Earlier today, The Duran podcast had a good discussion (Power of Siberia 2. EU faces dark, EXPENSIVE energy future) about how the EU leaders have wanted to cut out Russian gas – only for the Russians to cut out the Europeans with the Power of Siberia pipeline deals that will now power China as well as transform Mongolia (which will take Ukraine’s place and get its transit fees – potentially making the country rich or at-least less impoverished).

And there is nothing the Europeans can do in the future to get that gas back as its now contractually allocated to China – albeit at lower prices but without all the legal/regulatory headaches/interference/uncertainty EU leaders were causing. The Duran predicts things will get much much worse for Europe as now they will never be able to compete with China and Türkiye in manufacturing (or I would add, the USA for that matter…) with the Turks having even fewer reasons to look West instead of East…

The other interesting and recent piece of news for those following the digital space is the arrest of the founder of Indonesian digital giant GoTo Gojek Tokopedia Tbk PT (IDX: GOTO / FRA: CK8 / OTCMKTS: GTOFF)’s for alleged corruption when he was Indonesia’s education minister. Like Elon Musk, he apparently stepped on many toes while trying to change things in government (costing him much needed protection from the top) with Momentum Works’ blog having this interesting take that can also be applicable for other EM markets (Lessons from Gojek founder’s arrest):

What are the lessons for foreign founders and investors in Indonesia’s market? As one of our good friends in Indonesia once said: “Indonesia is not built for the outside world, nor should it be naturally that way”.

For foreign founders and investors, the message is simple: respect the market, add value, and build patiently. Success in Indonesia is possible – but only if you accept that you are also a piece on its larger chessboard.

Discipline and focus can pay off

GoTo, as the merged Gojek-Tokopedia entity, has actually improved drastically in the last two years, in terms of not only financial performance but also discipline and professionalism. The divesture of Tokopedia to TikTok Shop was a masterstroke, executed with speed and focus.

GoTo’s recent turnaround shows that discipline and focus can pay off.

Subscribe Now Via Substack

🔬 Emerging Market Stock Pick Tear Sheets

$ = behind a paywall

- 🌐 Emerging Market Stock Picks (July 2025) Partially $

- 🇰🇷 Korea – LG Energy Solution & POSCO Future M Co Ltd

- 🇹🇼 Taiwan – Minth Group Ltd & Taiwan Semiconductor Manufacturing Co Ltd

- 🇮🇩 Indonesia – Charoen Pokphand Indonesia Tbk PT, Sumber Alfaria Trijaya Tbk PT, Unilever Indonesia Tbk PT, Indosat Ooredo Hutchison Tbk PT, Vale Indonesia Tbk PT, Bank Central Asia Tbk PT, Mayora Indah Tbk PT, Mitra Adiperkasa Tbk PT, Bukalapak.com Tbk PT, PT Dayamitra Telekomunikasi Tbk (Mitratel), Astra International Tbk PT, Astra Agro Lestari Tbk PT, BFI Finance Indonesia Tbk PT, Bank Negara Indonesia (Persero) Tbk PT, Bank Jago Tbk PT, Telkom Indonesia (Persero) Tbk PT, Perusahaan Gas Negara Tbk PT, Indo Tambangraya Megah Tbk PT, Sarana Menara Nusantara Tbk PT & GoTo Gojek Tokopedia PT Tbk

- 🇲🇾 Malaysia – Frencken Group

- 🇸🇬 Singapore – Far East Hospitality Trust, CapitaLand Ascott Trust, CapitaLand India Trust, AIMS APAC REIT, Grab Holdings Ltd, Elite UK REIT, Singapore Exchange Ltd, CDL Hospitality Trusts, Sheng Siong Group Ltd, Mapletree Pan Asia Commercial Trust, Keppel REIT, CapitaLand China Trust, Singapore Airlines Ltd, Starhill Global Real Estate Investment Trust, AEM Holdings Ltd, Keppel Infrastructure Trust, ESR REIT, iFAST Corporation Ltd, Raffles Medical Group Ltd, Mapletree Industrial Trust, AKR Corporindo Tbk PT, Keppel DC REIT, OUE REIT, UMS Integration Ltd, Suntec Real Estate Investment Trust, Frasers Centrepoint Trust, Genting Singapore Ltd, Digital Core REIT, Mapletree Logistics Trust, ASMPT Ltd, Karooooo Ltd, SIA Engineering Company Ltd, Aztech Global Ltd, SEA Ltd, Frasers Logistics & Commercial Trust, Grand Venture Technology Ltd & Soilbuild Construction Group

- 🇹🇭 Thailand – Bangkok Expressway and Metro PCL, Muangthai Capital PCL, Mega Lifesciences PCL, Tidlor Holdings PCL, SCG Packaging PCL, Amata Corporation PCL, Central Pattana PCL, Home Product Center PCL, BGrimm Power PCL, Delta Electronics Thailand PCL, Osotspa PCL, PTT Exploration and Production PCL, Bangchak Corporation PCL, Bangkok Bank PCL, Global Power Synergy PCL, Kiatnakin Phatra Bank, Krung Thai Bank PCL, Kasikornbank PCL, IRPC PCL, SCB X PCL, PTT Global Chemical PCL, TMBThanachart Bank PCL, Minor International PCL, Chularat Hospital PCL, CP ALL PCL, Tisco Financial Group PCL, Praram 9 Hospital PCL, AEON Thana Sinsap Thailand PCL, Charoen Pokphand Foods PCL, KCE Electronics PCL, Bangkok Dusit Medical Services PCL, TIPCO Asphalt PCL & Thai Union Group PCL

- 🇮🇳 India – Infosys Ltd, WNS (Holdings) Ltd, HDFC Bank & ICICI Bank

- 🇴🇲 Oman – OQ Base Industries

- 🇿🇦 South Africa – KAL Group Ltd, Sea Harvest Group Ltd & Omnia Holdings

- 🇭🇺 Hungary – Wizz Air Holdings

- 🇲🇽 Mexico & Central America – America Movil SAB de CV, Alpek SAB de CV, GCC SAB de CV, Grupo Aeroportuario del Sureste (ASUR), Alsea SAB de CV, Grupo Aeroportuario del Pacífico or GAP, Arca Continental SAB de CV, Wal-Mart de Mexico SAB de CV, Fibra Monterrey SAPI de CV

📰🔬 Emerging Market Stock Picks / Stock Research

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🌏 Asia

🇯🇵 Asian Dividend Gems: Mars Group Holdings (Asian Dividend Stocks) $

- Mars Group Holdings Corp (TYO: 6419 / OTCMKTS: MNGNF) has three main business units including Amusement related (including pachinko/pachislot peripherals), Smart Solutions, and Hotels/restaurants related.

- It trades at P/E of 8.5x, P/B of 0.8x, and EV/EBITDA of 2.3x. Net cash is 48% of its market cap.

- Its sales, gross profit, and operating profit increased by 180%, 146%, and 680%, respectively from FY22 to FY25. However, it had a disappointing results in FY1Q26.

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

🇨🇳 Nasdaq Proposes Stricter IPO Rules, Raising Bar for Smaller Chinese Listings (Caixin) $

- Nasdaq is moving to tighten its listing standards, a step that could sharply limit the flow of smaller Chinese companies onto the exchange even after U.S. audit disputes have been resolved.

- In a proposal announced Wednesday, the exchange said it would raise the minimum public float and fundraising requirements for new listings, while enforcing faster suspension and delisting procedures for companies that fail to meet ongoing standards.

🇨🇳 BYD (1211 HK): Flat Sales Volume in August and Lower Margin in 1H25 (Smartkarma) $

- In August, BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF)’s total sales volume was still flat and its domestic sales volume continued to shrink.

- The operating margin declined significantly to 2.3% in 1H25 from 4.4% in 1H24.

- The P/E band suggests a downside of 23% and a price target of HK$89.00.

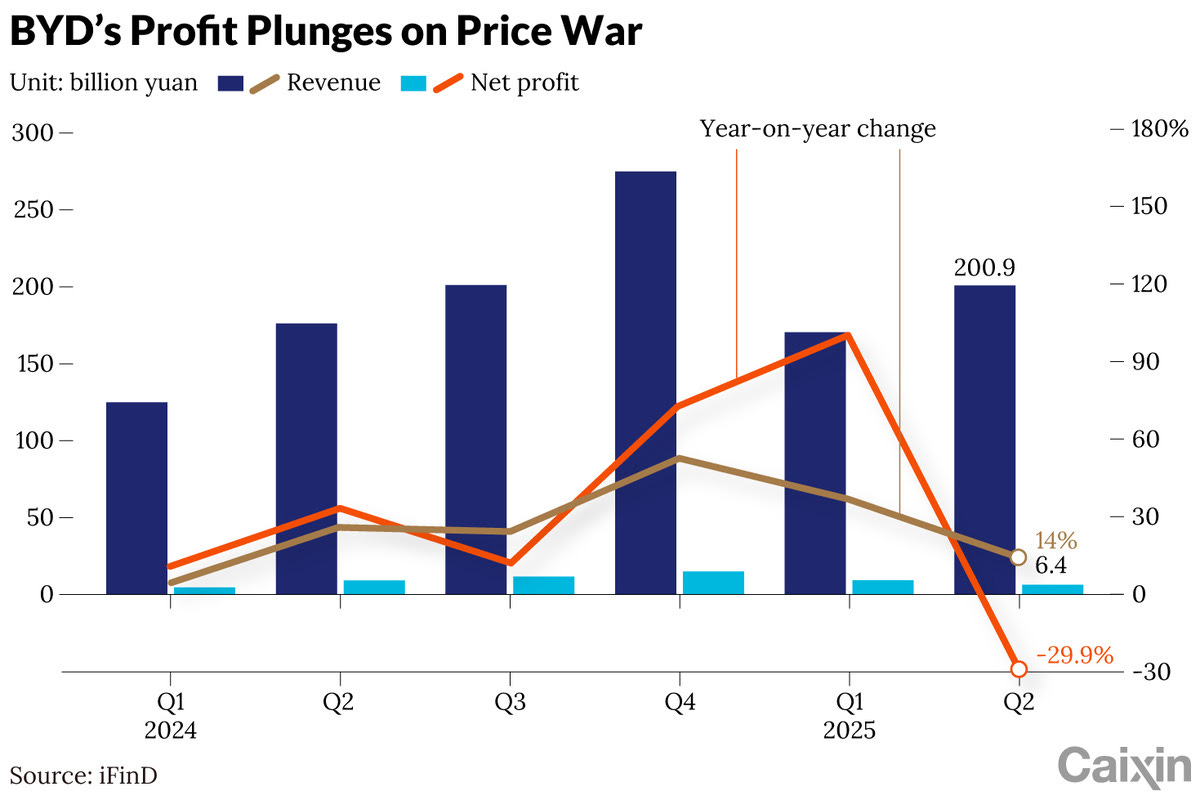

🇨🇳 Chart of the Day: Price War Takes Toll on BYD’s Profits (Caixin) $

- China’s aggressive price war has finally taken a toll on BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF), as the country’s top electric-car firm reported its first quarterly profit decline in more than three years.

- The Shenzhen-based carmaker reported a net profit of 6.36 billion yuan ($891 million) for the June quarter, down nearly 30% from a year earlier, according to data compiled by financial information provider iFinD. In the same period, revenue grew 14% to 200.92 billion yuan.

