CMB International Capital Corporation is a wholly owned subsidiary of China Merchants Bank (HKG: 3968 / SHA: 600036 / OTCMKTS: CIHKY / OTCMKTS: CIHHF) – one of the largest banking groups and the largest privately-owned bank in China. They come out with (and post on their website) a steady stream of free research pieces – namely China and Hong Kong stock picks (see our front page for a full list of TAGS for our EM Stock Pick Tear Sheets)

Stocks covered during the month of October and in this post include:

Tuhu Car, China Life, Innovent Biologics, BYD Company, GoerTek, Tsingtao Brewery, Yonyou Network Technology, Will Semiconductor, Zhejiang Dingli, Shennan Circuit, Shengyi Tech, Hangzhou Tigermed Consulting, Great Wall Motor, Glodon, Guangzhou Automobile Group, Li Ning, Shanghai Jahwa, FIT Hon Teng, Topsports, Luxshare Precision Industry, Kweichow Moutai, CSPC Pharmaceutical, Bilibili, Zhongji Innolight, China Three Gorges Renewables Group Co Ltd (CTGR Group), Kuaishou Technology, Baidu, iQIYI, Budweiser APAC, Xtep, Tencent, Weichai Power, GigaCloud Technology, Sunny Optical, JD.com, ANTA Sports Products, Alibaba, ZTE, China Tourism Group Duty Free, Tongcheng Travel Holdings, CR Power, BYD Electronic International and Samsonite International

They also come out with (and post on their website) a monthly list of 20+ high conviction stock ideas – namely Chinese stock picks (see our May, June, July, August, and September posts summarizing those) BUT these lists do not change too much from month to month. Stocks covered by the CMBI October list (including additions and deletions) and included in this post with updated stats and charts include:

Li Auto, Geely Automobile, SANY International, ANTA Sports Products, Weichai Power, Zhejiang Dingli, CR Power, CR Gas, ANTA Sports Products, JNBY Design, Vesync, CR Beer, Tsingtao Brewery, Kweichow Moutai, China Tourism Group Duty Free (CTGDF), Innovent Biologics, China Life, Ping An, AIA, Tencent, Pinduoduo, NetEase, Alibaba, Kuaishou Technology, CR Land, BYDE, Wingtech & Kingdee

This interesting piece and similar ones have been making the rounds this week:

Trillion Dollar Bailout: What Xi Really Wants From Biden (Oilprice.com)

- Despite a significant economic crisis in mainland China since 2015, Xi has taken minimal steps to address it.

- During his visit to San Francisco, Xi, seemingly desperate, requested a substantial $900-billion bailout for the Chinese economy from President Biden.

- The leak came from within the CCP, indicating a faction eager to bring down Xi.

I am not sure if this is the latest propaganda from the “coming collapse of China” crowd as frankly you could just as easily swap out the words Xi and China and insert Biden and the USA in their place.

But that does not mean China and Xi don’t have their share of problems at home as the truth is always somewhere in between the pro and anti China shrills…

Getting back CMBI’s stock research: Note that when I click on CMBI’s website, I receive NO pop-up asking what sort of investor I am or my location; but there is this disclaimer at the end of each research report that readers need to be aware of:

This post will NOT be quoting directly from the research documents themselves (beyond giving the title to the linked research report – please keep the above disclosures in mind).

To make your life easier, this post includes:

- A heading with the stock name.

- A quick description of the stock pick with links to the IR page and stock quote(s) on Yahoo! Finance.

- A link to any Wikipedia page (for what it might be worth…)

- The title of the report linked to the file page on the CMBI website about the stock pick.

- Forward or trailing P/E and dividend yields linked back to the Yahoo! Finance statistics page.

- The latest long term technical chart linked back to Yahoo! Finance.

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

CMBI Research (October 2023)

