moneycontrol is India’s leading financial and business portal who does short (roughly 4 minute) Stock of the Day video pitches about Indian stock picks.

Indian stocks featured in their February Stock of the Day videos (from newest to oldest) and covered in this post include:

Royal Orchid Hotels Ltd, ICICI Lombard Insurance, Cochin Shipyard, PG Electroplast Ltd, Faze Three Ltd, Global Health Limited (Medanta), Gabriel India, Aarti Industries, Kaynes Technology, Blue Star Ltd, Navin Fluorine International, Titan Company, Britannia Industries Ltd, Rategain Travel Technologies Ltd, BSE Ltd (Bombay Stock Exchange), Bharat Electronics, Kajaria Ceramics, Repco Home Finance & Krsnaa Diagnostics

Note that India will hold general elections over six weeks from April 19 with votes to be counted on June 4:

📰 JPMorgan sees foreign investors flocking to Indian stocks after elections (The Economic Times) March 2024

Rajiv Batra of JPMorgan Chase & Co, says global funds’ positioning in India’s $4.3 trillion stock market remains light and investors will use any correction as an opportunity to increase holdings. His views come as overseas flows have become more volatile ahead of the national vote amid concerns over stretched valuations.

📰 Foreign investors love Indian stocks, but India not as much (Nikkei Asia) March 2024

Power of clubby local tycoons discourages companies from entering market

However, there was a recent market drop that investors need to be aware of:

📰 After big crash in smallcap stocks, what wounded investors must do now (The Economic Times) March 2024

Indian Stock Market experienced a substantial decline, notably in smaller indices, impacting retail investors. A stock falling 20% needs 25% gain to recover losses. Investors should consider these factors to manage their portfolios effectively.

🎥 What Triggered the Crash in India’s Stock Market: All You Need to Know | Vantage with Palki Sharma (Firstpost) 6:49 Minutes (March 2024)

In a startling downturn, the Indian stock market experienced a significant crash, with the Nifty dropping over 300 points and the Sensex plummeting by nearly 1000 points. This sudden decline marks a sharp contrast to recent achievements, including India’s ascent to become the fourth largest global stock market, surpassing Hong Kong. Despite the International Monetary Fund’s continued optimism about India’s economic growth, the stock market witnessed a widespread sell-off. What factors have contributed to this sudden market downturn? Palki Sharma tells you.

