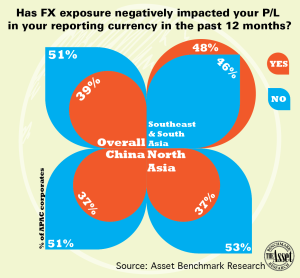

A survey of 1,123 corporate treasurers by Asset Benchmark Research found that nearly half of all corporates in Southeast Asia (48%) state that bottom line performance has been impacted negatively by FX exposure in 2015.

Southeast Asian corporates are the region’s most exposed companies to FX exposure, suffering from illiquid hedging markets, low penetration of their home currencies in international trade and their (growing) export focus. Overall in Asia, 39% of corporate treasurers and CFOs had to communicate hits to profitability due to FX exposure, arising from transactional, translational and/or economic exposure to currencies.

The negative impact was lowest among Chinese enterprises, likely a reflection of the higher predictability of the exchange rate (on most days) and the growing use of the renminbi in international trade finance.

To read the whole report, Bracing for Volatility, Embracing Change, and the article, FX exposure pillages P/L of APAC corporates, go to the website of The Asset.

To read the whole report, Bracing for Volatility, Embracing Change, and the article, FX exposure pillages P/L of APAC corporates, go to the website of The Asset.

Similar Posts:

- Risk Factors Triggering the Most Analyst Questions in Asia (Asset Benchmark Research)

- What Happens if Malaysia is Removed From the FTSE World Bond Index? (The Asset)

- YPO CEO Survey: Asia CEO Confidence at 2-year Low (YPO)

- Scottish Oriental Smaller Companies Trust – Annual Report for Year Ended Aug 31, 2022

- China’s Effective Tax Rate is Still Much Lower Than the US (The Asset)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- Chart: Asia GDP Per Capita Has Risen Sharply Since 1960 (Aberdeen)

- No Improvement in Asia Pacific Corporate Payments in 2015 (Coface)

- Changing Investor Attitudes About Emerging Markets (CNBC)

- Buying Stocks in Asia: The Ultimate Guide (InvestAsian)

- How Bad is China’s Manufacturing Exodus? (Caixinglobal.com)

- Sustained Growth Slowdown in China Would Spill Over to Asia-Pacific Region and Beyond (Moody’s Talk)

- Experts: Tread Carefully With Emerging Market Investments (FE Trustnet)

- Asia Equities: FAQS, Facts and Figures (UBS AM)

- Which Countries Are Most Influenced By China? (Oilprice.com)