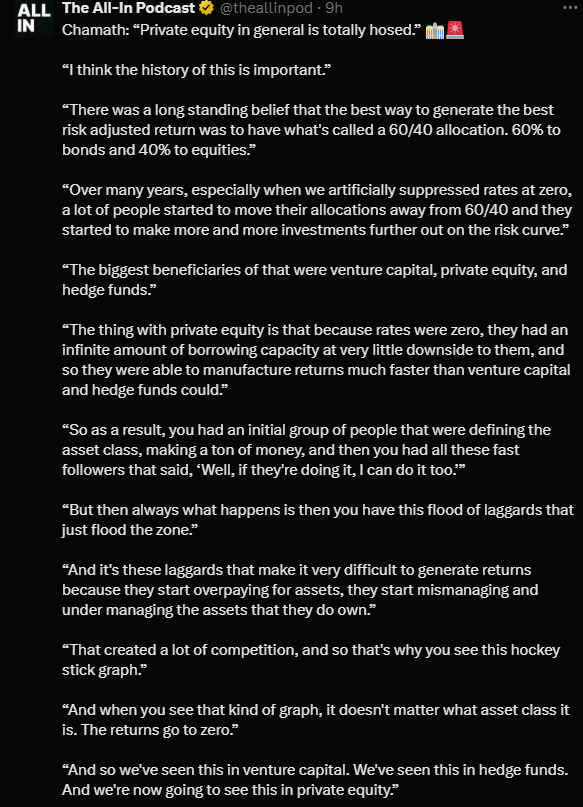

Our August 3rd, March 23rd, March 10, 2024 (almond industry) etc. covered how destructive private equity has become (e.g. also see the previously mentioned pieces, Collapse of Homeplus & More Bankruptcies of PE Owned Companies Globally [A Prelude to Big Short II?], The end of globalisation (Apollo Asia Fund: the manager’s report for 1Q25), etc) and now, of all people, Chamath Palihapitiya of the All-In Podcast is warning about it:

Note that Chamath himself has been hawking other types of garbage SPACs related to c**p like AI, blockchain and reshoring (BUT in his defense, he warns retail investors in the podcast to stay away from SPACs and his SPAC in general because of the risks involved – I just hope the IPO managers are listening…):

The piece in the twitter video screenshot is actually from 2023 and is a brutal read:

💻 The long, bloody lineage of private equity’s looting (Cory Doctorow) Jun 2, 2023

Or, if you prefer, “plundering.”

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster, and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears

The other piece in the screenshot is from the Guardian which also did a podcast on the subject:

📰 Slash and burn: is private equity out of control? (Guardian) 10 Oct 2024

From football clubs to water companies, music catalogues to care homes, private equity has infiltrated almost every facet of modern life in its endless search to maximise profits

Again and be warned that American University endowments (among others) need to find a bigger sucker to unload their already strip mined private equity investments onto and are apparently targeting Asian family offices, pension funds, etc. plus the USA may make it easier to load up the 401ks etc. of retail investors with these types of investments.

As of the start of October, some more August and a few September (our continuously updated post containing all funds is here with all July research removed) fund updates have dropped plus new research staring with some non-EM pieces:

- 🔬🇪🇺 Euro small cap vs US small cap – the golf edition (Aberdeen Investments) – Who will claim victory—Europe’s disciplined small caps or America’s bold innovators? Step onto the fairway with us for a Ryder Cup-inspired face-off for our thoughts on which team may outperform in today’s market.

- 🇬🇧 Games Workshop Group PLC (LON: GAW / FRA: G7W / OTCMKTS: GMWKF) 🇼

- 🇸🇪 Addtech AB (STO: ADDT-B / FRA: AZZ2) 🇼

- 🇺🇸 REV Group (NYSE: REVG) 🇼

- 🇺🇸 e.l.f. Beauty (NYSE: ELF) 🇼

- 🇬🇧 Diploma PLC (LON: DPLM / FRA: DP9 / OTCMKTS: DPLMF) 🇼

- 🇺🇸 Wintrust Financial Corp (NASDAQ: WTFC) 🇼

- 🔬🇩🇪 Germany’s strategic agenda: Reforming the future (Janus Henderson Investors) – European equities Portfolio Manager Robert Schramm-Fuchs delves into the intricate landscape of Germany’s ambitious reform agenda, exploring its implications for domestic growth and the broader European Union’s economic and geopolitical dynamics.

- 🎙️🇪🇺 Europe on a mission (The Macro Brief by HSBC Global Research) 14:04 Minutes – Simon Wells, Chief European Economist, assesses the growth outlook for the region and the contrasting fortunes of the ECB and Bank of England in their bid to tame

- 🔬🌐 Market Strain: What’s at Stake When the U.S. Government Shuts Down (Northern Trust) – Shutdowns are a recurring event — 20 of them in the past five decades, with most resolved relatively quickly. But the context surrounding this one makes it more complex. We analyze:

- How the shutdown may create blind spots for the Fed.

- The secondary consequences beyond the shutdown itself.

- The potential impact on stock and bond markets.

New Asia Fund Documents & Research

- 🔬🌏 abrdn Asia-Pacific Income Fund, Inc. (NYSEAMERICAN: FAX)’s quarterly commentary (market review and outlook) is dated from the Quarter ended July 31, 2025. It gives or covers an economic & market overview, Asian bonds, Asian currencies, Asian credit, EM debt & currencies and an outlook.

- 🔬🌏 Celebrating 30 years of abrdn Asia Focus (Aberdeen Investments) – 2025 marks the 30-year anniversary of Abrdn Asia Focus PLC (LON: AAS). To mark the occasion, we were delighted to close the market at the London Stock Exchange on Thursday 18 September 2025.

To read more, please visit this article on Substack

Similar Posts:

- EM Fund Stock Picks & Country Commentaries (September 1, 2024)

- EM Fund Stock Picks & Country Commentaries (May 26, 2024)

- EM Fund Stock Picks & Country Commentaries (March 23, 2025)

- EM Fund Stock Picks & Country Commentaries (December 22, 2024)

- EM Fund Stock Picks & Country Commentaries (October 26, 2025)

- EM Fund Stock Picks & Country Commentaries (December 29, 2024)

- EM Fund Stock Picks & Country Commentaries (October 6, 2024)

- EM Fund Stock Picks & Country Commentaries (June 8, 2025)

- EM Fund Stock Picks & Country Commentaries (January 4, 2026)

- EM Fund Stock Picks & Country Commentaries (March 9, 2025)

- EM Fund Stock Picks & Country Commentaries (July 14, 2024)

- EM Fund Stock Picks & Country Commentaries (March 30, 2025)

- EM Fund Stock Picks & Country Commentaries (September 29, 2024)

- EM Fund Stock Picks & Country Commentaries (November 23, 2025)

- EM Fund Stock Picks & Country Commentaries (November 17 2024)