The Global Retail Development Index 2017 finds that geopolitical instability and the growing power of local and regional competition in emerging markets are forcing global retailers to rethink their strategies. At the top of this year’s Global Retail Development Index rankings, India and China have switched places, with India overtaking China for first. In terms of both size and momentum, Asia is the driving force behind global retail and the expansion of branded food and beverage, personal care products, apparel, fashion, and luxury. North Africa is making a comeback with the Arab Spring in the rearview mirror, while the Gulf Cooperation Council (GCC) region, specifically the United Arab Emirates and Saudi Arabia, is developing new ideas for growth. Sub-Saharan Africa keeps growing and South America’s Andes markets continue to impress. Russia and other countries in the Commonwealth of Independent States are still battling with sluggish growth.

Top 30 Global Retail Development Index List (2017)

| Rank | Country | Score | Remarks | |

|---|---|---|---|---|

|

|

||||

| 1 | India | 71.7 | With a growing middle class and rapidly increasing consumer spending, India overtakes China for the number one spot in this year’s GRDI. | |

|

|

||||

| 2 | China | 70.4 | China, long the Index leader, drops to second place as the market matures, but the country still leads the pack in other areas, most notably e-commerce. | |

|

|

||||

| 3 | Malaysia | 60.9 | Malaysia’s long-term prospects are strong, thanks to tourists, higher disposable income, and government investments. | |

|

|

||||

| 4 | Turkey | 59.8 | Despite serious challenges in the past year, Turkey moves up two places to 4th in this year’s Index. | |

|

|

||||

| 5 | United Arab Emirates | 59.4 | The United Arab Emirates remains the most attractive market in the region, as growth opportunities expand beyond saturated Dubai. | |

|

|

||||

| 6 | Vietnam | 56.1 | Vietnam moves ahead and is emerging as an important market for retail expansion with its liberalized investment laws. | |

|

|

||||

| 7 | Morocco | 56.1 | Morocco continues to rise in the rankings thanks to government efforts to attract foreign investments. | |

|

|

||||

| 8 | Indonesia | 55.9 | Indonesia has long been an elusive target for foreign retailers, but continued liberalization and infrastructure investments are attracting more foreign interest. | |

|

|

||||

| 9 | Peru | 54.0 | Peru continues to outperform other regional economies, the result of two decades of solid growth. | |

|

|

||||

| 10 | Colombia | 53.6 | Despite lower than expected GDP growth, Colombia has remained attractive for retailers. | |

|

|

||||

| 11 | Saudi Arabia | 53.6 | Saudi Arabia is focusing on diversifying its economy away from oil, and the retail sector is in the spotlight. | |

|

|

||||

| 12 | Sri Lanka | 51.8 | Sri Lanka retains its 12th position in the Index despite sluggish GDP growth due to reduced investment from China, lower remittances, and moribund export markets. | |

|

|

||||

| 13 | Dominican Republic | 51.7 | Despite relatively low GDP per capita, trade-friendly policies make the Dominican Republic an attractive destination for investments. | |

|

|

||||

| 14 | Algeria | 50.1 | As oil revenues fall, Algeria’s economic circumstances remain difficult and consumer spending has dropped, but the country has risen four position in the Index. | |

|

|

||||

| 15 | Jordan | 49.0 | Jordan’s economy is gradually recovering from the aftershocks of regional conflicts. | |

|

|

||||

| 16 | Kazakhstan | 48.4 | Despite expected GDP growth through 2019, Kazakhstan falls 12 spots in this year’s rankings. | |

|

|

||||

| 17 | Côte d’Ivoire | 48.4 | The combination of a underpenetrated market and GDP growth of 8 percent makes Côte d’Ivoire an attractive target for retailers that can manage the risks. | |

|

|

||||

| 18 | Philippines | 46.8 | The outsourcing industry is boosting incomes and propelling retail growth as the Philippines’ large retail market begins spreading beyond the big cities. | |

