Caixin has a recent behind the paywall piece (Analysis: China’s Great Savings Migration Gains Steam) with the following summary that seems to indicate the Chinese stock market may be poised for some new domestic inflows:

A review of historical trends indicates that the probability of a new migration of household deposits is high. China has witnessed seven such migrations in its history, with notable flows into the stock market occurring in 2009 and 2014–2015. Several conditions that triggered past migrations are now in place.

These triggers include cuts to deposit interest rates, which began in 2022; an expansion of liquidity, with the monetary policy stance shifting from “prudent” to “moderately loose”; the initial emergence of profitable assets, evidenced by the Shanghai Composite Index’s 25% rise since the Sept. 24 new policy; and policy catalysts, such as the ban on “manual interest rate subsidies” and a new rule allowing 30% of new insurance premiums to be invested in A-shares.

On the other hand, Douglas Research Insights has noted that Koreans have been exiting local stocks to pile into the MAG7 with the question being when will they return home (7 Main Reasons Driving Surging Ownership into MAG7 Stocks by Korean Investors: When Will They Sell?):

In this insight, we discuss the sharp capital flight out of Korea into major stocks in the US in the past several years, especially into the MAG7 stocks.

Finally, I am traveling all next weekend and may or many not be able to do a normal Sunday post. But after that I will be able to get caught up on doing some missed posts (Yahoo! Finance charts that I normally screenshot were NOT loading at all late last week; but seem to be working fine now…), will be able to get these week ahead posts back out on Mondays, and further adding some stocks to our Frontier & Emerging Market Stock Index.

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 EM Fund Stock Picks & Country Commentaries (August 31, 2025) Partially $

- China/Indonesia trip reports, Chinese biotech breakthroughs/solar power/bonds, great wall of [Chinese] liabilities, shale’s long goodbye, the world of luxury supply chains, more AI reality checks, etc

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🌏 Asia

🌏 APAC family offices double down on private markets (The Asset) 🗃️

- Next-gen allocating capital with higher risk appetite, longer time horizon, and preference for alternatives

- Asia-Pacific’s family offices are maturing and scaling fast, diversifying broadly, and leaning heavily into private markets. What was once a niche domain of hyper-affluent families is now a rapidly expanding investment class reshaping how capital is allocated in the region.

- According to UK-based financial data group Preqin’s latest report, Family Offices in APAC 2025, the number of family offices in the region has grown sixfold since 2019. Today, one in four of the world’s family offices is based in Asia-Pacific, a significant rise from 17% to 22% of the global share.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Shandong Trip Report – Finding value amid sawdust and subsidies (Pyramids and Pagodas)

- From baijiu diplomacy to boardroom arbitrage, and finding a potential outperformer in China’s bloated wood panel board industry

🇨🇳 China’s stock market outpaces global peers as local investors pile in (FT) $ 🗃️

- CSI 300 has rallied more than US and European indices this year, even as foreign investors stay away

🇨🇳 Analysis: China’s Great Savings Migration Gains Steam (Caixin) $

- A review of historical trends indicates that the probability of a new migration of household deposits is high. China has witnessed seven such migrations in its history, with notable flows into the stock market occurring in 2009 and 2014–2015. Several conditions that triggered past migrations are now in place.

- These triggers include cuts to deposit interest rates, which began in 2022; an expansion of liquidity, with the monetary policy stance shifting from “prudent” to “moderately loose”; the initial emergence of profitable assets, evidenced by the Shanghai Composite Index’s 25% rise since the Sept. 24 new policy; and policy catalysts, such as the ban on “manual interest rate subsidies” and a new rule allowing 30% of new insurance premiums to be invested in A-shares.

🇨🇳 Alibaba (BABA): Q1 2026 Earnings Review (Coughlin Capital)

- After being written off quarter after quarter, it finally feels like sentiment is starting to turn.

- Alibaba (NYSE: BABA) reported results this morning, and for the first time in a long while, the stock actually reacted the way it should.

- Shares jumped more than 12%—the biggest post-earnings move we’ve seen in years. After being written off quarter after quarter, it finally feels like sentiment is starting to turn.

- On the surface, the numbers weren’t great. Revenue for the June quarter was RMB 247.7 billion (~$34.6 billion), up just 2% year-over-year and a bit below expectations. Adjusted profit also missed, weighed down by continued investment in quick commerce. But if you back out businesses they’ve sold, revenue growth was closer to 10%. And GAAP net income still came in strong—up 76% to RMB 42.4 billion (~$6 billion)—helped by some investment gains.

🇨🇳 Alibaba (BABA, 9988HK): June Quarter, Actually 2-Digit Growth, To Win Price War (Smartkarma) $

- The de facto total revenue increased by 10% YoY excluding two disposed shopping malls.

- We believe Alibaba (NYSE: BABA) will win the price war for food deliveries, because competitors’ earnings were even worse.

- The stock surged by 13% in NYSE after the result release, but we still believe it has an upside of 48% for next twelve months.

🇨🇳 Pinduoduo (PDD): Cheap for a Reason (Coughlin Capital)

- PDD Holdings (NASDAQ: PDD) or Pinduoduo is the kind of stock that, on paper, should be a layup.

- It’s growing faster than Alibaba, JD, and nearly every other Chinese internet platform. Profits are healthier, the balance sheet keeps swelling with cash, and it has managed to turn Temu—once dismissed as a cash-burning stunt—into a legitimate global business with traction in the U.S. and Europe.

- All of that should be rewarded. And yet, the stock is cheap. Not just cheap compared to global comps like Amazon or MercadoLibre (NASDAQ: MELI), but cheap even against other “out-of-favor” Chinese names.

- Alibaba (NYSE: BABA) and Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY) already trade at cheap multiples, and JD screens even lower. But that’s the strange part. Pinduoduo is growing circles around all of them, yet the market values it like it’s in the same bucket.

- Why?

🇨🇳 Is Pinduoduo a ghost ship, or a well-captained warship aiming for 5x growth in the next five years? (Johnny’s bearish Investing)

🇨🇳 Meituan drives to Brazil in search of growth, only to crash into Chinese rival DiDi (Bamboo Works)

- The two Chinese internet giants have sued each other in South America’s largest nation over unfair competition related to their food delivery businesses

- Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) and DiDi Global (OTCMKTS: DIDIY) filed lawsuits against each other in Brazil this month as both look to build up food-delivery operations in the country

- The move to Brazil is part of both companies’ efforts to expand overseas as they seek relief from their fiercely competitive home market

🇨🇳 Meituan (3690 HK): Down 12% After 2Q25 – What Spooked Investors? (Smartkarma) $

- Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) shares fell 12.5% post – 2Q2025 results, reflecting investor concerns over prolonged subsidy wars and lack of visibility on when rational competition may resume.

- 2Q 2025 revenue growth lagged the pace of delivery transaction growth as incentives sharply reduced effective revenue capture while rising marketing costs nearly wiped out quarterly profit.

- Along side the rapid growth in China’s instant delivery market, where groceries and daily essentials are delivered in 30 minutes or less, competition among leading retail/delivery players have escalated.

🇨🇳 Trip.com (9961HK, TCOM): 2Q25, Stock Surged On Release Day, But Still 24% Upside (Smartkarma) $

- The stock price surged by 7.7% on the 2Q25 release day.

- Total revenue increased by 16% YoY in 2Q25 among which accommodation reservation revenue increased by 21% YoY.

- The operating margin was stable at a level significantly higher than the period before COVID.

🇨🇳 ZTO waits for ebb of ‘race to the bottom’ in struggle to balance revenue, profits (Bamboo Works)

- The logistics provider’s profit fell in the first half of 2025 as rising costs and falling prices outweighed growing parcel volume

- ZTO Express (NYSE: ZTO)’s parcel volume increased 17.7% year-on-year to 19.85 billion pieces in the first half of 2025, as its market share rebounded to 20.8%

- The logistics company’s profit for the six-month period fell 2.6% to 3.93 billion yuan, while its gross margin tumbled from 32% to 24.8%

🇨🇳 BYD misses quarterly earnings forecasts due to supplier payments crackdown (FT) $ 🗃️

BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF)

- Chinese carmaker’s revenues also affected by Beijing’s campaign against discounting which has cooled EV price war

🇨🇳 BYD exports Thai-made EVs to Europe amid local glut (Caixin) $

- Chinese electric-vehicle giant BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) has begun exporting cars from its new factory in Thailand to Europe, as automakers grapple with a production glut in the local Thai market.

- On Monday, BYD Auto (Thailand) Co. Ltd. announced the first shipment of more than 900 Dolphin hatchbacks from its Thai facility. The vehicles are destined for Germany, Belgium and the Netherlands.

🇨🇳 Lenovo: Multiple Growth Drivers And Operating Flexibility Support A Higher Share Price (Seeking Alpha) $ 🗃️

- 🌐 Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF) 🇭🇰 – Designing, manufacturing & marketing consumer electronics, PCs, software, servers, converged & hyperconverged infrastructure solutions, etc. 🇼

🇨🇳 Foxconn challenger Luxshare offers up its $42 billion empire to foreign investors (Bamboo Works)

- The contract manufacturer, one of Apple’s top China partners, has filed for a Hong Kong IPO that could reportedly raise nearly $3 billion

- Luxshare Precision Industry (SHE: 002475) has filed for a Hong Kong IPO to complement its current Shenzhen listing, reporting its profit grew 31% in the first quarter to 3.4 billion yuan

- The contract manufacturer, whose clients include Apple, has also been growing through acquisitions, including its recent purchase of German car cable manufacturer Leoni

🇨🇳 Chinese AI chipmaker Cambricon posts record profit as Beijing pushes pivot from Nvidia (FT) $ 🗃️

- Revenues rise 44-fold on surging demand for homegrown semiconductors

- Chinese AI chipmaker Cambricon Technologies Corp (SHA: 688256) posted a record profit in the first half of the year, as it benefits from a surge in demand from companies including ByteDance for domestically made semiconductors to replace Nvidia’s chips.

🇨🇳 In Depth: Cambricon tops China’s market as domestic AI chip drive creates a new billionaire (Caixin) $

- Cambricon Technologies Corp (SHA: 688256) , a Chinese semiconductor firm seen as a future rival to Nvidia Corp., has seen its share price soar 468% over the past year amid a national push for tech self-sufficiency.

