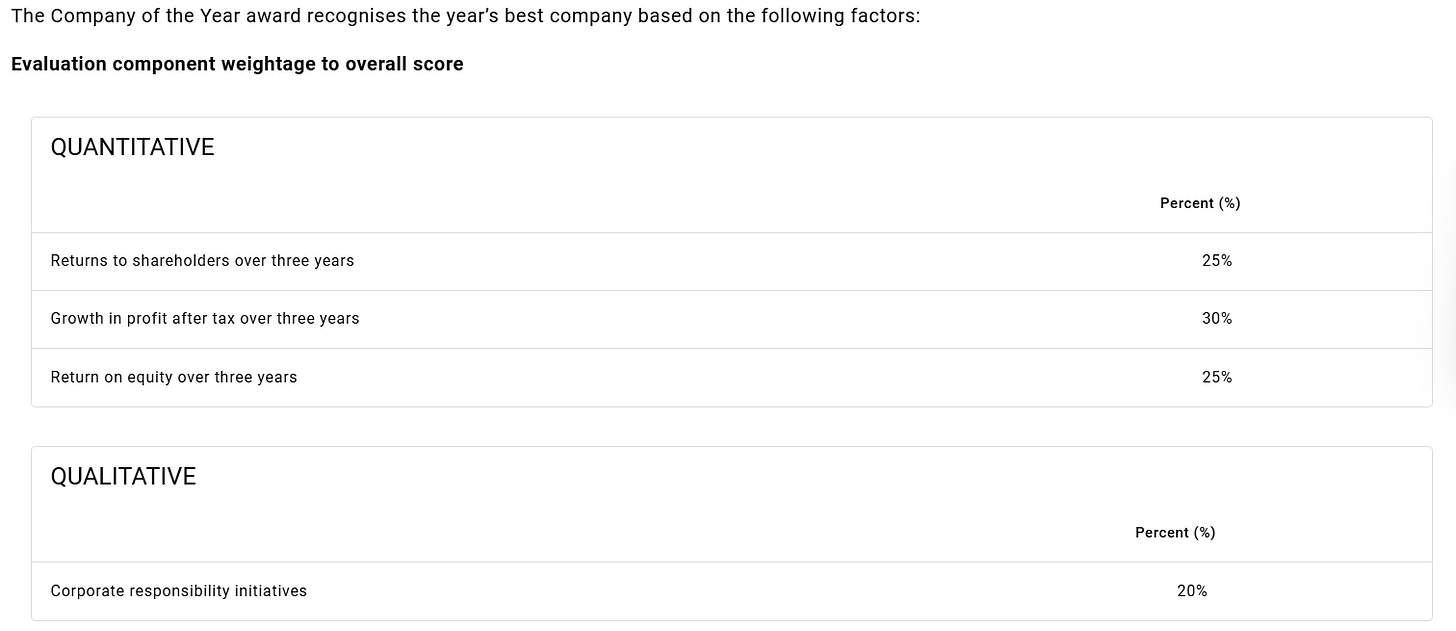

The Edge Malaysia (a local business paper) recently held The Edge Billion Ringgit Club (BRC) 2025 Awards (this was a few months ago) under categories such as growth in profit after tax over three years, returns to shareholders over three years, return on equity over three years, etc. which this post will cover in more detail.

In addition, Interactive Brokers announced in August 2024 that they would allow trading in Malaysian stocks plus Malaysia (and the Malaysian stock market) has attracted attention as a China + One and data center destination plus a so called AI adjacent play (which has pushed up Malaysian utility, some property, etc. stocks…) rather than a traditional oil or commodity play.

Anyone thinking of investing in Malaysian stocks (or for that matter, in the country itself under programs such as the relaunched Malaysia My Second Home or MM2H program) needs to be aware of some not so far off history covered in my 2024 post:

In addition and in the last few days, the Ringgit has suddenly appreciated to 2018 levels (3.90+) and has otherwise ranged from roughly as high as RM3 to US$1 to as low as RM4.8 to US$1 during my time here:

As you can see from the above charts, the Ringgit heavily depreciated (although not as bad as many other EM/FM currencies have done during similar periods of political/economic instability) during the twilight of Barisan Nasional (BN) rule with Prime Minister Najib’s many corruption (and other…) controversies and when the commodity bubble burst. Najib and the ruling party coalition lost the 2018 elections to former Prime Minister Mahathir who’s government collapsed at the start of COVID after the so-called Sheraton Move (when various political figures met at the Sheraton Hotel to hatch out various political schemes and plans…).

