As discussed in previous posts, I have been trying to improve these posts by finding additional equity research resources for other countries or regions to include in them to also further build up our Frontier & Emerging Market Stock Index.

Specific stocks covered in this belated post for December with January coming next week and with a focus on some countries or stocks that are hopefully more accessible to retail investors via Interactive Brokers or via a foreign listing (see our first posts – 🌐 Emerging Market Stock Picks (Mid-March 2025), 🌐 Emerging Market Stock Picks (Early April 2025), 🌐 Emerging Market Stock Picks (April 2025), 🌐 Emerging Market Stock Picks (May 2025), 🌐 Emerging Market Stock Picks (June 2025), 🌐 Emerging Market Stock Picks (July 2025), 🌐 Emerging Market Stock Picks (August 2025), 🌐 Emerging Market Stock Picks (September 2025), 🌐 Emerging Market Stock Picks (October 2025) & 🌐 Emerging Market Stock Picks (November 2025)) plus further DeepSeek analysis of this post:

[Note: On desktop browsers, an autogenerated table of contents will appear on the left side linked to each stock. I will add those links below after publishing/emailing this post…]

- Asia

- East Asia

- SE Asia

- 🇮🇩 Indonesia – Janu Putra Sejahtera Tbk PT, Jasa Marga (Persero) Tbk PT, Bank Tabungan Negara, Solusi Sinergi Digital Tbk PT, MDTV Media Technologies Tbk PT, Energi Mega Persada Tbk PT, Telkom Indonesia Persero Tbk PT, Wijaya Karya Bangunan Gedung Tbk PT, PT ITSEC Asia Tbk, MD Entertainment PT Tbk, Sinergi Inti Andalan Prima Tbk, Petrosea Tbk PT, Fast Food Indonesia Tbk PT, Bank Central Asia (BCA) Tbk PT & Raharja Energi Cepu Tbk Pt

- 🇲🇾 Malaysia

- 🇲🇲 Myanmar – Yoma Strategic Holdings

- 🇵🇭 Philippines

- 🇸🇬 Singapore – Seatrium Ltd, Singapore Technologies Engineering Ltd, Hong Leong Asia Ltd, Jumbo Group, Sembcorp Industries, SATS Ltd, Singapore Exchange Limited, Ever Glory United Holdings Ltd, Skylink Holdings Ltd, Keppel REIT, HRNetGroup, Singapore Telecommunications Ltd, Valuetronics Holdings, Delfi Limited, LHN Ltd, Centurion Corporation Ltd, Centurion Accommodation REIT, Marco Polo Marine Ltd & ASL Marine Holdings Ltd, Frasers Property Ltd, Lincotrade & Associates Holdings Ltd, Lum Chang Creations, Sheng Siong Group, Nanofilm Technologies, Nam Cheong Ltd, Old Chang Kee, Bukit Sembawang Estates & BRC Asia Limited

- Singapore Broker’s Digest

- 🇹🇭 Thailand – Advanced Info Services PCL, True Corporation PCL, TMBThanachart Bank PCL, TISCO Financial Group PCL, Krungthai Card PCL, PTT Exploration & Production PCL, Thaifoods Group PCL, Airports of Thailand PCL, Siam Cement PCL & SCG Packaging PCL

- South Asia

- Middle East

- Africa

- Eastern Europe & Emerging Europe

- 🇭🇺 Hungary – Opus Global Nyrt & ALTEO Energy Services PLC

- 🇵🇱 Poland – Warsaw Stock Exchange’s NewConnect Market Q3 Newsletter, Lubelski Wegiel Bogdanka SA, Grodno SA, Eurotel SA, Synthaverse SA, BioMaxima SA, Creotech Instruments SA, ATM Grupa SA, Bloober Team SA, Action SA, Elektrotim SA, Shoper SA, Torpol SA, Fabrity SA, Ailleron SA, Bioceltix SA, Dadelo SA, Enter Air SA, Mirbud SA, Eurocash SA, Agora SA, ZUE SA, Scope Fluidics SA, Medicalgorithmics SA, Makarony Polskie SA & VRG SA

- Latin America

Readers can decide whether these DeepSeek insights or summary about these stocks are accurate:

- High Dividend Yield & Value Plays

- Growth & Catalyst-Driven Stocks

- Undervalued & Turnaround Candidates

- Tech & Innovation Exposure

- Defensive & Consumer Staples

- Geographic & Sector Diversification

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

📈🗄️ Fund documents / updates; ⚠️ Disclosures or restricted access e.g. based on your location, investor status, etc.; 🇼 Wikipedia page; 🔬 Research analysis (including articles/blog posts from fund managers, etc.); 🎥 Video; 🎙️ Podcast; 🎬 Webinar; 📰 Newspaper/magazine article; 📯 Press release; 💻 Substack/blog/website article; ✅ Our own posts; 🗃️ Linked archived article; ⏰ Upcoming webinar or event.

