Its now the year of the dragon and as we noted on Monday, that has traditionally been a good year for the Hang Seng Index and Hong Kong stocks:

🇭🇰 Hoping for better luck, HK stocks enter the Year of the Dragon (Bamboo Works)

- The Hang Seng Index plunged 28.6% in the year of the rabbit, hurt by China’s slow economic recovery and simmering tensions with the United States. Investors will be looking for a rebound under the auspicious sign of the dragon

- Since its launch in 1969, the Hang Seng has always risen in the dragon years, with gains averaging around 14%

- But any rally this time could be hampered by uncertainties over the U.S. presidential election and interest rate policy

And here is a long term chart for the Shanghai Composite:

Many investors and western observers have waited for some sort of stimulus from Beijing; but as we also mentioned on Monday, there are reasons not to get your hopes up for significant stimulus:

- China’s playbook no longer involves a big stimulus bazooka(FT) February 2024 🗃️

- Indeed, that 2009-10 stimulus is still blamed in Beijing policy circles as a root cause of the current slowdown. The flood of cheap liquidity contributed to the continuing local government debt crisis, nurtured a network of underground banks, inflated property prices to unsustainable levels and spurred overcapacity in a host of industrial sectors.

Back in August, I covered some of the problems China faces that don’t get talked about as much by mainstream western business media:

Alternative media site Zero Hedge also recently had this dire headline:

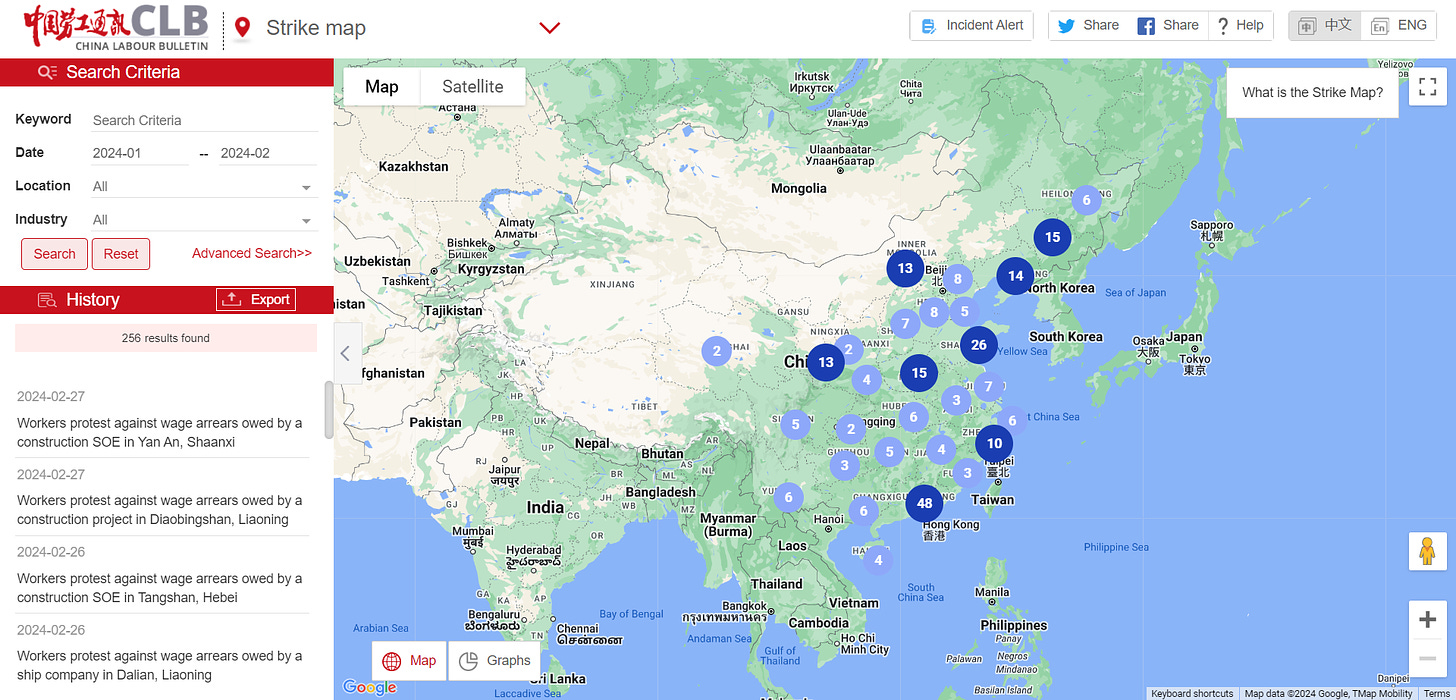

- China Pummeled By Dire Deflation, Trade And Credit Data As Labor Strikes, Protests Explode (Zero Hedge) January 2024

To back up their claim of rising labor strikes and protests, they cited data from Hong Kong based China Labour Bulletin (Although it’s not clear who funds the CLB and whether anything they report can be verified or trusted):

With all of that said, there is still value to be found among China and Hong Kong stocks – you just need to dig deeper to find it as well as manage your risk exposure.