- Since July, Cambricon’s Shanghai-listed shares have jumped more than 130%, briefly overtaking liquor giant Kweichow Moutai (SHA: 600519) on Wednesday to become China’s most valuable stock. The company now boasts a market capitalization of 579.3 billion yuan ($81 billion), more than 20 times its valuation at its July 2020 initial public offering (IPO).

🇨🇳 The Chinese gadget maker taking on Tesla and Apple (FT) $ 🗃️

🇨🇳 NetEase: Can Its Latest AI Innovation Propel It Into the Next Era of Gaming Leadership? (Smartkarma) $

- NetEase (NASDAQ: NTES)‘s second quarter financial results for 2025 illustrate a mixed yet promising outlook for the company.

- The broad performance metrics highlight both robust areas of growth and certain challenges the company continues to face.

- Key revenue drivers include the gaming and related value-added services (VAS) segment, which saw a 14% increase year-over-year, buoyed by solid returns from existing game franchises and successful new game launches like “Where Winds Meet” and “Marvel Rivals.” Notably, the company’s expertise in offering diverse gaming experiences and its strategic global expansion have positively influenced revenue growth.

🇨🇳 Shengjing Bank (2066 HK): Dire Straits, Dire Offer Price (Smartkarma) $

Shengjing Bank Co Ltd (HKG: 2066 / FRA: 6SY)

- HK$1.32/Share, a 15.79% premium to undisturbed, and a massive 86.49% discount to NAV. For a rural commercial bank privatisation, there is nothing pretty in those numbers.

- Even the Offers for Bank of Jinzhou (HKG: 0416 / FRA: 2JI) and Jilin Jiutai Rural Commercial Bank (HKG: 6122) were pitched (slightly) higher, from a P/NAV standpoint. And both were perennially suspended.

- This is privatisation via a voluntary offer, NOT a privatisation via a Merger by Absorption. As such there is scheme-like vote AND a 90% tendering condition.

🇨🇳 Anta Sports (2020 HK): 1H25, Revenue Up by 14% with “Other Brands” Up by 61% (Smartkarma) $

- ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) acquired Jack Wolfskin in April 2025 so that “other brands” revenues surged by 61% YoY in 1H25.

- The margin pressure came from e-commerce promotion and product function development.

- We conclude an upside of 18% and a price target of HK$120. Buy.

🇨🇳 Golden Throat (6896 HK) (Asian Century Stocks) $

Golden Throat Holdings Group Co Ltd (HKG: 6896)

- China’s leading lozenge maker at 10x P/E and a 10% dividend yield

🇨🇳 Despite stellar results, Mixue gets investor cold shoulder as delivery wars wind down (Bamboo Works)

- Analysts are calling the leading bubble tea chain’s revenue and profit gains unsustainable as its takeout delivery partners pledge to cut back on discounts and voucher.

- MIXUE Group (HKG: 2097 / OTCMKTS: MXUBY)’s shares slid by 15% in the week after the leading ice cream, fruit and tea drinks chain reported strong revenue and profit growth in the first half of 2025

- A price war among China’s takeout delivery companies that helped to fuel the growth of Mixue and its rivals is coming to an end, signaling slower gains ahead

🇨🇳 China East Education feasts on growing demand for skilled workers (Bamboo Works)

- The leading provider of vocational education services posted 10% revenue growth in the first half of the year, as its profit jumped nearly 50%

- China East Education (HKG: 0667 / FRA: ZX3)’s revenue rose 10% in the first half of this year, more than twice as fast as its growth rate over the previous two years

- The company is benefitting from a growing preference among young Chinese for vocational training, which is also getting strong support from Beijing

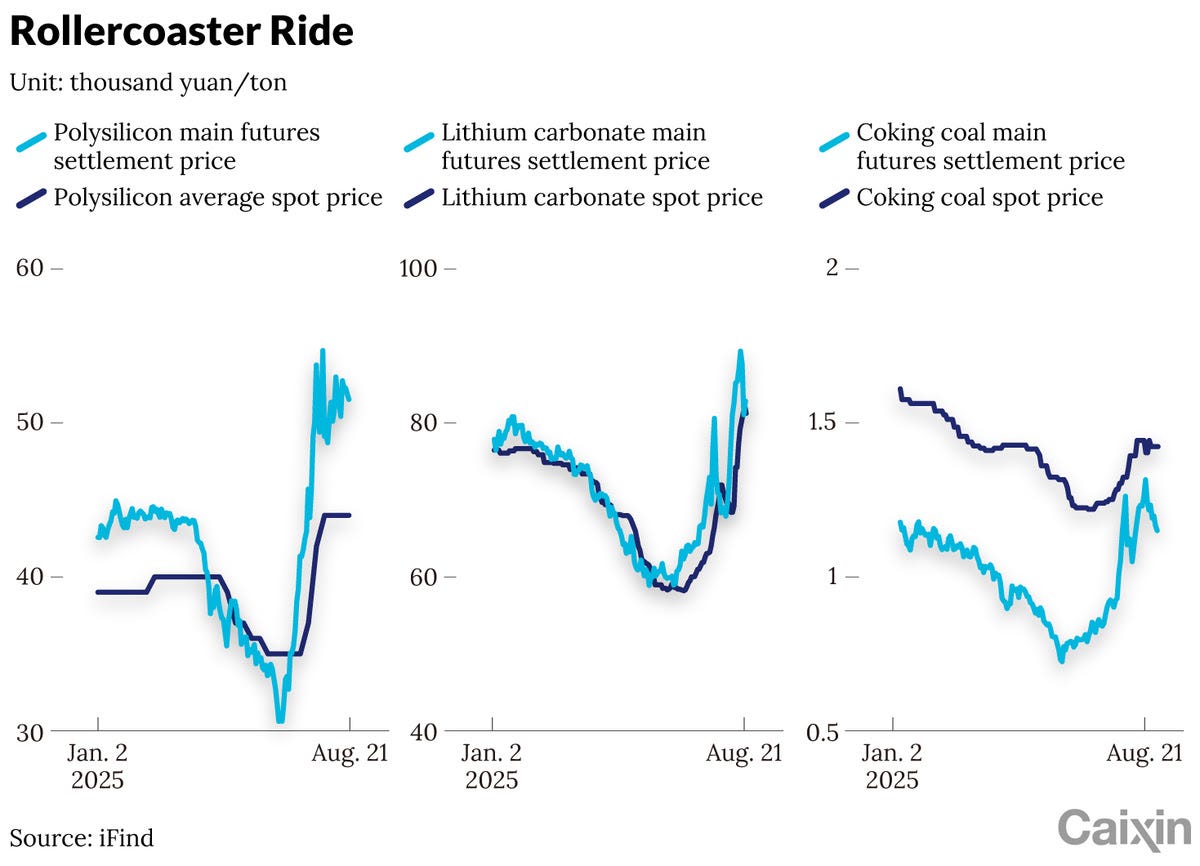

🇨🇳 In Depth: Policy bets send Chinese commodities on a rollercoaster ride (Caixin) $

- A speculative frenzy has gripped China’s commodity futures markets, creating breathtaking volatility as prices for key industrial materials such as lithium and polysilicon surge and collapse in a matter of days.

- Fortunes are won and lost overnight. On Aug. 18, one investor betting against lithium carbonate was wiped out, losing 16 million yuan ($2.2 million) and ending up millions in debt to his broker. Meanwhile, another trader turned 22 million yuan into a spectacular 280 million yuan in three weeks, only to see 200 million of that profit evaporate four days later.

🇨🇳 Investor gold rush burnishes profits at Zhaojin Mining (Bamboo Works)

Zhaojin Mining Industry Company Limited (HKG: 1818 / FRA: ZVL / OTCMKTS: ZHAOF)

- The mining company’s profits more than doubled in the first half of the year, boosted by a safe-haven rally on the gold market, but risks remain for investors

- The miner’s net profit for the six months surged 160%, but some analysts had been anticipating an even bigger jump

- A surge in impairment losses and other expenses took some of the shine off the earnings figures

🇨🇳 Laopu Gold Placement – Relatively Small Deal, past One Did Well (Smartkarma) $

- What seems to be the controlling shareholder of Laopu Gold Co Ltd (HKG: 6181), aims to raise around US$250m via selling 1.6% of the company.

- The shares have done very well since its listing and the previous deal in the name did well too.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

🇨🇳 Daqo looks to new government campaign to revive slumping solar sector (Bamboo Works)

- The leading polysilicon maker said its prices continued to fall to well below production costs in the second quarter as it produced at just a third of capacity

- Daqo New Energy (NYSE: DQ)’s revenue tumbled 66% in the second quarter and its polysilicon production fell by a similar 60%, as it produced at just 34% of capacity

- The company and its peers hope a new government campaign to promote “high quality development” will help to curb cutthroat competition in the solar sector

🇨🇳 ATRenew pumps up revenue, profits on leaner recycling (Bamboo Works)

- The company’s revenue grew 32% in the second quarter, its fastest rate in two years, as it stepped up an aggressive expansion of its offline store network

- ATRenew (NYSE: RERE)’s revenue grew at its fastest pace in two years and its profit approached a record high in the second quarter

- The recycling company’s stock now trades at a three-and-a-half-year high, following a 57% rally since the start of the year

🇨🇳 Legend Biotech’s 136% Sales Surge Signals Explosive CARVYKTI Momentum; How Long Will It Last? (Smartkarma) $

- Legend Biotech (NASDAQ: LEGN)‘s second quarter of 2025 was marked by significant milestones and notable financial and operational achievements, balanced by some ongoing challenges.

- On the positive side, the company reported substantial growth in CARVYKTI sales, reaching $439 million, an increase of 136% year-over-year.

- This robust growth underscores the rapid uptake of CARVYKTI, primarily driven by its expansion in second to fourthline settings for multiple myeloma treatments.