Frontier & Emerging Market Stock Index

Asia

East Asia

🇨🇳 China / 🇭🇰 Hong Kong / 🇲🇴 Macau

Note: For more China & Hong Kong stock picks or ideas, see our monthly China & Hong Kong Stock Picks posts…

Also see China & Hong Kong Stock Picks (November-December 2025) which missed the following pieces:

DFI Retail Group

📰 Analysts more confident on DFI’s Retail prospects following recent inaugural investor day (The Edge Singapore) December 05, 2025 $

- 🌏 DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY) 🇧🇲 🇸🇬 – Well-known brands across food, convenience, health & beauty, home furnishings, restaurants & other retailing. Part of Jardine Matheson (SGX: J36 / FRA: H4W / OTCMKTS: JARLF). 🇼 🏷️

- Price/Book (Current): 8.49

- Forward P/E: 17.18 / Forward Annual Dividend Yield: 2.67% (Yahoo! Finance)

Hongkong Land Holdings

📰 Morningstar raises fair value for Hongkong Land to US$7.40 on real estate fund (The Edge Singapore) December 15, 2025 $

- 🌏 Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY) 🇧🇲 – 2 segments: Investment Properties & Development Properties. Hotel investment, finance & project management businesses. Subs. of Jardine Strategic. 🇼 🏷️

- Price/Book (Current): 0.50

- Forward P/E: 18.80 / Forward Annual Dividend Yield: 3.26% (Yahoo! Finance)

🇰🇷 Korea

Note: For more Korean stock picks or ideas, see our monthly Korean Stock Picks posts…

Also see 🇰🇷 Korean Stock Picks (November-December 2025) which missed the following piece:

Hybe

📰 Nomura maintains ‘buy’ call for K-pop giant Hybe on BTS’s 2026 comeback (The Edge Singapore) December 15, 2025 $

- 🌐 HYBE (KRX: 352820) – Entertainment lifestyle platform company based on music. Record label, talent agency, music production company, event management & concert production company & music publishing house. 🇼 🏷️

- Price/Book (Current): 3.75

- Forward P/E: 30.96 / Forward Annual Dividend Yield: 0.07% (Yahoo! Finance)

🇹🇼 Taiwan

Note: I have note seen any good Twitter/Substack/blog accounts or (free) equity research providers with good coverage of Taiwanese stocks (at least not in English). Please contact me if you know of any…

Foxconn Interconnect Technology (FIT Hon Teng)

🔬 FIT Hon Teng (6088 HK) – Solid 3Q25 and strong AI revenue guidance in FY26-28E; Raise TP to HK$6.77 (CMB International) 11-12 2025 ⚠️

- 🌐 Foxconn Interconnect Technology (HKG: 6088 / FRA: 0FJ / OTCMKTS: FITGF) or FIT Hon Teng Limited – Precision components with offices & manufacturing sites in Asia, Americas & Europe. 🇼 🏷️

- Price/Book (Current): 1.74

- Forward P/E: 15.55 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

SE Asia

Note: Various DBS sites (Insights Direct, DBS Treasures, etc.) have good coverage of SE Asia and some Chinese/Hong Kong stocks, but some sites are restricted by geography (need VPN) or are harder to search for new research pieces…

