A couple of recent developments in the Korean stock market with the first worth noting being Korea’s National Pension Service will likely increase its allocation to Korean stocks in the coming months:

💻 NPS Could Raise Allocation of Korean Stocks = KOSPI to 5,000 Soon (Douglas Research Insights) Nov 10, 2025 $

- One of the biggest stories in the Korean stock market in the past several weeks has been the discussions about [National Pension Service] NPS potentially increasing the allocation of Korean stocks.

- If NPS announces a meaningful increase in the allocation of Korean stocks for its AUM, then there could certainly be an acceleration to KOSPI reaching 5,000.

- Based on what we have gathered so far, there is a higher probability (70-80%) that NPS meaningfully increases the allocation of Korean stocks in the next severalmonths.

In addition, there are key Korean index changes coming:

💻 KOSDAQ150 Index Rebalance Preview: Large Number of Changes Likely in December; Huge Outperformance (SmartKarma) 04 Nov 2025 $

- With the review period for the December rebalance complete, we highlight 17 potential changes for the KOSDAQ 150 Index (KOSDQ150 INDEX).

- The estimated impact on the potential inclusions ranges from 0.1-3.2 days of ADV while the impact on the potential deletions varies from 0.7-11.2 days of ADV.

- The forecast adds have outperformed the forecast deletes over the last 6 months with a big move higher in the last couple of months. Trim positions into strength.

Finally, out Monday posts recently noted these pieces about Korean beauty brands:

📰 K-Beauty’s Viral Rise in the U.S. Market (NIQ) 21 October 2025

- In partnership with Spate, NIQ explores how Korean beauty brands have strategically leveraged TikTok Shop to achieve explosive growth in the U.S. market. With a focus on viral content, influencer partnerships, and innovative product formats, K-Beauty has become a dominant force in the beauty category, reaching $2B in U.S. sales.