After two more Prime Ministers during COVID, jailed opposition figure Anwar Ibrahim’s opposition coalition emerged the winner of the November 2022 elections with him finally becoming Prime Minister. Since them, Anwar has no doubt done a few political deals to prevent the sort of backstabbing parliamentary or backroom game of thrones type deals that brought down previous governments – thus eliminating some of Malaysia’s political noise and risk for the time being.

However… the next general election must be held by 17 February 2028. What Anwar’s coalition will look like (assuming he will be running for re-election), and whether that will be another multiracial coalition including the Chinese dominated Democratic Action Party (DAP) or it ends up being an all Malay-Bumiputera party coalition with a strong Malay nationalist or an Islamic party component (as in PAS), remains to be seen. What can be certain is that UMNO (the principle Malay party component of the old Barisan Nasional coalition) along with a few Borneo political parties will somehow… and in some way… ensure they are in any winning political coalition or at least be the political kingmakers in deciding who ends up as Prime Minister……………

I should note that just like in almost every other “democracy” with elections, when you talk to ordinary Malaysians, nobody seems to be particularly happy with the current government or economy as any benefits or growth are not necessarily trickling down to them. But just like in almost every other “democracy” with elections (and especially in parliamentary systems) right now, its the ordinary people who have the least say in who ultimately gets elected and how their countries and economies are governed…

Politics aside, note that the Ringgit also suddenly strengthened before I wrote my previous Malaysia post and then hit a high around the RM4.08 mark only to rather swiftly fall back down and then slowly drift higher back towards the same level:

Much of that sudden appreciation was attributed to US interest rate cuts along with the China stimulus; but also, in part, due to Malaysian government linked companies (GLCs) (Malaysia has a mixed economy with many government controlled or linked companies…) along with private companies being encouraged by the government to bring money held overseas back into the country.

On the other hand, I suspect any strengthened Ringgit will encourage more Malaysians to get some of their money OUT of the country (with property in the UK and Australia being places where they may park it…) or to at least take more vacations abroad and do overseas study. In addition, many of the Malaysian stocks covered later in this post have operations regionally or globally – meaning repatriating earnings back into Malaysia makes less sense now while using earnings from home to invest more in operations abroad makes more sense (IF the government allows it…).

A stronger Ringgit may also be bad for Singapore stocks who derive significant revenue from Malaysia e.g. as noted on Monday:

🇲🇾 🇸🇬 Kimly & Oriental Food Update (Smartkarma) $

- Kimly Ltd (SGX: 1D0) stock has done very well since our initiation & now it does not look very cheap

- Oriental Food Industries Holdings Bhd (KLSE: OFI) has done nothing and we suspect market is concerned as its profits will be affected by the strength of Malaysian Ringitt

- We think Singapore restaurant companies’ earnings can be affected by RTS* between Singapore & Malaysia starting year end 2026.

*Note: The Johor Bahru–Singapore Rapid Transit System (RTS Link) is a cross-border light rail transit (LRT) system connecting Bukit Chagar station in Johor Bahru, Malaysia, with Woodlands North station in Singapore. In addition, the Electric Train Service (ETS) between Kuala Lumpur (KL) and Johor Bahru (JB) officially launched on December 12, 2025 – eliminating the need to transfer b/w diesel and electric trains at Gemas.

Here is a SGD/MYR chart:

Although connectivity with Singapore is improving thanks to new infrastructure projects, a stronger Ringgit is less good news for Singaporeans hunting for bargains in Johor:

📝 As Malaysian ringgit strengthens, Singapore shoppers in Johor reap less savings (SCMP)

The ringgit’s appreciation is also bad news for Malaysian export-oriented sectors, such as gloves and electronics, analysts say.

📝 Ringgit gains yet to curb Singaporeans’ spending in Malaysia, but more Malaysians could head south (The Straits Times)

Although the stronger ringgit has made it slightly more expensive for Singaporeans to shop and spend across the Causeway, many still see good value in Malaysia.

At the same time, the firmer currency has made Singapore more attractive to Malaysians, who now need fewer ringgit to fund their shopping trips here.