🇨🇳 Precision cancer drugs show promise for Kelun-Biotech (Bamboo Works)

Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. (HKG: 6990)

- The company reported rising sales of its signature cancer drug and could get national insurance coverage for other key products, potentially boosting full-year earnings

- Topline revenue actually fell in the first half of the year, but investors chose to focus on the positives, including around $43 million in sales of a newly launched antibody-drug conjugate

- Cash reserves and financial assets jumped in the six months, bolstering the firm’s capacity to promote existing drugs and develop other novel treatments

🇨🇳 AstraZeneca bounces back from scandal in China (FT) $ 🗃️

- Pharma group has installed new leadership in the country and pledged $2.5bn for a Beijing R&D centre

- Since Leon Wang’s arrest last October during a probe of alleged illegal drug sales, the UK-listed company has installed new local leadership, launched an employee incentive scheme and pledged $2.5bn for a Beijing research and development centre — the centrepiece of a strategy aimed at stabilising its China business.

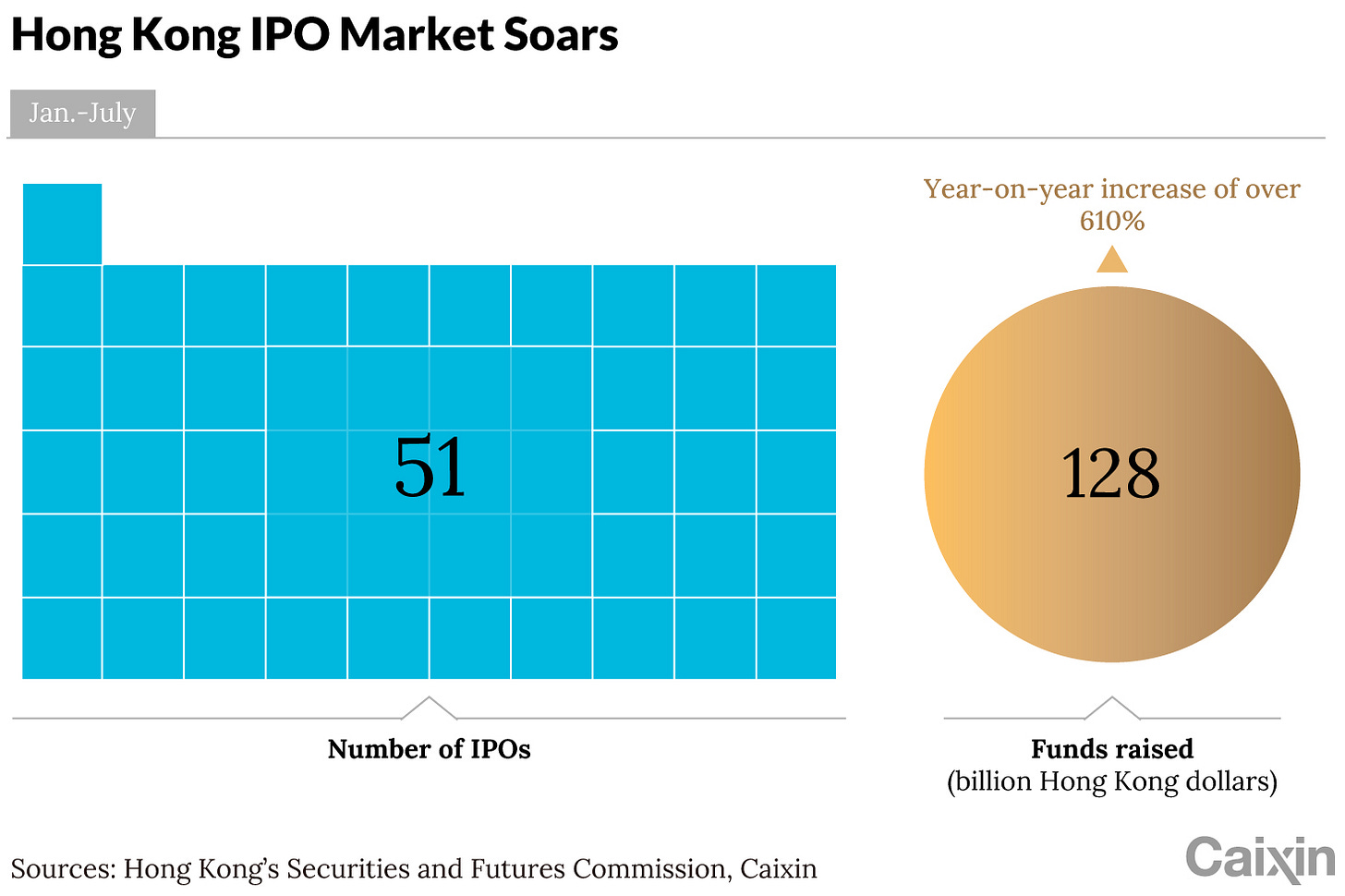

🇨🇳 🇭🇰 Chart of the Day: Mainland firms cement Hong Kong’s hold on IPO top spot

- Hong Kong has reaffirmed its leading position in the global IPO market this year, with funds raised in the first seven months jumping over 610% year-on-year, driven by Chinese mainland companies attracted by its review efficiency and market stability amid rising geopolitical tensions.

- A total of HK$128 billion ($16.4 billion) was generated from 51 IPOs in the period, according to a Wednesday statement published by the city’s Securities and Futures Commission. The proceeds underpinned Hong Kong’s rise to the top spot globally by funds raised in the first half of this year.

🇭🇰 Shin Hwa World Ltd 1H loss widens year-on-year, as revenue falls 22pct (GGRAsia)

- Hong Kong-listed Shin Hwa World Ltd (HKG: 0582), promoter of Jeju Shinhwa World (pictured in a file photo), a resort with a foreigner-only casino on the South Korean holiday island of Jeju, widened its net loss for the first half by 5.6 percent year-on-year.

- The loss was just below HKD244.4 million (US$31.4 million) in the first six months of 2025, compared with a loss of HKD231.5 million a year earlier, according to a Thursday filing.

- Revenue for the first half of this year stood at just below HKD410.4 million, down 21.8 percent year-on-year.

- The firm said one reason for the worsening results was a decline in revenue from the group’s integrated resort and gaming businesses, “due to the pressure on [hotel] room prices and dampened customer spending during the period”. Another factor impacting the group’s earnings was a decrease in the fair value of investment properties compared with the corresponding period in 2024.

🇭🇰 LET Group reports 1H profit up 69pct y-o-y just before delisting (GGRAsia)

- Casino investor LET Group Holdings (HKG: 1383) reported a profit attributable to its equity holders of HKD99.5 million (US$12.8 million), up 69.0 percent from a year earlier. Its half-year revenue rose 64.7 percent, to nearly HKD312.9 million.

- The firm saw its cost of sales for the January to June period increase by 124.5 percent year-on-year, to HKD196.7 million, it said in a filing on the final business day of its listing on the Hong Kong Stock Exchange on Friday.

- Shares in LET Group and Summit Ascent Holdings Ltd (HKG: 0102) were delisted from the Hong Kong bourse on Monday (September 1). Trading in the shares of both firms had been suspended since 2024 after they fell out of compliance with listing rules amid board member resignations.

🇲🇴 SJM’s 1H loss widens as revenue hits US$1.9bln, firm to spend US$68mln to buy part of Hotel Lisboa (GGRAsia)

- Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) reported total group revenue of nearly HKD14.64 billion (US$1.88 billion) for the first six months this year, up 6.1 percent from a year earlier, the company said in a Thursday filing to the Hong Kong Stock Exchange.

- First-half loss widened to HKD182.2 million, compared with a HKD162.4-million loss in the first half of 2024.

- Net gaming revenue in the six months to June 30 went up 5.7 percent year-on-year, to nearly HKD13.63 billion.

- The firm added: “By transferring certain gaming assets from satellite casinos to a central flagship location under Casino Lisboa, the group expects to generate stronger returns on these resources through enhanced gaming tables and slot machines productivity in an integrated, high-volume environment.”

🇲🇴 SJM 2Q results dragged by poor VIP hold, Casino Lisboa expansion plan little help to GGR market share: analysts (GGRAsia)

- Macau casino concessionaire SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) reported second-quarter results that were “below expectations” and on “very weak margins”, according to two different brokerages.

- The casino firm reported on Thursday group-wide revenue of nearly HKD14.64 billion (US$1.88 billion) for the first six months this year, up 6.1 percent from a year earlier. First-half loss widened to HKD182.2 million, compared with a HKD162.4-million loss in the first half of 2024.

🇲🇴 Success Universe trims 1H loss, revenue down 11pct y-o-y (GGRAsia)

- Success Universe Group Ltd (HKG: 0487), an investor in Macau casino hotel Ponte 16 (pictured), posted a net loss of just under HKD33.7 million (US$4.3 million) for the first six months of 2025. That compared with a HKD35.5-million loss a year earlier, according to a Thursday filing.

- The Hong Kong-listed company reported revenue of just under HKD29.0 million for the period, down 10.9 percent from first-half 2024.

- Success Universe added that the group’s shared profit of the associates relating to Ponte 16 stood at HKD48.5 million in the six months to June 30, down from HKD58.2 million in the prior-year period.

- Success Universe is a joint venture partner, with a unit of casino concessionaire SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY), in Ponte 16, a property at Macau’s Inner Harbour district. The gaming venue is considered a “satellite” casino of SJM Holdings.

🇲🇴 Paradise Ent announces interim dividend as profit grows to US$22mln (GGRAsia)

- Macau-based gaming equipment supplier and casino services firm Paradise Entertainment Ltd (HKG: 1180 / FRA: LIL3 / OTCMKTS: PDSSF) reported a profit attributable to its owners of just under HKD172.5 million (US$22.2 million) for the first six months of 2025. That was up 48.5 percent from the prior-year period, according to a Wednesday filing.

- The first-half result was on revenue that rose 19.4 percent year-on-year, to HKD507.9 million. Costs of sales and services increased by 7.3 percent from a year earlier, to HKD179.3 million.

- Paradise Entertainment said it expects to “report a material reduction in the reported revenue and profit attributable to shareholders after the expiry of the service agreement” with SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY).

🇲🇴 Satellite casino firm Macau Legend books US$182mln 1H loss (GGRAsia)

- Macau hotel and satellite casino services firm Macau Legend Development Ltd (HKG: 1680 / OTCMKTS: MALDF) confirmed for first-half 2025 a major loss as it had flagged earlier this month. Its loss was nearly HKD1.42-billion (US$182.3-million currently).