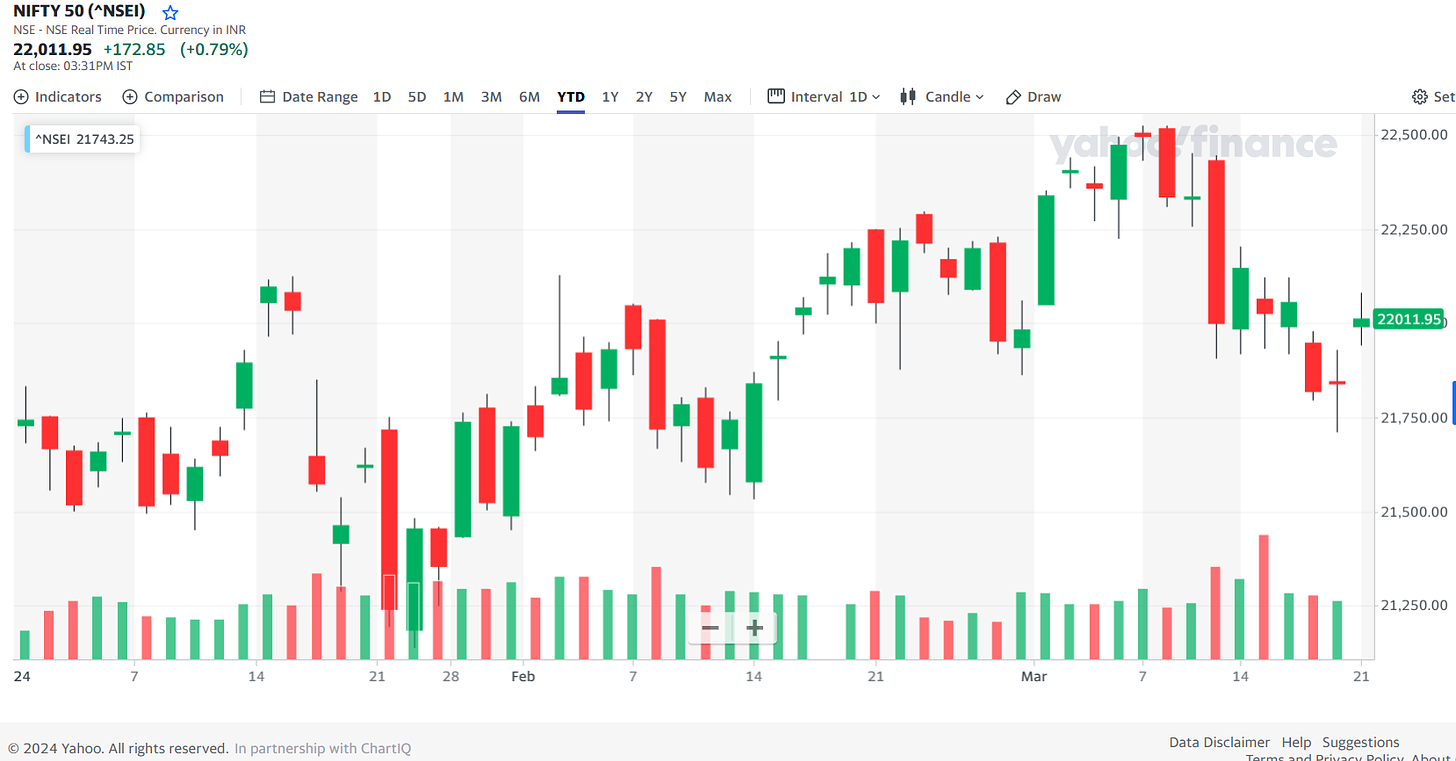

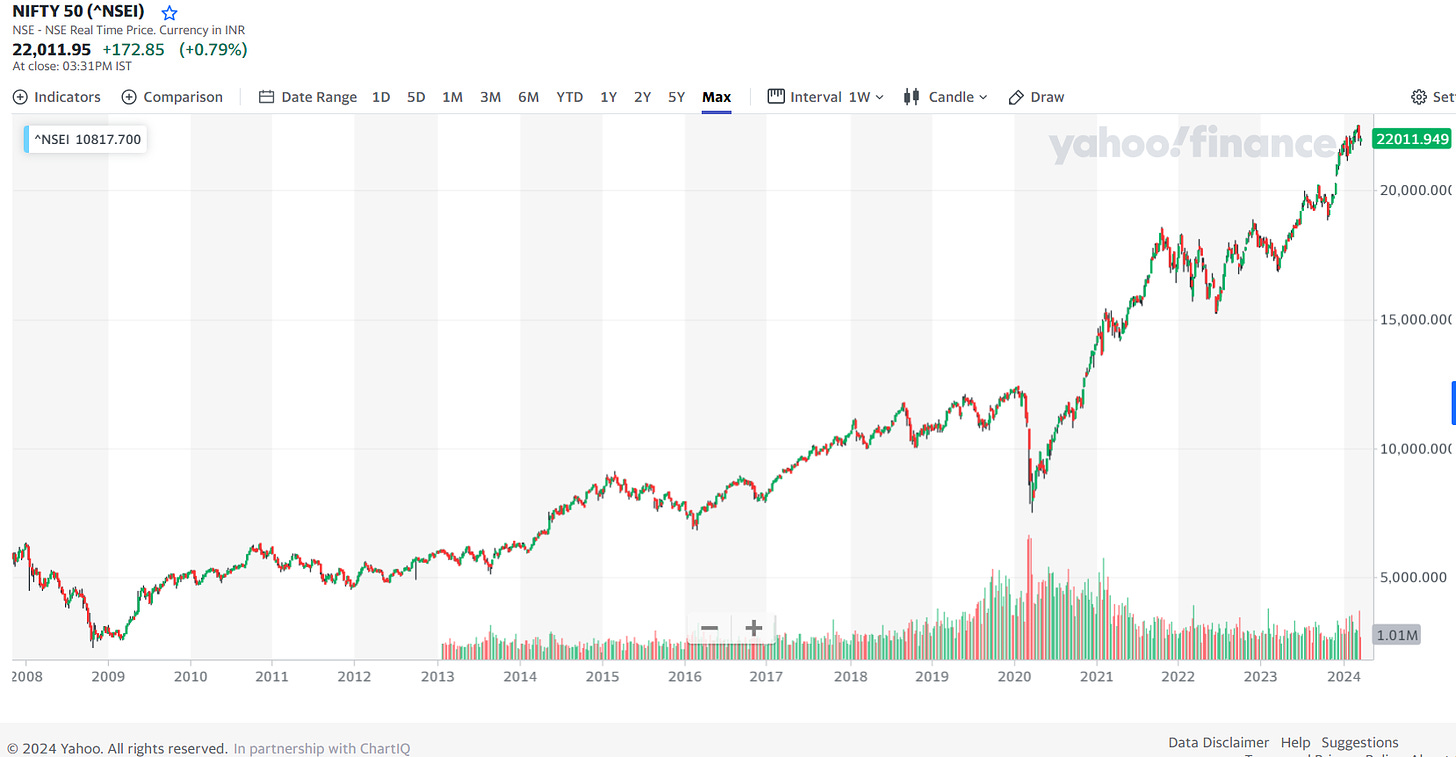

But the NIFTY 50 (which represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange) is still in positive territory:

As repeatedly mentioned in the past, India has tended to have high valuations; but this is somewhat justified given the large presence of local retail and local institutional investors – meaning the stock market is not dependent on fickle foreign investors or foreign fund inflows…

However, this also means investors will need to dig deeper and beyond the big names to look for value. Therefore, I have added Price/Book (Most Recent Quarter) data from Yahoo! Finance to this post’s template – only one stock covered in this post has a ratio below 1.00 (indicating it’s potentially undervalued).

