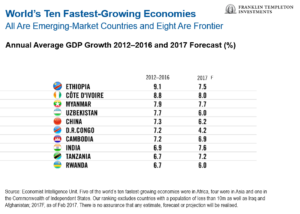

Carlos Hardenberg, senior vice president and director of frontier markets strategies at Templeton Emerging Markets Group, has pointed out that while the 10 fastest-growing economies in the world fall under the emerging markets banner, stripping out China and India means the eight remaining fastest-growers are actually frontier markets.

There are economic and demographic reasons why we see that trend of fast growth likely to continue, including a low median population age, increasing urbanisation in frontier markets compared with emerging and developed counterparts, and low but growing per-capita income.

There are economic and demographic reasons why we see that trend of fast growth likely to continue, including a low median population age, increasing urbanisation in frontier markets compared with emerging and developed counterparts, and low but growing per-capita income.

Hardenberg also noted that:

In the so-called boom years of 2000–2008, when commodity prices were doing well, there was little impetus for reform, especially in those countries that relied on commodity exports.

But when the big shock came and commodity prices corrected dramatically, a lot of these countries needed to go back to the drawing board and back to reforms to attract capital to finance development.

At the end of the day, in order to attract capital, countries—especially frontier markets—need to show the world they can enact reforms.

To read the whole blog post, Busting the Frontier-Market Myths, go to the Mobius Blog. In addition, check out our list of Frontier Market ETFs.

Similar Posts:

- Frontier Markets: Attractive Valuations with Limited Correlation (Mobius Blog)

- Busting Frontier Market Investing Myths (Mobius Blog)

- Frontier Market ETFs Have 72% Exposure to Oil-Dependent Countries (FT Adviser)

- Emerging Markets’ Foreign Exchange Reserves Have Dipped (Mobius Blog)

- Emerging Market 2018 Outlook (Mobius Blog)

- Investors Exit Africa for Other Frontier Markets (WSJ)

- Emerging Markets: Politics and Elections in 2021 (Wellington Management)

- Templeton’s Chow: “No Reason the Goat and the Bull Cannot be Friends” (Mobius Blog)

- Frontier Markets Post-pandemic (Capital Group)

- 2017 Global Retail Development Index (ATKearney)

- Russell Frontier Markets Equity Fund’s Manager Sees Neglected Gems (WSJ)

- Why It’s Not Time to Squeeze the Brakes on Indian Equities (Franklin Templeton)

- Africa Enjoys Oil Boom as Drilling Spreads Across Continent (Bloomberg)

- Mark Mobius’s Favorite Emerging Markets: Indonesia, Russia, Brazil, Vietnam and South Africa (WSJ)

- Why Emerging Markets Are Back in Style for Investors (Breakout)