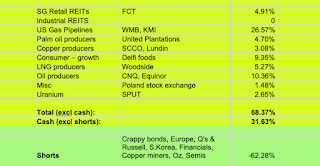

- My “China reopening play” is oil. Zero-covid reduced demand by an estimated 0.5 to 1.5m bpd. Long term I think oil goes up anyway, but China makes me buy it now. Bought more CNQ and Equinor in the last 2 weeks, now its a 9% position (at buying price). 1% more to go.Its a very oily portfolio: 10% in oil producers, plus another 35% in things correlated to oil (Gas pipelines, palm oil and LNG). READ MORE

Similar Posts:

- BNP Paribas’ Chi Lo: Patient Investors Should Build Up China Exposure Now (CMN)

- Variant View: China’s Zero-COVID Policy is Dead (Asian Century Stocks Substack)

- The Long View: China is Too Big to Fail (Fidante Partners)

- Fund Managers: Why We Couldn’t Resist the Alibaba IPO (FE Trustnet)

- Why Two Fund Managers Still Believe in Macau Casino Stocks (FE Trustnet)

- What Hong Kong Dollar Bond Exposure Means to Investors (The Asset)

- Newton’s Pidcock: Asian Recovery Just Getting Started (FE Trustnet)

- U.S.-China Trade War: The New Long March (Guggenheim Investments)

- Sinology: A 2023 Calendar for China’s Reopening and Recovery (The China Fund, Inc)

- BlackRock’s Swann: Look at the China Slowdown in a Long Term Context (FE Trustnet)

- Private Equity Firms in Southeast Asia Are Cashing Out Faster (WSJ)

- Chinese Stocks: Cheap Long-term Play or Value Trap? (FE Trustnet)

- Dead Sheep, Dumped Crops as China Covid Rules Hit (Bloomberg Supply Lines Newsletter)

- Didi Ekes Out 1% Gain After New York IPO Pop Fizzles (Nikkei Asia)

- Why Would the Chinese Pay $1B for a Talking Cat Game? (BloombergBusinessweek)