🇨🇳 Dwindling sales of luxury RVs stall New Gonow earnings (Bamboo Works)

- The Chinese motorhome maker has announced plans for a temporary retreat from the top-tier RV market after delivering weak half-year results

- New Gonow Recreational Vehicles Inc (HKG: 0805)’s revenue fell 2.4% and its net profit sank 22.4% compared with the first half of last year

- Deliveries of recreational vehicles dipped 4.2% to 1,367 units

🇨🇳 Chery Automobile IPO: The Bull Case (Smartkarma) $

- Chery Automobile (CH3456 CH), a Chinese automobile manufacturer, has secured HKEx listing approval for a US$1.5-2.0 billion IPO.

- Chery is the second largest Chinese domestic brand passenger vehicle company, and the 11th largest passenger vehicle company globally.

- The bull case rests on market share gains, encouraging NEV segmental performance, good margin profile and cash generation.

🇨🇳 Tencent Holdings: An Evergreen Game Strategy to Diversify Portfolio & Reinforce Market Position! (Smartkarma) $

- Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY) delivered a robust financial performance for the second quarter of 2025, driven by significant growth across its business segments.

- The company reported a 15% year-on-year increase in total revenue, reaching RMB 185 billion.

- This growth was supported by a 22% surge in gross profit to RMB 105 billion and an 18% increase in non-IFRS operating profit to RMB 69 billion.

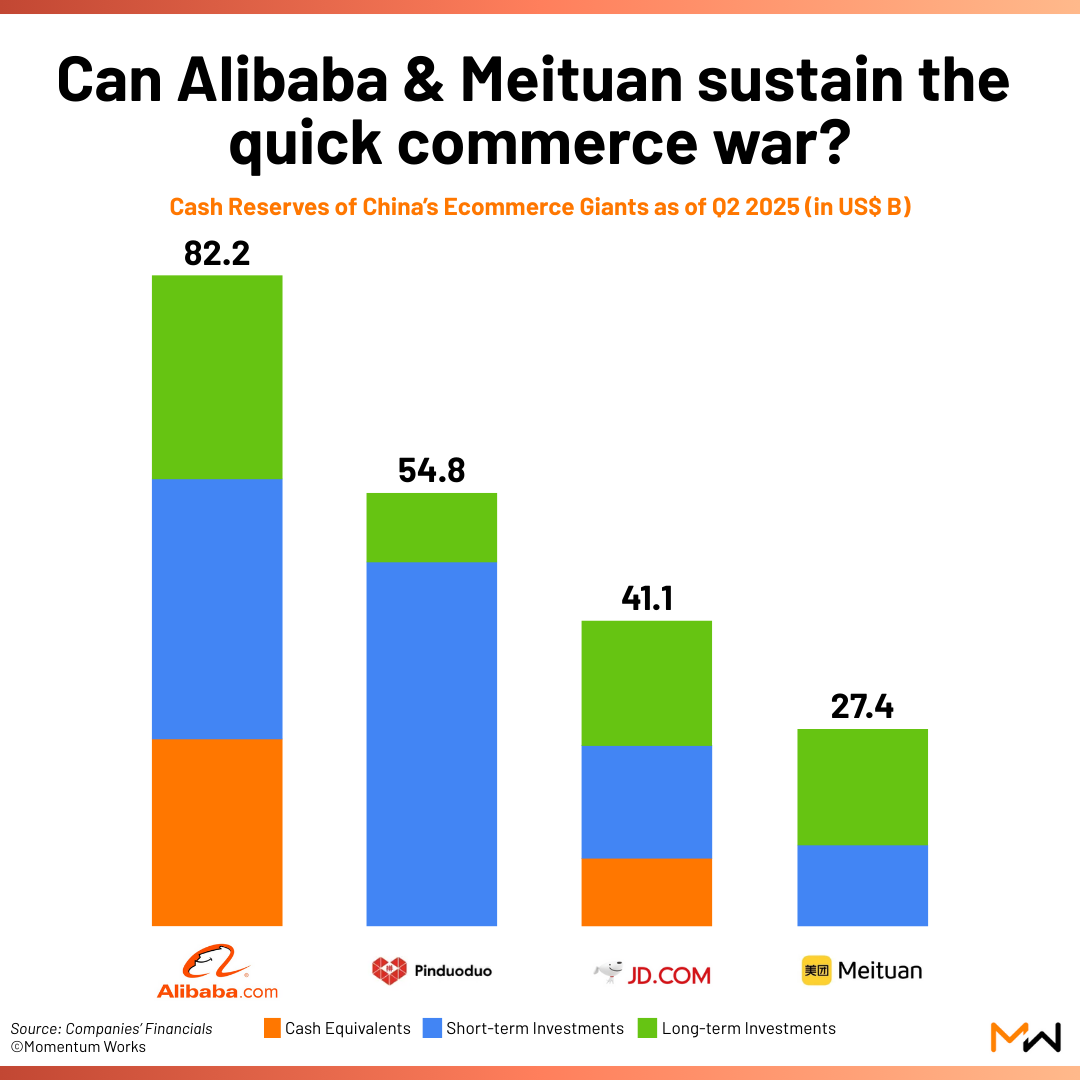

🇨🇳 The global stakes of Alibaba’s quick commerce bet (Momentum Works)

- China’s food delivery and quick commerce war does not seem to end any time soon.

- It has wiped out Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY)’s Q2 earnings (operating profit dropped by 98%), and taken a dent on Alibaba (NYSE: BABA)’s financials too.

- Considering that Alibaba only joined the war in May, and the subsidies reached peak levels only in July (i.e. Q3), Meituan is almost certainly going to report a large loss in Q3. Alibaba has announced a commitment of RMB50 billion (US$7 billion) in food delivery and quick commerce subsidies.

- With smaller than expected losses and a confident management in the earnings call, Alibaba’s share price rose more than 10% after the earnings, while Meituan’s plunged the same magnitude.

- This will have some global implications – amongst which these two are key:

🇨🇳 Alibaba (9988 HK): Stock Surges Post-Earnings, Options Market Reprices (Smartkarma) $

- Context: Alibaba (NYSE: BABA) reported Q1 results on 29 Aug. Despite a revenue miss, strong cloud growth and its AI chip announcement drove the stock up double digits.

- Highlight: Implied volatility deflated sharply post-earnings, with the September contract down 8.5% and back months also lower, while skew shifted down in parallel.

- Why it matters: Put the current volatility surface into context. This insight can serve as a case study of how earnings-driven repricing can inform positioning ahead of future events.

🇨🇳 Alibaba’s AI Chip Leap: A Threat To Nvidia’s China Dominance? (Smartkarma) $

- As geopolitical pressures and regulatory hurdles continue to stifle Nvidia’s ability to deliver its most powerful AI processors to Chinese buyers, Alibaba (NYSE: BABA) is rapidly stepping in to fill the void.

- The Chinese tech conglomerate has developed a new AI chip that is both more versatile and domestically manufactured—breaking its prior dependency on Taiwan Semiconductor Manufacturing.

- This new chip, tailored for a broad range of AI inference tasks, is currently in testing and could offer Chinese enterprises a viable alternative to Nvidia’s downgraded H20 processor, which was specifically built for the Chinese market under export restrictions.

🇨🇳 Alibaba Q2 2025: A New Chapter, or Just Another Shuffle? (The Great Wall Street) $

- Management’s tone shifted. The strategy looks clearer. But the segment reporting still smells fishy, and the real fight may just be starting.

- Something felt different this quarter.

- Alibaba (NYSE: BABA)’s tone changed. So did their posture. And a few moves suggest the story might be entering a very different phase. But it’s not all good news. There were parts of the reporting I didn’t like—and I’m also concerned about some developments we’re likely to see in the third quarter.

🇨🇳 Huitongda puts its cash to work with investment in struggling supplier

- The Alibaba (NYSE: BABA)-backed e-commerce company will pay 994 million yuan for 25% of Jin Tong Ling Technology Group Co Ltd (SHE: 300091), a maker of industrial equipment now undergoing a court-led restructuring

- Huitongda Network (HKG: 9878) will pay nearly 1 billion yuan for 25% of the struggling Jin Tong Ling, representing a steep discount to the Shenzhen-listed company’s recent stock price

- Huitongda believes Jin Tong Ling will quickly return to profitability following a quick court-led restructuring, and could become an important supplier for its e-commerce business

🇨🇳 Meituan enters open-source AI race with LongCat model (Caixin) $

- Chinese delivery giant Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) has joined the crowded field of open-source artificial intelligence (AI) models, unveiling its own system called LongCat-Flash-Chat Monday across GitHub, Hugging Face and its official website.

- The model, nicknamed “LongCat” in Chinese as “龙猫,” uses a Mixture-of-Experts (MoE) architecture with 560 billion total parameters, of which only 18.6 billion to 31.3 billion are activated at a time. While it does not feature reasoning capabilities, Meituan said LongCat-Flash-Chat delivers performance comparable to leading models while activating fewer parameters, excelling especially in agent-based tasks.

🇨🇳 DPC Dash lights up Domino’s global leader board with push into small-town China (Bamboo Works)

- The operator of Domino’s Pizza restaurants in China reported its revenue rose 27% in the first half of the year, as it opened 190 net new stores

- DPC Dash (HKG: 1405 / FRA: X12 / OTCMKTS: DPCDF) posted strong revenue and profit growth in the first half of the year, as it continued its aggressive opening of new Domino’s Pizza stores in China

- The restaurant operator opened 190 net new stores during the six-month period, bringing its total to 1,198 and putting it on track to reach its goal of 300 net new stores this year

🇨🇳 In Depth: East Buy’s Earnings Fizzle With the Exit of One Livestreamer (Caixin) $

- Chinese e-commerce company East Buy Holding Ltd (HKG: 1797 / OTCMKTS: KLTHF) may have had too many eggs in one basket.

- Plummeting sales and profits in its latest annual report reveal just how much the company had come to rely on a livestreamer who had become its public face and then parted ways with it last year after a public spat with the then-CEO.

- In the fiscal year ending May 31, the company’s gross merchandise volume (GMV) fell nearly 40% year-on-year to 8.7 billion yuan ($1.2 billion), according to its earnings report released Aug. 22. The number of paid orders on Douyin, TikTok’s Chinese cousin, was slashed in half to 91.6 million. Profit for the period collapsed by a staggering 97.5% to just 61.9 million yuan.

🇨🇳 Be Friends charts new path without famous founder (Bamboo Works)

- The livestreaming e-commerce company’s revenue rose 8.7% in the first half of 2025, as it uses a matrix-based operation model and AI to rebuild after losing its popular lead host

- Be Friends Holding Ltd (HKG: 1450) reported 8.7% revenue growth in the first half of the year, but its profit dropped a significant 32.7%

- The livestreaming e-commerce company’s gross margin tumbled from 53.8% to 43.7%, mainly due to higher traffic acquisition costs and heavier technology investment

🇨🇳 Tuya accelerates AI strategy with 93% of shipped products featuring full AI integration (Bamboo Works)

- The global cloud platform service provider is taking extensive steps to incorporate AI into tools for its developers and the hardware and apps they create

- Tuya Inc (NYSE: TUYA) said about 93% of the products shipped for use on its developer platform were equipped with AI capabilities at the end of June

- The company has developed a two-pronged strategy of using AI to assist its developers, and to improve their products connected to its platform

🇨🇳 China Tackles Price Wars As Bloated Solar Sector Amasses Huge Losses (OilPrice.com)

- China has launched in earnest the drive to curb excess capacity in the solar manufacturing sector, which has doomed many companies to price wars and deepening losses.

- The combined losses of six of China’s biggest solar panel and cell manufacturers doubled in the first half of 2025, to $2.8 billion (20.2 billion Chinese yuan), from the same period last year, the Financial Times reports, citing data from local financial information provider Wind.