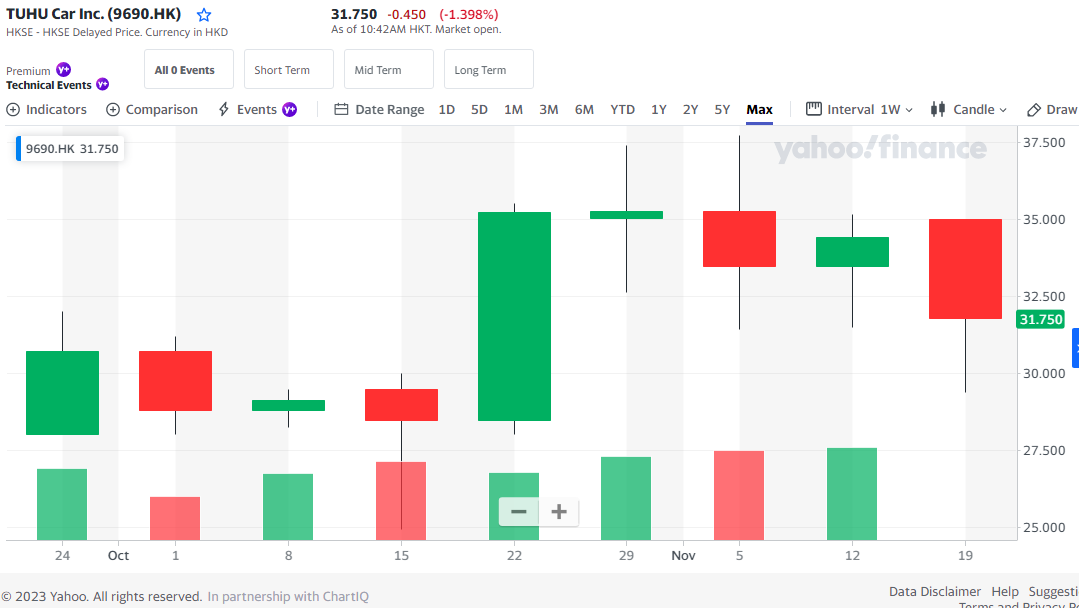

Tuhu Car

Tuhu Car (HKG: 9690) is one of the leading integrated online and offline platforms for automotive service in China. By providing a digitalised and on-demand service experience underpinned by their customer-centric model and streamlined supply chain, they directly address car owners’ diverse product and service needs, creating an automotive service platform consisting of car owners, suppliers, automotive service stores and other participants.

As of 30 June 2023, we had over 100 million registered users on their flagship “Tuhu Automotive Service (途虎養車)” app and online interfaces. And they had over 18 million transacting users in the last twelve months ended 30 June 2023. Their platform is the largest car owner community amassed by automotive service providers in China.

As of 30 June 2023, their growing service network of 5,129 Tuhu workshops and over 20,000 partner stores spans across the entire country, covering a majority of prefecture-level cities. Tuhu is the leading independent automotive service brand in China in terms of the number of automotive service stores operated and brand recognition.

- Tuhu Car (9690 HK)– A one-stop auto service ecosystem

- Forward P/E: 32.57 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

China Life

China Life Insurance (HKG: 2628 / SHA: 601628 / OTCMKTS: CILJF) is the largest Chinese life insurer by market share.

- Wikipedia

- China Life (2628 HK) – 3Q NP dragged by investment setbacks; first-in -sector steady agent scale props up 2024 NBV

- Forward P/E: 6.80 / Forward Annual Dividend Yield: 4.68% (Yahoo! Finance)

Innovent Biologics

Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY) has built a fully integrated, multifunctional platform, which includes R&D, CMC (Chemistry, Manufacturing and Controls), clinical development and commercialization capabilities, which has been leveraged to develop a pipeline of 35 valuable assets that cover oncology, metabolic disease, immunology and other major therapeutic areas.

- Innovent Biologics (1801 HK) – Mazdutide (9mg) continues to show its BIC potential with 48-week results

- Forward P/E: N/A / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- CMBI China and Hong Kong Equity Research (June 2023)

- CMBI Research China & Hong Kong Stock Picks (November 2023)

- Morningstar Hong Kong & Singapore Stock of the Week (Q2 2023)

- CMBI Research China & Hong Kong Stock Picks (March 2024)

- CMBI Research China & Hong Kong Stock Picks (July 2023)

- CMBI Research China & Hong Kong Stock Picks (December 2023)

- CMBI Research China & Hong Kong Stock Picks (January-February 2024)

- CMBI Research Focus List of China Stock Picks (May 2023)

- CMBI Research Focus List of China Stock Picks (June 2023)

- CMBI Research China & Hong Kong Stock Picks (August 2023)

- CMBI Research China & Hong Kong Stock Picks (September 2023)

- Occupy Central Protests Will Hurt These Hong Kong Stocks (SCMP)

- ZJLD Group (HKG: 6979): IPO of the First Baijiu Maker to List Outside of China Flops

- TOP Financial Group (NASDAQ: TOP): Hong Kong’s Latest Crazy Meme Stock

- Morningstar Hong Kong & Singapore Stock of the Week (Q3 2023)