declined by 30.7 percent year-on-year, despite sales rising 3.5 percent over the same period.

- The decline in net income was attributed to a “decrease in non-operating income year-on-year” during the reporting period, the firm said in a filing to the Korea Exchange on Wednesday.

- Kangwon Land Inc is scheduled to disclose its full set of results for 2025 on January 28. The firm operates the Kangwon Land resort (pictured) and its casino in an upland area outside the capital, Seoul.

- The net income announcement was made under a Korea Exchange provision that requires listed companies to disclose changes of 30 percent or more in sales, profits or losses.

🇰🇷 Overseas patrons help drive GKL’s 2025 net profit up 42pct (GGRAsia)

- Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, saw its net profit for full-year 2025 rise 42.4 percent year-on-year, to KRW47.07 billion (US$32.1 million).

- The company reported group-wide sales of nearly KRW422.95 billion last year, 6.7-percent higher than in 2024, according to provisional figures included in a Wednesday filing to the Korea Exchange.

- The firm’s aggregate casino sales for full-year 2025 reached KRW425.3 billion, 8.0-percent higher than in 2024, showed data published by Grand Korea Leisure earlier this month.

🇰🇷 Hotel inventory for Paradise City to rise 65.1pct from March onward says Paradise Co (GGRAsia)

- The Paradise City casino resort in South Korea is to see its hotel-room inventory leap by 65.1 percent from March onward, via its newly-rebranded acquisition “Hyatt Regency Incheon Paradise City”. That is according to one of the resort’s promoters, Paradise Co Ltd (KOSDAQ: 034230), an operator of foreigner-only casinos in that country.

- As per the firm’s update, the newly-branded Hyatt Regency Incheon Paradise City – formerly the West Wing of the Grand Hyatt Incheon hotel (pictured in a file photo) – is currently being renovated and should be available by March.

- It will add 501 rooms to Paradise City’s existing 769, taking to 1,270 the new tally available to the gaming complex. The casino resort’s current capacity is split between a Paradise City-branded hotel with 711 rooms, and the resort’s boutique facility the 58-room Art Paradiso hotel.

🇰🇷 Coupang Expert Insight Interview (No Paywall) (Speedwell Memos) $

- Coupang, Inc. (NYSE: CPNG) Executive on Taiwan, growth opportunities, and risks

- With $32bn in LTM revenues and a mature margin of 8%, they are currently trading at 15x mature margin earnings with a EV of $38bn (This sssumes they hit their 10% adjusted EBITDA target, and we layer in 2% of D&A and SBC. They already have 8.5% EBITDA margins in their Product Commerce Segment).

- Coupang has executed quarter after quarter, so what is giving investors trepidation?

- We talk to the Former VP of Strategy & Business at Coupang to understand all of the key risks and opportunities facing them. This is the only conversation with a Coupang executive that has touched on broader geographic ambitions (outside of Taiwan) and the detailed economics of the ecommerce business!

- We cover:

- Coupang’s most important growth initiatives and business levers

- How Taiwan is trending—and whether it can ever rival the core South Korea business

- The opportunity (and challenges) of further geographic expansion

- The role of 1P vs. 3P economics in long-term margin structure

- The strategic and competitive risks investors may be underestimating

🇰🇷 Kia Corp – Time to Catch Up to Hyundai Motor Amid Boston Dynamic’s Roll-Out of Atlas Robots (Douglas Research Insights) $

- Valuation estimates for Boston Dynamics have risen to more than 30 trillion won to 50+ trillion won post CES 2026.

- The main reason for the sharp share price appreciation of both companies in the past six months has been due to the surging optimism regarding Boston Dynamics’ Atlas humaniod robots.

- We argue that it is time for Kia Corp (KRX: 000270 / OTCMKTS: KIMTF)’s share price to catch up to Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) in the next 6-12 months.

🇰🇷 Strong Demand for Mirae Asset TIGER Korea Humanoid Robot Industry ETF (Douglas Research Insights) $

- Since the launch of the Mirae Asset TIGER Korea Humanoid Robot Industry ETF (0148J0 KS) on 6 January 2026, its share price is up 39%.

- This ETF benchmarks the KEDI Korea Humanoid Robot Industry Index. The humanoid robotics has been one of the strongest thematic sectors in Korea so far this year.

- The KEDI Korea Humanoid Robot Industry Index applies Large Language Model (LLM) technology to disclosure reports and other sources.

🇰🇷 Robots Need Food (Batteries) – Key Beneficiaries in Korea (Douglas Research Insights) $

- Robots need food. Its called batteries. As global investors realize the proximity of the mass adoption of humanoid robots, they increasingly recognize the importance of batteries that power these robots.

- The stage is set for increased capital allocation into the rechargeable battery sector in Korea once again, mainly driven by the expectation of higher battery demand from humanoid/industrial robots.

- Given the immense interest robotics related stocks, there is certainly a positive momentum on the battery related stocks that should benefit from higher demand for batteries required by humanoid robots.

- Share Price Performances of the Top Five Rechargeable Battery Stocks in Korea (1 year) – The five largest rechargeable battery stocks (Samsung SDI (KRX: 006400 / 006405 / FRA: XSDG), LG Energy Solution (KRX: 373220), Ecopro BM Co Ltd (KOSDAQ: 247540), L&F Co Ltd (KRX: 066970), and Posco Future M Co Ltd (KRX: 003670)) are up on average 43% in the past one year, underperforming KOSPI which is up 97% in the same period. However, in the past five days, these five stocks are up on average 16.3%, outperforming KOSPI which is up 2.8% in the same period.

🇰🇷 Samsung Electronics Preferred – Time to Catch Up to Common Shares (Douglas Research Insights) $

- Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) (common) is up 183.6%, outperforming Samsung Electronics (preferred) which is up 155.3% (past one year). The price ratio of the two stocks is above two standard deviation.

- The higher probability scenario is for Samsung Electronics preferred shares to outperform its common shares over the next 6-12 months.

- Currently, Samsung Electronics’ preferred shares are trading at 26.8% discount to their common shares, which is at a multi-year high discount.

🇰🇷 Korea Small Cap Gem #53: I-Scream Media (Park Young-Ok Goes Activist) (Douglas Research Insights) $

- A key catalyst is a famous local retail investor (Park Young-Ok) recently started to go activist on this company.