- All top Chinese solar equipment producers had already booked losses for the first quarter of 2025, blaming the continued losses on low product prices and the trade and tariff turbulence under U.S. President Donald Trump.

🇨🇳 Cango sets stage for next growth phase as bitcoin competition heats up (Bamboo Works)

- The bitcoin miner outlined plans to diversify into operation of high-performance computing centers over the mid- to long-term

- Cango (NYSE: CANG) reported 1 billion yuan in revenue during the second quarter, down slightly from the first quarter, as it boosted its bitcoin mining capacity by 44% in July

- The company made its first purchase of a mining facility in August, as it seeks greater efficiencies and hones its expertise in operating high-performance computing centers

🇨🇳 Noah finds second life in overseas voyage (Bamboo Works)

- The wealth manager’s international businesses drove it back to revenue growth in the second quarter as challenges continued to linger at home

- Noah Holdings Limited (NYSE: NOAH / HKEX: 6686)’ overseas revenue increased about 6.5% year-on-year in the second quarter to drive a 2.2% increase in its overall revenue

- The asset manager launched its international expansion in 2022, targeting wealthy Chinese living overseas, extending a pivot away from ordinary investors

🇨🇳 Chinese Money Launderers Are Moving Billions Through U.S. Banks (WSJ) $ 🗃️

- Black market for U.S. cash may have driven as much as $312 billion in illicit money flows through financial institutions

🇨🇳 China Rolls Out Subsidized Consumer Loans to Boost Spending (Caixin) $

- China launched a yearlong program Monday to subsidize household consumer loans, part of a nationwide effort to cut borrowing costs and spur spending as policymakers seek to revive demand.

- Under the plan, announced by the Ministry of Finance and two other agencies, residents who take out loans at 24 designated financial institutions will receive a 1 percentage point interest subsidy from Sept. 1, 2025, through Aug. 31, 2026. The policy excludes credit cards and is limited to loans that can be verified as used for consumption.

🇨🇳 Lanvin underperforms as its signature brand loses luster (Bamboo Works)

- The luxury arm of Fosun International (HKG: 0656 / FRA: FNI / OTCMKTS: FOSUF / FOSUY) reported its revenue fell 22% in the first half of 2025, led by a 42% plunge for its core Lanvin brand

- Lanvin Group Holdings Ltd (NYSE: LANV)’s revenue fell 22% in the first half of 2025, as its gross margin fell by four percentage points and its loss widened

- The luxury arm of Fosun International forecast improvement in the second half of the year, following an overhaul that has included store closures and arrival of a new president

🇨🇳 Pop Mart (9992 HK): Index Inclusion & Beyond. Toy Craze or Emerging ACG Play? (Smartkarma) $

- Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF) will be added to both the Hang Seng Index (HSI) and the Hang Seng China Enterprises Index (HSCEI) — effective Monday, September 8, 2025.

- Beyond the tail winds from this technical upgrade, stock’s further upside rests on investor conviction on its potential to continue to deliver strong growth beyond the short term.

- Pop Mart’s near term growth rests on proving IP durability and executing global scale-up.

🇨🇳 Pop Mart International – Valuation Using Peter Lynch’s PEGY Ratio (Douglas Research Insights) $

- In this insight, we discuss Pop Mart International Group (HKG: 9992 / FRA: 735 / OTCMKTS: PMRTY / POPMF)‘s valuation using Peter Lynch’s PEGY ratio.

- If Pop Mart misses current consensus estimates in 2026 and 2027 by 5%, this would result in PEGY ratio of 1.4x in 2026 which would make current valuations unattractive.

- WE EXPECT A HIGHER PROBABILITY OF POP MART’S VALUATION DECLINING BY 50% TO ABOUT US$25 BILLION, RATHER THAN INCREASING BY $75 BILLION FROM CURRENT LEVELS OVER THE NEXT 1-2 YEARS.

🇨🇳 MINISO Group Holding: Better Growth Outlook And Capital Returns Outlook (Seeking Alpha) $ 🗃️

- 🌐 MINISO Group Holding (NYSE: MNSO) – Lifestyle products retailer who copied Japanese retail chains or brands Uniqlo, Muji & Daiso. 🇼 🏷️

🇨🇳 Luckin Coffee: Gaining Vast Market Share Where Rivals Are Slipping (Seeking Alpha) $⛔🗃️

🇨🇳 Luckin Coffee: Long Growth Runway, Undemanding Valuation (Seeking Alpha) $ 🗃️

- 🇨🇳 Luckin Coffee (OTCMKTS: LKNCY) – Brewed drinks & pre-made food & beverage items. 🇼 🏷️

🇨🇳 Midea Group(300 HK)-Firing on All Cylinders; Disciplined Execution Across Legacy &Emerging Verticals (Smartkarma) $

- Firing on All Cylinders : Midea Group (SHE: 000333 / HKG: 0300 / FRA: 1520 / OTCMKTS: MGCOF) delivered robust 15.7% YoY revenue growth and 25% profit increase in H1 2025, driven by strong domestic demand and overseas expansion.

- Disciplined Execution : Smart Home remained the largest contributor, while Energy Solutions and Intelligent Building Technology delivered fastest growth; overseas revenue rose 17.7% YoY, now 42.5% of group sales.

- Available at compelling valuation of 13.7x P/E (FY25e), Midea emphasizes R&D leadership, digital transformation, and green solutions to sustain long-term growth.

🇨🇳 Can CR Beverage turn the tide after losing brutal water fight? (Bamboo Works)

- Less than a year after its Hong Kong IPO, the bottled water maker’s revenue tanked nearly 20% in the first half of the year amid aggressive tactics by archrival Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF)

- CR Beverage (HKG: 2460)’s revenue tumbled nearly 20% in the first half of the year, as its profit slid close to 30%

- The maker of C’estbon bottled water lags far behind rival Nongfu Spring in China’s huge but also fiercely competitive beverage market

🇨🇳 Kangji Medical (9997 HK): Precondition Satisfied for the Light Scheme Offer (Smartkarma) $

- The precondition for Kangji Medical Holdings Ltd (HKG: 9997 / FRA: 50J)’s scheme privatisation from a consortium is satisfied. The offer, which has been declared final, is at HK$9.25 per share.

- The key condition will be approval by at least 75% disinterested shareholders (<10% of all disinterested shareholders rejection). Crucially, the blocking stake is below the substantial disclosure threshold.

- Despite the recent derating of peers, the vote risk remains medium-to-high due to a solid interim, the imminent surgical robot growth story, unfavourable AGM voting patterns, and emerging retail opposition.

🇨🇳 Akeso shares take a hit despite surging sales of cancer drugs (Bamboo Works)

- The maker of oncology drugs posted higher half-year revenues but a widening net loss and share sales by its founders have dented investor confidence

- Drug sales rose 49% in the first half of the year, driving a nearly 38% jump in Akeso (HKG: 9926 / FRA: 4RY / OTCMKTS: AKESF)’s total revenue

- The company said detailed analysis of a pivotal trial had shown that its lung cancer drug ivonescimab could improve patient survival rates

🇭🇰 Hong Kong Property Deals Hit Four-Year High on Hopes of Rate Cuts and Buyer Incentives (Caixin) $ (

- Hong Kong’s property market recorded its busiest start in four years, with more than 50,000 transactions registered in the first eight months of 2025, even as monthly activity cooled in August.

- Data from the Land Registry showed 50,522 property deals — spanning new and secondhand homes as well as commercial units — between January and August, up 12% from a year earlier. Residential sales alone reached 42,379, a nearly 10% increase, both marking the highest levels since 2021.

🇭🇰 Swire Pacific: From Aviation To Real Estate, But No Reason To Buy (Seeking Alpha) $⛔🗃️

- 🌐 Swire Pacific (HKG: 0019 / 0087 / OTCMKTS: SWRAY / SWRAF) 🇭🇰 – Property, aviation, beverages & food chain, marine services & trading & industrial. 🇼

🇲🇴 Macau September casino GGR likely to increase by 13pct year-on-year: brokerages (GGRAsia)

- Two investment institutions are separately forecasting September casino gross gaming revenue (GGR) in Macau to increase by about 13 percent year-on-year. This follows August’s GGR rising by 12.2 percent year-on-year, standing at nearly MOP22.16 billion (US$2.76 billion), according to data released on Monday by the city’s Gaming Inspection and Coordination Bureau.

- Deutsche Bank Securities Inc said in a note on Monday – following the announcement of August’s tally by the Macau regulator – that its September GGR forecast of US$2.45 billion represented a projected increase of 13.6 percent year-on-year, compared with an investment-industry consensus of an expected growth rate of 10.0 percent.

- In a separate note, also issued after the announcement of Macau’s August GGR result, Seaport Research Partners flagged its estimate of a 13-percent growth for September’s GGR.

- “Our estimate could be negatively impacted if any typhoons in the area impact travel into Macau,” said senior analyst Vitaly Umansky. “Last year, September was negatively impacted by two major typhoons, somewhat offset by high VIP hold.”

🇲🇴 CLSA ups 2025 Macau GGR estimate on the strength of the Chinese yuan (GGRAsia)

- Macau’s “robust momentum” in terms of casino gross gaming revenue (GGR) growth “has continued in third-quarter 2025,” and is likely to sustain through the second half this year, suggested CLSA in a Wednesday memo.

- The brokerage forecasts the Chinese yuan to strengthen further against the U.S. dollar, which it said “bodes well” for Macau’s gaming sector’s GGR growth for the remainder of the year. Other factors supporting the momentum of Macau’s gaming industry include “Industrial profitability” and a “positive stock market performance,” stated the institution.

- “We note the renminbi [Chinese yuan] has appreciated by 0.4 percent against the U.S. dollar since the beginning of July,” wrote CLSA analysts Jeffrey Kiang and Leo Pan.

- “This bodes well for the [Macau gaming] sector’s GGR growth ahead due to better outbound travel from mainland China,” they added.

🇲🇴 Jefferies raises Macau full-2025 GGR forecast to US$31.8 billion on entertainment events, player incentives (GGRAsia)

- Brokerage Jefferies Hong Kong Ltd now expects Macau casino gross gaming revenue (GGR) for full-year 2025 to reach MOP248 billion (US$31.8 billion), “which is at the high end of the market estimates range and higher than [Macau] government estimates,” it said in a memo issued on Thursday.

- Such GGR growth is expected to be driven by “rich entertainment events” and “new properties” recently available in the Macau market – namely the all-suite Capella hotel at the Galaxy Macau casino resort [Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF)] – and the completion of renovation works at The Londoner Macao.

- Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY)’s free cash flow is likely to remain negative in fiscal year 2025 due to its pledge to fund the acquisition of a portion of Hotel Lisboa (pictured) as well as two other satellite casino properties. The company’s liquidity is also “inadequate” as it is facing “material” financing needs in the next fiscal year, says a memo from Lucror Analytics, a Singapore-based specialist in credit research.

- SJM Holdings’ net debt has increased in the first half of the current fiscal year. That was in contrast to its Macau market peers, which mostly reported “stable or lower net debt”, observed Lucror Analytics, in a note carried on the Smartkarma platform.

🇲🇴 Wynn Macau Ltd completes early redemption of 5.5pct senior notes due in 2026 (GGRAsia)

- Macau casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) has completed the early redemption of its US$1.0-billion principal remaining outstanding senior notes priced at 5.500 percent which were due in 2026. The confirmation was made in a filing on Tuesday to the Hong Kong Stock Exchange.

- Wynn Macau Ltd had announced the early redemption last month.

- The company stated in its latest filing that “there are therefore no outstanding 2026 notes” and that it had applied to the Hong Kong bourse to withdraw the listing of the notes.

