It feels like the mainstream corporate media has finally discovered the AI bubble that’s been talked about in alt-finance circles for some time:

📰 Why Fears of a Trillion-Dollar AI Bubble Are Growing (Bloomberg) October 4, 2025 🗃️

Investors have parted with unprecedented sums of money to help AI fulfil its lofty promise. But no one really knows how it will all pay off

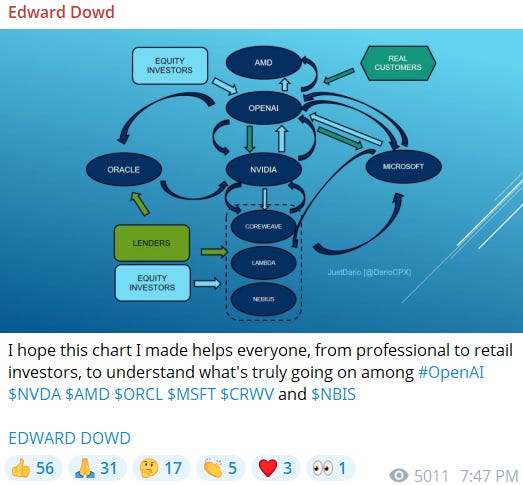

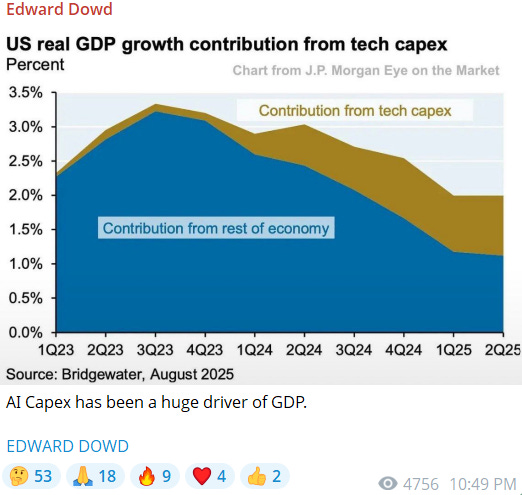

Tech firms are spending hundreds of billions of dollars on advanced chips and data centers, not just to keep pace with a surge in the use of chatbots such as ChatGPT, Gemini and Claude, but to make sure they’re ready to handle a more fundamental and disruptive shift of economic activity from humans to machines. The final bill may run into the trillions. The financing is coming from venture capital, debt and, lately, some more unconventional arrangements that have raised eyebrows on Wall Street.

📰 Goldman boss David Solomon warns of a stock market drawdown: ‘People won’t feel good’ (CNBC) Oct 3 2025 🗃️

- Goldman Sachs CEO David Solomon said AI presented opportunities but that some investors were overlooking “things you should be skeptical about.”

- Speaking at Italian Tech Week in Turin, Italy, he said a “drawdown” was likely to hit stock markets in the coming two years.

- “I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns,” he said.

📰 Peter Lynch on why he isn’t in the AI trade: ‘I literally couldn’t pronounce Nvidia until about 8 months ago’ Oct 6 2025 🗃️

- Legendary investor Peter Lynch joined “The Compound and Friends” podcast [How Peter Lynch Became The Greatest Fund Manager Of All Time | TCAF 211] to discuss artificial intelligence, his biggest investing lessons and the benefits of investing today.

- Lynch averaged a 29.2% return in his 13 years managing the Magellan Fund at Fidelity from 1977 until 1990

📰 AI-Generated “Workslop” Is Destroying Productivity (HBR) September 25, 2025 🗃️

Summary. Despite a surge in generative AI use across workplaces, most companies are seeing little measurable ROI. One possible reason is because AI tools are being used to produce “workslop”—content that appearspolished but lacks real substance, offloading cognitive labor onto coworkers. Research from BetterUp Labs and Stanford found that 41% of workers have encountered such AI-generated output, costing nearly two hours of rework per instance and creating downstream productivity, trust, and collaboration issues. Leaders need to consider how they may be encouraging indiscriminate organizational mandates and offering too little guidance on quality standards. To counteract workslop, leaders should model purposeful AI use, establish clear norms, and encourage a “pilot mindset” that combines high agency with optimism—promoting AI as a collaborative tool, not a shortcut.