- Park Young-Ok is demanding that the company return at least 50% of its free cash flow to its shareholders (30% for dividends and 20% for buybacks/share cancellations).

- I Scream Media Co Ltd (KOSDAQ: 461300) has cheap valuation multiples, trading at EV/EBITDA of 2.3x, with ROE of 20%+ and operating margin of nearly 30%.

🌏 SE Asia

🇲🇾 🇸🇬 Kimly & Oriental Food Update (Smartkarma) $

- Kimly Ltd (SGX: 1D0) stock has done very well since our initiation & now it does not look very cheap

- Oriental Food Industries Holdings Bhd (KLSE: OFI) has done nothing and we suspect market is concerned as its profits will be affected by the strength of Malaysian Ringitt

- We think Singapore restaurant companies’ earnings can be affected by RTS between Singapore & Malaysia starting year end 2026.

🇵🇭 Visa-free travel from China to help all Entertainment City Manila resorts: Maybank (GGRAsia)

- Visa-free travel to the Philippines for Chinese tourists “should support recovery of Entertainment City” casino resorts in the country’s capital Manila, which in 2025 experienced a downturn in visitor volume from China. But it might take “a few quarters for VIP volumes to recover,” said a Wednesday note from Maybank Securities Inc.

- Analyst Raffy Mendoza aired the view in a note with a focus on Bloomberry Resorts Corp (PSE: BLOOM / OTCMKTS: BLBRF), operator of Solaire Resort & Casino in Entertainment City, and of Solaire Resort North in nearby Quezon City.

- The Philippines government said on January 16 that Chinese nationals would be allowed to enter and stay in the country without a visa for up to 14 days starting from that date, as part of President Ferdinand Marcos Jr.’s effort to promote trade, investment and inbound tourism.

🇸🇬 Singapore fund managers optimistic on Asia for 2026 (The Asset) 🗃️

- Japan, China most promising, AI integration deepens, ESG moves from differentiation to implementation

- Market sentiment for 2026 among Singapore-based asset managers remains decidedly positive across the Asian landscape, according to a recent survey report.

- Japan and China were identified as the most promising markets ( each cited by 21% of respondents ), followed by India ( 13% ), Singapore ( 11% ) and Taiwan ( 11% ), finds the latest IMAS Investment Managers’ Outlook Survey, which annually gathers insights from C-suite professionals across 63 Investment Management Association of Singapore ( IMAS ) member firms, which include Singapore-based fund managers and asset owners that collectively oversee more than US$35 trillion in global assets.

🇸🇬 Hong Fok Corporation Ltd – Pay Without Performance (Corporate Monitor)

- 🇸🇬 Hong Fok Corporation Ltd (SGX: H30) – Property investment, development & construction, management; investment trading; & investment holding & management.

🇸🇬 SuperX AI Technology Limited: Buyback Plan Accounts For A Lot Of Recent Equity Raise (Seeking Alpha) $ 🗃️

- 🌐 SuperX AI Technology Ltd (NASDAQ: SUPX) – AI infrastructure solutions provider (comprehensive portfolio of proprietary hardware, advanced software & end-to-end services for AI data centers).

🇸🇬 Karooooo: Q3 Results Might Fuel A Positive Re-Rating (Seeking Alpha) $ 🗃️

🇸🇬 Karooooo Ltd. 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇸🇬 🇿🇦 Karooooo (NASDAQ: KARO / JSE: KRO) – Leading provider of an on-the-ground operations cloud that maximizes the value of data. The Cartrack SaaS platform provides insightful real-time data analytics & business intelligence reports. 🏷️

🇸🇬 Grab Holdings: A Massive Opportunity Hiding In Plain Sight (Seeking Alpha) $ 🗃️

- 🌏 Grab Holdings Limited (NASDAQ: GRAB) – Superapp in SE Asia for mobility, deliveries, & digital financial services to millions of Southeast Asians. 🇼 🏷️

🇸🇬 Sea Limited: Riding This Wave Higher; Bullish Opportunity (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited’s Pullback Is Creating A Rare Opportunity (Seeking Alpha) $ 🗃️

🇸🇬 Sea: Market Fear Creates A Compelling Entry Point For An SEA Growth Giant (Seeking Alpha) $ 🗃️

- 🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Why I’m Not Worried About $SE Sea Limited’s 38% Drawdown (GabGrowth)

- Sea Limited (NYSE: SE) is in a 38% drawdown from its most recent high in September 2025.

- This drawdown has understandably raised investor concerns and prompted questions around what is driving the correction.

- In this piece, I’ll break down the key factors behind the sell-off and assess whether they genuinely warrant concern for long-term investors.

🇸🇬 The Complete Guide to Investing in Singapore Hospitality REITs (The Smart Investor)

- Hospitality REITs offer attractive income but higher volatility — here’s how to assess risks, cycles, and sustainability before investing in these Singapore-listed REITs.

- What Are Hospitality REITs and How Are They Different?

- Prominent names include Far East Hospitality Trust (SGX: Q5T) and CDL Hospitality Trusts (SGX: J85 / OTCMKTS: CDHSF), or CDLHT.

- Key Drivers of Hospitality REIT Performance

- Dividend Profile: Why Hospitality REIT Yields Look Attractive

- Why the Balance Sheet Matters More for Hospitality REITs

- What to Look for in a Strong Hospitality REIT

- Key Risks Investors Must Understand

- Portfolio Strategy: Timing and Volatility

- Get Smart: Treat Hospitality REITs as Cyclical Income Plays

🇸🇬 3 Blue Chip Stocks That Could Benefit if SGX Reduces Board Lot Size (The Smart Investor)

- With the local market’s board lot size planned for another reduction since 2015, higher-priced stocks with great fundamentals are poised to benefit from the increased liquidity.

- Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) plans to reduce board lot sizes from 100 units to 10 units for securities with a value above S$10, potentially benefiting a select cohort of blue-chip stocks.

- To be clear, it’s not implemented yet.

- Still, given SGX’s precedent of reducing lot sizes previously, from 1,000 to 100 units on 19 January 2015, it’s reasonable to assume that the bourse operator will follow through with another reduction.

- Here are three Singapore blue-chip stocks priced above S$10 that could benefit from this potential reduction in board lot size.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) – Retail Investor Darling

- Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF) – SGX’s Highest Priced Conglomerate

- Haw Par Corporation (SGX: H02 / OTCMKTS: HAWPF) – Highly Priced Healthcare Stock

- What This Means for Investors

- Get Smart: Ride the Retail‑Driven SGX Surge

🇸🇬 Is It Too Late to Buy SGX? (The Smart Investor)

- SGX shares have rallied on stronger volumes and renewed market interest — but does the exchange still offer long-term upside for investors today?

- Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY), or SGX, last closed at S$17.50.

- Shares have been up about 43% over the last year, after a prolonged stagnation.

- Thinking about adding this blue-chip to your portfolio for the first time?

- Let’s dive into the facts and see if now is the right time for you to buy.

- Why SGX Attracts Long-Term Income Investors

- What Has Changed Recently?

- The Case for Buying SGX Even After the Rally

- The Case Against Buying Right Now

- What Long-Term Investors Should Focus On

- Get Smart: Focus on the Business, Not the Price Chart

🇸🇬 Singapore Banks in 2026: What Dividend Investors Need to Know (The Smart Investor)

- As Singapore banks report their earnings, here’s what you should watch.

- Singapore’s three major banks are entering a period of transition.

- For dividend investors, understanding how bank earnings work is essential to setting the right expectations for the year ahead.

- At the heart of this transition lies a simple dynamic: net interest income (NII) is falling, and non-interest income must do the heavy lifting.

- Two engines, different trajectories

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) expects NII to decline slightly in 2026.

- For United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), which derives around 70% of its revenue from NII compared to roughly 60% for DBS and Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY), the exposure to falling rates is more pronounced.

- Dividend sustainability hinges on profits

- Factors outside management’s control

- Get Smart: Three Things to Watch

🇸🇬 AEM Holdings vs Venture Corporation: Which Tech Manufacturing Stock Is the Better Buy? (The Smart Investor)

- AEM Holdings (SGX: AWX) vs Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF): compare growth potential, risks, dividends and business models to see which Singapore tech stock fits your portfolio.

- When comparing the duo, you’re looking at two very different horses in the Singapore tech scene. While both are “tech manufacturers”, Venture Corporation and AEM operate at opposite ends of the risk-reward spectrum.

- Let’s take a closer look.

- AEM Holdings: A Semiconductor Play

- Venture Corporation Limited: Tech Manufacturer with Stable Dividends

- Head-to-Head Comparison

- Get Smart: Which Is the Better Buy?

🇸🇬 3 Singapore Blue-Chip REITs To Watch This Week (The Smart Investor)

- All three Mapletree REITs are in the midst of strategic portfolio reshuffles. Here’s what to look for when they report results in late January.

- With earnings releases due in the week of 26 January 2026, here’s what dividend investors should be watching.

- Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF): Reporting on 26 January 2026

- What to watch: Has MLT made further progress on its divestment target of between S$100 million to S$150 million?

- Mapletree Pan Asia Commercial Trust (SGX: N2IU / OTCMKTS: MPCMF): Reporting on 30 January 2026

- What to watch: Can VivoCity’s momentum continue post-enhancement completion?

- Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF): Reporting on 28 January 2026

- What to watch: Is North American occupancy recovering from 87.8%?

- Get Smart: Patience required

🇸🇬 5 Income Stocks That Beat CPF Returns (The Smart Investor)

- These five income stocks offer yields higher than CPF’s 2.5 to 4% and provide investors with opportunities for stronger long-term passive income.

- Food Empire Holdings — A Cash-Rich Consumer Income Play

- Food Empire Holdings Ltd (SGX: F03) offers a dividend yield of 4% (at share price of S$2.75).

- Backing that yield is steadily rising profits, healthy cash flow, and a net cash balance.

- Genting Singapore — Tourism Recovery Turning Into Stable Income

- Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) offers a trailing dividend yield of about 5.5%, based on its share price of S$0.73, comfortably above CPF’s 2.5% to 4% returns.

- The company operates Resorts World Sentosa and holds a market duopoly with a casino license secured through 2036.

- Lendlease Global Commercial REIT (LREIT) — Retail & Office Income Above CPF

- At S$0.0625, Lendlease Global Commercial REIT (SGX: JYEU / OTCMKTS: LLGCF) offers a trailing distribution yield of 5.76%, having delivered a full-year FY2025 distribution of S$0.036 per unit.

- OUE REIT — High Yield From a Prime Commercial Portfolio

- At a unit price of S$0.36, OUE Real Estate Investment Trust (SGX: TS0U / OTCMKTS: OUECF) offers a 5.4% forward yield, significantly outpacing CPF rates.

- Suntec REIT — Market-Beaten, Yield-Rich Opportunity

- Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF) offers a trailing distribution yield of roughly 4.6% at a unit price of S$1.42.

- CPF vs Market: How Much Higher Are These Yields?

- Get Smart: Balancing Security with Market Yields

🇸🇬 3 Singapore Small-Cap Stocks Poised to Ride the AI Boom (The Smart Investor)

- Three Singapore small caps are quietly positioning themselves to profit from AI’s insatiable appetite for chips, power, and precision tools.

- Three Singapore-listed small caps – spanning data centre infrastructure, semiconductor equipment, and precision consumables – are positioning themselves to capture this demand.

- CSE Global: Powering the Data Centre Boom

- When Amazon.com (NASDAQ: AMZN) secured rights to acquire up to 63 million shares in CSE Global Ltd (SGX: 544 / FRA: XCC / OTCMKTS: CSYJY / CSYJF) in November 2025, the move validated the systems integrator’s pivot towards data centres.

- The strategic partnership, extending through 2030, signals where the cloud giant sees opportunity.

- UMS Integration: Manufacturing the Tools That Make AI Chips

- Every AI chip requires sophisticated front-end manufacturing equipment.

- UMS Integration Ltd (SGX: 558 / OTCMKTS: UMSSF) or UMS Holdings supplies critical components to the original equipment manufacturers building these machines.

- Micro-Mechanics: Consumables for the Chip Production Line

- While UMS benefits from equipment manufacturing, Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF) profits from ongoing chip production through its consumable precision tools.

- Get Smart: Three Entry Points Along the AI Value Chain

🇸🇬 The Dividend Sweet Spot: 3 Stocks That Balance Yield, Growth, and Stability (The Smart Investor)

- For income investors, the sweet spot lies between yield and growth, and these three Singapore stocks strike that balance in 2026.

- As we look at the corporate landscape in 2026, three Singaporean stocks stand out for hitting the sweet spot for income investors.

- Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) – The Heartland Cash Machine

- When it comes to stability, few can rival the local grocery giant Sheng Siong.

- Specializing in fresh produce and household essentials for Singapore’s heartlands, the group has turned the “boring” business of supermarkets into a high-performance engine.

- Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF) – The High-Margin Healer

- Raffles Medical Group (RMG) has long been a staple for those seeking exposure to the aging population and the rise of medical tourism in Southeast Asia.

- 2025 marked a year where the group focused on “quality over quantity,” optimizing its operations to boost the bottom line.

- Singapore Exchange Limited(SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY)– The Monopoly with a Growth Engine

- As the sole stock market operator in Singapore, Singapore Exchange (SGX) is the definition of a “moat”.

- However, in recent years, it has transformed from a local stock exchange into a global multi-asset powerhouse.

- Get Smart: The Power of the Trio

🇸🇬 Better Buy: CICT vs FCT (The Smart Investor)

- CICT and FCT are popular income REITs, but a closer look at fundamentals reveals which may offer stronger long-term value.

- We compare two well-known retail REITs, CapitaLand Integrated Commercial Trust(SGX: C38U / OTCMKTS: CPAMF), or CICT, and Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF), or FCT.- for investors to consider for their portfolios.

- Business Model and Portfolio Focus

- Income Stability and Distribution Track Record

- Growth Drivers and Rental Upside

- Balance Sheet Strength and Interest Rate Sensitivity

- Yield Versus Quality Trade-Off

- Get Smart: Compare Purpose, Not Just Price

🇸🇬 5 Dividend Stocks Set to Shine as Interest Rates Fall (The Smart Investor)

- As borrowing costs ease, some dividend stocks stand to benefit more than others through stronger cash flows and improved payout sustainability.

- Today, we examine five dividend stocks that are uniquely positioned to shine as interest rates fall.

- Why Falling Rates Matter for Dividend Stocks

- PropNex (SGX: OYY) – Singapore’s Leading Real Estate Service Provider

- Lower interest rates have an outsized benefit for PropNex; as rates decline, property value and transactions increase.

- Centurion Corporation Ltd (SGX: OU8) – Workers and Students Accommodation Provider

- Centurion Corporation Limited, or Centurion Corp, owns a portfolio of workers’ dormitories and student accommodations.

- UOB-Kay Hian Holdings Ltd (SGX: U10 / FRA: 4LJ) or UOBKH – Ride the Boom in Singapore Financial Markets

- UOB Kay Hian (UOBKH) is a regional financial services provider offering broking services alongside corporate advisory and fundraising services.

- CapitaLand India Trust (SGX: CY6U / OTCMKTS: ACNDF) – Capitalising on a Possible India Rebound

- CapitaLand India Trust (CLINT) owns a portfolio of industrial assets in India.

- Sasseur Real Estate Investment Trust (SGX: CRPU) – A Play on China’s 2026 Consumer Focus

- Sasseur REIT specialises in the retail outlet mall scene in China.

- Get Smart: Let Rates Work with Quality

🇸🇬 Beyond STI: 3 Cash-Rich Dividend Stocks to Boost Your Retirement Income (The Smart Investor)

- For income investors, cash-rich balance sheets matter, and these three dividend stocks outside the STI stand out for sustainable payouts built to last.

- Here are three cash-rich dividend stocks worth a closer look.

- Pan-United Corporation Ltd (SGX: P52)

- Pan-United is a familiar name in Singapore’s construction landscape.

- The group manufactures and supplies ready-mix concrete and slag while trading cement and refined petroleum products across Singapore, Vietnam, and Malaysia.

- Valuetronics Holdings (SGX: BN2 / FRA: GJ7)

- Valuetronics is an integrated electronics manufacturing services provider offering design, development, manufacturing, and supply chain support.

- The company operates through two segments: Industrial and Commercial Electronics (ICE) and Consumer Electronics (CE).

- SBS Transit (SGX: S61) or SBST

- SBS Transit operates Singapore’s Northeast Line and Downtown Line, alongside multiple bus packages across the island.

- The group’s business is split between public transport services, which generate the bulk of revenue, and other commercial services including advertising.

- Get Smart: Cash is king for dividend sustainability

🇸🇬 Could Singapore’s Engineering Stocks Be the Hidden Winners of 2026? (The Smart Investor)

- As long-cycle projects gain momentum, 2026 could mark a turning point for Singapore’s engineering sector.

- As the market is seeing increasingly fewer instances of momentum trading for profit, these blue chip names are increasingly gaining traction.

- These companies – though often labelled “boring” – may emerge as the hidden winners in the year ahead.

- Why Engineering Stocks Were Overlooked

- Structural Tailwinds Supporting the Engineering Sector

- Defence and Aerospace: Steady Growth Anchors

- Energy and Marine Engineering: Cyclical but Recovering

- Seatrium Ltd (SGX: SE2 / FRA: S8N / OTCMKTS: SMBMF) serves as a prime example, boasting a net order book of S$16.6 billion with revenue visibility extending through 2031.

- Yangzijiang Shipbuilding Holdings (SGX: BS6 / FRA: B8O / OTCMKTS: YSHLF) also sustained strong commercial momentum through 9M2025, securing US$2.17 billion in new contract wins.

- Infrastructure and Utilities Engineering: Stability Through Integration

- Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF) integrates engineering expertise with utilities and renewable energy operations, offering a hybrid model that balances growth with defensive cash flow.

- What Investors Should Watch

- Get Smart: Visibility Matters More Than Excitement

- Strategic exposure to industry leaders – such as ST Engineering (defense), Seatrium and Yangzijiang (marine and energy backlogs), and Sembcorp (hybrid utilities) – provides a blend of high-quality execution and structural growth.

🇸🇬 2026 Outlook: 5 Promising Stocks for a Brand-New Investing Year (The Smart Investor)

- For a brand-new investing year, these five Singapore stocks stand out in 2026 for earnings resilience, strong balance sheets, and sustainable dividends.

- The five stocks in this list do the hard things well: generating cash, absorbing volatility, and returning capital to shareholders.

- China Sunsine Chemical Holdings (SGX: QES) — Cash-Rich, Quietly Compounding

- China Sunsine is heading into 2026 in better shape than its top-line numbers let on.

- Q&M Dental (SGX: QC7) — Defensive Demand, Near-Term Noise

- Q & M Dental’s 1H2025 numbers might not look promising at first glance, with headline net profit diving 60% to S$3.9 million.

