- As we begin our travels again, this is the first travel report in almost three years. Ruchir Desai, co-fund manager of the AFC Asia Frontier Fund, visited Colombo in November for an investor conference and, after that, visited Weligama.

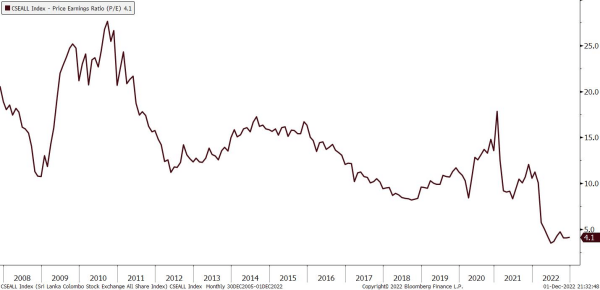

- Though I mentioned that Sri Lanka is not out of the woods yet, valuations are at extremely depressed and all-time low levels. The Colombo All Share Index now trades at a P/E ratio of only 4x! All blue-chip companies trade at a P/E ratio of less than 10x, with Ceylon Tobacco and Nestle Lanka, which the fund holds, trading at a P/E ratio of only 6x! And this includes strong fundamentals and RoEs of greater than 15-20% more most blue chip companies.

- It seems to me we are at the bottom of the cycle in Sri Lanka with valuations being so low and inflation and interest rates seemingly peaking out. If and when interest rates do begin to get cut sometime in 2023, it will not be surprising to see a stock market rally in Sri Lanka, given these depressed valuations. READ MORE

Similar Posts:

- The Emerging Asia Pacific Capital Markets: Sri Lanka (CFA Institute)

- Sri Lanka’s Economy Has ‘Completely Collapsed’: PM (Zero Hedge)

- Sri Lanka: Presidential Election Update (Asia Frontier Capital)

- Asian Frontier Markets See a Strong Rebound in August – Asia Frontier Capital (AFC) – August 2022 Update

- Sri Lanka’s Difficult Road Ahead (Manulife IM)

- Bangladesh: Excellent Growth Prospects Hampered by Uncertain Policy-making (Asia Frontier Capital)

- Food Riots In Sri Lanka Turn Deadly As Protesters Beat Up Police, Burn Down Politicians’ Houses (Zero Hedge)

- China Faces Pushback on Belt and Road Indebtedness (The Asset)

- AFC Asia Frontier Fund – Review 2022 and Outlook 2023 (AFC Asia Frontier Fund)

- Asia’s Ticking Debt Bomb: Sri Lanka Crisis Sounds Alarm Bells Across Region (Nikkei Asia via Sri Lanka Brief)

- Sri Lanka’s PM Describes Sri Lanka’s Crisis (@RW_UNP)

- China, IMF Bailouts for Poorer States Ease Bearish Sentiment Towards Emerging Markets (SCMP)

- There Will be a Wave of Emerging-Market Defaults, Says the Investor Who Seized One of Argentina’s Ships (MarketWatch)

- Chartbook #153: The South Asian Polycrisis (Chartbook Substack)

- Myanmar: Unmet Potential (Asia Frontier Capital)