This post is a compilation of links and briefs for our short EM Stock Pick Tear Sheets (separate section) for the last two weeks covering emerging market stock picks for China and South Korea.

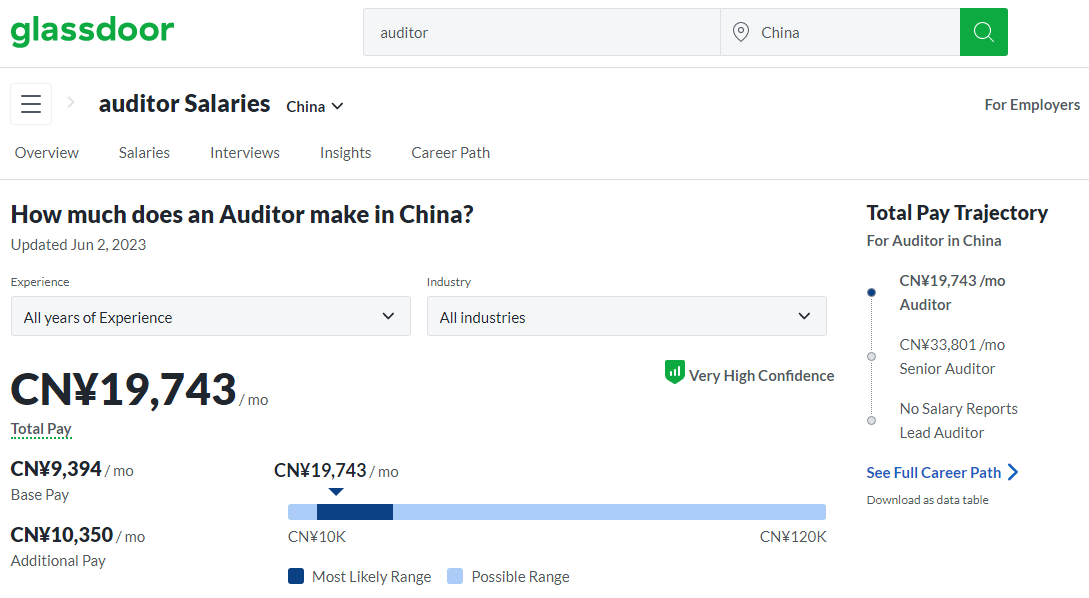

In order to keep their US listings, some Chinese stocks covered have recently switched to US based auditors or foreign ones registered with the Public Company Accounting Oversight Board (PCAOB). Now let me explain an overlooked problem with Chinese stocks audited in China (and this would be a problem for emerging markets everywhere and potentially even developed ones) with this glassdoor screenshot of auditor salaries in China:

The estimated total pay for a Auditor is CN¥19,743 [US$2,770.44] per month in the China area, with an average salary of CN¥9,394 [US$1,318.22] per month. These numbers represent the median, which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. The estimated additional pay is CN¥10,350 [US$1,452.37] per month. Additional pay could include cash bonus, commission, tips, and profit sharing. The “Most Likely Range” represents values that exist within the 25th and 75th percentile of all pay data available for this role.

(Note: I added the US$ figures)

Keep in mind that it’s going to be fairly junior and lower paid auditors who are doing the grunt audit work at most accounting firms. Also, the above salary figures are probably from big or coastal cities like Shanghai, Beijing, Shenzhen and Guangzhou where salaries are high and so is the cost of living.

I am not so familiar with Chinese salaries, taxes, and benefits; but when I lived and worked in the Philippines over a decade ago, an audit manager (e.g. someone maybe managing a small team of auditors) at one of the international (or Big 4 affiliated) accounting firms would probably be lucky to earn the equivalent of $US1,000 gross per month (the exchange also fluctuated a fair bit when I was there).

HOWEVER, he or she could go work in one of the offshore tax havens (e.g. Cayman Islands, Bermuda, Luxembourg, Dubai, etc) and could earn up to US$5-6k net (or mostly net) per month. And they may have gotten extra benefits like a small housing allowance (or free but shared accommodations) along with roundtrip flights home.

