NOTE: You need to register to see the replay.

- What ‘sleeping giant’ countries, sectors and companies offer the best picks

- Why sustainability is vital when assessing risks in emerging market economies

- How quant techniques can be applied to lower volatility or relative risk

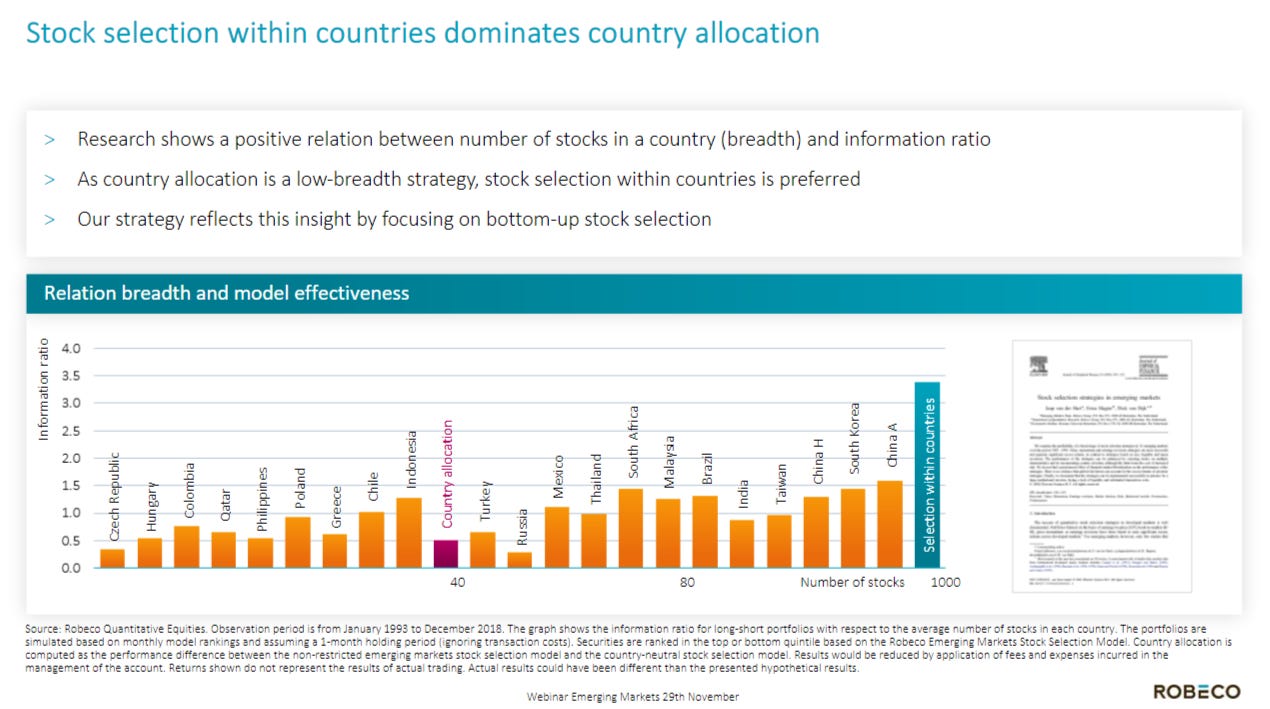

- Stock selection is key, but you can still make money from the right country allocation. You also need to look beyond short term volatility and “stick to your guns.”

- Defensive value stocks e.g. stocks (like telcos, consumer etc) you don’t see in the news who are in the business to survive rather than disrupt.

- Reliance on foreign capital has come down tremendously.

- Currencies are an outcome of underlying macro economic variables and they are also “silent assassins.” So you need to be comfortable with the currency. Over the last 30 years, you would have lost 3% of your return per year due to currency movements.

- You have to be “out of your mind” to do passive in emerging markets when active has won hands down (e.g. China).

- Sustainability data is inconsistent and unreliable – making sustainable investing more challenging.

- Their big allocations are in China, South Korea, Taiwan, India and Brazil. Vietnam is one of the frontier markets they have entered.

- Countries with no domestic investors will be at the mercy of foreign investors and their opinion of the country (e.g. China has negative international opinion right now but many local investors). READ MORE

Similar Posts:

- This Emerging Markets Manager Keeps Outperforming With This Strategy (Institutional Investor)

- Emerging Markets Hit by Record Streak of Withdrawals by Foreign Investors (Financial Times)

- Understanding Four Forces of Structural Change in Emerging Markets (Wellington Management)

- Brazil’s Grievous Manufacturing Collapse (The Emerging Markets Investor)

- Why Emerging Markets Are Up to the Stress Test (FP)

- EM Fund Stock Picks & Country Commentaries (June 20, 2023)

- What’s Next for Emerging Markets and the Dubai Stock Market? (Gulf Business)

- Pick Stocks, Not Countries, in Emerging Markets (FE Trustnet)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- Structural Change in Emerging Markets: 4 Key Forces to Understand (Wellington Management)

- PODCAST: The Question Is…Why Should Investors Bother with Emerging Markets? (Lazard AM)

- GAM’s Love: Emerging Markets Might Double Your Money Over Four Years (FE Trustnet)

- Capitalizing on Currencies to Boost Emerging Market Returns (Pictet Asset Management)

- Artemis’ Edelsten: Emerging Markets are Expensive With the Exception of China (What Investment)

- Ways to Become Over Exposed to Emerging Markets Without Knowing It (FE Trustnet)