🇮🇩 Indonesia

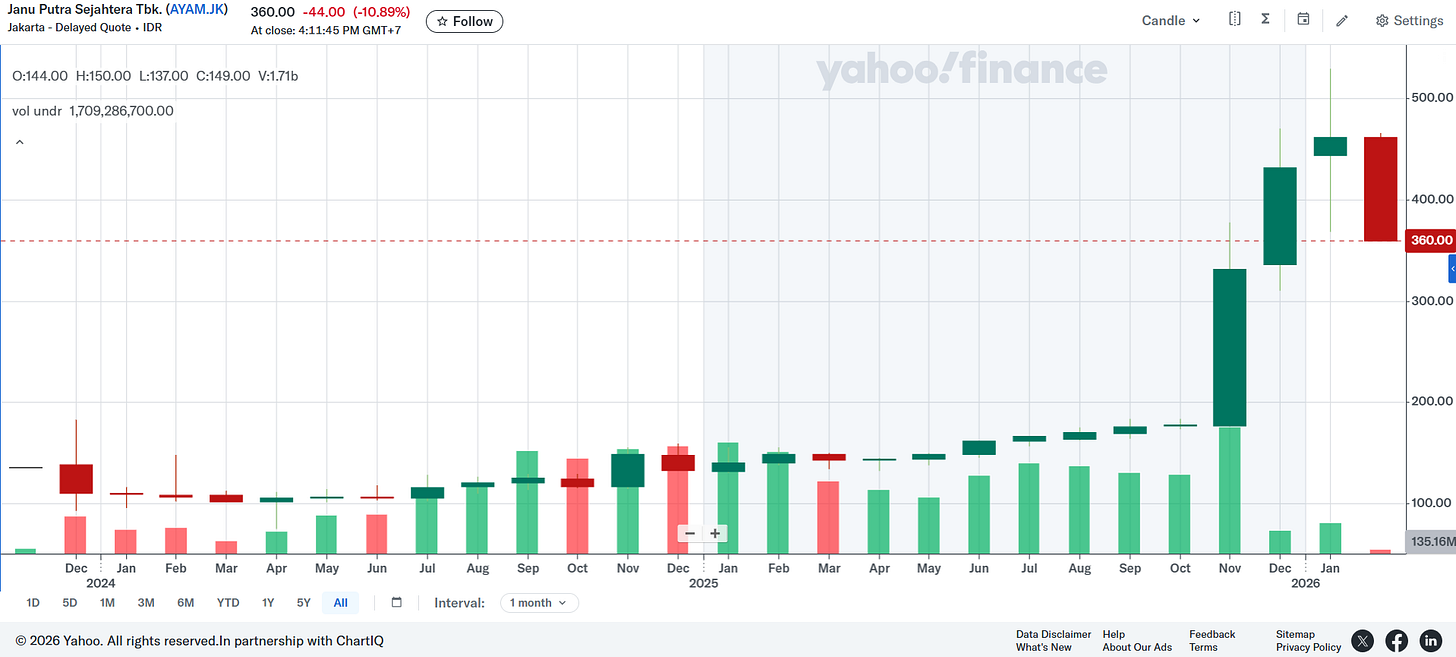

Janu Putra Sejahtera Tbk PT

🔬 PT Janu Putra Sejahtera Tbk (AYAM) – Near-term Pressure, Improving Demand Outlook (Kiwoom Sekuritas Indonesia) December 30, 2025 ⚠️

- 🇮🇩 Janu Putra Sejahtera Tbk PT (IDX: AYAM) – Integrated poultry company. 🏷️

- Price/Book (Current): N/A

- Forward P/E: N/A / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

Jasa Marga (Persero) Tbk PT

🔬 PT Jasa Marga (Persero) Tbk (JSMR) – Yield-Driven Growth; Tariff Hikes Anchor Medium-Term Upside (Kiwoom Sekuritas Indonesia) December 24, 2025 ⚠️

- 🇮🇩 Jasa Marga (Persero) Tbk PT (IDX: JSMR / FRA: 0JM / OTCMKTS: PTJSF) – Develops, constructs, operates, manages, & maintains toll roads + develops & constructs real estate properties. 🏷️

- Price/Book (Current): 0.77

- Forward P/E: 6.67 / Forward Annual Dividend Yield: 4.17% (Yahoo! Finance)

Bank Tabungan Negara

🔬 BBTN – Proven resilience; testing ‘26F stage for re-rating (KB Valbury Sekuritas) 23 December 2025 ⚠️

- 🇮🇩 Bank Tabungan Negara (Persero) Tbk PT (IDX: BBTN / FRA: TA2) – Personal, business & sharia banking. 🇼 🏷️

- Price/Book (Current): 0.54

- Forward P/E: 4.82 / Forward Annual Dividend Yield: 4.06% (Yahoo! Finance)

