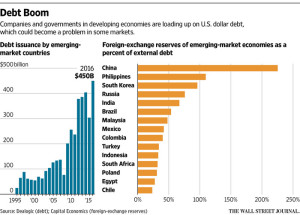

Emerging market companies and governments are binging on U.S. dollar debt – selling $179 billion in dollar-denominated debt in the first quarter – the most dollar debt ever raised in the first quarter and more than double the amount raised during the same period last year. This could become a source of trouble in some parts of the world if growth slows, interest rates rise or the dollar resumes its ascent as emerging market companies that don’t earn dollar revenues, including some telecoms, property developers and retailers, could stumble.

In all, U.S. dollar debt stood at $3.6 trillion in emerging markets through the third quarter of 2016 – an all-time high. Including local currency debt, emerging-market companies have increased their borrowing by a staggering $17 trillion since 2008.

Analysts say that countries such as India and the Philippines, which have relatively low stocks of external debt and healthy foreign-exchange reserves, are in better shape while countries like Malaysia and South Africa, which have small currency reserves and high levels of dollar-denominated debt, are at particular risk. Venezuela and Turkey look especially vulnerable.

To read the whole article, Flood of Dollar Debt Could Come Back to Haunt Emerging Economies, go to the website of the Wall Street Journal.

Similar Posts:

- The Emerging Market Sand Trap: Financial Reports, Currency & Other Risks (Epoch Times)

- Disentangling EM Debt (AberdeenStandard Investments)

- Emerging Market CDS Volume Up 46% in 2014 (EMTA)

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- What Makes Emerging Market Debt Tick? (CFA Institute)

- Emerging Markets’ Foreign Exchange Reserves Have Dipped (Mobius Blog)

- What Risks Do Emerging Markets Pose to US Economy? (Bloomberg)

- “Fragile Five” Emerging Markets No Longer That “Fragile” (AP)

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- The Future of Yuan (Express Tribune)

- Falling Oil Prices Puts a Spotlight on Malaysia’s Debt (Reuters)

- Infographic: Countries Not Using the US Dollar for Trade (Sputnik)

- Frontier Markets: 2019 Outlook (FIS Group)

- The Renminbi’s Creeping Internationalisation (BNP Paribas)