Coface’s annual survey on Asia-Pacific economies which questioned 2,793 companies in 8 markets (Australia, China, Hong Kong, India, Japan, Singapore, Taiwan and Thailand) is out and according to the press release:

- 70% of the companies experienced overdues, reporting no improvement on 2014.

- 56% believe the global economy is unlikely to pick up in 2016.

- Deterioration was noted in India, China and Singapore, while other countries were stable in terms of payment experience.

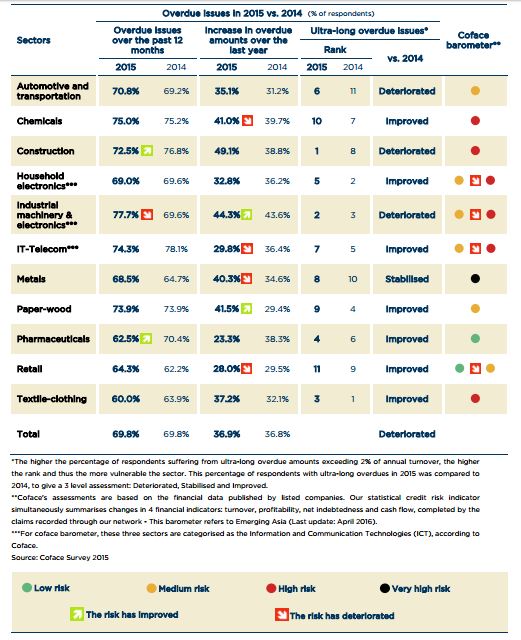

- The riskiest sectors are construction, industrial machinery & electronics, automotive & transportation and metals.

Approximately 7 out of 10 companies experienced overdue payments in 2015 with the main reasons being “customer financial difficulties” (52%), “fierce competition impacting margins” (35.6%) and “lack of financing resources” (26.4%). Three countries saw the strongest deterioration:

- In India, 84% of respondents faced overdue issues and there was a marked percentage increase in respondents (32%, vs. 24% in 2014) with more than 2% of their annual turnover involved in ultra-long overdue issues. The problem of non-performing assets is likely to reduce the lending capacity and profitability of banks – which means that some companies could suffer from tightening bank credit controls. The slower than expected implementation of reforms is clouding the medium term outlook.

- China’s overall corporate payment experience remained weak, with 80% of respondents reporting overdues in 2015. 21% noted average overdue times of more than 90 days – the highest percentage among the regional countries surveyed. In addition to the unsolved issues of high leveraging and overcapacity in many sectors, downwards pressure on the RMB and stock market volatility are further concerns for the Chinese market in 2016.

- Singapore saw a sharp increase in respondents (35%, vs. 23% in 2014) with more than 2% of their annual turnover involved in ultra-long overdue issues. In addition, more companies (14%, vs. 10% in 2014) reported average overdue times of more than 90 days and increases in overdue amounts (49%, vs. 35% in 2014). Singapore, as the Asian base for the world’s leading players in the commodities market, is now also faced with a backdrop of low commodity prices and mounting global uncertainties.

On the other hand, overall company payment experience remained fairly stable in Japan. In Hong Kong, overall company payment experience stabilised thanks to companies there adopting a more prudent approach to credit in 2015, with fewer respondents offering sales on credits (69.4%, vs. 76.8% in 2014) and a slight decrease in average credit terms. Taiwan’s overall company payment experience improved as any economic recovery in the US and the Eurozone will probably mitigate the adverse impacts from China on the country’s highly export-dependent economy.

As for individual sectors:

- Construction was the most at risk sector in the Asia Pacific region in 2015 as the sector reported the most companies with turnovers impacted by ultra-long overdues.

- Industrial machinery & electronics had the highest percentage of respondents (78%, vs. 70% in 2014) experiencing overdue issues in 2015 and 2016 is likely to be another difficult year for the sector.

- The automotive and transportation sector saw a worrying deterioration in overdue issues during 2015 compared to 2014 as more companies reported an increase in overdue amounts (35%, vs. 31% in 2014) and suffered from ultra-long overdue issues (23%, vs. 14% in 2014).

- There were no improvements for the metals sector in 2015 and it will probably continue to face challenges.

Jackit Wong, Asia Pacific Economist of Coface, had this to say in the actual report:

Jackit Wong, Asia Pacific Economist of Coface, had this to say in the actual report:

“Looking ahead, 56.0% of respondents consider that the global economy is unlikely to pick up in 2016, in line with Coface’s predictions. This cautious stance could suggest a more prudent approach to credit control when offering sales on credit. 2016 is set to be a challenging year, with mounting global uncertainties linked to China’s growth moderation, the fiscal difficulties experienced by oil exporting countries and US monetary normalisation. Taking these factors into consideration, overall company payment experience in the 8 selected regional economies is likely to remain weak.”

To read the whole press release and report, No Improvement in Asia Pacific Corporate Payments in 2015, go to the website of Coface. In addition, check out Asian payments situation worsens and Rise in late payments cause for concern in Asia in Global Trade Review (GTR) and The Asset, respectively.

Similar Posts:

- Asia at a Crossroads: Demographics, Economics & Investment (State Street)

- Sustained Growth Slowdown in China Would Spill Over to Asia-Pacific Region and Beyond (Moody’s Talk)

- Who Leads in Southeast Asia in Digital Payment Adoption? (The Asset)

- Korea & Taiwan Use Renminbi for Majority of Payments with China & Hong Kong (The Asset)

- The Spoils of Trade War: Asia’s Winners and Losers in US-China Clash (SCMP)

- Which Countries Are Most Influenced By China? (Oilprice.com)

- Morningstar Hong Kong & Singapore Stock of the Week (Q2 2023)

- Bloomberg’s Misery Index’s Least Miserable Emerging Markets

- Economic Prospects in Several Emerging Asia Countries (Wells Fargo Securities)

- Asia is Home to 50% of World’s Fastest Growing Companies (Nikkei Asian Review)

- Singapore’s GIC Bets on Emerging Market Technolgy Investments (Reuters)

- Luckin Coffee is Launching in Singapore, Will it Do Well? (Momentum Asia)

- BlackRock’s Swann: Look at the China Slowdown in a Long Term Context (FE Trustnet)

- MOBIUS INVESTMENT TRUST: Mobius Scans Far Horizons as China Shunned – Manager Carlos Hardenberg Says he is Facing Strong Headwinds (Daily Mail)

- Asian Banks Are Nibbling the Lunches of Global Banks (CCTV)