- The group had an impairment loss of just over HKD1.27 billion. That related to its satellite gaming operation, it stated in its half-year results filed on Friday with the Hong Kong Stock Exchange.

🇹🇼 Taiwan

🇹🇼 Taiwan Semiconductor: Ultra Bullish On Nvidia’s (Likely) B30/B30A To China (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇹🇼 Silicon Motion: Execution Outpaces Expectations As MonTitan And Mobile Drive Tactical Upside (Seeking Alpha) $ 🗃️

- 🌐 Silicon Motion Technology Corporation (NASDAQ: SIMO) – Designs, develops, & markets NAND flash controllers for solid-state storage devices. 🇼

🇰🇷 Korea

🇰🇷 7 Main Reasons Driving Surging Ownership into MAG7 Stocks by Korean Investors: When Will They Sell? (Douglas Research Insights) $

- In this insight, we discuss the sharp capital flight out of Korea into major stocks in the US in the past several years, especially into the MAG7 stocks.

- We provide seven major reasons why Koreans’ investments in the US stocks (especially MAG7) have been surging in the past several years.

- When will they sell? We provide some clues on this.

🇰🇷 Is NPS Really Going for Board Seat Play Via Cumulative Voting? Field Check on This Narrative (Smartkarma) $

- Short-Term, pinpointing exact tickers off this NPS/cumulative voting narrative is tough—activism risk is real, but predicting moves in governance-sensitive names is still premature.

- NPS may go aggressive, potentially sparking a market-wide narrative. If limited activism unwinds, Korean stocks could see a broad re-rate, beyond just individual governance names.

- Tactically, consider enhanced setups in these names under a passive framework, while closely monitoring governance developments and NPS-driven activism for actionable alpha in individual tickers.

🇰🇷 Woori Financial: Stay The Course On Korea’s Banking Laggard (Seeking Alpha) $⛔🗃️

- 🇰🇷 Woori Financial Group (NYSE: WF) – Commercial bank. Range of financial services to individual, business & institutional customers. 🇼 🏷️

🇰🇷 Robotis – Rights Offering of 100 Billion Won (Douglas Research Insights) $

- On 28 August, Robotis Co Ltd (KOSDAQ: 108490) announced a rights offering capital increase of 100 billion won.

- Rights offering plan is to allocate 1,349,528 new shares (10% of outstanding shares) to existing shareholders, and then conduct a public offering for general investors once forfeited shares are issued.

- The expected rights offering price is 74,100 won per share (12.8% lower than current price). We are Negative on this rights offering.

🇰🇷 Korea Small Cap Gem #44: Tovis (Douglas Research Insights) $

- Tovis Co Ltd (KOSDAQ: 051360) is one of the key beneficiaries of continued opening of new casinos in Asia/globally. The company provides specialty monitors for slot machines, casino gaming cabinets, and arcade/gaming machines.

- The growth of the automotive/other displays unit has been driven mostly by domestic sales which increased from 36.6 billion won in 2022 to 239.2 billion won in 2024.

- Tovis is trading at EV/EBITDA of 4.5x based on LTM financials and recent prices. This is much lower than average EV/EBITDA multiple of 12.4x from 2020 to 2024.

🇰🇷 Korean Air: A Major Rights Offering Capital Raise Likely In Next 1-2 Years (Douglas Research Insights) $

- We believe a major rights offering capital raise is likely for Korean Air (KRX: 003490 / 003495) in the next 1-2 years.

- On 25 August, Korean Air announced a 70 trillion won investment plan in the United States. This plan is likely to have been pressured heavily by the Korean government.

- A big problem with this plan is Korean Air does not produce enough cash flow and its balance sheet is not strong enough to invest such huge amounts of capital.

🇰🇷 A Merger Between HD Hyundai Heavy Industries and HD Hyundai Mipo (Douglas Research Insights) $

- It was announced today that HD Hyundai Heavy Industries (KRX: 329180) will merge with HD Hyundai Mipo Co Ltd (KRX: 010620). The merger ratio between HD Hyundai Heavy Industries and HD Hyundai Mipo is 1:0.4059146.

- HD Korea Shipbuilding & Offshore Engineering Co., Ltd. (KRX: 009540) will own a 66.29% stake in the merged entity.

- HD KSOE is proceeding with this merger of its two major subsidiaries ahead of the full-scale launch of the MASGA (“Make America Shipbuilding Great Again”) project.

🇰🇷 Hyundai Glovis: Cumulative Voting System Could Improve Corporate Governance of Hyundai Motor Group [Bullish] (Douglas Research Insights) $

- A major critical reason Hyundai Glovis (KRX: 086280) has been outperforming this year has been due to the potential passage of the cumulative voting system under second amendment to the Commercial Act.

- In addition, Hyundai Glovis’ profits have been improving. Hyundai Glovis is also expected to benefit from the continued higher use of robotics in its operations.

- The value of its Boston Dynamics is also becoming more highlighted. Hyundai Glovis currently has a 10.9% stake in Boston Dynamics.

🇰🇷 Gemvax & Kael – Rights Offering of 249 Billion Won (Douglas Research Insights) $

- On 29 August, [clinical-stage biopharmaceutical working on proprietary therapeutics for neurodegenerative diseases] Gemvax & Kael Co Ltd (KOSDAQ: 082270) (Gemvax) announced a rights offering capital raise of 249 billion won.

- Gemvax will issue 6.7 million new shares in this rights offering, representing 16% of its outstanding shares.

- The expected rights offering price is 37,100 won which is 13.4% lower than current price. We are negative on this rights offering.

🇰🇷 KT&G: Selling 57 Real Estate Properties to Generate 1 Trillion Won in Additional Cash Flow (Douglas Research Insights) $

- KT&G Corp (KRX: 033780) or Korea Tobacco & Ginseng Corporation announced that it is selling numerous properties nationwide as well as financial assets, aiming to generate about 1 trillion won in additional cash flow.

- KT&G has started to sell off a number of real estate properties in Seoul, Bundang, Daegu, Sejong, Busan, and North Chungcheong, and other parts of Korea through public bidding process.

- Four key catalysts with KT&G include an increasing probability of cigarette price hike, asset sales of non-core properties/improving corporate governance, high dividend yields, and profitable growth of core tobacco business.

🇰🇷 Increasing Probability of Hanwha Group Selling Its 8% Stake in Korea Zinc (Douglas Research Insights) $

- There has been an increasing probability of the Hanwha Group selling its stake in Korea Zinc (KRX: 010130) mainly due to increasing burden of its petrochemical affiliates.

- For now, the Hanwha Group has denied all news regarding its potential sale of stake in Korea Zinc.

- In our view, the timing of this potential sale in Korea Zinc by Hanwha Group is less likely in 2025 but could occur in 2026/2027.

🇰🇷 Alipay: Issuing EB Worth 627 Billion Won Backed By Its Shares in Kakao Pay [A Quasi Block Deal Sale] [Bearish on Kakao Pay] (Douglas Research Insights) $

- Alipay (second largest shareholder of Kakao Pay (KRX: 377300)) is issuing an overseas exchangeable bonds (EB) worth 627 billion won (backed by its shares in Kakao Pay).

- The exchange price of the EB is 54,744 won (4.5% discount to current price). Total amount of EB issue is 627 billion won ($450 million).

- This deal is basically a quasi-block deal. Alipay is trying to unload some of its stake in Kakao Pay to improve its finances.

🇰🇷 ‘Battlegrounds’ game maker extends frontline with Indian expansion (FT) $ 🗃️

- South Korea’s Krafton (KRX: 259960) faces a tough fight to wring revenues from price-sensitive players

- The South Korean games developer behind global hit PUBG: Battlegrounds is eyeing major expansion in India, hoping to capitalise on a ban on Chinese rivals in the fast-growing market.

- Krafton is seeking acquisitions there as growth slows in China and the US, the company’s India head Sean Sohn told the Financial Times. It also plans to invest at least $50mn annually in India, where its flagship title has been one of the top-grossing games in recent years.

🌏 SE Asia

🇲🇾 Malaysian Budget in trouble after Petronas profits take a tumble (Murray Hunter)

- Petronas financial report for the first half of the year to June 30, 2025 is out. Revenue has declined from RM 173.567 bil in 2024 to RM 132.563 bil in 2025. Profit after tax have decreased from RM 32.382 bil in 2024 to RM 26.192 bil in 2025, for the first semester.

- Petronas management blame the impact of exchange rates and lower than expected prices for the different. However, rising operational costs contributed to this situation, where Petronas has responded in terminating around 5,000 employees. In addition, some Petronas subsidiaries like Petronas Chemicals Bhd (KLSE: PCHEM / OTCMKTS: PECGF) recorded a RM 1.08 bil loss in Q2.

- The government expects an RM 32 billion dividend from Petronas in 2025. However, Petronas own business analysis expects subdued trading over the next year due to lower use of ‘hydrocarbons’ throughout the world.

- Petronas performance will have major implications upon the 2026 budget.

🇲🇾 RGB posts 2Q profit as revenue down nearly 5pct from a year earlier (GGRAsia)

- Malaysian casino equipment supplier and distributor RGB International Bhd (KLSE: RGB) reported a second-quarter profit attributable to its shareholders of abou MYR14.0 million (US$3.3 million), down 25.7 percent from a year earlier.

- The company reported revenue of MYR94.9 million for three months to June 30, down 4.7 percent from a year ago, according to a Wednesday filing to Bursa Malaysia.

- The company said the decline was mainly due to “weaker performance” in some “key” gaming outlets in which RGB is involved, “driven by adverse weather conditions, high jackpot payouts and the temporary closure of certain … outlets in the Poipet region in the current quarter,” stated the firm.

- RGB said in Wednesday’s filing that the group’s prospects “remain robust, bolstered by the promising market conditions, especially in … the Philippines and Cambodia”.

🇲🇾 Genting Malaysia skips interim dividend to build cash even as 2Q profit soars (GGRAsia)

- Net profit attributable to shareholders of global casino operator Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) reached MYR416.7 million (US$98.8 million) for the three months to June 30, up 406.8 percent year-on-year. It took such first-half 2025 profit to MYR489.3 million, compared to MYR140.0-million in first-half 2024.

- But the firm said in a Thursday announcement to Bursa Malaysia that its board had decided not to declare an interim dividend for the current quarter.