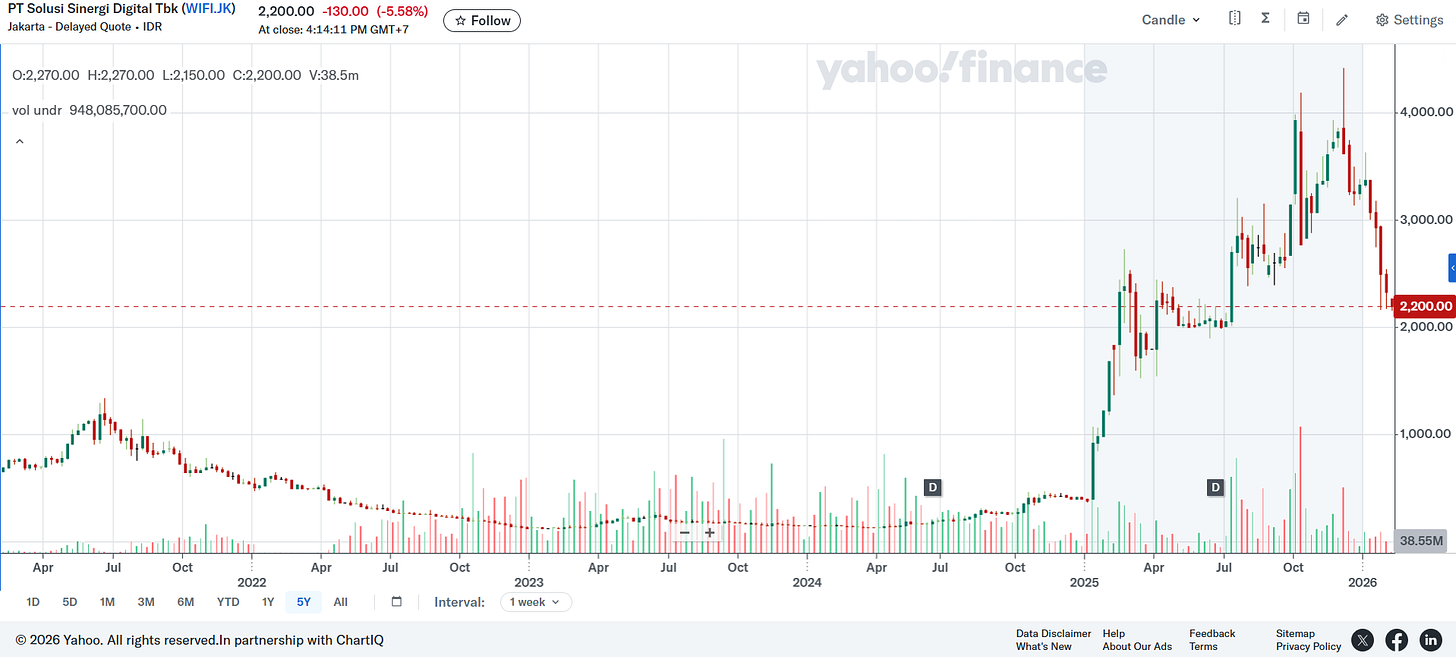

Solusi Sinergi Digital Tbk PT

🔬 WIFI: 3Q25 Results: Bottomline in Line with Our Forecast – BUY, SSI TP: IDR 5,200 (Samuel Sekuritas Indonesia) Dec 18, 2025 ⚠️

- 🇮🇩 Solusi Sinergi Digital Tbk PT (IDX: WIFI) – Fiber optic network infrastructure, digital products and services & fiber optic networks. 🏷️

- Price/Book (Current): 1.75

- Forward P/E: 11.38 / Forward Annual Dividend Yield: 0.09% (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- Emerging Market Stock Picks (November 2025)

- Emerging Market Stock Picks (January 2026)

- Emerging Market Stock Picks (October 2025)

- Emerging Market Stock Picks (June 2025)

- Emerging Market Stock Picks (September 2025)

- Emerging Market Stock Picks (May 2025)

- China & Hong Kong Stock Picks (December 2024)

- China & Hong Kong Stock Picks (November 2024)

- Morningstar Hong Kong & Singapore Stock of the Week (Q2 2023)

- Emerging Market Stock Picks (Early April 2025)

- Central and Eastern Europe Fund Holdings (Q3 2024)

- Central and Eastern Europe Fund Holdings (Q3 2023)

- Emerging Market Stock Picks (April 2025)

- Emerging Market Stock Picks (Mid-March 2025)

- China & Hong Kong Stock Picks (May 2025)