🇲🇴 Macau casino operator Galaxy Entertainment, UFC sign multi-event strategic partnership (GGRAsia)

- Casino resort Galaxy Macau, operated by Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF), is set to host three “UFC Fight Night” mixed martial arts events at its Galaxy Arena between 2026 and 2029. This follows the signing of a four-year multi-event strategic partnership agreement between Galaxy Entertainment and the Ultimate Fighting Championship (UFC).

- The signing was announced on Thursday in a joint press release.

🇹🇼 Taiwan

🇹🇼 US curbs TSMC’s tool shipments to China (FT) $ 🗃️

- Sending American chipmaking tools to Nanjing plant will now require US licences

🇹🇼 The TSMC Paradox: How Strength Became Weakness (Seeking Alpha) $ 🗃️

🇹🇼 3 Reasons Taiwan Semiconductor Belongs In Every Growth Portfolio (Seeking Alpha) $ 🗃️

🇹🇼 U.S. Hits TSMC China Operations: More Theatrics Than Threat (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: An Undervalued AI Winner (Seeking Alpha) $ 🗃️

- 🌐 Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) – World’s largest dedicated independent (pure-play) semiconductor foundry. 🇼 🏷️

🇰🇷 Korea

🇰🇷 KB Financial Group: An Interesting Value Play In The Financial Sector (Seeking Alpha) $ 🗃️

- 🌏 KB Financial Group (NYSE: KB) – Financial holding company. Banking, credit card, financial investment, insurance business etc. 🇼 🏷️

🇰🇷 POSCO Holdings: A Buy With External And Internal Tailwinds (Seeking Alpha) $ 🗃️

- 🌐 POSCO Holdings (NYSE: PKX) – Integrated steel producer. 6 segments: Steel, Trading, Construction, Logistics & Others, Green Materials & Energy & Others. 🇼 🏷️

🇰🇷 Jeju Dream Tower’s casino sales up 31pct y-o-y in August (GGRAsia)

- Casino sales for the promoter of Jeju Dream Tower, a resort with foreigner-only casino (pictured) on Jeju island, South Korea, rose 30.5 percent year-on-year in August, to nearly KRW42.99 billion (US$30.8 million). Last month’s tally was down 1.0 percent from July.

- Casino sales are net sales after deducting from gross sales certain items including commissions paid to agents.

- The information was given in a Monday filing to the Korea Exchange by Jeju Dream Tower’s promoter, Lotte Tour Development (KRX: 032350).

🇰🇷 US chipmaking curbs hit Samsung and SK Hynix (FT) $ 🗃️

- Shares fall after Washington revokes waivers that let South Korean groups send equipment to China without a licence

- SK Hynix (KRX: 000660) shares declined almost 5 per cent, while Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) shares shed more than 2 per cent after the US government said it was removing the companies’ “validated end user” status.

🇰🇷 Clearing up the FSS’s Sudden Call on Samsung Life’s Samsung Elec Stake Accounting Shift (Smartkarma) $

- Today’s FSS IFRS17 ruling is an accounting fix (equity vs. liability), not the Samsung Life Law, which is a regulatory cap on affiliate stakes based on market value.

- The FSS ruling signals Samsung Life Insurance (KRX: 032830) doesn’t need to treat its Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) stake as a forced-sale liability, lowering near-term sale risk.

- This eases the overhang, delays potential stake moves, and reinforces the relative underperformance setup on Samsung C&T Corp (KRX: 028260 / 02826K) highlighted in earlier posts.

🇰🇷 Alipay: Issuing EB Worth 627 Billion Won Backed By Its Shares in Kakao Pay [A Quasi Block Deal Sale] (Smartkarma) $

- Alipay (second largest shareholder of Kakao Pay (KRX: 377300)) is issuing an overseas exchangeable bonds (EB) worth 627 billion won (backed by its shares in Kakao Pay).

- The exchange price of the EB is 54,744 won (4.5% discount to current price). Total amount of EB issue is 627 billion won ($450 million).

- This deal is basically a quasi-block deal. Alipay is trying to unload some of its stake in Kakao Pay to improve its finances.

🇰🇷 Paradise Co’s casino sales upward trend extends into August (GGRAsia)

- Casino sales at Paradise Co Ltd (KOSDAQ: 034230) rose 11.7 percent year-on-year to KRW80.45 billion (US$57.7 million) in August, according to a Tuesday filing with the Korea Exchange. Measured sequentially, the August tally increased by 7.0 percent.

- August was the fourth consecutive month in which Paradise Co reported year-on-year increases in casino sales. In July, the firm’s casino sales went up by 23.0 percent year-on-year to KRW75.67 billion.

🇰🇷 Grand Korea Leisure’s August casino sales down 15pct year-on-year (GGRAsia)

- Casino sales in August at Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, stood at KRW35.08 billion (US$25.2 million), according to a Wednesday filing to the Korea Exchange.

- The August tally was down 15.0 percent from a year earlier, and down 10.0 percent from July.

- In its filing, the group did not give commentary on the reasons for the decline.

🇰🇷 LS Cable – To Issue an EB Worth 400 Billion Won Using LS Marine Solution as Base Asset? (Douglas Research Insights) $

- Major major local media including Maekyung Business Daily and Chosun Daily have reported that LS Cable & System is pushing forward with an EB worth 400 billion won.

- The target stock to be used in the EB is LS Cable‘s shares in its subsidiary LS Marine Solution (KOSDAQ: 060370).

- LS Marine Solution is one of the largest marine engineering companies in Korea, specializing in the installation and maintenance of submarine cables, offshore wind infrastructure, and marine energy systems.

🇰🇷 A Block Deal Sale of 1.4 Trillion Won of Hanwha Ocean Shares by Hanwha Impact Partners (Douglas Research Insights) $

- Hanwha Impact Partners sold 1.4 trillion won worth of Hanwha Ocean (KRX: 042660) shares in a block deal sale.

- Hanwha Ocean’s share price closed down at 5.4% to 112,500 won on the KRX exchange today but still 5% higher than block deal price of 107,100 won.

- We believe that this block deal sale of 1.4 trillion won worth of Hanwha Ocean is likely to have a near-term negative impact on Hanwha Ocean’s stock price.

🇰🇷 SK Chemicals: A Potential EB Issue of 240 Billion Won Using Its Stake in SK Bioscience (Douglas Research Insights) $

- Hankyung Business Daily reported today that SK Chemicals Co Ltd (KRX: 285130 / 28513K) is pursuing an issuance of exchangeable bonds (EB) worth 240 billion won using its stake in SK Bioscience (302440 KS).

- SK Chemicals has not officially announced its plans to issue such EB which is likely to have a positive impact on SK Chemicals and negative impact on SK Bioscience.

- SK Chemicals’ market cap is now 1.1 trillion won. Its 66.4% stake in SK Bioscience Co Ltd (KRX: 302440) is worth 2.6 trillion won.

🇰🇷 Harim Holdings – EB Issue of Its Treasury Shares for 143 Billion Won (Douglas Research Insights) $

- Harim Holdings Co Ltd (KOSDAQ: 003380) announced that it plans to sell its 14.744 million treasury shares through an issuance of EB worth 143 billion won.

- The EB exchange price is 9,713 won (15.6% higher than its current price). The company plans to use the EB proceeds to pay down debt and for working capital.

- We are NEGATIVE on Harim Holdings’ EB issue using its treasury shares as the main asset to be exchanged.

🇰🇷 POSCO: Reviewing a Potential M&A of HMM (Douglas Research Insights) $

- The biggest potential M&A event right now in Korea is the potential acquisition of HMM (KRX: 011200) by POSCO Holdings (NYSE: PKX).

- Overall, we believe there is a higher probability of POSCO backing out of this potential acquisition of HMM, rather than POSCO completing this M&A deal.

- Although POSCO claims that it spends about 3 trillion won annually on logistics, the actual synergies among these three businesses (steel, rechargeable battery, and logistics) remain murky.

🇰🇷 Klarna IPO Valuation Analysis (Douglas Research Insights) $

- Klarna is getting ready to complete its IPO on the New York Stock Exchange.

- Klarna is offering 34.3 million shares at $35 to $37 per share. At the high end of the IPO price range, the company would be able to raise $1.27 billion.

- Our base case valuation is 5.4% lower than the low end of the IPO price range. Given the lack of upside, we have a Negative View of the Klarna IPO.

🌏 SE Asia

🇮🇩 Lessons from Gojek founder’s arrest (Momentum Works)

- Former education minister and founder of GoTo Gojek Tokopedia Tbk PT (IDX: GOTO / FRA: CK8 / OTCMKTS: GTOFF) Nadiem Makarim was detained by Indonesian investigators on 4 September.

- He was named as a suspect in the investigations of the US$600m Chromebook procurement case that happened during his tenure as education minister. Investigator Nurcahyo Jungkung Madyo said the case involved violation of Indonesia’s anti-corruption law.

- Nadiem left his post as Gojek founder CEO in 2019 to serve as education minister under president Joko Widodo’s 2nd term. Many observers placed a lot of hope in that cabinet to drive modern changes in Indonesia’s politics.

- What are the lessons for foreign founders and investors in Indonesia’s market? As one of our good friends in Indonesia once said: “Indonesia is not built for the outside world, nor should it be naturally that way”.

- For foreign founders and investors, the message is simple: respect the market, add value, and build patiently. Success in Indonesia is possible – but only if you accept that you are also a piece on its larger chessboard.

- Discipline and focus can pay off

- GoTo, as the merged Gojek-Tokopedia entity, has actually improved drastically in the last two years, in terms of not only financial performance but also discipline and professionalism. The divesture of Tokopedia to TikTok Shop was a masterstroke, executed with speed and focus.

- GoTo’s recent turnaround shows that discipline and focus can pay off.

🇲🇾 Malaysia Still Living Beyond Its Means, Though Less Recklessly (Murray Hunter)

- Malaysia’s fiscal position is often dressed up in comforting words: consolidation, discipline, resilience. Strip away the jargon and the picture is starker. The government is still living beyond its means—though not as recklessly as before.

🇲🇾 Signs of a major economic slowdown in Malaysia (Murray Hunter)

- If you listen to the mainstream media, the economy is being painted as robust. There are very few economists talking about an economic slowdown and barely anyone mentioning the word ‘recession’. The government is giving all appearances that the upcoming budget (being prepared now) will be a ‘steady as we go’ one, with no talk of the potential economic dangers ahead.

- The 2025 GDP forecast is still between 4-4.5 percent growth, and all of us are reading stories about strong exports, FDI, and domestic consumer demand.

- However, behind all this ‘wishful thinking’ are signs that tell a different story. FDI is being pulled out at a phenomenal rate, consumer spending is weakening, and there are some doubts manufacturing and exports will continue at the same rate as it did in the first half of 2025. The government will be very restricted in the strategies that can be applied that could alleviate some of the problems at hand. The impression is given the budget will still carry a deficit of around RM90-110 billion, although this may be party covered up on budget night, as it was last year (estimated at RM 80 billion for 2025).

🇵🇭 Public revenue generated from online gaming sector a main funding support for Philippines’ social causes: Pagcor (GGRAsia)

- The Philippine Amusement and Gaming Corp (Pagcor), the country’s casino regulator, has stressed the importance of public revenue derived from legal online gaming activities in funding education, health care, and community development initiatives across the country.

- Online gaming has been one of the “biggest revenue drivers” for the Philippines’ authorities, stated Pagcor in a report to the House Committee on Games and Amusements, a standing committee of the country’s House of Representatives.

