EM fund stock picks for China and India are in focus this week (along with a number of other countries and regions) as more Q4 fund updates have dropped while we wait for more January factsheets or updates to become available. Some of the EM funds mentioned in this week’s post tend to be from lesser known emerging market fund managers.

As mentioned before, China is not just about large caps like Tencent and Alibaba and the same can be said about India. Both countries have many lesser known stock picks to choose from – often in the tech, manufacturing, and base materials (e.g. chemicals, pharma compounds etc) sectors.

Warren Buffett’s Berkshire Hathaway has been selling shares of a Chinese auto and EV battery maker stock while some of the EM funds profiled in this post are still share buyers. Why Buffet is selling may only be revealed when Berkshire Hathaway produces their annual letter to shareholders.

One EM fund has issued a statement concerning their holdings in troubled Adani Group companies while another fund also mentioned holding a Latin American stock with a USA listing being targeted by a different short-seller. However, the latter’s shares have started to slowly recover thanks in part to share buybacks.

A South Africa based Africa EM fund has pointed out how around half of the value of listed businesses in Africa are banking shares. Therefore, with rates rising, they are confident bank earnings will grow (despite a soft global environment). There is also a potentially interesting Nigerian stock with a dual listing (in London) and it should be noted how the country will be having elections later this month.

One EM fund rotated out of one Brazilian bank into another while other funds have stayed put (the technical charts for both have shares trending in opposite directions). However, I think investors need to be extremely wary about the direction Brazil appears to be heading in under Lula.

Finally, some EM funds have strategies or frameworks in place for investing in emerging markets which this post also covers. Maybe later in the quarter (while waiting for more fund updates) would be a good time for some posts covering such investing strategies in more detail.

Subscribe Now Via Substack

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

For a further disclaimer and an explanation of the reasoning behind these posts: DISCLAIMER: EM Fund Stock Picks & Country Commentaries Posts.

Note: Where possible, company links are to their respective investor relations or corporate pages. Region and country links are to our ADR or ETF pages where there are further country specific resources (e.g. links to local stock markets and media websites). Please report any bad links in the comments section.

Asia

East Asia

China

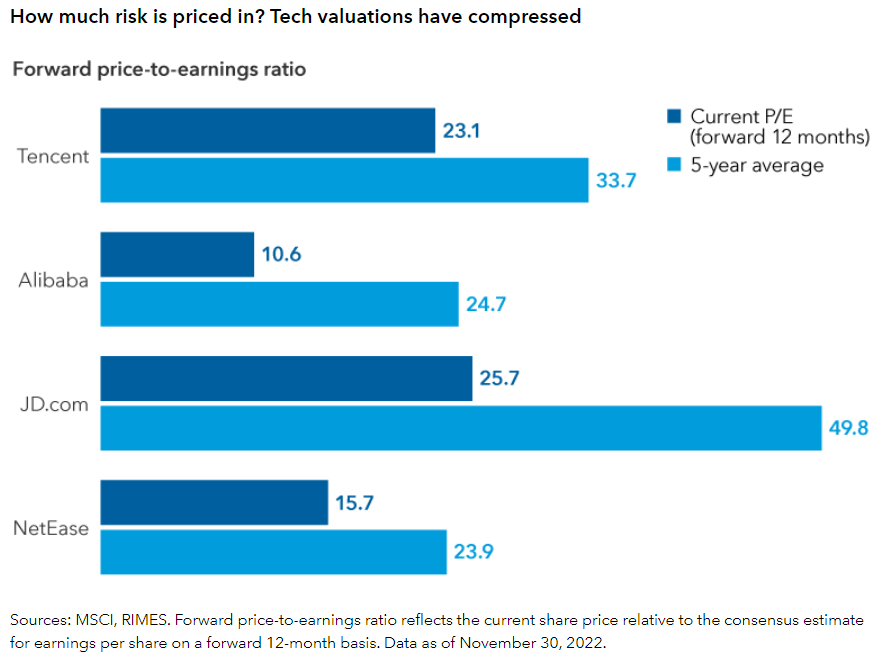

Before we get started with EM fund China stock picks, let me bring attention to a couple of charts from China: What could drive its markets in 2023 (Capital Group) published January 24, 2023 that I also mentioned in yesterday’s link collection post:

To read more, please visit this article on Substack after Tuesday, 9AM EST.

Similar Posts:

- EM Fund Stock Picks & Country Commentaries (February 21, 2023)

- EM Fund Stock Picks & Country Commentaries (June 27, 2023)

- EM Fund Stock Picks & Country Commentaries (July 18, 2023)

- EM Fund Stock Picks & Country Commentaries (August 22, 2023)

- EM Fund Stock Picks & Country Commentaries (June 13, 2023)

- EM Fund Stock Picks & Country Commentaries (March 7, 2023)

- EM Fund Stock Picks & Country Commentaries (March 14, 2023)

- EM Fund Stock Picks & Country Commentaries (March 21, 2023)

- EM Fund Stock Picks & Country Commentaries (March 28, 2023)

- EM Fund Stock Picks & Country Commentaries (January 14, 2024)

- EM Fund Stock Picks & Country Commentaries (February 28, 2023)

- EM Fund Stock Picks & Country Commentaries (January 7, 2024)

- EM Fund Stock Picks & Country Commentaries (November 1, 2023)

- EM Fund Stock Picks & Country Commentaries (December 20, 2023)

- EM Fund Stock Picks & Country Commentaries (January 24, 2023)