KraneShares recently had an article noting that the volatility in the Chinese onshore stock markets has proliferated a few misconceptions in the media about China’s stock markets that they believe necessitates further clarification. These misconceptions are the following:

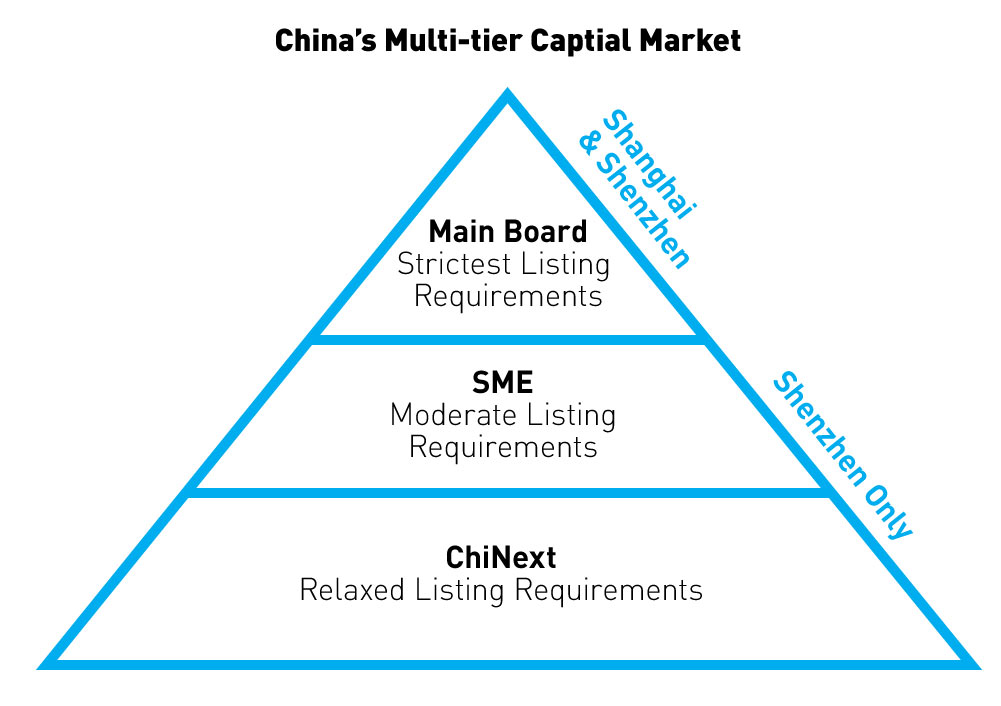

- MISCONCEPTION 1: The average stock in China has a Price to Earnings (P/E) ratio of 90. China’s stock exchanges are organized into a multi-tier system that categorizes listed companies based on specific qualifications:

In late July, the ChiNext had the highest P/E, the highest number of halted or suspended stocks and the lowest market cap compared to the other tiers. ChiNext stocks also had a P/E of 81 versus their five-year average of 58.9 – down from their June 12th high of 128.4.

In late July, the ChiNext had the highest P/E, the highest number of halted or suspended stocks and the lowest market cap compared to the other tiers. ChiNext stocks also had a P/E of 81 versus their five-year average of 58.9 – down from their June 12th high of 128.4.

- MISCONCEPTION 2: The Chinese stock market has stopped trading. At the height of the pullback on July 9th, 1,442 stocks were halted for a little over half the total number of listed stocks. However, the stocks that stopped trading never exceeded 30% of the onshore market cap.

- MISCONCEPTION 3: The stock market will derail the Chinese economy. Chinese brokerage firm China International Capital Corporation (CICC) recently estimated that Chinese households held $8.65 trillion of household deposits, $6.46 trillion of non-equity non-property assets and $3.59 trillion of stock market investments. Moreover, China economic research firm PRC Macro has estimated that less than 5% of Chinese household savings are invested in the stock market.

- MISCONCEPTION 4: The pullback undermines the reform agenda. Unlike Western politicians / policymakers, China’s politicians / policymakers are transparent about their 2015 goals: Renminbi internationalization, continued opening of the capital markets to foreign investors and streamlining state owned enterprises.

- MISCONCEPTION 5: Onshore Chinese equities are no longer on track to be included into global indices. Most investors outside of China define the country’s stock market by the roughly 145 Chinese stocks listed in Hong Kong which excludes the roughly 2,883 Chinese stocks listed on the onshore stock exchanges. Onshore Chinese stocks have been excluded from the definition of China within international indices due to access restrictions placed on foreign investors. However, that will soon change. In June, MSCI announced that the Chinese onshore stock markets would be included upon the resolution of three outstanding issues: 1) Quota caps, 2) Beneficial ownership, and 3) Quota being based on firm size. Despite the pullback, KraneShares believes these issues are not insurmountable.

To read the whole article, Five Misconceptions About China’s Markets, go to the website of KraneShares. In addition, check out our China closed-end fund list and China ETF list pages.

Similar Posts:

- Podcast: A Beginner’s Guide to Investing in China (KraneShares)

- Macro Tailwinds That Could Propel China’s Internet Sector (KraneShares)

- 3 Misconceptions You Might Have About China (KraneShares)

- Be Wary of the MSCI China Inclusion Hype (WSJ)

- Understanding China’s Onshore Equity Market Rally (KraneShares)

- China’s Mutual Funds Industry Now the Second Biggest in Asia (The Asset)

- Some Key Points: The Renminbi & China Commercial Paper Market (KraneShares)

- Uncommon Yields: How China is a Rare Bright Spot in a World Deprived of Yield (KraneShares)

- Is Your Emerging Market Strategy Overexposed to These 3 Factors? (KraneShares)

- US-Chinese Business Partnerships Are Thriving (Kraneshares)

- Why China’s Stock Market Tumble is Giving India’s a Lift (Nikkei Asia)

- Naspers’ Tencent Stake Drives the MSCI South Africa Index’s Returns (KraneShares)

- The 40 Biggest Chinese Stocks Being Added to the MSCI Index (Fortune)

- China Internet Flash Report: 2015 & Beyond + an Overview of 2014 Results (KraneShares)

- Pick Stocks, Not Countries, in Emerging Markets (FE Trustnet)