Mirae Asset Securities (KRX: 006800 / KRX: 520003) is the largest investment banking and stock brokerage company by market capitalization in South Korea. They come out with (and post on their website) a steady stream of free research pieces – namely about Korean stock picks.

Stocks covered by their research during the month of July and (in the order they covered them from the most recent to the earliest in the month) in this post include:

S-Oil Corp, Hyundai Glovis, LX International, SK Innovation, Lotte Data Communication, DGB Financial Group, NH Investment & Securities, Hotel Shilla, LG Chem, Hanwha Solutions, LG H&H, F&F Co, OCI Holdings, Hana Financial Group, BNK Financial Group, Shinhan Financial Group, Joy City Corp, LG Energy Solution, HL Mando Corp, Hyundai Mobis, Samsung SDI, Samsung SDS, Kia Corp, Hyundai Motor, Doosan Fuel Cell, Samsung Biologics, JB Financial Group, Amorepacific Corp, Industrial Bank of Korea, KB Financial Group, Samsung Card, HMM, CowinTech, Dio Corp, SK Telecom, LG Uplus, KT Corp, YG Entertainment, Cosmax, Pan Ocean, People & Technology, KakaoBank, SKC, HYBE, Kakao Games, Samsung Electronics, Nexon Games, Aekyung Industrial, Kolmar Korea & CJ Logistics

Some of these Korean stocks (e.g. duty free, cosmetics, etc.) will directly benefit from the lifting of the ban on Chinese group tours to South Korea mentioned in our Monday post (see: China lifts bans on group tours to US, Japan and other key markets or the Archived Article). Other stocks should directly or indirectly benefit from “Chinese plus one” trends as the USA tries to decouple from China along with EV battery hype.

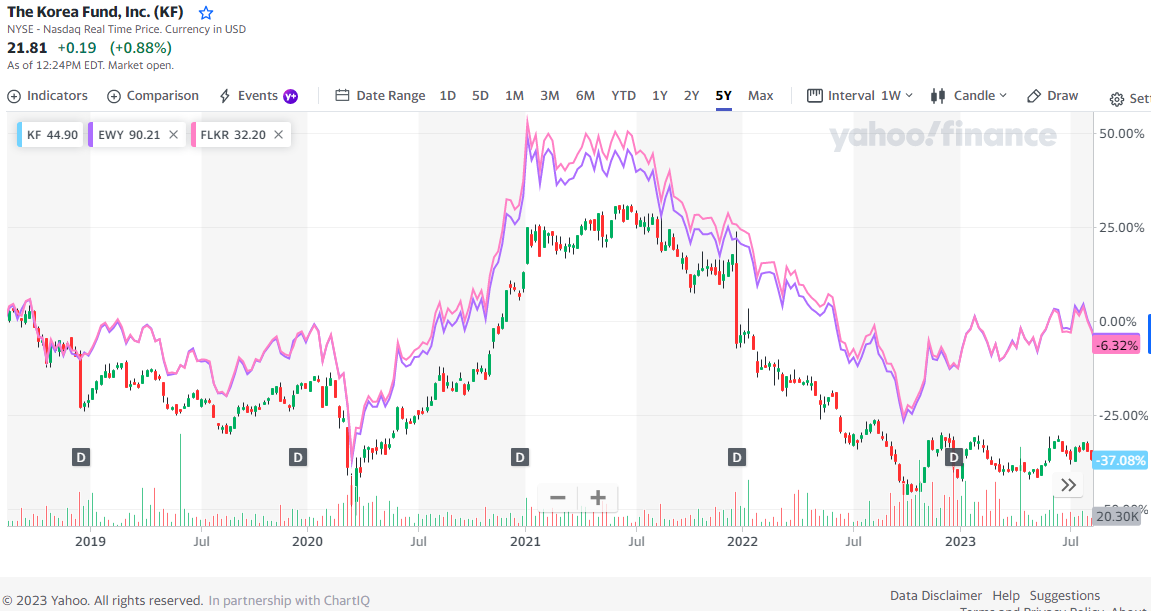

However, a quick look at the recent performance of the The Korea Fund, Inc (NYSE: KF) and the two primary Korean ETFs show that as with China, stock selection remains key for investing in Korea as the previously mentioned positive trends are not yet lifting all stocks:

As noted in our previous Mirae research compilation posts (May and June), South Korea is changing for the better and slowly becoming more foreign investor friendly. However, it can still be challenging to find investor relations type information and financials in English.