- Nordic Group Ltd (SGX: MR7) – Steady Dividend Payer with Work Locked In

- Nordic Group gave a strong performance in 1H2025.

- Pan-United Corporation Ltd (SGX: P52) – A Low-Carbon Concrete Supplier Riding Singapore’s Build Cycle

- Pan-United had a solid 1H2025.

- Straits Trading Company (SGX: S20 / FRA: W2F / OTCMKTS: SSTVF / STTSY) – Asset-backed with Steady Dividends

- Straits Trading Company (STC) sits on a diversified portfolio spanning resources, hospitality, and property, anchored by its controlling stake in Malaysia Smelting Corporation and its interest in Far East Hospitality.

- Get Smart: Position Before Results Hit the Headlines

🇹🇭 TMBThanachart Bank Public Company Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 TMBThanachart Bank PCL (BKK: TTB / TTB-F / FRA: TMLF / NVPJ / OTCMKTS: TMBBY) – Various commercial banking products. 🇼 🏷️

🇹🇭 Kasikornbank Public Company Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

- 🇹🇭 Kasikornbank PCL (BKK: KBANK / SGX: TKKD / FRA: TFBF / OTCMKTS: KPCPY / KPCPF) – Commercial Banking. 🇼 🏷️

🇻🇳 Fitch upgrades Vietnam’s secured bonds to BBB- (The Asset) 🗃️

- Updated sovereign methodology shows structural collateral benefits

- Global credit rating agency Fitch Ratings has upgraded the long-term senior secured debt ratings of Vietnam to BBB- from ‘BB+’, effectively removing the ratings from being under criteria observation.

- This rating decision, according to Fitch, is a direct result of the application of Fitch’s new sovereign rating criteria, introduced in September 2025, which for the first time integrates specific recovery assumptions into sovereign debt ratings.

- While the secured bonds have seen an upward adjustment, this action does not constitute a change to Vietnam’s long-term foreign currency issuer default rating ( IDR ), which the agency last affirmed at BB+ with a stable outlook in June 2025.

🇮🇳 India / South Asia / Central Asia

🇮🇳 US regulator steps up effort to serve summons to Indian billionaire Gautam Adani (FT) $ 🗃️

- SEC tries to move bribery case forward after India’s government refused to formally notify tycoon of charges

🇮🇳 IFN: Indian Stock Market Correction Set To Continue As Headwinds Remain In 2026 (Seeking Alpha) $ 🗃️

- 🇮🇳 The India Fund, Inc. (NYSE: IFN)

🇮🇳 MakeMyTrip Limited 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $

- 🇮🇳 Makemytrip (NASDAQ: MMYT) – Online travel services. 🇼

🇮🇳 UltraTech Cement Limited 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $

- 🇮🇳 Ultratech Cement (NSE: ULTRACEMCO / BOM: 532538 / OTCMKTS: UCLQF) – Grey cement, ready-mix concrete (RMC) & white cement. Aditya Birla Group. 🇼

🇮🇳 Wipro: Consider Above-Consensus Earnings And Muted Prospects (Seeking Alpha) $ 🗃️

🇮🇳 Wipro Limited 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $

🇮🇳 Wipro Limited 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha) $

🇮🇳 ICICI Bank: Good Asset Quality, But Earnings Disappointed (Seeking Alpha) $ 🗃️

- 🌐 ICICI Bank (NYSE: IBN) – MNC bank & financial services. Wide range of banking & financial services for corporate & retail customers. 🇼 🏷️

🇮🇳 HDFC AMC: From SIP Scale to Alternatives, the Earnings Flywheel Strengthens (Smartkarma) $

- Industry flows remain resilient despite muted equity returns, while HDFC Asset Management Company Ltd (NSE: HDFCAMC / BOM: 541729) delivers steady AUM growth, strong profitability, and expands alternatives.

- SIP-Led flows and operating leverage cushion near-term regulatory headwinds, supporting sustainable profit compounding.

- With scale, brand, and disciplined execution, HDFC AMC appears well-positioned to navigate TER changes while building optionality beyond mutual funds.

🇮🇳 Indian QSR Consolidation: A Rare Cash Arbitrage Play In RBA? (Smartkarma) $

- Inspira Global is acquiring a controlling stake in Restaurant Brands Asia Ltd (NSE: RBA / BOM: 543248) at INR 70 per share, marking the complete exit of former promoter Everstone Capital.

- The transaction involves a INR 460 crore stake purchase, a INR 900 crore preferential equity issue, and INR 600 crore in warrants to fuel long-term growth

- Investors can capture an 8.36% arbitrage spread over 3-4 months via the open offer, though success depends on regulatory approvals and the final public acceptance ratio.

🇮🇳 Mukesh Ambani’s Jio listing set to headline record year for Indian IPOs (FT) $ 🗃️

- Telecoms operator’s flotation could be biggest in country’s history

- India is heading for a third record-breaking year of initial public offerings, with a pipeline of multibillion-dollar listings led by the flotation of Reliance Jio Infocomm, which could be the country’s largest ever.

- The amount raised by Indian IPOs is poised to surpass last year’s record of just over $20bn, multiple bankers in Mumbai told the FT. The dealmaking comes despite Indian equities’ underperformance against other emerging markets and investor concerns about punishing 50 per cent US tariffs and high stock valuations.

🇰🇿 Freedom Holding’s Dip Is A Buying Opportunity (Seeking Alpha) $ 🗃️

🇰🇿 Freedom Holding Corp.: We Like Kaspi Better On Lower Multiple, Network Effects (Seeking Alpha) $ 🗃️

- 🌍 Freedom Holding Corp (NASDAQ: FRHC) – Securities brokerage & financial services. 🇼

🌍 Middle East

🇮🇱 Mobileye’s CES Robotics Buzz Explained: What Pilots Prove (Smartkarma) $

- Mobileye Global (NASDAQ: MBLY), a leader in advanced driver-assistance systems (ADAS) and autonomous driving technology, reported its financial results for the fourth quarter and full year of 2025.

- The company achieved 15% revenue growth, with a notable 45% increase in adjusted operating profit and more than a 50% rise in operating cash flow compared to the previous year.

- These results are attributed to strong demand for Mobileye’s products, driven by growth in the auto industry and innovations in ADAS technology.

