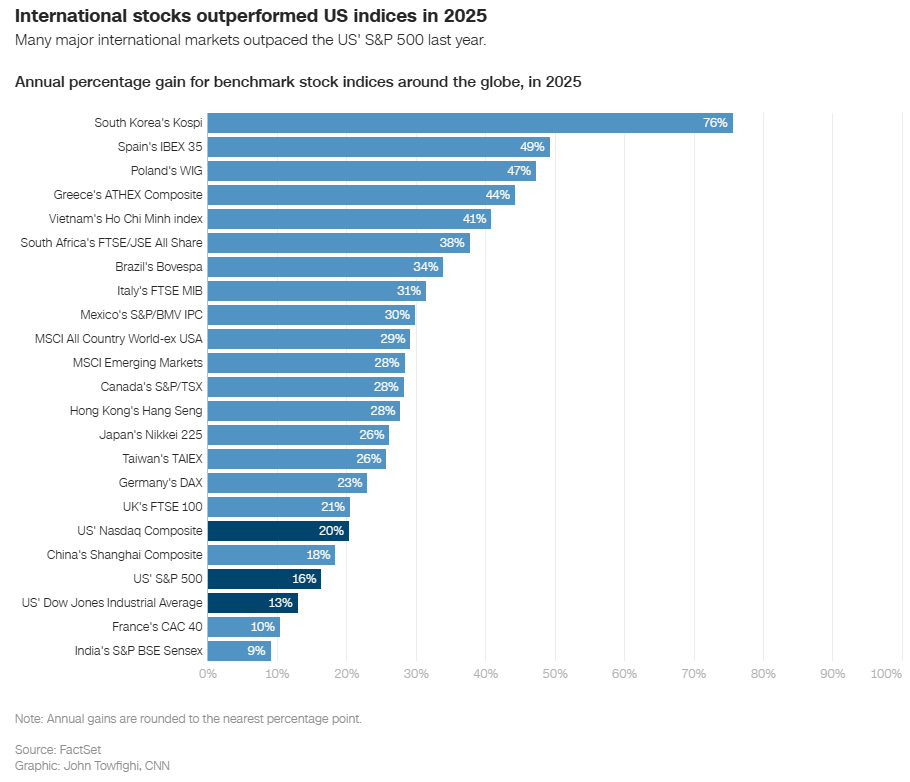

As mentioned on Monday [US stocks had a remarkable 2025, but international markets did much better], Korea’s Kospi outperformed both US and other international markets last year:

💻 Korean Stock Market – The Best Performing Among Major Countries Indices in 2025 (Douglas Research Insights) $ Dec 31, 2025

- We discuss the five most important factors driving the Korean stock market this year which was the best performing among all major country equity markets in the world in 2025.

- These five factors included the global AI boom, wars and rumors of wars, beneficiaries of MASGA, Korea Value-Up initiatives, and reduced political uncertainties with new President elected in June 2025.

- Our best bet to diversify one’s portfolio and be more cautious because staying alive will be a key in 2026 rather than FOMO, especially in 2H 2026.

In addition, this is worth considering:

🇰🇷 Clear Recent Outperformance of Korean Preferred Vs. Common Shares (Douglas Research Insights) $ Nov 11, 2025

- In this insight, we provide reasoning behind the clear recent outperformance of Korean preferred shares versus common shares.

- Among the 10 pairs, nine of them have preferred shares outperforming common shares in the past five days.

- One of the main reasons why the preferred shares have recently outperformed their common counterparts is because of the expectation of the higher probability of lowering tax on dividends.

However, the Korean preference shares focused Weiss Korea Opportunity Fund (LSE: WKOF) covered in our Sunday posts is in the process of winding down.

Korean indices will experience some adjustments:

💻 An Early Look at Potential Additions and Deletions to KOSDAQ150 in June 2026 (Douglas Research Insights) $ Dec 22, 2025

- In this insight, we provide an early look at the potential additions and deletions to KOSDAQ150 rebalance in June 2026.