In other words, there is no free lunch with a strong or a weak currency – only good or bad trade-offs…

Foreign investors should also be aware that Malaysian media and investment analysts are not exactly in a position to speak freely criticize the government or economy. So expect plenty of cheerleading or carefully guarded statements in the local press e.g.:

📝 Rising ringgit to raise appeal of Malaysian stocks, benefit importers, says Public Investment (The Edge Malaysia)

A strengthening ringgit will raise the appeal of Malaysian equities, benefiting index stocks and importers, said Public Investment Bank.

Funds rotation would see capital being diverted from the developed markets into higher-growth and more fiscally-disciplined emerging economies such as Malaysia, the research house said in a note, as the ringgit appreciated past 4.00 per US dollar for the first time in more than seven years.

“Policy predictability and solid economic growth [have] attracted international investors into Malaysian financial assets, particularly the government bonds,” the research house said. “This has partially led to the strengthening of the ringgit in 2025, and the momentum is expected to continue into 2026.”

Public Investment favours KLCI constituents such as Malayan Banking Bhd (KLSE: MAYBANK / OTCMKTS: MLYBY / MLYNF) aka Maybank, CIMB Group Holdings Bhd (KLSE: CIMB / OTCMKTS: CIMDF), Tenaga Nasional Bhd (KLSE: TENAGA / FRA: 6TN0 / OTCMKTS: TNABF / TNABY) and Telekom Malaysia Bhd (KLSE: TM / OTCMKTS: MYTEF). Among consumer stocks, Public Investment likes Spritzer Bhd (KLSE: SPRITZER) and CCK Consolidated Holdings Berhad (KLSE: CCK).

📝 How long can the ringgit keep rising? (The Star)

Tradeview Capital fund manager Neoh Jia Man said the ringgit’s appreciation is still largely a dollar story, driven by expectations that the upcoming new Federal Reserve (Fed) chair appointee could usher in a more dovish rate-cut cycle.

This piece from earlier this month contained a good reality check as the range cited does feel like a more reasonable range the Ringgit should be trading at (and may quickly move back like it did during the last brief runup) that’s ultimately better for the Malaysian economy and ordinary Malaysians:

📝 A stronger ringgit, but at what price? (The New Straits Times)

Economist Dr Geoffrey Williams said a stronger exchange rate makes imports cheaper but raises costs for exporters.

“This means domestic businesses have to compete harder against cheaper imports and cut costs to remain competitive in overseas markets,” he said.

“While this is good for consumers if it leads to lower prices, it is not positive for businesses that are unable to compete. A rate of RM3.93 is possible, but it may not be desirable or sustainable,” he told Business Times.

Williams said domestic fundamentals point to a fair value range of RM4.20 to RM4.40, adding that the ringgit is currently overvalued and could be vulnerable to a sharp correction this year.

He attributed the currency’s recent strength to a weaker dollar, US interest rate cuts and continued repatriation of profits by Malaysian companies overseas.

“This is not sustainable in my view,” he said.

As for any AI or data center talk, it makes significantly more sense to locate a data center in Malaysia rather than expensive Singapore (who still gets some water and natural gas for electricity from Malaysia). In fact, there are a couple of data centers in older office buildings around the corner from where I live (one building was refurbished a couple of years ago and I think it was a normal office complex before that).

The completion of The Exchange 106 and surrounding TRX (the master plan includes a total of 26 high-rise buildings) and soon Merdeka 118 (the second-tallest building in the world with Malayan Banking Bhd (KLSE: MAYBANK / OTCMKTS: MLYBY / MLYNF) aka Maybank in the process of vacating the Maybank Tower, which was Kuala Lumpur’s tallest building before the Petronas Towers, in order to move into it) means there is plenty of lower grade office space in older buildings that could conceivably be turned into data centers (assuming floor plates / ceilings / connectivity, etc. allow for it).

However, this also means that Malaysia has gotten dragged into the AI-data center bubble or narratives and to whatever happens when it eventually pops (or slows) or the narrative changes. Likewise and once a data center is built/fitted out, any economic growth is pretty much done as very few jobs are created beyond some technicians and security guards (who are usually from Nepal).