- Last month, members of the Philippines’ Senate began discussing stricter regulation of the country’s online gambling sector. The Philippines’ central bank ordered providers of electronic wallets (e-wallets) and other digital payment systems to remove links that provided access to online gambling platforms in the country.

🇵🇭 Suntrust to take on minority role as it eyes agreement with Travellers group regarding completion of Manila complex (GGRAsia)

- Suntrust Resort Holdings Inc (PSE: SUN), the developer of the LETX Resort, a casino hotel at Westside City in the Philippine capital Manila, plans to reach an agreement with some third parties in a bid to “expedite the completion” of what it described as the “now-expanded” Westside integrated resort project.

- In a Monday filing to the Philippine Stock Exchange, Suntrust said its board of directors authorised the company to “pursue a strategic working agreement” with a number of companies, including Travellers International Hotel Group Inc.

- The casino property being developed by Suntrust, dubbed LETX Resort (pictured in an artist’s rendering), uses the gaming licence of Travellers International, the latter a unit of Philippine conglomerateAlliance Global Group (PSE: AGI / OTCMKTS: ALGGF / ALGGY).

🇵🇭 Suntrust confirms US$56 million share subscription as part of plan to ‘expedite completion’ of Westside project (GGRAsia)

- Suntrust Resort Holdings Inc (PSE: SUN), the developer of the LETX Resort – a casino hotel at Westside City in the Philippine capital, Manila –, says it has subscribed to 400 million common shares of Westside Bayshore Holding Corp (WBHC), representing a 40 percent stake in the firm. This was part of a plan announced on Monday, aiming to “expedite the completion” of what it described as the “now-expanded” Westside integrated resort project.

- In a filing to the Philippine Stock Exchange on Thursday, Suntrust stated that the share subscription had taken place the previous Saturday (August 30) at a price of PHP8.00 (US$0.14) per share, amounting to a total consideration of PHP3.20 billion, equivalent to approximately US$56.0 million.

🇸🇬 CreditSights raises concerns over Genting Singapore’s ability to stay competitive (GGRAsia)

- Credit and market research provider CreditSights Inc says it is “concerned” that Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) “may be facing some structural challenges in its ability to stay competitive” in the city-state’s casino market.

- Genting Singapore is the operator of Resorts World Sentosa (pictured), one of Singapore’s two casino resorts, the other being Marina Bay Sands, promoted by a unit of Las Vegas Sands (NYSE: LVS). Genting Singapore is a subsidiary of Malaysian conglomerate Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY).

- “We grow concerned that Genting Singapore may be facing some structural challenges in its ability to stay competitive, seeing Marina Bay Sands’ robust results and Genting Singapore’s deteriorating mass-market share,” wrote CreditSights analysts Lakshmanan R. and Jonathan Tan Jun Jie in a note published on Monday.

- They were referring to the first-half results of Genting Singapore and those of Marina Bay Sands.

🇸🇬 3 Singapore Stocks That More Than Doubled Their Dividends (The Smart Investor)

- It’s dividends galore for these three stocks that managed to increase their dividends by more than 100%.

- Here are three Singapore stocks that more than doubled their dividends during the latest earnings season.

- APAC Realty Ltd (SGX: CLN) is a real estate services provider which holds the exclusive ERA regional master franchise licence for 17 countries and territories in the Asia Pacific region.

- Bumitama Agri Ltd (SGX: P8Z) manages close to 190,000 hectares of oil palm plantation in Indonesia and operates 17 mills with a processing capacity of 6.99 million tonnes annually.

- PropNex (SGX: OYY) is Singapore’s largest real estate agency with more than 13,000 salespersons.

🇸🇬 Top 3 Worst-Performing Blue-Chip Stocks in August (The Smart Investor)

- If the business is performing well, why did the stock prices fall?

- The Straits Times Index (SGX: STI) increased by 2.2% in August 2025.

- But not every stock joined the rally.

- A few big names ended up at the bottom of the pack.

- Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF), Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering, and CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF) all reported solid numbers for the first half of the year.

- Yet their share prices slid last month.

- Let’s break down why.

🇸🇬 Top 3 Best Performing Singapore Blue-Chip Stocks in August (The Smart Investor)

- Three unlikely blue-chip winners emerged in August, highlighting the market’s diversity.

- “A shipbuilder, a contract manufacturer, and a telco walked into a bar.”

- It sounds like the setup to a joke, but in August, this unlikely trio turned out to be the month’s best-performing Singapore blue-chips.

- While most Singapore investors celebrated the Straits Times Index‘s (SGX: ^STI) modest 2.2% gain in August, shareholders of three blue-chip giants had even more reason to pop the champagne.

- Yangzijiang Shipbuilding Holdings (SGX: BS6 / FRA: B8O / OTCMKTS: YSHLF), Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF), and Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel didn’t just beat the market; they crushed it, delivering returns that were four to seven times higher than the broader index.

- These standout performances came amid diverse tailwinds: a shipbuilding boom, resilient tech manufacturing margins, and aggressive capital recycling strategies that rewarded patient investors.

🇸🇬 Share Prices of These 5 Singapore REITs Are Hitting Their 52-Week Highs: Can This Momentum Continue? (The Smart Investor)

- The REIT sector is seeing more green shoots in recent months as expectations of an interest rate cut rise.

- Many REIT managers will be relieved to know that finance costs should ease once interest rates start to decline.

- Distributions should also start to recover as interest costs moderate over time.

- Meanwhile, optimism is pushing the unit prices of several REITs to new 52-week highs.

- Here are five that recently hit a high, and income investors may want to assess if this momentum can carry on.

- Suntec Real Estate Investment Trust (SGX: T82U / OTCMKTS: SURVF) is a retail and commercial REIT that owns stakes in properties across Singapore, the UK, and Australia.

- Keppel REIT (SGX: K71U / OTCMKTS: KREVF) is an office REIT with a portfolio value of over S$9 billion, comprising 13 properties spread across Singapore (4) , Japan (1), South Korea (1), and Australia (7).

- Starhill Global Real Estate Investment Trust (SGX: P40U / OTCMKTS: SGLMF), or SGREIT, is an office and retail REIT with a portfolio of nine properties in Singapore, Australia, Malaysia, Japan, and China.

- Frasers Centrepoint Trust (SGX: J69U / OTCMKTS: FRZCF), or FCT, is a retail REIT with a portfolio of nine suburban malls and an office building, all located in Singapore.

- Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) is a data centre REIT with a portfolio of 24 data centres across 10 countries.

🇸🇬 Boustead Singapore’s Share Price Soared Over 65% Year-to-Date: Can the Conglomerate Continue to Do Well? (The Smart Investor)

- Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF) is one of the oldest companies in Singapore, having been founded way back in 1828 by Sir Edward Boustead.

- The conglomerate is also a steady dividend stalwart and has paid out a dividend every single year since its IPO back in 2002.

- As of 3 September 2025 (1:30pm), shares of Boustead have surged by more than 65% year-to-date, giving the group a market capitalisation of close to S$870 million.

- That’s including a 14% gain today, at the time of writing.

- Can the conglomerate continue to outperform and break through its 52-week high of S$1.72?

- Let’s find out.

- Multiple businesses

- A mixed set of earnings

- Rebuilding its order book

- A potential REIT listing

- Get Smart: Improving the order book and unlocking value

🇸🇬 5 Singapore Blue-Chip Stocks Soaring 26% or More This Year: Are They Screaming Buys? (The Smart Investor)

- We track the good performance of these five blue-chip stocks to assess if they qualify as good investment candidates.

- City Developments Limited (SGX: C09 / FRA: CDE / OTCMKTS: CDEVY), or CDL, is a real estate group with a network spanning 168 locations in 29 countries and regions.

- Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering, or STE, is an engineering and technology company serving customers in the aerospace, smart city, and public defence sectors.

- Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) is a global asset manager offering sustainability-related solutions spanning the infrastructure, real estate, and connectivity sectors.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel is Singapore’s largest telecommunication company (telco) offering a comprehensive range of services, including mobile, pay TV, and broadband.

- Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY), or HKL, is a property investment, management and development group with a real estate footprint spanning more than 850,000 square metres of prime commercial and luxury retail property.

🇸🇬 Singtel’s Investor Day 2025: 5 Key Things Investors Should Note About the Blue-Chip Telco (The Smart Investor)

- The telco has trained its sights on growing its revenue and profits under its ST28 long-term plan.

- Several Singapore blue-chip companies have been updating their shareholders annually on the progress and status of their long-term goals.

- Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel is one of them.

- Singapore’s largest telecommunication company (telco) recently released its presentation slides for its latest Investor Day event, which details the group’s strategies and long-term objectives for 2028 (ST28).

- Investors can check out last year’s Investor Day 2024 if they are interested in finding out more about the progress of these goals.

- Here are five things that investors need to know about Singtel’s long-term plans.

- Strengthening its Singapore core

- Consumer market to drive growth in Australia

- AI as the pillar of growth for NCS

- A bright data centre future

- Associates to help drive further growth

- Get Smart: On track for low double-digit ROIC

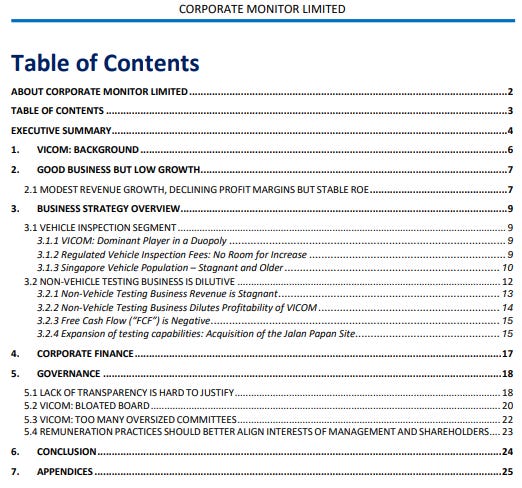

🇸🇬 VICOM LTD. – When less is more (Corporate Monitor)

- 🌏 Vicom Ltd (SGX: WJP) – Comprehensive range of inspection & testing services. Subs. of ComfortDelGro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY). 🇼 🏷️

- The election of construction tycoon Anutin Charnvirakul as Thailand’s new prime minister – confirmed by the nation’s parliament on Friday – is in likelihood another blow to the prospects of casino legalisation in the country, according to Daniel Cheng, a prominent commentator on the Asia-Pacific casino sector and a former casino executive.

- He told GGRAsia: “You can pretty much move the entertainment complex [bill] to the bottom drawer and lock it up for the next half year; and if I were a betting man, don’t count on an early sequel.”

- Friday’s election of Mr Anutin as prime minister ended a week-long power vacuum following the ouster of his predecessor, Paetongtarn Shinawatra.

🇻🇳 Cover Story: China’s Factory Exodus Is Turning Vietnam Into the World’s Assembler (Caixin) $

- A 90-minute drive north of Hanoi, a red banner with gold Chinese characters wishing prosperity flutters over the gate of Mingjie Co. Ltd.’s newly completed factory. Inside, brand-new injection molding machines stand idle, awaiting activation. Outside, farmers in conical hats work rice paddies.

- Once a quiet patchwork of farming villages, Bac Ninh is emerging as the industrial engine of northern Vietnam. The transformation reflects a broader trend as Chinese manufacturers steadily move operations southward in response to U.S. tariffs and an overhaul of global supply chains.

🇻🇳 Analysis: Two Big Questions Face Chinese Firms Investing in Vietnam (Caixin) $

- Chinese companies need to pay special attention to choosing suppliers and factory sites when investing in Vietnam, analysts said, as the Southeast Asian country sharpens its policies for attracting foreign investment so it can upgrade its industry.