- We provide 8 potential deletion candidates including Seoul Semiconductor Co Ltd (KOSDAQ: 046890), KolmarBNH Co Ltd (KOSDAQ: 200130 / OTCMKTS: KHCLF), Golfzon Co Ltd (KOSDAQ: 215000), and Devsisters Corp (KOSDAQ: 194480).

- Of the eight potential additions in KOSDAQ150 in June 2026, six of them are IPOs in 2025.

💻 An Early Look at Potential Additions and Deletions to KOSPI200 in June 2026 (Douglas Research Insights) $ Dec 19, 2025

- In this insight, we provide an early look at the potential additions and deletions to KOSPI200 rebalance in June 2026.

- We provide 8 potential deletion candidates including Miwon Specialty Chemical Co Ltd (KRX: 268280), Seah Steel Holdings Corp (KRX: 003030), Asia Holdings Co Ltd (KRX: 002030), and Miwon Commercial (KRX: 002840).

- Eight potential additions in KOSPI200 in June 2026 are up on average 41.7% on average in the past six months, outperforming KOSPI in the same period.

💻 KRX Announces Changes to KOSPI200 Index (Douglas Research Insights) $ Nov 18, 2025

- KRX announced changes to KOSPI200 and KOSDAQ150 indices. These changes will be effective from 12 December 2025.

- In KOSPI200, there are 8 new additions and 8 deletions. Among the new additions include LG CNS Co Ltd (KRX: 064400), Sanil Electric Co Ltd (KRX: 062040), Asia Holdings Co Ltd (KRX: 002030), and Paradise Co Ltd (KOSDAQ: 034230).

- There could be a buying opportunity for LG CNS due to its inclusion in KOSPI200 combined with its attractive valuations and accelerating sales and operating profit growth in 2026.

This is also worth noting:

💻 Top 12 Korean Companies – Key Beneficiaries of the SpaceX IPO in 2026 (Douglas Research Insights) $ Dec 14, 2025

- In this insight, we discuss the top 12 Korean companies that could benefit from the SpaceX IPO in 2026.

- Share prices of 12 Korean companies that are beneficiaries of the SpaceX IPO are up on average 16.7% in the past one week versus KOSPI (up 1.6% in same period).

- SeAH Besteel Holdings Corp (KRX: 001430) is a potential supplier of specialty steel to SpaceX. Kencoa Aerospace Corp (KOSDAQ: 274090) provided rocket parts to SpaceX. Intellian Technologies Inc (KOSDAQ: 189300) partnered with SpaceX on its launch vehicle recovery experiment.

Finally, some recent news or possible policy developments over the past 2 months:

📰 Risk-loving Korean investors made to watch training video before trading (FT) $ 🗃️ 14 Dec 2025

- South Korean regulators want to strengthen oversight of retail traders

- From Monday, brokerages will automatically block investors wanting to put their funds into leveraged or inverse ETFs and who cannot provide the certification number given to those who have completed the one-hour online training.

- The training focuses on the structure of leveraged ETFs, the cost of hedging and the compounding effect that can magnify gains and losses. Those investing in derivative products overseas will have to do a three-hour mock trading session.

- The training, an expansion of regulations governing domestic trading, follows a record surge of Korean money into US equities, up more than 50 per cent this year to a record $161bn at the end of November, according to the Korea Securities Depository. It is unclear how much Korean money has gone into ETFs, though anecdotal evidence suggests it is substantial.

💻 Likely Increase In Mandatory Tender Offer from the Current 50% + 1 Share Requirement (Douglas Research Insights) $ Dec 01, 2025

- Korean government is likely to increase the mandatory tender offer from current 50% + 1 share requirement (minimum majority stake) to much higher levels (but below the maximum 100% requirement).

- There is an increasing probability that indeed the Korean government is likely to increase the minimum majority stake requirement to 60% to 75% of total shares in 1H26.

- If the minimum maximum stake rises to 60%-75% of outstanding shares, this would have a further beneficial impact on the minority shareholders.

💻 Top Bracket Dividend Tax Rate Lowered to 30% in Korea [Moderately Positive] (Douglas Research Insights) $ Nov 28, 2025

- On 28 November, the Korean National Assembly reached an agreement on a tax reform plan to officially lower taxes on dividends income.