🌍 Africa

🇿🇦 Aspen Pharmacare Holdings Limited (APNHY) Discusses Proposed Divestment of APAC Operations Excluding China – Slideshow (Seeking Alpha)

- 🌐 Aspen Pharmacare Holdings Limited (JSE: APN / FRA: LDZA / LDZU / OTCMKTS: APNHY / APNHF) – Global specialty & branded mnc pharmaceutical company with a presence in emerging & developed markets. High quality, affordable medicines. 🇼 🏷️

🇿🇦 Gold Fields Shines As Gold Creeps Closer To $5,000, Reiterate ‘Buy’ (Seeking Alpha) $ 🗃️

- 🌐 Gold Fields (JSE: GFI / NYSE: GFI) – One of the world’s largest gold mining firms. 9 operating mines in Australia, Peru, South Africa & Ghana (including the Asanko JV) & 2 projects in Canada & Chile. 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇵🇱 Poland cools on joining Eurozone after its economy surges (FT) $ 🗃️

- Finance minister says the country’s performance is clearly better than most of those in the single currency

- Finance minister Andrzej Domański told the FT that the case for adopting the euro had weakened as Poland has outpaced most Eurozone economies, even as EU member states are obliged to join the single currency area when certain criteria are met.

🇵🇱 Dino Polska: Are Unions About To Bite This Growth Story? (Seeking Alpha) $ 🗃️

- 🇵🇱 Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) – Nationwide network of medium-sized supermarkets. 🇼 🏷️

🌎 Latin America

🌎 Adecoagro Integrates Upstream Into Fertilizers With A Bold Downcycle Bet (Seeking Alpha) $ 🗃️

- 🇦🇷 🇧🇷 🇺🇾 Adecoagro Sa (NYSE: AGRO) – Luxembourg HQ’s agro industrial company that produces & manufactures food & renewable energy. 3 segments: Farming; Sugar, Ethanol & Energy; & Land Transformation. 🏷️

🌎 MercadoLibre: Stage Is Set For A Big 2026, Monitoring Costs And The Chart (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Incredible Growth Acceleration Amid LatAm Fears (Seeking Alpha) $ 🗃️

- 🌎 MercadoLibre (NASDAQ: MELI) – Uruguay HQ’d. The largest online commerce & payments ecosystem in Latin America. 🇼 🏷️

🌎 🎙️ Mercado Libre: More than the Amazon of LATAM?! (The Intrinsic Value Newsletter)

- [Just 5 minutes to read]

- Mercado Libre has an incredible track record. In fact, it’s the only public company ever to grow by more than 30% year over year for 27 consecutive quarters…That’s almost 7 years.

- But today, the pendulum has swung in the other direction. MercadoLibre (NASDAQ: MELI) trades at its lowest valuation ever on an EV-to-EBIT basis, at roughly 30x operating earnings. On the surface, that doesn’t sound cheap. But for a company growing revenues around 30%, expanding profits, and still operating in massively underpenetrated markets, it’s at the very least worth a closer look.

🌎 dLocal (The Compounder Score) (The Cash Flow Compounder)

- Incredibly efficient company with a 30% expected growth

- Dlocal (NASDAQ: DLO) is a cross-border payment platform that connects global enterprise merchants and consumers in emerging markets (EMs), where international credit cards are often not used or accepted. Through a sophisticated API, the company is able to simplify the inherent complexity of localized card processing, bank transfers, compliance, tax, and currency regulations which differs in each EM. Due to having a physical presence and regulatory licenses in ever market, it is able to offer over 900 local and alternative payment methods (APMs), essential for large, multinational clients.

- The company charges a transaction-based fee called the take rate as a percentage of the Total Payment Volume (TPV) it processes for its clients, which applies for both its collection and its disbursement services. This asset-light model provides substantial operating leverage, which may lead to strong profitability and stable margins. However, its recent focus on larger customers and more competitive markets has caused a sustained margin contraction.

- Let’s analyze the company by using The Compounder Score:

🇧🇷 Companhia Siderúrgica Nacional: Too Much Debt For Too Little Margin Of Error (Seeking Alpha) $ 🗃️

🇧🇷 Companhia Siderúrgica Nacional: Deleveraging Needs To Materialize For A Rerating (Seeking Alpha) $ 🗃️

- 🇧🇷 Companhia Siderurgica Nacional SA (NYSE: SID) – Fully integrated steel producer. 5 segments: Steel industry, mining, logistics, energy & cement. 🇼

🇧🇷 Suzano: A Few Good Reasons To Believe The Worst Is Likely Behind (Seeking Alpha) $ 🗃️

🇧🇷 Lavoro: Too Low To Sell (Seeking Alpha) $ 🗃️

- 🌎 Lavoro Ltd (NASDAQ: LVRO) – Agricultural/fertilizer inputs, soil analysis, insurance, forestry inputs/equipment, etc.

🇧🇷 Banco do Brasil: Valuation Looks Compelling, But It’s Cheap For A Reason (Seeking Alpha) $ 🗃️

- 🌐🅿️🏛️ Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY) – Oldest bank in Brazil. 🇼

🇧🇷 StoneCo Enters 2026 Cheap, With Credit Set To Drive The Next Leg Of Earnings (Seeking Alpha) $ 🗃️

- 🇧🇷 StoneCo Ltd (NASDAQ: STNE) 🇰🇾 – Fintech. Financial technology & software solutions to merchants for eCommerce.

🇨🇱 Sociedad Química y Minera de Chile: Positioned To Benefit From Geopolitical Tensions (Seeking Alpha) $ 🗃️

- 🌐 Sociedad Química y Minera de Chile (NYSE: SQM) – Lithium, potassium nitrate, iodine & thermo-solar salts. 🇼

🇲🇽 The combative billionaire challenging Mexico’s ruling party (FT) $ 🗃️

- Ricardo Salinas Pliego, one of the country’s richest men, toys with a presidential run

- There is a bigger obstacle to Salinas’s political ambitions: a huge tax bill owed by his companies dating back 16 years, estimated by government officials at up to $4.2bn.

- His companies include the broadcaster TV Azteca SAB de CV (BMV: AZTECACPO / BME: XTZA / OTCMKTS: AZTEF), the Elektra retail giant [Grupo Elektra SAB de CV (BMV: ELEKTRA / FRA: GE7C)] and a bank, Banco Azteca, as well as a brokerage, insurance company, pension fund, motorcycle maker and consultancy.