- “The group will continue to exercise prudent capital management to support business needs to drive growth and pare down existing debt,” it said, adding it “remains committed to delivering long-term shareholder value”.

🇲🇾 New mass casino at Genting Highlands boosts GGR after poor 1Q: Maybank (GGRAsia)

- Gross gaming revenue (GGR) at Resorts World Genting, Malaysia’s casino monopoly at Genting Highlands, seems to have grown sequentially in the second quarter “due to the new Genting Casino mass gaming floor,” said a Friday note from Maybank Investment Bank Bhd. That followed a “poor first quarter” for Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF), said the institution.

- Genting Malaysia, promoter of Resorts World Genting, reported on Thursday its results for the three months to June 30.

🇵🇭 Morgan Stanley trims 2025 EBITDA forecast for Bloomberry (GGRAsia)

- Brokerage Morgan Stanley Asia Ltd has trimmed by 25.0 percent its forecast for 2025 adjusted earnings before interest, taxation, depreciation, and amortisation (EBITDA) at Philippine casino operator Bloomberry Resorts Corp (PSE: BLOOM / OTCMKTS: BLBRF). It now expects the firm’s adjusted EBITDA to be circa PHP13.38 billion (US$235.1 million) this year, down from its previous estimate of PHP17.83 billion.

- Bloomberry’s first and flagship property is Solaire Resort & Casino (pictured) at Entertainment City in the Philippine capital. In May last year, the group launched its US$1.0-billion Solaire Resort North complex in Quezon City, outside Metro Manila.

- The casino firm reported a fortnight ago a second-quarter net loss of nearly PHP1.41 billion, on revenue that rose by 3.6 percent year-on-year, to PHP12.64 billion.

🇸🇬 Fed Rate Cuts 2025: Should You Buy Singapore REITs or Sell Bank Stocks? (The Smart Investor)

- Fed rate cuts in 2025 could spark a shift in Singapore markets. Are REITs set to rebound while bank stocks face margin pressure?

- Here’s what Singapore investors need to know about positioning between REITs and banking stocks.

- How Interest Rate Changes Impact Singapore Stocks

- Singapore REIT Performance: Winners vs Strugglers in 2025

- Singapore Bank Stock Outlook: Diverging Margin Pressures

- What Should Investors Do?

🇸🇬 3 Singapore Stocks at 52-Week Highs: Can They Go Even Higher (The Smart Investor)

- As several Singapore blue-chip stocks are hitting 52-week highs, those chasing greens in stock charts are probably grinning ear to ear.

- Three Singapore stocks are shining bright right today. Let’s get into the nitty gritty to find out more about their business and whether these highs can go even higher.

- DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF)’s largest bank, and a dominant player in key markets like Hong Kong, Greater China, and India, providing a full suite of banking, insurance, and investment services.

- A key player in Southeast Asia’s financial market, Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY), or SGX (SGX: S68) is a leading securities and derivatives hub based in Singapore.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel, with a market cap of approximately S$71 billion, is Singapore’s largest telecom operator.

🇸🇬 3 Singapore Stocks at 52-Week Lows: Bargains or Value Traps? (The Smart Investor)

- Today, we will look at Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY), StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF), and Riverstone Holdings (SGX: AP4), all of which reached their 52-week lows, and figure out if they are undervalued opportunities or traps for unsuspecting investors.

- Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY) is one of Asia’s largest agribusiness companies and owns over 1,000 manufacturing plants globally.

- StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF) is a telco that provides communications, information, and digital solutions for both consumer and corporate customers.

- Riverstone Holdings (SGX: AP4) is a Malaysia-based company that manufactures premium cleanroom and healthcare gloves.

🇸🇬 4 Singapore REITs with Overseas Properties Delivering Dividend Yields of 6.8% or Higher (The Smart Investor)

- Here are four REITs that hold overseas properties and boast dividend yields of 6.8% or better.

- Daiwa House Logistics Trust (SGX: DHLU / OTCMKTS: DHAWF), or DHLT, is an industrial REIT with a portfolio of 18 logistics properties across Japan and a property in Vietnam.

- CapitaLand India Trust (SGX: CY6U / OTCMKTS: ACNDF) formerly Ascendas India Trust, or CLINT, has a portfolio of 10 IT business parks, three industrial facilities, one logistics park, and four data centre developments, all located in India.

- Stoneweg European REIT (SGX: CWBU / OTCMKTS: CRMWF), or SERT, has a portfolio of 100+ predominantly freehold properties located in countries such as France, Germany, Poland, Denmark, and Finland, to name a few.

- Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF), or DCR, is a data centre REIT with a portfolio of 11 data centres spread across the US, Canada, Germany, and Japan.

🇸🇬 From Banking to Gaming: Sea Limited Overtakes DBS as Singapore’s Largest Company (The Smart Investor)

- Everyone in Singapore knows Shopee.

- But did you know its parent company just overtook Southeast Asia’s biggest bank?

- Shares of Sea Limited (NYSE: SE) have quietly surged past DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) to become Singapore’s most valuable company by market cap.

- The numbers tell the story: on Tuesday, Sea Limited was valued at S$143 billion, just above DBS at under S$142 billion.

- That’s a lead of roughly S$1 billion.

- It’s a remarkable shift that says as much about where investors are placing their bets as it does about these two very different companies.

- When Investors Choose Dreams Over Dividends

- Sea Limited’s Comeback Story

- DBS’s Quiet Strength

- Two Different Bets, Two Different Rewards

- Get Smart: Beyond the Headlines

🇸🇬 3 Singapore Blue-Chip Stocks Whose Share Prices Plunged After Earnings: Are They Worth a Closer Look? (The Smart Investor)

- It’s unusual for blue-chip stocks to plunge after releasing their earnings, so investors may be wondering if these three stocks could be bargains waiting to be scooped up.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering, or STE, is an engineering and technology group serving customers in the aerospace, smart city, defence, and public security sectors.

- Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF), or SCI, is an energy and urban solutions provider.

- Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF), or SIA, is Singapore’s flagship airline.

🇸🇬 Lion-Phillip S-REIT ETF: 8 Must-Know Facts To Know Before You Buy (The Smart Investor)

- Investor interest in Singapore REIT ETFs has been on the rise, with the sector attracting over S$300 million in net inflows over the past year.

- Leading the pack is the Lion-Phillip S-REIT ETF (SGX: CLR), the first and largest of its kind, which now manages more than S$585 million, as of 30 July 2025, and continues to deliver an attractive yield of close to 6%.

- But if you are thinking of buying the ETF, here are eight things that you should know:

🇸🇬 5 Small and Mid-Cap Singapore Stocks That Grew Their Revenue and Profits

- We shine the spotlight on five small and mid-sized companies that grew both their revenue and earnings during the recent earnings season.

- First Resources Ltd (SGX: EB5 / FRA: 5F1 / OTCMKTS: FTROF) is a leading palm oil producer that manages over 260,000 hectares of oil palm plantations across Indonesia.

- Frencken Group Ltd (SGX: E28) is a technology solutions company that serves customers in the aerospace, analytical life sciences, healthcare, industrial, and semiconductor sectors.

- ISEC Healthcare Ltd (SGX: 40T) provides a comprehensive suite of specialist medical eye care services and has ambulatory surgical centres located in Singapore, Malaysia, and Myanmar.

- AEM Holdings (SGX: AWX) provides comprehensive semiconductor and electronics test solutions.

- CSE Global Ltd (SGX: 544 / FRA: XCC / OTCMKTS: CSYJY / CSYJF) is a systems integrator providing electrification, communications, and automation solutions.

🇸🇬 4 Singapore Blue-Chip Dividend Stocks Reporting Higher Profits (The Smart Investor)

- We highlight four blue-chip companies that managed to increase their profits during this latest earnings season.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering, or STE, is an engineering and technology group serving the aerospace, smart city, defence, and public security sectors.

- UOL Group Limited (SGX: U14 / FRA: U1O / OTCMKTS: UOLGY / UOLGF) is a property and hospitality group with total assets of around S$23 billion.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel is Singapore’s largest telecommunications company (telco), offering a comprehensive range of services including mobile, broadband, and pay TV, as well as business-to-business services such as ICT and cybersecurity.

- City Developments Limited (SGX: C09 / FRA: CDE / OTCMKTS: CDEVY), or CDL, is a global real estate company with a network spanning 168 locations in 29 countries and regions.

🇮🇳 India / South Asia / Central Asia

🇮🇳 Indian rupee tumbles to new low on Trump tariff concerns (FT) $ 🗃️

- Stronger than forecast GDP in April to June quarter seen as cushion ahead of expected growth hit from trade war

🇮🇳 Inside India’s endless trials (FT) $ 🗃️

- By the time a Delhi court concluded one property dispute, both of the original litigants were dead

- One of the reasons for this accumulation is human resources. India has around 16 judges per million people, compared to over 150 for the US.

🇮🇳 Maruti E‑Vitara Launch: Make in India, Make for the World… (Smartkarma) $

- Prime Minister Modi kick‑started production and global dispatch of Maruti Suzuki (NSE: MARUTI / BOM: 532500)’s e‑Vitara EV with a “Make in India, Make for the World” pitch.

- It marks India’s ascent as a global EV manufacturing hub while bolstering local EV infrastructure and Japan‑India industrial synergy.

- Suzuki is investing INR 70,000 crore (~US$8 billion) over 5–6 years and targeting 50k to 1L units of EV exports each year.

🇮🇳 Ola Electric 2.0: From Scooters to Cells and Rare-Earth-Free Motors (Smartkarma) $

- Ola Electric Mobility Ltd (NSE: OLAELEC / BOM: 544225) secured Auto-PLI compliance for its Gen-3 scooters and guided first deliveries with in-house “Bharat” 4680 cells in Q2 FY26, with heavy rare-earth-free motors in Q3 FY26.

- ACC-PLI plus Auto-PLI and insourced cells/motors can lift gross margins structurally, derisk China-centric magnet supply, and shift Ola from assembler to integrated value-chain player.

- Watch PLI accrual from Q2 FY26, the 1.4→5 GWh cell ramp, and ferrite motor rollout in Q3 FY26. Execution across these will validate the “not just an EV company” narrative.