As mentioned before, Ed Dowd (ex-Blackrock etc) thinks AI will behave just like the dot.com bubble with the future AI winners not in existence yet (like Facebook, Twitter, etc. which came later); but they will be positioned to eventually take advantage of the AI infrastructure buildout (as in data center) glut:

[Note: In the latest All-In Podcast from Friday – “(1:05:45) Circular AI deals: cause for concern or no big deal?”…]

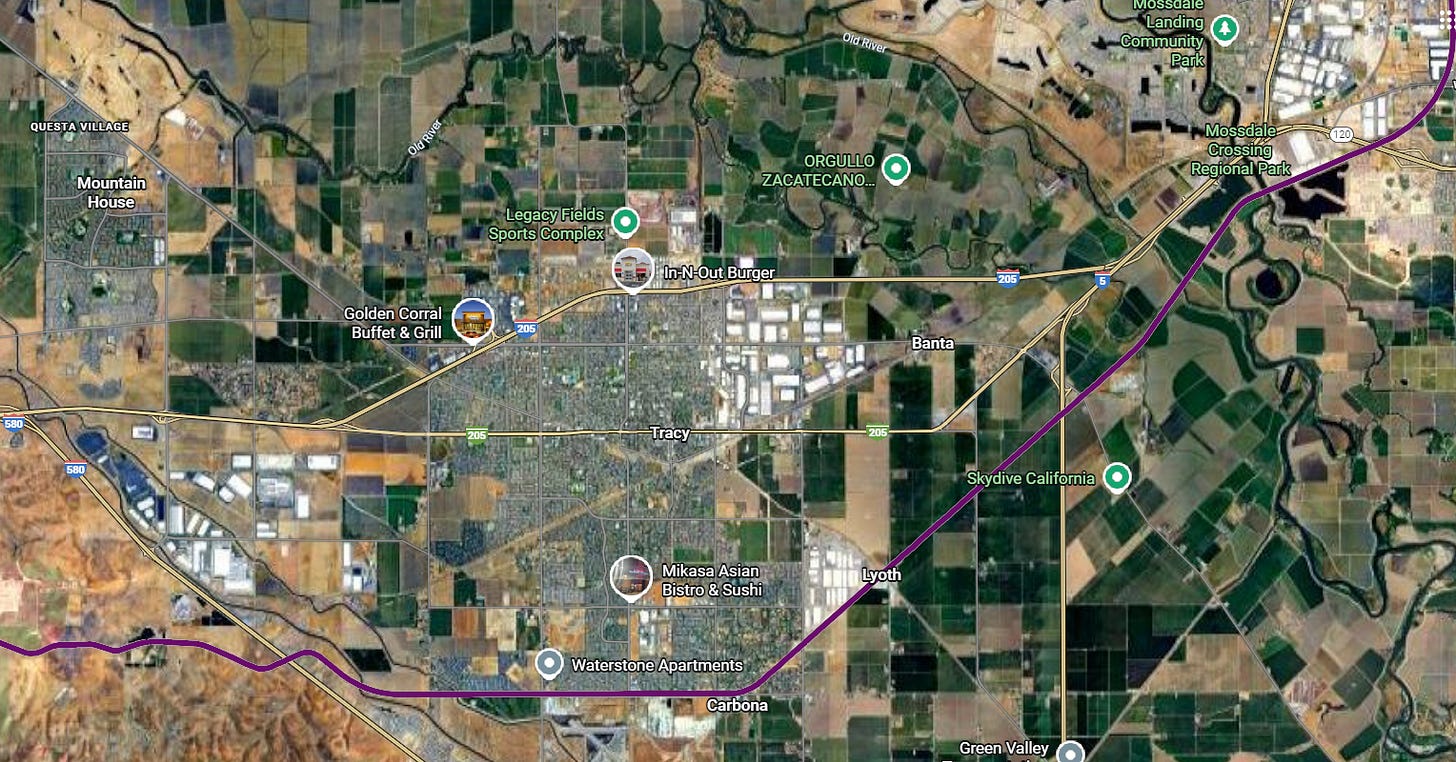

I would add that in addition to the USA’s AI/data center and multifamily housing bubbles that get talked about in alt-finance circles, there might be a warehouse/logistics center bubble.