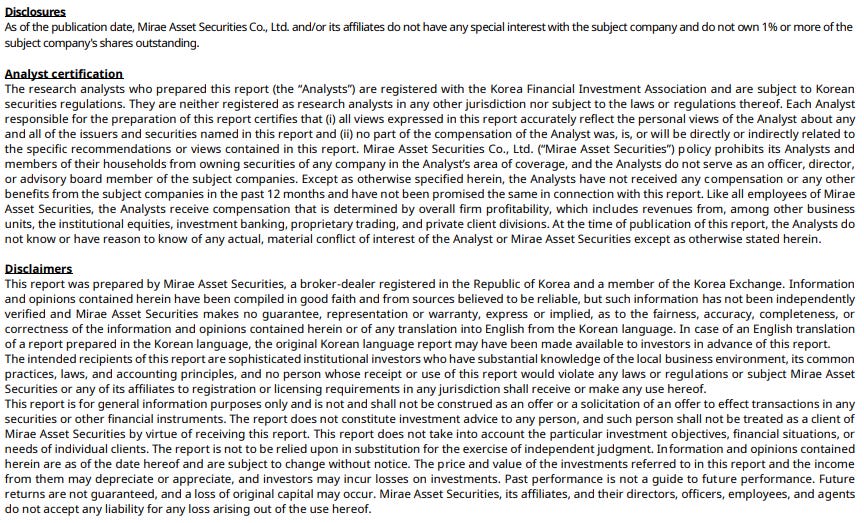

Mirae Asset Securities publishes their Korean stock pick research in English. Note that when I click on their website, I receive NO pop-up asking what sort of investor I am or my location; but there is this disclaimer at the end of each of the research report PDF files:

This post will NOT be quoting directly from the website or research documents themselves (beyond giving the title of the report and a link to it).

Note that their summaries and the more detailed research contained in the PDF files do NOT include good long term technical charts, descriptions of what the company does or links to the stock pick’s IR page, current quote, or most recent statistics – all pet peeves of mine when reading stock write-ups or research.

To make your life easier, this post includes:

- A heading with the stock name.

- A quick description of the stock pick with links to the IR page and stock quote(s) on Yahoo! Finance.

- A link to any Wikipedia page (for what it might be worth…)

- The title of the report linked to the short summary brief on the Mirae Asset Securities website.

- The link to the Mirae Asset Securities research report PDF file about the stock pick.

- Forward or trailing P/E and dividend yields linked back to the Yahoo! Finance statistics page.

- The latest long term technical chart linked back to Yahoo! Finance.

And as always, this post is provided for informational purposes only (and again, to make your life easier…). It does not constitute investment advice and/or a recommendation…

Keep in mind that Mirae Asset Securities would more or less be doing sell side research (with all the usual conflicts of interest that can arise from doing that) and you probably will never or rarely see a sell recommendation from them – just like you almost never see a sell recommendation coming from Wall Street…

But their equity research comes with good stock financials and it’s in English (as again, many Korean stocks still do not have detailed IR pages or financial reports in English) – meaning its a good starting point for anyone interested in investing directly in Korean stocks.

S-Oil Corp

S-Oil Corp (KRX: 010950) was established in 1976 under its original name Iran-Korea petroleum company. It produces petroleum, petrochemical, and lubricant products.

Specifically, the Company offers gasoline, diesel, kerosene, jet fuel, LPG, fuel oil, and asphalt; benzene, toluene, xylene, para-xylene, propylene, methyl tert-butly ether, propylene oxide, and polypropylene; and lubricant products. It also operates facilities that produce lube base oil and petro-chemical products; crude oil refining facilities of 669,000 barrels a day; and a bunker-C cracking center that produces petroleum products.

S-Oil Corporation exports its oil products to Southeast Asia, the United States, China, Japan, Australia, Europe, and internationally. It is a subsidiary of Aramco Overseas Co., B.V.

- Wikipedia

- S-Oil (010950 KS/Buy) Capable of delivering solid earnings at the current refining margin levels

- Forward P/E: 5.92 / Forward Annual Dividend Yield: 4.12% (Yahoo! Finance)

Hyundai Glovis

Hyundai Glovis (KRX: 086280) is a global total logistics and distribution leader in South Korea and internationally. It offers ocean transportation logistics advice, cargo space, loading/unloading, and packaging services.