🇰🇿 Update: Kaspi Q2 2025 (KSPI) (Stock Doctor)

- Things are progressing as planned during the transition phase.

- KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS)’s growth in Q2 was in-line with management’s previous guidance (14% net income growth y/y). Although this figure might not seem impressive at first given the high inflation rate in the country (11%), there are a few metrics that suggest the future is bright. Let’s look under the hood.

- If you missed my original article on Kaspi, you can find that here:

- 38% Net Margin, PE 8, 21% growth. Kaspi is my biggest holding.

🌍 Middle East

🇮🇱 Teva’s Pivot To (Innovative) Growth: Re-Rating Should Continue (Seeking Alpha) $ 🗃️

- 🌐 Teva Pharmaceutical Industries Ltd (NYSE: TEVA) – Branded-drugs, active pharmaceutical ingredients, contract manufacturing services & out-licensing platform. 🇼

🇹🇷 TAV Airports Holding: Middle East Tension Drives Down Sentiment, Creates Buying Opportunity (Seeking Alpha) $ 🗃️

- 🌍 TAV Havalimanlari Holding AS (IST: TAVHL / OTCMKTS: TAVHF) – Turkish airport operation & services with 15 airports in 8 countries (Turkey, Croatia, Georgia, Kazahstan, Latvia, North Macedonia, Saudi Arabia & Tunisia). Part of Groupe ADP (EPA: ADP). 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🇵🇱 Dino Polska: Great Business At A Fair Price (Seeking Alpha) $ 🗃️

- 🇵🇱 Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) – Nationwide network of medium-sized supermarkets. 🇼 🏷️

🌎 Latin America

🌎 Globant: AI Demand Is Promising, But Growth Is Still Not There (Seeking Alpha) $ 🗃️

- 🌐 Globant (NYSE: GLOB) – Luxembourg HQ’d. Argentina-founded IT & software development with a presence in 25+ countries. 🇼 🏷️

🌎 $DLO’s $150M Africa Bet (Rose’s Substack)

- When I saw that Dlocal (NASDAQ: DLO) is buying AZA Finance for about $150M, my first thought was that they’re not doing this for fun. This isn’t management wasting money. They’re smart, and there’s a clear reason behind it.

- The way I see it, a lot of the big global merchants that use $DLO are telling them they want to sell in Africa. And that makes sense because, Africa has a huge, very young population, and over the next couple of decades those people are going to be spending more and more online. It would be crazy for companies not to want in on that.

- So of course those merchants are asking $DLO for access to rails in Africa. And the fastest way to do that is to buy AZA. They already has the licenses, the compliance experience, the FX infrastructure, all of that messy stuff you don’t want to start from scratch. They’ve been moving billions through their platform. Plug that into $DLO and suddenly merchants have an easy way to scale across Africa.

🌎 MercadoLibre: Growth, Profitable And Upside (Seeking Alpha) $ 🗃️

🌎 Why MercadoLibre Might Outperform The Market (Seeking Alpha) $ 🗃️

- 🌎 MercadoLibre (NASDAQ: MELI) – Uruguay HQ’d. The largest online commerce & payments ecosystem in Latin America. 🇼 🏷️

🌎 Mercado Libre: Cementing LatAm Supremacy (Business Ontology)

- $MELI Q2 2025 ER Update

- MercadoLibre (NASDAQ: MELI) delivered another solid quarter, with net revenues and financial income growing 34% year-over-year to $6.8 billion (53% FX-neutral) and gross merchandise volume up 21% to $15.3 billion (37% FX-neutral), reinforcing its position as Latin America’s e-commerce powerhouse while fueling growth in fintech.

- The company is aggressively investing in market penetration, even at the cost of short-term margins, to capture the region’s vast untapped potential—where e-commerce still represents just a fraction of retail. This aligns perfectly with the thesis I’ve outlined in my deep dives: build an unbeatable commerce moat to drive users into a sticky fintech ecosystem.

🌎 Liberty Latin America: Puerto Rico Carve-Out Not A Needle Mover (Seeking Alpha) $ 🗃️

- 🌎 Liberty Latin America Ltd (NASDAQ: LILA / LILAK) – Communications company. 20+ countries across Latin America & Caribbean (consumer brands Flow, Liberty, Más Móvil & BTC). 🇼

🇧🇶 HAL Trust: H1 results update on my largest position

- HAL Trust (AMS: HAL / FRA: HA4 / OTCMKTS: HALFF) shares have increased in value & the gap between fair value and market has increased.

- A year ago I wrote about HAL Trust. The stock has done ok, but spectacular. With this update I will update my valuation in what is now clearly my largest position at 11.9%. I increased my exposure in steps with new funds and the sale of my position in Tessenderlo Group.

🇦🇷 Transportadora de Gas del Sur: Cerri Incident Dragged Down Q2 Results, But It Still Faces Multiple Risks (Seeking Alpha) $ 🗃️

🇦🇷 Transportadora de Gas del Sur: A Rare Combination Of Stability, Profitability, And Upside (Seeking Alpha) $ 🗃️

- 🇦🇷 Transportadora de Gas del Sur Sa (NYSE: TGS) – Largest gas transportation company in Argentina + longest pipeline system in Latin America. 🇼🏷️

🇦🇷 Supervielle: Moving Forward, But Still Far From Safe Ground (Seeking Alpha) $ 🗃️

- 🇦🇷 Grupo Supervielle SA (NYSE: SUPV) – Provides a range of financial & non-financial services. 🏷️

🇦🇷 Telecom Argentina: Growth Diluted By Structural Weakness (Seeking Alpha) $ 🗃️

- 🇦🇷 🇵🇾 🇺🇾 Telecom Argentina SA (NYSE: TEO) – Leading telco & entertainment company + operations in Paraguay & Uruguay. 🇼 🏷️

🇧🇷 StoneCo Q2: No Reason To Ease Off The Gas (Seeking Alpha) $ 🗃️

- 🇧🇷 StoneCo Ltd (NASDAQ: STNE) 🇰🇾 – Fintech. Financial technology & software solutions to merchants for eCommerce.

🇧🇷 PagSeguro Is Still Growing Mid-Single-Digits Into A Challenging Cycle And Trades At 6x Earnings (Seeking Alpha) $ 🗃️

- 🇧🇷 PagSeguro Digital (NYSE: PAGS) 🇰🇾 – Financial services & digital payments. 🇼 🏷️

🇧🇷 Cemig: Hold For Now, But Brace For A Large Dividend Cut In 2027 (Seeking Alpha) $ 🗃️

- 🇧🇷🏛️🅿️ Companhia Energética de Minas Gerais (CEMIG) (BVMF: CMIG3 / CMIG4 / NYSE: CIG) – Generation, transmission, distribution & commercialization of electric energy + distribution of natural gas. 🇼

🇧🇷 Nu Holdings: Strong Growth, Profitable, Cheap P/E (Seeking Alpha) $ 🗃️

🇧🇷 From Startup To Superbank: Why Nu Holdings Still Has Room To Run (Seeking Alpha) $ 🗃️

- 🌎 Nu Holdings (NYSE: NU) – Digital banking platform / fintech. 🇼

🇧🇷 Nubank’s Valuation Update (PatchTogether Investing)

- Thesis: If Nu Holdings (NYSE: NU) simply doubles ARPAC from $12.2 → $20 over five years while keeping users flat at 122.7M and landing at a 20% net margin, the math alone implies a market cap comfortably above today’s $67.2B—before giving any credit for user growth, mix shift, or margin upside.

🇧🇷 Klabin: A Unique Play On Brazil’s Irreplaceable Value Assets (Seeking Alpha) $ 🗃️

- 🇧🇷🅿️ Klabin (BVMF: KLBN3 / KLBN11 / KLBN4 / OTCMKTS: KLBAY) – Packaging paper & sustainable paper packaging solutions. 🇼

🇨🇴 August 21, 2025 – Tecnoglass (TGLS): From Barranquilla to Sinaloa (Culper Research)

- Tecnoglass (NYSE: TGLS) CEO & COO Jose & Christian Daes Alleged to Aid Sinaloa Cartel Illicit Financing Schemes, According to Recently Leaked Intelligence Memos

- Tecnoglass “Independent” Board Members Ensnared; Memos Allege Money Laundering via Banco Serfinanza; Numerous Insiders Hold Longstanding Ties

- Tecnoglass Financial and Related Party Questions Intensify; We Identified At Least Seven Situations of Concern, e.g., Tecnoglass Claims to Pay Millions to a Shell that Had Been Dissolved Months Prior

- Tecnoglass Fallout Looms; Hector “Yogi Bear” Amaris Already Co-Operating with Authorities; Daes Associate Julio Gerlein Charged Just Days Ago

- Tecnoglass Shares Totally Divorced from Peers After Passive Index Inclusion; Daes Have Unloaded $345 Million in Stock in the Past 9 Months

🇲🇽 Grupo Aeroportuario del Centro Norte: Monterrey Hub, Cash Flow Machine (Seeking Alpha) $ 🗃️

- 🇲🇽 Grupo Aeroportuario del Centro Norte or OMA (NASDAQ: OMAB / BMV: OMA) – Operate, manage & develop 13 international airports in central & northern Mexico. 🇼 🏷️

🌐 Global

🌐 Kering H1 2025 Earnings Report (Saadiyat Capital)

Kering SA (EPA: KER / OTCMKTS: PPRUF)

- We continue to explore the likelihood of a turnaround for the luxury giant

🌐 Nebius: Deja Vu 2021, How To Spot An AI Bubble (Seeking Alpha) $ 🗃️

🌐 Nebius Group: My Update On Avride’s Fair Value (Seeking Alpha) $ 🗃️

🌐 Nebius: Animal Spirits Taking Over; Speculative Opportunity (Seeking Alpha) $ 🗃️

🌐 Nebius: The Value Opportunity Just Keeps Compounding (Rating Upgrade) (Seeking Alpha) $⛔🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 Nebius Group (NBIS): Is It Too Late to Buy? My Updated Valuation Model (MVC Investing)

- Back in January, I wrote my first Deep Dive on Nebius Group (NBIS).

- This is how it started: “I haven’t been this excited about a stock in a long time.”

- Since then, I made it my largest position at an average cost of $25.67/share, because I just couldn’t let this opportunity pass me by.