Finally, I should mention that my rent has probably gone up by roughly $100+ a month in dollar conversion terms between the Ringgit’s COVID era lows and today. However… where else in the world (aside from a few other SE Asian cities) can you rent a multi-bedroom condo for several hundred dollars a month in a well maintained building with a swimming pool, gym, etc. in the city center of a major city that’s reasonably safe to walk around at all hours of the day or night, has a warm climate year round, and is in walking distance to dozens of shopping malls and unlimited food/restaurants/hawker stands that meets all budgets?

Malaysia and Kuala Lumpur may or may not be the best place to invest for stock or property investors (especially foreign ones given the high state minimum property purchase prices for foreigners), but will always be an attractive place to live and visit compared to many alternatives…

With that said and getting back to the The Edge Billion Ringgit Club 2025, I realize these sorts of award events are often paid-for and sponsored corporate PR events that probably don’t mean much (in fact, there was such an article in a local Malaysian paper a some years ago about all of these “phony” pay-to-win award dinner ceremonies for local companies…), but this one is a little different given the methodology:

We did a post for 2024 winners plus posts covering The Edge Billion Dollar Club for Singapore listed or based stocks:

- Remembering the CLOB Stock Trading Fiasco + The Edge Billion Ringgit Club (BRC) 2024 Award Winners

- Singapore Stocks: The Edge Billion Dollar Club 2025 Award Winners

- Singapore Stocks: The Edge Billion Dollar Club 2024 Award Winners

- Singapore Stocks: The Edge Billion Dollar Club 2023 Award Winners

Note that the Malaysia section of our Oceania & Southeast Asia Stock Index now has 97 Malaysia stocks.

The rest of this post is organized as follows:

[Note: On desktop browsers, an autogenerated table of contents will appear on the left side linked to each stock. I will add those links below after publishing/emailing this post…]

- The Edge Billion Dollar Club 2025 Award Winners

- Winners

- SUPER BIG CAP COMPANIES: ABOVE RM40B MARKET CAPITALISATION

- BIG CAP COMPANIES: RM10B TO RM40B MARKET CAPITALISATION

- CONSTRUCTION

- CONSUMER PRODUCTS & SERVICES

- ENERGY

- FINANCIAL SERVICES: BELOW RM10B MARKET CAPITALISATION

- FINANCIAL SERVICES: RM10B AND ABOVE MARKET CAPITALISATION

- HEALTHCARE

- INDUSTRIAL PRODUCTS & SERVICES

- PLANTATION

- PROPERTY : BELOW RM3B MARKET CAPITALISATION

- PROPERTY: RM3B AND ABOVE MARKET CAPITALISATION

- REIT

- TECHNOLOGY

- TELECOMMUNICATIONS & MEDIA

- TRANSPORTATION & LOGISTICS

- UTILITIES

- Previous BRC Winners…

Readers can decide whether these DeepSeek insights or summary about these stocks are accurate:

- 🏆 Top Picks by Investment Thesis

- 📌 Thematic Investment Opportunities

- ⚠️ Important Macro & Risk Context from the Report

- ✅ Final Investor Takeaways

Finally, all of the stocks below have been added to our Oceania & Southeast Asia Stock Index which includes additional stocks and resources:

Oceania & Southeast Asia Stock Index

Frontier & Emerging Market Stock Index

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

🔬 Research analysis (including articles/blog posts from fund managers, etc.); 🎥 Video; 🎙️ Podcast; 🎬 Webinar; 📰 Newspaper/magazine article; 📯 Press release; 💻 Substack/blog/website article; ✅ Our own posts; 🗃️ Linked archived article; ⏰ Upcoming webinar or event; ⚠️ Disclosures or restricted access e.g. based on your location, investor status, etc.; 🇼 Wikipedia page; 🏷️ Tagged links to other posts about the stock.