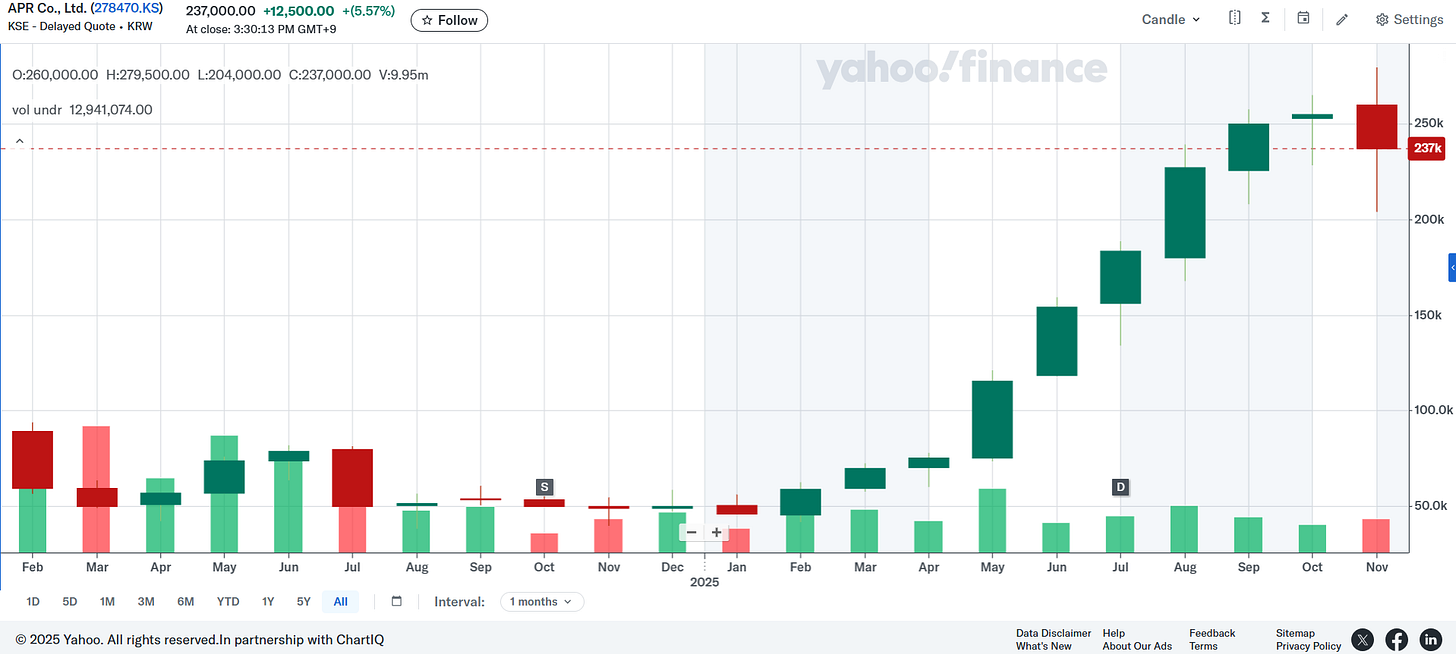

📰 Kardashian endorsement of skincare gadget creates K-beauty champion (FT) 21 Oct 2025 $ 🗃️

- Shares in South Korea’s APR Co Ltd (KRX: 278470) have surged 400% this year as it expands in US and Europe

- Led by 36-year-old founder Kim Byung-hoon, APR has surpassed the valuation of other K-beauty brands Amorepacific [Amorepacific Corp (KRX: 090430 / 090435) / Amorepacific Holdings (KRX: 002790)] and LG H&H (KRX: 051900 / 051905 / OTCMKTS: LGHMF) partly as a result of his wide social media following and sleek product design.

- But some investors have questioned whether APR can maintain its popularity overseas as competitors launch rival products.

- 🌐 APR Co Ltd (KRX: 278470) – Global beauty tech D2C company. Offers medical cosmetics & diet products; operates instant photo booths + caps, sweat shirts & track tops through its online store. 🏷️

- Price/Book (Current): 24.10

- Forward P/E: 23.64 / Forward Annual Dividend Yield: 3.20% (Yahoo! Finance)

Korean stocks from a variety of research sources covered in the rest of this post for October (but with up-to-date charts and key data):

[Note: On desktop browsers, an autogenerated table of contents will appear on the left side linked to each stock. I will add those links below after publishing/emailing this post…]

LG Innotek, Hyundai Motor, W-Scope Chungju Plant, SK Telecom, Hyundai Glovis, Hyundai Steel, Samsung E&A, Samsung Electronics, ST Pharm, Samsung Electro-Mechanics, SK Hynix, Samsung Biologics, Samsung C&T, Samsung SDI, POSCO Holdings, GS Retail, POSCO International, Hanmi Pharmaceutical, LG Energy Solution, Daeduck Electronics, BGF Retail, Samsung Heavy Industries, GS E&C, DL E&C, Daewoo Engineering & Construction Co Ltd, HD Hyundai Mipo, HD Hyundai Heavy Industries, Hyundai Engineering & Construction, Korean Air, Cosmecca Korea, PharmaResearch, Krafton, JYP Entertainment, Dear U, JB Financial Group, Woori Financial Group, SK Square, Pan Ocean, Hanwha Ocean, OCI Holdings, HYBE, SM Entertainment, Kakao Corp, Netmarble, NAVER, Hotel Shilla, Hyundai Department Store, Shinsegae Inc & LX International

Readers can decide whether these DeepSeek insights about these stocks are accurate:

- For Value & Deep Value Investors (Low P/B, Low P/E)

- For Dividend & Income Investors (High Dividend Yield)

- For Growth & Momentum Investors (Positive Catalysts & Secular Trends)

- For “Story Stock” & Thematic Investors (Unique & High-Potential Narratives)

- Summary & Key Takeaways

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

🔬 Research analysis (including articles/blog posts from fund managers, etc.); 🎥 Video; 🎙️ Podcast; 🎬 Webinar; 📰 Newspaper/magazine article; 📯 Press release; 💻 Substack/blog/website article; ✅ Our own posts; 🗃️ Archived article; ⏰ Upcoming webinar or event; ⚠️ Disclosures or restricted access e.g. based on your location, investor status, etc.; 🇼 Wikipedia page; 🏷️ Tagged links to other posts about the stock.