- Wikipedia

- Hyundai Glovis (086280 KS/Buy) Resilient earnings and improved 2H23 outlook

- Hyundai Glovis (086280 KS/Buy) Earnings resilience plus new business expectations

- Forward P/E: 5.86 / Forward Annual Dividend Yield: 3.36% (Yahoo! Finance)

LX International

LX International (KRX: 001120) is a global trading company that provide a full suite of services across the entire value chain ranging from trading to business development, investment to financing & raw material supply to logistics.

The Company is involved in the development, investment, operation, and trading business of coal mines in Indonesia, China, Australia, etc.; operation of oil palm plantations in Indonesia; and agro and food trading business. It also invests in, develops, and constructs power plants comprising hydro, thermal, cogeneration, as well as petrochemical plants in China, Vietnam, India, and Poland; and develops and invests in oil and gas plant projects in the Middle East, Southeast Asia, and Kazakhstan. In addition, the company trades in synthetic resins; supplies petrochemical products, such as ethanol, MTBE, coolants, and organic/non-organic chemicals; and promotes the plastic recycling business. Further, it produces and supplies steel products for home appliances and vehicles, as well as explores for nonferrous metal related new businesses, such as lithium, a core material of the secondary battery. Additionally, the company provides vendor management inventory service embracing procurement, customs clearance, warehousing, and transportation based on its business network and logistics infrastructure; and develops ICT-based next generation business.

- LX International (001120 KS/Trading Buy) Market weakness takes its toll

- Trailing P/E: 2.70 (no forward P/E) / Forward Annual Dividend Yield: 8.55% (Yahoo! Finance)

SK Innovation

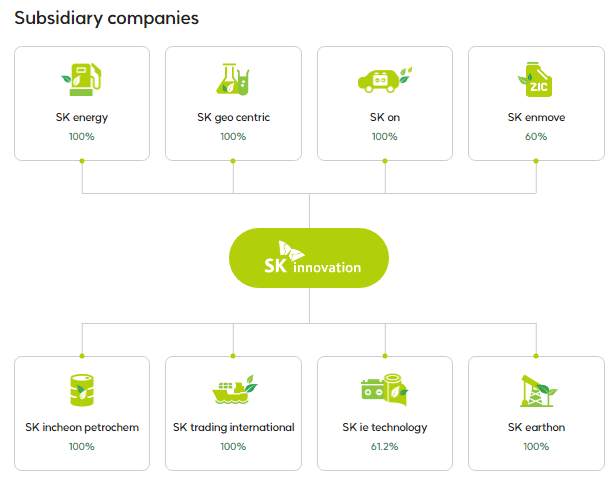

SK Innovation (KRX: 096770) is an intermediate holding company of SK Group (second largest South Korean chaebol behind Samsung Group) involved in petroleum, alternative energy, and oil exploration via eight major subsidiaries.

Note that SK On is a leading electric vehicle (EV) battery manufacturer (See: SK Innovation (KRX: 096770): Raises More Funds and is Making Georgia Battery Plant Productivity Gains).

- Wikipedia

- SK Innovation (096770 KS/Buy) Getting back on track after a brief detour

- Forward P/E: 10.78 / Forward Annual Dividend Yield: (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- Mirae Asset Securities’ Korean Stock Picks (October 2023)

- Mirae Asset Securities’ Korean Stock Picks (September 2023)

- Mirae Asset Securities’ Korean Stock Picks (November-December 2023)

- Mirae Asset Securities’ Korean Stock Picks (August 2023)

- Mirae Asset Securities’ Korean Stock Picks (May 2024)

- Mirae Asset Securities’ Korean Stock Picks (January 2024)

- Mirae Asset Securities’ Korean Stock Picks (May 2023)

- Mirae Asset Securities’ Korean Stock Picks (June 2023)

- Mirae Asset Securities’ Korean Stock Picks (June 2024)

- Mirae Asset Securities’ Korean Stock Picks (March-April 2024)

- Mirae Asset Securities’ Korean Stock Picks (February 2024)

- Business Day TV Daily Stock Picks (June 2023)

- Investing in South Korea ADRs / South Korean Stocks List

- Publicly Listed Stock Exchange Stocks (Mid-2024)

- Morningstar Hong Kong & Singapore Stock of the Week (Q2 2023)