|

|

||||

| 19 | Paraguay | 45.7 | Paraguay’s GDP grew well above Latin American averages in 2016, driven by investment incentives and manufacturing. | |

|

|

||||

| 20 | Romania | 45.6 | With 20 million people, Romania is a natural expansion target for foreign retailers looking to enter Eastern Europe. | |

|

|

||||

| 21 | Tanzania | 45.4 | Making its Index debut, Tanzania has a fast-growing economy and an underdeveloped retail market. | |

|

|

||||

| 22 | Russia | 43.2 | The Russian economy continues its slow path to stabilization, but timelines remain unclear. | |

|

|

||||

| 23 | Azerbaijan | 42.9 | Azerbaijan’s GDP has begun to recover, but the economic outlook remains uncertain and dependent on oil prices. | |

|

|

||||

| 24 | Tunisia | 42.7 | Tunisia rises two positions amid small improvements across all dimensions of the Index. | |

|

|

||||

| 25 | Kenya | 41.3 | A growing population, increasing per capita incomes, urbanization, and a property boom make Kenya attractive for modern retail. | |

|

|

||||

| 26 | South Africa | 40.2 | South Arica’s apparel and e-commerce sectors are growing rapidly, as local retailers seek new ways to grow. | |

|

|

||||

| 27 | Nigeria | 39.9 | Nigeria presents immediate challenges, yet its large population, growing middle class, and long-term potential keep it on the Index. | |

|

|

||||

| 28 | Bolivia | 39.6 | After a decade of five percent average GDP growth driven by natural gas and mining exports, Bolivia enters the Index for the first time this year. | |

|

|

||||

| 29 | Brazil | 39.3 | Brazil drops nine spots on the back of a contracting economy, political chaos, and record unemployment. | |

|

|

||||

| 30 | Thailand | 37.8 | Thailand re-enters the Index this year despite political and security challenges. | |

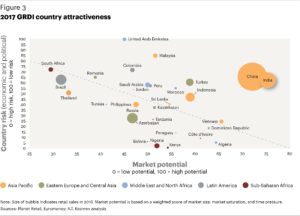

The Global Retail Development Index identifies “windows of opportunity” for investing in organized retail in emerging markets. The concept is based on the notion that markets pass through four stages of retail development (opening, peaking, declining, and closing) as they mature, a process that typically takes 10 to 15 years. The following figure shows how some markets are moving toward peak attractiveness while others are approaching retail maturity:

To read the whole index or the report, The Age of Focus: The 2017 Global Retail Development Index, go to the website of ATKearney.

To read the whole index or the report, The Age of Focus: The 2017 Global Retail Development Index, go to the website of ATKearney.

Similar Posts:

- The World in 2050 (PWC)

- Bloomberg’s Misery Index’s Most Miserable Emerging Markets

- “Fragile Five” Emerging Markets No Longer That “Fragile” (AP)

- Africa’s Consumer Market Potential: Trends, Drivers, Opportunities and Strategies (Brookings Institution)

- Frontier Market ETFs Have 72% Exposure to Oil-Dependent Countries (FT Adviser)

- Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ)

- Key Findings: Credit Suisse Emerging Markets Consumer Survey

- How the MSCI Emerging Markets Index Changes Will Impact Investors (P&I)

- Global Emerging Markets: Country Allocation Review 2021 (Federated Hermes)

- Global Emerging Markets: Country Allocation Review, H1 2021 (Federated Hermes)

- The 15 Most Miserable Emerging Market Economies (Bloomberg)

- Pick Stocks, Not Countries, in Emerging Markets (FE Trustnet)

- Southeast Asia Bucks Trend of Sinking Global Foreign Investment (Nikkei Asian Review)

- 8 of 10 Fastest Growing Markets are Frontier Markets (Mobius Blog)

- Economic Prospects in Several Emerging Asia Countries (Wells Fargo Securities)