🇲🇽 America Movil Not Getting Its Due, But Also Lacks Obvious Buyers (Seeking Alpha) $ 🗃️

- 🌎 America Movil SAB de CV (NYSE: AMX) – Leading Latin America telecommunication service provider. 🇼 🏷️

🌐 Global

🌐 Emerging markets are a better gauge of investors’ mood than gold (FT) $ 🗃️

- US moves on Greenland may have boosted traditional havens such as precious metals but the developing world is on a roll

- Emerging market specialist Ashmore last week reported the first quarterly net inflow into its funds in more than four years and pointed to investor jitters over the US.

🌐 No consistent dollarization or de-dollarization trend (The Asset) 🗃️

- US currency has waxed and waned over the past 60 years, BIS study finds

- A new study by the Bank for International Settlements ( BIS ) has found no “consistent dollarization trend” after looking at the US currency’s share of international debt securities issued over the past six decades.

- “The dollar’s dominance has waxed and waned over time rather than rising or falling,” it says.

- Instead, the authors – four economists from the bank’s Monetary and Economic Department – observe several “dollarization waves” over the period, “belying narratives about both rising dollar dominance and de-dollarization”.

- Published on January 22, the study [Dollarization Waves: New Evidence from a Comprehensive International Bond Database] finds that the value of international debt securities ( bonds listed or registered in or following the legal covenants of financial markets outside where the issuer resides ) rose from US$2 billion in 1970 to US$30 trillion in 2024 – US$6 trillion more than the outstanding cross-border loans of banks in BIS reporting countries.

🌐 Nebius Is Past The Narrative Phase (Seeking Alpha) $ 🗃️

🌐 Nebius Is My Number One Stock For 2026, But Not For The Reason You Think (Seeking Alpha) $ 🗃️

🌐 Nebius: I Was All Wrong About AI Infrastructure Demand (Upgrade) (Seeking Alpha) $ 🗃️

🌐 Nebius: When Betting The Farm Leads To A Surge (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