In other words, a Filipino auditor who is a “team player” (to put it diplomatically…) could go work in an offshore tax haven and (if they carefully manage their money) easy net a few thousand dollars a month for their savings. The catch was they had to be a “team player” – whether working in Manila or offshore…

I am not sure how many opportunities Chinese auditors or accountants have to work abroad in foreign tax havens, but that does not matter. Knowing these salary levels and potential differentials, can you fully trust any audited financial statements coming out of any emerging market?

[The topic of (low) salaries and their connection to “corruption” or “fraud” (or being a “team player…”) is a topic worth exploring in some detail in a future post…]

Last week’s EM Fund Stock Picks & Country Commentaries post along with our March 21st post also covered how “getting China right” will almost certainly be the single most important factor going forward for funds investing there. As explained in those posts, one fund’s strategy was to identify the next Asian Warren Buffets or Peter Lynchs who have on the ground experience investing in China (plus share the same investing philosophy) and to allocate them funds to invest while another fund’s China strategy involved picking stocks that fall under one of a couple of key investing themes they have for the country.

Some of our Chinese stock picks covered over the past two weeks fall in the tech and semiconductor space. And they could benefit directly from the US-China chip conflict and Chinese government policies and subsidies designed to help domestic companies.

Nevertheless, China still faces serious hurdles in the chip space. For example: Semiconductor Manufacturing International Corporation (SMIC) is one of the leading foundries in the world and is considered to be China’s most important chipmaker. However, the Company’s origins lay with stolen Taiwan Semiconductor Manufacturing Company technology that led to a several year court battle ultimately won by the latter while hamstringing the former’s ability to come up with it’s own technology.

Finally, our recent Emerging Market Links + The Week Ahead posts have included articles about more and more international investors throwing in the towel when it comes to investing in China… Or they are reducing their exposure to the country… Tomorrow’s post will link to more such articles…

As explained in our Mirae Asset Securities’ Korean Stock Picks (May 2023) post covering a number of Korean stocks, South Korea is a good place to consider shifting China investments to. The country offers many interesting stock picks covering a full range of sectors – from tech along with EV battery and green transition hyped stocks to idiocentric stock picks covering complex dentistry equipment, online gaming, cosmetic surgery, etc. And its starting to get easier to invest in Korea…

The catch? Many Korean stocks are invested in China – meaning they could be caught between a rock and a hard place should the US-China conflict get any worse…

Subscribe Now Via Substack

EM Stock Pick Tear Sheets Region/Country TAGS

Africa, Argentina, Chile, China, Colombia, Eastern Europe, Guyana, Hong Kong, India, Japan, Latin America, Macau, Malaysia, Mexico, Middle East, Nigeria, Poland, Singapore, South Africa, Southeast Asia, South Korea, Turkey & United Arab Emirates (UAE)

EM Stock Pick Tear Sheets Sector TAGS

Alcohol Stocks, AI Stocks, Auto Stocks, Bank Stocks, Battery Stocks, Biotech Stocks, Casino Stocks, Consumer Stocks, Financial Services Stocks, Fintech Stocks, Food & Beverage Stocks, Gaming Stocks, Health Care Stocks, Industrial Stocks, Insurance Stocks, Internet Stocks, IT Services Stocks, Meme Stocks, Oil Stocks, Property Developer Stocks, Real Estate Stocks, REITs, Restaurant Stocks, Retail Stocks, Semiconductor Stocks, Tech Stocks & Telco Stocks

PAYWALLED

- CMBI Research Focus List of China Stock Picks (June 2023) Partially $

- Includes: Li Auto, Great Wall Motor, Zoomlion Heavy Industry, Yancoal Australia, SANY International, CR Gas, Xtep, Yum China, Xiabu Xiabu Catering (XBXB), Midea, CR Beer, Tsingtao, Prada SpA, Kweichow Moutai, Innovent Biologics, AK Medical, AIA, Tencent, Pinduoduo, NetEase, Alibaba, Kuaishou, CR Land, BOE Varitronix, Wingtech & Kingdee

- Mirae Asset Securities’ Korean Stock Picks (May 2023) Partially $

- Includes: HMM, PI Advanced Materials, Chong Kun Dang Holdings, SK Hynix, i-SENS, SOCAR, Hanon Systems, Ray, Seegene, NCsoft, KEPCO, KT, LG Uplus, InBody, Vatech, Nexon Games, Pan Ocean, Lotte Chemical, Wemade, Krafton, Classys, Dentium, SK Telecom, Contentree JoongAng, NAVER, SK Innovation, Kakao, CJ Logistics, Vieworks, Studio Dragon, Kakao Games, Korean Air, Kumho Petrochemical, ST Pharm & LX International