CMB International Capital Corporation is a wholly owned subsidiary of China Merchants Bank (HKG: 3968 / SHA: 600036 / OTCMKTS: CIHKY / OTCMKTS: CIHHF) – one of the largest banking groups and the largest privately-owned bank in China. They come out with (and post on their website) a steady stream of free research pieces – namely China and Hong Kong stock picks (see our front page for a full list of TAGS for our EM Stock Pick Tear Sheets)

Stocks covered during the month of February (Chinese New Year) and in this post include:

iQIYI, JNBY Design, Baidu, Shengyi Tech, ZTE, BeiGene, Li Auto, Yancoal Australia, Trip.com, New Oriental Education, Amazon.com Inc, Microsoft, NIO Inc, Tongcheng Travel Holdings, XPeng, Xiaomi Corp, Guangzhou Automobile Group, Yum China, Alibaba, FIT Hon Teng, Q Technology (Group) Company, Jiumaojiu International Holdings, PICC Property and Casualty Co Ltd, China Yongda Automobile Services Holding & Unity Group Holdings International Ltd

Stocks covered during the month of January and in this post include:

Stella International Holdings Ltd, Sunny Optical, China MeiDong Auto Holdings, BYD Electronic International Co Ltd, Zhongji Innolight, GigaCloud Technology, JD.com, Netflix, Sinotruk Hong Kong Ltd, Weichai Power, Tencent Music Entertainment Group, Tencent, Kuaishou Technology, Shanghai Henlius Biotech, Inner Mongolia Yili Industrial Group, Horizon Construction Development, WuXi Biologics, Geely Automobile Holdings, Prada SpA, Sirnaomics Ltd, FriendTimes Inc, Xtep, Kingdee International Software Group, ANTA Sports Products & Samsonite International

They also come out with (and post on their website) a monthly list of 20+ high conviction stock ideas – namely Chinese stock picks (see our May, June, July, August, September, October, November and December posts summarizing those) BUT these lists do not change too much from month to month. Stocks covered by the CMBI January list (including additions and deletions) and included in this post with updated stats and charts include:

Li Auto, Geely Automobile, Weichai Power, Zhejiang Dingli, CR Power, CR Gas, JNBY, JS Global, Vesync, Kweichow Moutai, BeiGene, PICC P&C, Tencent, Pinduoduo, Alibaba, Netflix, Kuaishou, GigaCloud, CR Land, BYDE, Luxshare, Innolight & Kingdee

Stocks covered by the CMBI February list:

Li Auto, Geely Automobile, Weichai Power, Zhejiang Dingli, CR Power, CR Gas, JNBY, JS Global, Vesync, Kweichow Moutai, BeiGene, PICC P&C, Tencent, Alibaba, Pinduoduo, Amazon.com, Netflix, Kuaishou, GigaCloud, CR Land, BYDE, Luxshare, Innolight & Kingdee

Note that when I click on CMBI’s website, I receive NO pop-up asking what sort of investor I am or my location; but there is this disclaimer at the end of each research report that readers need to be aware of:

This post will NOT be quoting directly from the research documents themselves (beyond giving the title to the linked research report – please keep the above disclosures in mind).

To make your life easier, this post includes:

- A heading with the stock name.

- A quick description of the stock pick with links to the IR page and stock quote(s) on Yahoo! Finance.

- A link to any Wikipedia page (for what it might be worth…)

- The title of the report linked to the file page on the CMBI website about the stock pick.

- Forward or trailing P/E and dividend yields linked back to the Yahoo! Finance statistics page.

- The latest long term technical chart linked back to Yahoo! Finance.

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

CMBI Research (February 2023)

iQIYI

iQIYI (NASDAQ: IQ) is a leading provider of online entertainment video services in China.