Japan, Korea & Taiwan Stock Index

Frontier & Emerging Market Stock Index

LG Innotek

🔬 LG Innotek (011070 KS/Buy) – Upbeat outlook (Mirae Asset Securities) 10.31.2025 ⚠️

🔬 LG Innotek (011070 KS) – 3Q earnings forecast revised up; buy on dips! (Daishin Securities) 17-10-2025 ⚠️

🔬 LG Innotek (011070 KS/Buy) – Favorable price, volume, and cost dynamics expected in 2026 (Mirae Asset Securities) 10.10.2025 ⚠️

- 🌐 LG Innotek (KRX: 011070) – Korea’s first electronic components company. Global materials & components (mobile, display, semiconductor, automobile & IoT). 🇼 🏷️

- Price/Book (Current): 1.02

- Forward P/E: 9.06 / Forward Annual Dividend Yield: 0.87% (Yahoo! Finance)

Hyundai Motor

🔬 Hyundai Motor (005380 KS/Buy) – Tariff impact continues to be offset; US market share in focus (Mirae Asset Securities) 10.31.2025 ⚠️

- 🌐🅿️ Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) – Multinational automotive manufacturer. 🇼 🏷️

- Price/Book (Current): 0.61

- Forward P/E: 8.35 / Forward Annual Dividend Yield: 3.79% (Yahoo! Finance)

W-Scope Chungju Plant

🔬 W-Scope Chungju Plant (393890 KQ/Buy) – Long-term potential deserves attention (Mirae Asset Securities) 10.31.2025 ⚠️

- 🇰🇷 W-Scope Chungju Plant Co Ltd (KOSDAQ: 393890) – Battery parts & materials for automobiles & energy storage. 🏷️

- Price/Book (Most Recent Quarter): 0.26

- Trailing P/E: 24.30 (no forward P/E) / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

SK Telecom

🔬 SK Telecom (017670 KS/Buy) – Additional costs and subscriber churn to slow from 4Q25 (Mirae Asset Securities) 10.31.2025 ⚠️

- 🇰🇷 SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) – Wireless telecommunication services in Korea. 3 segments: Cellular Services, Fixed-Line Telecommunications Services & Other Businesses. 🇼 🏷️

- Price/Book (Current): 0.93

- Forward P/E: 10.31 / Forward Annual Dividend Yield: 7.04% (Yahoo! Finance)

Hyundai Glovis

🔬 Hyundai Glovis (086280 KS/Buy) – Expectations outweigh concerns (Mirae Asset Securities) 10.31.2025 ⚠️

- 🌐 Hyundai Glovis (KRX: 086280) – Global total logistics & distribution leader in Korea & internationally. Ocean transportation logistics advice, cargo space, loading/unloading & packaging services. 🇼 🏷️

- Price/Book (Current): 1.23

- Forward P/E: 5.43 / Forward Annual Dividend Yield: 2.29% (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- Korean Stock Picks (October 2024)

- Mirae Asset Securities’ Korean Stock Picks (July-August 2024)

- Korean Stock Picks (April 2025)

- Korean Stock Picks (November 2024)

- Mirae Asset Securities’ Korean Stock Picks (June 2024)

- Korean Stock Picks (January 2026)

- Korean Stock Picks (September 2024)

- Korean Stock Picks (May 2025)

- Mirae Asset Securities’ Korean Stock Picks (May 2024)

- Mirae Asset Securities’ Korean Stock Picks (January 2024)

- Mirae Asset Securities’ Korean Stock Picks (November-December 2023)

- Mirae Asset Securities’ Korean Stock Picks (October 2023)

- Mirae Asset Securities’ Korean Stock Picks (September 2023)

- Mirae Asset Securities’ Korean Stock Picks (March-April 2024)

- Korean Stock Picks (December 2024)