- The Vietnamese government on Monday enacted a decree to use government subsidies to integrate more industries into domestic supply chains, with the ultimate goal of reducing the country’s dependence on imports. The decree focuses on supporting upstream suppliers vital to the development of the textile and garment, electronics and automotive industries, according to information provided by Deloitte LLP.

🇮🇳 India / South Asia / Central Asia

🇮🇳 Invest in India’s Top Stocks: Here’s How. (The Smart Investor)

- Discover the leading companies in India driving its future.

- Among India’s many companies, three stand out for their strong performance and high growth potential.

- Infosys (NYSE: INFY) is one of India’s largest technology and consulting companies, widely known for its digital transformation services.

- Apollo Hospitals (NSE: APOLLOHOSP / BOM: 508869) is one of Asia’s largest integrated healthcare systems and India’s pioneer private healthcare group.

- HDFC Bank (NYSE: HDB) or Housing Development Finance Corp is India’s largest private-sector bank providing mainly retail and corporate banking services along with investment and insurance products.

🇮🇳 Long Kotak Mahindra (KMB IN) Vs. Short Bajaj Finance (BAF IN): Statistical Arbitrage in Indian Banks (Smartkarma) $

- Context: The Kotak Mahindra Bank (NSE: KOTAKBANK / BOM: 500247) vs. Bajaj Finance Limited (NSE: BAJFINANCE / BOM: 500034) price-ratio has deviated more than two standard deviations from its one-year average, presenting a potential relative value opportunity.

- Highlights: Going long Kotak Mahindra Bank (KMB IN) and short Bajaj Finance (BAF IN) targets a 9% return, with the long position supported by cheaper valuations.

- Why Read: Essential for quantitative traders seeking mean-reversion opportunities, with detailed execution framework, risk management protocols, and historical simulation showing the statistical basis for this relative value play.

🌍 Middle East

🇮🇱 Ituran Location: Telematics Compounder Facing Country Concentration Risks (Seeking Alpha) $ 🗃️

🇮🇱 Ituran Location: A Buy In The Telematics Industry (Seeking Alpha) $ 🗃️

🇮🇱 Ituran: Not As Cheap As Before, But Still Offers A Few Merits (Seeking Alpha) $⛔🗃️

- 🌐 🇧🇷 Ituran Location And Control Ltd (NASDAQ: ITRN) – Leader in the emerging mobility technology field, providing value-added location-based services, including a full suite of services for the connected-car. 🇼 🏷️

🇸🇦 Saudi Arabia’s small-town brands go national (FT) $ 🗃️

- Growth of homegrown businesses is sign of how economy is modernising

- Saudi Arabian local brands from bakeries to mango farms are expanding into national chains, in what they say is a sign that efforts to diversify the kingdom’s economy are starting to work for some small businesses.

🇸🇦 Saudi power giant ACWA bets big on China’s renewable energy market (Caixin) $

- Saudi Arabia’s largest power producer, Acwa Power Company SJSC (TADAWUL: 2082), is intensifying its expansion into China’s renewable energy sector, with plans to boost capacity to more than 30 gigawatts and grow assets worth to more than $50 billion by 2030, according to its China head.

- “China is critical for us,” said Saleh Al Khabti, ACWA Power’s China president, in an interview with Caixin in late August. “Over half of our global projects involve Chinese partners, and more than 95% of our equipment comes from Chinese suppliers.”

🇹🇷 Turkey ends ban on short selling as stocks recover from political crisis (FT) $ 🗃️

- Authorities decide not to extend measure put in place in March after Istanbul mayor’s arrest rocked markets

🇹🇷 Turkish stocks fall after court ousts Istanbul opposition leadership (FT) $ 🗃️

- Market move recalls investor panic following arrest of city mayor and presidential rival Ekrem İmamoğlu

🌍 Africa

🇿🇦 Harmony Gold: Bright Future With Gold And Potentially Copper At An Attractive Price (Seeking Alpha) $ 🗃️

- 🇿🇦 🇦🇺 🇵🇬 Harmony Gold Mining Company Limited (JSE: HAR / NYSE: HMY) – Global gold mining & exploration + significant copper footprint. 🇼

🇿🇦 Why I’m Buying Sasol: Cash Flow Up, Debt Down, Valuation Too Cheap (Seeking Alpha) $ 🗃️

- 🌐 Sasol (NYSE: SSL) – Global chemicals & energy company. 3 distinct market-focused businesses, namely: Chemicals, Energy & Sasol ecoFT. 🇼 🏷️

🇿🇦 Sibanye Stillwater’s Diversification Strategy Pays Off (Seeking Alpha) $ 🗃️

- 🌐 Sibanye Stillwater Ltd (JSE: SSW / NYSE: SBSW) – World’s largest primary producers of platinum, palladium & rhodium & is a top-tier gold producer. Projects & investments across 5 continents. 🇼 🏷️

🌍 Eastern Europe & Emerging Europe

🌍 Power of Siberia 2. EU faces dark, EXPENSIVE energy future (The Duran) 37:22 Minutes

- 00:00 Power of Siberia 2 Agreement Announced

- 02:00 Pipeline Route and Strategic Shift

- 04:00 Overcoming Doubts and Delays

- 07:00 Pandemic, Sanctions, and China’s Role

- 10:00 Europe’s Lost Access to Russian Gas

- 13:00 Cheaper Gas for China, Declining LNG Demand

- 16:00 Mongolia’s New Opportunity and Europe Cut Out

- 19:00 The Misunderstanding of European Elites

- 22:00 Pipeline Politics: Trust in China vs Europe

- 26:00 Geopolitical and Economic Consequences for Europe

- 31:00 Turkey and Central Europe: Energy Alternatives

- 35:00 Final Thoughts: Future of Europe’s Energy

🌍 Southern Europe stocks lead market rally (FT) $ 🗃️

- Equities in countries at the heart of the region’s debt crisis over a decade ago are now thriving

- Equity indices in Greece, Italy and Spain — countries at the epicentre of the region’s debt crisis more than a decade ago — have raced ahead of larger peers in Germany and France this year, outperforming the pan-continental Stoxx Europe 600 index.

- Greek lender Alpha Bank [Alpha Services and Holdings (ASE: ALPHA / FRA: ACBB / ACBC / OTCMKTS: ALBKY / ALBKF)] has led gains on the Athens Stock Exchange, more than doubling in price this year, while Spanish information technology group Indra Sistemas is up more than 90 per cent.

🇵🇱 InPost: “Strong Buy” On Undervaluation And Strong Earnings (Seeking Alpha) $⛔🗃️

- 🌍 InPost SA (AMS: INPST / LON: 0A6K / FRA: 669) – Specializes in parcel locker service + courier, package delivery & express mail service. 🇼 🏷️

🌎 Latin America

🌎 Patria Investments: Unlocking Latin American Value And Exceptional Growth (Seeking Alpha) $ 🗃️

- 🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇦🇷 Edenor: Discounted Assets In Argentina’s Largest Power Distributor (Seeking Alpha) $ 🗃️

- 🇦🇷 Empresa Distribuidora y Comercializadora Norte Sa (NYSE: EDN) or Edenor – Largest electricity distribution company in Argentina in terms of number of customers. 🇼 🏷️

🇦🇷 Supervielle: A Fwd P/E Of 4.87x Is Cheap Even With Its Sluggish Performance (Seeking Alpha) $ 🗃️

- 🇦🇷 Grupo Supervielle SA (NYSE: SUPV) – Provides a range of financial & non-financial services. 🏷️

🇦🇷 YPF Sociedad: The Easy Gains Are Gone; Now It’s About Performance (Seeking Alpha) $ 🗃️

- 🇦🇷 🏛️ Ypf Sa (NYSE: YPF) – Vertically integrated, majority state-owned Argentine energy company. Oil & gas exploration & production + transportation, refining & marketing of gas & petroleum products. 🇼 🏷️

🇧🇷 Brazil Targets Banks, Fintechs in Laundering Crackdown (Bloomberg) $ 🗃️

- Takeaways by Bloomberg AIHide

- Police raided firms on São Paulo’s Faria Lima Avenue, allegedly tied to a massive criminal scheme, as investigators searched offices linked to a criminal group accused of using investment funds to hide illicit assets.

- The investigation targeted funds overseen by Banco Genial SA and fintechs BK Instituição de Pagamento and Bankrow, which were allegedly used by a criminal group to control fuel assets and launder money.

- Authorities said the criminal organization controls at least 40 investment funds with assets, and that organized crime in Brazil is using digital financial platforms to move illicit money, prompting calls for stricter oversight and regulation of fintechs.

🇧🇷 BrasilAgro Q4 2025: Challenging Quarter, But Upside Is Attractive (Seeking Alpha) $ 🗃️

- 🇧🇷 Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3 / FRA: 52BA) – One of Brazil’s largest companies in terms of arable land. Acquisition, development, operation & sale of rural properties suitable for agricultural activities. IRSA (NYSE: IRS) has a stake. 🏷️

🇧🇷 Petrobras: Oil Giant With Exceptional Margins Worth The Political Risk (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: When Market Fear Creates Long-Term Value (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras’ Dividend Story Still Rich, Thanks To Volatile State-Run Status (Seeking Alpha) $ 🗃️

- 🌐🏛️ Petrobras (NYSE: PBR / PBR-A / BCBA: PBR / PETR4) or Petróleo Brasileiro SA – Explores, produces & sells oil & gas. 🇼

🇧🇷 Vale: Staying The Course While The Cycle Works Against It (Seeking Alpha) $ 🗃️

- 🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇧🇷 Cyrela: Brazil’s Interest-Rate Boost Hits Peak, Upside Seems Priced In (Seeking Alpha) $⛔🗃️

- 🇧🇷 🇦🇷 🇺🇾 Cyrela Brazil Realty Sa Empreendimentos (BVMF: CYRE3 / OTCMKTS: CYRBY) – Largest homebuilder & real estate company by revenue & market value in Brazil + Argentina & Uruguay. 🇼 🏷️

