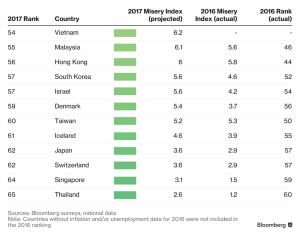

Bloomberg’s Misery Index, which combines countries’ 2017 inflation and unemployment outlooks, ranks the least miserable “emerging markets” as being Vietnam (#54), Malaysia (#55), Hong Kong (#56), South Korea (#57), Israel (also #57), Taiwan (#60), Singapore (#64) and Thailand (#65).

More importantly, some emerging markets have made strides to become less miserable:

More importantly, some emerging markets have made strides to become less miserable:

Peru had the biggest noteworthy move of 13 positions. However, Peru was more miserable than expected in 2016 as a drought sparked food-price inflation and weak domestic demand weighed on the labor market. Economists though appear to agree with Peru’s central bank which sees improvement in investment and trade on the horizon.

Peru had the biggest noteworthy move of 13 positions. However, Peru was more miserable than expected in 2016 as a drought sparked food-price inflation and weak domestic demand weighed on the labor market. Economists though appear to agree with Peru’s central bank which sees improvement in investment and trade on the horizon.

Note that the U.S. has remained among the 20 least miserable countries (#49), a few spots worse than China, with which it tied in 2016.

To read the whole article, These Economies Are Getting More Miserable This Year, go to the website of Bloomberg. In addition, check out: Bloomberg’s Misery Index’s Most Miserable Emerging Markets

Similar Posts:

- Bloomberg’s Misery Index’s Most Miserable Emerging Markets

- The 15 Most Miserable Emerging Market Economies (Bloomberg)

- Asia at a Crossroads: Demographics, Economics & Investment (State Street)

- Which Countries Are Most Influenced By China? (Oilprice.com)

- Korea & Taiwan Use Renminbi for Majority of Payments with China & Hong Kong (The Asset)

- The Spoils of Trade War: Asia’s Winners and Losers in US-China Clash (SCMP)

- Secret to Enduring Stagflation Sends Traders to Emerging Markets (Bloomberg)

- Sustained Growth Slowdown in China Would Spill Over to Asia-Pacific Region and Beyond (Moody’s Talk)

- Buying Stocks in Asia: The Ultimate Guide (InvestAsian)

- Are There Greater Opportunities In Asia’s Frontier Markets Than in China? (FT)

- Quarterly Frontier Markets Recap 1Q21 (FitchRatings)

- Investors in Emerging Market ETFs Should ‘Look Under the Hood’ (Reuters Video)

- 2017 Global Retail Development Index (ATKearney)

- Emerging Market Risk Ranking: Most Vulnerable to the Strongest (FT)

- Why the MSCI Emerging Markets Index Has Some BIG Problems (WSJ)