- LG Chem (KRX: 051910): Owns Battery Stock LG Energy Solution (And Might Be the Better Stock to Own)

- LG Energy Solution (KRX: 373220): World’s Biggest Non-Chinese EV Battery Stock

- SK Innovation (KRX: 096770): Raises More Funds and is Making Georgia Battery Plant Productivity Gains

- CMBI Research Focus List of China Stock Picks (May 2023) Partially $

- Includes: Li Auto, Great Wall Motor, Zoomlion Heavy Industry, Yancoal Australia, CR Gas, Xtep, Yum China, Xiabu Xiabu Catering (XBXB), CR Beer, Tsingtao, Prada SpA, Kweichow Moutai, Innovent Biologics, AK Medical, AIA, Tencent, Pinduoduo, NetEase, Kuaishou, CR Land, BOE Varitronix, Wingtech & Kingdee

- Semiconductor Manufacturing International Corp (SHA: 688981 / HKG: 0981 / FRA: MKN2): China’s Most Important Chipmaker

- NAURA Technology Group (SHE: 002371): A Potential US-China Chip Conflict Beneficiary

- Hua Hong Semiconductor (HKG: 1347 / FRA: 1HH / OTCMKTS: HHUSF): Plans a $2.6B Shanghai Share Sale to Fuel Expansion

- Advanced Micro-Fabrication Equipment (SHA: 688012): China’s #2 Chip Tool Maker

NON-PAYWALLED

(NOTE: P/Es, dividend yields and charts are from June 16th):

CATL (SHE: 300750): World’s Largest EV Battery Maker Who Elon Musk Recently Met With

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) is the world’s largest EV battery maker who Elon Musk recently met with amid concerns about ties between the Company and Tesla may fray as the US-China conflict escalates.

CATL manufactures and sells electric vehicle and energy storage battery systems worldwide. The company’s products are used in road passenger transport and heavy-duty transport application; light trucks, minibuses, and minivans for express, supermarket, and fresh food deliveries; electric washing vehicles, electric washing and sweeping vehicles, electric garbage trucks, and other vehicles; forklifts and slag trucks; two-wheeled vehicles for commuting, food delivery, express delivery, etc.; vessel electrification; and special vehicle solutions. The Company also provides battery recycling services. Also see: EV Battery Maker Market Share Chart & Stock List (China, Japan & South Korea Stocks)

- P/E (Google Finance): 25.80 / Forward P/E (Yahoo! Finance): 28.57

- Dividend Yield (Google Finance): 0.76% / Forward Dividend & Yield (Yahoo! Finance): 1.35%

Legend Biotech (NASDAQ: LEGN): The J&J Partner Recently Surged on Leaked Data About It’s Multiple Myeloma Treatment

China-USA based Legend Biotech (NASDAQ: LEGN) is a developer of commercial-stage biotech medicines partnered with J&J. A May 16th Nikkei Asia and FT article noted the Company had told them how concerns about the Holding Foreign Companies Accountable Act (HFCAA) had prompted them to shift its auditing work from Ernst & Young Hua Ming in Shanghai to an E&Y office in New Jersey in 2022.

Headquartered in Somerset, New Jersey, Legend Biotech is developing advanced cell therapies across a diverse array of technology platforms, including autologous and allogenic chimeric antigen receptor T-cell and natural killer (NK) cell-based immunotherapy.

Specifically, Legend Biotech is currently discovering and developing a broad portfolio of cell therapies to help strengthen patients’ immune systems and fight disease. The Company explores several innovative and evolving technologies to treat hematologic malignancies and solid tumors: autologous chimeric antigen receptor T-cell therapy (CAR-T), allogeneic non-gene-editing CAR-T, natural killer (NK) cells and CAR-γδ T cells.

