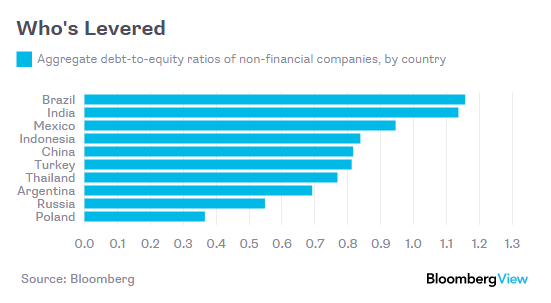

BloombergView columnist Mark Whitehouse has come up with a ranking of which emerging markets have companies with the most leverage and hence, the most risk. As he explained, there are some caveats and difficulties with coming up with a calculation for individual emerging markets:

National differences in accounting standards and industry concentrations, for example, will inevitably affect the results. That said, it’s still worth taking a look. To that end, I queried the Bloomberg terminal for publicly traded nonfinancial companies in 10 large emerging-market economies (setting a minimum threshold of $300 million in assets). I then calculated the aggregate corporate leverage for each country.

Brazil ended up coming out on top as its companies had about $1.16 in debt for each dollar in equity. Brazil was followed closely by India with $1.14 while China and Turkey were in the middle with more than 80 cents for each dollar in equity. Russia was near the bottom at just 54 cents as Western sanctions have complicated borrowing for Russian companies.

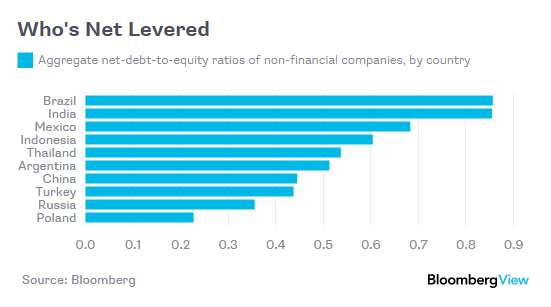

However and when cash is taken into account, the “net” debt loads of corporate China and Turkey look smaller:

However and when cash is taken into account, the “net” debt loads of corporate China and Turkey look smaller:

To read the whole article, The Riskiest Emerging Markets, go to the website of BloombergView.

To read the whole article, The Riskiest Emerging Markets, go to the website of BloombergView.

Similar Posts:

- Election Results in Some Fragile Five Emerging Markets Calm Investors (Reuters)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- S&W’s McGrath: Emerging Markets Are at the Perfect Entry Point (FE Trustnet)

- “Fragile Five” Emerging Markets No Longer That “Fragile” (AP)

- Mark Mobius’s Favorite Emerging Markets: Indonesia, Russia, Brazil, Vietnam and South Africa (WSJ)

- What Risks Do Emerging Markets Pose to US Economy? (Bloomberg)

- Emerging Markets Election Timetable 2014 (Aberdeen)

- Mark Mobius Answers Readers’ Questions (Mobius Blog)

- Emerging Market Acronyms Like “Fragile Five” are Misleading and Unhelpful (SCMP)

- Global Emerging Markets: Country Allocation Review 2021 (Federated Hermes)

- Emerging Markets Debt: Springtime in January? (Barings)

- Global Emerging Markets: Country Allocation Review, H1 2021 (Federated Hermes)

- New Fragile Five Facing a Forex Crisis: Argentina, Brazil, South Africa, Ukraine & Venezuela (Institutional Investor)

- The Emerging Market Sand Trap: Financial Reports, Currency & Other Risks (Epoch Times)