Between where I grew up and the Bay Area, there is a major logistics hub (Highway 5/205/580/120 corridors in the Tracy / Manteca, CA areas) where massive warehouses have been built (I don’t think they are data centers given local water and electricity rates) – seemingly on speculation as more than a few appear completely empty when driving by them. They are even visible from outer space albeit a day time satellite screenshot seems to show a bit more activity than what I have seen when going by them at night and on weekends:

As of the early October, a few September/Q3 fund updates have become available (our continuously updated post containing all funds is here) plus plenty of new research starting with a non-EM piece:

- 🔬🌐 Data Deprivation (Northern Trust) – Private sources can fill some of the gaps left by deferred government statistics.

New Asia Fund Documents & Research

- 🎙️🌏 A macro whip round the region (Under the Banyan Tree by HSBC Global Research) 14:03 Minutes – Fred has the studio all to himself, and that can only mean one thing: a comprehensive review of the key talking points shaping Asian economics from tariffs to central bank action and, of course, AI.

- 🔬🌏 Asia Investment Grade Outlook for Q4 2025 (Invesco) – The Asian credit market remained resilient throughout the third quarter, underpinned by stable macroeconomic fundamentals, supportive technicals, and limited new issuance, despite persistent trade and geopolitical uncertainties. Credit spreads continued to tighten, driven by strong technicals and easing trade tensions. Overall, improved US-China trade relations helped bolster investor confidence, although unresolved trade negotiations and regional geopolitical uncertainties posed challenges.

- 🔬🌏 Thoughts from the Road: Asia – September 2025 (KKR) – I recently spent time with many of my KKR colleagues in China and Japan, including Changchun Hua (who serves as our economist for Greater China and Northern Asia), meeting with business executives, monetary policymakers, government officials, and our KKR deal teams. This was my second trip to the region this year and the sixth since COVID. Lucky or good, my timing for my recent trips to Asia has been quite fortuitous. Last September, for example, China had a ‘whatever it takes’ moment the day I landed, while Japan elected a new Prime Minister that very same week (see Thoughts from the Road Asia, October 2024, for details). Meanwhile, my first trip to Asia this year (during the first quarter of 2025) occurred near the height of trade tensions. That backdrop led to multiple high-level discussions on how the global economy would function as it transitioned from an era of benign globalization to one of great power competition.

To read more, please visit this article on Substack

Similar Posts:

- EM Fund Stock Picks & Country Commentaries (December 29, 2024)

- EM Fund Stock Picks & Country Commentaries (September 22, 2024)

- EM Fund Stock Picks & Country Commentaries (October 6, 2024)

- EM Fund Stock Picks & Country Commentaries (October 26, 2025)

- EM Fund Stock Picks & Country Commentaries (September 29, 2024)

- EM Fund Stock Picks & Country Commentaries (April 6, 2025)

- EM Fund Stock Picks & Country Commentaries (May 26, 2024)

- EM Fund Stock Picks & Country Commentaries (October 13, 2024)

- EM Fund Stock Picks & Country Commentaries (October 19, 2025)

- EM Fund Stock Picks & Country Commentaries (November 30, 2025)

- EM Fund Stock Picks & Country Commentaries (November 22, 2023)

- EM Fund Stock Picks & Country Commentaries (December 15, 2024)

- EM Fund Stock Picks & Country Commentaries (October 17, 2023)

- EM Fund Stock Picks & Country Commentaries (November 3, 2024)

- EM Fund Stock Picks & Country Commentaries (November 24 2024)