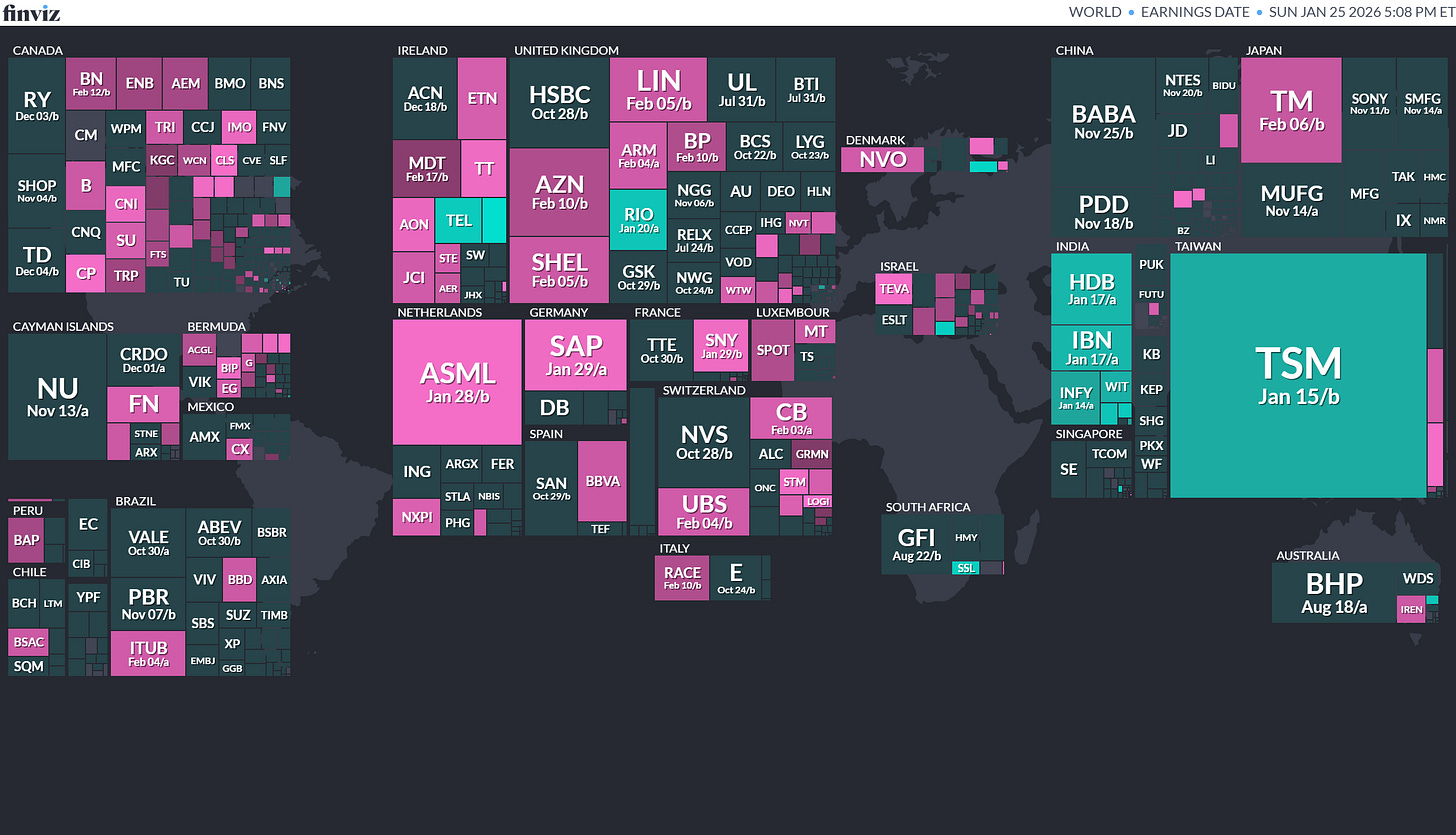

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

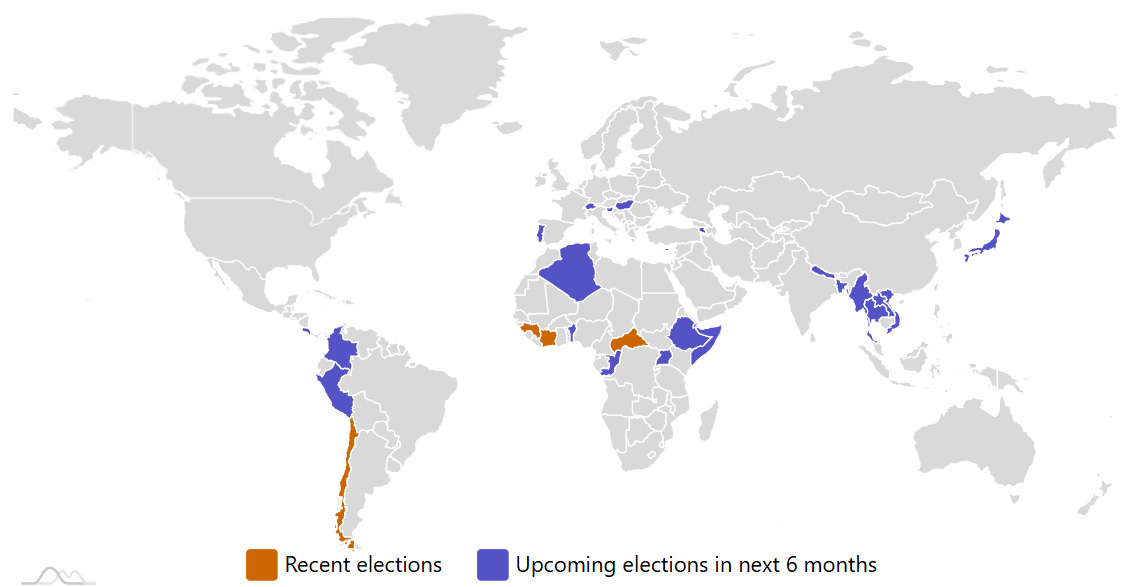

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Thailand Thai House of Representatives 2026-02-08 (t) Confirmed 2023-05-14

- Thailand Thai House of Representatives 2026-02-08 (t) Confirmed 2023-05-14

- Bangladesh Bangladeshi National Parliament 2026-02-12 (d) Confirmed 2024-01-07

- Bangladesh Referendum 2026-02-12 (d) Confirmed

- Colombia Colombian Senate 2026-03-08 (d) Confirmed 2022-03-13

- Colombia Colombian House of Representatives 2026-03-08 (d) Confirmed 2022-03-13

- Slovenia Slovenian National Assembly 2026-03-22 (t) Confirmed 2022-04-24

- Peru Peruvian Congress of the Republic 2026-04-12 (d) Confirmed 2021-04-11

- Peru Peruvian Presidency 2026-04-12 (d) Confirmed 2021-04-11

- Hungary Hungarian National Assembly 2026-04-30 (t) Date not confirmed 2022-04-03

- Cyprus Cypriot House of Representatives 2026-05-31 (t) Date not confirmed2021-05-30

- Colombia Colombian Presidency 2026-05-31 (t) Date not confirmed 2022-06-19

- Morocco Moroccan Chamber of Representatives 2026-09-30 (t) Date not confirmed 2021-09-08

- Czech Republic Czech Senate 2026-09-30 (t) Date not confirmed 2024-09-27

- Russian Federation Russian Federal Duma 2026-09-30 (t) Date not confirmed 2021-09-19

- Brazil Brazilian Federal Senate 2026-10-04 (d) Confirmed 2022-10-02

- Brazil Brazilian Chamber of Deputies 2026-10-04 (d) Confirmed 2022-10-02

- Brazil Brazilian Presidency 2026-10-04 (d) Confirmed 2022-10-30

- Israel Israeli Knesset2026-10-27 (d) Confirmed 2022-11-01

- Bulgaria Bulgarian Presidency 2026-11-30 (t) Date not confirmed 2021-11-21

- Bahrain Bahraini Council of Representatives 2026-11-30 (t) Date not confirmed 2022-11-12

- Viet Nam Vietnamese National Assembly 2026-03-15 (d) Confirmed 2021-05-23

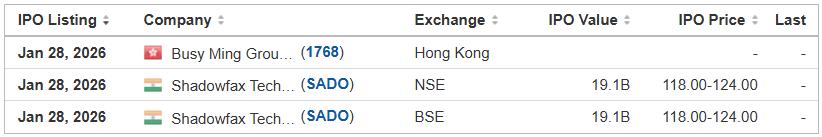

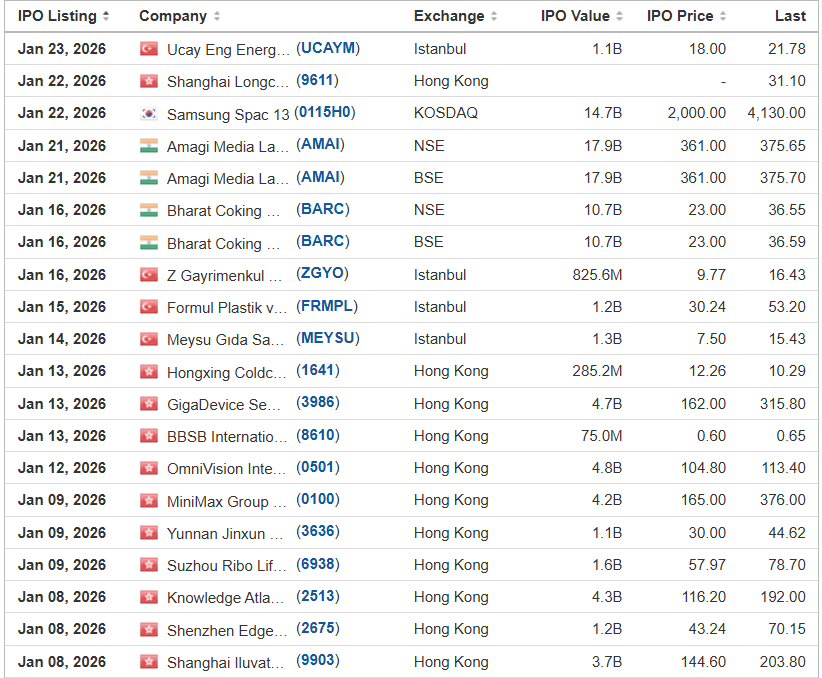

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Picpay Holdings Netherlands B.V. PICS Citigroup/BofA Securities/RBC Capital Markets/Mizuho/Wolfe Nomura Alliance, 22.9M Shares, $16.00-19.00, $400.1 mil, 1/29/2026 Thursday

(Incorporated in The Netherlands)