- P/E (Google Finance): N/A / Forward P/E (Yahoo! Finance): N/A

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

ACM Research (NASDAQ: ACMR): Successfully Straddling the US-China Chip Conflict (So Far…)

Silicon Valley and China based ACM Research (NASDAQ: ACMR) is a leading supplier of wafer processing solutions for semiconductor and advanced wafer-level packaging (WLP) applications. A May 16th Nikkei Asia and FT article noted the Company switched its accounting work to Armanino in San Ramon, California, from BDO China Shu Lun Pan in Shenzhen, which had served the chip material supplier since 2015. The company said it made the move so it would “no longer be subject to the related delisting guidelines of the HFCAA.”

Founded in 1998 in Silicon Valley by U.S. citizen David Wang (went public on the NASDAQ in 2017), ACM Research develops wet processing technology and products for the semiconductor industry. The company has produced equipment for a range of applications in IC manufacturing and wafer level packaging — with a special focus on cleaning technologies for advanced semiconductor devices.

- P/E (Google Finance): 14.55 / Forward P/E (Yahoo! Finance): 11.79

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

Mercurity Fintech Holdings (NASDAQ: MFH): Speculative Chinese Fintech, Blockchain and Bitcoin Stock

Mercurity Fintech Holdings (NASDAQ: MFH) is a speculative Chinese fintech and blockchain stock. A May 16th Nikkei Asia and FT article noted the Company switched from auditor Shanghai Perfect to Onestop Assurance PAC of Singapore as the latter is registered with the Public Company Accounting Oversight Board (PCAOB) and has been inspected by the Board “on a regular basis.”

The move reduces the risk of Mercurity Fintech being thrown off American stock exchanges. However, its still not clear exactly what the Company is doing – other than trying to cash in on fintech, blockchain, and bitcoin hype.

- P/E (Google Finance): N/A / Forward P/E (Yahoo! Finance): N/A

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

Fangdd Network (NASDAQ: DUO): Can the Online Marketplace Ride Out the Chinese Property Downturn?

Chinese online real estate marketplace Fangdd Network (NASDAQ: DUO) said in its annual report that on July 25, 2022, the Company switched auditors to the Audit Alliance of Singapore from KPMG Huazhen – one of the companies recently criticized by the Public Company Accounting Oversight Board (PCAOB).

Fangdd Network Group is a leading PropTech company in China, focusing on providing real estate transaction digitalization services. The company operates a real estate-focused online platform in China. Leveraging technological capabilities, the company has built a suite of modular software products and SaaS solutions that simplify the traditionally cumbersome processes in real estate transactions and allow marketplace participants to effectively carry out their businesses. By improving the transparency and efficiency of the real estate transaction, the company brings a better experience for all parties involved in the real estate transaction process, including real estate sellers, agents and real estate buyers.

- P/E (Google Finance): N/A / Forward P/E (Yahoo! Finance): N/A

- Dividend Yield (Google Finance): N/A / Forward Dividend & Yield (Yahoo! Finance): N/A

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Stock Pick Tear Sheets (June 1-18, 2023) was also published on our Substack.

Emerging Markets Investing Tips + Advice

Emerging Market Skeptic (Website)

Website List Updates + Site Map

Stocktwits @EmergingMarketSkptc

Similar Posts:

- Mirae Asset Securities’ Korean Stock Picks (June 2023)

- Mirae Asset Securities’ Korean Stock Picks (May 2023)

- Mirae Asset Securities’ Korean Stock Picks (November-December 2023)

- EV Battery Maker Market Share Chart & Stock List (China, Japan & South Korea Stocks)

- Mirae Asset Securities’ Korean Stock Picks (September 2023)

- Mirae Asset Securities’ Korean Stock Picks (January 2024)

- Mirae Asset Securities’ Korean Stock Picks (October 2023)

- Morningstar Hong Kong & Singapore Stock of the Week (Q3 2023)

- LG Chem (KRX: 051910): Owns Battery Stock LG Energy Solution (And Might Be the Better Stock to Own)

- Mirae Asset Securities’ Korean Stock Picks (August 2023)

- Mirae Asset Securities’ Korean Stock Picks (March-April 2024)

- Emerging Market Stock Pick Tear Sheets (July 1-15, 2023)

- Morningstar Hong Kong & Singapore Stock of the Week (Q2 2023)

- Mirae Asset Securities’ Korean Stock Picks (February 2024)

- CMBI Research Focus List of China Stock Picks (June 2023)