- Fast forward to August: the stock now trades above $70/share, and a lot has happened in between.

- The question I hear most often is simple: is it too late to buy? This article updates my Valuation Model to reflect the company’s latest developments.

🌐 Nebius: The AI Cloud Rocket Already Priced for Perfection (Next’s Substack)

- Explosive growth, NVIDIA backed, but already valued like a $3B, 20% margin business three years out.

- Big picture: Nebius is pushing to be the independent “AI cloud” alongside hyperscalers, lean, specialized, and priced to win developer mindshare.

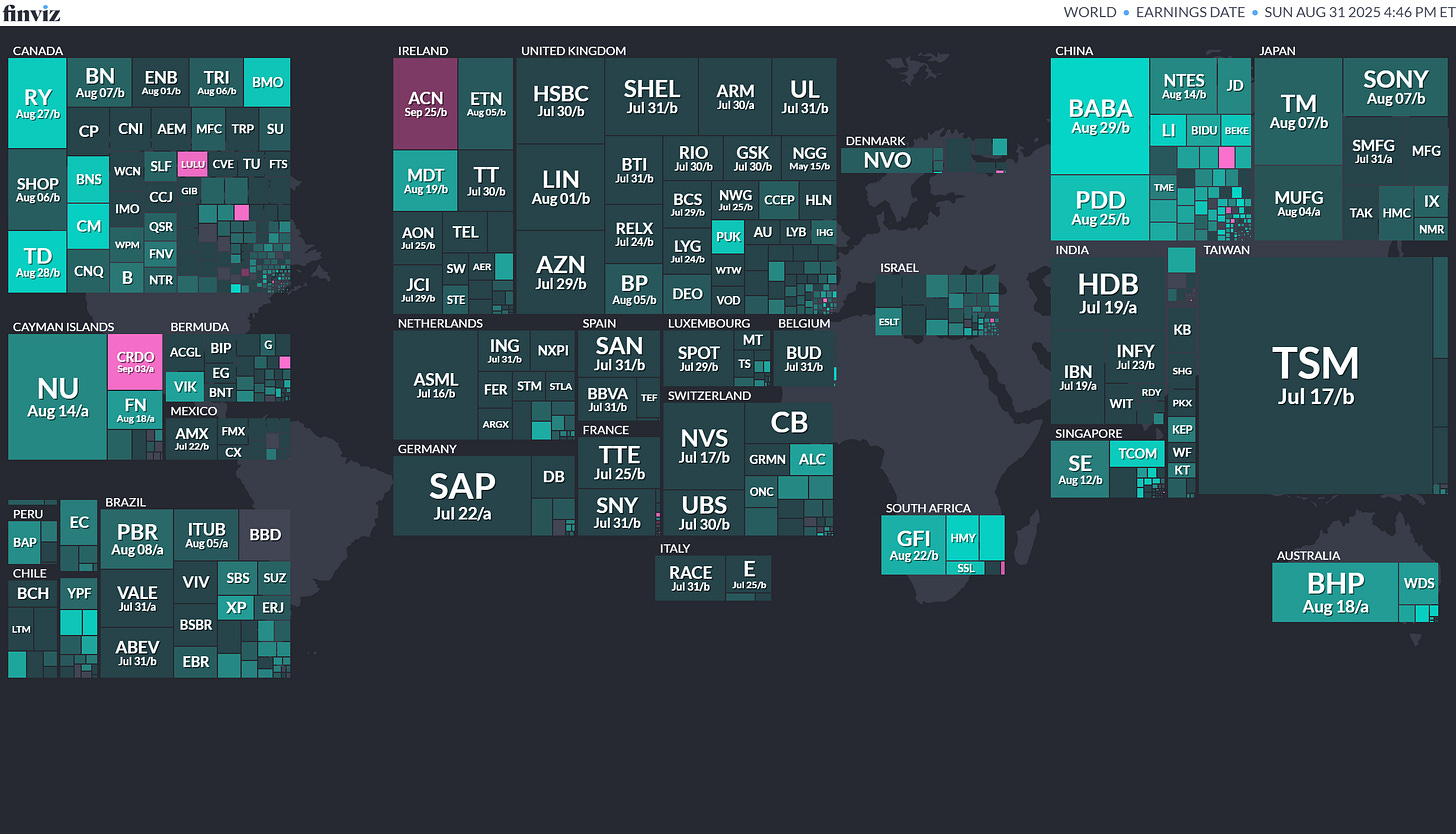

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

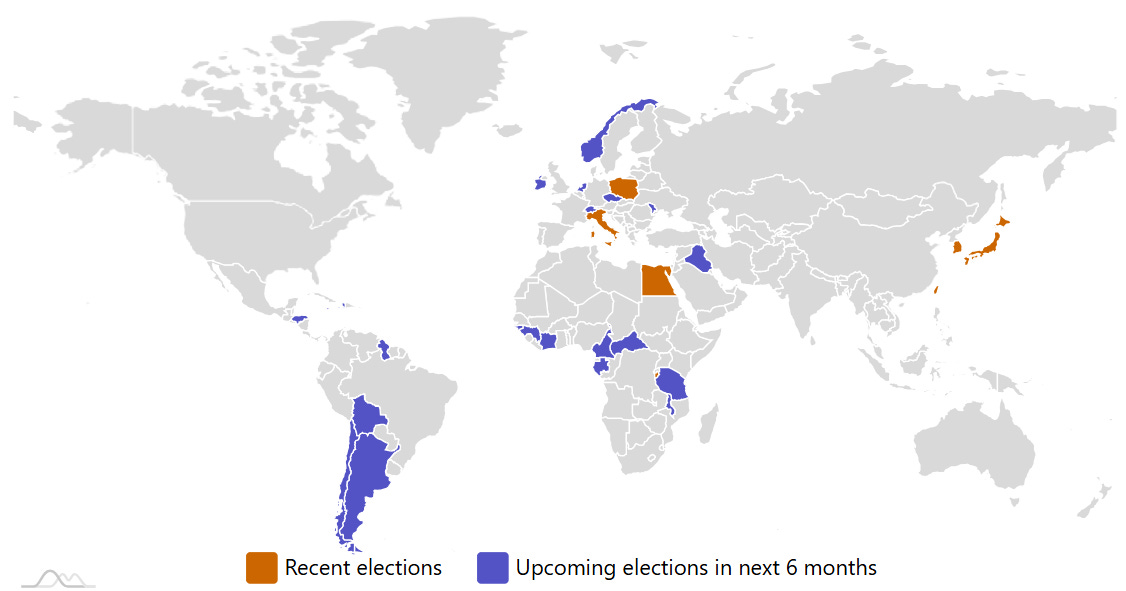

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

TaiwanReferendum2025-08-23 (d) Confirmed 2022-11-26EgyptEgyptian Senate2025-08-27 (t) Date not confirmed 2025-08-04- Macau Chinese Legislative Council (Macau) 2025-09-14 (d) Confirmed 2021-09-12

- Czech Republic Czech Chamber of Deputies 2025-10-03 (d) Confirmed 2021-10-08

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

- Argentina Argentinian Chamber of Deputies 2025-10-26 (d) Confirmed 2023-10-22

- Argentina Argentinian Senate 2025-10-26 (d) Confirmed 2023-10-22

- Iraq Iraqi Council of Representatives 2025-11-11 (d) Confirmed 2021-10-10

- Chile Chilean Chamber of Deputies 2025-11-16 (d) Confirmed 2021-11-21

- Chile Chilean Presidency 2025-11-16 (d) Confirmed 2021-12-19

- Chile Chilean Senate 2025-11-16 (d) Confirmed 2021-11-21

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

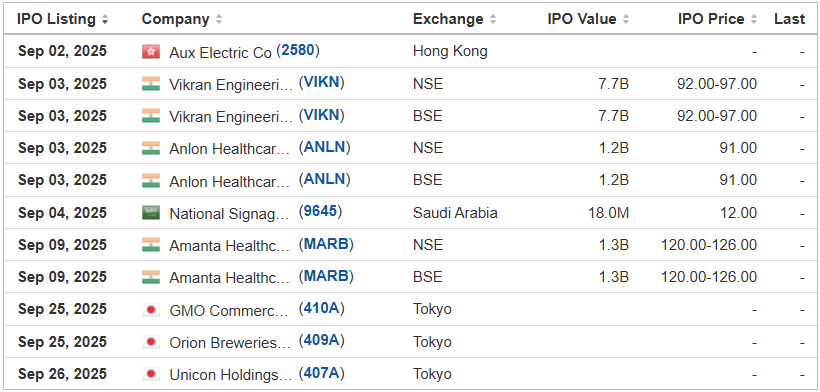

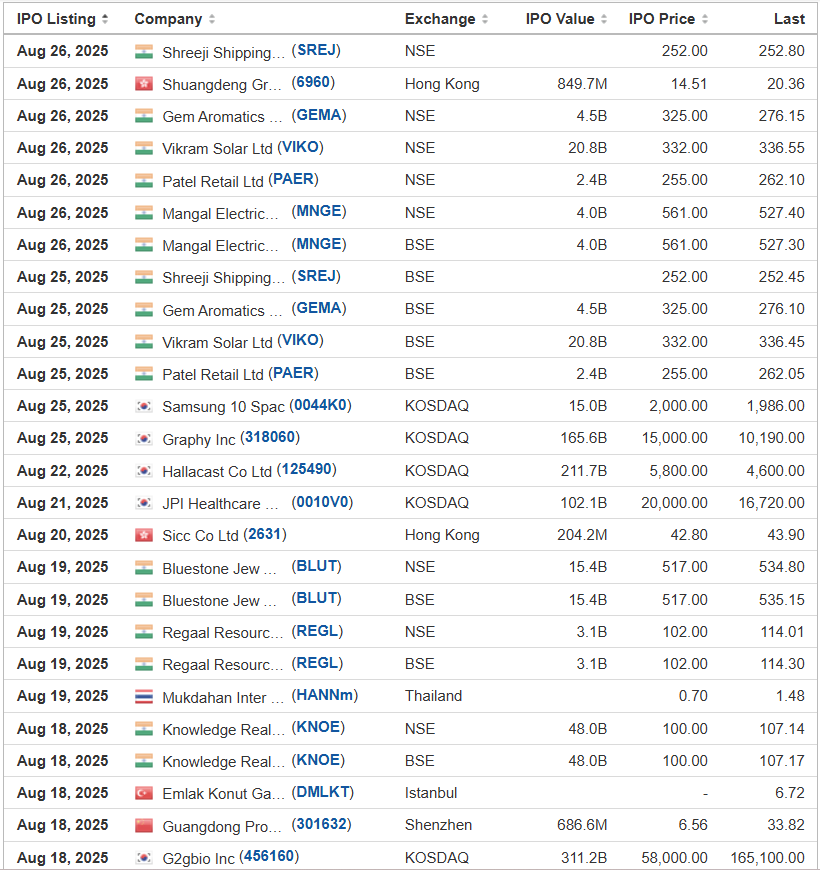

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

FG Holdings FGO Cathay Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 9/4/2025 Thursday

We are a holding company whose Hong Kong subsidiaries run a FinTech platform that provides mortgage loan brokerage services. (Incorporated in the British Virgin Islands)

We offer – through our operating subsidiaries – a FinTech platform for mortgage loan brokerage services available through private credit and banks. The company gives borrowers mortgage application simulation and access to several mortgage loan options from various lenders.

