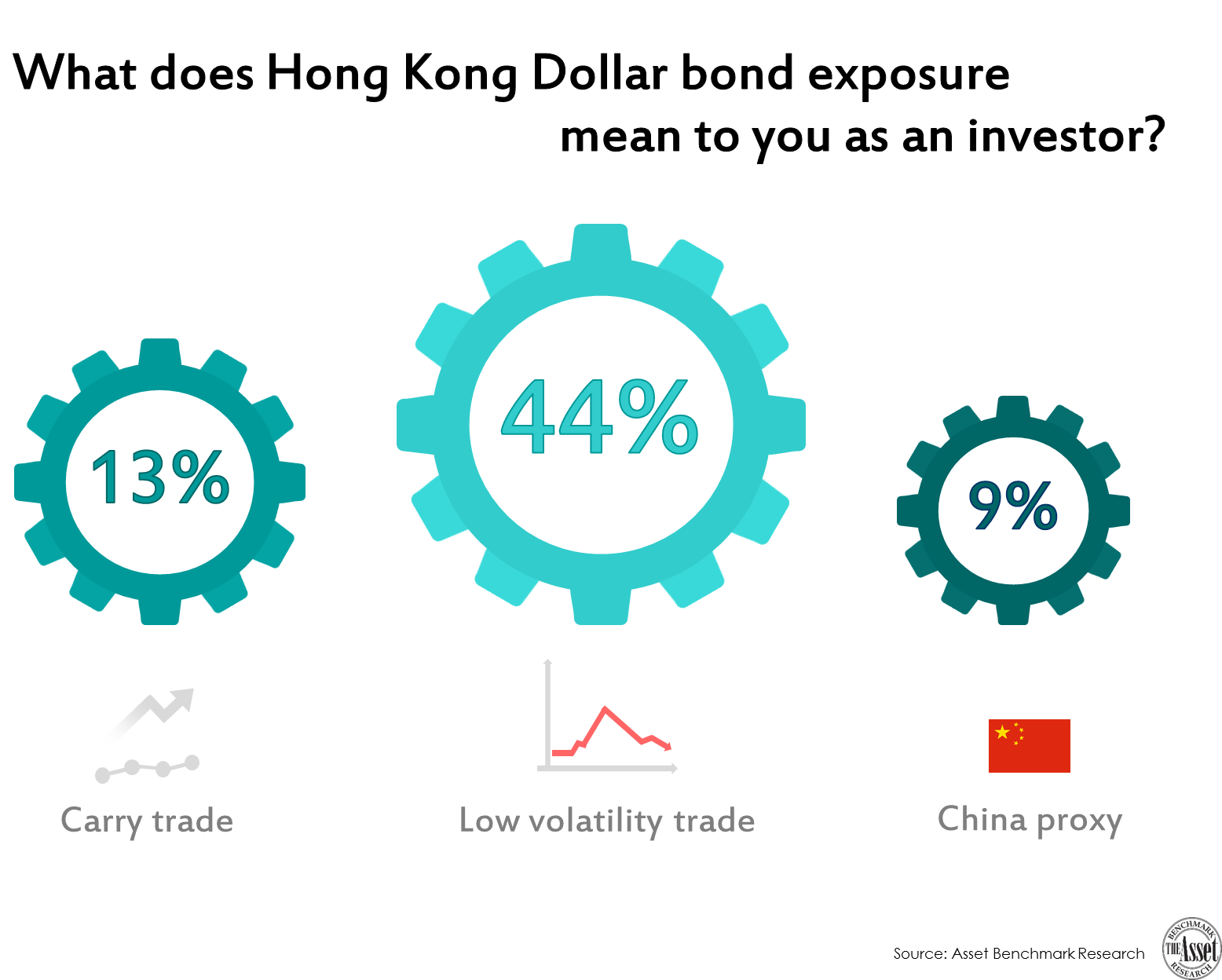

The US$320 billion Hong Kong dollar bond market looks rather anemic as issuances by the government make up ten times that of the rest of the market, but there are still investors who see the value of investing in that market. In an investor survey conducted by Asset Benchmark Research, 44% of respondents say they participate in the Hong Kong dollar bond market for its low volatility and another 13% invest in Hong Kong dollar bonds as part of a carry trade. Only 9% say they see Hong Kong dollar bonds as a proxy for China.  The Asset quoted Binay Chandgothia, a fund manager with Principal Global Investors, as saying:

The Asset quoted Binay Chandgothia, a fund manager with Principal Global Investors, as saying:

“You have a situation where the government in Hong Kong has a surplus so they don’t need to borrow a lot of money. That ensures that there’s not a lot of pressure on the yield curve for the government side of things…. There does not tend to be a prolonged sell-off. Even when sell-offs happen, they happen for a short period.”

And:

“With Hong Kong dollar bonds, you don’t get very long-duration bonds. Most of the time, issuance tends to be five to 10 years. In the US, you actually get a much longer yield curve going out to 30 years. Even the Hong Kong government does not issue bonds that are longer than 15 years. Buying one is a struggle; the supply is tight.”

Chandgothia also said that since Hong Kong is a net-savers market, there is always a lot of demand for long-term savings products from insurance companies, banks and asset managers.

To read the whole article, Hong Kong dollar bonds struggle to find a meaning, go to the website of The Asset. In addition, check out our Bond ETFs list and our Hong Kong ETFs list.

Similar Posts:

- Korea & Taiwan Use Renminbi for Majority of Payments with China & Hong Kong (The Asset)

- Investors Could Short Hong Kong to Hedge Long Shanghai Positions (BOCOM International)

- Fund Manager Consensus: Hong Kong Needs China More Than Vice Versa (AsianInvestor)

- Lalatech, the Start-up Behind Lalamove Logistics Service, Files for Hong Kong IPO After Turning its Back on New York (SCMP)

- Podcast: Our Man in Hong Kong (Robeco)

- Hong Kong Tycoons Start Moving Assets Offshore as Fears Rise Over New Extradition Law (Reuters)

- Moody’s Downgrades Hong Kong’s Rating to Aa2 From Aa1; Raises Outlook to Stable from Negative (Moody’s)

- Hong Kong Stocks Roar Into 2021 on Surge of Investment From China (Nikkei Asia)

- Two Systems, Zero Trust? Hong Kong’s Extradition Row Risks Business Exodus (Nikkei Asian Review)

- Analysis: China Investors Hedge U.S. Delisting Risk With Hong Kong Play (Reuters)

- ZJLD Group (HKG: 6979): IPO of the First Baijiu Maker to List Outside of China Flops

- Russia’s Bourse to Start Trading HK Stocks (Asia Times)

- Climate Change: Hong Kong to Pay 30 Per Cent More for ESG Jobs as Companies Fight for Talent to Meet Sustainability Targets (SCMP)

- CMBI Research China & Hong Kong Stock Picks (June 2024)

- Occupy Central Protests Will Hurt These Hong Kong Stocks (SCMP)