🌐 Global

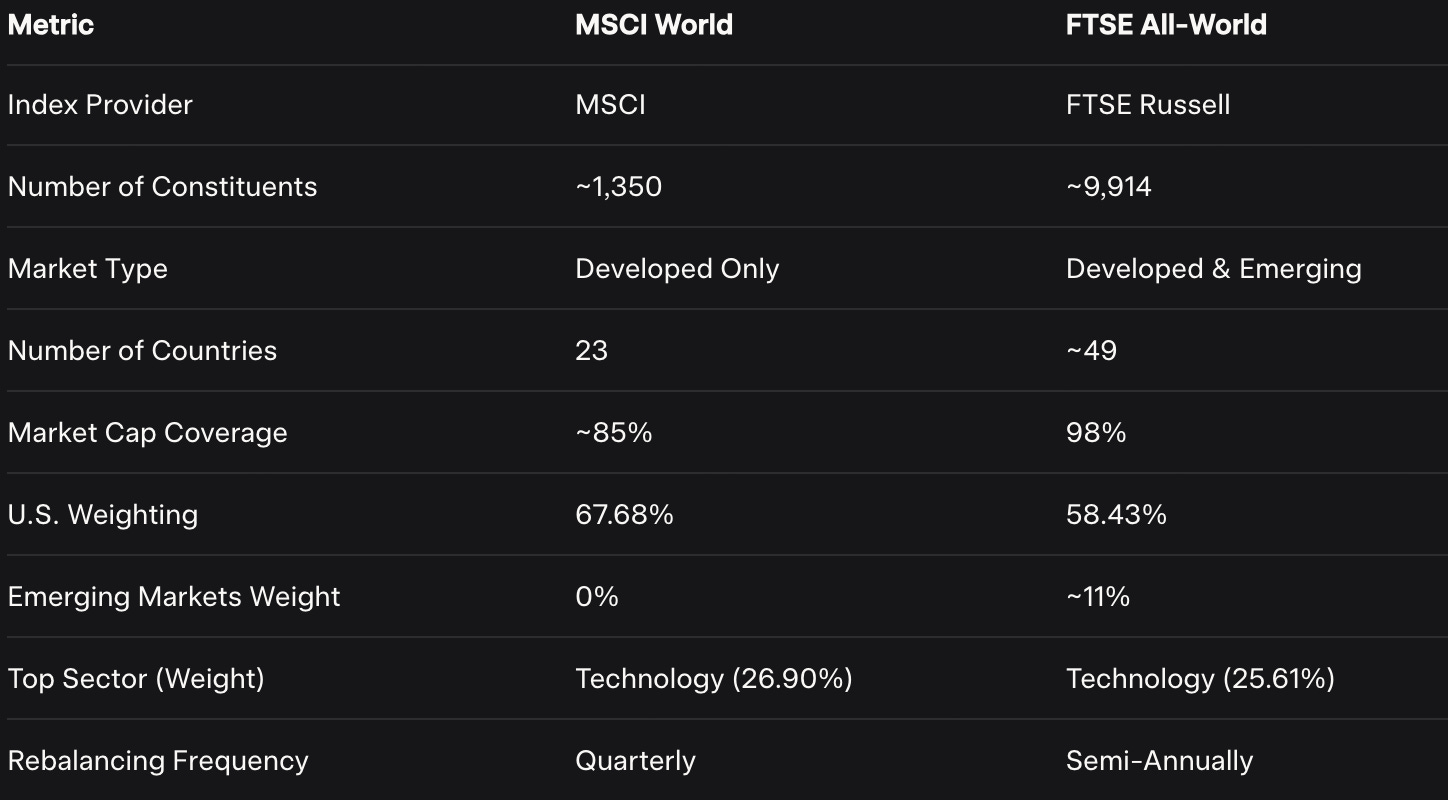

🌐 MSCI World vs FTSE Global All Cap: Don’t Get It Wrong (The Pareto Investor)

- MSCI World vs FTSE Global All Cap: discover key differences in coverage, emerging markets, and performance to choose the right global ETF.

- If you’re comparing the MSCI World Index (tracked by iShares ETFs with ticker like URTH and EUNL) with the FTSE Global All Cap (tracked by Vanguard ETFs like VT and VWCE), you’re not alone.

- These are two of the most popular global index funds for long-term investors.

🌐 Nebius Drops The Mic (Seeking Alpha) $⛔🗃️

🌐 Nebius Group: 3 Reasons Why It’s A Fantastic Long-Term Pick (Seeking Alpha) $ 🗃️

