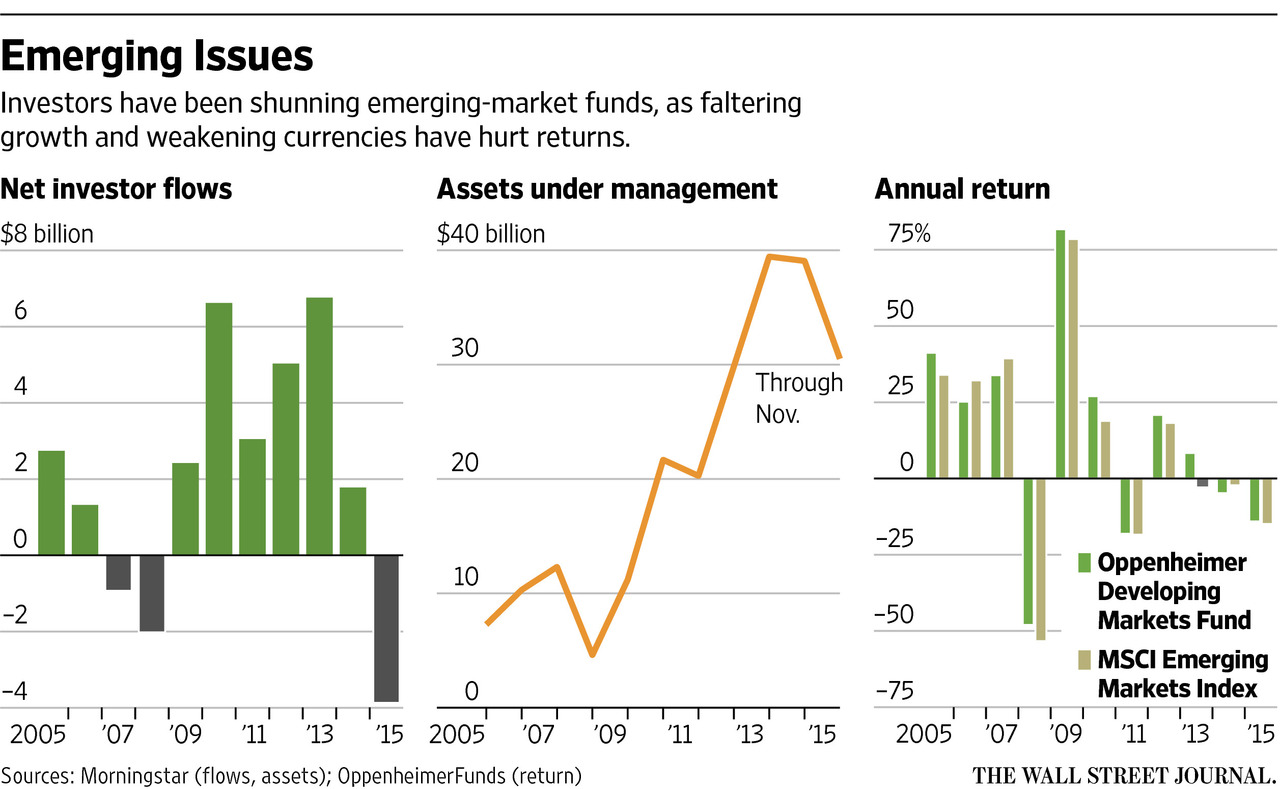

While many emerging market stocks, bonds and currencies have largely stabilized over the last quarter of 2015, many investors still expect renewed turmoil as capital flows out and the commodities bust continues to grind on. In contrast, a total $1.6 trillion of investor money had flowed into emerging markets from 2009 through 2014 (according to the Institute of International Finance) as investors searched for higher returns as interest rates fell to near zero in most of the developed world.

To read the whole article, Risky Business: Cutting a Path Through Emerging-Markets Turmoil, go to the website of the Wall Street Journal.

Similar Posts:

- 2018 Emerging Markets Outlook (Nikko Asset Management)

- Nomura: “Slow Grind” Recovery Needed for Macau

- How ETFs Amplify the Global Financial Cycle in Emerging Markets (Federal Reserve)

- Infographic: Brazil Left in the Lurch by China (WSJ)

- Franklin Templeton’s $7.6bn Bond Bet on the Ukraine is 6X Bigger Than its Russian Bond Holdings (EM)

- Oppenheimer’s Leverenz Blames “Radical Collapse” in FX Markets for Poor Performance (WSJ)

- Emerging Market Investing: Remember Demographics and Take a Selective Approach (ThinkAdvisor)

- Russian Stocks and the Ruble to Remain Under Pressure (Capital Economics)

- A Simple Allocation Strategy for Including EM Stocks in Global Portfolios (The Emerging Markets Investor)

- What Makes Emerging Market Debt Tick? (CFA Institute)

- Chart: Brazil Exports to China Begin to Cool (WSJ)

- What Does it Take to be an Emerging Markets Investor? G&M

- Emerging Markets Hit by Record Streak of Withdrawals by Foreign Investors (Financial Times)

- Thinking Strategically About Emerging Markets (UBS)

- Emerging Market Exchange Rates: Cheap or Value Traps? (Capital Group)