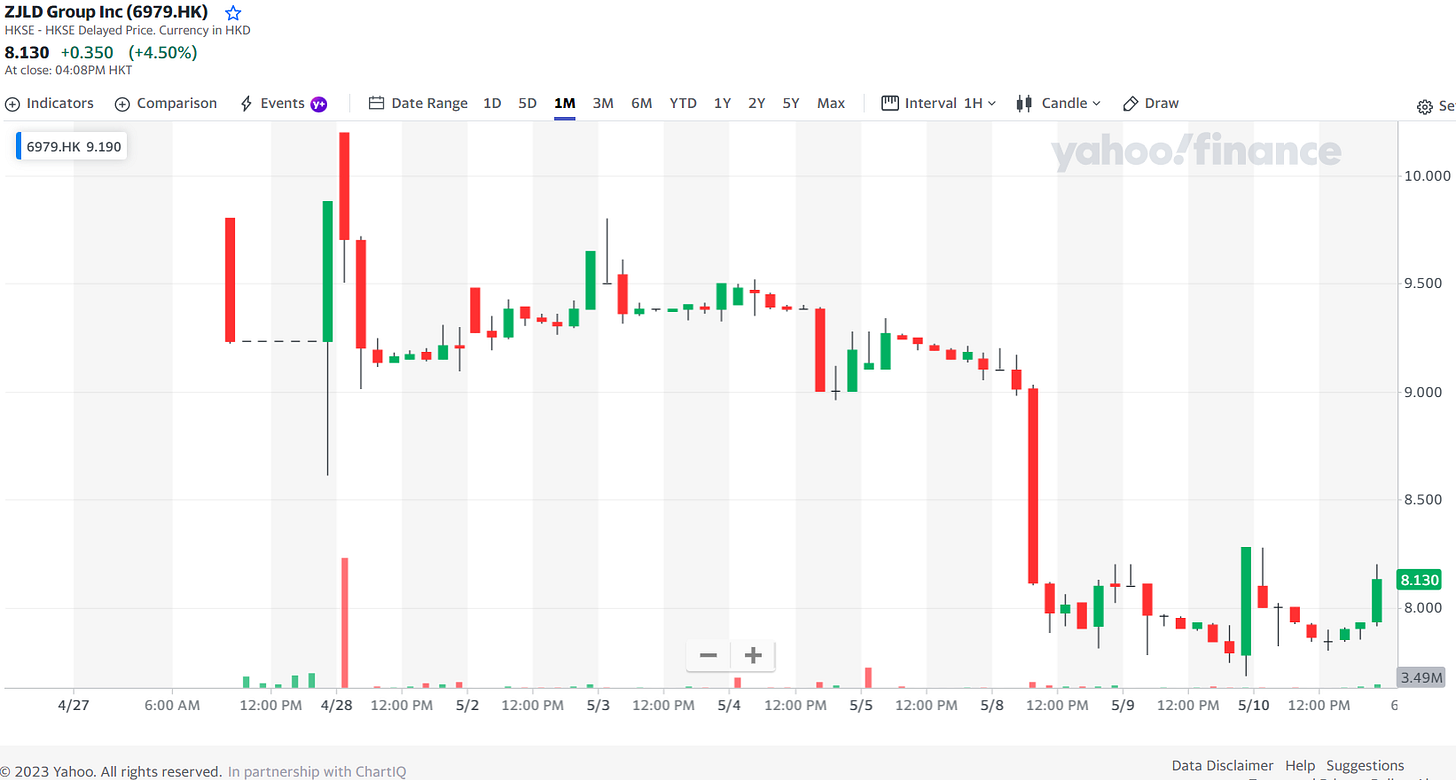

In late April, baijiu liquor maker ZJLD Group (HKG: 6979) was the biggest Hong Kong IPO of the year (and the first baijiu to list outside of China) and it flopped:

- Chinese liquor: ZJLD is no match for Kweichow Moutai (FT) (Baijiu maker ZJLD’s wobbly entry suggests the market’s hangover has yet to end)

[Also see: Kweichow Moutai (SHA: 600519): China’s Communist Spirit and Most Valuable Company]

With an alcohol content of as high as 60% by volume, baijiu (distilled from fermented sorghum) is China’s most popular liquor and accounts for third of global alcohol sales:

OVERVIEW:

- ZJLD has six plants, with three in Southwest Guizhou province’s Zunyi town, where Kweichow Moutai (SHA: 600519) is located. Wu Xiangdong, 54, who founded the company in 2003, now controls 81% of the company through Zhenjiu Holding.