- The decline in tax on dividends is a definite step in the right direction. Nonetheless, the top bracket dividend tax rate cut was slightly less than what market was expecting.

- Given that about 15%-25% dividend tax rates are more common in other developed countries, Korea’s reduction of dividend taxes is likely to be welcomed highly by many global investors.

💻 Foreigners Integrated Accounts Starting in January 2026: Impact on IBKR & Foreign Trading Platforms (Douglas Research Insights) $ Nov 27, 2025

- On 27 November, the Korean Financial Services Commission (FSC) finally announced that it has completely abolished the restrictions on the foreigners opening integrated accounts to trade Korean stocks.

- This amendment will start to take effect on 2 January 2026.

- What this means is that major global trading platforms such as IBKR will most likely be allowed to trade Korean stocks without any major restrictions sometime starting 1H 2026.

💻 Confirmation of Cancellation of Treasury Shares To Be Made Into Law by End of 2025 and a Loophole? (Douglas Research Insights) $ Nov 25, 2025

- On 25 November, the Democratic Party of Korea confirmed that the cancellation of treasury shares will be made into law by the end of 2025.

- Companies that buyback their shares (as treasury shares) will be required to cancel them within one year of the buyback.

- There may be a LOOPHOLE if the company fails to cancel the treasury shares on time. Fine per director is only 50 million won and this may be too low.

💻 NPS Could Raise Allocation of Korean Stocks = KOSPI to 5,000 Soon (Douglas Research Insights) $ Nov 10, 2025

- One of the biggest stories in the Korean stock market in the past several weeks has been the discussions about [National Pension Service] NPS potentially increasing the allocation of Korean stocks.

- If NPS announces a meaningful increase in the allocation of Korean stocks for its AUM, then there could certainly be an acceleration to KOSPI reaching 5,000.

- Based on what we have gathered so far, there is a higher probability (70-80%) that NPS meaningfully increases the allocation of Korean stocks in the next severalmonths.

Korean stocks from a variety of research sources covered in the rest of this post for November-December (but with up-to-date charts and key data):

[Note: On desktop browsers, an autogenerated table of contents will appear on the left side linked to each stock. I will add those links below after publishing/emailing this post…]

Tomocube, Shinsegae, F&F, Misto Holdings, PharmaResearch, ST Pharm, LG Innotek, Hansae, Youngone Corp., SoluM, Shinsegae International, Samsung Biologics, Jeju Air, LG Electronics, Samsung Electro-Mechanics, SK Oceanplant, Meritz Financial Group, Samsung Fire & Marine, Samsung Life, Korea Investment Holdings, KEPCO, HMM, Lotte Chemical, OCI Holdings, Dentium, PearlAbyss Corp, NCsoft, Wemade, Shift Up, Classys, CJ Logistics, Cosmax, Kolmar Korea, CS Wind, Daewoong Pharmaceutical, Samsung Securities, KT, Kumho Petrochemical, Kia Corp, GS Retail, Kakao, L&F, Hugel, Cosmecca Korea, DL E&C, APR, LIG Nex1, Netmarble, HD Korea Shipbuilding & Offshore Engineering, SM Entertainment, Hanwha Solutions, Hyundai Department Store, LG Uplus, Korea Aerospace Industries, Kakao Games, NAVER, Hyundai Livart, GS Engineering & Construction Corp, Celltrion, HD Hyundai Mipo, Dear U, Krafton, Hanwha Aerospace, GC Biopharma, HD Hyundai Heavy Industries, JB Financial Group, S-Oil, i-SENS, Hyundai Rotem, Industrial Bank of Korea, iM Financial Group, BNK Financial Group, Shinhan Financial Group, Hana Financial Group, POSCO Future M, Hanwha Systems, Woori Financial Group, SK Innovation, LG Chem, HD Hyundai, KB Financial Group, Hyundai Mobis, Soop, Daewoo Engineering & Construction Co Ltd, Hyundai Engineering & Construction, NH Investment & Securities, Kiwoom Securities & Hyundai Motor

Readers can decide whether these DeepSeek insights about these stocks are accurate:

1. Value & Deep Value Plays (Low P/B, Attractive Valuation)

2. High Dividend Yield Stocks (Income Investors)

3. Growth & Theme-Based Opportunities

4. Policy & Index Inclusion Catalysts

5. Turnaround & Recovery Stories

6. Speculative & High-Risk/High-Reward

Summary of Top Picks by Investor Profile

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

🔬 Research analysis (including articles/blog posts from fund managers, etc.); 🎥 Video; 🎙️ Podcast; 🎬 Webinar; 📰 Newspaper/magazine article; 📯 Press release; 💻 Substack/blog/website article; ✅ Our own posts; 🗃️ Archived article; ⏰ Upcoming webinar or event; ⚠️ Disclosures or restricted access e.g. based on your location, investor status, etc.; 🇼 Wikipedia page; 🏷️ Tagged links to other posts about the stock.

Japan, Korea & Taiwan Stock Index

Frontier & Emerging Market Stock Index

Tomocube

🔬 Tomocube (475960 KQ) – Exclusive technology turning into commercial gains (Daishin Securities) 29-12-2025 ⚠️

- 🌐 Tomocube Inc (KOSDAQ: 475960) – Optical devices & medical equipment. Holotomography imaging & analysis solution. 🏷️

- Price/Book (Current): 17.11

- Forward P/E: N/A / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

Shinsegae

🔬 Shinsegae (004170 KS/Buy) – Still the most attractive retail play even after recent rally (Mirae Asset Securities) 12.22.2025 ⚠️

🔬 Shinsegae (004170 KS/Buy) – Significantly undervalued (Mirae Asset Securities) 11.11.2025 ⚠️

- 🇰🇷 Shinsegae Inc (KRX: 004170) – Department store franchise. Affiliate of Shinsegae Group chaebol. 1 of the big 3 department store firms (Lotte Department Store (Lotte Shopping Co Ltd (KRX: 023530)) & Hyundai Department Store Co Ltd (KRX: 069960). 🇼 🏷️

- Price/Book (Current): 0.50

- Trailing P/E: 54.34 (no forward P/E) / Forward Annual Dividend Yield: 1.73% (Yahoo! Finance)

F&F

🔬 F&F (383220 KS/Buy) – TaylorMade issue approaching resolution (Mirae Asset Securities) 12.22.2025 ⚠️

🔬 F&F (383220 KS/Buy) – Turning the corner (Mirae Asset Securities) 11.11.2025 ⚠️

- 🇰🇷 F&F Co (KRX: 383220) – Manufactures & sells sewn wearing apparels in Korea. Operates independently of F&F Holdings Co (KRX: 007700). 🏷️

- Price/Book (Current): 1.39

- Forward P/E: 6.00 / Forward Annual Dividend Yield: 2.33% (Yahoo! Finance)

Misto Holdings

🔬 Misto Holdings (081660 KS/Buy) – Earnings turnaround, structural improvement, and shareholder returns (Mirae Asset Securities) 12.22.2025 ⚠️

🔬 Misto Holdings (081660 KS) – Margins see broad recovery after US operation wind-down (Daishin Securities) 18-11-2025 ⚠️

🔬 Misto Holdings (081660 KS/Buy) – Turnaround potential coming into view (Mirae Asset Securities) 11.28.2025 ⚠️

- 🌐 Misto Holdings Corp (KRX: 081660) – Textile products, clothing, footwear, leather products, watches, cosmetics, golf equipment & other products under the FILA brand. 🏷️

- Price/Book (Current): 1.14

- Forward P/E: 11.53 / Forward Annual Dividend Yield: 4.26% (Yahoo! Finance)