🌐 Nebius Group: There Is No AI Bubble To Burst (Seeking Alpha) $ 🗃️

- 🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

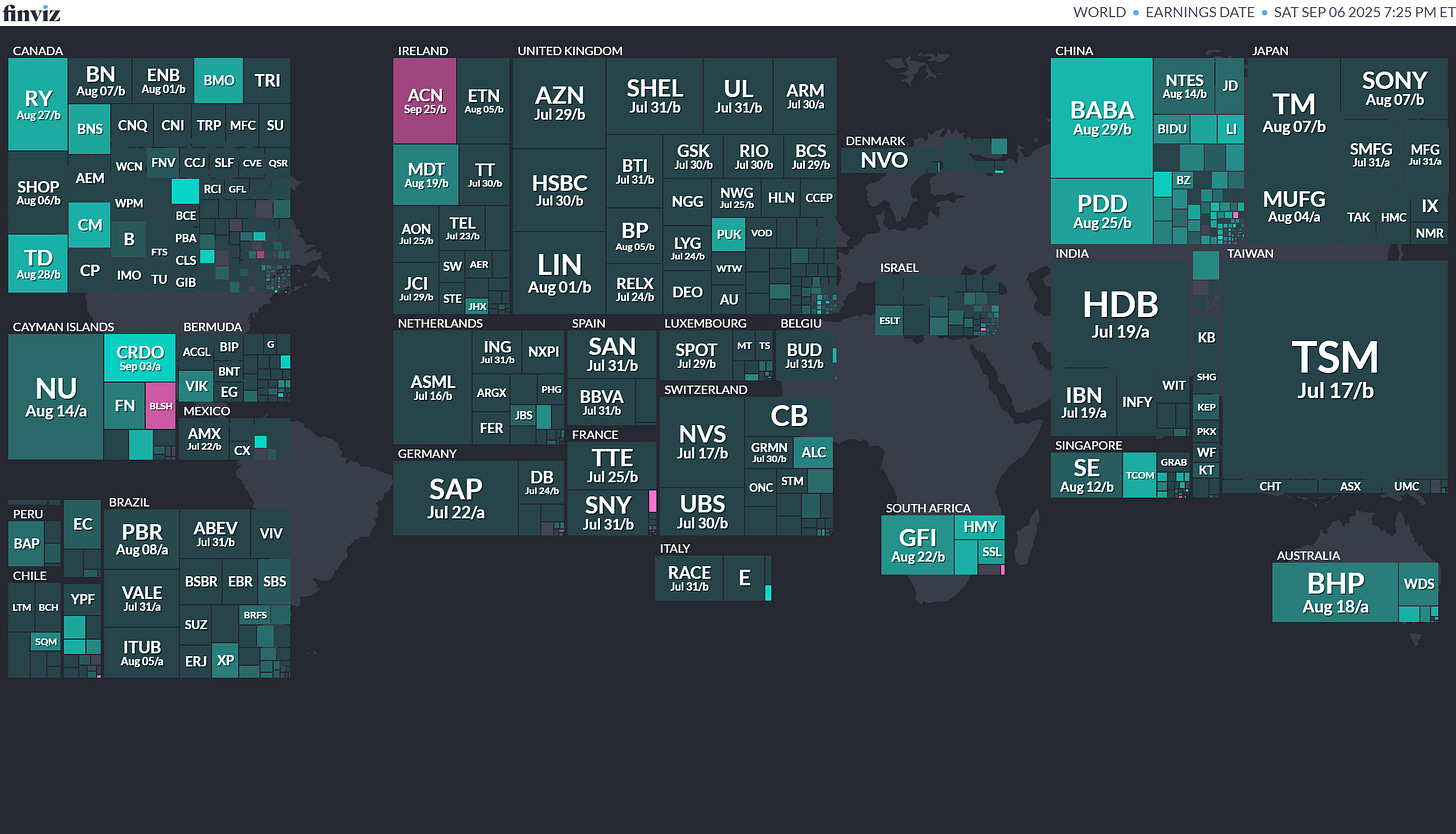

📅 Earnings Calendar

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

📅 Economic Calendar

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

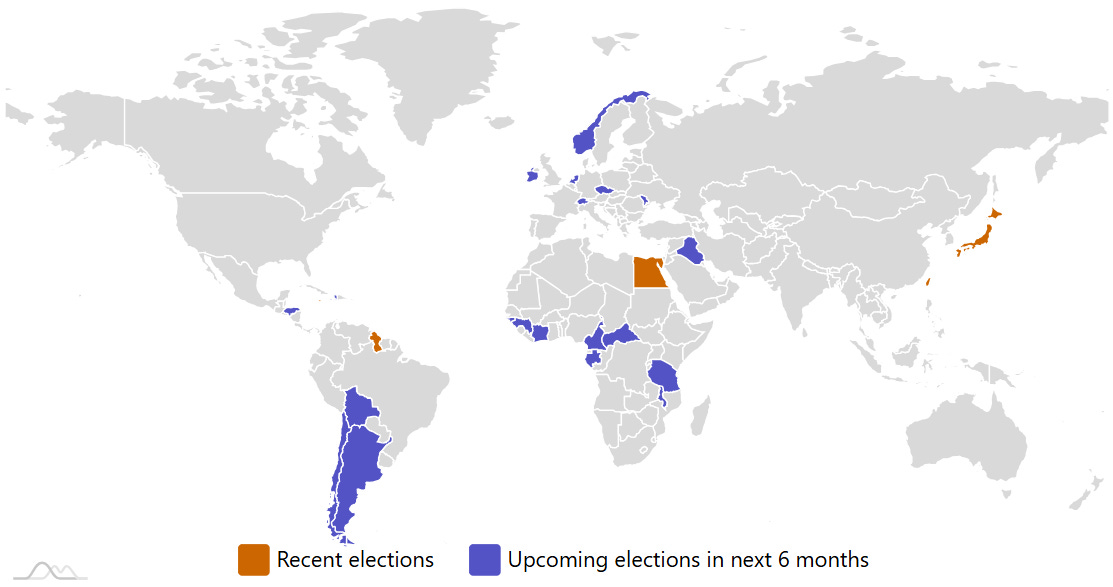

🗳️ Election Calendar

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

- Macau Chinese Legislative Council (Macau) 2025-09-14 (d) Confirmed 2021-09-12

- Czech Republic Czech Chamber of Deputies 2025-10-03 (d) Confirmed 2021-10-08

- Argentina Argentinian Chamber of Deputies 2025-10-26 (d) Confirmed 2023-10-22

- Argentina Argentinian Senate 2025-10-26 (d) Confirmed 2023-10-22

- Iraq Iraqi Council of Representatives 2025-11-11 (d) Confirmed 2021-10-10

- Chile Chilean Chamber of Deputies 2025-11-16 (d) Confirmed 2021-11-21

- Chile Chilean Presidency 2025-11-16 (d) Confirmed 2021-12-19

- Chile Chilean Senate 2025-11-16 (d) Confirmed 2021-11-21

- Hong Kong Hong Kong Legislative Council 2025-12-07 (d) Confirmed 2021-09-05

- Côte d’Ivoire Ivorian Presidency 2025-10-25 (d) Confirmed 2020-10-31

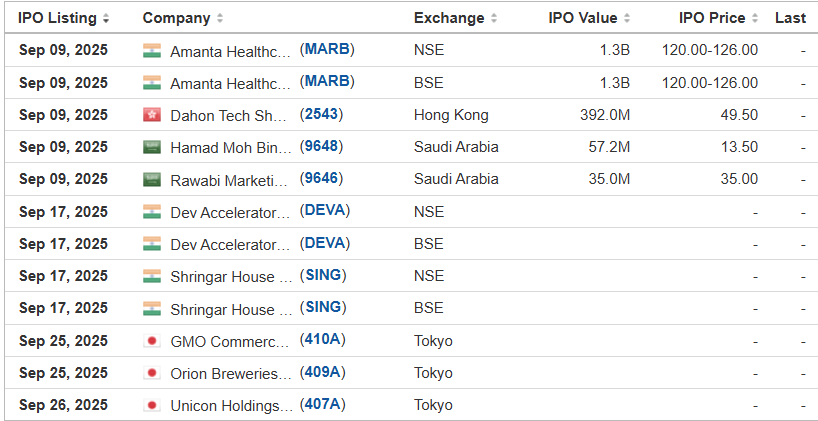

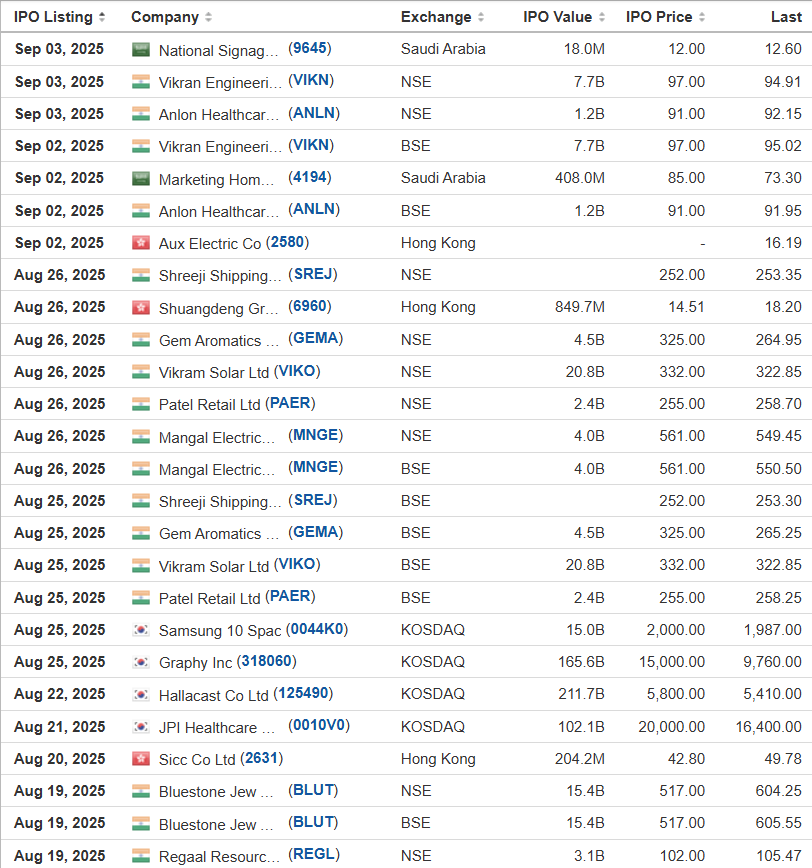

📅 Emerging Market IPO Calendar/Pipeline

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Rise Smart Group Holdings Ltd. RSMH American Trust Investment Services/Prime Number Capital, 1.8M Shares, $4.00-4.00, $7.2 mil, 9/10/2025 Wednesday

We are a holding company whose operating subsidiary, Rise Smart Holdings Limited, provides educational services to local students who are seeking secondary education and higher education studies in the United Kingdom (UK), Australia, Canada and New Zealand. (Incorporated in the Cayman Islands)

Our mission is to become the leading overseas studies consultancy service provider in Hong Kong. We strive to provide one-stop services that cater to students’ overseas studies needs.

We believe that the following strengths have contributed to our success and are differentiating factors that set us apart from our peers.

• Established track record: In our operating history of more than 15 years, we have focused on providing overseas studies consultancy services and built up our expertise and track record in overseas studies consultancy. We devoted substantial efforts to expanding our network of overseas education providers. We take pride in our network in successfully placing students with the overseas education providers. Through our quality of service and continued marketing efforts, we believe we have established our reputation as a reliable overseas studies consultancy services provider in Hong Kong.

• One-stop service to cater to students’ overseas studies need: We provide a one-stop service to cater to students’ overseas studies needs by offering a wide range of services to students before and after their placement to overseas education providers. In 2018, we expanded our service offerings to provide value-added services such as tutoring and visa consultation to students. We believe that by providing a one-stop service to the students we can ensure their satisfaction and eliminate the hassle of looking for other service providers.

• Established network of subagents: Since 2018, we have been establishing business relationships with subagents, which include overseas studies consultancy service providers and individuals, who refer students seeking overseas studies with overseas education providers who we have a business relationship with. Since 2021, we have been actively cooperating with subagents to enhance our market presence among students. We believe having a wide network of subagents allow us to reduce reliance on word of mouth referrals from students and parents, while enabling us to broaden the base of potential students whom we can serve and ensure a stable revenue stream.• Experienced and dedicated management and education consultants: Our management team has extensive knowledge and experience in providing overseas studies consultancy services in Hong Kong. Mr. Kin Cho Li, our Chief Executive Officer and Chairman, has approximately 15 years of experience in the overseas studies consultancy service industry. We believe our management and our education consultants understand the needs of students and their parents well to offer them suitable study programs, assist them with their applications, and offer them value-added services to cater to their individual needs. We plan to expand our presence in North America by setting up regional offices in major cities in Canada and/or the U.S.. We plan to selectively pursue mergers and acquisitions, investments, and corporations with local companies to deepen our connection with local education service providers. We will also explore the possibility of forming strategic partnerships with other overseas education consultancy service providers in Hong Kong with a strong establishment in North America to expand our service coverage in North America in a swift and effective manner. We plan to invest in our technological platform by upgrading the function and capabilities of our existing information technology system by (i) investing in the use of artificial intelligence in the recommendation of overseas education providers to students in the application process; and (ii) improving our existing data related technology in relation to student relationship management and commission management. Such improvements will increase the likelihood of our successful placement and enable our management to closely monitor and manage each student’s case to provide the best possible services to them.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: American Trust Investment Services and Prime Number Capital are the lead joint book-runners, replacing Pacific Century Securities and Revere Securities.)

(Note: Rise Smart Group Holdings Ltd. filed its F-1 on May 13, 2024. The Hong Kong-based company submitted confidential IPO documents to the SEC on Aug. 25, 2023.)

Regentis Biomaterials, Ltd. RGNT ThinkEquity, 1.0M Shares, $10.00-12.00, $11.0 mil, 9/11/2025 Thursday

We are a regenerative medicine developing orthopedic hydrogel implants. (Incorporated in Israel)

We are a regenerative medicine company dedicated to developing innovative tissue repair solutions that seek to restore the health and enhance the quality of life of patients. Our current efforts are focused on orthopedic treatments using our Gelrin platform based on degradable hydrogel implants to regenerate damaged or diseased tissue. Gelrin is a unique hydrogel matrix of polyethylene glycol diacrylate (a polymer involved in tissue engineering) and denatured fibrinogen (a biologically inactivated protein that normally has a role in blood clotting).

Our lead product candidate is GelrinC, a cell-free, off-the-shelf hydrogel that is cured into an implant in the knee for the treatment of painful injuries to articular knee cartilage. GelrinC was approved as a device, with a Conformité Européene, or CE, mark in Europe, in 2017 (number 3900600CE02); we plan to identify strategic partners in Europe to bring our product to market. While we currently do not have any strategic partners in place in Europe, we plan to engage strategic partners in Europe in the future.

With GelrinC, we aim to bring to market a product for the therapy of an unmet need for the large market of cartilage injuries in the knee. Because GelrinC serves as an impenetrable barrier that stops cells from migrating away from the wound’s edges, we believe our product is the only product that helps to regenerate cartilage inwards from the edges of the cell walls. Creating new contiguous tissue is not the natural, lowest energy, alternative for cartilage cells. If such cells were left alone, they would tend to migrate and either not create new cartilage tissue or create cartilage tissue that is fibrotic (containing an excessive deposition of extracellular matrix, leading gradually to the disturbance and finally to loss of the original tissue architecture and function). By GelrinC creating such impenetrable barrier and thereby preventing the migration of the cells, the cells are forced to take a different route of creating aggregate and contiguous tissue. Unlike GelrinC, cellular products used by competing companies require a plug of two layers of which the lower layer is a mineral scaffold, which is a foreign body material that has been engineered to be inserted into the bone tissue even though the bone is often healthy. Additionally, GelrinC does not have any biological activity. As a result, we believe our product offers a simple and economic procedure, which we believe will allow patients to recover quickly with potentially long-term outcomes.

Note: Net loss and revenue are for the 12 months that ended June 30, 2024.

(Note: Regentis Biomaterials, Ltd. increased its IPO’s size to 1.0 million shares – up from 909,090 shares – and kept the price range at $10.00 to $12.00 to raise $11.0 million, according to its S-1/A filing in May 2025. Initial Filing: Regentis Biomaterials, Ltd. is offering 0.9 million shares (909.090 shares) at a price range of $10.00 to $12.00 to raise $10.0 million, according to the company’s S-1 filing dated March 11, 2025.)

Texxon Holding NPT D. Boral Capital (ex-EF Hutton), 2.0M Shares, $4.00-5.00, $9.0 mil, 9/12/2025 Week of

We are a holding company. ((Incorporated in the Cayman Islands)

We do business through our operating subsidiary, Zhejiang Net Plastic Technology Co., which started its business in Yuyao, China, in 2011.

We offer more than 3,600 plastic and chemical SKUs. Our intention is to be a one-stop shop to expedite procurement for our network of 2,213 suppliers and 3,528 customers.

We are a leading provider of supply chain management services in East China, servicing customers in the plastics and chemical industries in China. Through our technology-enabled platform, we provide a full spectrum of services to Chinese SME customers, including but not limited to, procurement, shipping and logistics, payments and fulfillment services.

To address the extensive need from SMEs in China for more stable sources of supply, lower procurement costs, higher product quality, and enhanced risk management in the plastics and chemical markets in China, we aspire to build the largest one-stop plastic and chemical raw material supply chain management platform in China, to streamline the complex and labor-intensive raw material procurement process in the plastics and chemical industries and make it more convenient, cost-effective, and efficient for our customers. We believe that our platform has the capacity to help streamline and optimize operational processes of market participants, enhance sustainability and resilience in the entire supply chain, and create a dynamic ecosystem where stakeholders can engage in transactions with ease and efficiency.

Note: Net income and revenue are for the year that ended June 30, 2024.

(Note: Texxon Holding filed its F-1 on March 31, 2025, and disclosed the terms – 2.0 million shares at a price range of $4.00 to $5.00 – to raise $9.0 million.)

PomDoctor POM Joseph Stone Capital/Uphorizon, 5.0M Shares, $4.00-6.00, $25.0 mil, 9/15/2025 Week of

We run an online platform in China to provide chronic disease management services. (Incorporated in the Cayman Islands)

As of Dec. 31, 2024, PomDoctor had over 212,800 doctors (under contract) who had issued about 3.13 million prescriptions. The company had 699,000 patients (also referred to as transacting patients) as of Dec. 31, 2024.

Our mission is to provide effective prevention and treatment solutions to alleviate patients’ suffering from illnesses.

Our vision is to become the most trustworthy medical and healthcare services platform.

We are a leading online medical services platform for chronic diseases in China, ranking sixth on China’s Internet hospital market measured by the number of contracted doctors in 2022, according to Frost & Sullivan.

With focuses on chronic disease management and pharmaceutical services, our business model forms a one-stop platform for medical services, which organically connects patients to doctors and pharmaceutical products. Our experience in tackling chronic diseases can be traced back to 2015 when we launched our platform on mobile devices. We strategically chose to focus on this field because chronic diseases last at least one year by definition, and they are hard to cure, prone to complications and require ongoing medical attention. As such, patients with chronic diseases have a great and relatively inelastic demand for frequent and repeat follow-up visits and of drug purchases, which gives a competitive advantage to platforms that are able to maintain long-term, stable doctor-patient relationships.

Note: Net loss and revenue are in U.S. dollars (converted from China’s currency) for the year that ended Dec. 31, 2024.

(Note: PomDoctor disclosed its IPO’s terms in an F-1/A filing dated July 15, 2025: The company is offering 5.0 million American Depositary Shares (ADS) at a price range of $4.00 to $6.00 to raise $25 million, if the IPO is priced at the $5.00 mid-point of its range. Background: PomDoctor filed its F-1 on March 13, 2025, without disclosing the terms for its IPO. and disclosed the terms for its IPO.)

🏁 Emerging Market ETF Launches

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

- Aug 11, 2025NEMDNeuberger Berman Emerging Markets De

- 04/02/2025 – Goldman Sachs India Equity ETF – GIND