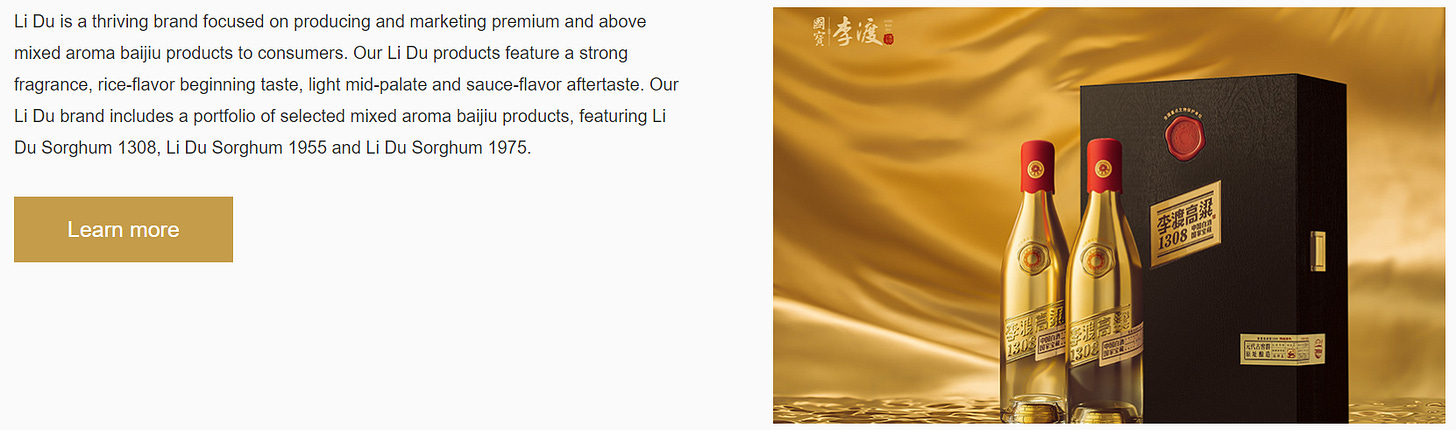

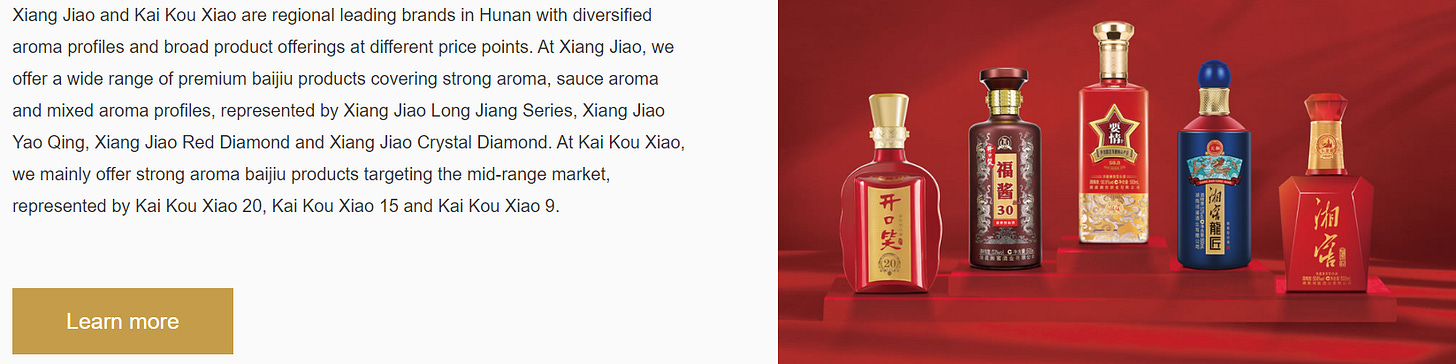

- Brands

- Baijiu distiller eyes up to US$811 million in biggest Hong Kong IPO of year (SCMP) April 2023

