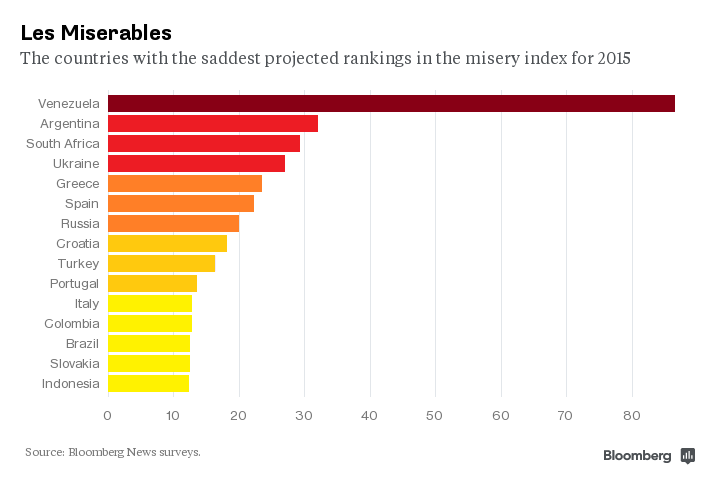

Bloomberg has come up with a list of the fifteen most miserable economies (with most being emerging markets) in the world with their 2015 misery index being calculated (using the latest research, private forecasts and survey data) as follows: unemployment rate + change in the consumer price index = misery. Based on their calculations, three of the countries that will probably see the most economic misery in 2015 – Venezuela, Argentina and South Africa – haven’t actually budged much from their 2014 misery rankings when they occupied three of the top four spots (albeit Argentina and South Africa managed to leap past the conflict mired Ukraine for a second and third place finish). Rounding out places four through ten on this year’s misery index are the Ukraine (still mired in conflict), Greece, Spain, Russia, Croatia, Turkey and Portugal. They are followed by Italy, Colombia, Brazil, Slovakia and Indonesia.

To read the whole article, The 15 Most Miserable Economies in the World, go to the website of Bloomberg.

Similar Posts:

- Bloomberg’s Misery Index’s Most Miserable Emerging Markets

- Bloomberg’s Misery Index’s Least Miserable Emerging Markets

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- Election Results in Some Fragile Five Emerging Markets Calm Investors (Reuters)

- Which Emerging Markets Have the Most Leveraged Stocks? (Bloomberg)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- Eleven Frontier or Emerging Markets Near Bankruptcy (USA Today)

- S&W’s McGrath: Emerging Markets Are at the Perfect Entry Point (FE Trustnet)

- Volkswagen Hit By Falling Emerging Market Sales (FT)

- “Fragile Five” Emerging Markets No Longer That “Fragile” (AP)

- Downgraded Countries Were Top Emerging Market Performers in 2016 (IOL)

- Emerging Market Acronyms Like “Fragile Five” are Misleading and Unhelpful (SCMP)

- 2017 Global Retail Development Index (ATKearney)

- Emerging Markets Election Timetable 2014 (Aberdeen)

- Resolving the SE Ukraine Conflict Would be a “Massive Buy Signal” for Russia (CNBC)