Since our inception in 2019, FG Global has helped match 528 borrowers with more than $906 million in loans. That loan volume includes $401 million for the fiscal year that ended June 30, 2024.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: Cathay Securities is the sole book-runner, according to an F-1/A filing in late June 2025.)

(Note: FG Holdings filed its F-1 on Nov. 18, 2024, and disclosed the terms for its small-cap IPO: 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million. Background: FG Holdings submitted confidential IPO documents to the SEC on Dec. 28, 2023.)

Texxon Holding NPT D. Boral Capital (ex-EF Hutton), 2.0M Shares, $4.00-5.00, $9.0 mil, 9/8/2025 Week of

We are a holding company. ((Incorporated in the Cayman Islands)

We do business through our operating subsidiary, Zhejiang Net Plastic Technology Co., which started its business in Yuyao, China, in 2011.

We offer more than 3,600 plastic and chemical SKUs. Our intention to be a one-stop shop to expedite procurement for our network of 2,213 suppliers and 3,528 customers.

We are a leading provider of supply chain management services in East China, servicing customers in the plastics and chemical industries in China. Through our technology-enabled platform, we provide a full spectrum of services to Chinese SME customers, including but not limited to, procurement, shipping and logistics, payments and fulfillment services. To address the extensive need from SMEs in China for more stable sources of supply, lower procurement costs, higher product quality, and enhanced risk management in the plastics and chemical markets in China, we aspire to build the largest one-stop plastic and chemical raw material supply chain management platform in China, to streamline the complex and labor-intensive raw material procurement process in the plastics and chemical industries and make it more convenient, cost-effective, and efficient for our customers. We believe that our platform has the capacity to help streamline and optimize operational processes of market participants, enhance sustainability and resilience in the entire supply chain, and create a dynamic ecosystem where stakeholders can engage in transactions with ease and efficiency.

Note: Net income and revenue are for the year that ended June 30, 2024.

(Note: Texxon Holding filed its F=1 on March 31, 2025, and disclosed the terms – 2.0 million shares at a price range of $4.00 to $5.00 – to raise $9.0 million.)

PomDoctor POM Joseph Stone Capital/Uphorizon, 5.0M Shares, $4.00-6.00, $25.0 mil, 9/15/2025 Week of

We run an online platform in China to provide chronic disease management services. (Incorporated in the Cayman Islands)

As of Dec. 31, 2024, PomDoctor had over 212,800 doctors (under contract) who had issued about 3.13 million prescriptions. The company had 699,000 patients (also referred to as transacting patients) as of Dec. 31, 2024.

Our mission is to provide effective prevention and treatment solutions to alleviate patients’ suffering from illnesses.

Our vision is to become the most trustworthy medical and healthcare services platform.

We are a leading online medical services platform for chronic diseases in China, ranking sixth on China’s Internet hospital market measured by the number of contracted doctors in 2022, according to Frost & Sullivan.

With focuses on chronic disease management and pharmaceutical services, our business model forms a one-stop platform for medical services, which organically connects patients to doctors and pharmaceutical products. Our experience in tackling chronic diseases can be traced back to 2015 when we launched our platform on mobile devices. We strategically chose to focus on this field because chronic diseases last at least one year by definition, and they are hard to cure, prone to complications and require ongoing medical attention. As such, patients with chronic diseases have a great and relatively inelastic demand for frequent and repeat follow-up visits and of drug purchases, which gives a competitive advantage to platforms that are able to maintain long-term, stable doctor-patient relationships.

Note: Net loss and revenue are in U.S. dollars (converted from China’s currency) for the year that ended Dec. 31, 2024.

(Note: PomDoctor disclosed its IPO’s terms in an F-1/A filing dated July 15, 2025: The company is offering 5.0 million American Depositary Shares (ADS) at a price range of $4.00 to $6.00 to raise $25 million, if the IPO is priced at the $5.00 mid-point of its range. Background: PomDoctor filed its F-1 on March 13, 2025, without disclosing the terms for its IPO. and disclosed the terms for its IPO.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- 04/02/2025 – Goldman Sachs India Equity ETF – GIND

- 03/21/2025 – FT Vest Emerging Markets Buffer ETF – March – TMAR

- 02/25/2025 – Touchstone Sands Capital Emerging Markets ex-China Growth ETF – TEMX

- 02/19/2025 – abrdn Emerging Markets Dividend Active ETF – AGEM

- 02/14/2025 – GMO Beyond China ETF – BCHI

- 02/06/2025 – PLUS Korea Defense Industry Index ETF – KDEF

- 01/04/2025 – Simplify China A Shares PLUS Income ETF – CAS

- 12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

- 11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

- 11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

- 11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

- 10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

- 09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

- 09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

- 09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

- 09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

- 09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

- 09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

- 08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

- 08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

- 07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

- 05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

- 05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

- 03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

- 03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

- 03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

- 02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

- 01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

- 01/10/2024 – Matthews China Discovery Active ETF – MCHS – Active, equity, small caps

🚽 Emerging Market ETF Closures/Liquidations

Frontier and emerging market highlights:

- 02/14/2025 – Global X MSCI Emerging Markets Covered Call ETF – EMCC

- 01/06/2025 – iShares Frontier and Select – FM

- 10/10/2024 – Pacer CSOP FTSE China A 50 ETF – AFTY

- 09/26/2024 – American Century Emerging Markets Bond ETF – AEMB

- 09/19/2024 – KraneShares S&P Pan Asia Dividend Aristocrats Index ETF – KDIV

- 09/19/2024 – KraneShares CICC China 5G & Semiconductor Index ETF – KFVG

- 09/05/2024 – Amplify Emerging Markets FinTech ETF – EMFQ

- 07/27/2024 – iPath GEMS Asia 8 ETN – AYTEF

- 05/23/2024 – Defiance Israel Fixed Income ETF – CHAI

- 05/17/2024 – Global X Next Emerging & Frontier ETF – EMFM

- 03/25/2024 – Global X MSCI Nigeria ETF – NGE

- 03/21/2024 – VanEck Egypt Index ETF – EGPT

- 03/14/2024 – KraneShares Bloomberg China Bond Inclusion Index ETF – KBND

- 03/14/2024 – KraneShares China Innovation ETF – KGRO

- 03/14/2024 – KraneShares CICC China Consumer Leaders Index ETF – KBUY

- 03/13/2024 – Xtrackers MSCI All China Equity ETF – CN

- 03/13/2024 – Xtrackers MSCI China A Inclusion Equity ETF – ASHX

- 02/16/2024 – Global X MSCI China Real Estate ETF – CHIH

- 02/16/2024 – Global X MSCI China Biotech Innovation ETF – CHB

- 02/16/2024 – Global X MSCI China Utilities ETF – CHIU

- 02/16/2024 – Global X MSCI Pakistan ETF – PAK

- 02/16/2024 – Global X MSCI China Materials ETF – CHIM

- 02/16/2024 – Global X MSCI China Health Care ETF – CHIH

- 02/16/2024 – Global X MSCI China Financials ETF – CHIX

- 02/16/2024 – Global X MSCI China Information Technology ETF – CHIK

- 02/16/2024 – Global X MSCI China Consumer Staples ETF – CHIS

- 02/16/2024 – Global X MSCI China Industrials ETF – CHII

- 02/16/2024 – Global X MSCI China Energy ETF – CHIE

- 02/14/2024 – BNY Mellon Sustainable Global Emerging Markets ETF – BKES

- 01/26/2024 – The WisdomTree Emerging Markets ESG Fund – RESE

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (September 2, 2025) was also published on our Substack.

Frontier & Emerging Market Stock Index

Emerging Market Skeptic (Website)

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Housebound Consumers Lift Lenovo to Record Revenues & Profits (HKEXnews)

- China Internet Update (KraneShares)

- Yale University Added $100M to the Vanguard FTSE Emerging Markets ETF (VWO) in 1Q2014 (P&I)

- Johnson & Johnson vs Abbott Laboratories in Emerging Markets (TheStreet)

- What the HSBC Earnings Report Tells Us About Emerging Markets (Forbes)

- Global Smartphone Shipments to Reach 1.2Bn This Year on Emerging Market Strength (Juniper Research)

- FPA Crescent (FPACX) Fund Makes Some Interesting Emerging Market Stock Bets (Kiplinger)

- Didi Ekes Out 1% Gain After New York IPO Pop Fizzles (Nikkei Asia)

- Singapore Stocks: The Edge Billion Dollar Club 2024 Award Winners

- Singapore Stocks: The Edge Billion Dollar Club 2025 Award Winners

- ZJLD Group (HKG: 6979): IPO of the First Baijiu Maker to List Outside of China Flops

- Russian Stocks Are Trading Cheaper Than Half of Their Book Net Asset Value (MT)

- Best Consumer Stocks for Emerging Market Investors (Morningstar)

- TOP Financial Group (NASDAQ: TOP): Hong Kong’s Latest Crazy Meme Stock

- Huawei Says U.S. Ban Hurting More Than Expected, to Wipe $30 Billion Off Revenue (Reuters)