Their platform combines creative talent with technology to foster an environment for continuous innovation and the production of blockbuster content. They produce, aggregates and distributes a wide variety of professionally produced content, as well as a broad spectrum of other video content in a variety of formats. The Company distinguishes itself in the online entertainment industry by its leading technology platform powered by advanced AI, big data analytics and other core proprietary technologies. With in-house studios spearheading their original content production, they are home to many acclaimed original drama series and variety show franchises, and have successfully serialized our original content into blockbuster sequels to accumulate and amplify IP value overtime. Through their curated premium content, they attract a daily subscriber base of more than 100 million, and their diversified monetization model includes membership services, online advertising services, content distribution, online games, IP licensing, talent agency, online literature, etc.

- Wikipedia

- iQIYI (IQ US) – Margin intact with continued ARM expansion

- iQIYI (IQ US) – Improving profitability with solid guidance

- Forward P/E: 2.81 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

JNBY Design

JNBY Design (HKG: 3306) designs and sells fashion apparel, footwear, accessories and home products under a portfolio of brands, including JNBY (women’s wear), CROQUIS (men’s wear), jnby by JNBY (kids’ wear), LESS (women’s wear), POMME DE TERRE (kids’ wear), JNBYHOME (lifestyle) and A PERSONAL NOTE 73 (men’s wear).

As of June 30, 2022, the Company had 1,956 stores worldwide, including 1,937 stores in China, Hong Kong, and Taiwan as well as Japan, Russia and Australia.

- JNBY Design (3306 HK) – An all-rounded beat and an optimistic outlook

- JNBY Design (3306 HK) – An impressive beat but a conservative outlook

- Forward P/E: 9.98 / Forward Annual Dividend Yield: 6.01% (Yahoo! Finance)

Baidu

Baidu (NASDAQ: BIDU) is a Chinese multinational technology company specializing in Internet-related services, products, and artificial intelligence (AI). Baidu offers various services, including a Chinese search engine, as well as a mapping service called Baidu Maps.

Baidu is composed of two segments: 1) Baidu Core, which accounted for over 70% of revenue in the past three years, and 2) iQIYI, for the remaining revenue. Powered by AI, Baidu Core provides mainly online marketing services and non-marketing value added services, as well as products and services from new AI initiatives, which together powers three growth engines:

- Mobile Ecosystem: a portfolio of over one dozen apps, including Baidu App, Haokan and Baidu Post, which provides an open platform that aggregates a wide range of third-party, long-tail content and services through their AI building blocks and which helps communities connect and share knowledge and information.

- AI Cloud: a full suite of cloud services and solutions, including PaaS, SaaS and IaaS and uniquely differentiated by their AI solutions.

- Intelligent Driving & Other Growth Initiatives (OGI): their growth initiatives include intelligent driving (self-driving services, including HD Maps, automated valet parking and autonomous navigation pilot, intelligent electric vehicles and robotaxi fleets), as well as Xiaodu smart devices powered by DuerOS smart assistant and AI chip development.

- Wikipedia

- Baidu (BIDU US) – Ramp-up of generative AI-related revenue on track

- Baidu (BIDU US) – Eyeing on the pace of gen-AI rev generation

- Forward P/E: 9.49 / Forward Annual Dividend Yield: N/A (Yahoo! Finance)

To read more, please visit this article on Substack

Similar Posts:

- Morningstar Hong Kong & Singapore Stock of the Week (Q2 2023)

- CMBI Research China & Hong Kong Stock Picks (November 2023)

- CMBI Research China & Hong Kong Stock Picks (October 2023)

- CMBI China and Hong Kong Equity Research (June 2023)

- CMBI Research China & Hong Kong Stock Picks (July 2023)

- CMBI Research China & Hong Kong Stock Picks (March 2024)

- CMBI Research China & Hong Kong Stock Picks (December 2023)

- Hong Kong Stocks Roar Into 2021 on Surge of Investment From China (Nikkei Asia)

- Occupy Central Protests Will Hurt These Hong Kong Stocks (SCMP)

- Fund Manager Consensus: Hong Kong Needs China More Than Vice Versa (AsianInvestor)

- TOP Financial Group (NASDAQ: TOP): Hong Kong’s Latest Crazy Meme Stock

- CMBI Research China & Hong Kong Stock Picks (September 2023)

- Investors Could Short Hong Kong to Hedge Long Shanghai Positions (BOCOM International)

- Back in Hong Kong Stocks (Turtles all the way down! Substack)

- ZJLD Group (HKG: 6979): IPO of the First Baijiu Maker to List Outside of China Flops