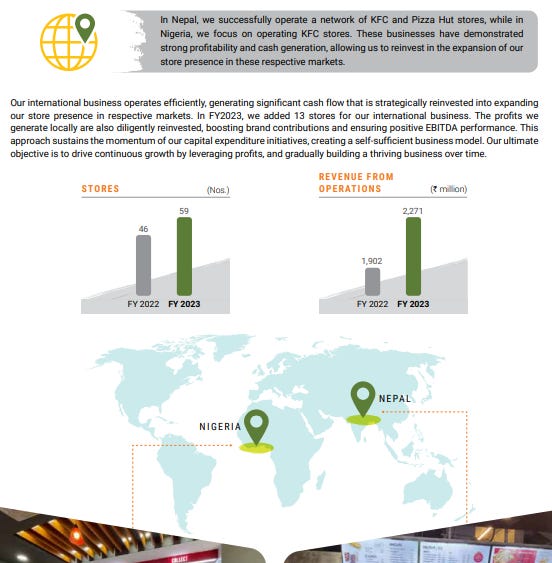

Devyani International (NSE: DEVYANI / BOM: 543330) is Yum! Brands largest (on a non-exclusive basis) franchisee for KFC & Pizza Hut in India, plus they operate Costa Coffee, have developed their own South Indian concept, and operate food courts. They have also expanded operations to Nepal and Nigeria (only KFC).

For the financial year ended March 2023, Devyani International reported record revenues, the highest-ever margins and record profits. However, Q1 results were more nuanced with net profit down 20%, but revenue was up 28%.

OVERVIEW:

- Devyani International is the largest (on a non-exclusive basis) franchisee for Yum! Brands (KFC & Pizza Hut) in India, Nigeria (only KFC) and Nepal. Devyani International Limited is also the sole franchisee for Costa Coffee brand and stores in India. In addition, DIL caters to the South Indian vegetarian food lovers with Vaango, launched a decade ago and is a prominent brand in the Food Retail Business (FRB) category with its Food Courts. DIL has a strong presence across Airports in India where it serves a variety of F&B offerings.

- As of December 31, 2022, DIL operates over 1,177 stores across brands in 225 plus cities in India, Nigeria and Nepal. The Company is an integral growth engine for RJ Corp, a conglomerate that today is a powerhouse multinational with thriving businesses in beverages, fast-food restaurants, retail, ice-cream, dairy products, healthcare, and education.

RECENT FINANCIALS / NEWS:

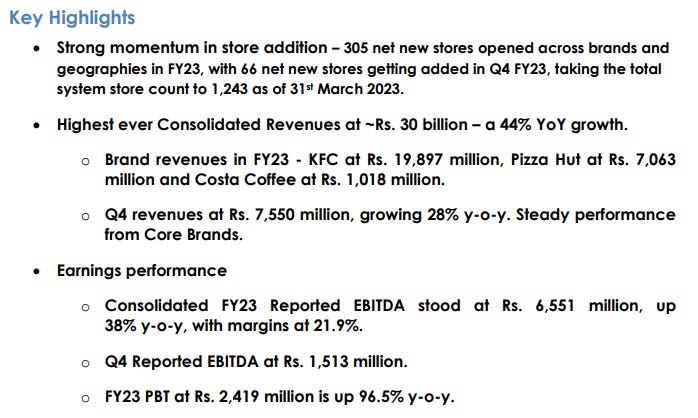

- Devyani International’s Q4 & FY23 Financial Results

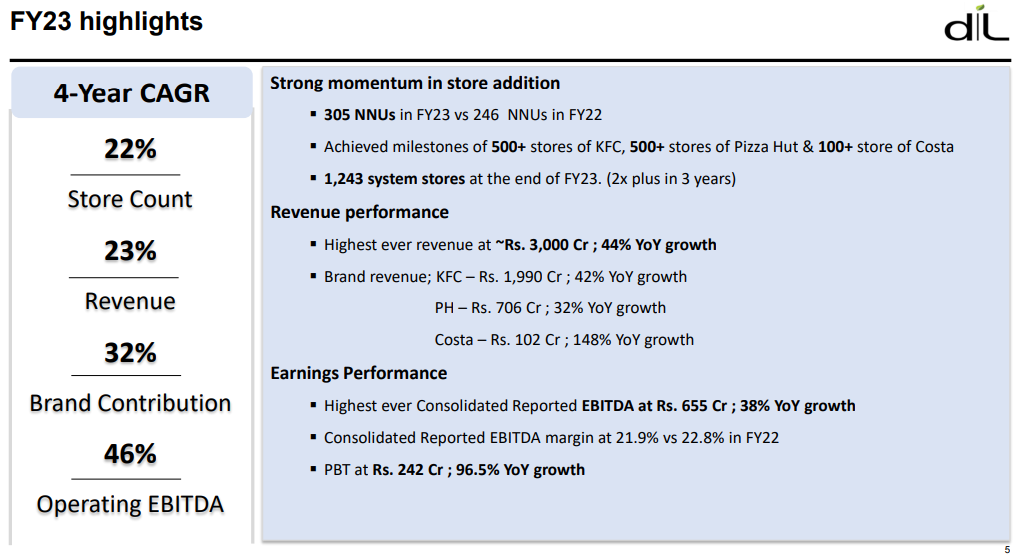

- Mr. Ravi Jaipuria, Non-Executive Chairman, Devyani International Limited said, “In FY23, DIL demonstrated strong growth momentum and we have crossed some very significant milestones. Our consolidated revenues have reached Rs. 3,000 Crore. We now operate 1,243 stores across our portfolio of countries and brands, more than doubling our store count over the last three years. Both KFC and Pizza Hut crossed important store milestones of 500 stores each & Costa Coffee has crossed 100 stores as of March 31, 2023.

- This phenomenal growth performance by DIL India was acknowledged and felicitated by Yum! at the International Franchise Conference, held in Singapore earlier this year where DIL India was awarded the ‘Explosive Restaurant Growth Award’.

- We continue to actively pursue new trade areas in metro cities and upcoming locations. This will help us take our brands closer to our customers and give them better experience, thus solidifying our presence in the domestic markets.

- Looking ahead, the confidence in our brands and the Indian market remains strong. We are seeing initial signs of inflation stabilizing. This gives us hope for a rebound in consumer spending in second half of the coming fiscal.

- By maintaining the financial discipline and operational excellence, we are well-positioned to emerge stronger and capture growth opportunities in the future. We remain firmly committed to our objective of creating sustainable long-term value for all our stakeholders.”

- Devyani International Q4 net profit falls 20% to Rs 607.20 mn, revenue jumps 28% (The Indian Express) May 2023

- Devyani International, which is the largest franchisee of Yum Brands (KFC and Pizza Hut) in India, said its net profit for the fiscal year 2023 jumped 69.50 per cent to Rs 2,649.97 million, from Rs 1,563.36 million in FY22.

- Devyani International’s non-executive chairman Ravi Jaipuria said the company is hopeful of “a rebound in consumer spending in the second half of the coming fiscal,” and pointed to the “initial signs of inflation stabilizing.”

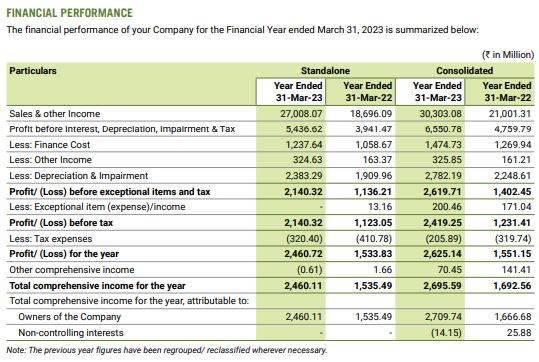

- 2022-23 Annual Report

- Our store expansion success supported our financial performance, which was marked by record revenues, highest-ever margins and record profits. These achievements are especially commendable considering the unprecedented inflation in the past year, potentially the highest in a decade. Our income grew 44% yearon-year, amounting to `30,303 million, showcasing the robustness of our brand portfolio. Through our strong emphasis on financial discipline and effective management of input costs, we achieved the highest-ever consolidated reported EBITDA of `6,551 million, reflecting a 38% year-on-year growth. Furthermore, our net profit reached `2,625 million, 69% increase from the previous year’s `1,551 million.

- ‘Is it ethically proper for a cardiologist to be on the board of a fast food company?’ asks proxy advisory firm SES (The Economic Times) June 2023 (Archived Article)

- Proxy advisory firm Stakeholders Empowerment Services (SES) has raised concerns over the presence of cardiologist Dr. Naresh Trehan as an independent director on the boards of Devyani International and Varun Beverages. Devyani International operates fast-food chains such as Pizza Hut and KFC, while Varun Beverages is a major franchisee of Pepsico. SES advises shareholders of Devyani International to vote against certain resolutions due to a potential conflict of interest. The report questions whether Dr. Trehan’s position on the boards conflicts with his professional stance on promoting healthy lifestyles. Requests for comment from Dr. Trehan and Devyani International remain unanswered.