- ZJLD Group on Monday started selling up to 490.7 million shares at a price range of HK$10.78 to HK$12.98

- The IPO prices ZJLD at a higher price-earning multiple than bigger onshore-listed rival distillers

- At the top of the range, the pricing would give ZJLD a market value of HK$42 billion, or roughly 2 per cent that of China’s biggest liquor producer Kweichow Moutai. The offering would also let global investors access China’s lucrative baijiu market at a price-earnings multiple of 47, compared with 35 to 27 times for onshore-listed market leaders Kweichow Moutai and Wuliangye Yibin Co., Ltd. (SHE: 000858), which are available to offshore investors via the Stock Connect scheme.

- Net income dropped 8.8 per cent from a year ago to 712.2 million yuan in 2022, while revenue rose 17 per cent to 4.2 billion yuan…

- Chinese liquor: ZJLD is no match for Kweichow Moutai (FT) May 2023

- China’s second most valuable listed company, Kweichow Moutai (SHA: 600519) at $315bn, is no tech stock. It is a hot stock nonetheless. This leading maker of baijiu — a local liquor known as China’s firewater — has proven one of the most lucrative businesses and local investments in the past decade.

- KKR-backed ZJLD had high hopes because it was the first Chinese baijiu maker to list outside the mainland markets.

- Unfortunately, the drink’s popularity did not translate into investor demand for ZJLD, which raised $675mn. Shares fell 17 per cent at the open, even after the stock priced its initial public offering at the bottom of the price range amid weak demand for new share sales. The listing values the company at about $4bn, at a steep 27 times earnings.

- Chinese Baijiu brand ZJLD shares slump 18% on HK market debut, will that dash investors confidence? (Youtube) 2:59 Minutes

- P/E (Google Finance): 45.03 / Forward P/E (Yahoo! Finance): n/a

- Dividend Yield (Google Finance): n/a / Forward Dividend & Yield (Yahoo! Finance): n/a

CHART:

ADDITIONAL RESOURCES:

- Website

- Investor Relations (No financials posted yet)

- IRAsia Page

- GLOBAL OFFERING (in PDF)

- Baijiu: China’s Most Feared and Loved Drink with a 5,000 Year Old History – Drink China (E2) (Youtube) 12:11 Minutes

- Baijiu distiller eyes up to US$811 million in biggest Hong Kong IPO of year (SCMP) April 2023

- Chinese liquor: ZJLD is no match for Kweichow Moutai (FT) May 2023

- Chinese Baijiu brand ZJLD shares slump 18% on HK market debut, will that dash investors confidence? (Youtube) 2:59 Minutes

- Also see: Kweichow Moutai (SHA: 600519): China’s Communist Spirit and Most Valuable Company

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Similar Posts:

- TOP Financial Group (NASDAQ: TOP): Hong Kong’s Latest Crazy Meme Stock

- Kweichow Moutai (SHA: 600519): China’s Communist Spirit and Most Valuable Company

- CMBI Research China & Hong Kong Stock Picks (October 2023)

- CMBI Research China & Hong Kong Stock Picks (April 2024)

- CMBI Research China & Hong Kong Stock Picks (July 2023)

- Hong Kong Stocks Roar Into 2021 on Surge of Investment From China (Nikkei Asia)

- Climate Change: Hong Kong to Pay 30 Per Cent More for ESG Jobs as Companies Fight for Talent to Meet Sustainability Targets (SCMP)

- CMBI Research China & Hong Kong Stock Picks (November 2023)

- CMBI Research China & Hong Kong Stock Picks (May 2024)

- CMBI Research China & Hong Kong Stock Picks (December 2023)

- Morningstar Hong Kong & Singapore Stock of the Week (Q2 2023)

- CMBI Research China & Hong Kong Stock Picks (January-February 2024)

- Will Meituan Become Hong Kong’s Tesla? (The Asset)

- CMBI Research China & Hong Kong Stock Picks (June 2024)

- Investors Could Short Hong Kong to Hedge Long Shanghai Positions (BOCOM International)