To make your life easier, this post includes:

- A quick description of the stock pick with links to the IR page and stock quote(s) on Yahoo! Finance.

- A link to any Wikipedia page (for what it might be worth…)

- The title of the moneycontrol Stock of the Day and their summary of what makes the stock pick interesting.

- The embedded video (again, they are usually 4 minutes long).

- A price/book (most recent quarter) ratio plus forward or trailing P/E and dividend yields linked back to the Yahoo! Finance statistics page.

- The latest long term technical chart linked back to Yahoo! Finance.

And as always, this post is provided for informational purposes only (and to make your life easier by providing you with relevant information, links, and charts). It does not constitute investment advice and/or a recommendation…

Royal Orchid Hotels Ltd

Royal Orchid Hotels Ltd (NSE: ROHLTD / BOM: 532699) has a robust portfolio encompassing over 100+ properties nationwide plus Sri Lanka and Nepal. Established in 2001 by the visionary Mr. Chander K Baljee, the brand has evolved into a trusted name renowned for excellence and innovation in hospitality.

- Wikipedia

- Royal Orchid Hotels | This hotelier is set to enter the big league | Stock Of The Day

- The tourism industry upcycle is expected to sustain the pricing growth for hotel operators. ROHL with robust expansion plans and the opportunity to tap large-sized hotels is well-positioned to take the next leg of growth. A strong balance sheet and attractive valuations make it an apt investment choice.

- Price/Book (Most Recent Quarter): 5.08

- Trailing P/E: 20.93 (no forward P/E) / Forward Annual Dividend Yield: 0.59% (Yahoo! Finance)

ICICI Lombard Insurance

ICICI Lombard Insurance (NSE: ICICIGI / BOM: 540716) is the largest private sector non-life insurance company in India and is a joint venture of ICICI Bank (NYSE: IBN) and Canada based Fairfax Financial Holdings Limited (TSE: FFH / OTCMKTS: FRFHF). The Company offers a comprehensive and well-diversified range of products through multiple distribution channels, including motor, health, crop, fire, personal accident, marine, engineering, and liability insurance.

- Wikipedia

- ICICI Lombard | Shift In Product Mix In Favor Of Health Insurance May Grow | Stock Of The Day

- ICICI Lombard, one of the largest private non-life insurer, continues to strengthen its market position and make overall profit as the underwriting loss is getting offset by higher investment income. After merging Bharti AXA General Insurance business with itself in FY22, the focus now is on organic growth. While motor insurance segment has seen weak growth, ICICI Lombard is making big strides in the health insurance segment. To capture the opportunity in retail health segment, ICICI Lombard has been increasing its distribution network by adding retail health agency managers. The favorable shift in ICICI Lombard’s product mix in favor of health insurance augurs well for future profitability. The most encouraging bit is management’s confidence of achieving high-teen growth in premium in FY25 and improving the combined ratio to 102% by FY25.

- Price/Book (Most Recent Quarter): 6.91

- Trailing P/E: 44.05 (no forward P/E) / Forward Annual Dividend Yield: 0.61% (Yahoo! Finance)

Cochin Shipyard

Cochin Shipyard (NSE: COCHINSHIP / BOM: 540678) is the largest shipbuilding and maintenance facility in India. It is part of a line of maritime-related facilities in the port-city of Kochi, in the state of Kerala, India. Of the services provided by the shipyard are building platform supply vessels and double-hulled oil tankers. It built the first indigenous aircraft carrier for the Indian Navy, the INS Vikrant.

- Wikipedia

- Cochin Shipyard CSL | Defense Shipbuilder Riding On Strong Execution | Stock Of The Day

- Cochin Shipyard would remain in the limelight with management forecasting 12-15% revenue growth for fiscal 2025, aiming to maintain margins at 18-19%. The company has seen strong growth in execution along with expansion in margins led by higher scale. Revenue visibility is quite strong supported by a hefty order book of Rs 22900 crore. With a bidding pipeline of Rs 9000 to 10000 crore, growth prospects are only improving.

- Price/Book (Most Recent Quarter): 4.91

- Trailing P/E: 40.97 (no forward P/E) / Forward Annual Dividend Yield: 1.42% (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- moneycontrol India Stock of the Day (August 2023)

- moneycontrol India Stock of the Day (March 2024)

- moneycontrol India Stock of the Day (November 2023)

- moneycontrol India Stock of the Day (September 2023)

- moneycontrol India Stock of the Day (October 2023)

- moneycontrol India Stock of the Day (June 2023)

- moneycontrol India Stock of the Day (January 2024)

- moneycontrol India Stock of the Day (July 2023)

- moneycontrol India Stock of the Day (December 2024)

- India – Insight trip (March 2023) (Alquity)

- CLSA Equity Strategist Says India is the Best BRICs Investment Destination (LM)

- India to Offer More Investment Options Through ADRs (The Asset)

- Quick Service Restaurant (QSR) Stocks in India (May 2024)

- India Economic Boom: 2031 Growth Outlook (Morgan Stanley)

- Seven Reasons India Is Primed for Growth (Enterprising Investor)