- Stock Of The Day: Devyani International | What Makes This A Great Bet in QSR Space (YouTube) 3:45 Minutes (moneycontrol) May 2023

- Devyani International is the largest franchisee of Yum Brands (KFC and Pizza Hut) in India. With the relative under-penetration of both KFC and Pizza Hut in India, Devyani is aggressively expanding its store reach. Menu innovations based on Indian tastes and preferences would also be a key growth lever. With a reputed promoter, adequate cash generation, and healthy return ratios, Devyani International is on track to deliver industry-leading earnings growth over the next few years.

- Sapphire Foods vs Devyani International: The Valuation Debate | In The Swotlight | Inside Out (YouTube) 3:05 Minutes (moneycontrol) September 2022

- Will there be a narrowing of gap between Yum Brands franchise operators in India? Sapphire Foods vs Devyani International: The valuation debate. In The Swotlight with Nigel D’Souza (See Sapphire Foods (NSE: SAPPHIRE / BOM: 543397): Institutional Shareholders Remain Bullish as They Buy More Shares).

- Devyani International: Why Long-Term Investors Should Add This Stock To Their Portfolio (YouTube) 3:51 Minutes (moneycontrol) May 2022

- One of the fastest growing QSRs in India, Devyani International is reaping the benefits of restructuring of business model, leading to the company posting a profit in FY22 after a long gap. Should you invest?

KEY RATIOS:

- P/E (Google Finance): 86.02 / Trailing P/E (Yahoo! Finance): 86.69 (no forward P/E)

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

1 YEAR CHART:

LONG TERM CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations

- Wikipedia (Chairman Ravi Jaipuria)

- Devyani International’s Q4 & FY23 Financial Results

- Q4 FY 23 Results Presentation

- 2022-23 Annual Report

- ‘Is it ethically proper for a cardiologist to be on the board of a fast food company?’ asks proxy advisory firm SES (The Economic Times) June 2023 (Archived Article)

- Devyani International Q4 net profit falls 20% to Rs 607.20 mn, revenue jumps 28% (The Indian Express) May 2023

- Stock Of The Day: Devyani International | What Makes This A Great Bet in QSR Space (YouTube) 3:45 Minutes (moneycontrol) May 2023

- Sapphire Foods vs Devyani International: The Valuation Debate | In The Swotlight | Inside Out (YouTube) 3:05 Minutes (moneycontrol) September 2022

- Devyani International: Why Long-Term Investors Should Add This Stock To Their Portfolio (YouTube) 3:51 Minutes (moneycontrol) May 2022

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- Restaurant Brands Asia Ltd (NSE: RBA / BOM: 543248): Inflation Pains as Expansion Continues in India and Indonesia

- Sapphire Foods (NSE: SAPPHIRE / BOM: 543397): Institutional Shareholders Remain Bullish as They Buy More Shares

- Jubilant FoodWorks (NSE: JUBLFOOD / BOM: 533155): Inflation Bites as They Aggressively Expand Domino’s Pizza

- Westlife Foodworld Ltd (NSE: WESTLIFE / BOM: 505533): India’s McDonald’s Master Franchisee is Hitting New Highs

- Barbeque Nation (NSE: BARBEQUE / BOM: 543283): India’s Successful Homegrown Casual-Dining-Restaurant

- MapMyIndia (NSE: MAPMYINDIA / BOM: 543425): Maps Every Door in India

- moneycontrol India Stock of the Day (October 2023)

- Persistent Systems (NSE: PERSISTENT / BOM: 533179): One of India’s Fastest Growing IT Firms You Probably Have Not Heard Of

- moneycontrol India Stock of the Day (August 2023)

- moneycontrol India Stock of the Day (November 2023)

- moneycontrol India Stock of the Day (February 2024)

- Seven Reasons India Is Primed for Growth (Enterprising Investor)

- India Moves Up the Ranks of Asia300 Companies (Nikkei Asian Review)

- moneycontrol India Stock of the Day (December 2024)

- moneycontrol India Stock of the Day (March 2024)