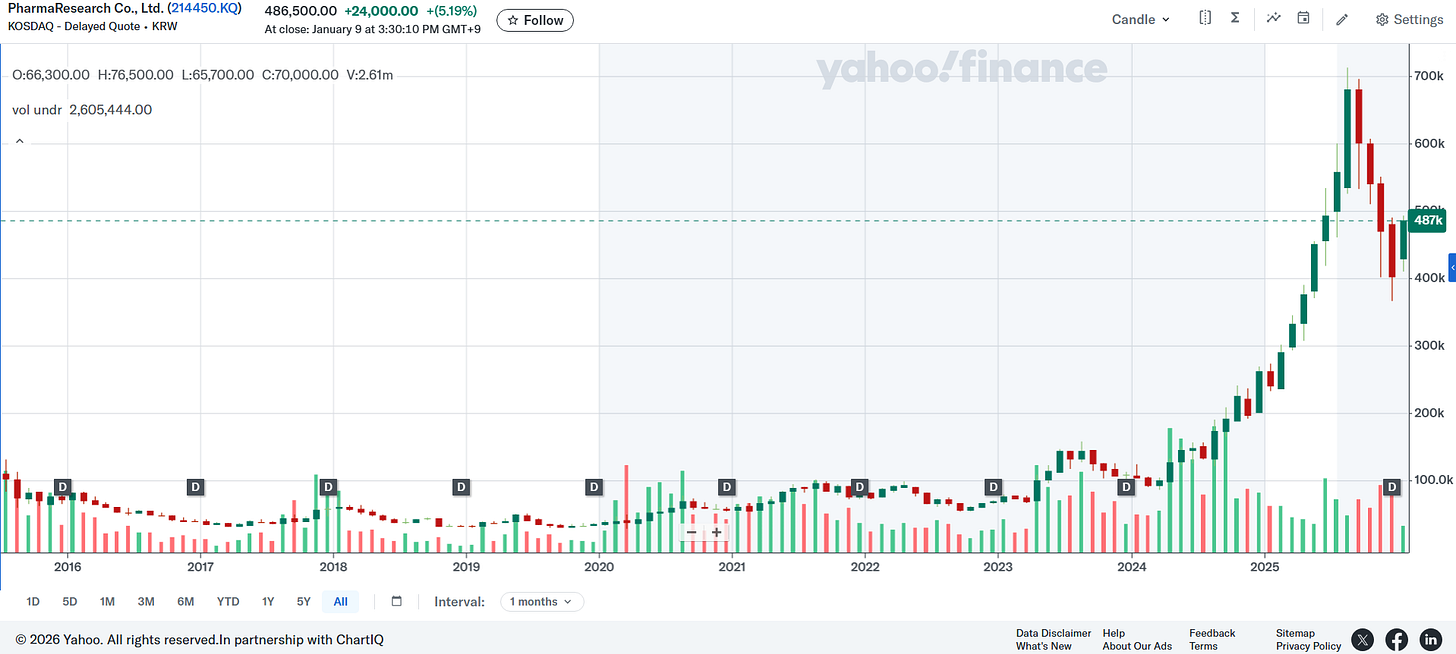

PharmaResearch

🔬 Pharma Research (214450 KQ) – Correction underway, yet growth story intact (Daishin Securities) 12-11-2025 ⚠️

🔬 PharmaResearch (214450 KQ/Buy) – An inevitable valuation reset (Mirae Asset Securities) 11.12.2025 ⚠️

- 🇰🇷 PharmaResearch Co Ltd (KOSDAQ: 214450) – Pharmaceutical license consulting + import & sales of innovative drugs. Aesthetic medical devices, derma cosmetics, botulinum toxin preparations etc. 🏷️

- Price/Book (Current): 7.65

- Trailing P/E: 34.05 (no forward P/E) / Forward Annual Dividend Yield: 0.29% (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- Korean Stock Picks (November 2024)

- Korean Stock Picks (April 2025)

- Korean Stock Picks (December 2024)

- Korean Stock Picks (October 2025)

- Mirae Asset Securities’ Korean Stock Picks (November-December 2023)

- Korean Stock Picks (September 2024)

- Mirae Asset Securities’ Korean Stock Picks (October 2023)

- Korean Stock Picks (March 2024)

- Korean Stock Picks (May 2025)

- Korean Stock Picks (June-July 2025)

- Mirae Asset Securities’ Korean Stock Picks (July-August 2024)

- Korean Stock Picks (February 2024)

- Korean Stock Picks (October 2024)

- Mirae Asset Securities’ Korean Stock Picks (September 2023)

- Mirae Asset Securities’ Korean Stock Picks (August 2023)