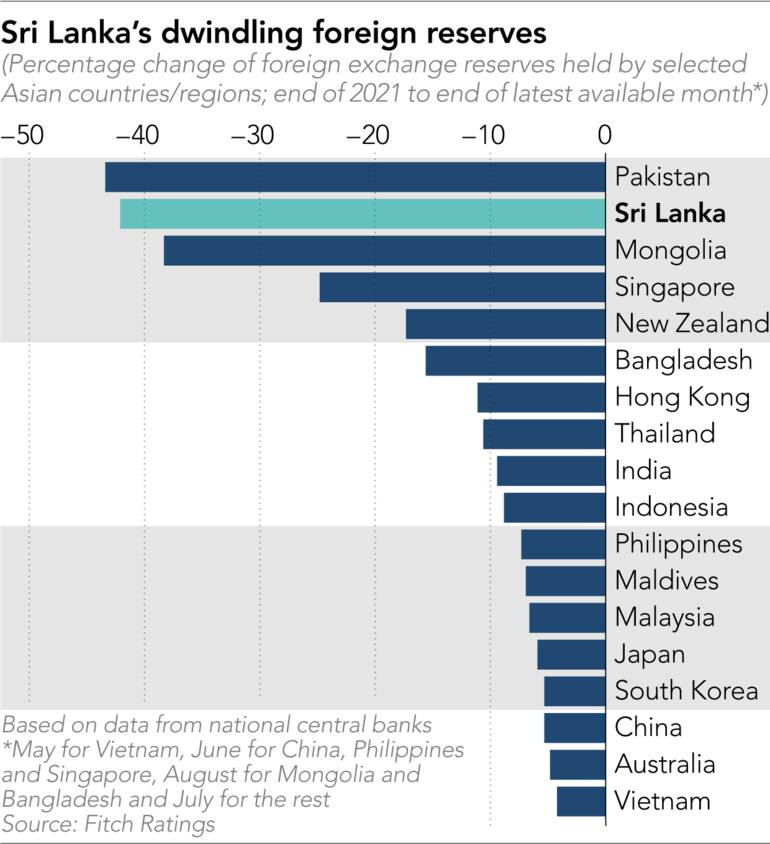

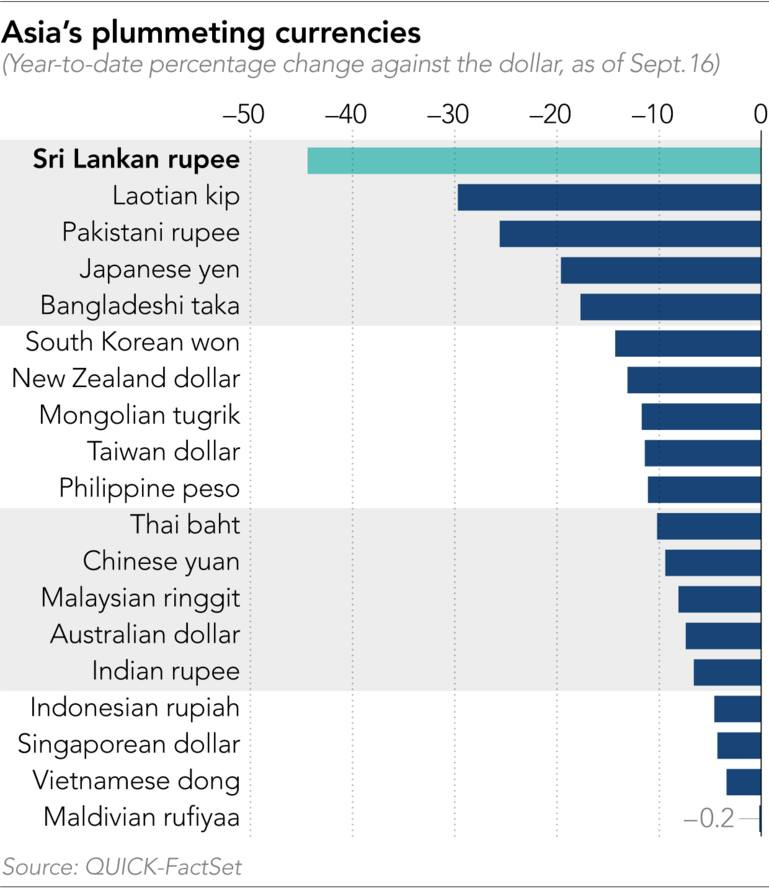

In country after country, foreign exchange reserves are plunging, currencies are wobbling and governments — and their creditors — are panicking. READ MORE

Similar Posts:

- Sri Lanka’s Economy Has ‘Completely Collapsed’: PM (Zero Hedge)

- Sri Lanka’s Difficult Road Ahead (Manulife IM)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- China Faces Pushback on Belt and Road Indebtedness (The Asset)

- The Emerging Asia Pacific Capital Markets: Sri Lanka (CFA Institute)

- F/X Exposure Hit APAC Corporates (Asset Benchmark Research)

- Southeast Asia Gains New Leverage as China and US Battle for Influence (Nikkei Asian Review)

- Food Riots In Sri Lanka Turn Deadly As Protesters Beat Up Police, Burn Down Politicians’ Houses (Zero Hedge)

- China is a Minefield for International Creditors (Washington Examiner)

- There Will be a Wave of Emerging-Market Defaults, Says the Investor Who Seized One of Argentina’s Ships (MarketWatch)

- Indonesia’s Energy Pipeline Springs Leak as Chevron Eyes Exit (Nikkei Asia)

- Emerging Markets’ Foreign Exchange Reserves Have Dipped (Mobius Blog)

- Asian Frontier Markets See a Strong Rebound in August – Asia Frontier Capital (AFC) – August 2022 Update

- 2017 Global Retail Development Index (ATKearney)

- Sri Lanka’s PM Describes Sri Lanka’s Crisis (@RW_UNP)