The Edge Billion Dollar Club 2025 Award Winners

Winners

United Plantations Berhad

COMPANY OF THE YEAR

📝 Living up to its ‘second to none’ credo (The Edge Malaysia) October 2025

- 🇲🇾 🇮🇩 United Plantations Berhad (KLSE: UPBMF / OTCMKTS: UPBMF) – One of the larger medium-sized plantation groups in Malaysia. Upstream plantation operations in Malaysia + Indonesia + several downstream refining activities. 🇼 🏷️

- Price/Book (Current): 3.47

- Trailing P/E: 14.09 (no forward P/E) / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

CIMB Group Holdings Bhd

BEST CR INITIATIVES – SUPER BIG CAP COMPANIES ABOVE RM40B MARKET CAPITALISATION

[HIGHEST GROWTH IN PROFIT AFTER TAX OVER THREE YEARS]

[BEST CR INITIATIVES]

📝 Strong upward trajectory in earnings (The Edge Malaysia) October 2025

- 🌏 CIMB Group Holdings Bhd (KLSE: CIMB / OTCMKTS: CIMDF) – Various banking products & services. 🇼 🏷️

- Price/Book (Current): 1.32

- Forward P/E: 11.22 / Forward Annual Dividend Yield: 4.57% (Yahoo! Finance)

SD Guthrie Bhd

BEST CR INITIATIVES – BIG CAP COMPANIES RM10B TO 40B MARKET CAPITALISATION

📝 Making a tangible impact daily (The Edge Malaysia) October 2025

- 🌐 SD Guthrie Bhd (KLSE: SDG / OTCMKTS: SDPNF) – Upstream & downstream palm oil + land development & renewable energy. 🇼 🏷️

- Price/Book (Current): 1.96

- Forward P/E: 20.12 / Forward Annual Dividend Yield: 3.36% (Yahoo! Finance)

Heineken Malaysia Bhd

BEST CR INITIATIVES – BELOW RM10B MARKET CAPITALISATION

📝 Brewing a better world with focused, consistent efforts (The Edge Malaysia) October 2025

- 🇲🇾 Heineken Malaysia Bhd (KLSE: HEIM) – Produces, packages, markets, & distributes alcoholic beverages primarily in Malaysia. 51% held indirectly by Heineken NV (AMS: HEIA / FRA: HNK1 / OTCMKTS: HEINY) via its wholly owned subs. GAPL Pte Ltd. 🇼 🏷️

- Price/Book (Current): 18.26

- Forward P/E: 16.08 / Forward Annual Dividend Yield: 6.58% (Yahoo! Finance)

SUPER BIG CAP COMPANIES: ABOVE RM40B MARKET CAPITALISATION

CIMB Group Holdings Bhd

HIGHEST GROWTH IN PROFIT AFTER TAX OVER THREE YEARS

[BEST CR INITIATIVES – SUPER BIG CAP COMPANIES ABOVE RM40B MARKET CAPITALISATION]

[BEST CR INITIATIVES]

📝 Strong upward trajectory in earnings (The Edge Malaysia) October 2025

Press Metal Aluminium Holdings Bhd

HIGHEST RETURN ON EQUITY OVER THREE YEARS

📝 Aluminium giant with healthy double-digit returns (The Edge Malaysia) October 2025

- 🌐 Press Metal Aluminium Holdings Bhd (KLSE: PMETAL) – Integrated aluminium producer. 🏷️

- Price/Book (Current): 6.66

- Forward P/E: 26.74 / Forward Annual Dividend Yield: 1.03% (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- Remembering the CLOB Stock Trading Fiasco + The Edge Billion Ringgit Club (BRC) 2024 Award Winners

- Singapore Stocks: The Edge Billion Dollar Club 2025 Award Winners

- Singapore Stocks: The Edge Billion Dollar Club 2024 Award Winners

- Falling Oil Prices Puts a Spotlight on Malaysia’s Debt (Reuters)

- Bursa Malaysia (KLSE) (Profit Hunting blog)

- Malaysian Elections: Will The Malaysia ETF Rally or Sink?

- The Emerging Asia Pacific Capital Markets: Malaysia (CFA Institute)

- Malaysia Can Draw Up to $33b in Rare Earth Investment Over Next 10 Years (Straits Times)

- Karex Bhd: The World’s Biggest Condom Maker (NST)

- Public Bank (KLSE: PBBANK / OTCMKTS: PBLOF): Consistently Strong Financial Performance & Prudent Management

- The Malay Dilemma: Is the Malaysia ETF a Safe Emerging Market Investment?

- Singapore Stocks: The Edge Billion Dollar Club 2023 Award Winners

- What Happens if Malaysia is Removed From the FTSE World Bond Index? (The Asset)

- Will Emerging Markets and Berjaya Corporation Save RadioShack?

- MSCI Islamic Total Return Index vs. MSCI Emerging Markets Total Return Index (Mobius Blog)